Ophthalmic Devices Market Report

Published Date: 31 January 2026 | Report Code: ophthalmic-devices

Ophthalmic Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the ophthalmic devices market, covering insights on market size, CAGR, segmentation, regional insights, technology trends, and forecasts from 2023 to 2033.

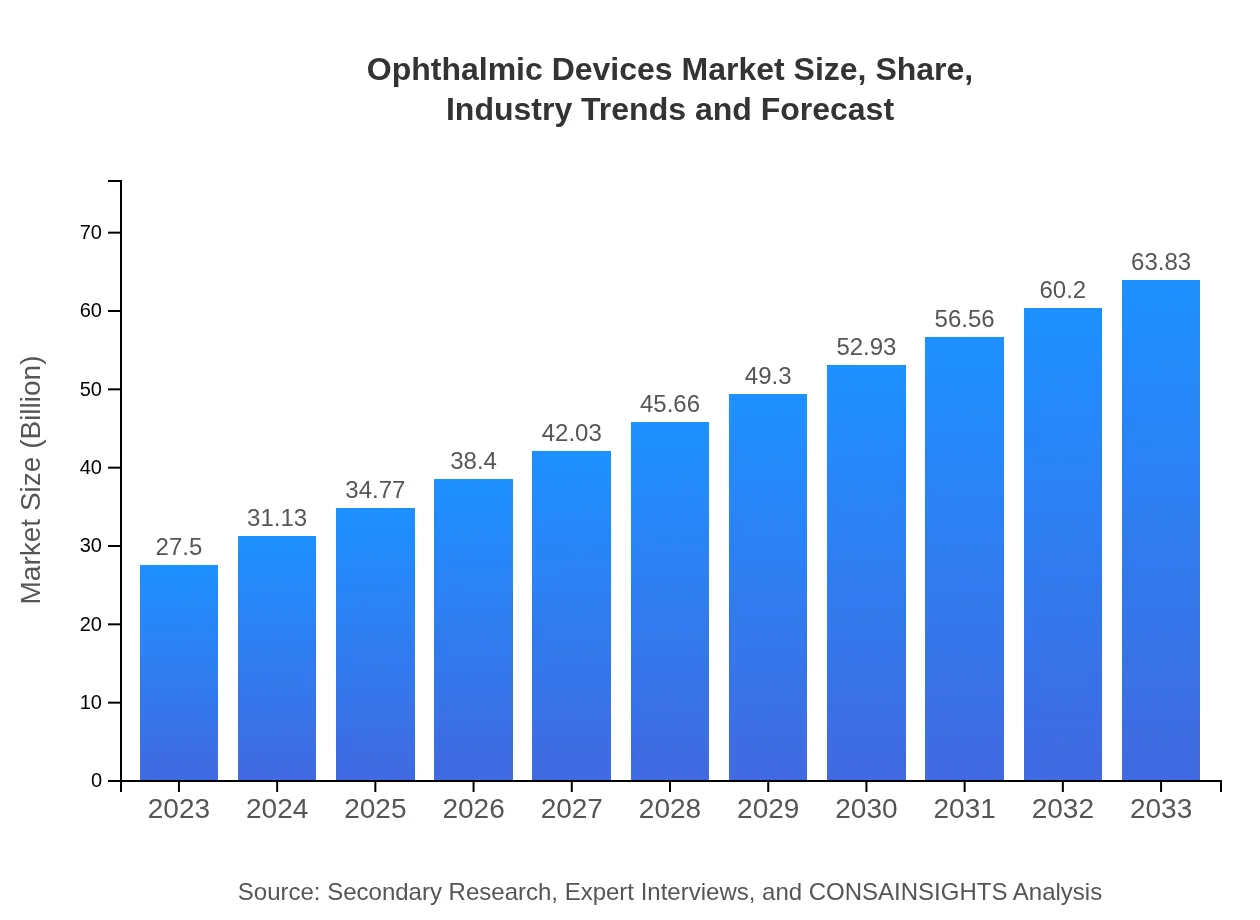

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $27.50 Billion |

| CAGR (2023-2033) | 8.5% |

| 2033 Market Size | $63.83 Billion |

| Top Companies | Johnson & Johnson Vision, Ziemer Ophthalmic Systems AG, Alcon Inc., Bausch + Lomb, Carl Zeiss AG |

| Last Modified Date | 31 January 2026 |

Ophthalmic Devices Market Overview

Customize Ophthalmic Devices Market Report market research report

- ✔ Get in-depth analysis of Ophthalmic Devices market size, growth, and forecasts.

