Optical Ceramics Market Report

Published Date: 31 January 2026 | Report Code: optical-ceramics

Optical Ceramics Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Optical Ceramics market, including market trends, size forecasts from 2023 to 2033, and regional performance insights. It aims to deliver comprehensive data for informed decision-making regarding investments and strategic planning.

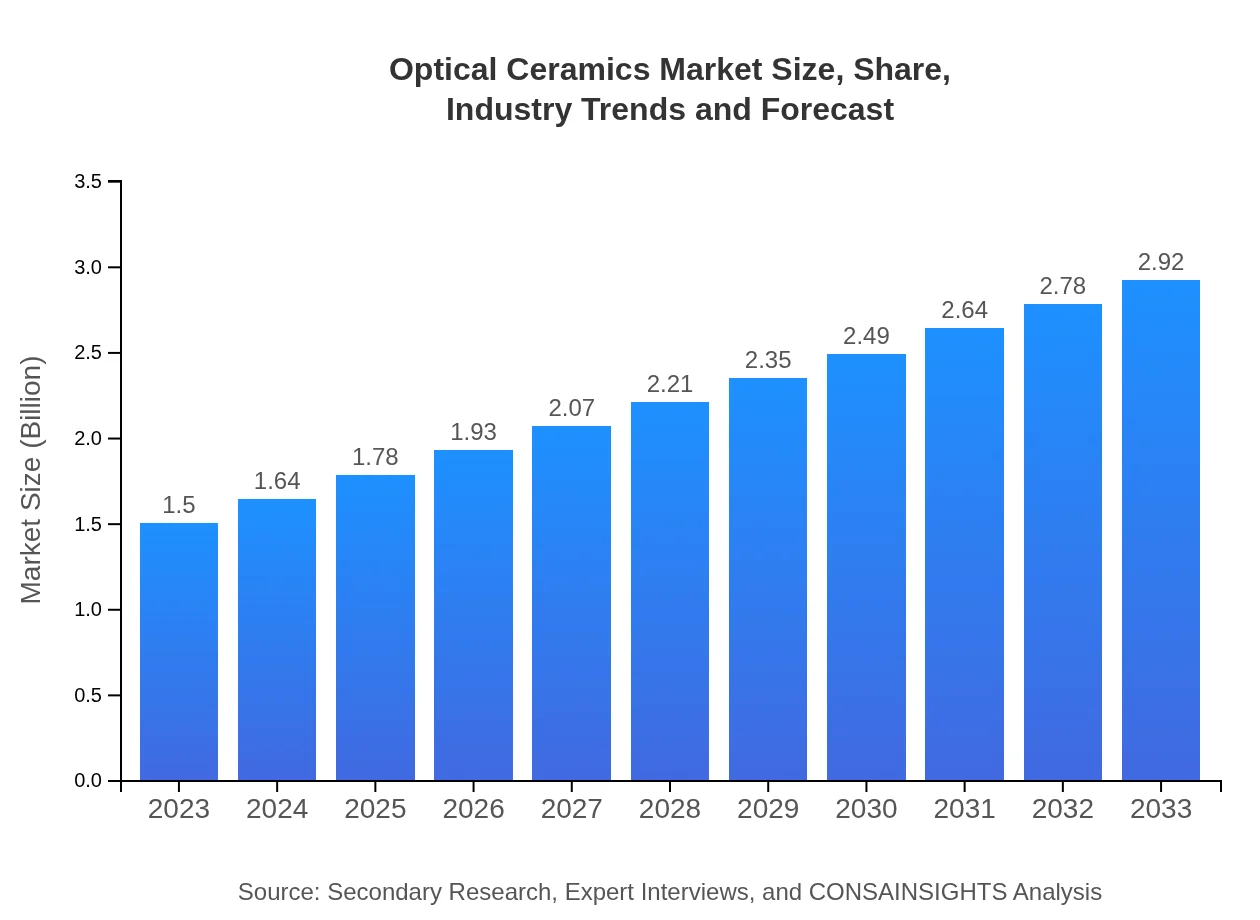

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.7% |

| 2033 Market Size | $2.92 Billion |

| Top Companies | Corning Incorporated, CeramTec GmbH, Mitsubishi Chemical Corporation, Schott AG |

| Last Modified Date | 31 January 2026 |

Optical Ceramics Market Overview

Customize Optical Ceramics Market Report market research report

- ✔ Get in-depth analysis of Optical Ceramics market size, growth, and forecasts.

