Ophthalmic Drugs Market Report

Published Date: 31 January 2026 | Report Code: ophthalmic-drugs

Ophthalmic Drugs Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Ophthalmic Drugs market from 2023 to 2033, including market size, trends, segmentation, and regional insights. It offers data-driven forecasts and identifies key players influencing the market landscape.

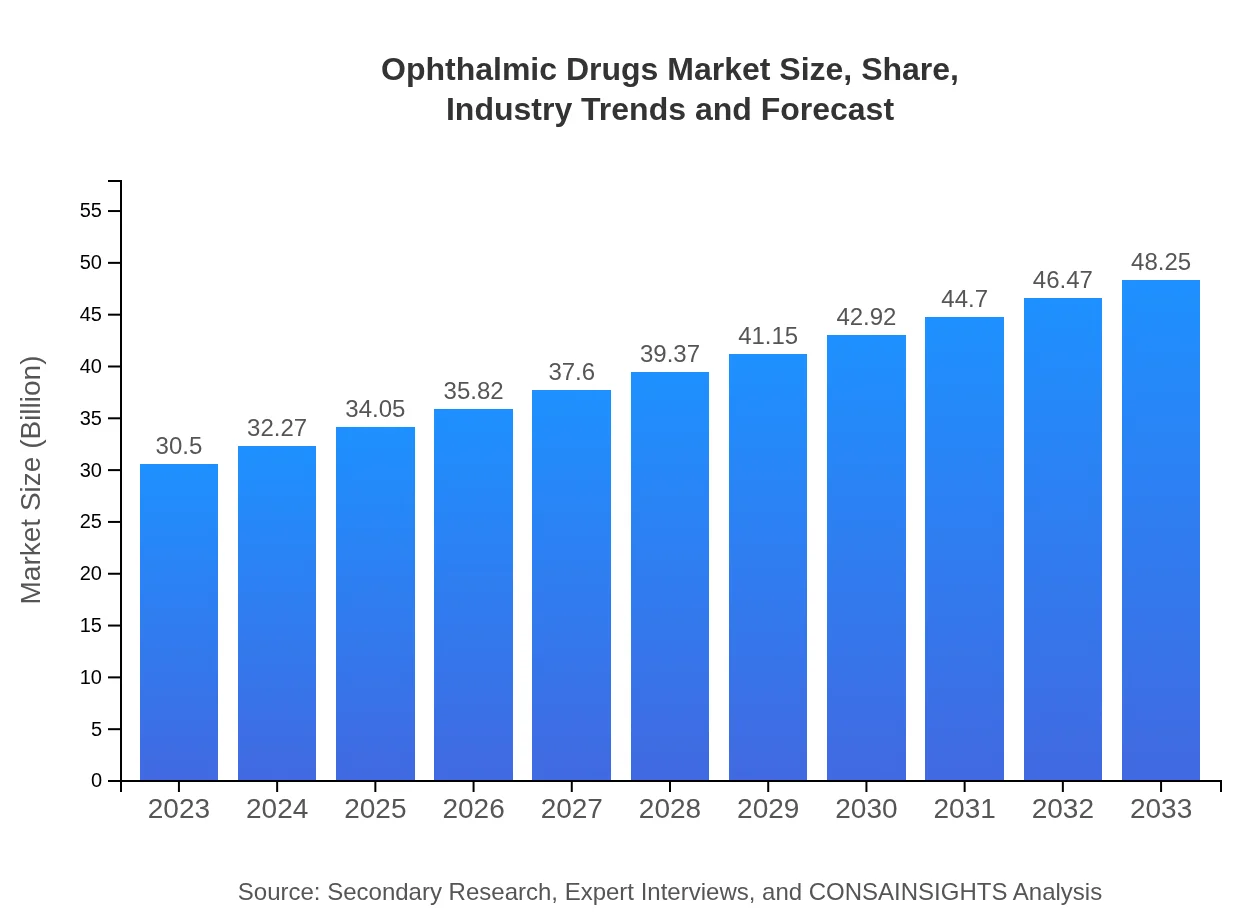

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $30.50 Billion |

| CAGR (2023-2033) | 4.6% |

| 2033 Market Size | $48.25 Billion |

| Top Companies | Novartis AG, Allergan plc, Regeneron Pharmaceuticals, Inc., Bausch Health Companies Inc., Santen Pharmaceutical Co., Ltd. |

| Last Modified Date | 31 January 2026 |

Ophthalmic Drugs Market Overview

Customize Ophthalmic Drugs Market Report market research report

- ✔ Get in-depth analysis of Ophthalmic Drugs market size, growth, and forecasts.