- ✔ Understand Ophthalmic Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ophthalmic Devices

What is the Market Size & CAGR of Ophthalmic Devices market in 2023?

Ophthalmic Devices Industry Analysis

Ophthalmic Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ophthalmic Devices Market Analysis Report by Region

Europe Ophthalmic Devices Market Report:

The European ophthalmic devices market is valued at $7.34 billion in 2023, growing to $17.03 billion by 2033. The region benefits from robust healthcare systems and a growing population aged over 60, which increases the demand for ophthalmic care.Asia Pacific Ophthalmic Devices Market Report:

The Asia Pacific region is experiencing substantial growth, with a market value of $5.32 billion in 2023, expected to reach $12.35 billion by 2033. Rising healthcare infrastructure and increasing investments in eye care technologies fuel this growth, alongside a large population at risk for eye-related conditions.North America Ophthalmic Devices Market Report:

North America occupies a significant share of the market with a value of $10.48 billion in 2023, anticipated to grow to $24.33 billion by 2033. This growth is mainly attributed to the high prevalence of eye disorders, advanced medical infrastructure, and favorable reimbursement policies.South America Ophthalmic Devices Market Report:

In South America, the ophthalmic devices market is valued at $2.27 billion in 2023, with projections of $5.26 billion by 2033. Market growth is driven by improving healthcare facilities and increased awareness about eye health in countries like Brazil and Argentina.Middle East & Africa Ophthalmic Devices Market Report:

The Middle East and Africa market is projected to grow from $2.09 billion in 2023 to $4.86 billion in 2033. Growth in this region is supported by improving healthcare access and increasing government initiatives to enhance eye care standards.Tell us your focus area and get a customized research report.

