Ophthalmology Drug And Device Market Report

Published Date: 31 January 2026 | Report Code: ophthalmology-drug-and-device

Ophthalmology Drug And Device Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Ophthalmology Drug and Device market, covering current trends, market size, forecast data for 2023 to 2033, technological advancements, and key players influencing this dynamic sector.

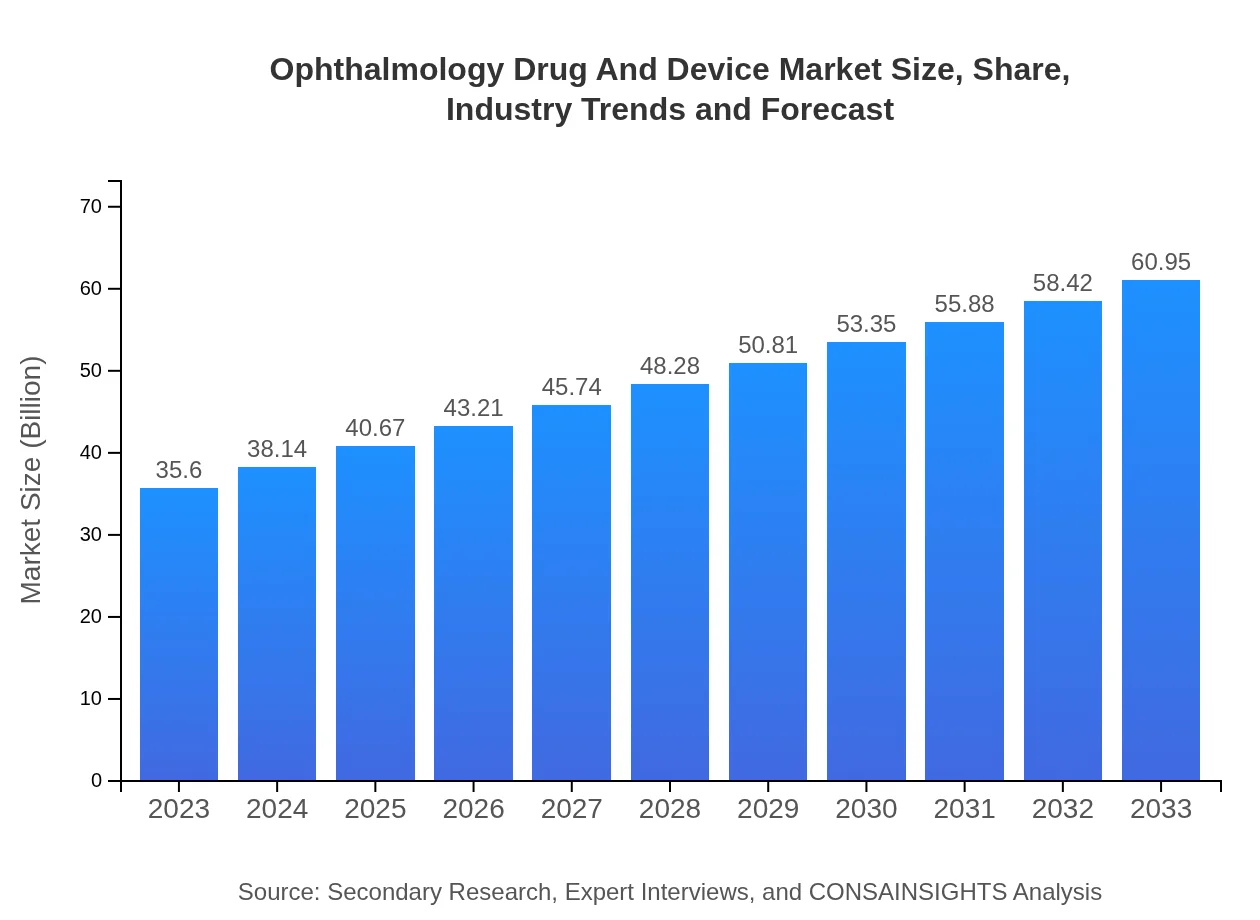

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $35.60 Billion |

| CAGR (2023-2033) | 5.4% |

| 2033 Market Size | $60.95 Billion |

| Top Companies | Novartis AG, Allergan (AbbVie Inc.), Bausch + Lomb, Regeneron Pharmaceuticals, Johnson & Johnson Vision |

| Last Modified Date | 31 January 2026 |

Ophthalmology Drug And Device Market Overview

Customize Ophthalmology Drug And Device Market Report market research report

- ✔ Get in-depth analysis of Ophthalmology Drug And Device market size, growth, and forecasts.

