Operation And Business Support System Market Report

Published Date: 31 January 2026 | Report Code: operation-and-business-support-system

Operation And Business Support System Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Operation and Business Support System (OSS/BSS) market from 2023 to 2033, covering insights such as market size, growth trends, and regional analysis, along with a look at current industry challenges and future forecasts.

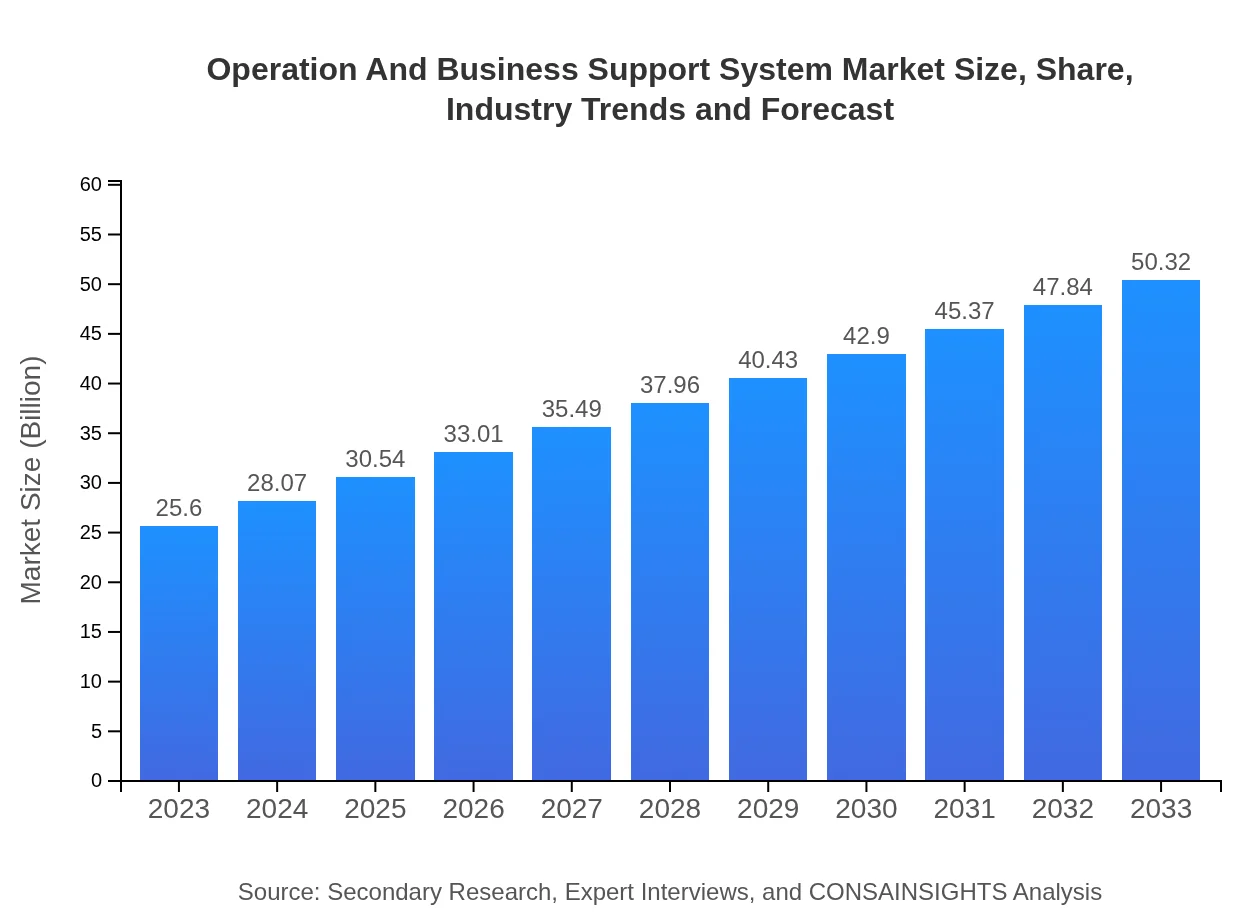

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $50.32 Billion |

| Top Companies | Huawei Technologies, Amdocs, IBM, Oracle, Cisco |

| Last Modified Date | 31 January 2026 |

Operation And Business Support System Market Overview

Customize Operation And Business Support System Market Report market research report

- ✔ Get in-depth analysis of Operation And Business Support System market size, growth, and forecasts.

