Operating Room Or Integration Market Report

Published Date: 31 January 2026 | Report Code: operating-room-or-integration

Operating Room Or Integration Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Operating Room Or Integration market, exploring its current conditions, market size, trends, and forecasts from 2023 to 2033. It offers insights into segmentation, regional performance, and key players in the industry.

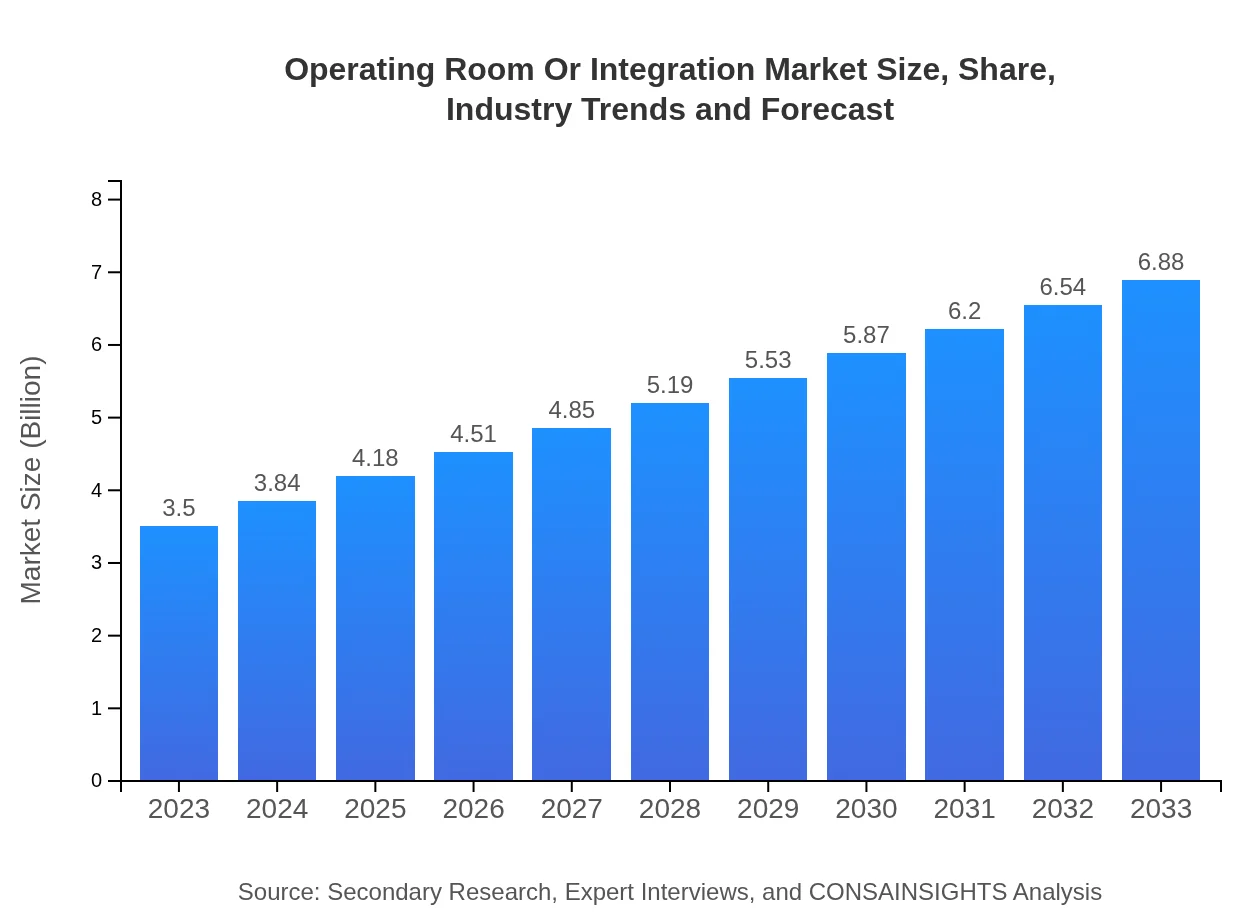

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $6.88 Billion |

| Top Companies | Medtronic , Stryker Corporation, Johnson & Johnson, Olympus Corporation |

| Last Modified Date | 31 January 2026 |

Operating Room Or Integration Market Overview

Customize Operating Room Or Integration Market Report market research report

- ✔ Get in-depth analysis of Operating Room Or Integration market size, growth, and forecasts.

