Ophthalmology Devices

Published Date: 31 January 2026 | Report Code: ophthalmology-devices

Ophthalmology Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Ophthalmology Devices market from 2023 to 2033, highlighting market dynamics, segmentation, regional insights, and competitive landscape, alongside trends and forecasts to guide industry stakeholders.

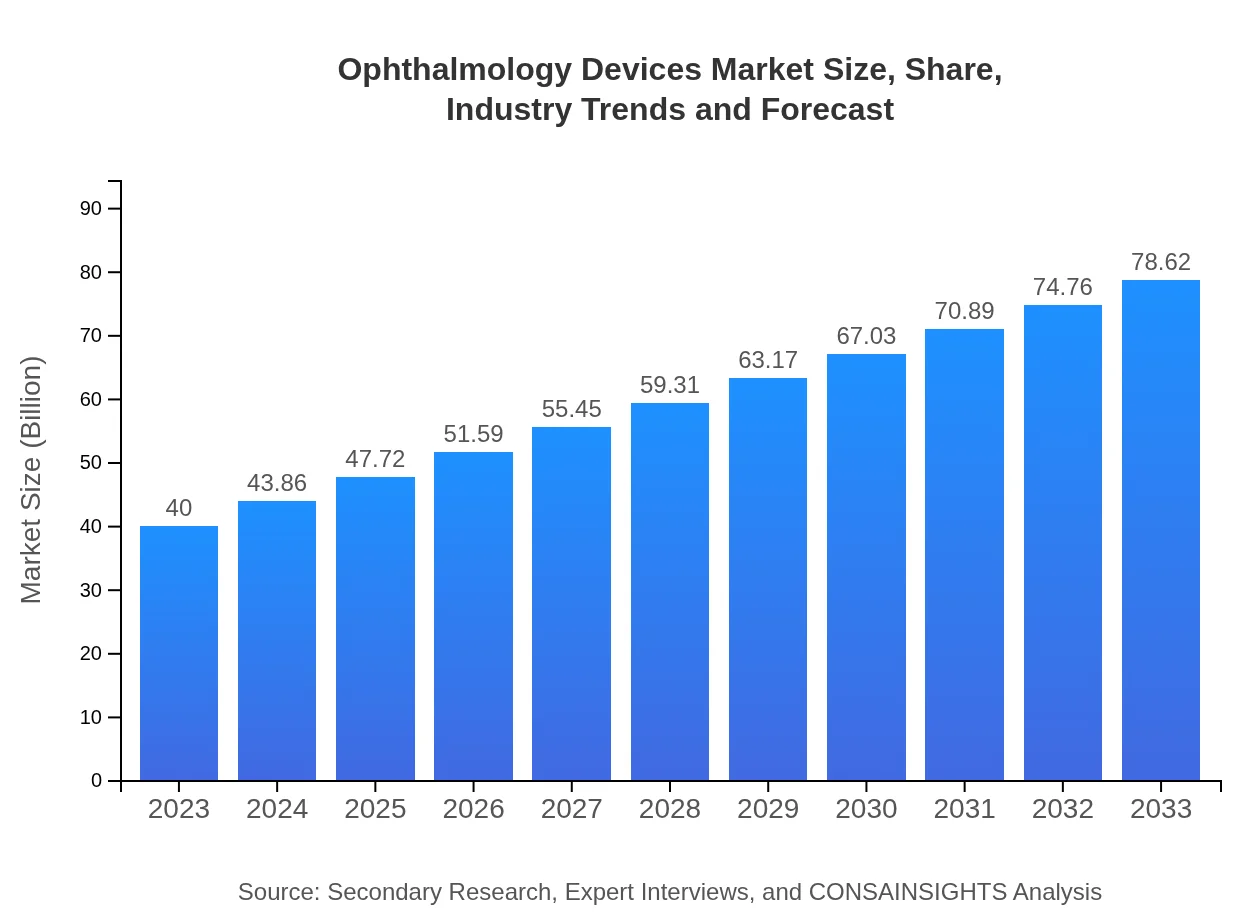

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $40.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $78.62 Billion |

| Top Companies | Johnson & Johnson Vision, Alcon, Inc., Bausch + Lomb, Carl Zeiss AG, Abbott Laboratories |

| Last Modified Date | 31 January 2026 |

Ophthalmology Devices Market Overview

Customize Ophthalmology Devices market research report

- ✔ Get in-depth analysis of Ophthalmology Devices market size, growth, and forecasts.

