Ophthalmic Lasers Market Report

Published Date: 31 January 2026 | Report Code: ophthalmic-lasers

Ophthalmic Lasers Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Ophthalmic Lasers market covering trends, market size, segmentation, region-wise insights, and key players. The forecast period spans from 2023 to 2033, providing valuable insights for stakeholders in the industry.

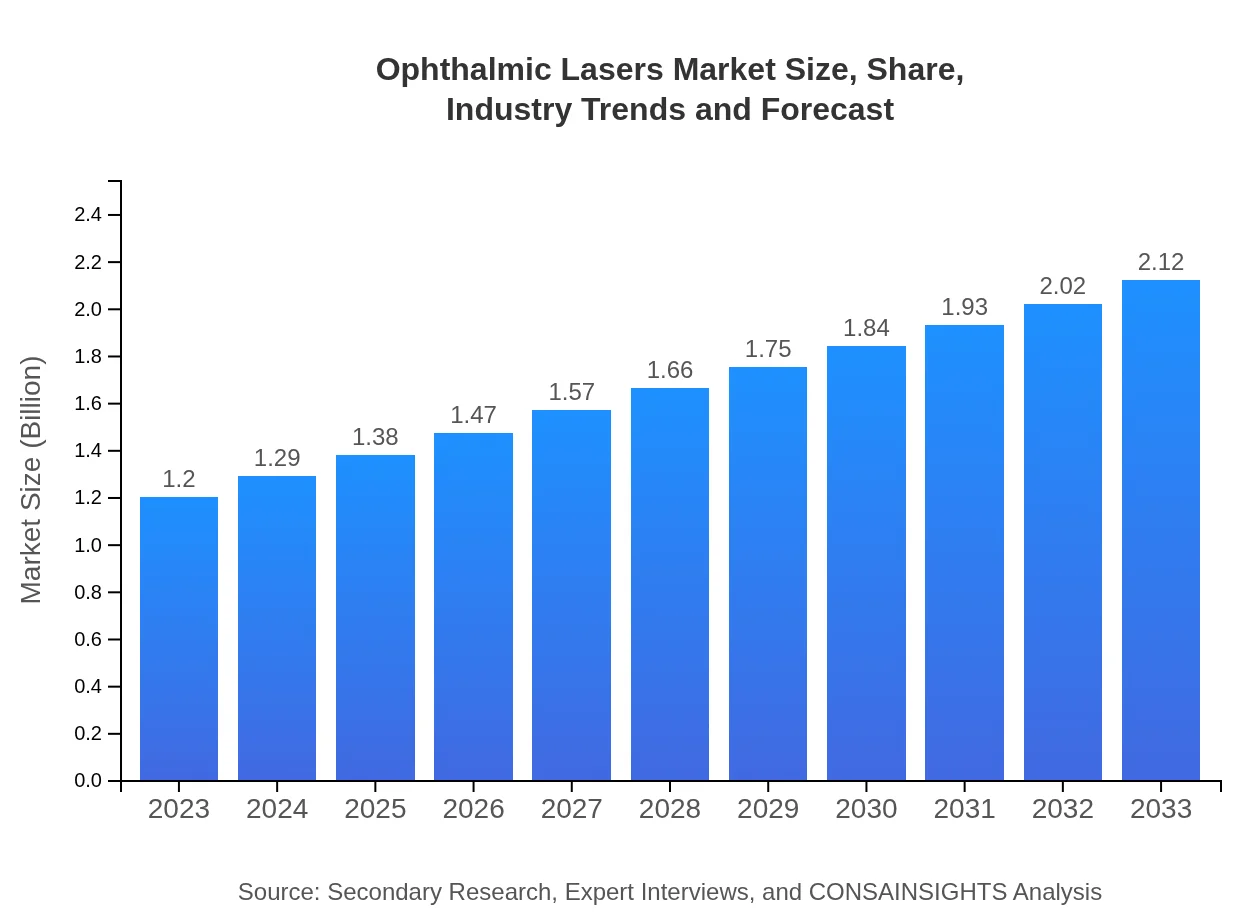

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.20 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $2.12 Billion |

| Top Companies | Alcon Inc., Carl Zeiss AG, Bausch & Lomb, Lumenis Ltd. |

| Last Modified Date | 31 January 2026 |

Ophthalmic Lasers Market Overview

Customize Ophthalmic Lasers Market Report market research report

- ✔ Get in-depth analysis of Ophthalmic Lasers market size, growth, and forecasts.

