Ophthalmology Surgical Devices Market Report

Published Date: 31 January 2026 | Report Code: ophthalmology-surgical-devices

Ophthalmology Surgical Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Ophthalmology Surgical Devices market, focusing on market size, growth trends, regional insights, and competitive landscape, with forecasts spanning 2023 to 2033.

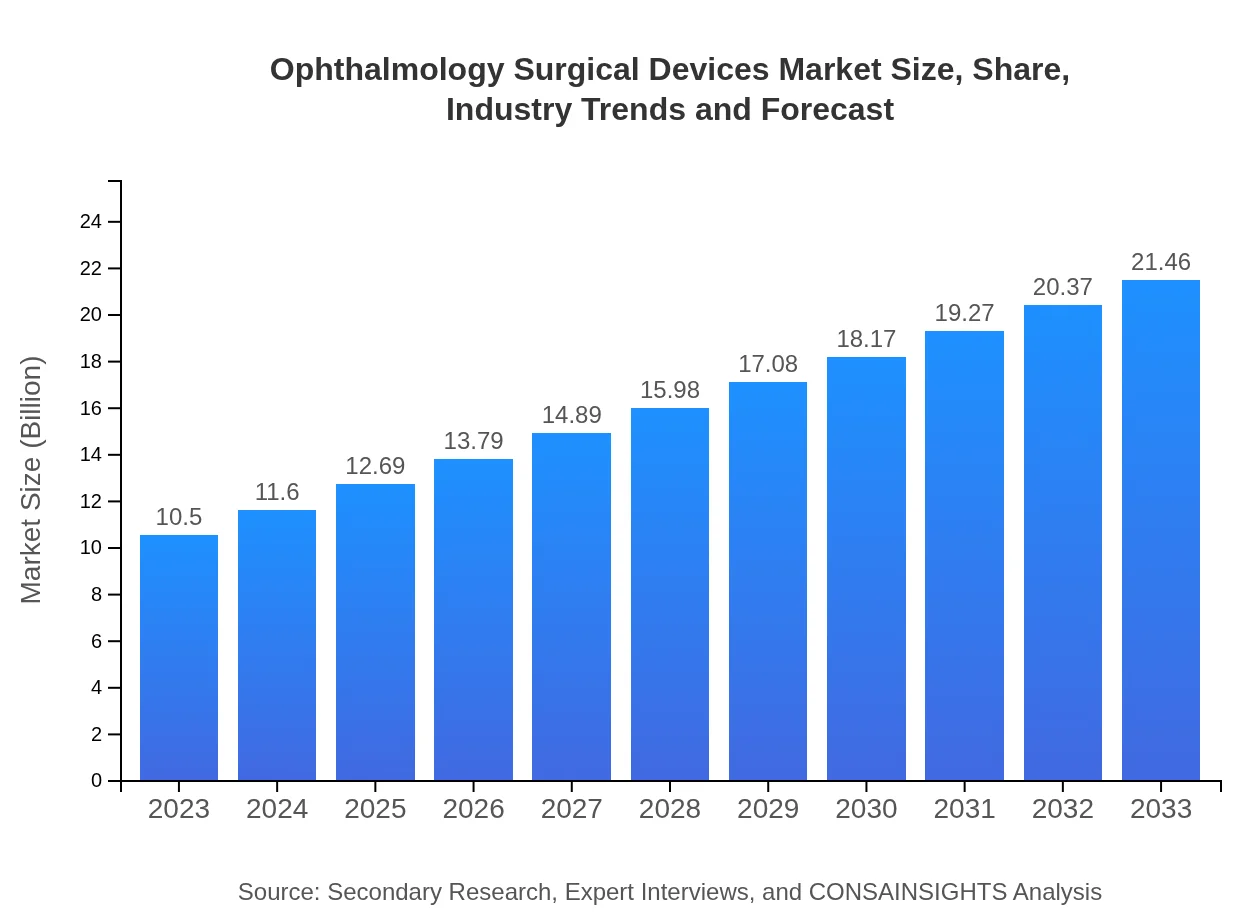

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $21.46 Billion |

| Top Companies | Abbott Laboratories, Alcon Inc., Johnson & Johnson Vision, Bausch Health |

| Last Modified Date | 31 January 2026 |

Ophthalmology Surgical Devices Market Overview

Customize Ophthalmology Surgical Devices Market Report market research report

- ✔ Get in-depth analysis of Ophthalmology Surgical Devices market size, growth, and forecasts.