- ✔ Understand Optical Ceramics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Optical Ceramics

What is the Market Size & CAGR of Optical Ceramics market in 2023?

Optical Ceramics Industry Analysis

Optical Ceramics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Optical Ceramics Market Analysis Report by Region

Europe Optical Ceramics Market Report:

In Europe, the market's value is projected to grow from USD 0.48 billion in 2023 to USD 0.94 billion by 2033. The region's well-established manufacturing capabilities and strong emphasis on R&D are key growth facilitators.Asia Pacific Optical Ceramics Market Report:

In the Asia Pacific region, the market for Optical Ceramics is expected to grow from USD 0.29 billion in 2023 to USD 0.56 billion by 2033, reflecting significant market potential due to rapid industrialization and increasing technology adoption.North America Optical Ceramics Market Report:

North America represents a heavily significant sector in the Optical Ceramics market, with its anticipated growth from USD 0.48 billion in 2023 to USD 0.94 billion by 2033, fueled by advancements in military and aerospace applications.South America Optical Ceramics Market Report:

The South American market reflects a steady growth trajectory, with a forecast from USD 0.12 billion in 2023 to USD 0.24 billion in 2033, driven primarily by escalating demand in telecommunications and consumer electronics.Middle East & Africa Optical Ceramics Market Report:

The Middle East and Africa region is also poised for growth, projected to expand from USD 0.13 billion in 2023 to USD 0.25 billion by 2033, propelled by investments in energy and defense sectors.Tell us your focus area and get a customized research report.