- ✔ Understand Operation And Business Support System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Operation And Business Support System

What is the Market Size & CAGR of Operation And Business Support System market in 2023?

Operation And Business Support System Industry Analysis

Operation And Business Support System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Operation And Business Support System Market Analysis Report by Region

Europe Operation And Business Support System Market Report:

The European market is estimated to grow from $7.71 billion in 2023 to $15.15 billion by 2033. This growth is driven by increased investment in technology and a move towards more integrated communications solutions across multiple sectors.Asia Pacific Operation And Business Support System Market Report:

The Asia Pacific OSS/BSS market is projected to grow from $4.70 billion in 2023 to $9.23 billion by 2033. The region benefits from a large telecommunications user base and a rapid increase in mobile penetration rates, coupled with ongoing digital transformation initiatives across various economics.North America Operation And Business Support System Market Report:

North America's OSS/BSS market is expected to expand from $9.94 billion in 2023 to $19.54 billion by 2033. The region leads in technological advancements and adoption of AI-driven analytics, benefitting from a strong IT infrastructure.South America Operation And Business Support System Market Report:

The South America market for OSS/BSS is experiencing challenges, with projections indicating a slight decrease, from $-0.19 billion in 2023 to $-0.38 billion in 2033. Political instability and economic fluctuations are major impediments to market growth.Middle East & Africa Operation And Business Support System Market Report:

The Middle East and Africa region will see the OSS/BSS market grow from $3.45 billion in 2023 to $6.78 billion by 2033, spurred by increased demand for telecom services and innovative business support models in burgeoning industries.Tell us your focus area and get a customized research report.