- ✔ Understand Ophthalmology Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ophthalmology Devices

What is the Market Size & CAGR of Ophthalmology Devices market in 2023?

Ophthalmology Devices Industry Analysis

Ophthalmology Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ophthalmology Devices Market Analysis Report by Region

Europe Ophthalmology Devices:

The European market was valued at $11.28 billion in 2023 and is expected to reach $22.18 billion by 2033. Growth factors include an increase in the geriatric population, extensive research activities, and a robust healthcare infrastructure, alongside increasing patient awareness of eye disorders and treatments available.Asia Pacific Ophthalmology Devices:

In 2023, the Asia Pacific Ophthalmology Devices market was valued at $8.17 billion and is expected to grow to $16.05 billion by 2033. This growth can be attributed to rising healthcare expenditures, increasing awareness of eye health, and government initiatives promoting regular eye check-ups. Additionally, the aging population in countries like China and India is contributing significantly to market expansion.North America Ophthalmology Devices:

North America dominated the Ophthalmology Devices market, valued at $14.46 billion in 2023, with a forecasted growth to approximately $28.43 billion by 2033. This region holds a leading position owing to advanced healthcare technologies, strong customer awareness, and high prevalence of eye diseases. The presence of major players also fosters innovation and investment.South America Ophthalmology Devices:

The South American market for Ophthalmology Devices was valued at $2.10 billion in 2023 and is forecasted to reach $4.13 billion by 2033. Key growth drivers include urbanization, healthcare reforms, and an increase in disposable incomes allowing more people to seek eye care services. However, infrastructural challenges may impede the overall pace of development in certain regions.Middle East & Africa Ophthalmology Devices:

The Middle East and Africa market was valued at $3.98 billion in 2023 and is anticipated to grow to $7.83 billion by 2033. The growth is driven by improving healthcare facilities, increasing prevalence of visual impairments, and rising awareness regarding advanced ophthalmic treatments.Tell us your focus area and get a customized research report.