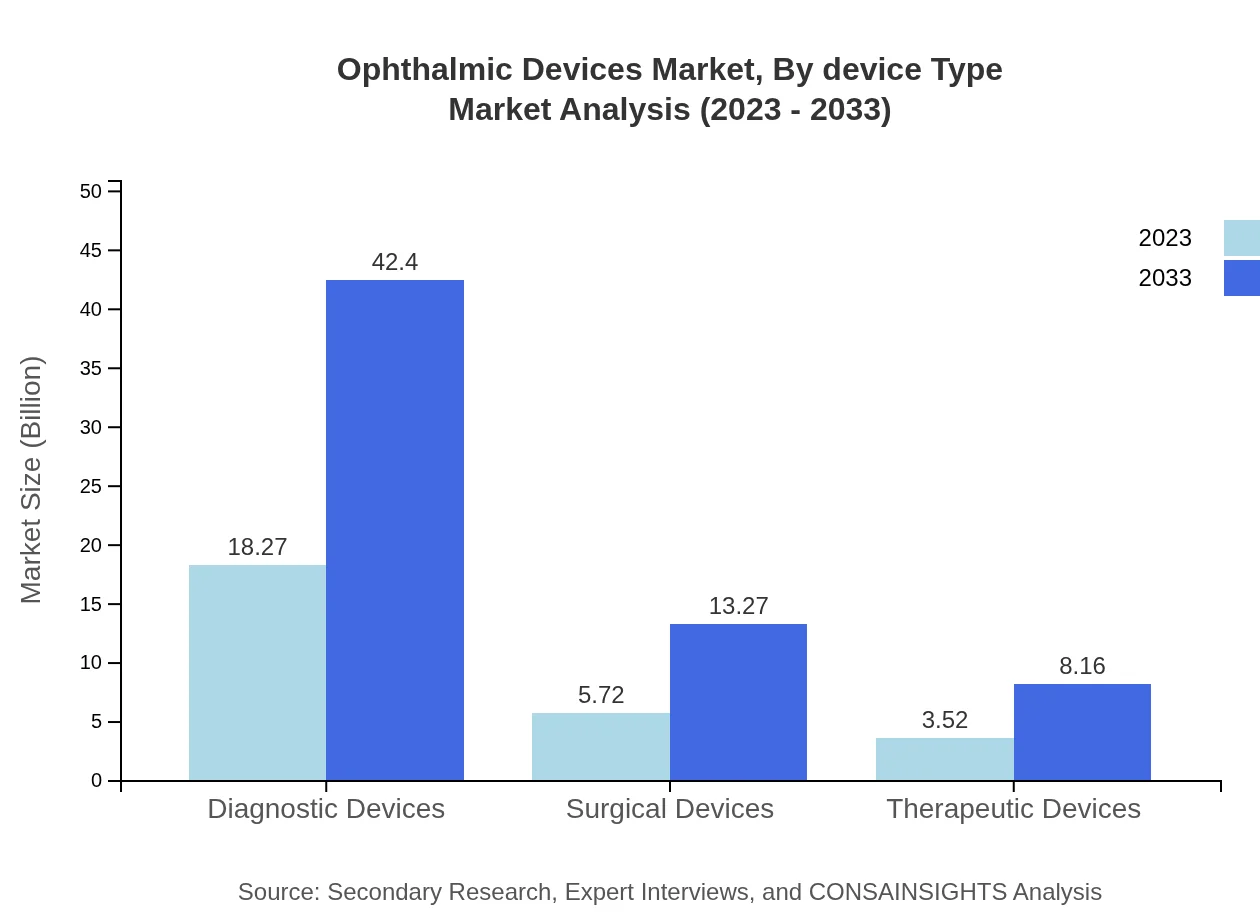

Ophthalmic Devices Market Analysis By Device Type

By device type, hospitals dominate the market with a size of $18.27 billion in 2023, growing to $42.40 billion by 2033, holding a share of 66.42% throughout this period. Eye clinics follow, with a projected market size increase from $5.72 billion in 2023 to $13.27 billion by 2033, capturing about 20.79% of the market. Home care devices and their emerging importance are also noted as a growing segment.