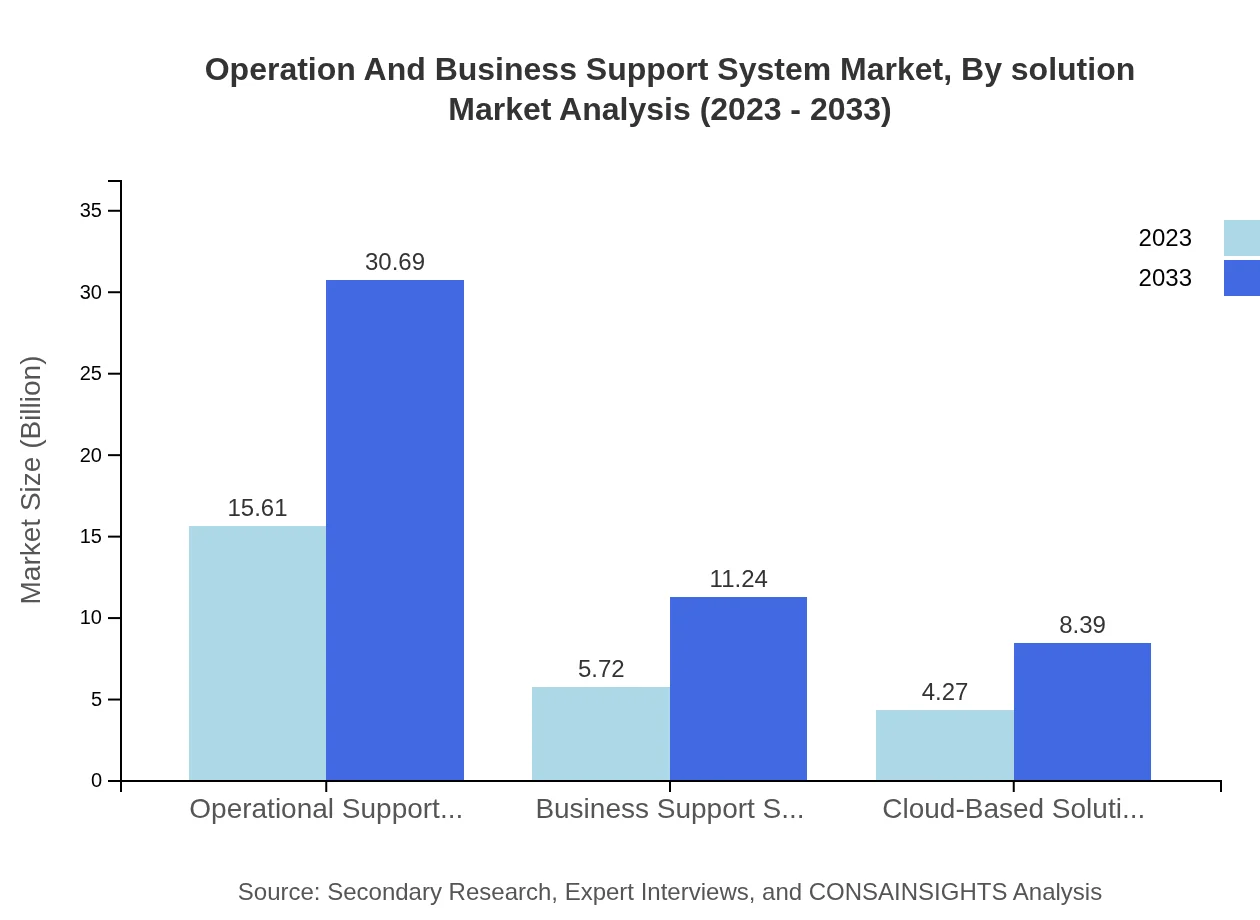

Operation And Business Support System Market Analysis By Solution

OSS and BSS play distinct roles in the market, with OSS addressing operational functions such as network management while BSS focuses on customer interactions and billing systems. OSS represents approximately 60.99% market share and is projected to have a market size of $30.69 billion by 2033, reflecting rising demand for network automation and service orchestration. BSS, dealing with customer relations, shows similar growth trends, with a corresponding growth pattern anticipated.

