Operational Technology Market Report

Published Date: 22 January 2026 | Report Code: operational-technology

Operational Technology Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Operational Technology market, covering current trends, segmentation, and regional insights from 2023 to 2033. It offers detailed forecasts and examines the industry's growth dynamics, providing valuable insights for stakeholders.

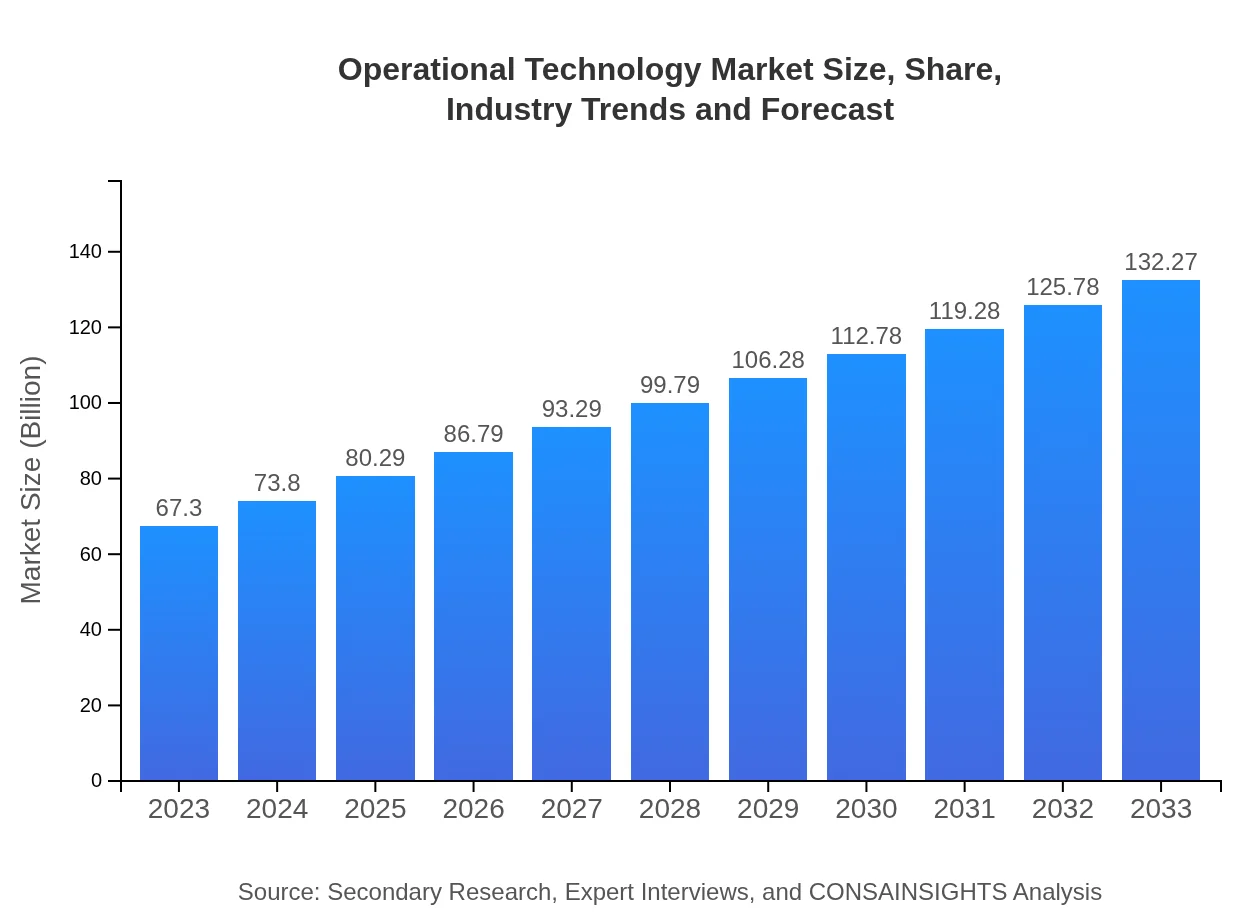

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $67.30 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $132.27 Billion |

| Top Companies | Siemens AG, Rockwell Automation, Inc., Honeywell International Inc., General Electric Company, ABB Ltd. |

| Last Modified Date | 22 January 2026 |

Operational Technology Market Overview

Customize Operational Technology Market Report market research report

- ✔ Get in-depth analysis of Operational Technology market size, growth, and forecasts.