- ✔ Understand Operating Room Or Integration's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Operating Room Or Integration

What is the Market Size & CAGR of Operating Room Or Integration market in 2023?

Operating Room Or Integration Industry Analysis

Operating Room Or Integration Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Operating Room Or Integration Market Analysis Report by Region

Europe Operating Room Or Integration Market Report:

Europe's market, estimated at $1.10 billion in 2023 with expectations to reach $2.16 billion by 2033, is bolstered by stringent regulations encouraging safe surgical outcomes. Technological advancements and collaborations among healthcare providers are essential contributors to growth in this region.Asia Pacific Operating Room Or Integration Market Report:

The Asia Pacific region, currently valued at $0.64 billion in 2023, is anticipated to see significant growth, reaching approximately $1.27 billion by 2033. This surge is attributed to increasing healthcare expenditures, growing surgical procedures, and a rising focus on patient safety and outcomes. Countries like China and India are making notable investments in healthcare infrastructure, propelling market expansion.North America Operating Room Or Integration Market Report:

North America is the largest market, valued at $1.32 billion in 2023 and expected to grow to $2.60 billion by 2033. The region benefits from advanced healthcare infrastructure, increased adoption of surgical robots, and significant R&D investments. The presence of major healthcare organizations and a focus on minimally invasive surgeries are major drivers of this market.South America Operating Room Or Integration Market Report:

In South America, the market is projected to grow from $0.20 billion in 2023 to $0.40 billion by 2033. Improvements in healthcare accessibility and investment in technology are driving this growth. Brazil, being the largest market, is leading various initiatives to enhance surgical facilities, thus attracting key players.Middle East & Africa Operating Room Or Integration Market Report:

The Middle East and Africa market, currently valued at $0.23 billion in 2023 and projected to reach $0.45 billion by 2033, is witnessing growth due to improving healthcare infrastructure and rising investments in surgical technology. Focused initiatives by governments and stakeholders to enhance surgical facilities contribute significantly to regional growth.Tell us your focus area and get a customized research report.