- ✔ Understand Ophthalmology Drug And Device's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ophthalmology Drug And Device

What is the Market Size & CAGR of Ophthalmology Drug And Device market in 2023?

Ophthalmology Drug And Device Industry Analysis

Ophthalmology Drug And Device Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ophthalmology Drug And Device Market Analysis Report by Region

Europe Ophthalmology Drug And Device Market Report:

Europe's Ophthalmology Drug and Device market stands at $12.77 billion in 2023, estimated to expand to $21.87 billion by 2033. A well-established healthcare framework, stringent regulatory standards, and a focus on research and development are key contributors to market growth in this region. Innovations in surgical procedures play a significant role here.Asia Pacific Ophthalmology Drug And Device Market Report:

The Asia Pacific region presents significant growth opportunities, driven by increasing incidences of eye diseases, escalating healthcare investments, and a rising aging population. The market was valued at $6.45 billion in 2023 and is projected to reach $11.04 billion by 2033. Enhanced healthcare infrastructure and awareness about eye care services are further propelling the growth in this region.North America Ophthalmology Drug And Device Market Report:

In North America, the market is robust, anticipated to grow from $12.15 billion in 2023 to $20.80 billion by 2033. Advances in medical technology, high healthcare expenditure, and a significant presence of leading pharmaceutical companies drive the region. The USA and Canada are pivotal in adopting innovative treatment methodologies.South America Ophthalmology Drug And Device Market Report:

The South American market for Ophthalmology Drug and Device is anticipated to face challenges with negative market growth, estimated at -0.64 billion in 2023 and -1.09 billion by 2033. Factors such as economic instability and limited healthcare access impede market expansion but hold potential as healthcare reforms continue.Middle East & Africa Ophthalmology Drug And Device Market Report:

The Middle East and Africa region is projected to exhibit steady growth, with a market size of approximately $4.87 billion in 2023 growing to $8.34 billion by 2033. Increased investment in healthcare infrastructures, coupled with rising disease prevalence rates in areas such as diabetic retinopathy, will likely sustain the upward growth trajectory in this region.Tell us your focus area and get a customized research report.