- ✔ Understand Ophthalmology Surgical Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ophthalmology Surgical Devices

What is the Market Size & CAGR of Ophthalmology Surgical Devices market in 2023?

Ophthalmology Surgical Devices Industry Analysis

Ophthalmology Surgical Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ophthalmology Surgical Devices Market Analysis Report by Region

Europe Ophthalmology Surgical Devices Market Report:

In Europe, the market is forecasted to move from USD 3.19 billion in 2023 to USD 6.51 billion by 2033. Factors such as the aging population and demand for high-quality medical technologies are propelling growth in this market.Asia Pacific Ophthalmology Surgical Devices Market Report:

In 2023, the Ophthalmology Surgical Devices market in the Asia Pacific is valued at approximately USD 1.82 billion and is expected to reach around USD 3.72 billion by 2033. Increased healthcare expenditure, a rising population of elderly individuals, and the growing prevalence of eye diseases drive the growth in this region.North America Ophthalmology Surgical Devices Market Report:

North America holds a significant portion of the market, with an estimated value of USD 3.95 billion in 2023, growing to around USD 8.08 billion by 2033. The region is characterized by advanced healthcare systems and high disposable incomes, allowing for increased adoption of innovative surgical devices.South America Ophthalmology Surgical Devices Market Report:

The market in South America is projected to grow from USD 0.35 billion in 2023 to USD 0.71 billion by 2033. This growth can be attributed to the improving healthcare infrastructure and rising awareness about eye health, leading to an increase in surgical procedures.Middle East & Africa Ophthalmology Surgical Devices Market Report:

The Middle East and Africa market is expected to rise from USD 1.20 billion in 2023 to USD 2.45 billion by 2033. Enhanced access to healthcare services and the proliferation of specialized ophthalmic hospitals are key factors driving market growth in this region.Tell us your focus area and get a customized research report.