- ✔ Understand Ophthalmic Lasers's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ophthalmic Lasers

What is the Market Size & CAGR of Ophthalmic Lasers market in 2023-2033?

Ophthalmic Lasers Industry Analysis

Ophthalmic Lasers Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ophthalmic Lasers Market Analysis Report by Region

Europe Ophthalmic Lasers Market Report:

The European Ophthalmic Lasers market is expected to rise from $0.36 billion in 2023 to $0.64 billion by 2033, influenced by a growing emphasis on public healthcare spending and supportive regulatory frameworks for innovative treatment solutions.Asia Pacific Ophthalmic Lasers Market Report:

In the Asia Pacific region, the Ophthalmic Lasers market size is expected to grow from $0.24 billion in 2023 to $0.43 billion by 2033. This growth is attributed to increasing disposable income, rapid urbanization, and a rising incidence of eye disorders.North America Ophthalmic Lasers Market Report:

In North America, market size is projected to increase from $0.39 billion in 2023 to $0.69 billion by 2033, fueled by strong healthcare infrastructure and widespread adoption of cutting-edge laser technologies.South America Ophthalmic Lasers Market Report:

The South American market is anticipated to move from $0.09 billion in 2023 to $0.17 billion by 2033. The growth is driven by advancements in healthcare facilities and increased accessibility of treatment options.Middle East & Africa Ophthalmic Lasers Market Report:

In the Middle East and Africa, the market is projected to grow from $0.10 billion in 2023 to $0.18 billion by 2033, driven by improving healthcare systems and rising awareness of advanced treatment options.Tell us your focus area and get a customized research report.