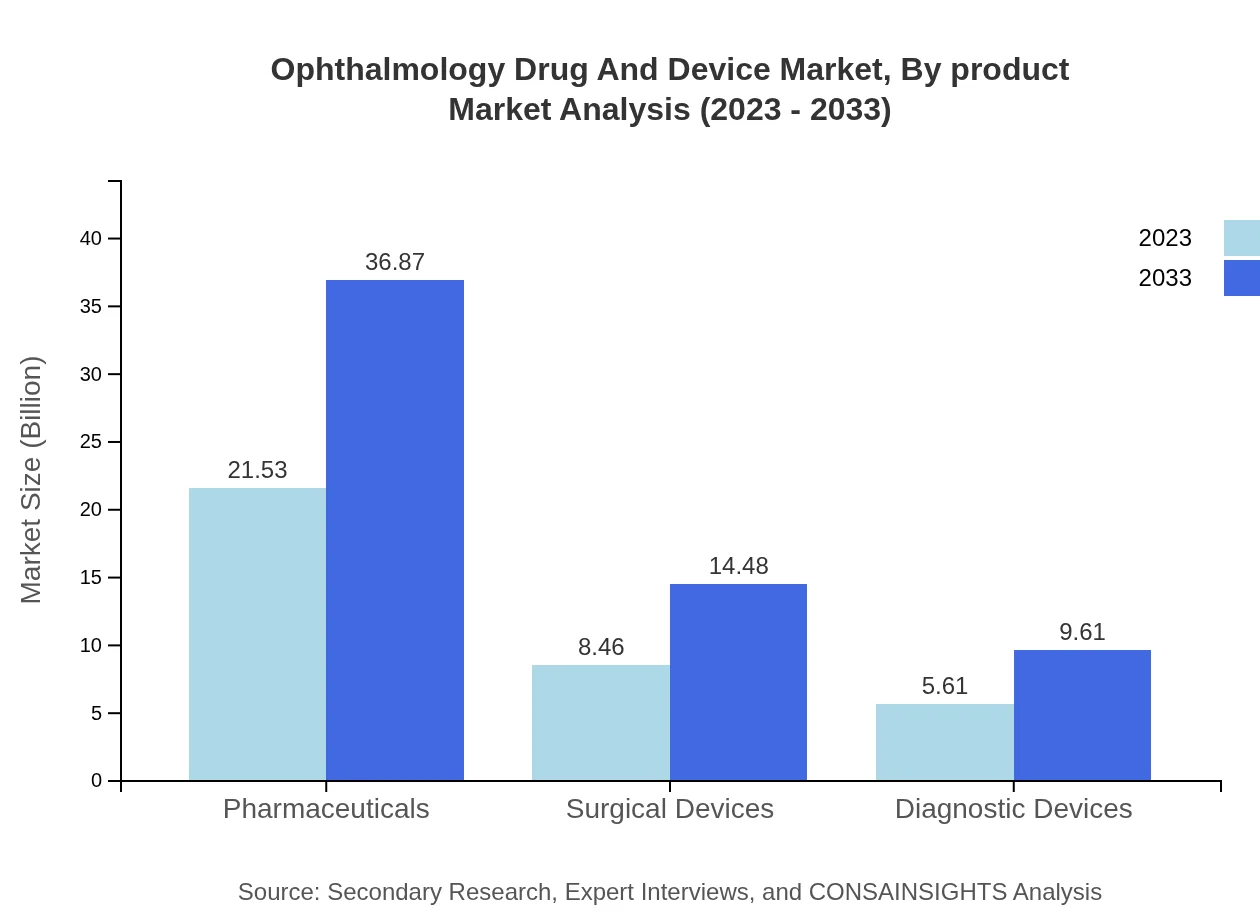

Ophthalmology Drug And Device Market Analysis By Product

The market can be classified into pharmaceuticals, surgical devices, and diagnostic devices. Pharmaceuticals hold a dominant market share, accounting for $21.53 billion in 2023, projected to grow to $36.87 billion by 2033, reflecting the growing demand for effective drug therapies. Surgical devices are also significant, estimated at $8.46 billion in 2023 and projected to increase to $14.48 billion by 2033.