- ✔ Understand Operational Technology's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Operational Technology

What is the Market Size & CAGR of Operational Technology market in 2023?

Operational Technology Industry Analysis

Operational Technology Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Operational Technology Market Analysis Report by Region

Europe Operational Technology Market Report:

In Europe, the market is forecasted to grow from USD 21.06 billion in 2023 to USD 41.40 billion by 2033. The region's push for sustainable industrial practices and transformative initiatives for Industry 4.0 are key factors driving this growth. Government regulations emphasizing energy efficiency and operational safety bolster the investment in OT systems.Asia Pacific Operational Technology Market Report:

The Asia Pacific region is expected to witness remarkable growth with a market size projected to reach USD 22.39 billion by 2033, up from USD 11.39 billion in 2023. This growth is fueled by rapid industrialization, government initiatives promoting smart manufacturing, and increasing investments in infrastructure development. Countries such as China, India, and Japan are at the forefront of this expansion, investing heavily in digital transformation and automation technologies.North America Operational Technology Market Report:

North America is projected to lead the Operational Technology market with an estimated market size of USD 48.68 billion by 2033, significantly increasing from USD 24.77 billion in 2023. The region's robust technological infrastructure and the early adoption of automation technologies across various industries contribute to this growth. The ongoing expansion of IIoT investments is also noteworthy, as organizations upgrade their operational systems.South America Operational Technology Market Report:

In South America, the Operational Technology market is set to grow from USD 3.20 billion in 2023 to USD 6.28 billion by 2033. The growth is primarily driven by increasing demand for improved industrial processes and the adoption of new technologies to enhance productivity and operational efficiency in key sectors such as mining and energy.Middle East & Africa Operational Technology Market Report:

The Middle East and Africa region’s Operational Technology market is expected to grow from USD 6.88 billion in 2023 to USD 13.52 billion by 2033. This growth is driven by rising investments in smart cities, oil and gas sectors, and increasing adoption of technological solutions for enhanced operational efficiency amid economic diversification trends.Tell us your focus area and get a customized research report.