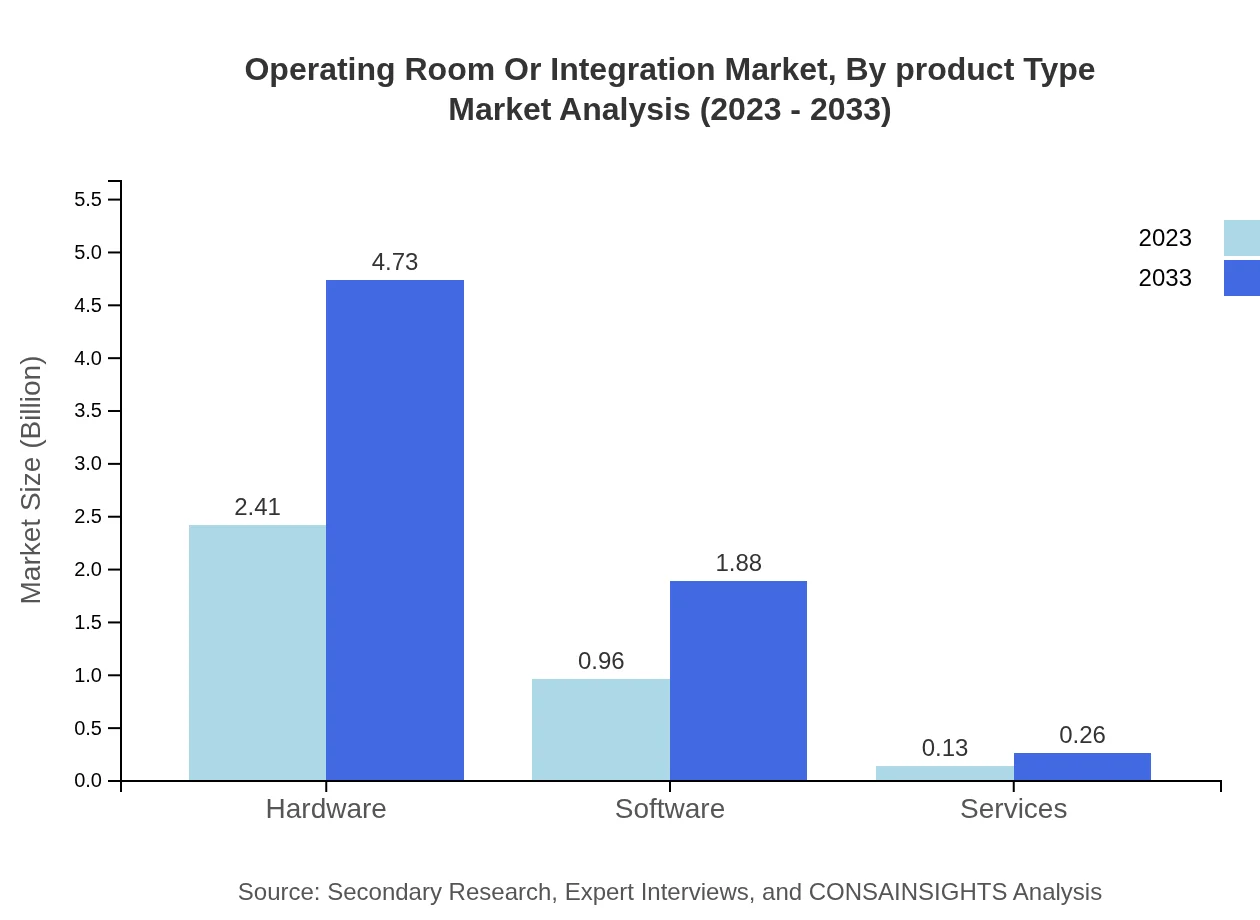

Operating Room Or Integration Market Analysis By Product Type

The product type segment of the Operating Room Or Integration market reveals a pronounced demand for hardware solutions which held a significant market share of 68.77% in 2023 valued at $2.41 billion. This segment is expected to achieve a valuation of $4.73 billion by 2033. Software solutions also reflect substantial growth from $0.96 billion and projected to reach $1.88 billion. Integrated systems streamline processes, while software enhances operational and analytical capabilities across surgical workflows.