- ✔ Understand Ophthalmic Drugs's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ophthalmic Drugs

What is the Market Size & CAGR of Ophthalmic Drugs market in 2023?

Ophthalmic Drugs Industry Analysis

Ophthalmic Drugs Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ophthalmic Drugs Market Analysis Report by Region

Europe Ophthalmic Drugs Market Report:

The European ophthalmic drugs market is projected to grow from $8.30 billion in 2023 to $13.12 billion by 2033. Factors leading to this growth include high prevalence rates of eye diseases, improved accessibility to ophthalmic treatments, and supportive regulatory frameworks fostering drug approvals.Asia Pacific Ophthalmic Drugs Market Report:

In 2023, the Ophthalmic Drugs market in the Asia Pacific region is valued at $6.16 billion, projected to reach $9.74 billion by 2033. The region is characterized by a growing population, increasing awareness of eye health, and expanding healthcare infrastructure. With rising disposable incomes and a surge in ophthalmic surgeries, the market is expected to flourish.North America Ophthalmic Drugs Market Report:

North America dominates the ophthalmic drugs market, valued at $11.06 billion in 2023, expected to reach approximately $17.49 billion by 2033. This growth is driven by high healthcare expenditure, advanced healthcare facilities, and the presence of leading pharmaceutical companies invested in research and development.South America Ophthalmic Drugs Market Report:

The South American market for ophthalmic drugs is projected to grow from $3.03 billion in 2023 to $4.79 billion by 2033. The growth is attributed to an increase in healthcare initiatives targeting ophthalmic conditions and rising incidences of ocular diseases in the region.Middle East & Africa Ophthalmic Drugs Market Report:

In 2023, the Middle East and Africa's ophthalmic drugs market is valued at $1.96 billion, with expectations to reach $3.11 billion by 2033. The region's growth is driven by an increasing prevalence of ocular diseases, improving healthcare access, and investments in healthcare infrastructure.Tell us your focus area and get a customized research report.