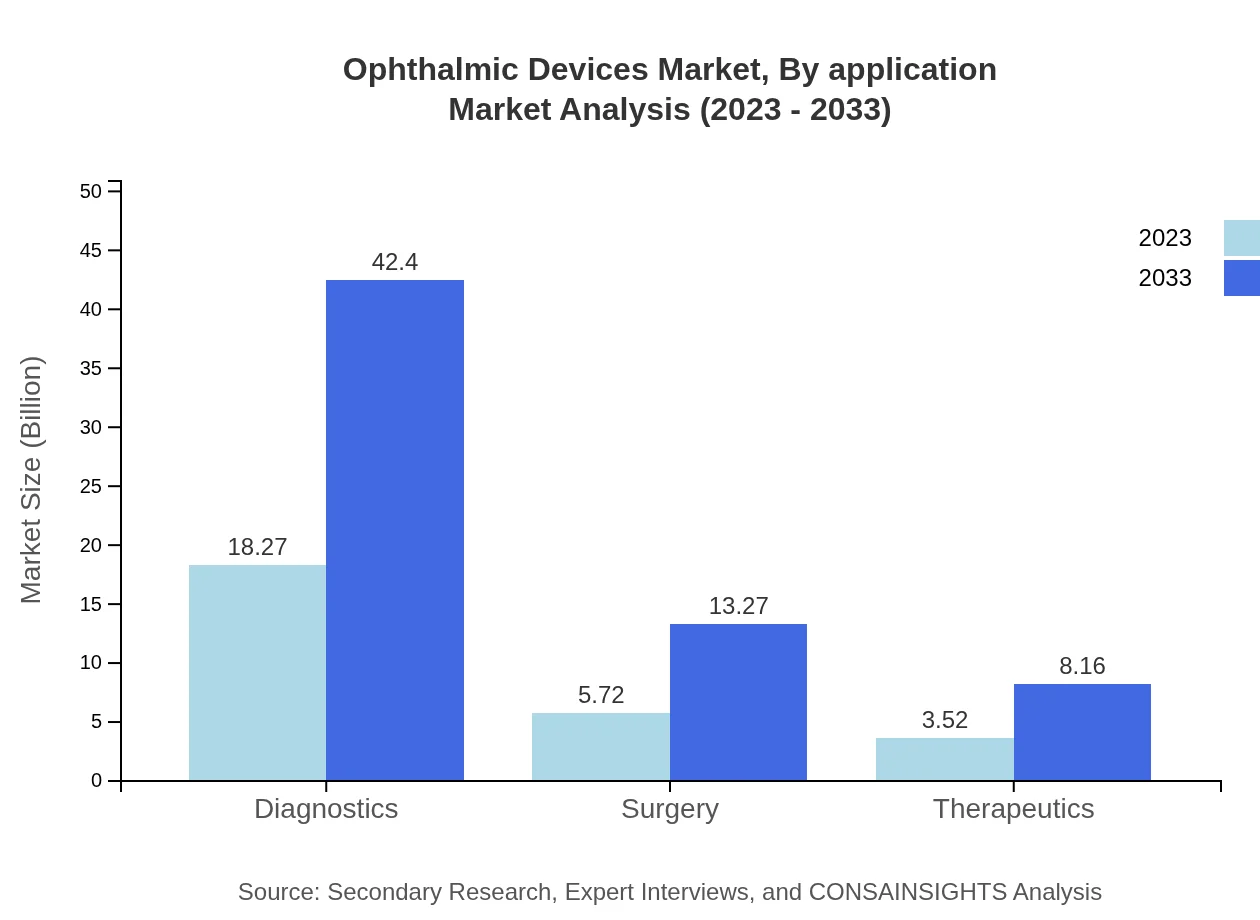

Ophthalmic Devices Market Analysis By Application

The applications of ophthalmic devices span diagnostics, therapeutics, and surgical procedures. Diagnostics lead the segment, showing strong growth as the need for early detection of eye diseases increases. Therapeutic applications are projected to witness significant advancements due to new treatment modalities. Surgical applications are also expanding, driven by technological innovations.