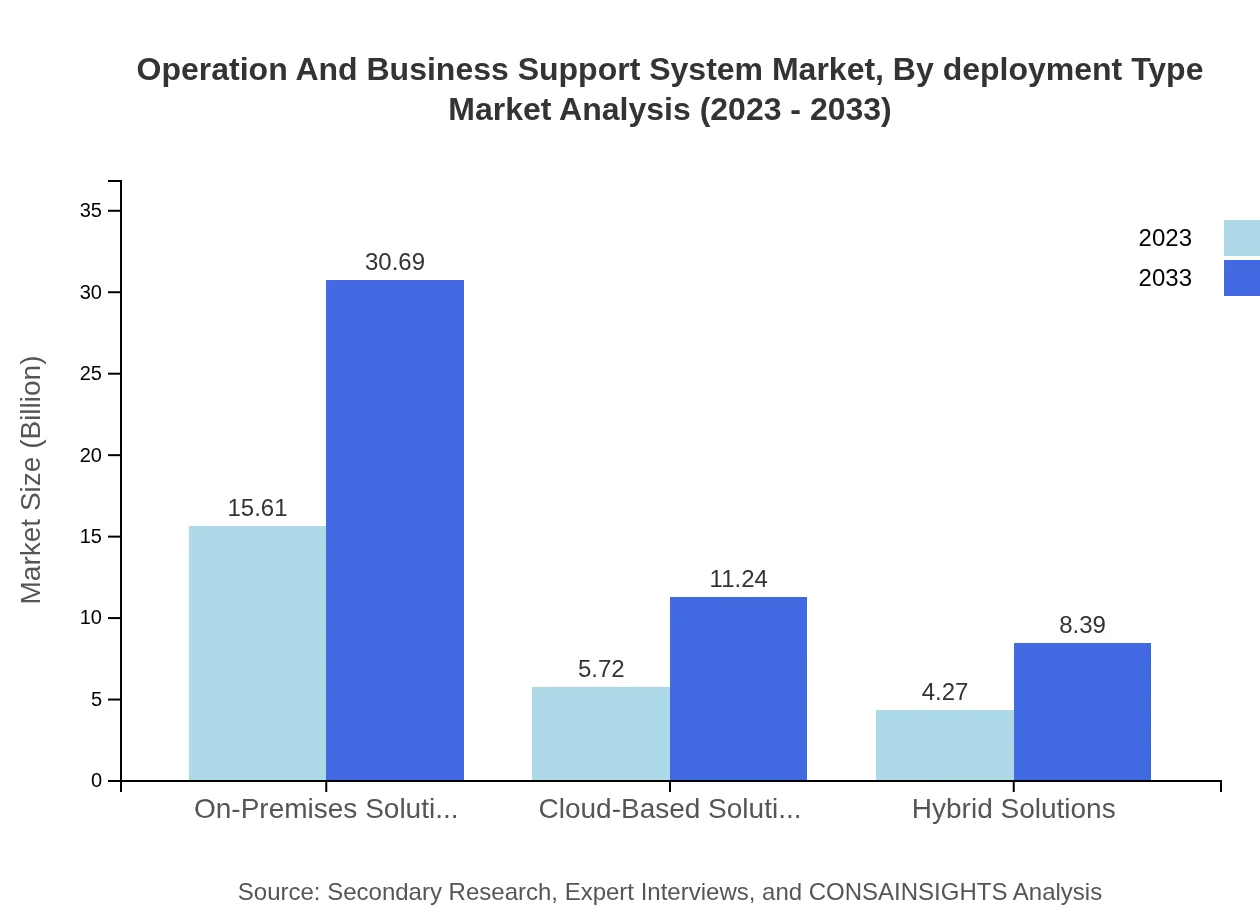

Operation And Business Support System Market Analysis By Deployment Type

Deployment methods segment the OSS/BSS market into on-premises, cloud-based, and hybrid solutions. On-premises solutions hold a substantial market share, around 60.99% and are favored by enterprises requiring stringent data security protocols. However, the impending shift to cloud-based solutions is gaining momentum, as they offer flexibility and scalability, projected to account for a 16.68% market share by 2033. Hybrid solutions are also emerging, catering to organizations aiming for a mix of both deployment types.