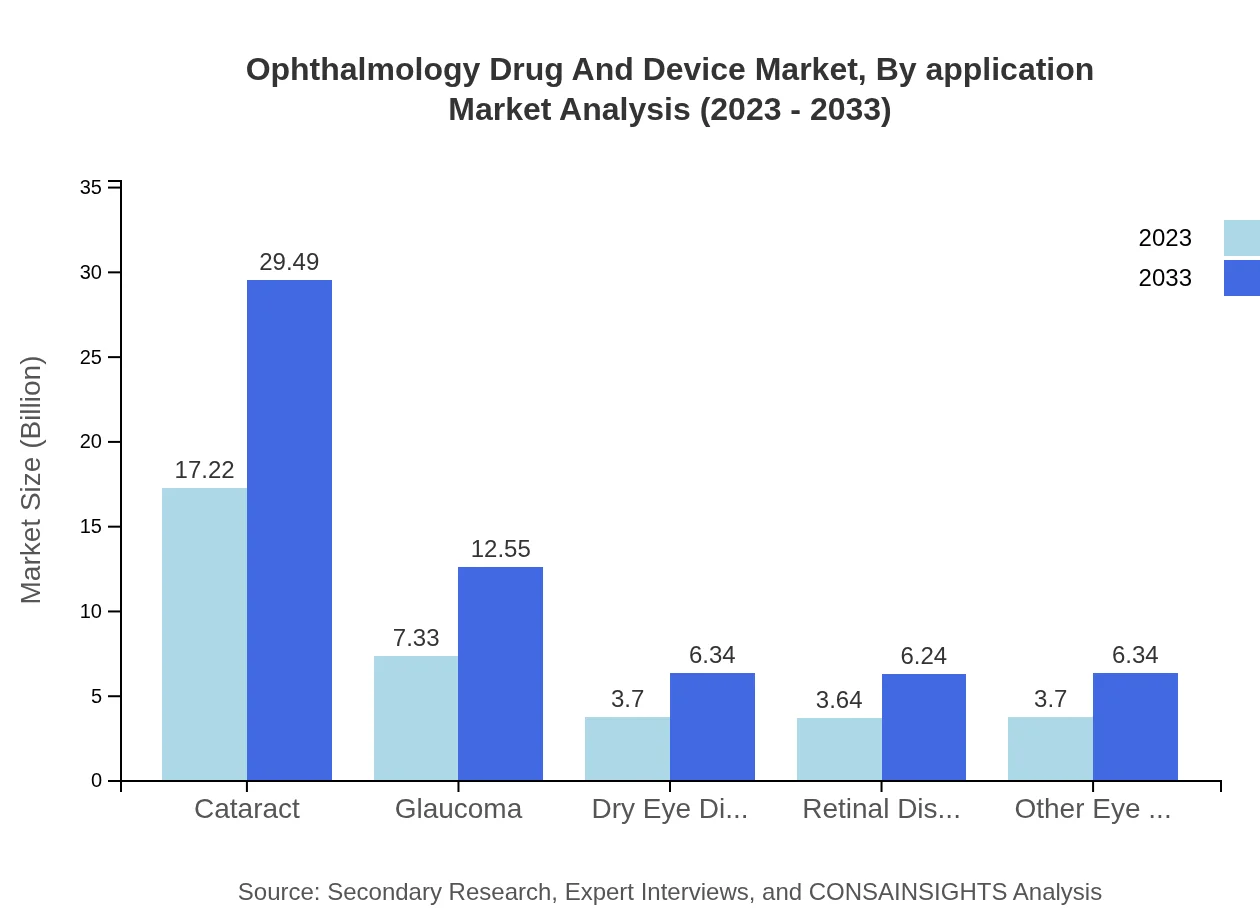

Ophthalmology Drug And Device Market Analysis By Application

The primary applications include cataract treatment, glaucoma management, dry eye disease therapy, and others. Cataract treatment leads with a market share of $17.22 billion in 2023, expected to reach $29.49 billion by 2033, reflecting advancements in surgical technologies.

