Ophthalmology Pacs Picture Archiving And Communication System Market Report

Published Date: 31 January 2026 | Report Code: ophthalmology-pacs-picture-archiving-and-communication-system

Ophthalmology Pacs Picture Archiving And Communication System Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Ophthalmology PACS Picture Archiving and Communication System market, covering key insights, trends, and forecasts from 2023 to 2033. It provides data on market size, growth projections, segmentation, and regional dynamics to guide stakeholders in strategic decision-making.

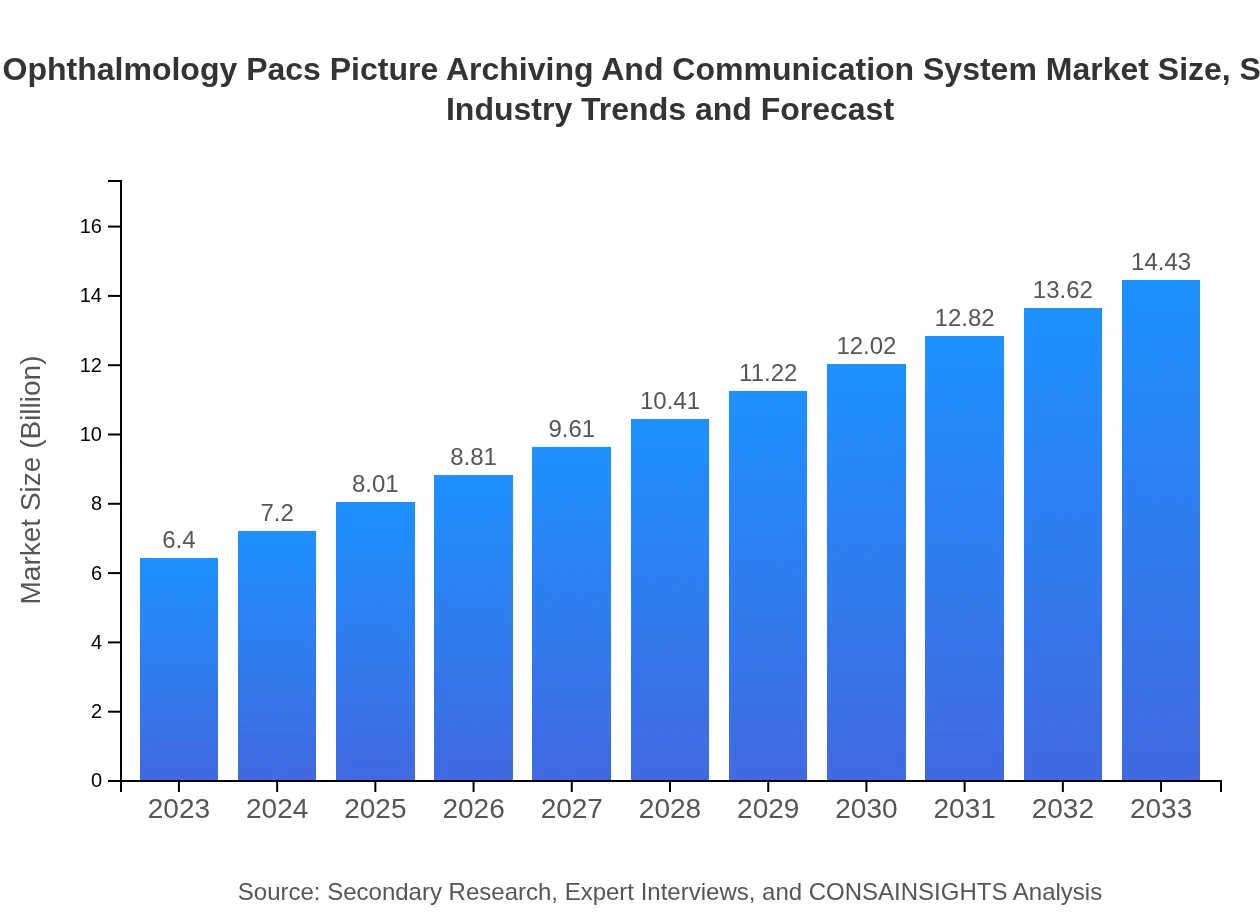

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.40 Billion |

| CAGR (2023-2033) | 8.2% |

| 2033 Market Size | $14.43 Billion |

| Top Companies | Canon Inc., Visiogen, Inc., Siemens Healthineers, GE Healthcare |

| Last Modified Date | 31 January 2026 |

Ophthalmology Pacs Picture Archiving And Communication System Market Overview

Customize Ophthalmology Pacs Picture Archiving And Communication System Market Report market research report

- ✔ Get in-depth analysis of Ophthalmology Pacs Picture Archiving And Communication System market size, growth, and forecasts.