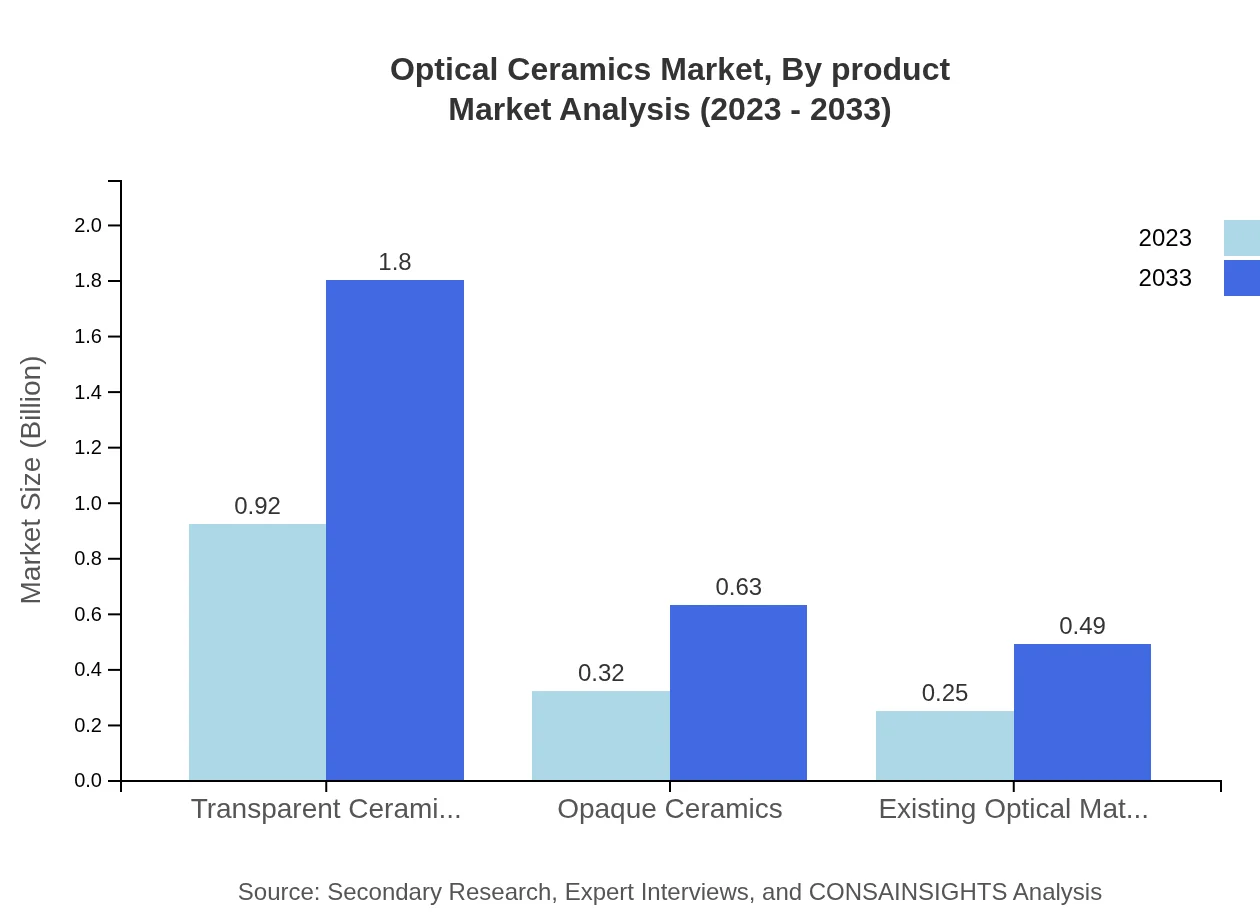

Optical Ceramics Market Analysis By Product

The market for Optical Ceramics products is dominated by Transparent Ceramics, with a market size of USD 0.92 billion in 2023, expected to rise to USD 1.80 billion by 2033, accounting for a significant market share of 61.65%. Opaque ceramics hold a viable position as well, projecting growth from USD 0.32 billion in 2023 to USD 0.63 billion in 2033, maintaining a share of 21.59%.