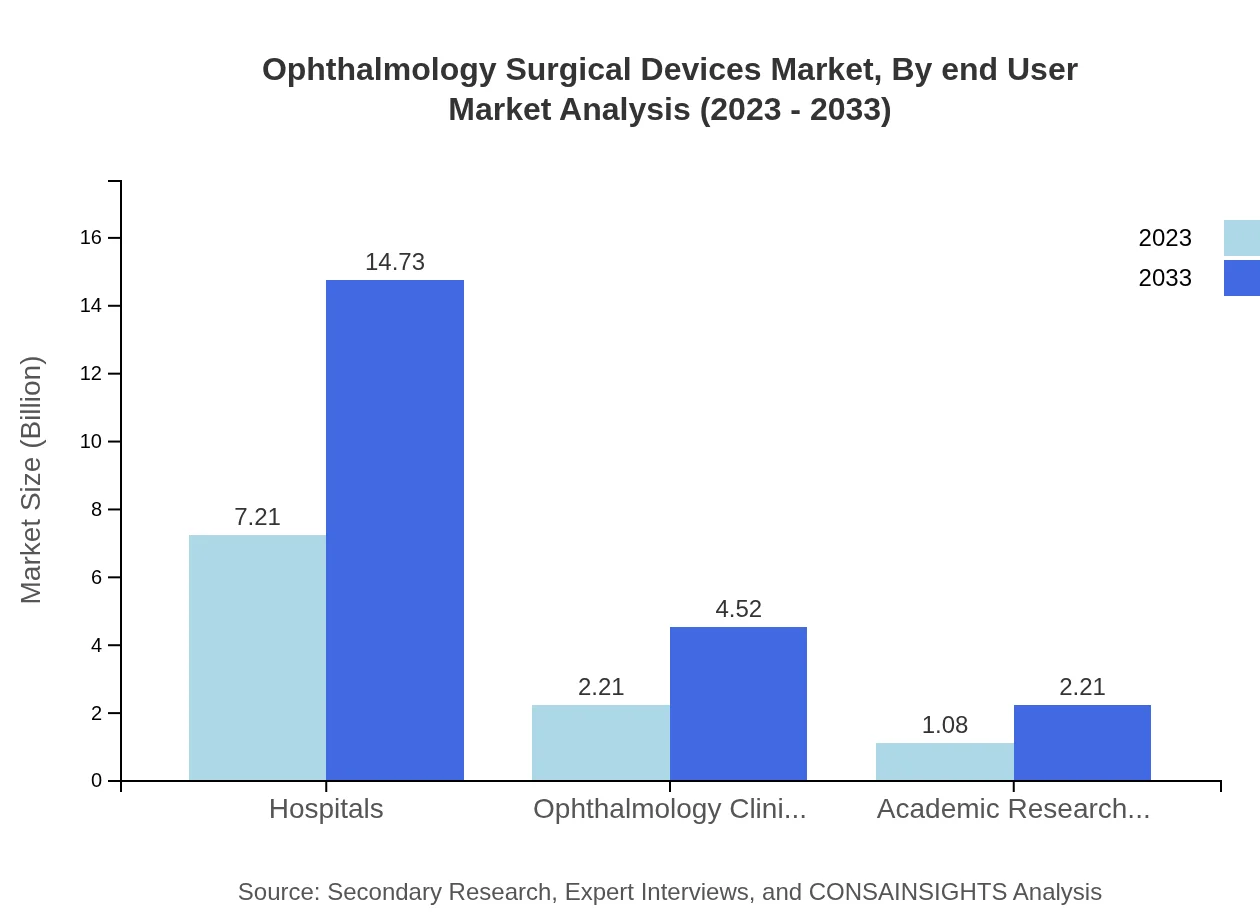

Ophthalmology Surgical Devices Market Analysis By End User

The end-user segment indicates a significant market size for hospitals, estimated at USD 7.21 billion in 2023 and expected to grow to USD 14.73 billion by 2033, holding a market share of 68.64%. Ophthalmology clinics represent another important segment, estimated at USD 2.21 billion in 2023, growing to USD 4.52 billion. Academic research institutions also contribute with a market size projected to rise from USD 1.08 billion in 2023 to USD 2.21 billion by 2033.