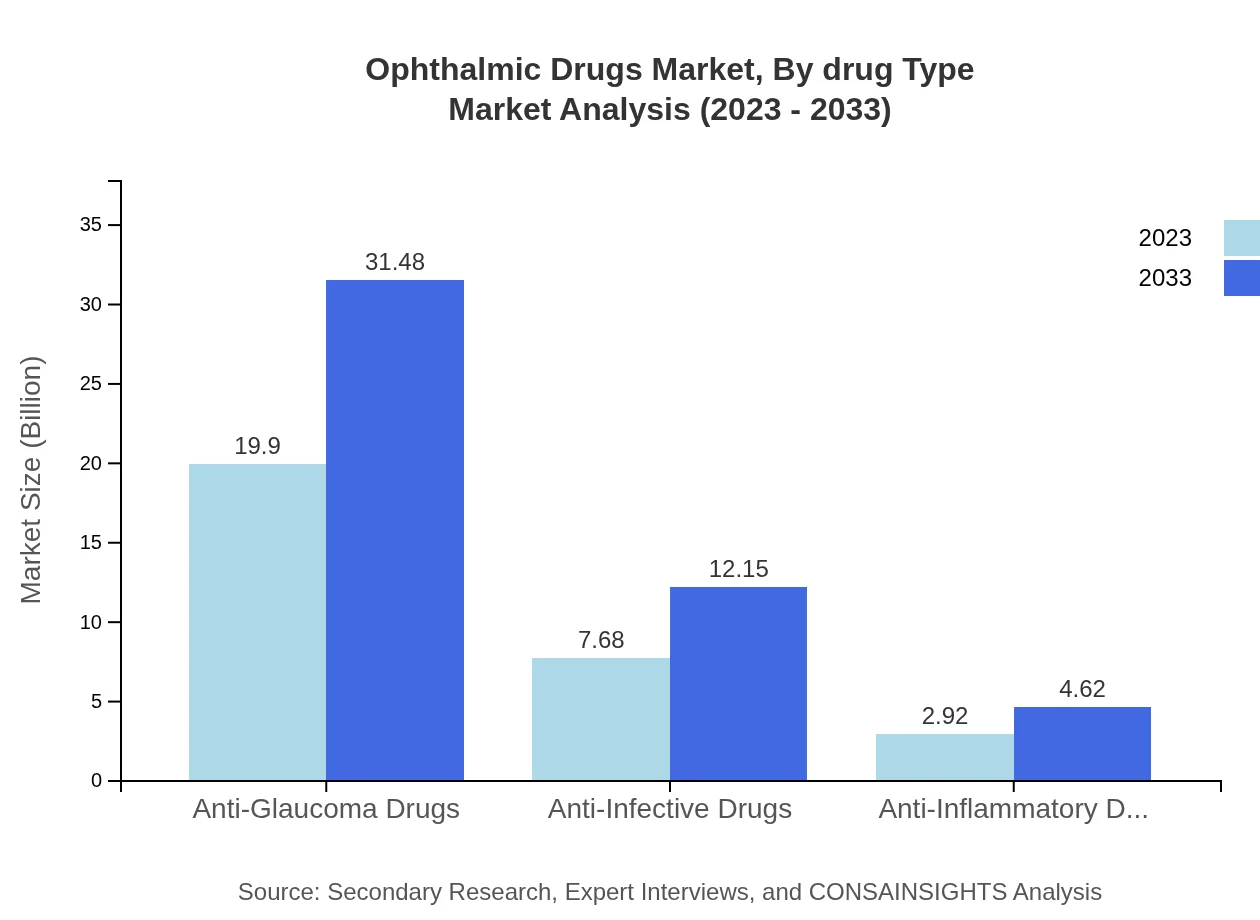

Ophthalmic Drugs Market Analysis By Drug Type

The market for anti-glaucoma drugs, estimated at $19.90 billion in 2023 and projected to reach $31.48 billion by 2033, constitutes a significant share of the ophthalmic drug industry. Anti-infective drugs follow with a market size of $7.68 billion in 2023, growing to $12.15 billion by 2033. Anti-inflammatory drugs, while smaller in market size at $2.92 billion in 2023, will also see growth, projected to reach $4.62 billion by 2033. Overall, these segments showcase the diversity within the ophthalmic drugs market, catering to critical therapeutic needs.