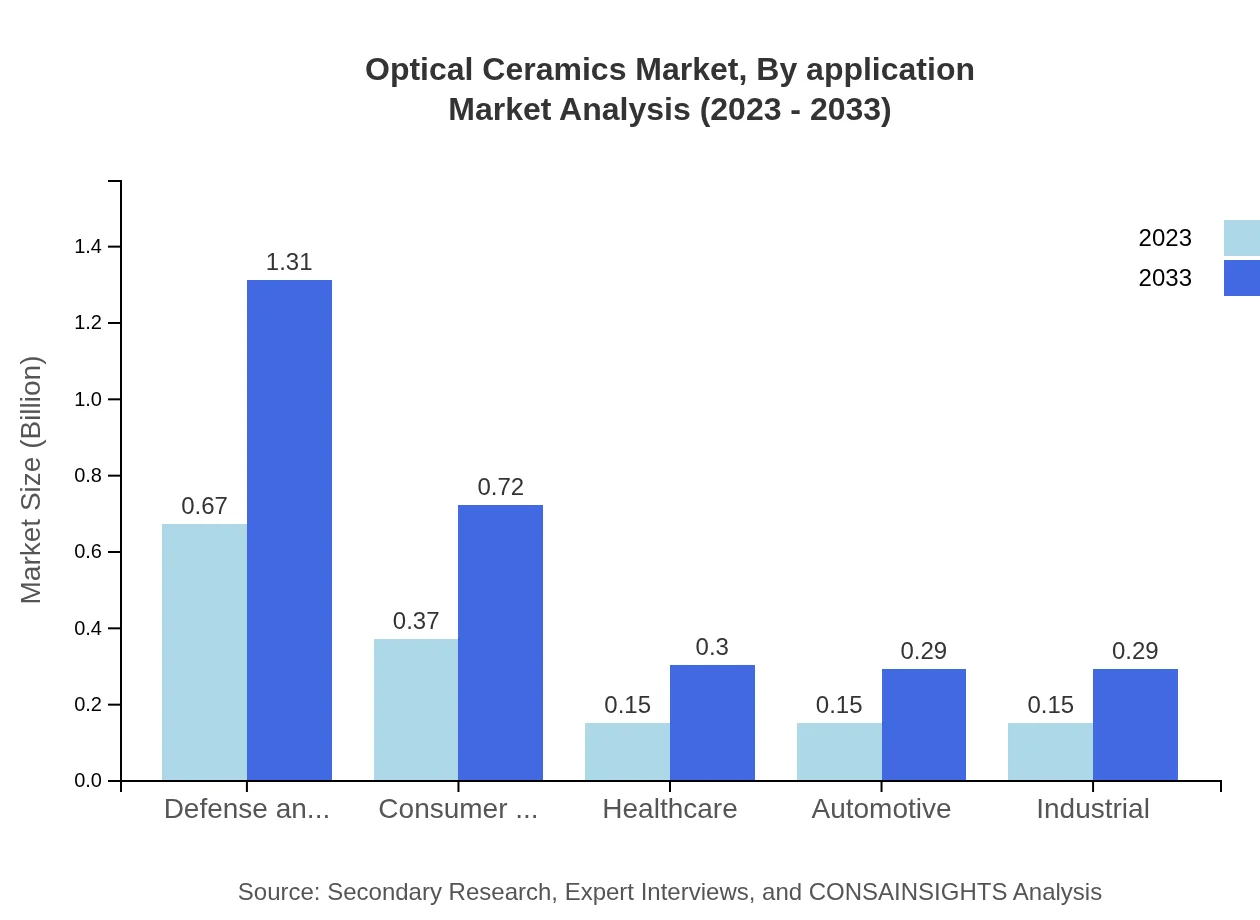

Optical Ceramics Market Analysis By Application

The defense and aerospace application of Optical Ceramics is expected to grow from USD 0.67 billion in 2023 to USD 1.31 billion by 2033, representing nearly 44.73% of the market. Consumer electronics and healthcare applications continue to exhibit similar growth trajectories with respective anticipated market sizes of USD 0.37 billion and USD 0.15 billion in 2023, growing to USD 0.72 billion and USD 0.30 billion by 2033.