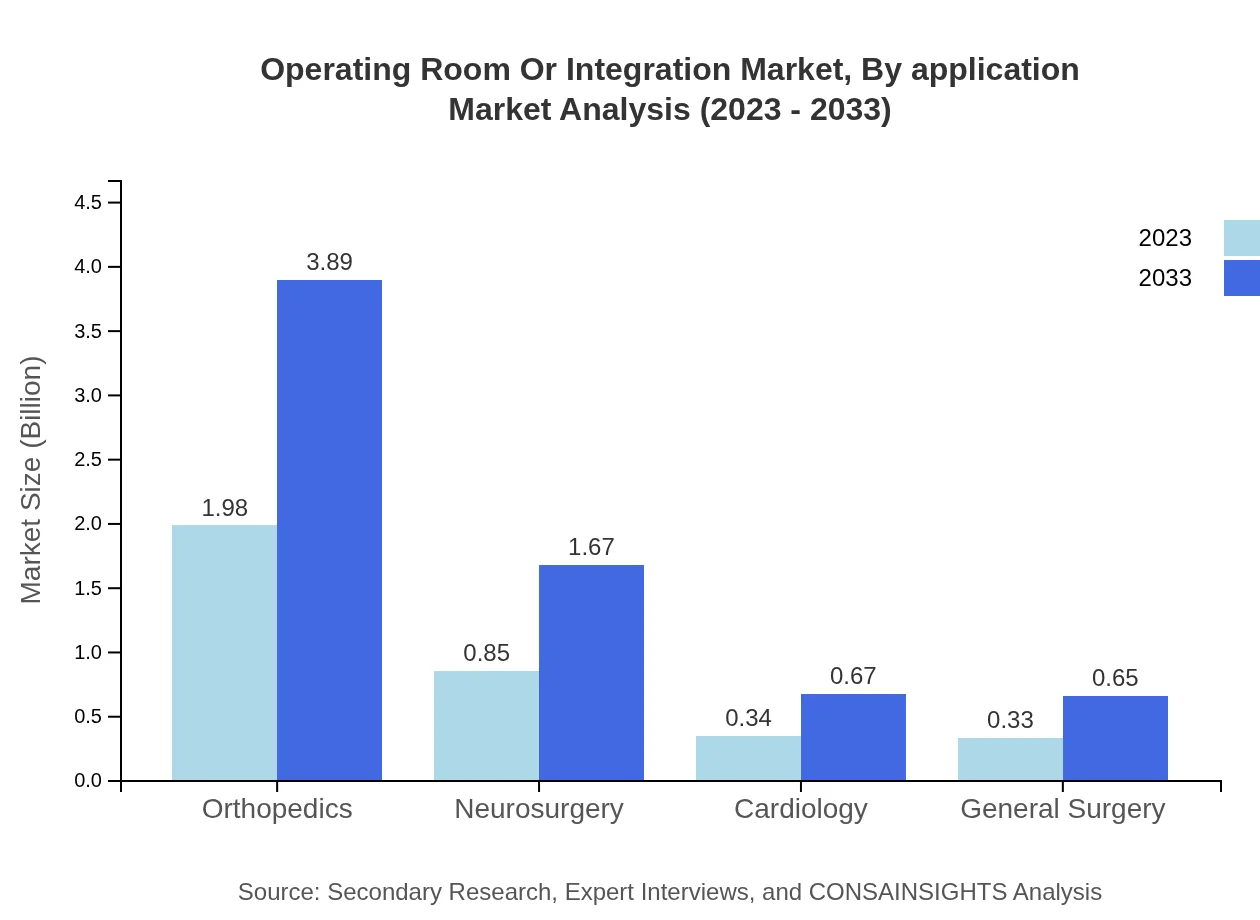

Operating Room Or Integration Market Analysis By Application

The application segment indicates that orthopedic surgeries maintain the largest share at 56.57%, generating $1.98 billion in 2023 and forecasted to grow to $3.89 billion by 2033. Neurosurgery and cardiology follow with 24.27% and 9.72% shares respectively, which highlight the critical nature of integrated operating room systems in specialized surgical domains. The ongoing innovations drive the demand for integrated solutions, enhancing performance and outcomes.