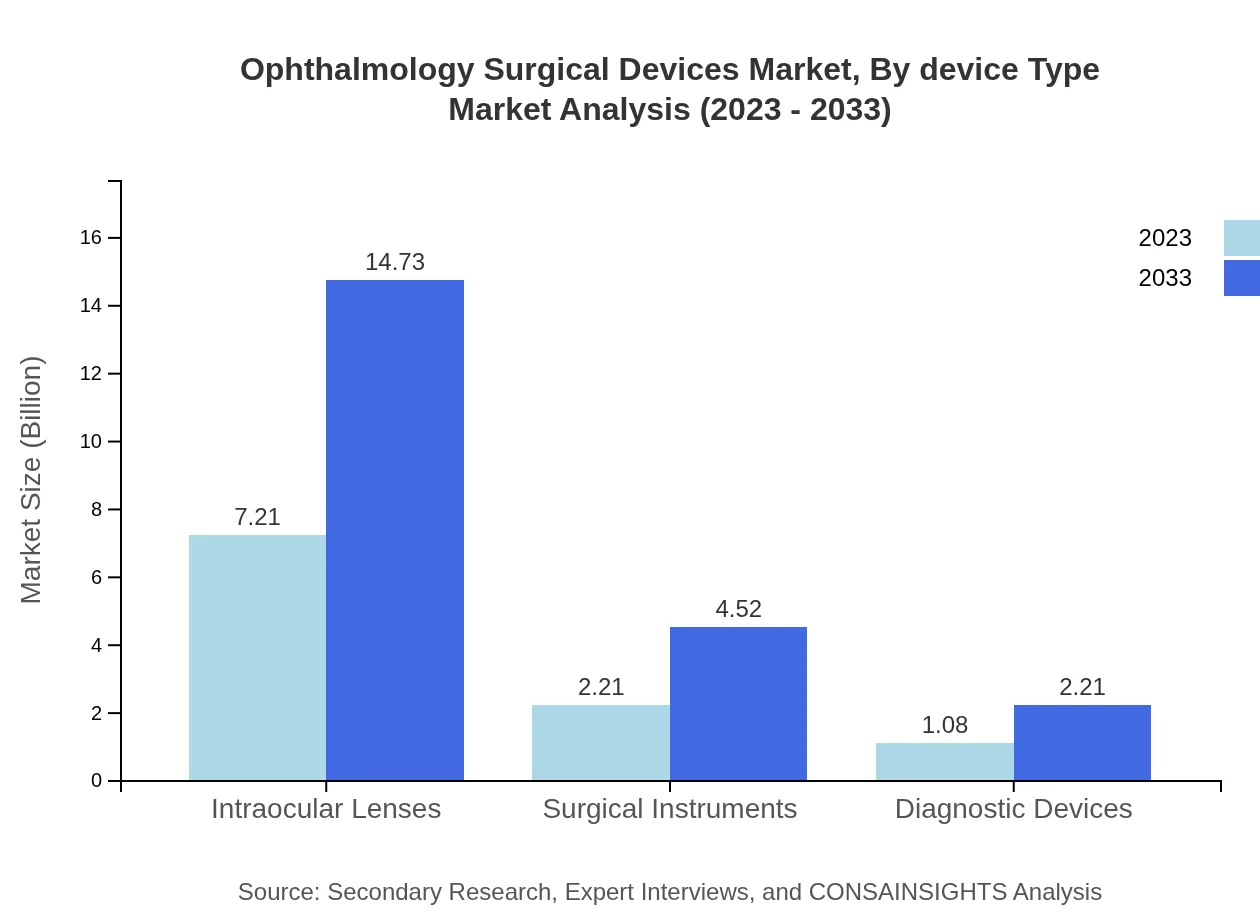

Ophthalmology Surgical Devices Market Analysis By Device Type

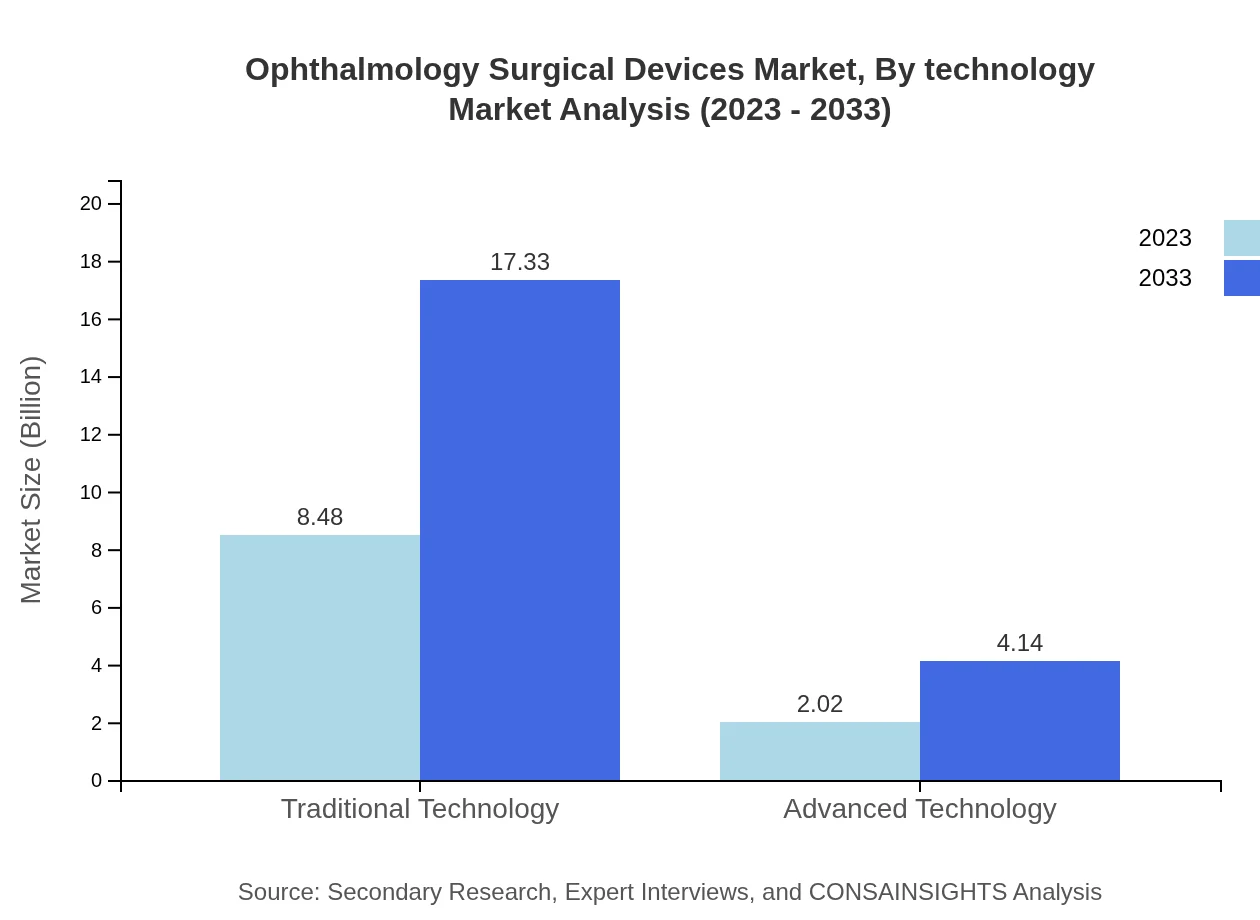

The market is predominantly driven by traditional technology, expected to grow from USD 8.48 billion in 2023 to USD 17.33 billion by 2033, maintaining an 80.73% share. Advanced technology devices, estimated at USD 2.02 billion in 2023, aim for growth to USD 4.14 billion, reflecting a shift in preference towards innovative solutions.