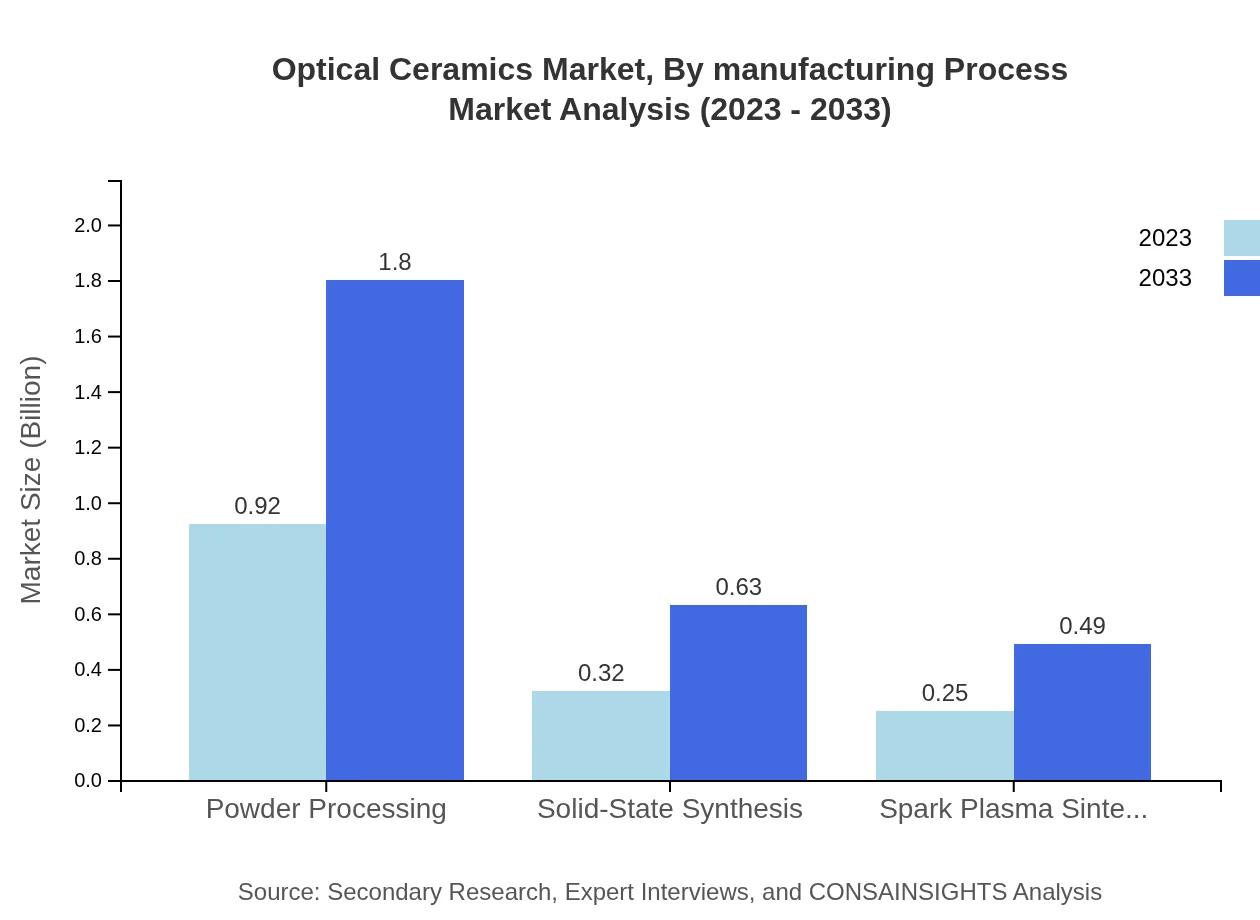

Optical Ceramics Market Analysis By Manufacturing Process

The Powder Processing method dominates the manufacturing segment, estimated at USD 0.92 billion in 2023 and anticipated to reach USD 1.80 billion by 2033, holding a 61.65% share. Solid-State Synthesis, although smaller, is expected to grow from USD 0.32 billion to USD 0.63 billion during the same period.