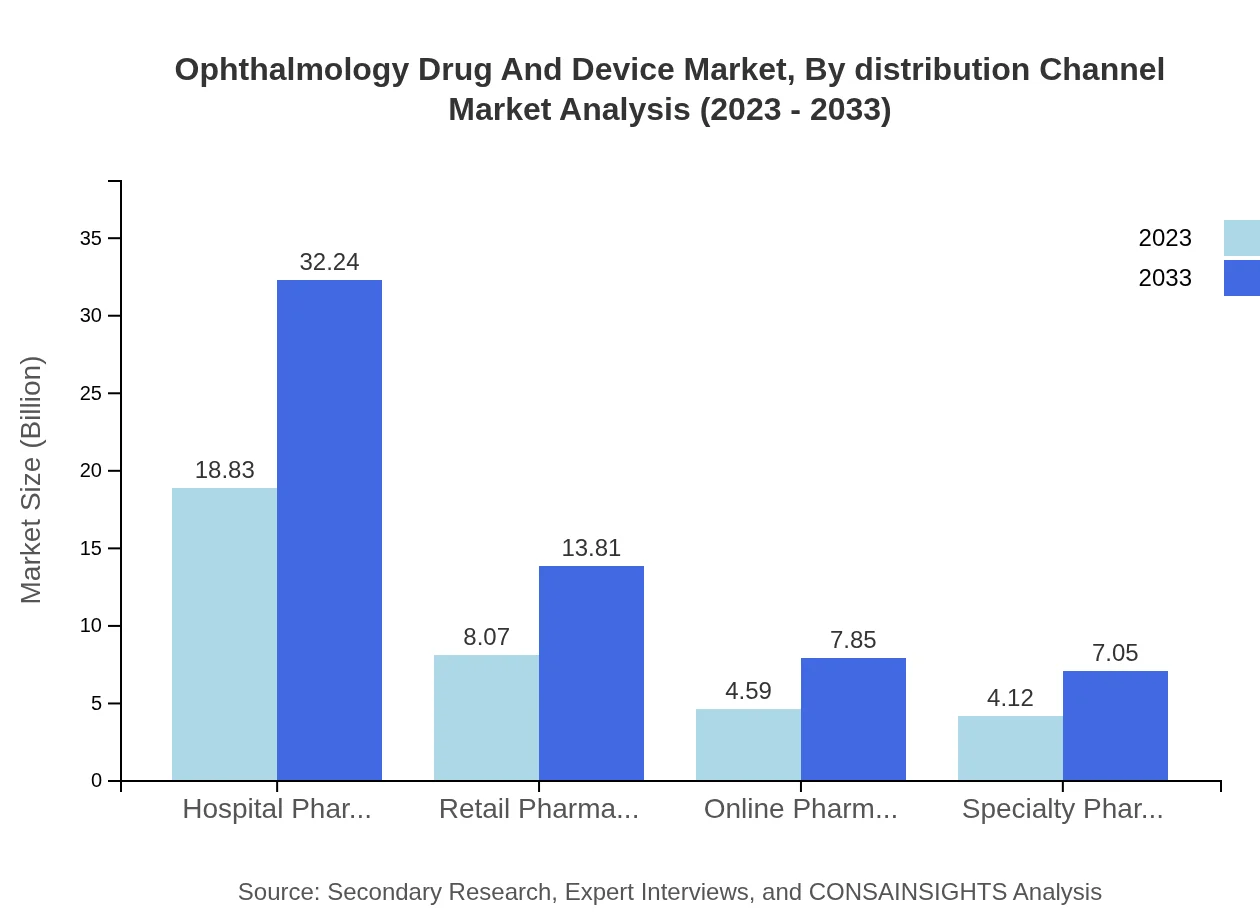

Ophthalmology Drug And Device Market Analysis By Distribution Channel

Major distribution channels for ophthalmological products can be categorized into hospital pharmacies, retail pharmacies, online pharmacies, and specialty pharmacies. Hospital pharmacies dominate with a market size of $18.83 billion in 2023, growing to $32.24 billion by 2033, supported by the high demand for integrated healthcare delivery.