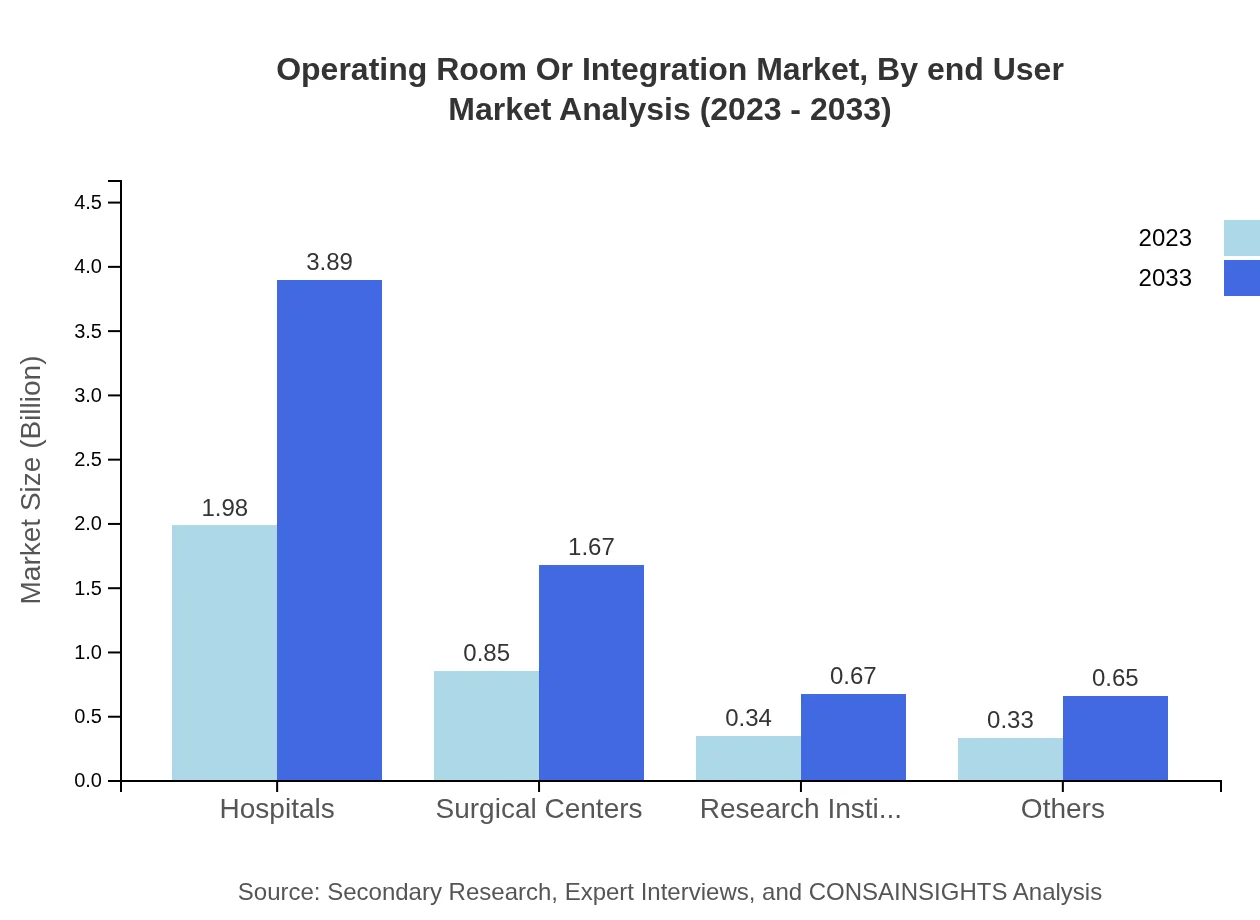

Operating Room Or Integration Market Analysis By End User

Hospitals dominate the end-user segment with a significant share of 56.57%, translating to $1.98 billion in 2023, expected to expand to $3.89 billion by 2033. Surgical centers exhibit potential growth, currently valued at $0.85 billion and projected to rise to $1.67 billion, reflecting an increase in outpatient surgeries. Research institutes also represent a noteworthy segment, reflecting various applications of integration technology across surgical practices.