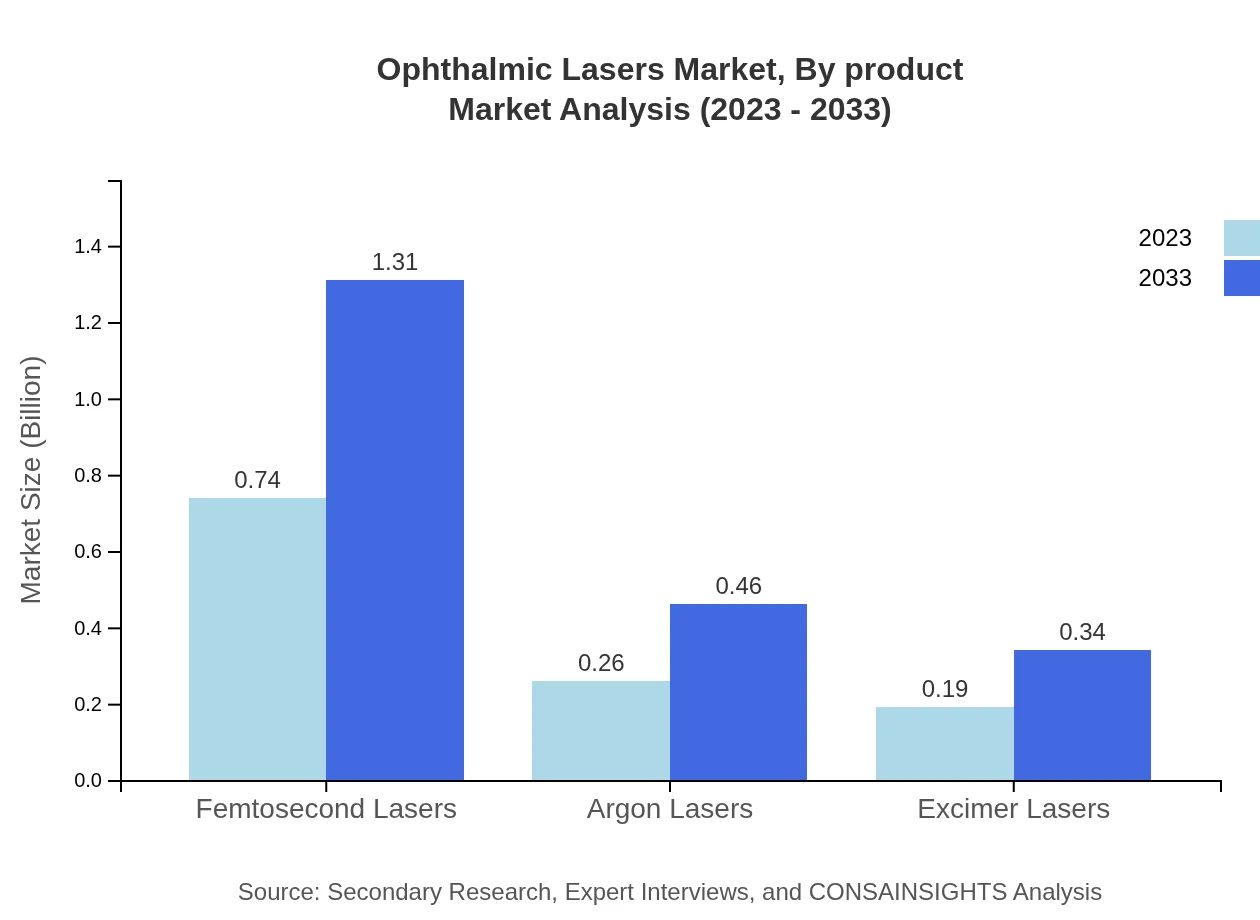

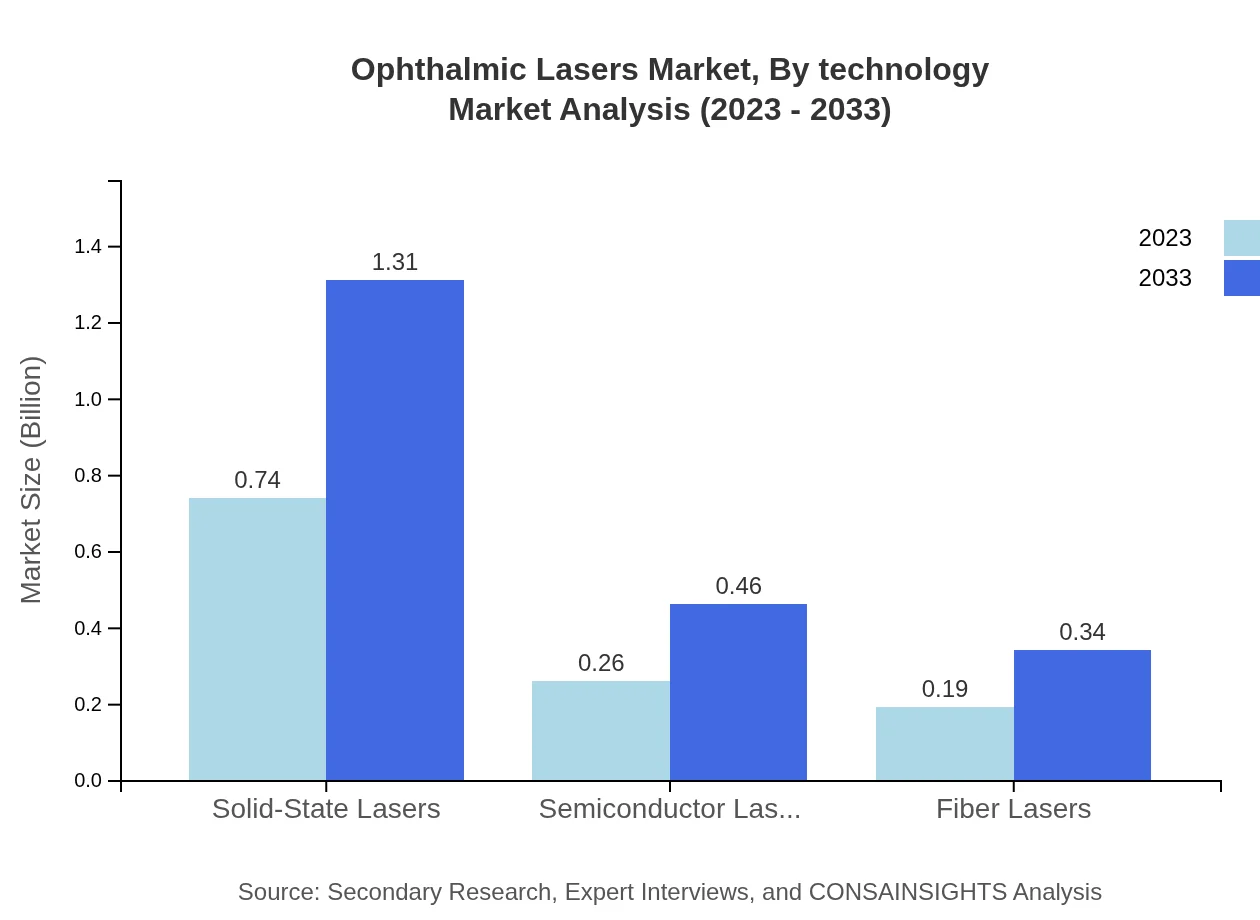

Ophthalmic Lasers Market Analysis By Product

The product segmentation highlights the dominance of femtosecond lasers, with market sizes of $0.74 billion in 2023 and growing to $1.31 billion by 2033, capturing 61.86% of the market share. Solid-state and semiconductor lasers follow with market sizes of $0.74 billion ($1.31 billion by 2033) and $0.26 billion ($0.46 billion by 2033) respectively. These segments play a crucial role in various surgeries, impacting overall market dynamics.

