Ophthalmic Surgical Instruments Market Report

Published Date: 31 January 2026 | Report Code: ophthalmic-surgical-instruments

Ophthalmic Surgical Instruments Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Ophthalmic Surgical Instruments market, covering market size, trends, segments, innovations, and forecasts from 2023 to 2033, offering essential insights for stakeholders and decision-makers.

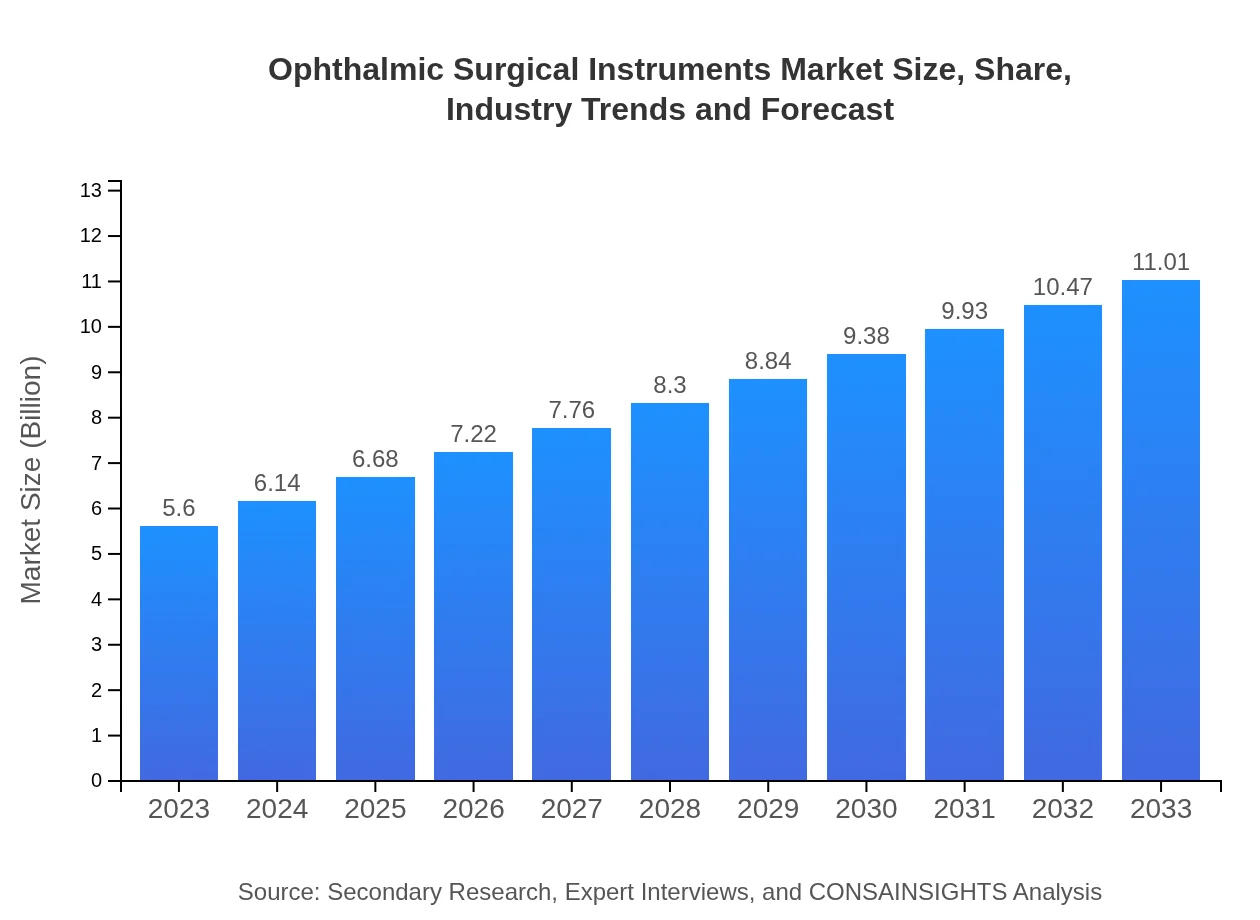

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $11.01 Billion |

| Top Companies | Alcon, Inc., Bausch + Lomb, Johnson & Johnson Vision, Carl Zeiss AG, Abbott Laboratories |

| Last Modified Date | 31 January 2026 |

Ophthalmic Surgical Instruments Market Overview

Customize Ophthalmic Surgical Instruments Market Report market research report

- ✔ Get in-depth analysis of Ophthalmic Surgical Instruments market size, growth, and forecasts.