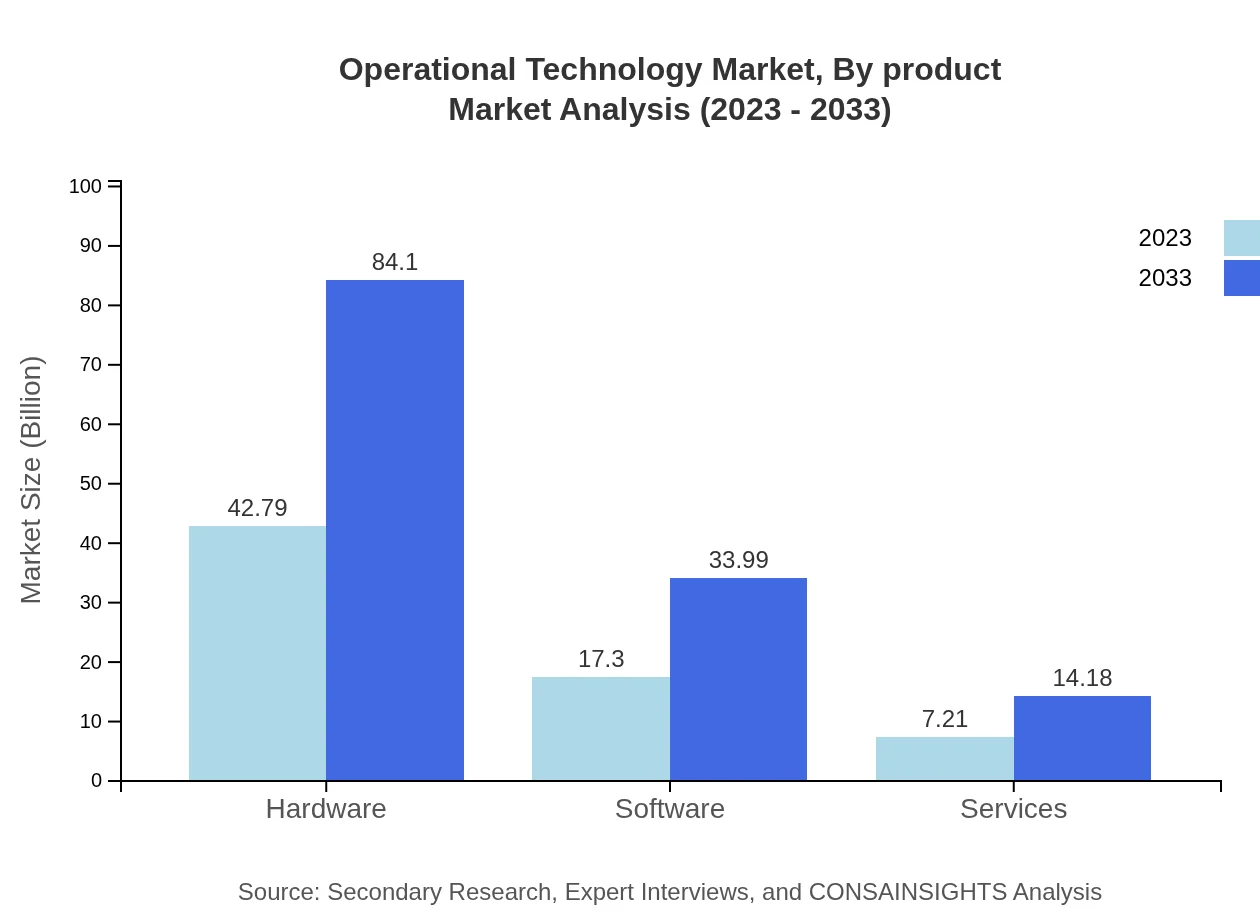

Operational Technology Market Analysis By Product

The Operational Technology market is divided into hardware, software, and services. Hardware, which includes components such as sensors and controllers, accounted for a significant market size of USD 42.79 billion in 2023, expected to reach USD 84.10 billion by 2033. Software encompasses analytics and monitoring applications, growing from USD 17.30 billion to USD 33.99 billion within the same period. Services, which include system integration and maintenance, are anticipated to increase from USD 7.21 billion to USD 14.18 billion. This diversification across segments illustrates the multi-faceted nature of OT solutions.