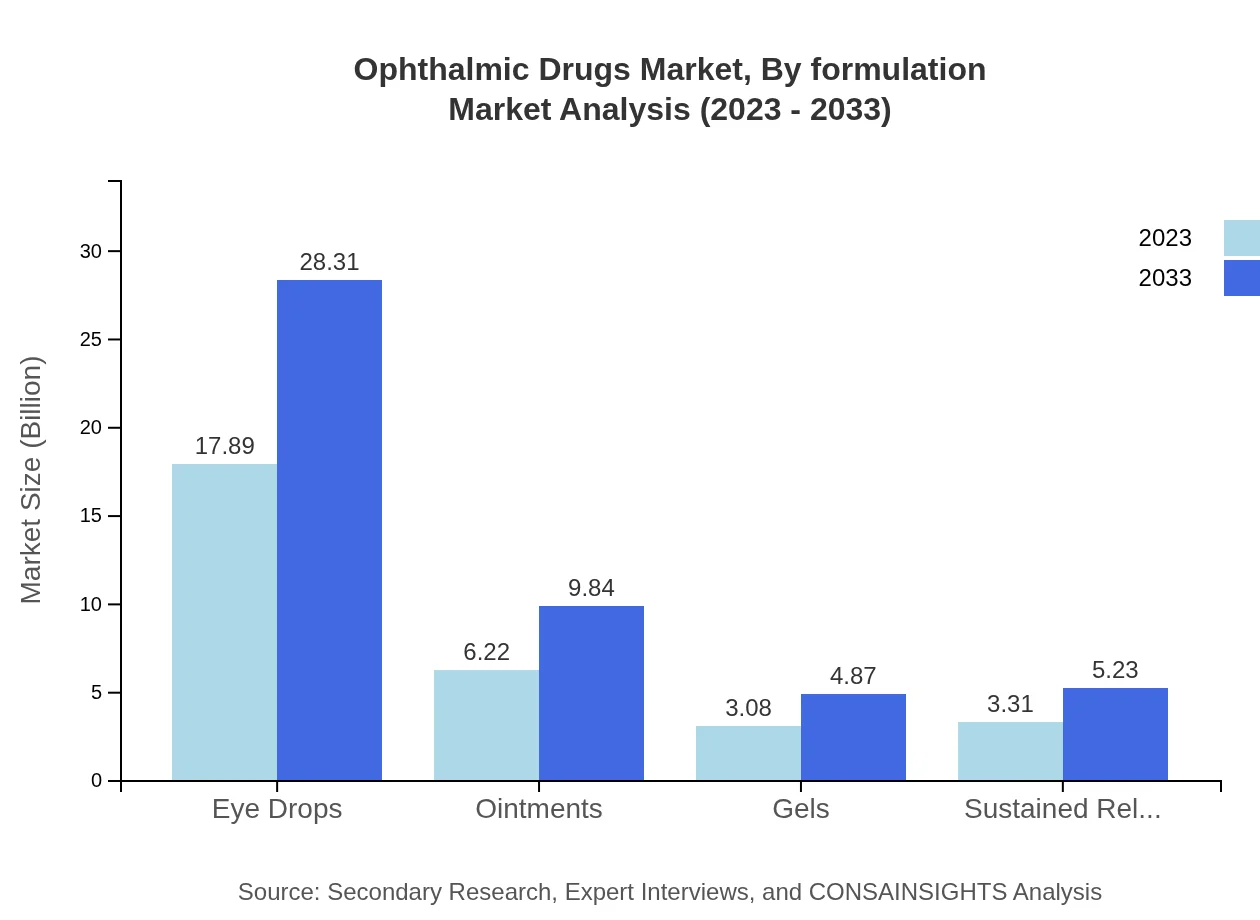

Ophthalmic Drugs Market Analysis By Formulation

The formulation segment is dominated by eye drops, constituting a significant portion of the market with a size of $17.89 billion in 2023, expected to rise to $28.31 billion by 2033. Other formulations include ointments and gels, valued at $6.22 billion and $3.08 billion respectively in 2023, both anticipated to see steady growth through 2033. Sustained release systems, although more niche, represent innovation in drug delivery that promises to enhance patient compliance and therapeutic outcomes.