- ✔ Understand Ophthalmology Pacs Picture Archiving And Communication System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ophthalmology Pacs Picture Archiving And Communication System

What is the Market Size & CAGR of Ophthalmology Pacs Picture Archiving And Communication System market in 2023?

Ophthalmology Pacs Picture Archiving And Communication System Industry Analysis

Ophthalmology Pacs Picture Archiving And Communication System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ophthalmology Pacs Picture Archiving And Communication System Market Analysis Report by Region

Europe Ophthalmology Pacs Picture Archiving And Communication System Market Report:

Europe is expected to experience growth from $1.69 billion in 2023 to $3.82 billion by 2033. The presence of well-established healthcare systems, ongoing advancements in diagnostic imaging technologies, and favorable government initiatives to improve healthcare informatics drive the market growth.Asia Pacific Ophthalmology Pacs Picture Archiving And Communication System Market Report:

In 2023, the Ophthalmology PACS market in Asia Pacific is valued at approximately $1.33 billion and is expected to grow to $2.99 billion by 2033. The growing population, increasing prevalence of chronic eye diseases, and investments in healthcare infrastructure are key growth drivers. Additionally, digitalization initiatives in healthcare across countries like India and China further support market expansion in the region.North America Ophthalmology Pacs Picture Archiving And Communication System Market Report:

The North American Ophthalmology PACS market is projected to grow from $2.32 billion in 2023 to $5.23 billion by 2033. The region leads the market due to the high adoption rate of advanced healthcare technologies, increasing investments in research and development, and a surge in eye-related health issues among the aging population.South America Ophthalmology Pacs Picture Archiving And Communication System Market Report:

The South American market is anticipated to expand from $0.53 billion in 2023 to $1.18 billion by 2033. This growth is attributed to rising healthcare expenditure and the incorporation of advanced PACS solutions in hospitals and clinics, addressing the urgent need for better diagnostic tools in the region.Middle East & Africa Ophthalmology Pacs Picture Archiving And Communication System Market Report:

The Middle East and Africa market growth is expected, increasing from $0.54 billion in 2023 to $1.21 billion by 2033. Key factors include expanding healthcare facilities and increasing awareness about eye care, alongside efforts to improve the region’s healthcare infrastructure.Tell us your focus area and get a customized research report.