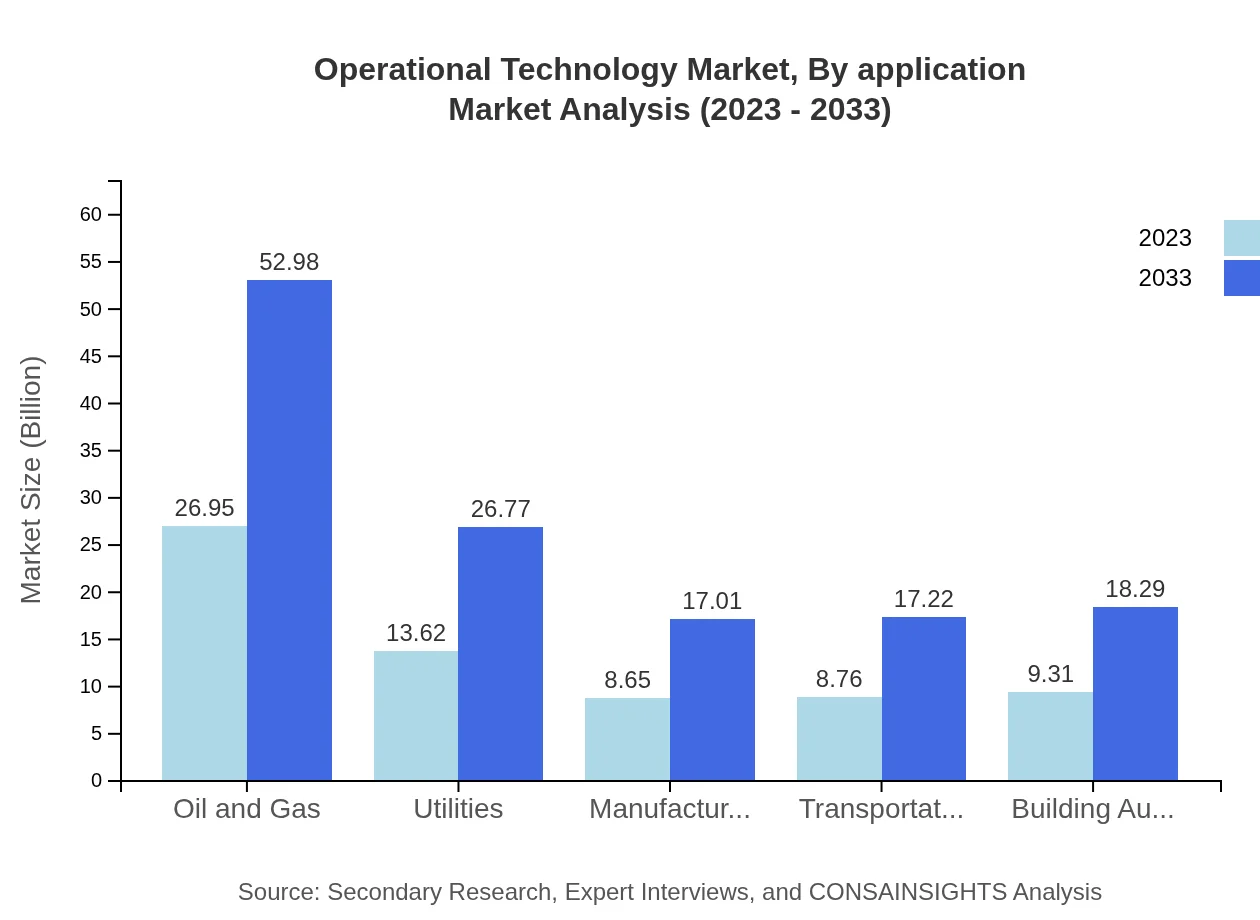

Operational Technology Market Analysis By Application

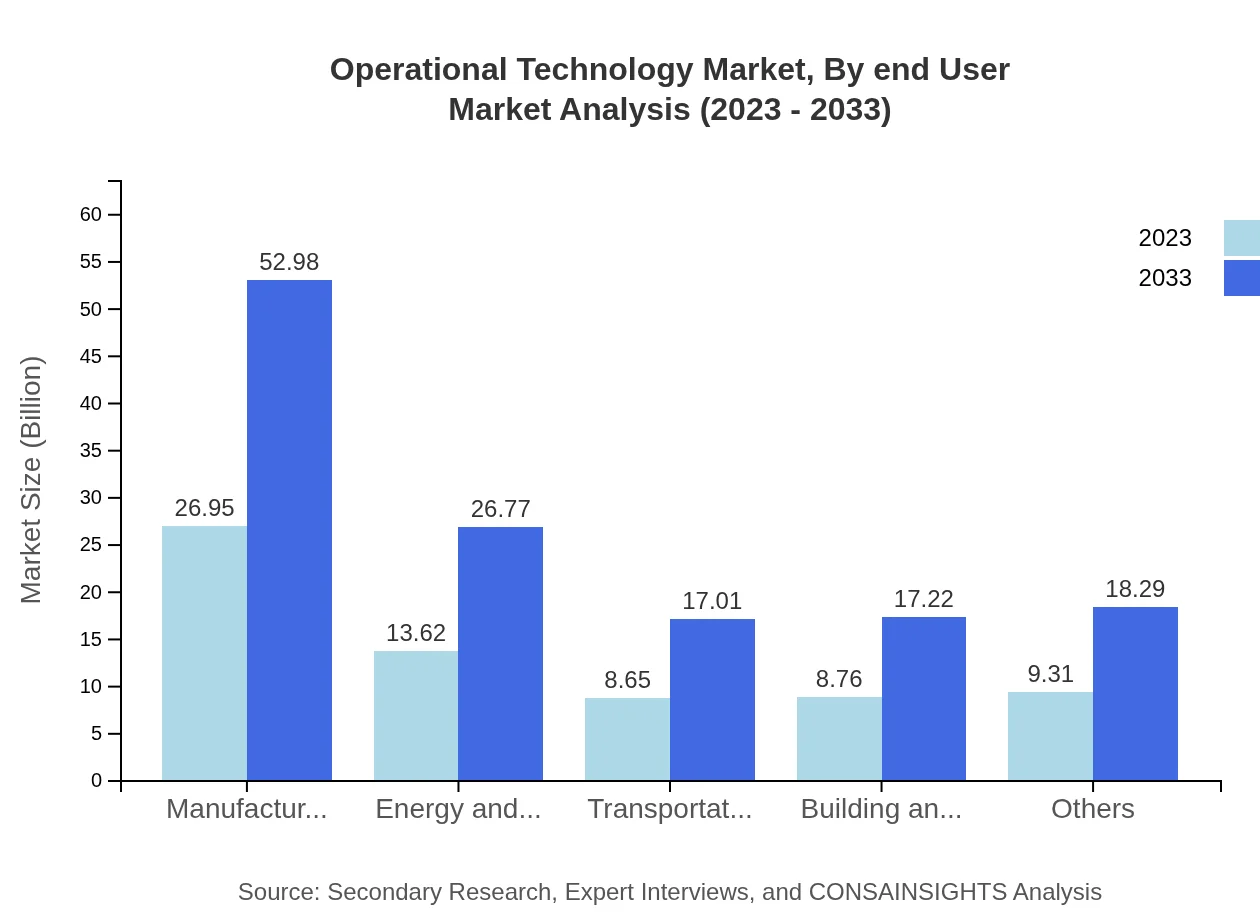

Within the OT market, applications are segmented into manufacturing, energy and utilities, transportation, building automation, and more. Manufacturing applications dominate with a market share of 40.05%, reflecting the significant reliance on automation technologies in production lines, totaling USD 26.95 billion in 2023. Energy and utilities also hold a considerable share, reflecting the global shift towards sustainable energy solutions, with a market size of USD 13.62 billion.