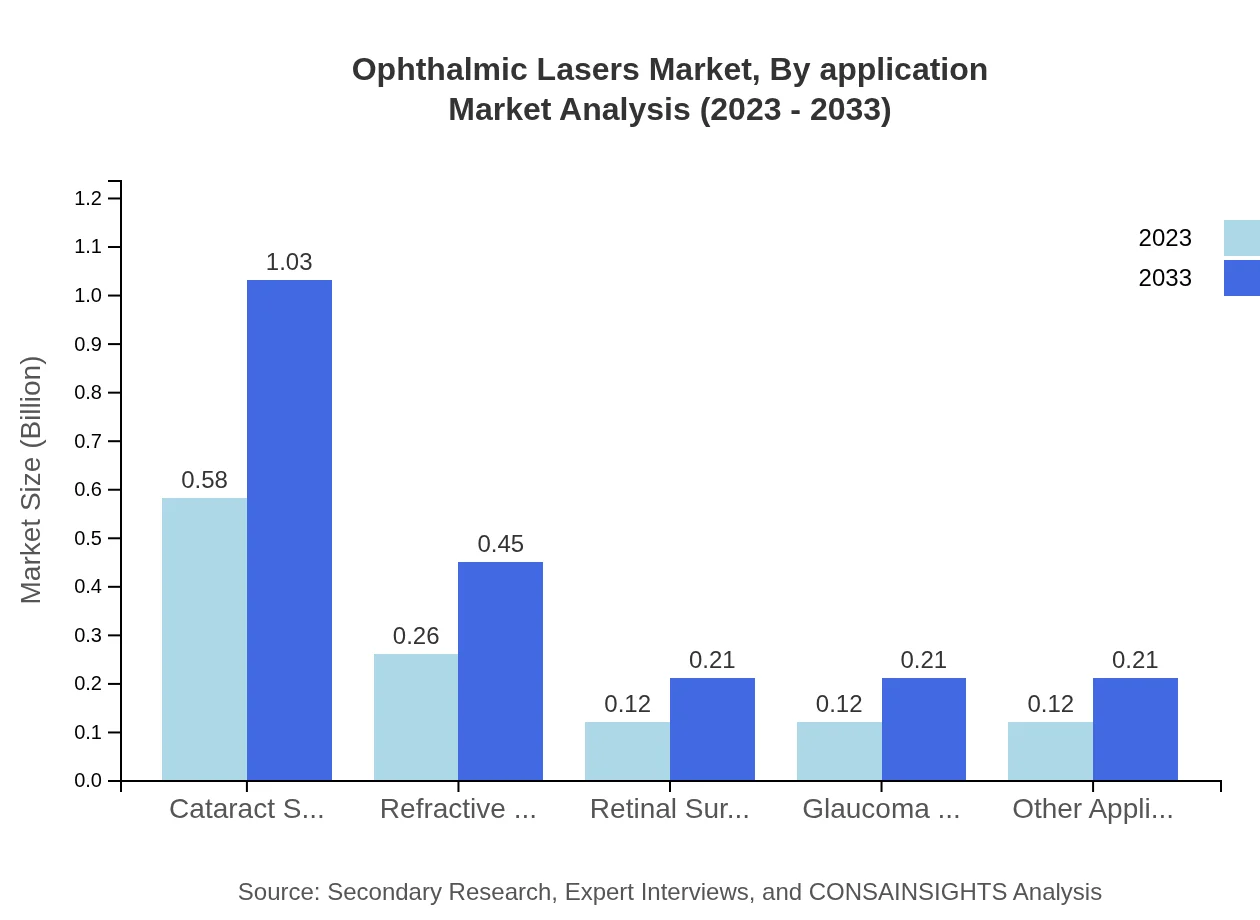

Ophthalmic Lasers Market Analysis By Application

In the application segment, cataract surgery dominates with a market size of $0.58 billion in 2023, projected to reach $1.03 billion by 2033, representing 48.45% market share. Refractive surgery and retinal surgery follow, showcasing growth trends that highlight the ongoing evolution in surgical practices and patient needs.