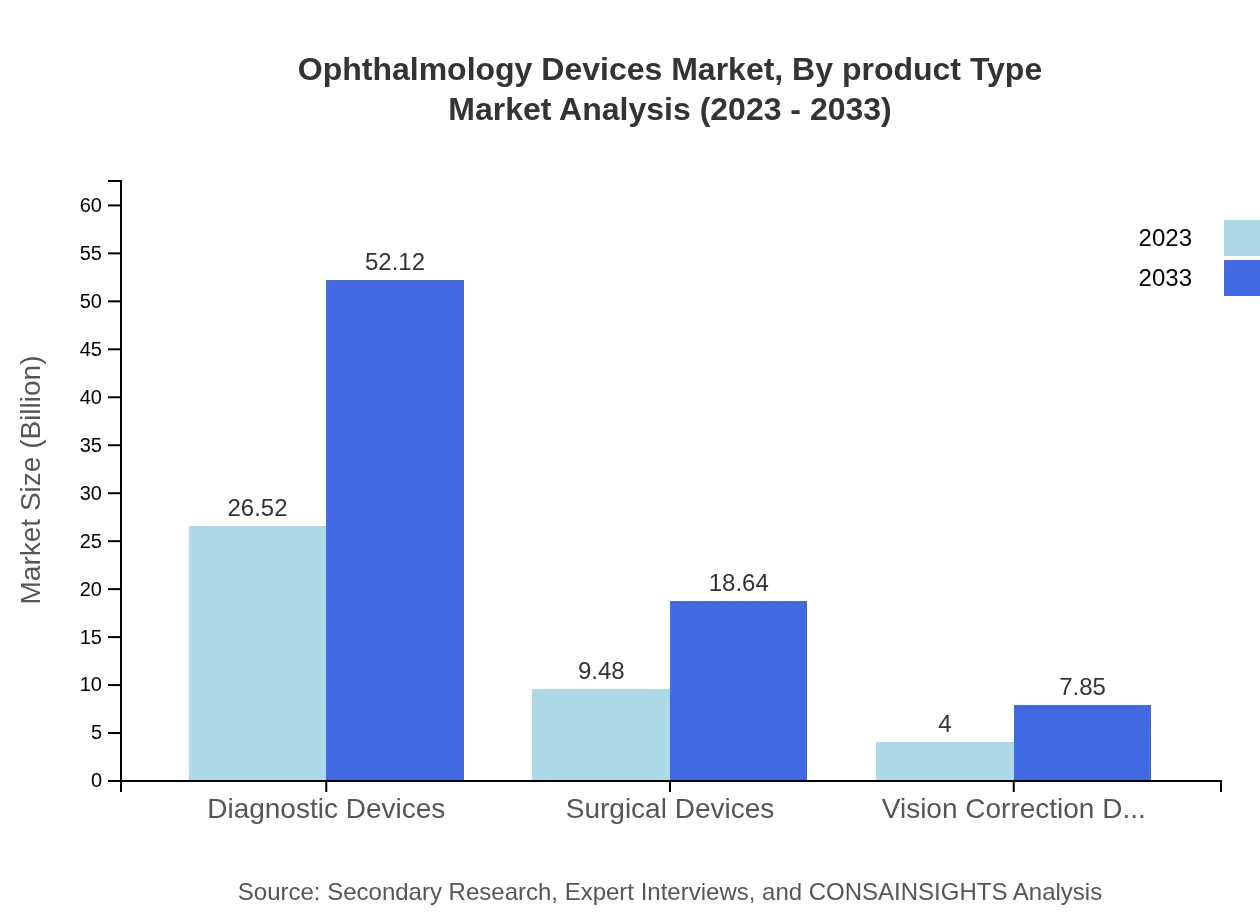

Ophthalmology Devices Market Analysis By Product Type

The Ophthalmology Devices market by product type includes Surgical Devices, Diagnostic Devices, Vision Correction Devices, and Low Vision Aids. Among these, Laser Technology is leading with a market size of $26.52 billion in 2023, anticipated to grow to $52.12 billion by 2033. Surgical Devices and Diagnostic Devices also maintain significant market shares with increasing application in various eye surgeries and diagnostics.