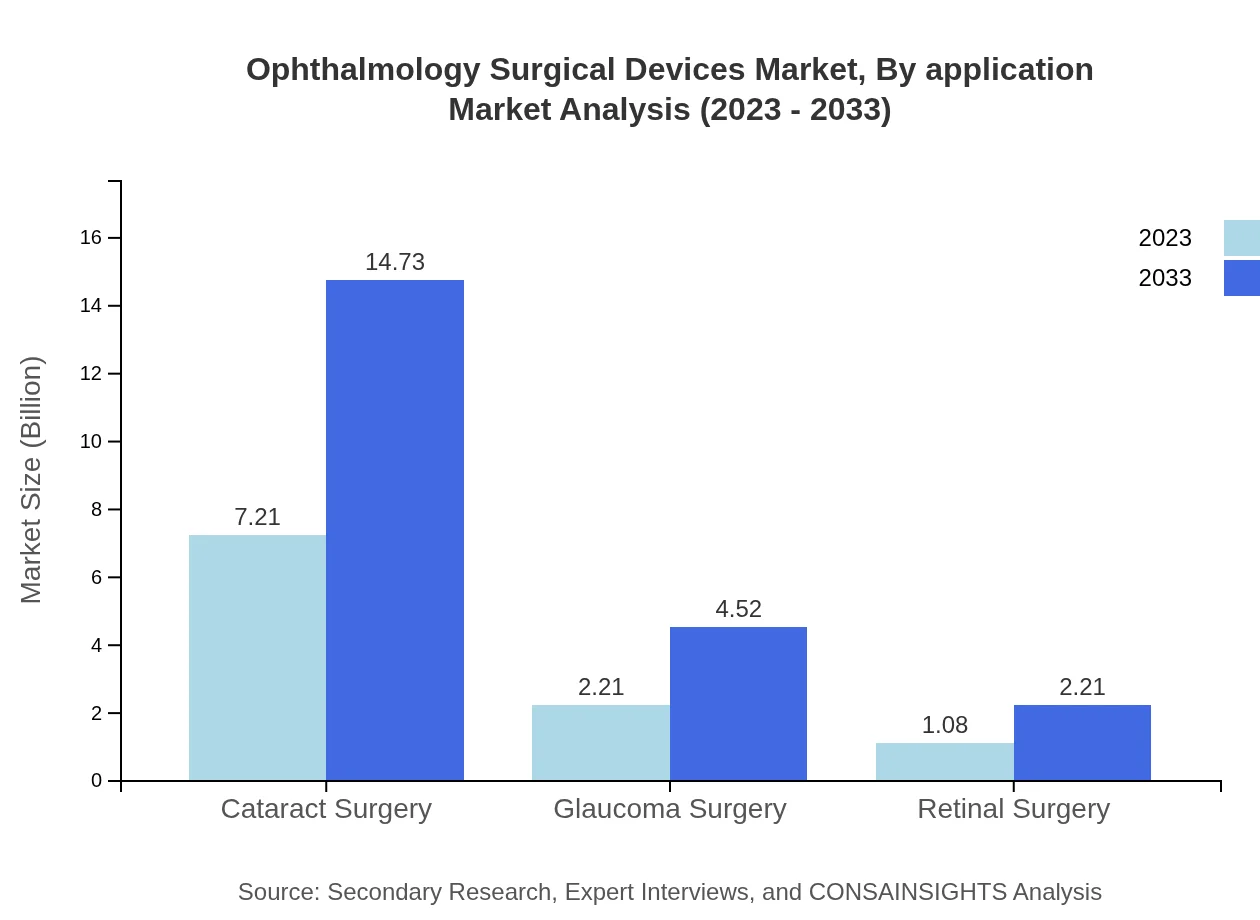

Ophthalmology Surgical Devices Market Analysis By Application

Cataract surgery remains the leading application segment, estimated at USD 7.21 billion in 2023 and expected to reach USD 14.73 billion by 2033, capturing a market share of 68.64%. Glaucoma surgery also shows growth potential, increasing from USD 2.21 billion in 2023 to USD 4.52 billion, while retinal surgery is growing at a slower rate from USD 1.08 billion to USD 2.21 billion over the same period.

Ophthalmology Surgical Devices Market Analysis By Technology

The technological advancements in the market are evident with traditional technologies leading the market. Advanced technologies, currently at USD 2.02 billion, are projected to capture a larger market share by 2033 as innovations continue to emerge, impacting surgical practices and patient outcomes.

Ophthalmology Surgical Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ophthalmology Surgical Devices Industry

Abbott Laboratories:

A leading healthcare company that is known for its wide range of products including advanced surgical instruments and intraocular lenses aimed at improving visual outcomes.Alcon Inc.:

A global leader in eye care products, Alcon specializes in developing innovative surgical devices and products that address critical needs in ophthalmology.Johnson & Johnson Vision:

Focused on transforming the treatment of eye health, Johnson & Johnson Vision provides a wide array of solutions for cataract and refractive surgeries.Bausch Health:

Bausch Health offers a range of ophthalmic surgical devices and is committed to advancing innovative eye care to enhance patient outcomes.We're grateful to work with incredible clients.

FAQs

What is the market size of ophthalmology Surgical Devices?

The ophthalmology surgical devices market is valued at approximately $10.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 7.2%, indicating robust growth potential through 2033.

What are the key market players or companies in this ophthalmology Surgical Devices industry?

Key players in the ophthalmology surgical devices market typically include major companies specializing in medical devices, pharmaceuticals, and surgical technologies, such as Alcon, Johnson & Johnson Vision, Bausch + Lomb, and Carl Zeiss AG.

What are the primary factors driving the growth in the ophthalmology Surgical Devices industry?

Growth in the ophthalmology surgical devices market is primarily driven by the increasing prevalence of eye disorders, advancements in surgical techniques, and rising investments in ophthalmic research and development within healthcare sectors globally.

Which region is the fastest Growing in the ophthalmology Surgical Devices?

The North American region is the fastest-growing area of the ophthalmology surgical devices market, with a market size projected to grow from $3.95 billion in 2023 to $8.08 billion by 2033, reflecting an increased demand for innovative surgical solutions.

Does ConsaInsights provide customized market report data for the ophthalmology Surgical Devices industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the ophthalmology surgical devices industry, ensuring clients receive relevant insights and data to support their strategic planning.

What deliverables can I expect from this ophthalmology Surgical Devices market research project?

Deliverables from the ophthalmology surgical devices market research project typically include comprehensive reports, data analysis, market forecasts, and insights on competitive landscapes, regional trends, and emerging technologies.

What are the market trends of ophthalmology Surgical Devices?

Current trends in the ophthalmology surgical devices market include the increasing adoption of minimally invasive surgical techniques, the integration of advanced technologies such as AI in diagnostics, and a growing emphasis on patient-centric solutions.