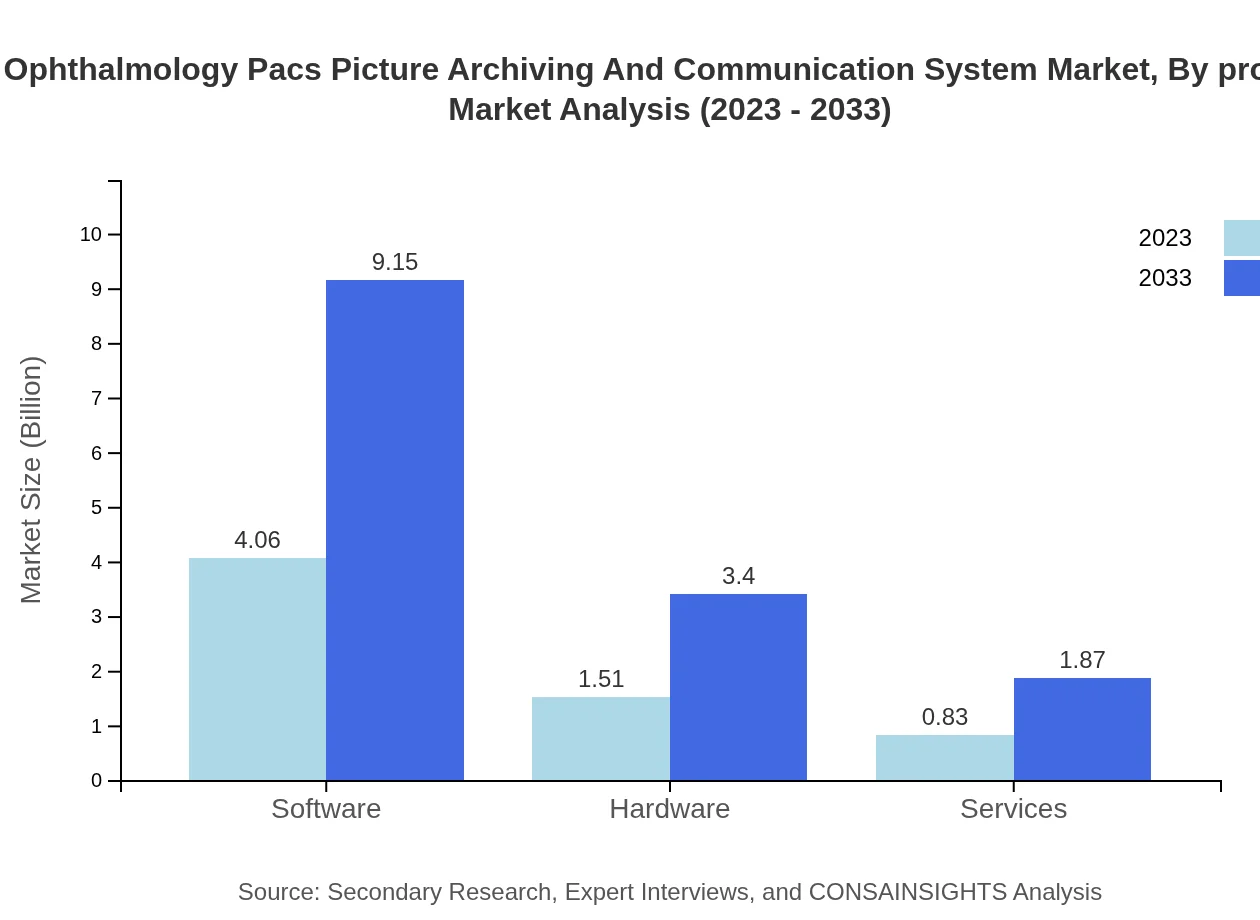

Ophthalmology Pacs Picture Archiving And Communication System Market Analysis By Product

The Ophthalmology PACS market by product reveals software as the predominant segment, escalating from $4.06 billion in 2023 to $9.15 billion by 2033. The software segment alone constitutes 63.41% of the total market share due to its critical role in data management. Hardware and services also contribute significantly, with hardware projected to increase from $1.51 billion to $3.40 billion, and services anticipated to rise from $0.83 billion to $1.87 billion over the same period.