- ✔ Understand Ophthalmic Surgical Instruments's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ophthalmic Surgical Instruments

What is the Market Size & CAGR of Ophthalmic Surgical Instruments market in 2023?

Ophthalmic Surgical Instruments Industry Analysis

Ophthalmic Surgical Instruments Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ophthalmic Surgical Instruments Market Analysis Report by Region

Europe Ophthalmic Surgical Instruments Market Report:

Europe holds a substantial market share, valued at 1.70 billion USD in 2023, anticipated to reach 3.33 billion USD by 2033. The growing geriatric population and advancements in surgical technologies are driving demand in this region.Asia Pacific Ophthalmic Surgical Instruments Market Report:

In 2023, the Asia Pacific ophthalmic surgical instruments market is estimated at 1.07 billion USD, expected to grow to 2.11 billion USD by 2033. The growth is driven by increasing healthcare expenditure, rising awareness of eye health, and growing surgical procedures in countries like India and China.North America Ophthalmic Surgical Instruments Market Report:

North America's market stands at 1.90 billion USD in 2023 with projections of reaching 3.74 billion USD by 2033. The high prevalence of eye disorders and significant investments in advanced surgical technologies for better patient outcomes support this growth.South America Ophthalmic Surgical Instruments Market Report:

The South American market is valued at 0.46 billion USD in 2023 and poised for growth to 0.91 billion USD by 2033. The rise in cataract surgeries and investments in healthcare infrastructure are key growth factors in this region.Middle East & Africa Ophthalmic Surgical Instruments Market Report:

The Middle East and Africa's market is valued at 0.47 billion USD in 2023, expected to grow to 0.92 billion USD by 2033. Increased healthcare investments and a rising incidence of eye diseases are significant growth contributors.Tell us your focus area and get a customized research report.