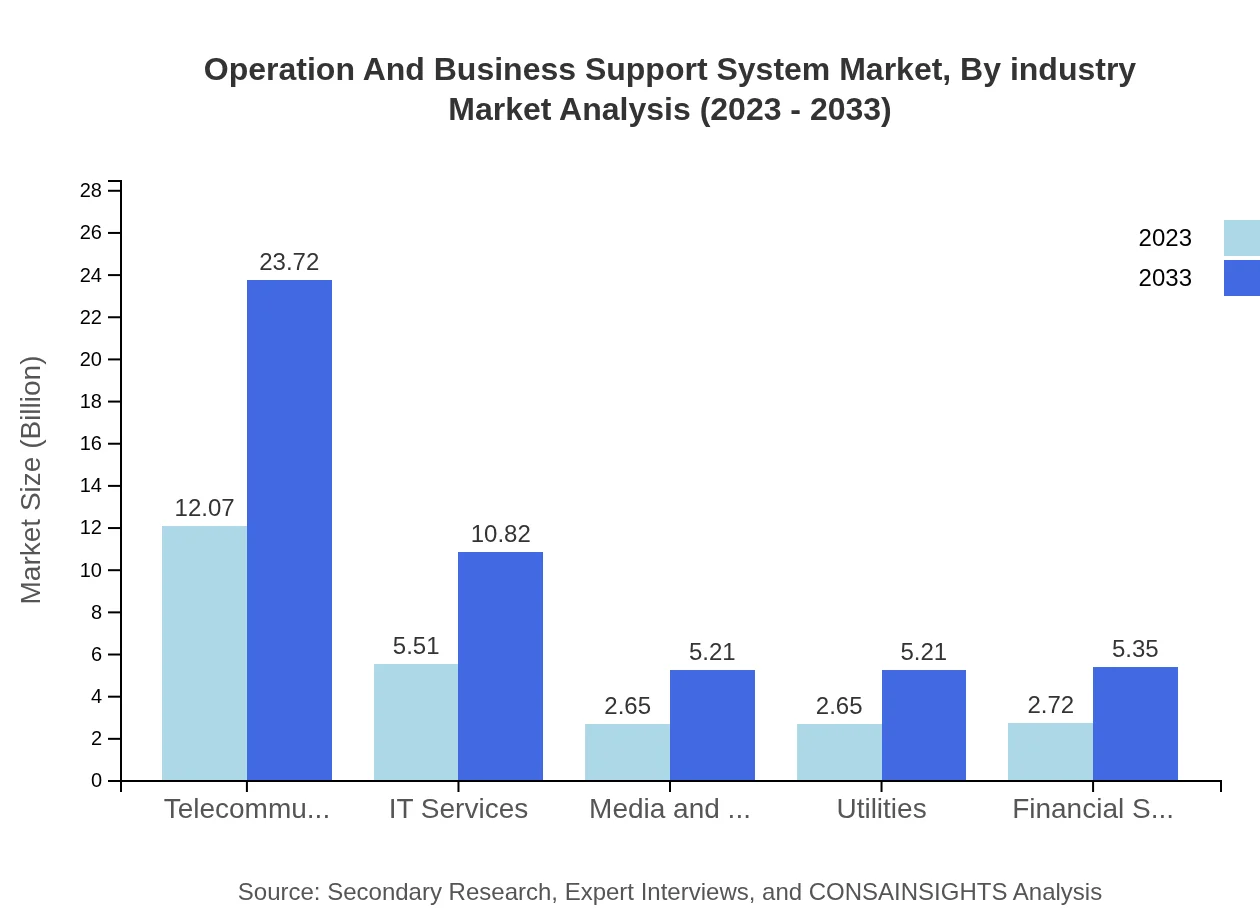

Operation And Business Support System Market Analysis By Industry

OSS/BSS applications span several sectors including telecommunications, financial services, media, and utilities. The telecommunications sector dominates the market, capturing approximately 47.14% share, reflecting the necessity for robust service management. Other significant industries include IT services and financial companies, needing to enhance operational efficiency and deliver superior customer experiences through OSS/BSS capabilities.