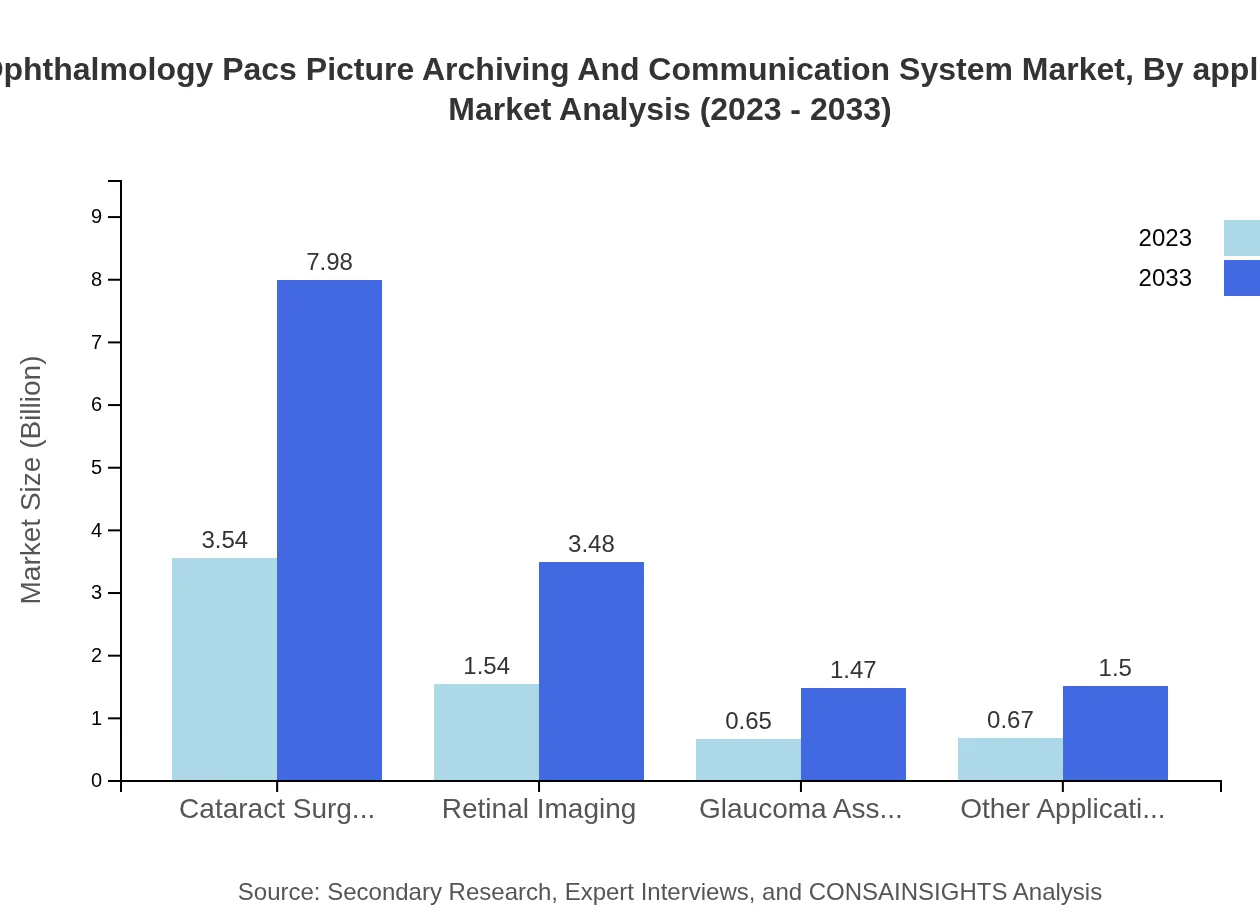

Ophthalmology Pacs Picture Archiving And Communication System Market Analysis By Application

By application, the cataract surgery segment commands the largest market share at 55.31%, expected to grow from $3.54 billion in 2023 to $7.98 billion in 2033. Following this, retinal imaging contributes 24.12%, anticipated to rise from $1.54 billion to $3.48 billion, while glaucoma assessment holds a 10.16% share, projected to reach $1.47 billion. Other applications also play a notable role in the overall market dynamics.