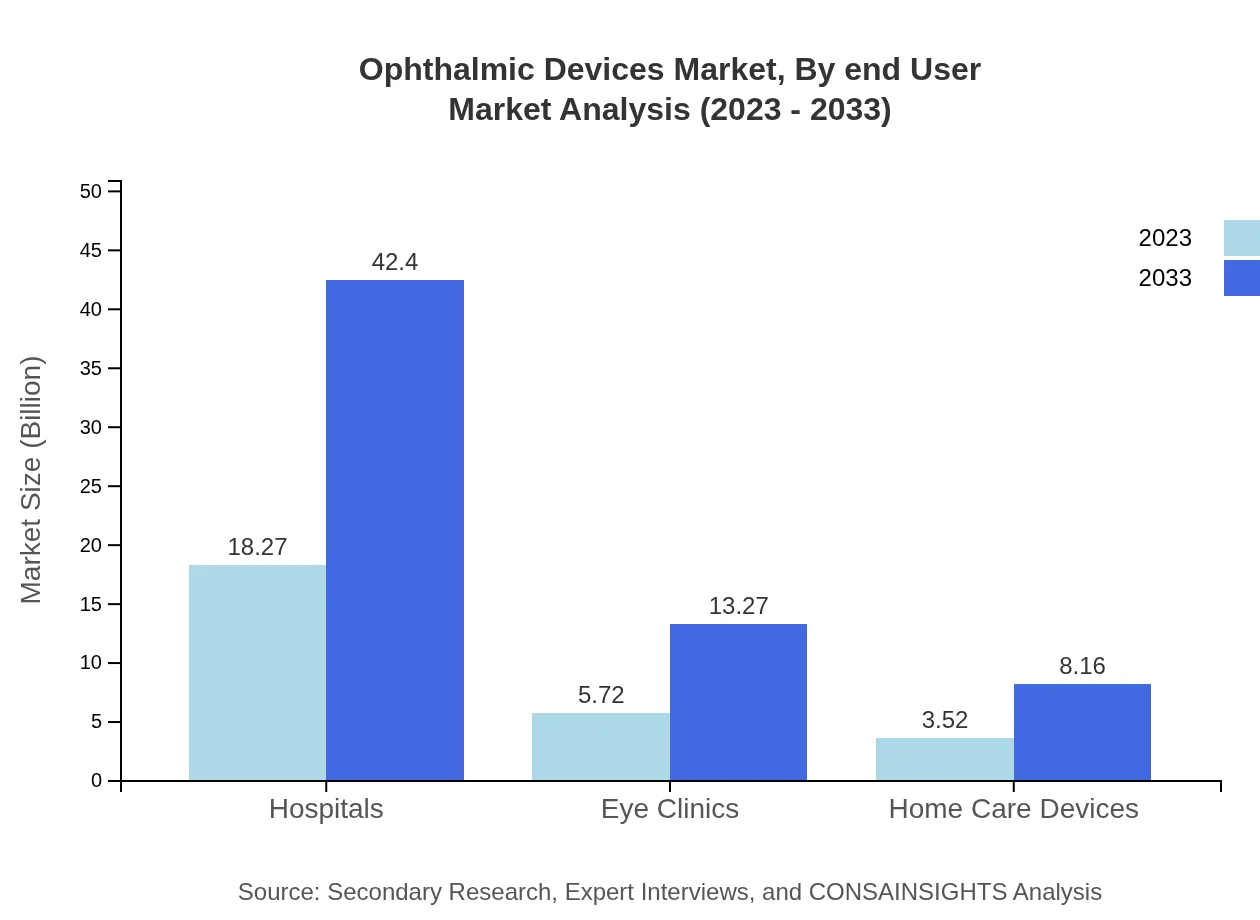

Ophthalmic Devices Market Analysis By End User

End-users include hospitals, eye clinics, and home care settings. Hospitals are the primary end-users given their robust patient load and comprehensive care facilities. Eye clinics and home care settings are emerging as significant contributors, reflecting a shift towards outpatient and remote care provisions.