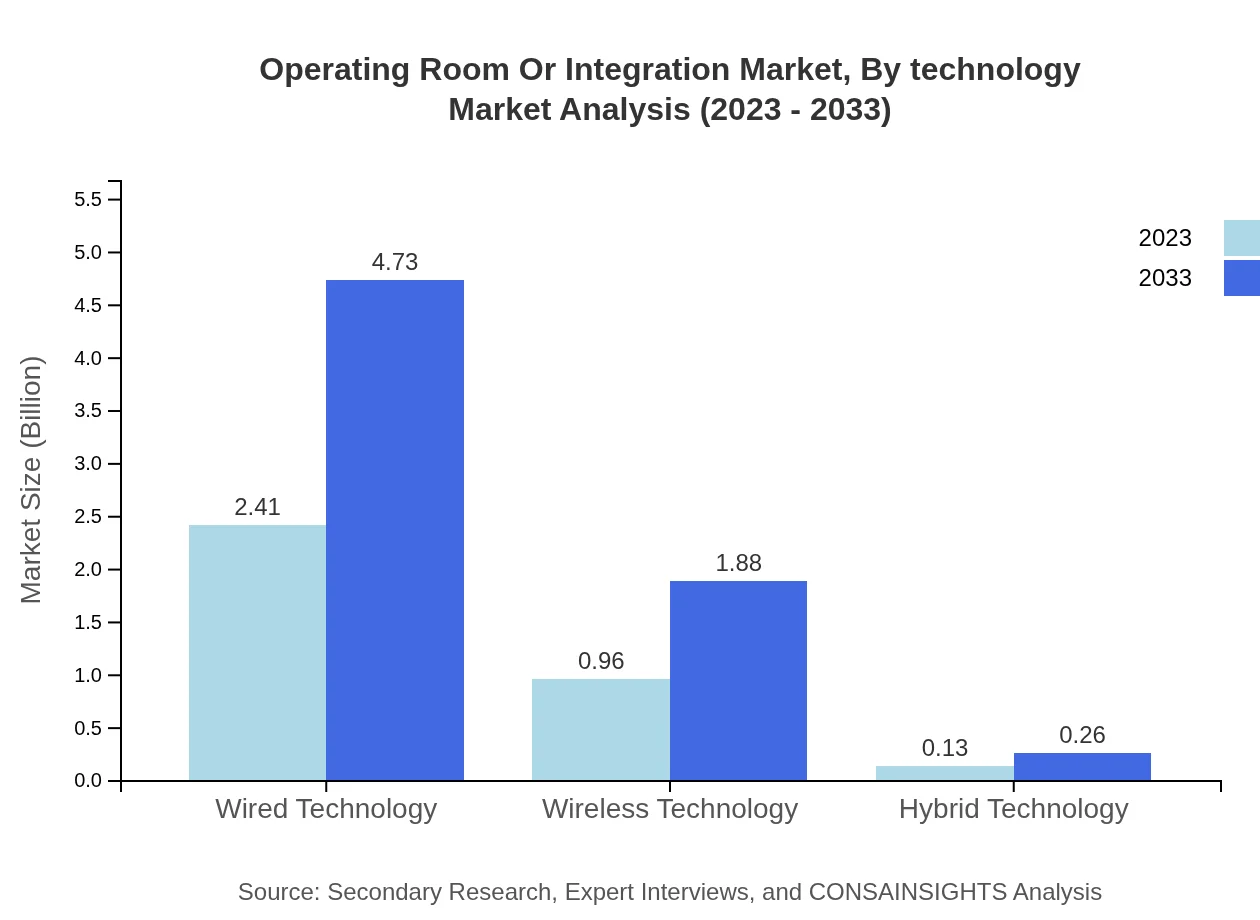

Operating Room Or Integration Market Analysis By Technology

The technology segment reveals that wired technology holds a dominating position with 68.77% of the market share valued at $2.41 billion in 2023. This technology segment is expected to reach $4.73 billion by 2033. Wireless technology is also on an upward trajectory garnering 27.4% of the share which translates to $0.96 billion in 2023 with expectations of reaching $1.88 billion by 2033, exhibiting its growing importance in offering flexibility and efficiency in integrated operating solutions.

Operating Room Or Integration Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Operating Room Or Integration Industry

Medtronic :

A leading medical technology company providing a diverse portfolio of minimally invasive therapies and innovative devices to improve patient outcomes in surgical procedures.Stryker Corporation:

Renowned for their advanced surgical technology, Stryker focuses on precision surgical equipment and integrated solutions that enhance operating room efficiency.Johnson & Johnson:

Through its subsidiary, Ethicon, Johnson & Johnson provides comprehensive surgical products and integrated operating room solutions aimed at improving surgical performance.Olympus Corporation:

Olympus leads in developing advanced endoscopic imaging and integrated solutions for surgical settings, optimizing workflow for healthcare professionals.We're grateful to work with incredible clients.

FAQs

What is the market size of operating Room Or Integration?

The global Operating Room Integration Market is projected to reach approximately $3.5 billion by 2033, growing at a CAGR of 6.8%. This indicates significant expansion and demand within this sector over the next decade.

What are the key market players or companies in this operating Room Or Integration industry?

Key players in the Operating Room Integration industry include companies specializing in surgical equipment, integration technologies, and medical devices. Their innovations drive market dynamics and competition.

What are the primary factors driving the growth in the operating Room Or Integration industry?

Growth is primarily driven by advancements in surgical technologies, increasing demand for minimally invasive procedures, and the need for improved workflow efficiencies in operating rooms.

Which region is the fastest Growing in the operating Room Or Integration?

The North American region is currently the fastest-growing market for Operating Room Integration, with a projected increase from $1.32 billion in 2023 to $2.60 billion by 2033.

Does ConsaInsights provide customized market report data for the operating Room Or Integration industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs, enabling stakeholders to gain in-depth insights and actionable strategies suited to their focus areas.

What deliverables can I expect from this operating Room Or Integration market research project?

Deliverables typically include comprehensive reports, market analysis, competitive landscape insights, and forecasts across various segments and regions relevant to the operating-room-integration market.

What are the market trends of operating Room Or Integration?

Key trends include the shift towards hybrid operating rooms, increased utilization of AI in surgical procedures, and the growth of telemedicine technologies driving operating room efficiencies.