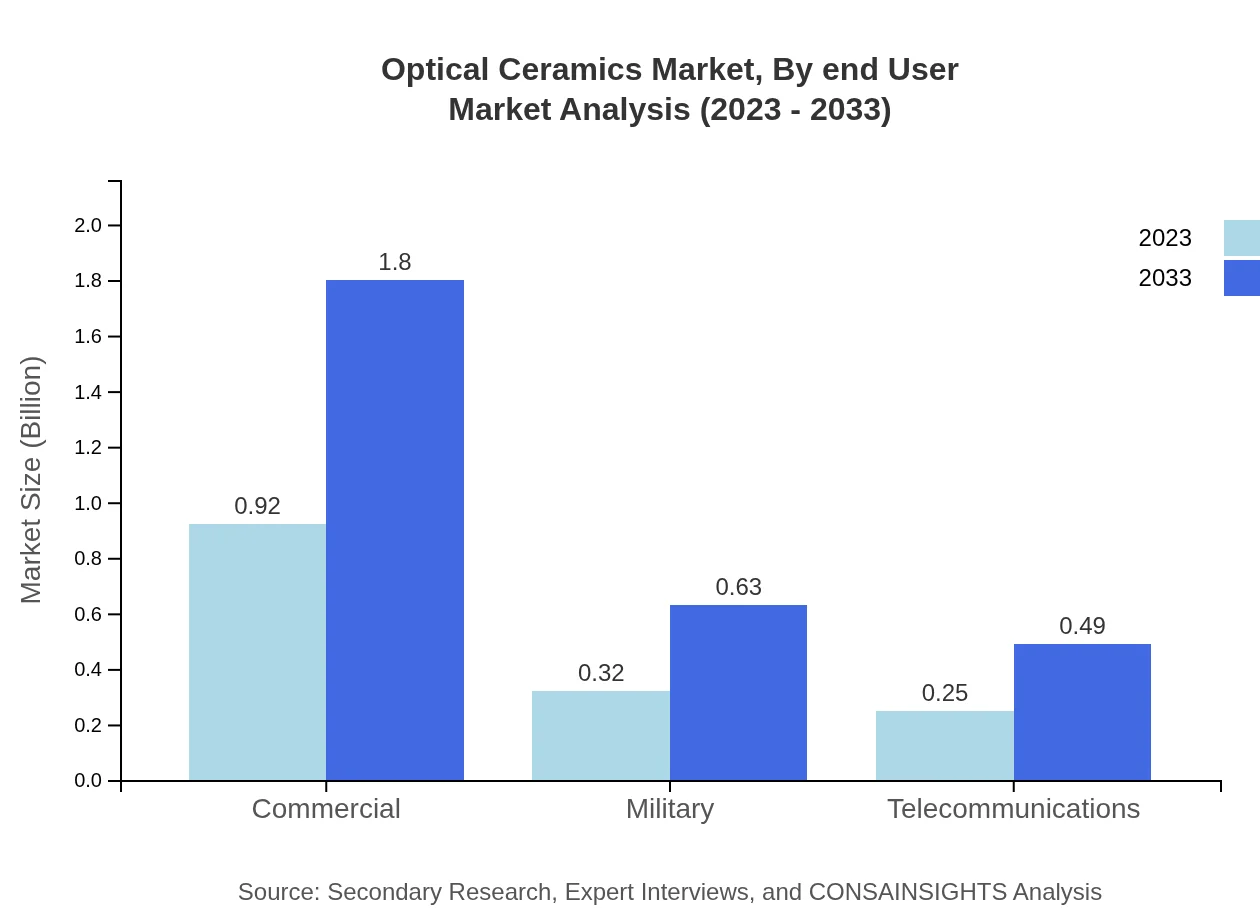

Optical Ceramics Market Analysis By End User

The industrial application sector for Optical Ceramics is poised for growth, expanding from USD 0.15 billion in 2023 to USD 0.29 billion by 2033. Concurrently, the defense and aerospace segment remains predominant, expected to maintain its share and grow substantially in value.