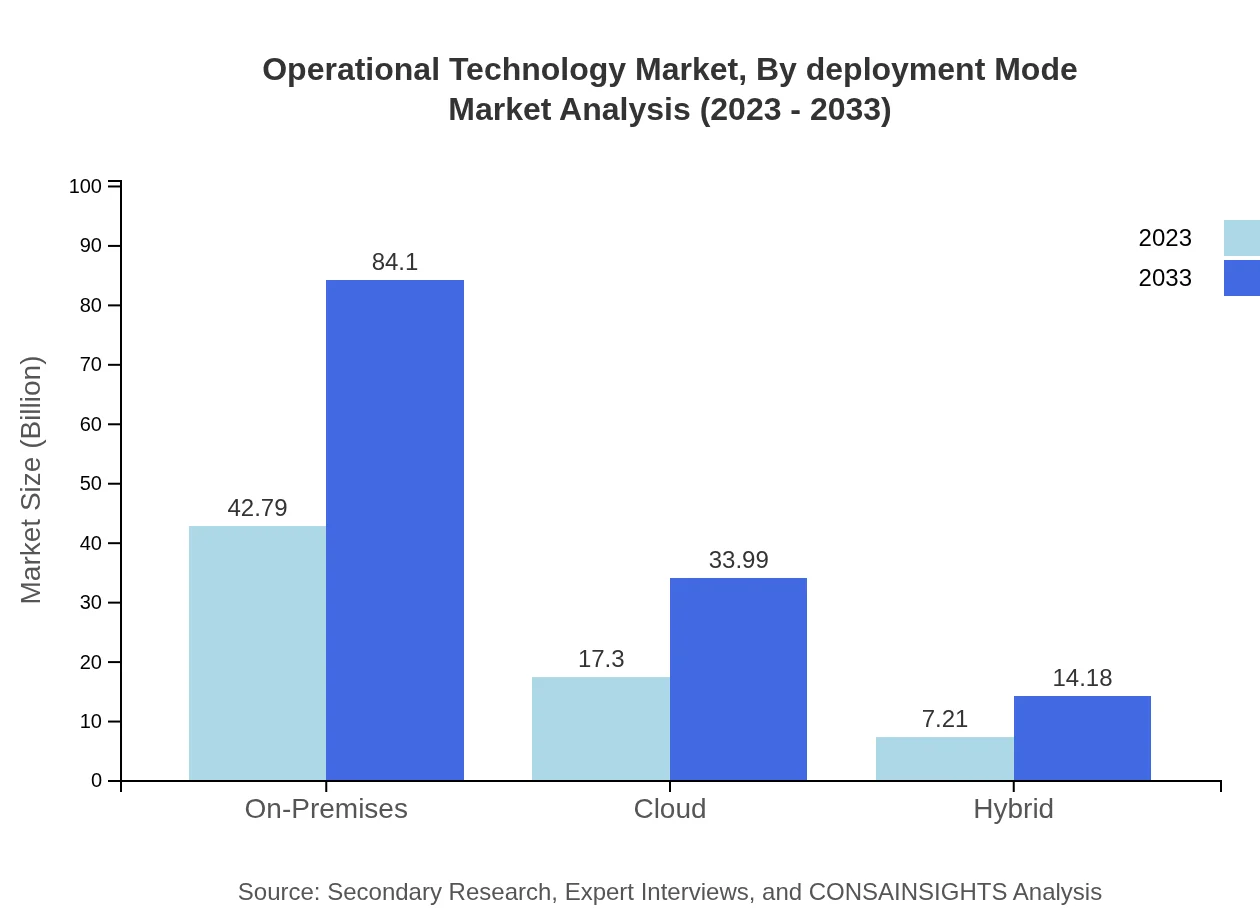

Operational Technology Market Analysis By Deployment Mode

The deployment modes in the Operational Technology market are categorized into on-premises, cloud, and hybrid solutions. The on-premises segment leads the market, with a size of USD 42.79 billion in 2023, poised for expansion to USD 84.10 billion by 2033. The growing adoption of cloud technologies offers flexibility, reflected in growth from USD 17.30 billion to USD 33.99 billion, while hybrid models serve as a bridge, increasing from USD 7.21 billion to USD 14.18 billion.

Operational Technology Market Analysis By End User

End-user industry segmentation highlights critical sectors, including manufacturing, energy, transportation, and building automation. Manufacturing as an end-user industry commands a market share of 40.05%, indicative of extensive automation needs. The energy sector, representing a shift towards sustainable practices, is crucial as well, reflecting an industry-forward approach in OT investments.