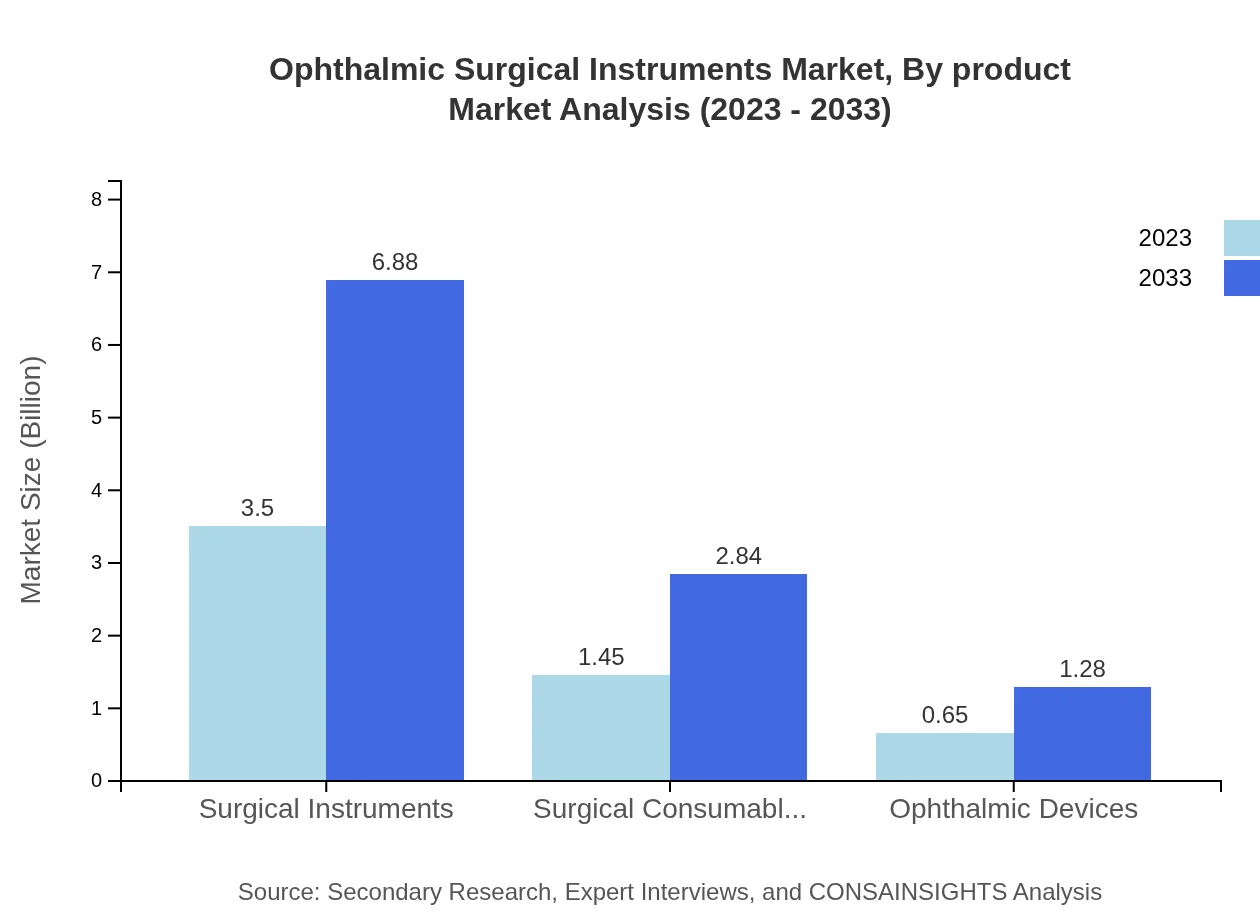

Ophthalmic Surgical Instruments Market Analysis By Product

Surgical instruments dominated the market in 2023, valued at 3.50 billion USD and projected to rise to 6.88 billion USD by 2033, holding a market share of 62.54%. Surgical consumables, with revenue of 1.45 billion USD in 2023, are expected to reach 2.84 billion USD by 2033, maintaining a share of 25.83%. Ophthalmic devices contributed 0.65 billion USD in 2023, anticipated to grow to 1.28 billion USD by 2033 with an 11.63% market share.