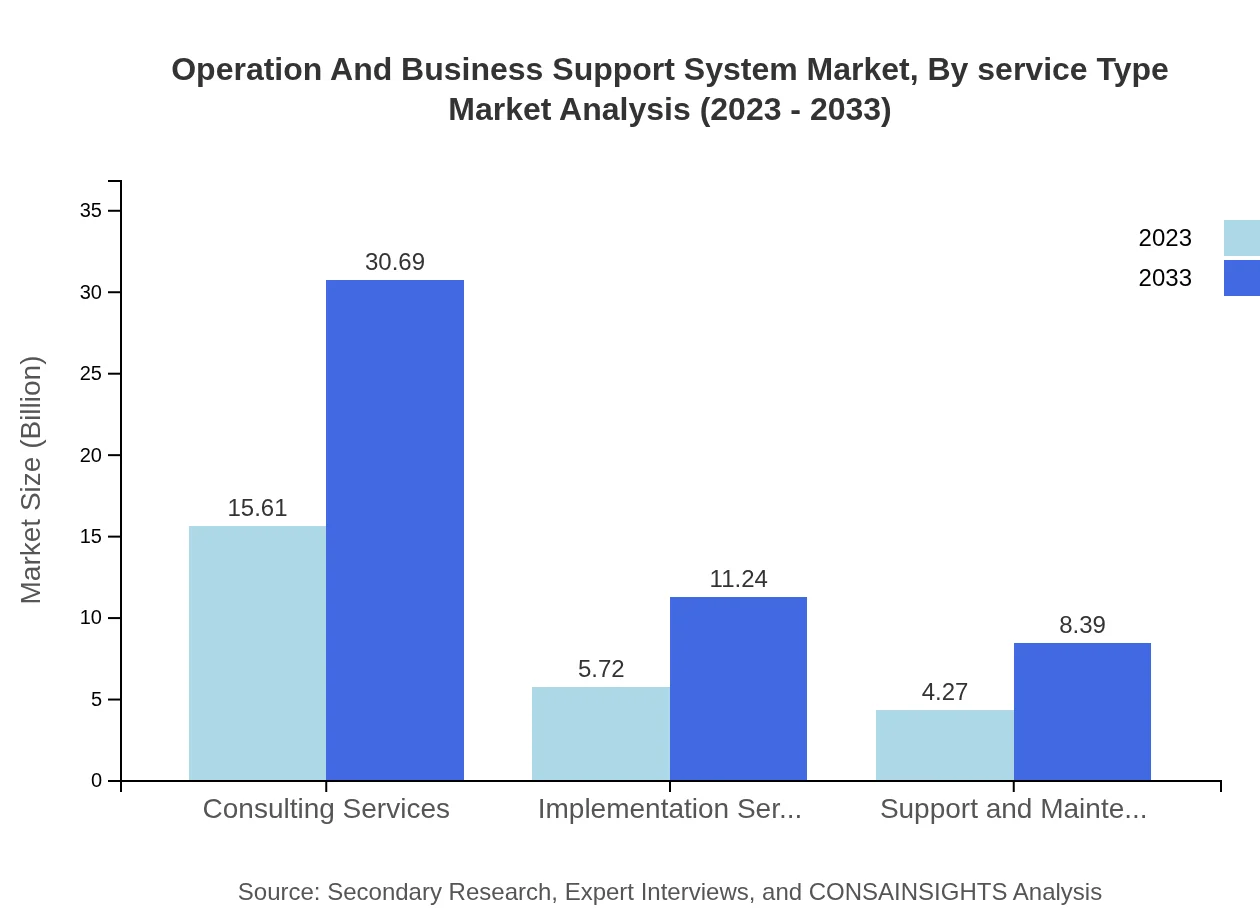

Operation And Business Support System Market Analysis By Service Type

The service type segment comprises consulting services, implementation services, and support and maintenance services. Consulting services lead with a 60.99% market share, facilitating businesses in technology adoption, while support and maintenance services are critical for operational continuity, contributing to service viability in a competitive ecosystem.