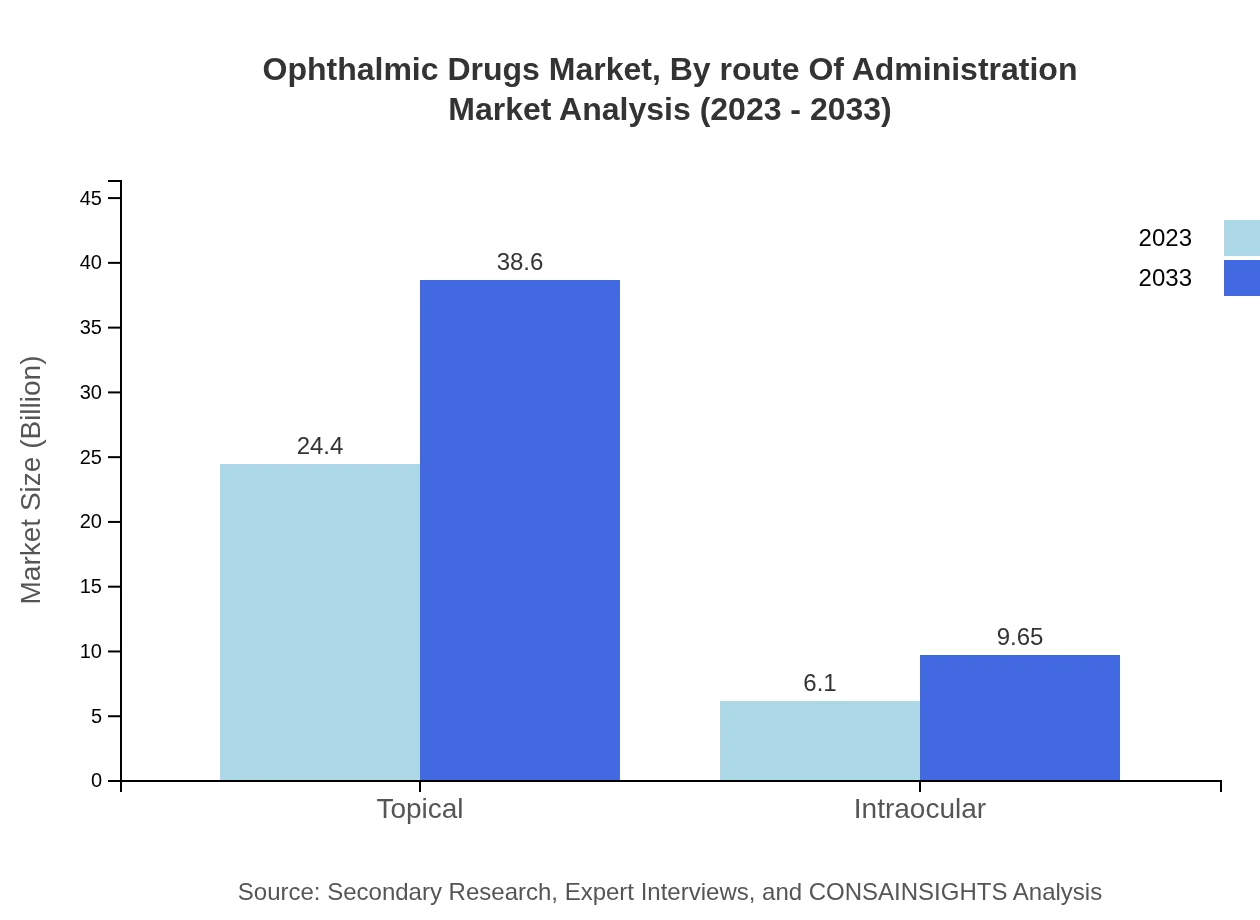

Ophthalmic Drugs Market Analysis By Route Of Administration

Topical delivery remains the predominant route of administration in the ophthalmic drugs market, accounting for a casual 80% share in 2023, while intraocular delivery holds a 20% share. With the growing complexity of ocular diseases requiring specialized treatments, both routes are essential for effective management of conditions, with topical solutions leading in usage due to their ease of application and patient preference.