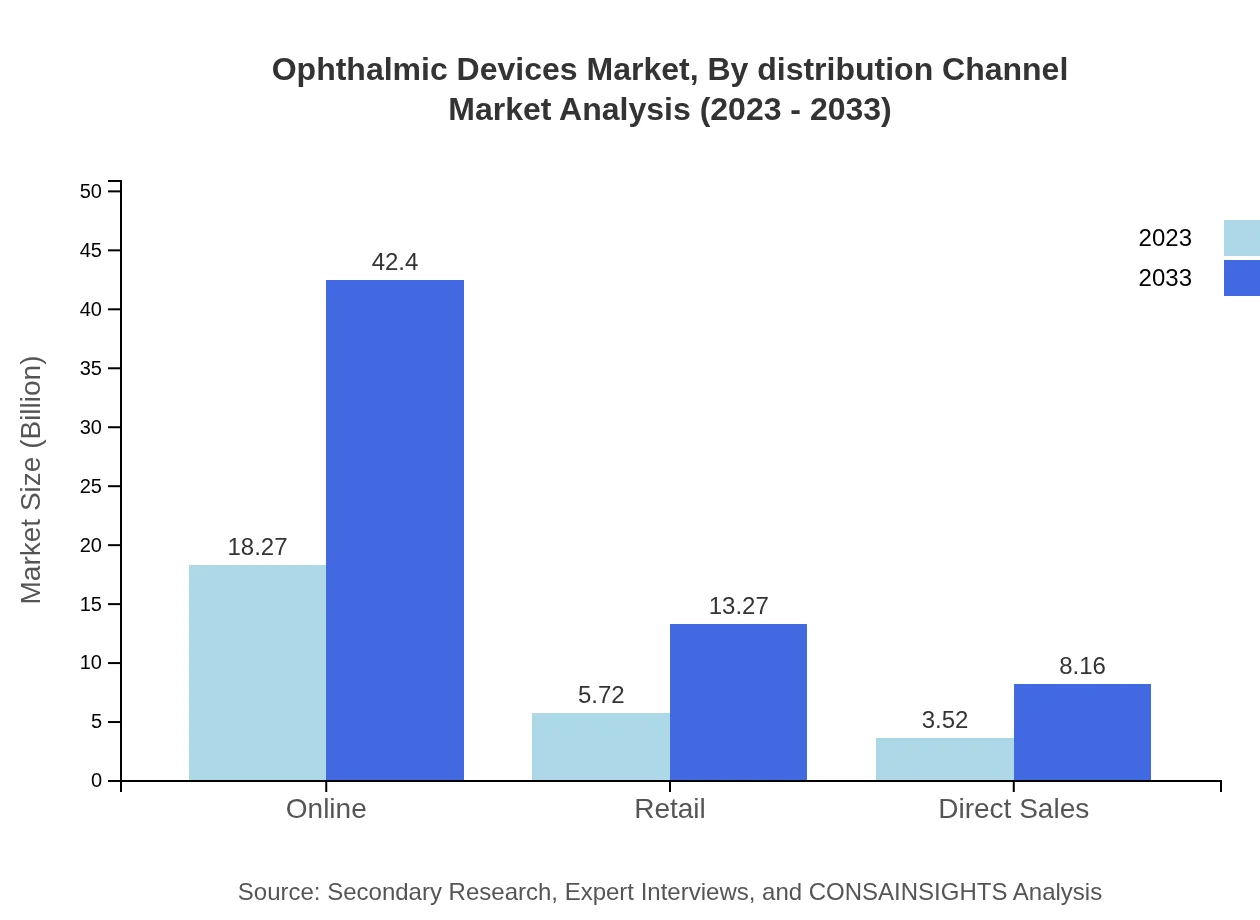

Ophthalmic Devices Market Analysis By Distribution Channel

The market distribution channels include online retail, direct sales, and retail pharmacies. Online channels are gaining traction due to convenience, while direct sales remain vital for complex devices requiring demonstration and expert consultation. Retail pharmacies are crucial for consumer engagement and accessibility.