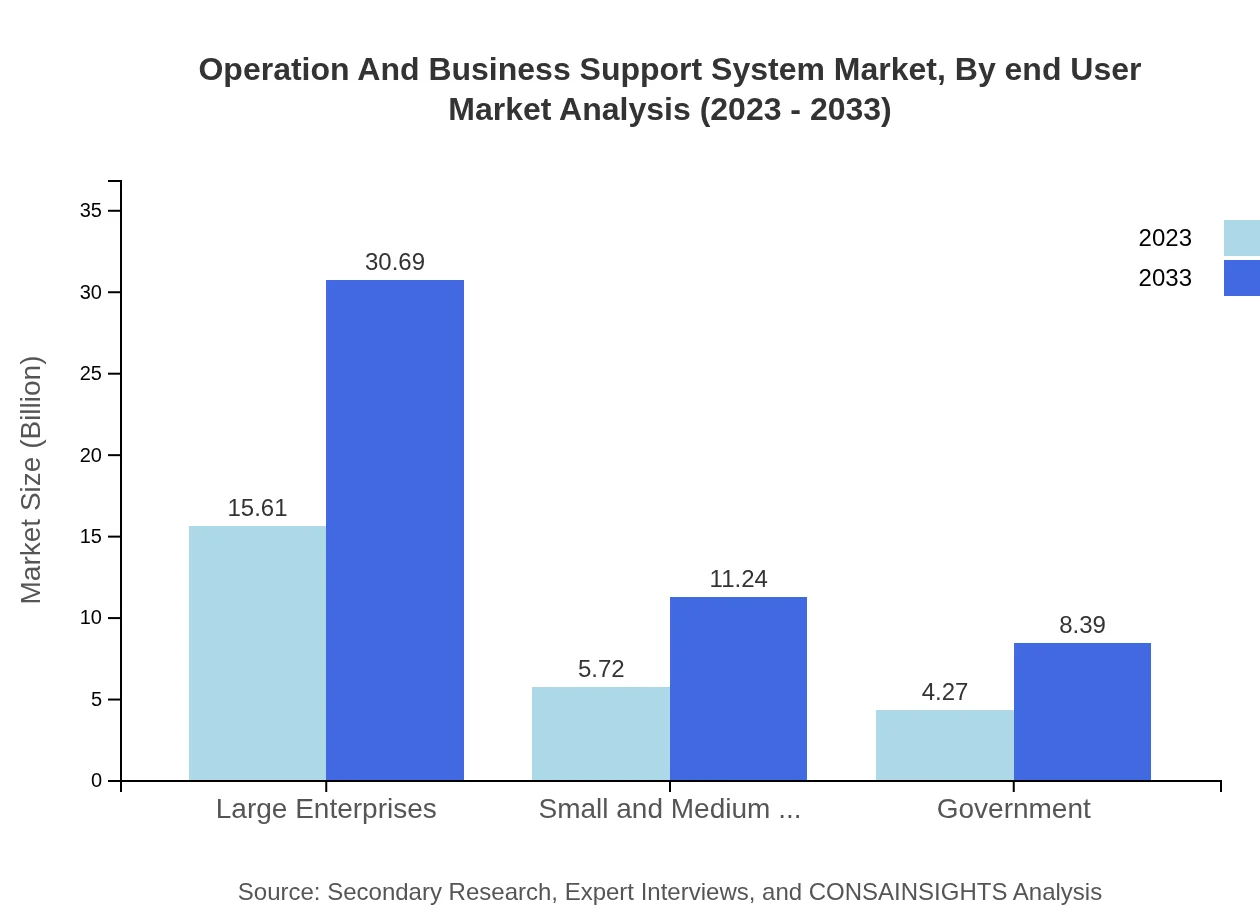

Operation And Business Support System Market Analysis By End User

End-user segmentation reveals sectors such as telecommunications, government, and utilities to be major contributors to OSS/BSS utilization. Telecommunications specifically comprises a significant portion of the end-user market, driven by the need for managing and enhancing service relationships amidst increasing customer expectations.

Operation And Business Support System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Operation And Business Support System Industry

Huawei Technologies:

Huawei is an innovative global provider of information and communications technology (ICT) infrastructure, offering a comprehensive suite of OSS/BSS solutions tailored for telecom operators.Amdocs:

Amdocs specializes in software and services for communications and media companies, with a focus on improving customer experience through comprehensive BSS solutions.IBM:

IBM provides advanced analytics and cloud-based OSS/BSS solutions designed to enhance operational efficiency and provide seamless user experiences across various platforms.Oracle:

Oracle has a wide array of OSS/BSS products aimed at helping telecommunications and media companies manage their operations more effectively through integrated solutions.Cisco:

Cisco focuses on developing intelligent networking and security software that enhances OSS/BSS functionalities, empowering businesses to improve customer service and operational agility.We're grateful to work with incredible clients.

FAQs

What is the market size of Operation and Business Support System?

The Operation and Business Support System market is valued at approximately $25.6 billion in 2023, with a projected CAGR of 6.8% from 2023 to 2033, reflecting significant growth in the sector.

What are the key market players or companies in this Operation and Business Support System industry?

Key players in the Operation and Business Support System industry include major telecommunications companies, IT service providers, and specialized software firms, each contributing unique solutions that drive the market forward.

What are the primary factors driving the growth in the Operation and Business Support System industry?

Growth in operation and business support systems is being driven by increasing demand for efficient management solutions, advancements in technology, and the need for enhanced customer experience across various sectors.

Which region is the fastest Growing in the Operation and Business Support System?

The fastest-growing region for the Operation and Business Support System market is North America, projected to increase from $9.94 billion in 2023 to $19.54 billion by 2033, indicating robust growth opportunities.

Does ConsaInsights provide customized market report data for the Operation and Business Support System industry?

Yes, ConsaInsights offers customized market report data tailored to the needs of clients in the Operation and Business Support System industry, ensuring relevant insights and detailed analysis.

What deliverables can I expect from this Operation and Business Support System market research project?

From this market research project, you can expect comprehensive market analysis, segment Insights, competitive landscape evaluation, along with tailored recommendations for strategic decisions.

What are the market trends of Operation and Business Support System?

Current trends in the Operation and Business Support System market include the rise of cloud-based solutions, increased automation in service management, and a focus on integrating AI technologies to enhance operational efficiency.