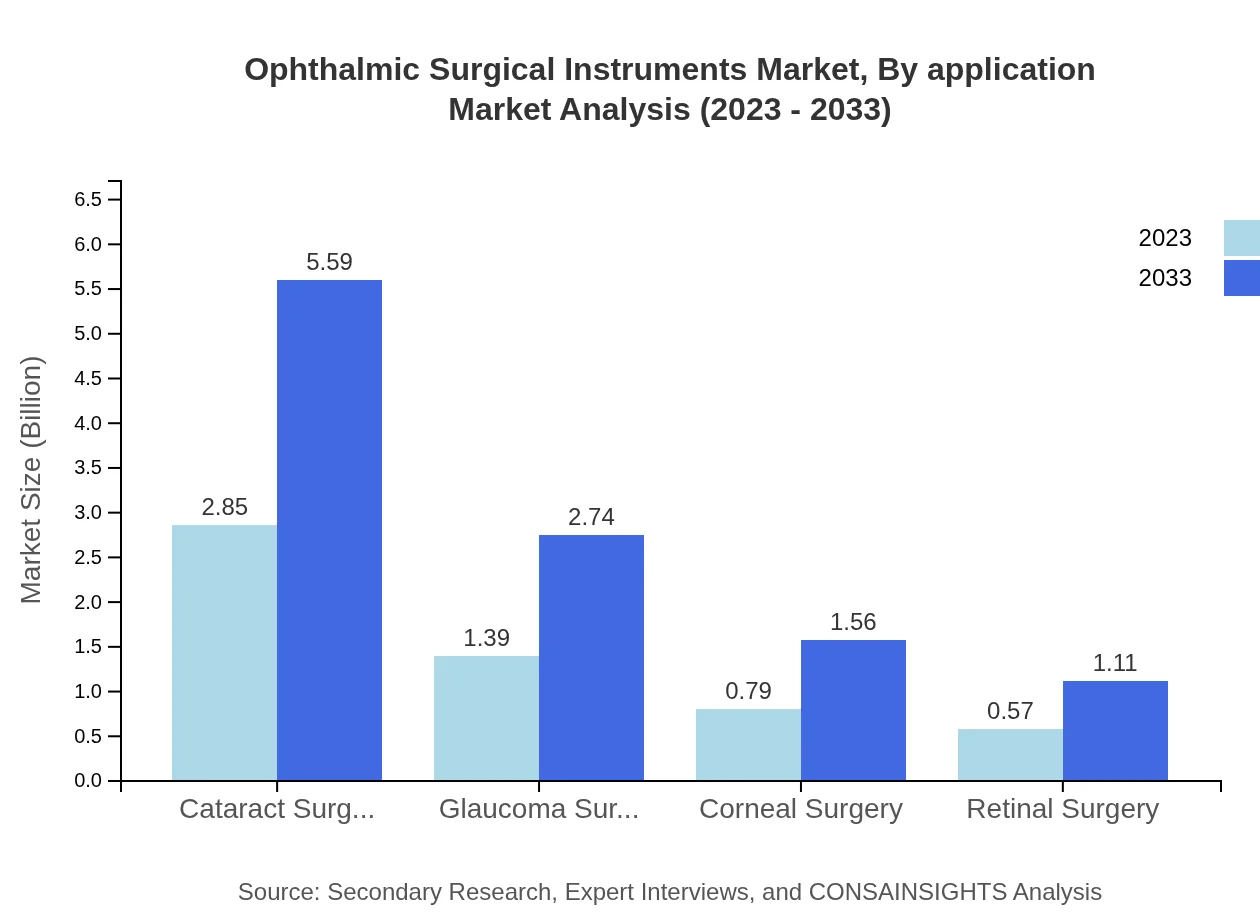

Ophthalmic Surgical Instruments Market Analysis By Application

Cataract surgery remains the leading application segment, comprising 50.83% of the market share in 2023, valued at 2.85 billion USD, and forecast to reach 5.59 billion USD by 2033. Glaucoma surgery accounts for 24.88% share, projecting growth from 1.39 billion USD in 2023 to 2.74 billion USD by 2033. Additional applications such as corneal and retinal surgeries are also expected to show significant growth.