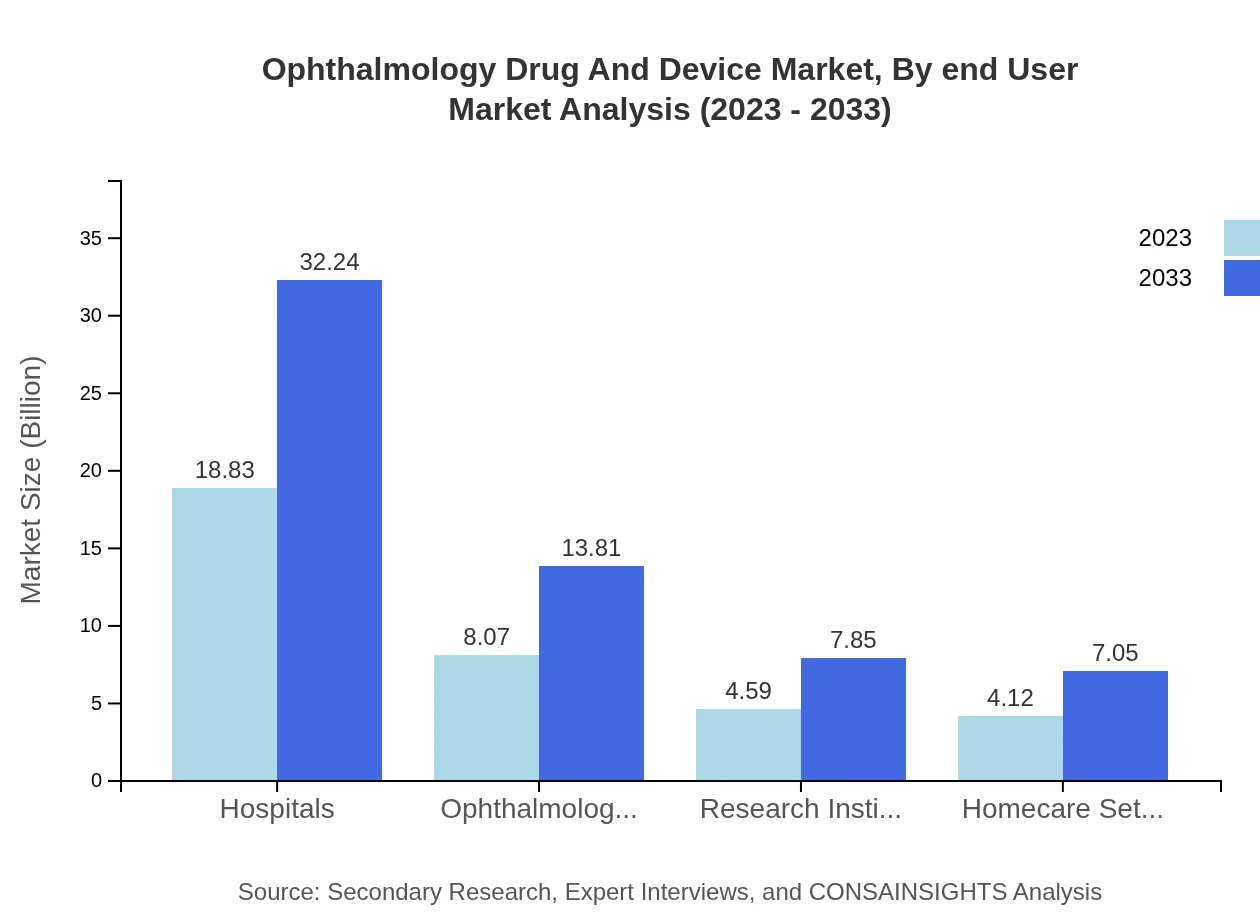

Ophthalmology Drug And Device Market Analysis By End User

End-users encompass hospitals, ophthalmology clinics, research institutions, and homecare settings. Hospitals maintain the largest market share with $18.83 billion in 2023, projected to rise to $32.24 billion by 2033, driven by a rise in surgical interventions and outpatient care.