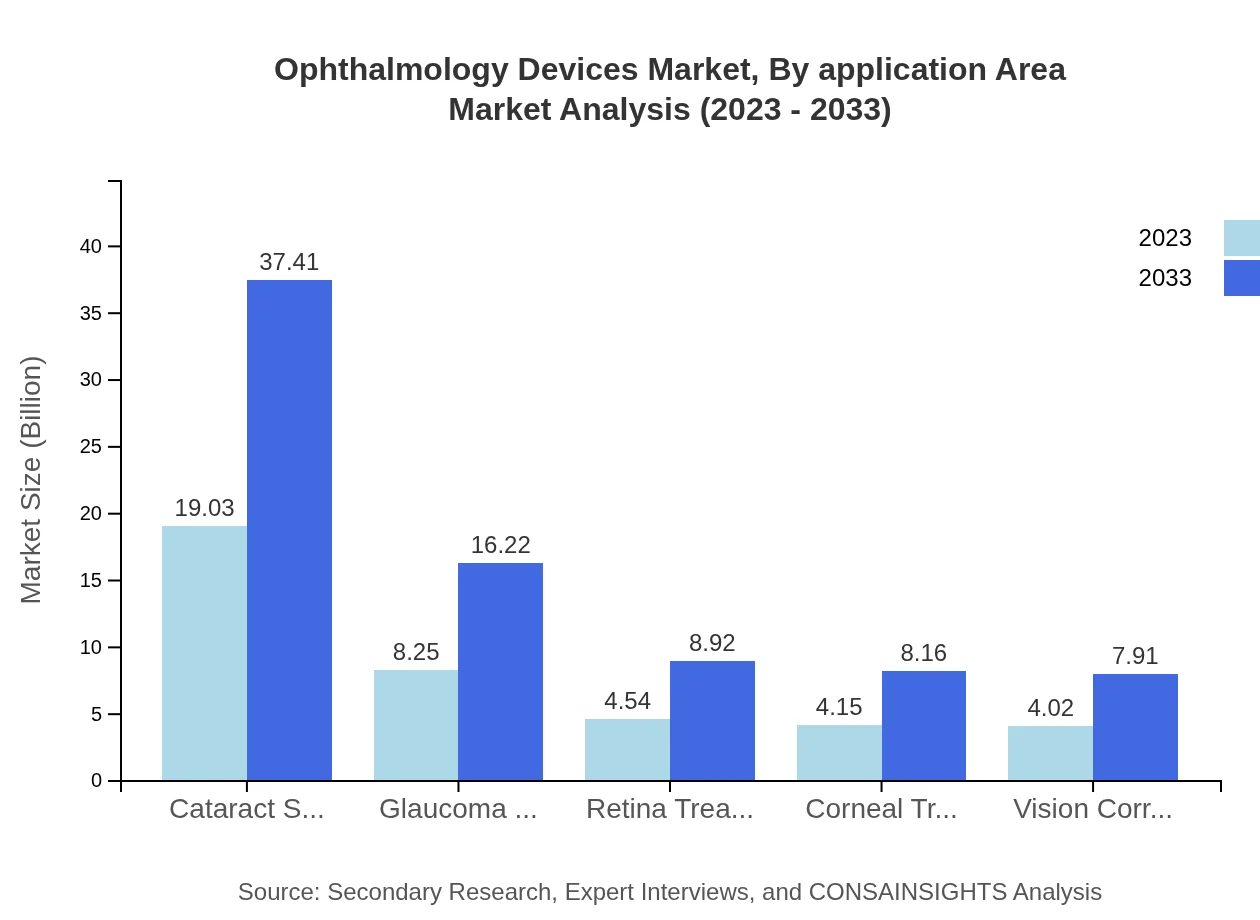

Ophthalmology Devices Market Analysis By Application Area

The market by application area is segmented into Cataract Surgery, Glaucoma Management, Retina Treatment, and Corneal Treatment. Cataract Surgery holds the largest share, with a market size of $19.03 billion in 2023, expected to rise to $37.41 billion by 2033. Other areas, such as Glaucoma Management and Retina Treatment, also show promising growth due to technological advancements.