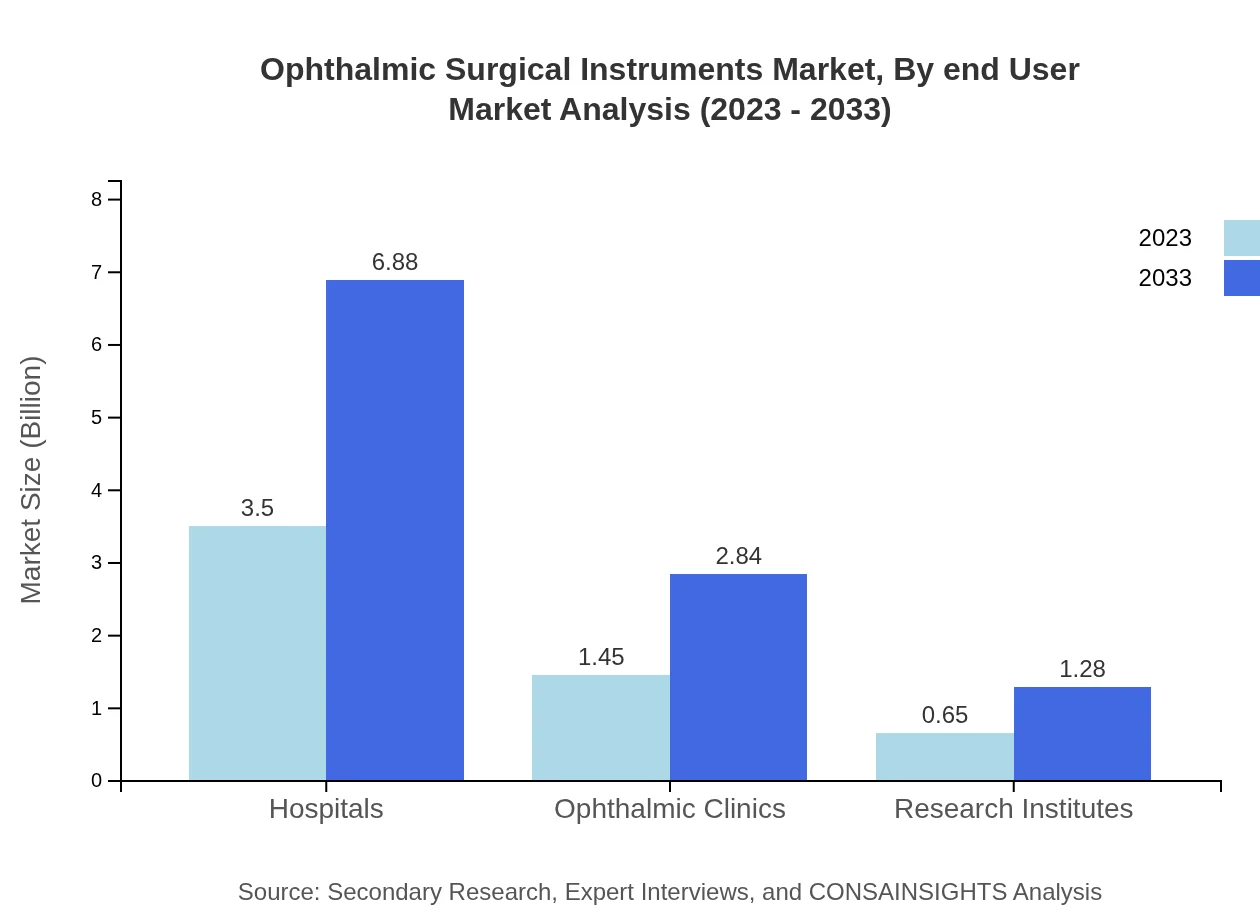

Ophthalmic Surgical Instruments Market Analysis By End User

Hospitals dominate the end-user market, with a size of 3.50 billion USD in 2023, expected to rise to 6.88 billion USD by 2033, maintaining a share of 62.54%. Ophthalmic clinics and research institutes represent 25.83% and 11.63% shares respectively, with forecasts predicting growth aligned with overall market trends.