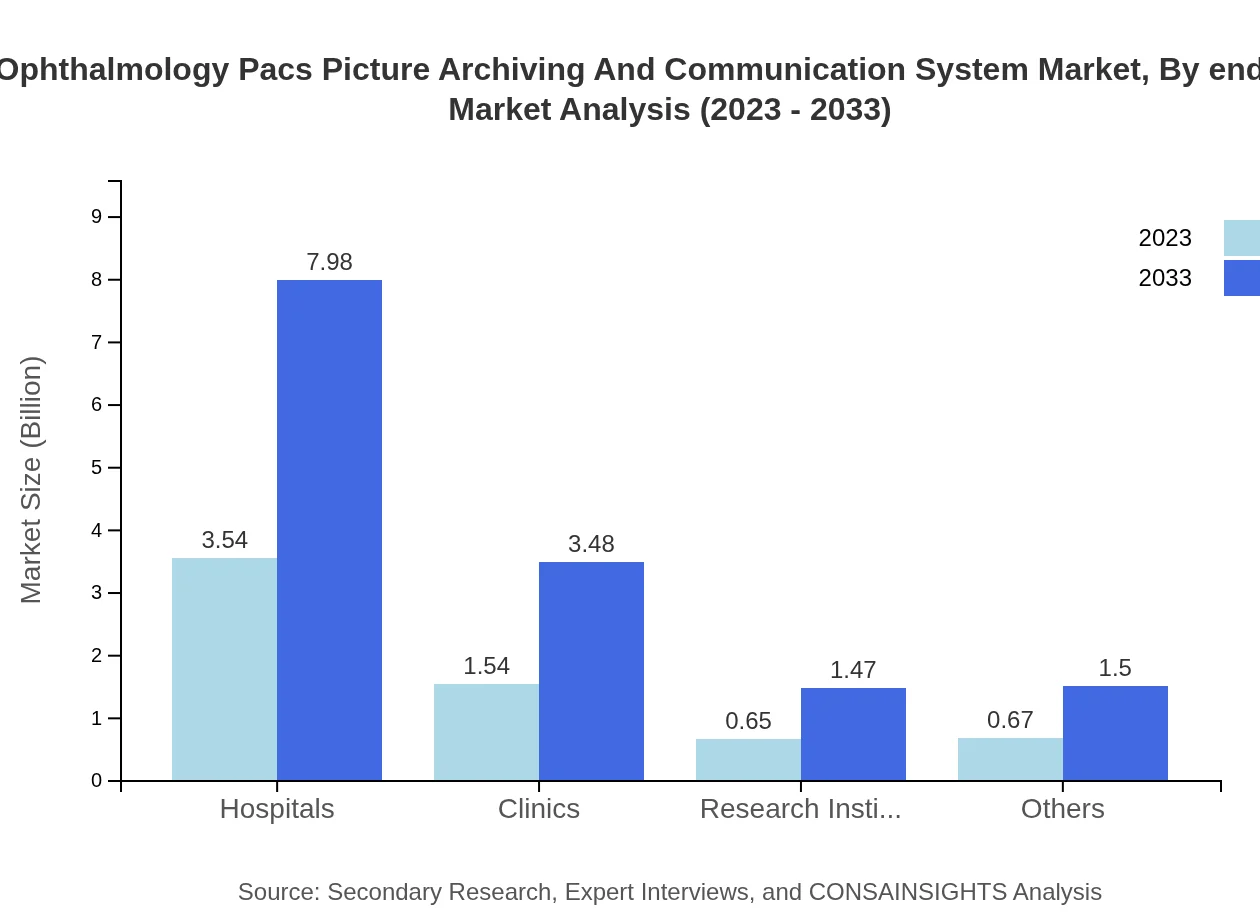

Ophthalmology Pacs Picture Archiving And Communication System Market Analysis By End User

The end-user analysis shows that hospitals are the key consumers of Ophthalmology PACS systems, holding 55.31% of the market share, with a growth trajectory taking their value from $3.54 billion in 2023 to $7.98 billion by 2033. Clinics represent 24.12%, expected to develop from $1.54 billion to $3.48 billion, while research institutions account for a smaller yet significant share, with revenues projected to increase proportionately.

Ophthalmology Pacs Picture Archiving And Communication System Market Analysis By Region Type