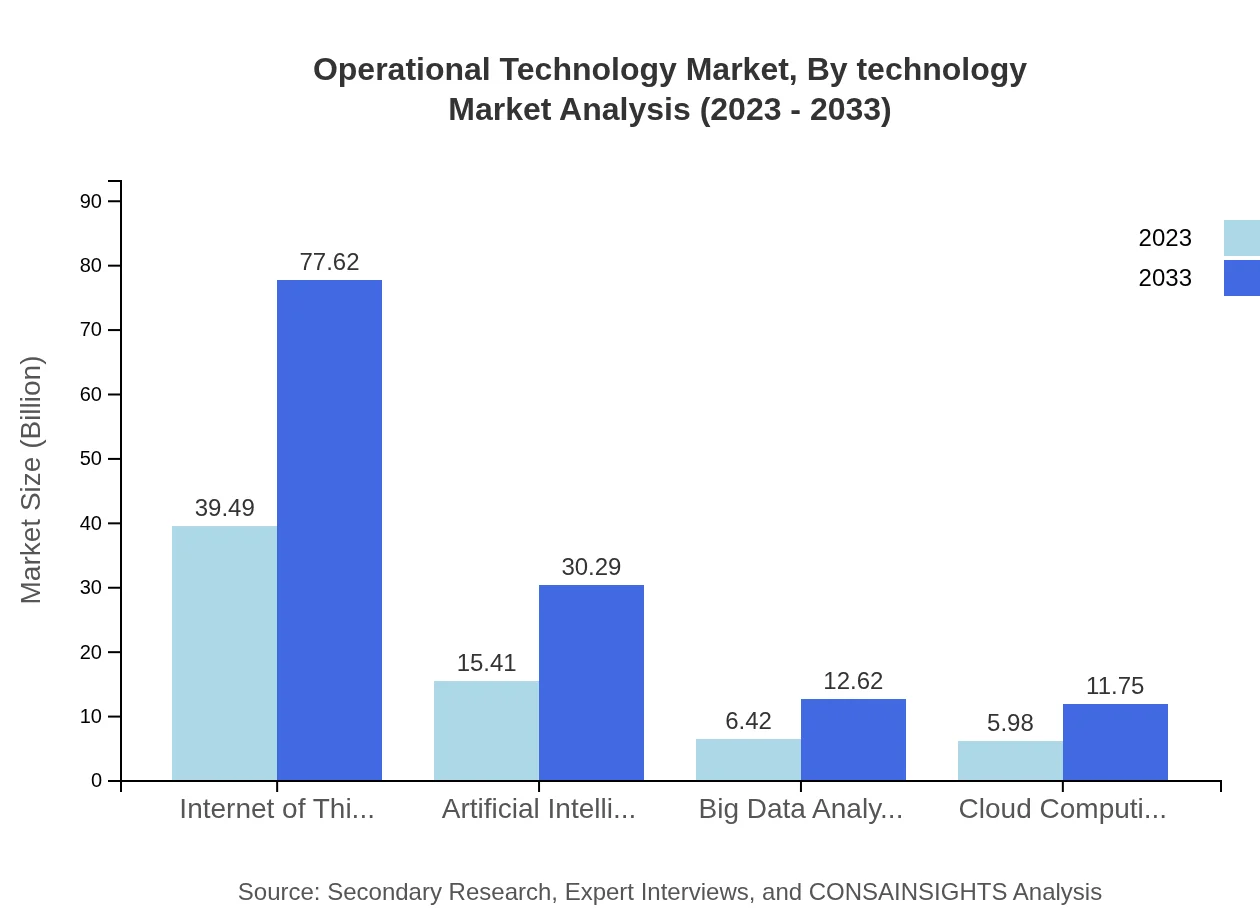

Operational Technology Market Analysis By Technology

Technological segmentation identifies critical components such as IoT, AI, big data analytics, and cloud computing. IoT technologies dominate the market, projected to grow from USD 39.49 billion in 2023 to USD 77.62 billion by 2033, while AI technologies are expected to expand from USD 15.41 billion to USD 30.29 billion. This demonstrates the drive towards digital transformation and data-driven decision-making in operational technology.

Operational Technology Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Operational Technology Industry

Siemens AG:

Siemens AG is a global leader in automation and digitalization in manufacturing and the building industries, offering comprehensive solutions for optimizing the operation of factories and infrastructure.Rockwell Automation, Inc.:

Rockwell Automation provides advanced industrial automation and information technology, helping manufacturers to enhance productivity, efficiency, and sustainability through innovative and integrated solutions.Honeywell International Inc.:

Honeywell specializes in aerospace products, building technologies, performance materials, and safety and productivity solutions, focusing on improving operational efficiency and safety across industries.General Electric Company:

GE delivers digital industrial solutions that improve efficiency and productivity in the operations of energy, transportation, and advanced manufacturing sectors.ABB Ltd.:

ABB provides electrification and automation solutions that enable industries to increase productivity while reducing environmental impact, playing a pivotal role in advancing smart technologies.We're grateful to work with incredible clients.

FAQs

What is the market size of operational Technology?

The operational technology market is currently valued at approximately $67.3 billion, with a projected CAGR of 6.8% from 2023 to 2033. This dynamic growth reflects increasing automation in various sectors.

What are the key market players or companies in this operational Technology industry?

Key players include Siemens, Schneider Electric, ABB, Rockwell Automation, and Honeywell. These companies lead the industry in developing innovative operational technology solutions, focusing on enhancing efficiency and safety.

What are the primary factors driving the growth in the operational technology industry?

Growth is driven by advancements in IoT technology, rising demand for automation, the need for improved operational efficiency, and heightened security measures in industrial environments. Additionally, regulatory compliance significantly fuels this market.

Which region is the fastest Growing in the operational technology?

North America is the fastest-growing region in operational technology, projected to grow from $24.77 billion in 2023 to $48.68 billion in 2033. This growth is driven by high adoption rates of advanced technologies across industries.

Does ConsaInsights provide customized market report data for the operational technology industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the operational technology sector. Clients can request detailed insights based on their requirements, ensuring relevant and actionable data.

What deliverables can I expect from this operational technology market research project?

Deliverables include comprehensive market insights, segmented data analysis, regional growth forecasts, competitive landscape evaluations, and strategic recommendations. These insights empower stakeholders to make informed decisions.

What are the market trends of operational technology?

Current trends include the rising integration of AI and machine learning, increased focus on cybersecurity, and the expansion of digital twin technologies. Additionally, industries are moving towards cloud-based solutions and smart manufacturing practices.