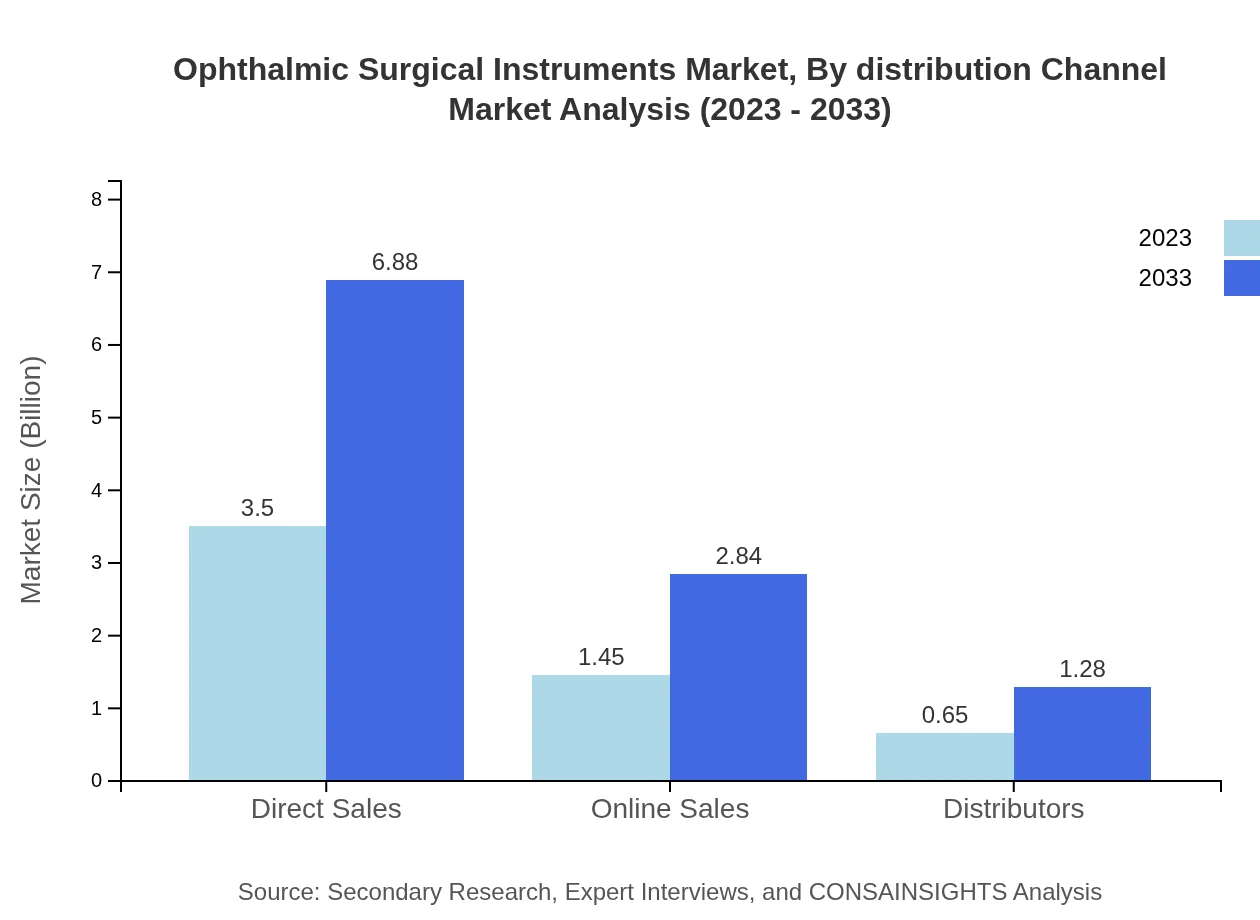

Ophthalmic Surgical Instruments Market Analysis By Distribution Channel

Direct sales are the primary distribution channel, valued at 3.50 billion USD in 2023 and expected to grow to 6.88 billion USD by 2033, holding a market share of 62.54%. Online sales are also significant, with a size of 1.45 billion USD in 2023 projected to grow to 2.84 billion USD by 2033, capturing 25.83% of the market share. Distributors contribute to a smaller share of 11.63%.