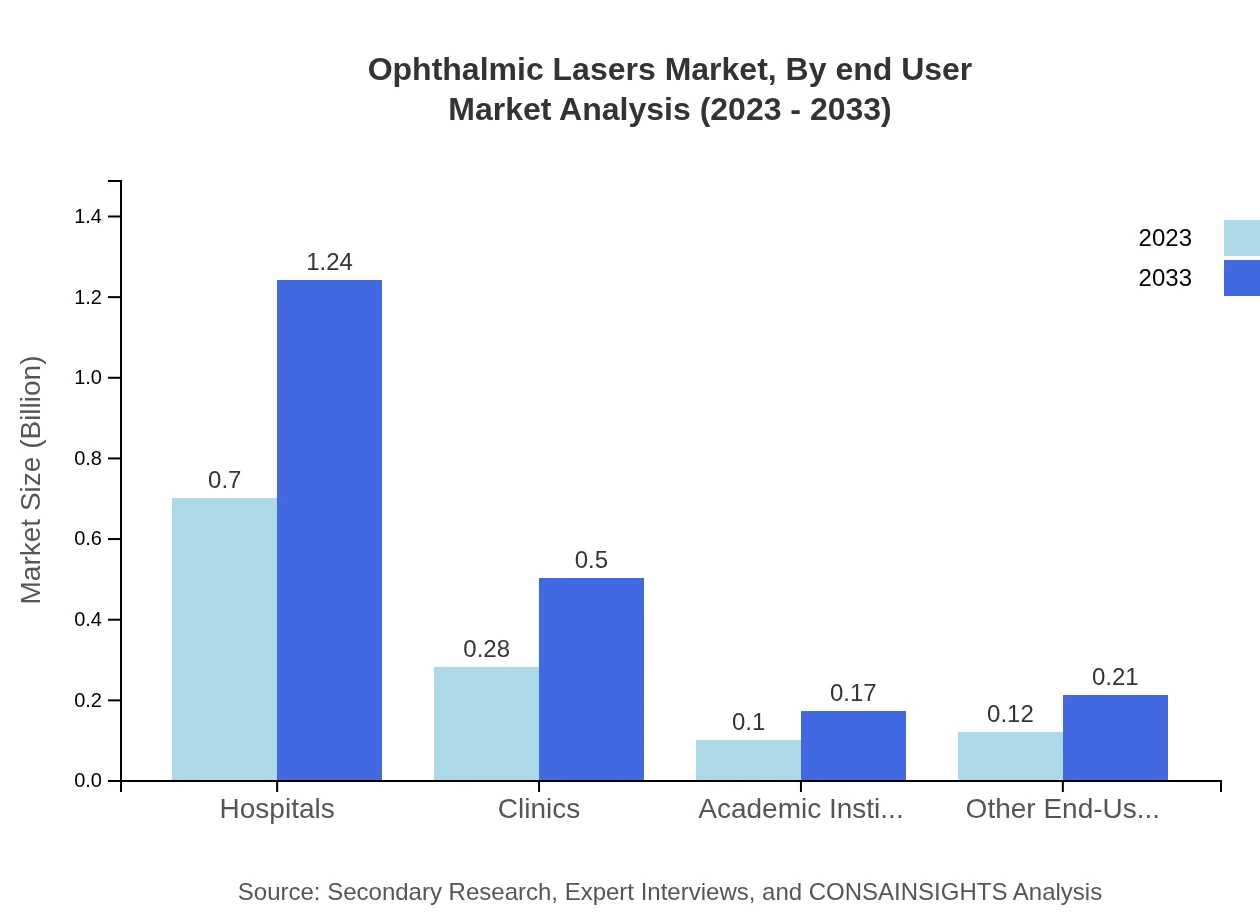

Ophthalmic Lasers Market Analysis By End User

The end-user segmentation indicates that hospitals lead with a market size of $0.70 billion in 2023, increasing to $1.24 billion by 2033, accounting for 58.54% of the segment. Clinics and academic institutions also play significant roles, responding to market demands for advanced treatments.

Ophthalmic Lasers Market Analysis By Technology

Recent technological advancements, particularly in femtosecond and solid-state lasers, have significantly enhanced the capabilities of ophthalmic procedures. The market is witnessing innovations aimed at improving precision and safety in surgeries, marking a notable shift in consumer preference towards these advanced technologies.