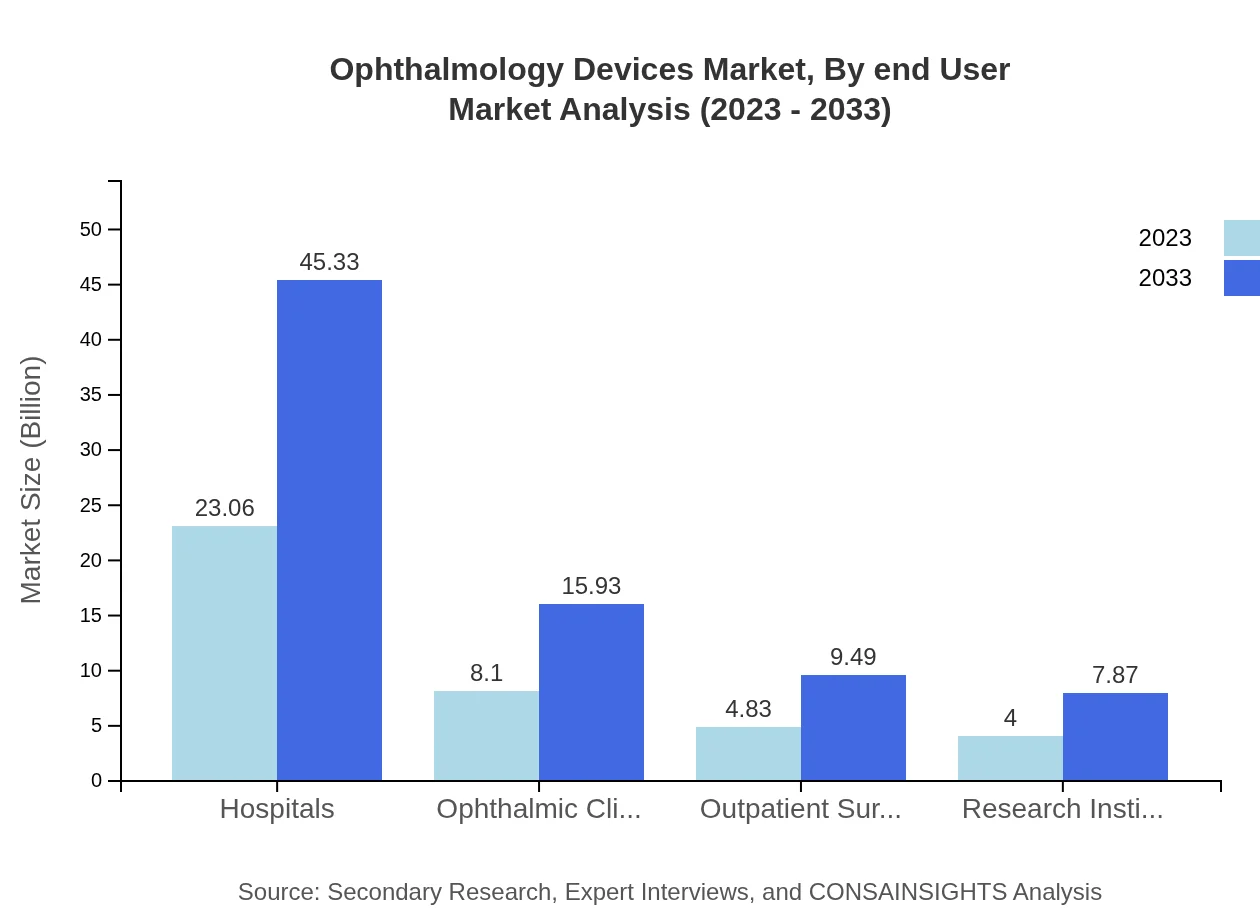

Ophthalmology Devices Market Analysis By End User

The primary end-user segments for Ophthalmology Devices include Hospitals, Ophthalmic Clinics, Outpatient Surgery Centers, and Research Institutes. Hospitals dominate with a market size of $23.06 billion in 2023, expected to grow to $45.33 billion by 2033, owing to their critical role in providing comprehensive eye care services.