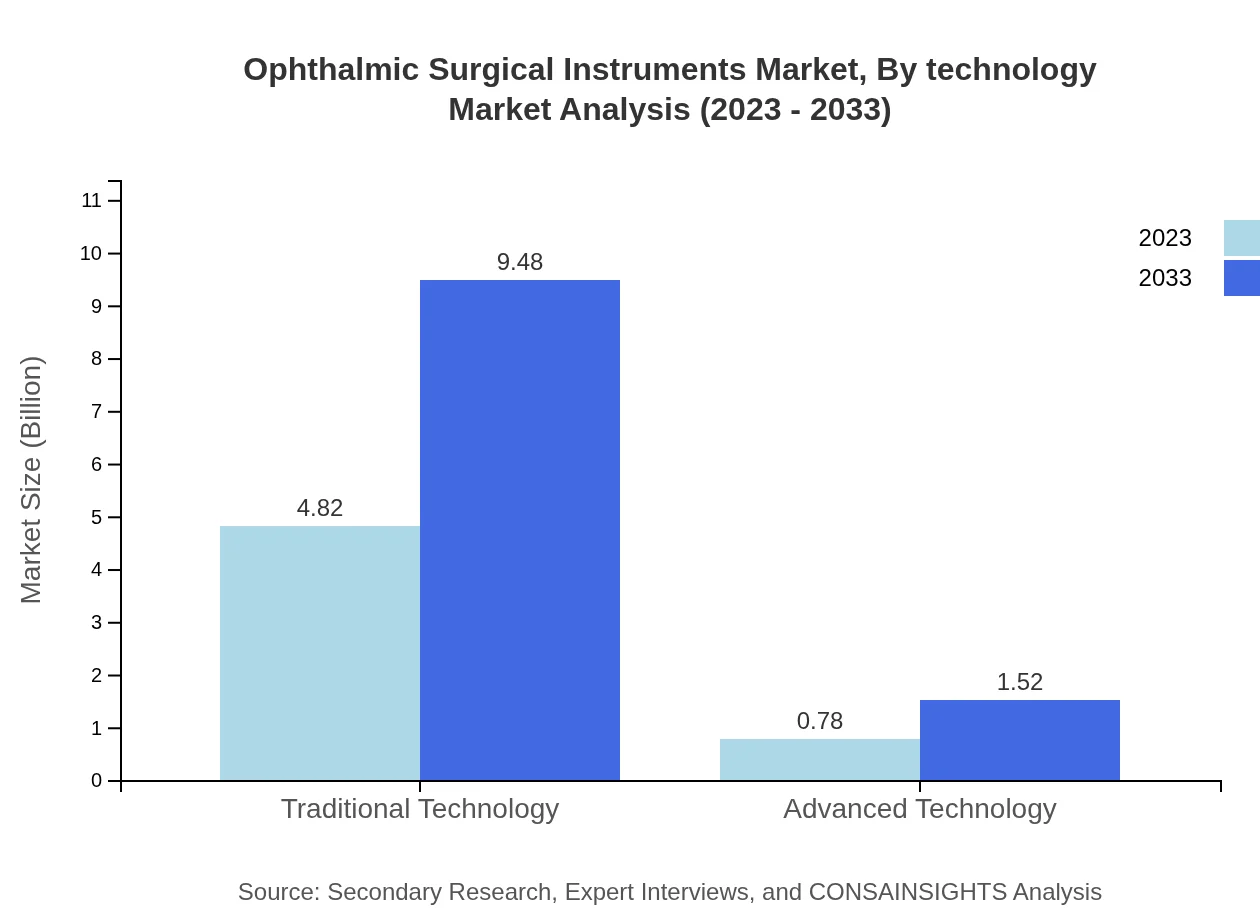

Ophthalmic Surgical Instruments Market Analysis By Technology

Traditional technology remains prevalent within the ophthalmic instruments market with a size of 4.82 billion USD in 2023, growing to 9.48 billion USD by 2033 (86.15% share). However, advanced technology is beginning to gain traction, with a size of 0.78 billion USD in 2023, expected to reach 1.52 billion USD by 2033, holding a share of 13.85%.

Ophthalmic Surgical Instruments Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ophthalmic Surgical Instruments Industry

Alcon, Inc.:

A global leader in eye care products, Alcon specializes in innovative surgical instruments and devices dedicated to improving vision. Their strong research and development focus drives the creation of advanced cataract and retinal surgery solutions.Bausch + Lomb:

With a rich heritage in ocular health, Bausch + Lomb develops a wide range of ophthalmic surgical instruments, focusing on providing innovative solutions for eye health and optometry. Their products are pivotal in cataract and corneal surgeries.Johnson & Johnson Vision:

A division of Johnson & Johnson, this company develops advanced eye care solutions including surgical instruments that enhance surgical outcomes in cataract and corneal surgeries. Their dedication to innovation is significant in the ophthalmic field.Carl Zeiss AG:

Known for precision optics, Zeiss plays a major role in ophthalmic surgical instruments with cutting-edge technologies improving surgical precision and outcomes. Their microscopes and visualization tools are highly regarded in the industry.Abbott Laboratories:

Abbott Laboratories offers a comprehensive range of devices for eye surgery, focusing on quality and innovation to support patient care. Their investments in surgical instrumentation enhance the capabilities of ophthalmic surgeons globally.We're grateful to work with incredible clients.

FAQs

What is the market size of ophthalmic Surgical Instruments?

The ophthalmic surgical instruments market was valued at approximately $5.6 billion in 2023 and is projected to grow at a CAGR of 6.8%, reaching about $10.1 billion by 2033. This growth reflects the increasing demand for advanced surgical solutions.

What are the key market players or companies in this ophthalmic Surgical Instruments industry?

Key players in the ophthalmic surgical instruments market include leading companies known for their innovative products, including Carl Zeiss AG, Bausch & Lomb, and Alcon. These companies are recognized for their contribution to research and development in the sector.

What are the primary factors driving the growth in the ophthalmic Surgical Instruments industry?

Major growth factors include the rising prevalence of eye disorders, technological advancements in surgical procedures, and increased healthcare expenditure. Additionally, growing awareness of eye health among the population drives the demand for such surgical instruments.

Which region is the fastest Growing in the ophthalmic Surgical Instruments?

The Asia Pacific region is the fastest-growing market for ophthalmic surgical instruments. By 2033, it is expected to double its market size from approximately $1.07 billion in 2023 to $2.11 billion, which indicates robust growth potential in this area.

Does ConsaInsights provide customized market report data for the ophthalmic Surgical Instruments industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the ophthalmic surgical instruments industry. This customization ensures that businesses receive relevant insights that align with their strategic goals.

What deliverables can I expect from this ophthalmic Surgical Instruments market research project?

Deliverables from this market research include comprehensive reports detailing market size, growth forecasts, competitive analysis, key trends, and strategic recommendations, providing a thorough understanding necessary for informed decision-making.

What are the market trends of ophthalmic Surgical Instruments?

Current market trends include a shift towards minimally invasive surgical techniques, increased adoption of advanced technologies, and a growing focus on emerging markets. These trends indicate a dynamic landscape that continues to evolve rapidly.