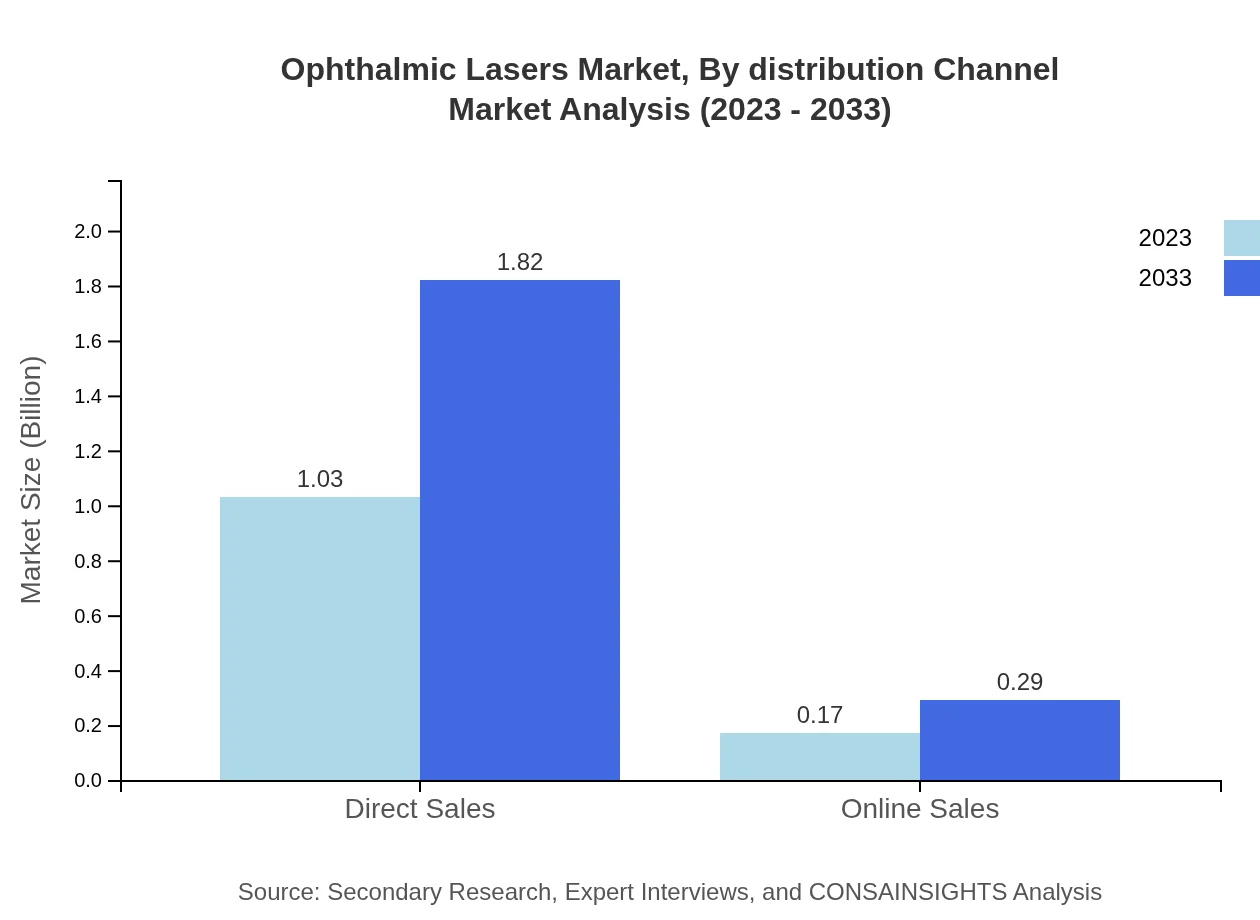

Ophthalmic Lasers Market Analysis By Distribution Channel

Direct sales remain the predominant distribution channel for the Ophthalmic Lasers market, seeing growth from $1.03 billion in 2023 to $1.82 billion by 2033. Online sales are also gaining traction, reflecting shifts in consumer purchasing behavior and increased accessibility to advanced medical equipment.

Ophthalmic Lasers Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ophthalmic Lasers Industry

Alcon Inc.:

Alcon is a global leader in eye care providing innovative surgical and vision care products including a wide range of ophthalmic lasers used in eye surgeries.Carl Zeiss AG:

Carl Zeiss AG offers advanced technology in laser surgery equipment and cutting-edge diagnostic devices in ophthalmology, supporting eye surgeons globally.Bausch & Lomb:

Bausch & Lomb specializes in eye health products and has a leading portfolio in ophthalmic laser systems, focusing on improving surgical outcomes.Lumenis Ltd.:

Lumenis is known for its innovative laser-based technologies including those specifically designed for ophthalmic applications.We're grateful to work with incredible clients.

FAQs

What is the market size of ophthalmic lasers?

The ophthalmic lasers market was valued at approximately $1.2 billion in 2023, with an anticipated growth at a CAGR of 5.7%. By 2033, the market is projected to expand significantly, reflecting advancements in laser technology and increasing demand for eye surgeries.

What are the key market players or companies in the ophthalmic lasers industry?

Key players in the ophthalmic lasers industry include established companies such as Alcon, Bausch & Lomb, and Carl Zeiss Meditec. These companies are leaders in innovation, focusing on enhancing surgical outcomes and expanding product offerings through technology advancements.

What are the primary factors driving the growth in the ophthalmic lasers industry?

Drivers of growth in the ophthalmic lasers market include an increasing prevalence of eye diseases, advancements in laser technologies, growing geriatric population, and rising demand for minimally invasive surgeries. These factors encourage more healthcare providers to adopt laser-based treatments.

Which region is the fastest Growing in the ophthalmic lasers market?

The North America region is forecasted to be the fastest-growing market for ophthalmic lasers, with market size projected to rise from $0.39 billion in 2023 to $0.69 billion by 2033. This growth is supported by advanced healthcare infrastructure and widespread adoption of laser surgeries.

Does ConsaInsights provide customized market report data for the ophthalmic lasers industry?

Yes, ConsaInsights offers customized market report data tailored to the ophthalmic lasers industry. Clients can request specific insights or data segmentation to meet their individual market research needs, ensuring relevance to their specific market goals.

What deliverables can I expect from this ophthalmic lasers market research project?

Deliverables include a comprehensive market analysis report, insights on growth trends, competitive landscape assessments, and detailed data segmentation. Clients will receive visuals such as charts and graphs to support decision-making and strategic planning initiatives.

What are the market trends of ophthalmic lasers?

Current trends in the ophthalmic lasers market indicate a shift towards advanced laser technologies, increased adoption of femtosecond lasers, and a rise in surgeries like cataract and refractive procedures. There's also a growing trend in online sales channels for easier access to products.