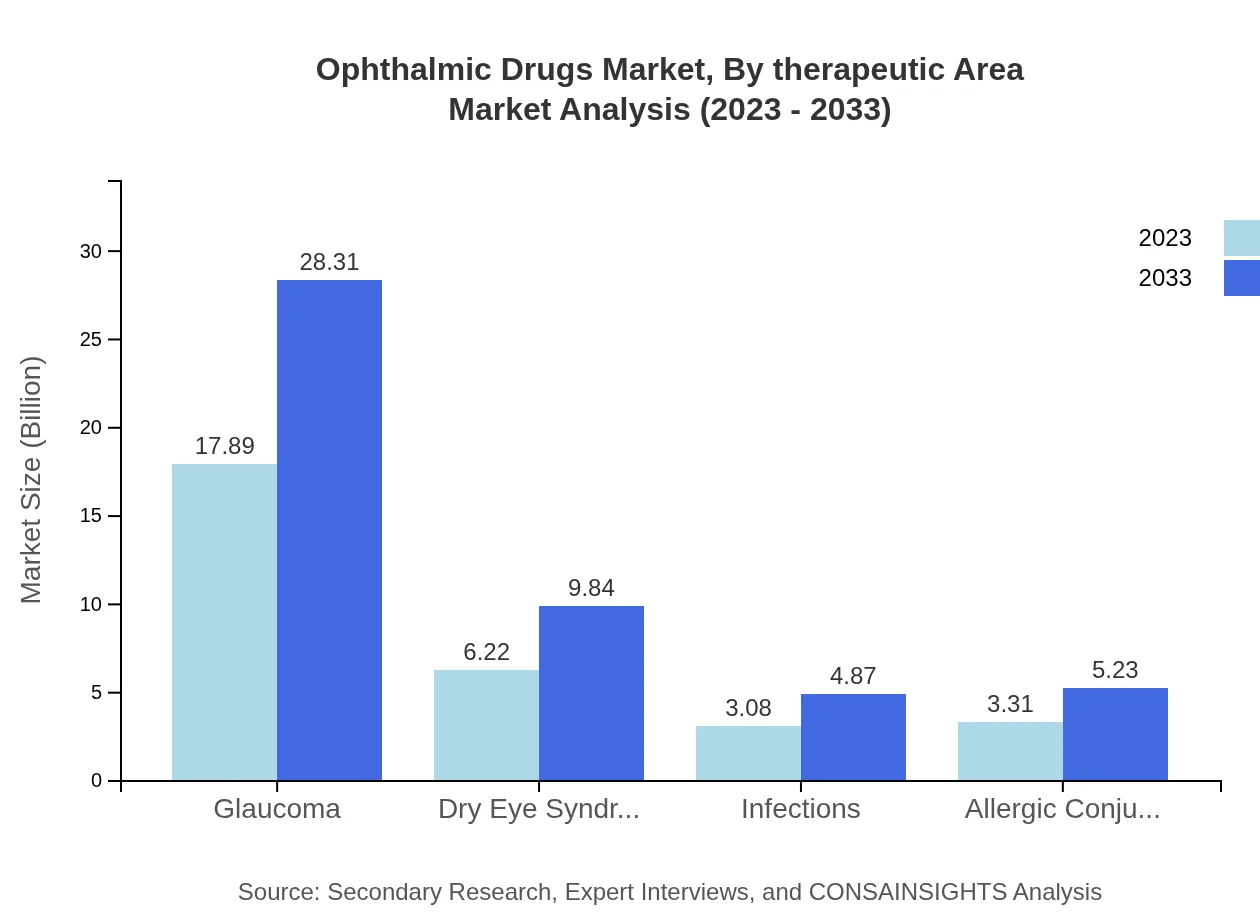

Ophthalmic Drugs Market Analysis By Therapeutic Area

Therapeutically, the ophthalmic drugs market is sharply focused on glaucoma treatment, which holds a significant market share of 58.67% in 2023, valued at $17.89 billion, and expected to grow to $28.31 billion by 2033. Other crucial areas include dry eye syndrome at 20.4% share, valued at $6.22 billion in 2023, and infections at a share of 10.09%. Each therapeutic area showcases unique needs, underscoring the importance of diverse drug offerings and targeted therapies.

Ophthalmic Drugs Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ophthalmic Drugs Industry

Novartis AG:

A leading player in the ophthalmic sector, Novartis focuses on innovative treatment solutions particularly in anti-glaucoma drugs and eye care therapeutics.Allergan plc:

Allergan is renowned for its eye care products, including anti-infective and anti-inflammatory drugs, significantly contributing to the ophthalmic drugs market.Regeneron Pharmaceuticals, Inc.:

A key innovator in retinal treatments, Regeneron specializes in advanced therapies for age-related macular degeneration and diabetic eye diseases.Bausch Health Companies Inc.:

Bausch Health offers a diverse range of ophthalmic products, significantly impacting the ocular health market through its extensive portfolio.Santen Pharmaceutical Co., Ltd.:

A notable player dedicated entirely to ophthalmic disease treatments, Santen is known for its broad spectrum of therapies addressing various eye conditions.We're grateful to work with incredible clients.

FAQs

What is the market size of ophthalmic drugs?

The global market size for ophthalmic drugs is projected to reach approximately $30.5 billion by 2033, with a compound annual growth rate (CAGR) of 4.6%. This growth is attributed to increasing eye diseases and advancements in treatment options.

What are the key market players or companies in the ophthalmic drugs industry?

Key players in the ophthalmic drugs market include established pharmaceutical companies such as Novartis, Allergan, Roche, and Pfizer. These companies focus on research and development to innovate new products aimed at treating various eye conditions.

What are the primary factors driving the growth in the ophthalmic drugs industry?

Mainly, rising prevalence of ocular diseases, an aging population, and advancements in ophthalmic drug formulations contribute to market growth. Additionally, increased healthcare expenditure and awareness about eye care further stimulate demand.

Which region is the fastest Growing in the ophthalmic drugs market?

The Asia Pacific region is the fastest-growing market for ophthalmic drugs, projected to grow from $6.16 billion in 2023 to $9.74 billion by 2033. This growth is supported by increasing healthcare investments and expanding patient populations.

Does ConsaInsights provide customized market report data for the ophthalmic drugs industry?

Yes, ConsaInsights offers customized market reports for the ophthalmic drugs industry. These tailored reports address specific client needs, providing in-depth analysis and forecasts based on unique market segments.

What deliverables can I expect from this ophthalmic drugs market research project?

Deliverables from the ophthalmic drugs market research project typically include detailed market analysis, competitive landscape assessment, growth forecasts, and segmented data insights, providing comprehensive information to guide strategic decisions.

What are the market trends of ophthalmic drugs?

Key trends in the ophthalmic drugs market include a shift towards personalized medicine, increased use of biologics, growth in telemedicine for eye care, and a rise in the development of combination therapies targeting multiple conditions.