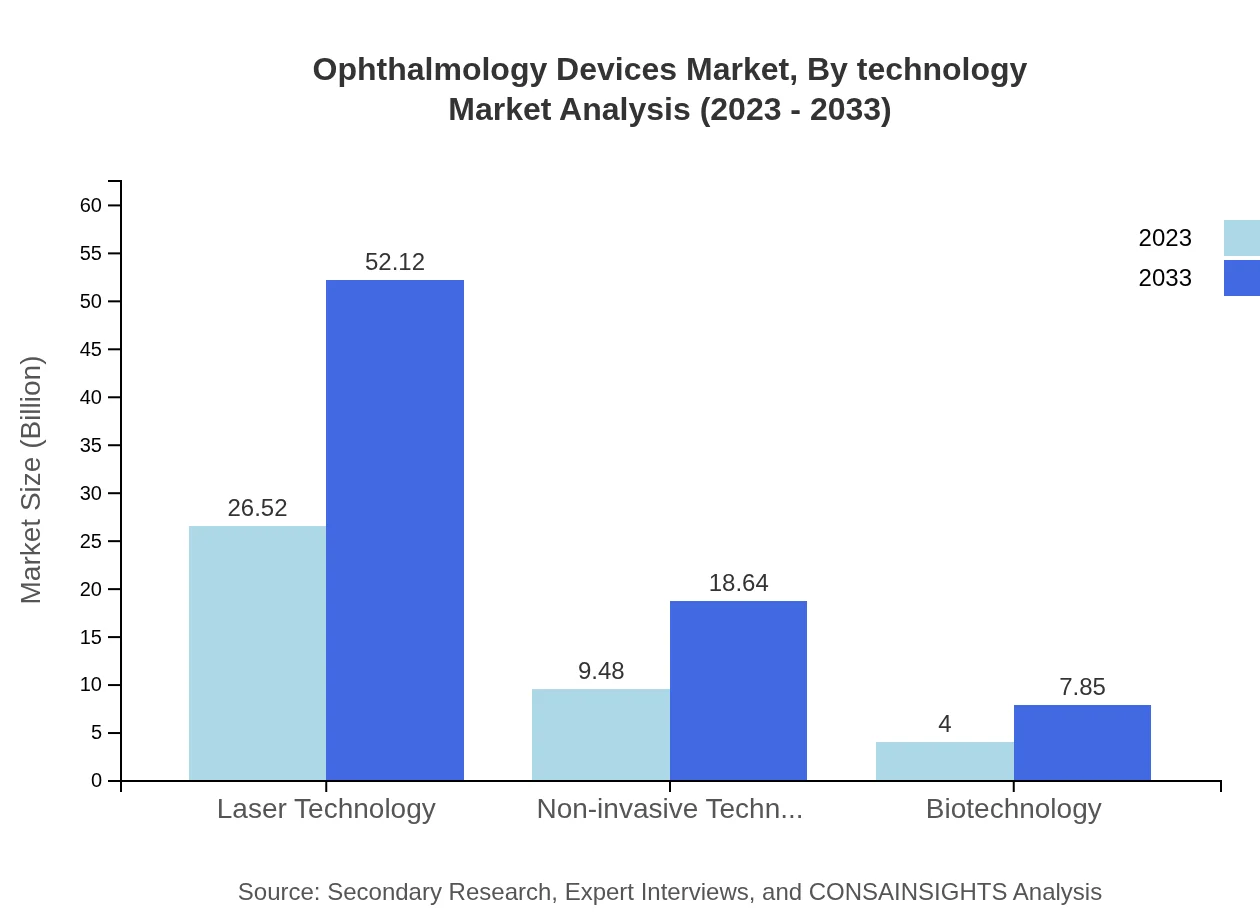

Ophthalmology Devices Market Analysis By Technology

The market by technology includes sectors such as Laser Technology, Non-invasive Technology, and Biotechnology. Laser Technology is predominant with a market size of $26.52 billion in 2023, anticipated to reach $52.12 billion by 2033. Non-invasive technologies are increasingly adopted for their patient-friendly procedures, driving substantial demand.

Ophthalmology Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ophthalmology Devices Industry

Johnson & Johnson Vision:

A major player that specializes in ophthalmic surgical products and vision care, known for its innovative technologies such as the TECNIS Intraocular Lens.Alcon, Inc.:

One of the largest global manufacturers of eye care products, providing a range from surgical equipment to contact lenses, focusing heavily on advancing surgical technologies.Bausch + Lomb:

A historical leader in the field, Bausch + Lomb is known for its eye health products and surgical devices for various ophthalmic procedures.Carl Zeiss AG:

Zeiss is recognized for its precision eyecare instruments and diagnostic systems used globally, driving advancements in the field of ophthalmology.Abbott Laboratories:

Involved in diverse healthcare sectors, Abbott provides several ophthalmological devices focusing on innovative surgical techniques and treatments.We're grateful to work with incredible clients.

FAQs

What is the market size of ophthalmology Devices?

The global ophthalmology devices market is valued at approximately $40 billion in 2023, with a projected compound annual growth rate (CAGR) of 6.8%, expected to expand significantly by 2033.

What are the key market players or companies in this ophthalmology Devices industry?

Key players in the ophthalmology devices industry include renowned companies such as Alcon, Johnson & Johnson Vision, Bausch + Lomb, and Novartis, which dominate with innovative technologies and a broad product portfolio.

What are the primary factors driving the growth in the ophthalmology devices industry?

Growth in the ophthalmology devices industry is primarily driven by increasing global prevalence of eye diseases, technological advancements, rising aging population, and significant healthcare investments catering to vision correction.

Which region is the fastest Growing in the ophthalmology devices?

North America is expected to be the fastest-growing region, with market size growing from $14.46 billion in 2023 to $28.43 billion by 2033, followed closely by Europe and Asia Pacific.

Does ConsaInsights provide customized market report data for the ophthalmology devices industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the ophthalmology devices industry, allowing for in-depth analysis and targeted insights.

What deliverables can I expect from this ophthalmology Devices market research project?

Expect comprehensive deliverables including detailed market size analysis, trend forecasts, competitive landscape, segment performance data, and regional insights tailored to the ophthalmology devices market.

What are the market trends of ophthalmology Devices?

Current market trends in ophthalmology devices include increased adoption of minimally invasive procedures, advancements in laser technology, and a growing focus on personalized treatment solutions for vision-related issues.