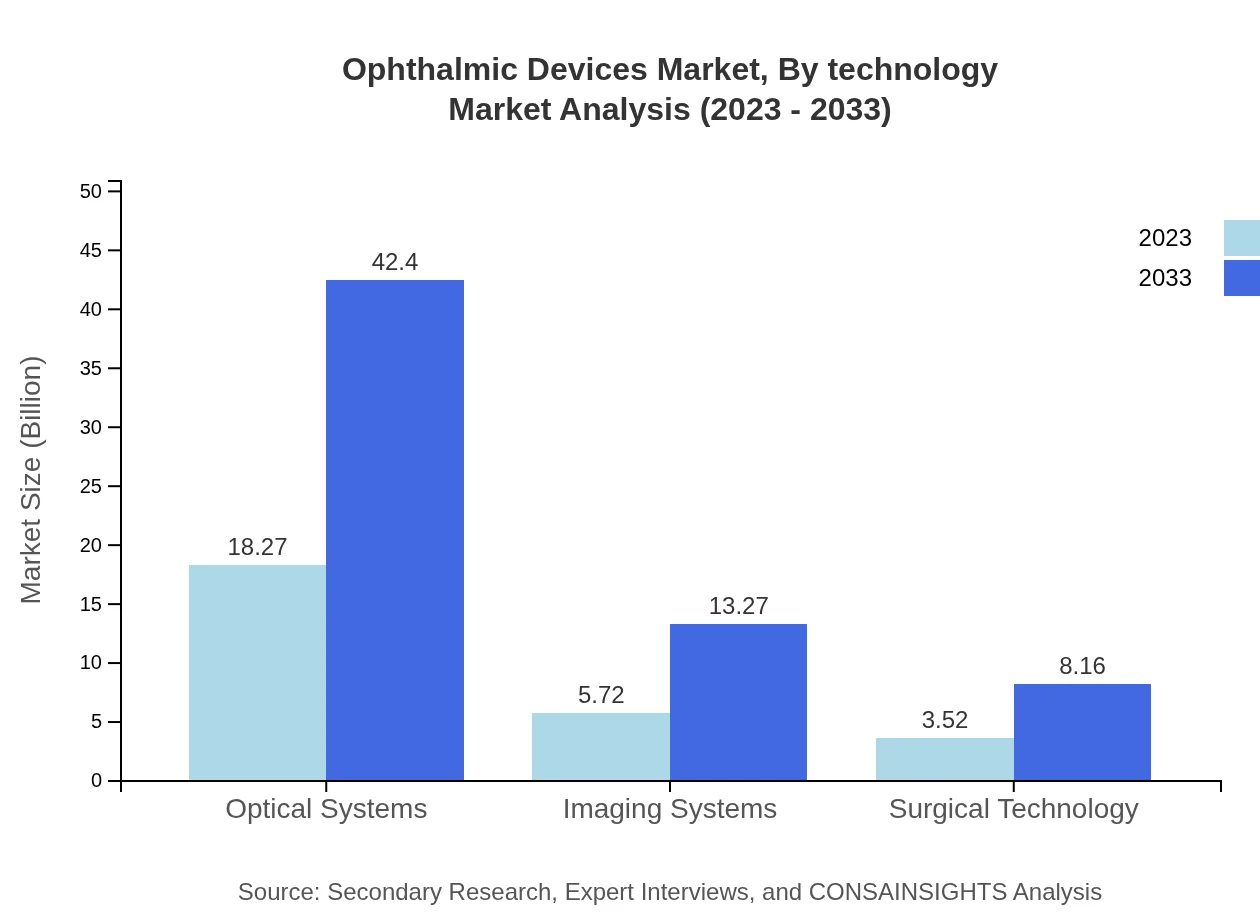

Ophthalmic Devices Market Analysis By Technology

The technological landscape includes advancements like digital imaging, telemedicine, and smart diagnostic tools. Technologies that integrate AI and machine learning are at the forefront, enhancing diagnostic accuracy and treatment personalization.

Ophthalmic Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ophthalmic Devices Industry

Johnson & Johnson Vision:

A market leader known for its innovative contact lenses and surgical products that enhance vision across various demographics.Ziemer Ophthalmic Systems AG:

Specializes in advanced laser technology for cataract surgery and other eye treatments, contributing to minimally invasive surgery innovations.Alcon Inc.:

Offers a wide range of eye care products, including surgical, therapeutic, and diagnostic solutions, with a significant market presence globally.Bausch + Lomb:

Focuses on producing high-quality therapeutic, diagnostic, and surgical devices, with a strong emphasis on consumer eye health.Carl Zeiss AG:

Known for its high precision ophthalmic systems and instruments, Zeiss is integral in eye care advancements and surgical innovations.We're grateful to work with incredible clients.

FAQs

What is the market size of ophthalmic Devices?

The ophthalmic devices market is projected to reach $27.5 billion by 2033, growing at a CAGR of 8.5%. The market is expected to exhibit substantial growth due to advancements in technology and rising demand for vision correction devices.

What are the key market players or companies in this ophthalmic Devices industry?

Key players in the ophthalmic devices market include Johnson & Johnson, Alcon, Novartis AG, Bausch Health Companies, and CooperVision. These companies are known for their innovative solutions and technologies in eye care.

What are the primary factors driving the growth in the ophthalmic Devices industry?

The growth of the ophthalmic devices industry is primarily driven by increasing prevalence of eye diseases, aging population, technological advancements, and rising awareness of eye health. Enhanced healthcare spending also contributes significantly to this growth.

Which region is the fastest Growing in the ophthalmic Devices?

The fastest-growing region in the ophthalmic devices market is North America, expected to reach $24.33 billion by 2033 from $10.48 billion in 2023. This is followed by Europe and Asia Pacific, both showing significant market expansion.

Does ConsaInsights provide customized market report data for the ophthalmic Devices industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs and interests of clients in the ophthalmic devices industry, addressing unique market dynamics and trends.

What deliverables can I expect from this ophthalmic Devices market research project?

Deliverables include comprehensive market reports, analytical insights, data segmentation, competitive landscape analysis, and forecasts. Clients will also receive tailored recommendations based on market trends and dynamics.

What are the market trends of ophthalmic Devices?

Current trends in the ophthalmic devices market include increasing adoption of minimally invasive surgical techniques, growth in telemedicine, advancements in diagnostic devices, and a rise in home care device utilization for eye care.