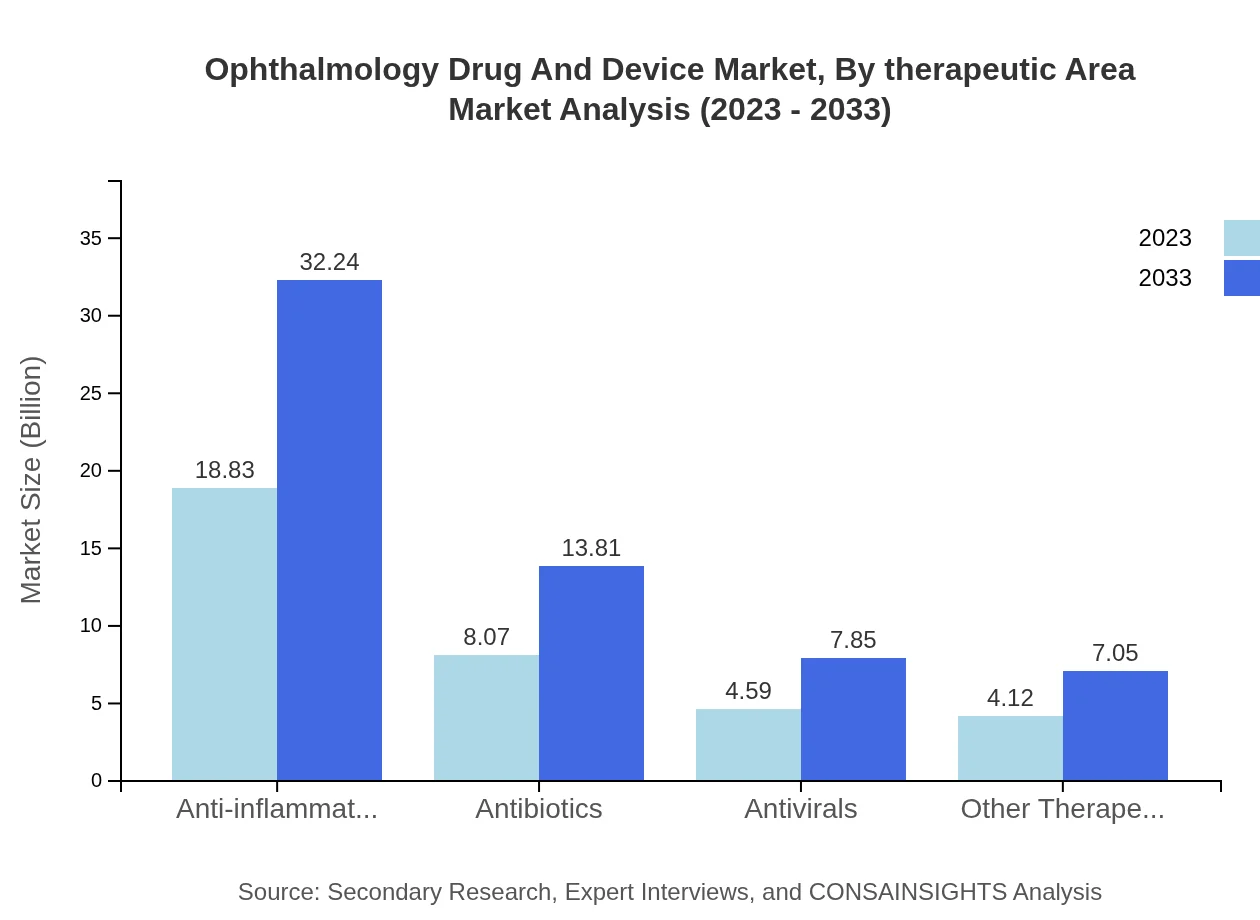

Ophthalmology Drug And Device Market Analysis By Therapeutic Area

This segment includes anti-inflammatory treatments, antibiotics, antivirals, and other therapeutics. Anti-inflammatory drugs contribute the largest segment share at $18.83 billion in 2023 and are expected to grow to $32.24 billion by 2033, indicating a robust market trend towards managing inflammatory eye conditions.

Ophthalmology Drug And Device Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ophthalmology Drug And Device Industry

Novartis AG:

A leader in ophthalmology, Novartis specializes in innovative solutions for retinal diseases and ocular health, driving significant advancements in drug development and therapies.Allergan (AbbVie Inc.):

Known for its innovative eye care products, Allergan specializes in surgical and pharmaceutical solutions, significantly impacting the market with its comprehensive portfolio.Bausch + Lomb:

A prominent player in the eye health sector, Bausch + Lomb provides an extensive range of surgical and therapeutic products, escalating its influence in the ophthalmology market.Regeneron Pharmaceuticals:

Regeneron focuses on ophthalmology research and is recognized for its advanced therapies in retinal diseases, significantly shaping treatment paradigms.Johnson & Johnson Vision:

A major contributor to eye health, Johnson & Johnson Vision develops innovative consumer and surgical solutions that address various eye conditions worldwide.We're grateful to work with incredible clients.

FAQs

What is the market size of ophthalmology Drug And Device?

The global ophthalmology drug and device market is valued at approximately $35.6 billion in 2023 and is projected to grow at a CAGR of 5.4% through 2033, driven by increasing prevalence of eye diseases and technological advancements.

What are the key market players or companies in this ophthalmology Drug And Device industry?

Key players in the ophthalmology drug and device market include major pharmaceuticals and medical device manufacturers, which are actively enhancing their product portfolios through innovation, mergers, and collaborations to improve patient outcomes and capitalize on market growth.

What are the primary factors driving the growth in the ophthalmology Drug And Device industry?

Growth in the ophthalmology drug and device market is driven by factors such as rising geriatric population, increased incidence of ocular diseases, advancements in technology, and increased healthcare spending focused on eye care treatments and preventative measures.

Which region is the fastest Growing in the ophthalmology Drug And Device?

The European region is the fastest-growing market for ophthalmology drugs and devices, expected to rise from $12.77 billion in 2023 to $21.87 billion by 2033, reflecting a high demand for eye care solutions.

Does ConsaInsights provide customized market report data for the ophthalmology Drug And Device industry?

Yes, ConsaInsights offers customized market report data tailored to the ophthalmology drug and device industry, enabling clients to access precise analyses and insights tailored to their specific needs and strategic interests.

What deliverables can I expect from this ophthalmology Drug And Device market research project?

Deliverables from the ophthalmology drug and device market research project typically include comprehensive market reports, growth forecasts, competitive analysis, segmentation data, and actionable insights to support strategic decision-making.

What are the market trends of ophthalmology Drug And Device?

Current trends in the ophthalmology drug and device market include increasing adoption of minimally invasive surgical techniques, focus on personalized medicine, growth of telemedicine services, and the rise of digital health solutions enhancing patient care.