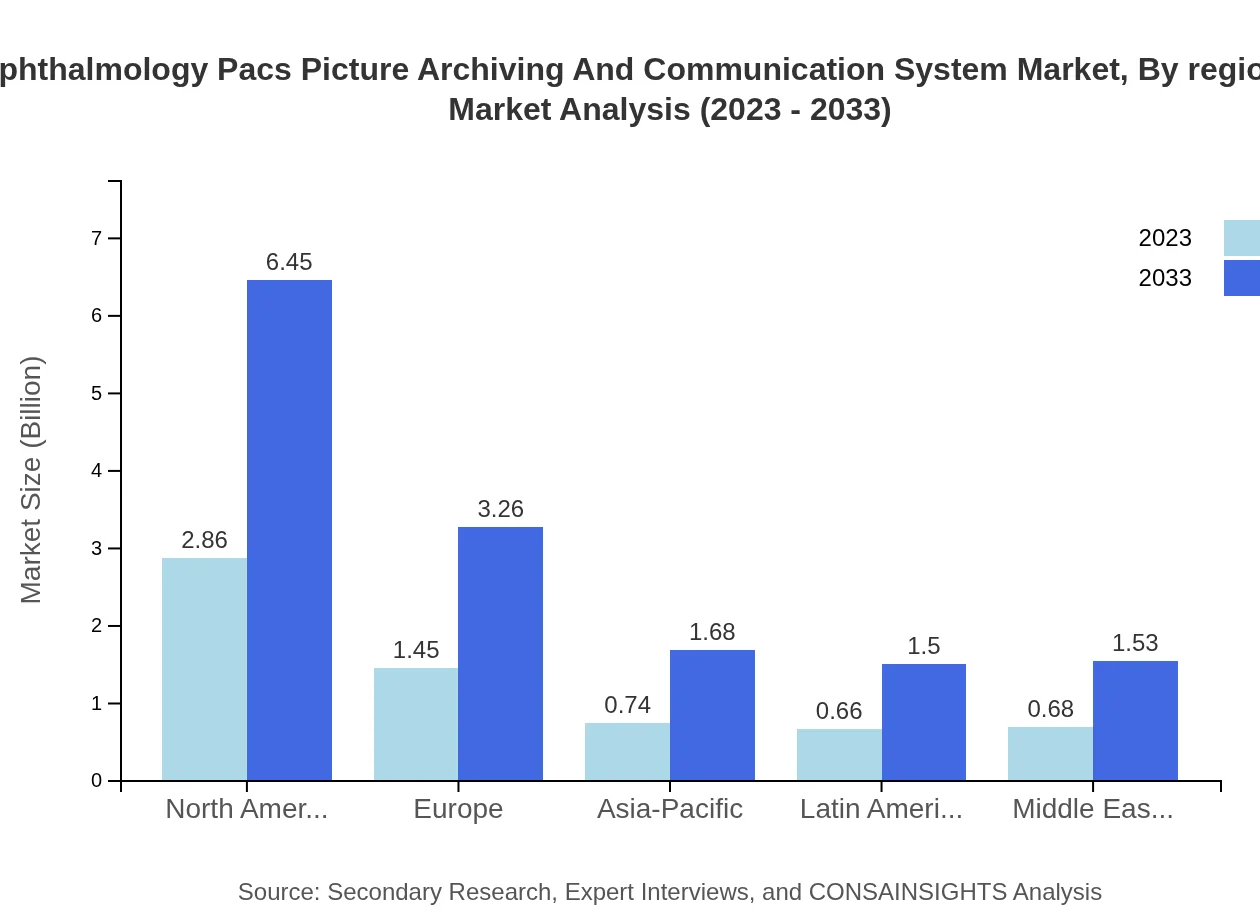

The regional breakdown indicates North America as the lead market, capturing 44.72% share, expected to rise from $2.86 billion to $6.45 billion from 2023 to 2033. Europe and Asia-Pacific also show substantial shares of 22.63% and 11.62%, respectively, while Latin America and the Middle East & Africa trail with shares of 10.39% and 10.64%.

Ophthalmology Pacs Picture Archiving And Communication System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ophthalmology Pacs Picture Archiving And Communication System Industry

Canon Inc.:

Canon is a global leader in imaging technologies, providing state-of-the-art ophthalmic imaging solutions that enhance the efficiency and accuracy of diagnostics.Visiogen, Inc.:

A pioneer in ophthalmic surgery innovations, Visiogen's PACS solutions integrate seamlessly with surgical workflows, improving image handling and patient care.Siemens Healthineers:

Siemens is renowned for reliable imaging systems and a wide range of PACS solutions tailored for ophthalmology, enhancing diagnostics through advanced imaging technology.GE Healthcare:

GE Healthcare is focused on providing sophisticated imaging equipment along with robust PACS solutions that facilitate better management of ophthalmic data and images.We're grateful to work with incredible clients.

FAQs

What is the market size of ophthalmology Pacs Picture Archiving And Communication System?

The ophthalmology PACS market is valued at $6.4 billion in 2023, growing at a CAGR of 8.2%. Forecasted growth could see the market expand significantly over the next decade.

What are the key market players or companies in this ophthalmology Pacs Picture Archiving And Communication System industry?

Key players in the ophthalmology PACS market include major tech companies and specialized healthcare software providers that enhance imaging and data dissemination processes critical for healthcare facilities.

What are the primary factors driving the growth in the ophthalmology Pacs Picture Archiving And Communication System industry?

Growth in this sector is driven by advancements in imaging technology, increasing prevalence of eye diseases, and the demand for efficient data management systems within healthcare facilities.

Which region is the fastest Growing in the ophthalmology Pacs Picture Archiving And Communication System?

North America currently leads the market but Asia-Pacific is projected to be the fastest-growing region, with its market expected to rise from $0.74 billion in 2023 to $1.68 billion by 2033.

Does ConsaInsights provide customized market report data for the ophthalmology Pacs Picture Archiving And Communication System industry?

Yes, Consainsights offers customized market report data, tailoring insights and analytics to meet specific client needs within the ophthalmology PACS market.

What deliverables can I expect from this ophthalmology Pacs Picture Archiving And Communication System market research project?

Deliverables typically include comprehensive market analysis, trend reports, regional data, segmented data breakdown, and actionable strategic recommendations.

What are the market trends of ophthalmology Pacs Picture Archiving And Communication System?

Key trends include increasing digital transformations in healthcare, a focus on telemedicine, and enhanced interoperability among PACS systems, reflecting a shift towards integrated healthcare solutions.