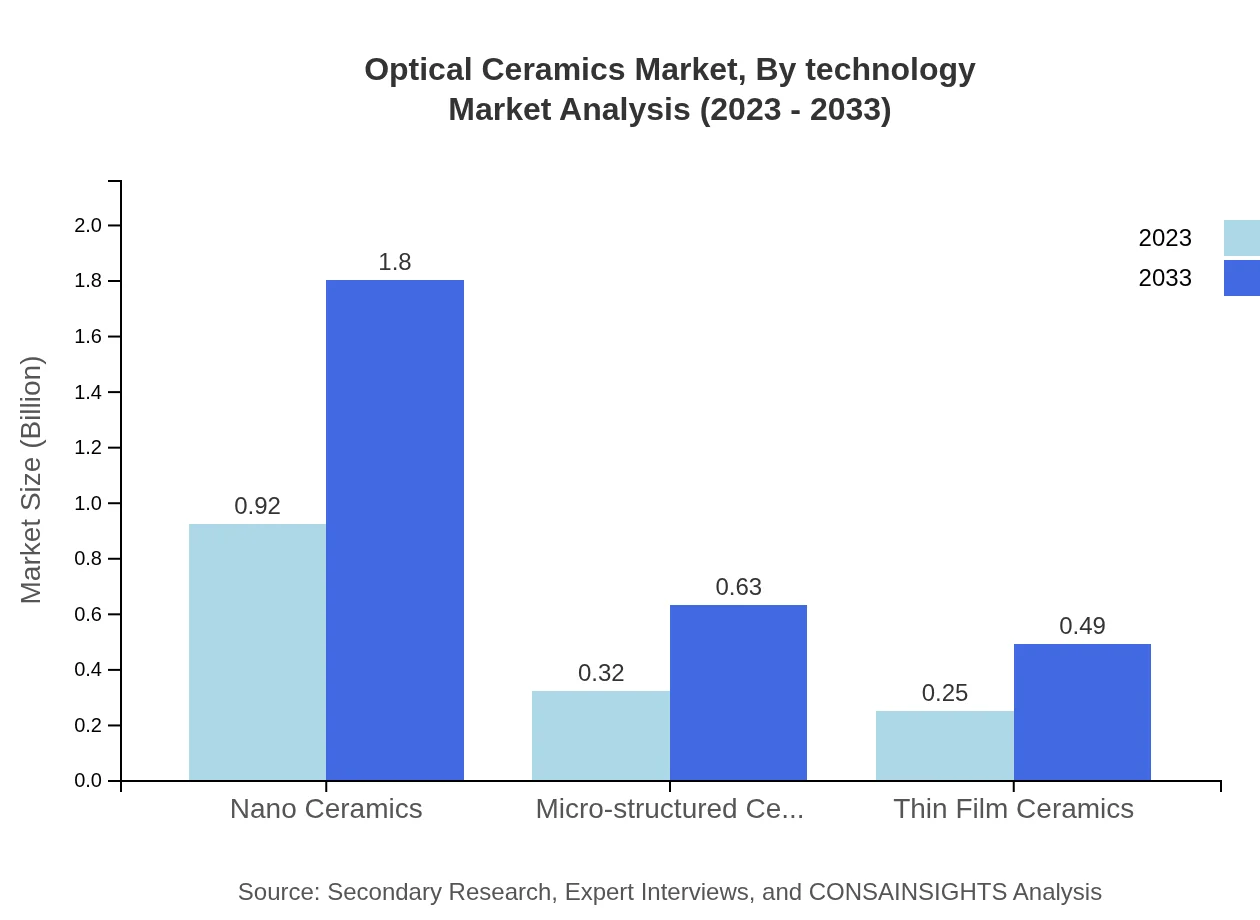

Optical Ceramics Market Analysis By Technology

Technological advances in production methods, particularly spark plasma sintering and thin film technologies, are reshaping the Optical Ceramics landscape. Spark Plasma Sintering is anticipated to demonstrate notable growth and innovation over the next decade, with its market size projected to increase from USD 0.25 billion to USD 0.49 billion by 2033.

Optical Ceramics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Optical Ceramics Industry

Corning Incorporated:

A leading manufacturer recognized for its innovation in ceramic materials, specifically in optics and glass-related solutions.CeramTec GmbH:

Known for high-performance ceramics, CeramTec specializes in optical applications and advancements in ceramic technology.Mitsubishi Chemical Corporation:

A prominent global player in the ceramics industry, focusing on the development of optical ceramics for various applications.Schott AG:

A leading manufacturer in optics with extensive product offerings in optical ceramics that cater to diverse industries.We're grateful to work with incredible clients.

FAQs

What is the market size of optical Ceramics?

The optical ceramics market is projected to reach a size of approximately $1.5 billion by 2033, growing at a significant CAGR of 6.7% from 2023. This growth reflects increased demand across various applications, highlighting the sector's potential.

What are the key market players or companies in the optical Ceramics industry?

Key players in the optical-ceramics market include major manufacturers and research institutions that focus on innovation and production of advanced ceramic materials used in various applications, ensuring competitive dynamics in the industry.

What are the primary factors driving the growth in the optical Ceramics industry?

Growth in the optical-ceramics industry is primarily driven by advancements in technology, increasing demand in sectors like consumer electronics and aerospace, as well as the rising need for efficient materials in high-performance applications.

Which region is the fastest Growing in the optical Ceramics market?

The fastest-growing region in the optical ceramics market is projected to be Europe, with market size growing from $0.48 billion in 2023 to $0.94 billion by 2033, indicating robust demand and expansion in the industry.

Does ConsaInsights provide customized market report data for the optical Ceramics industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements within the optical-ceramics industry, allowing businesses to gain focused insights relevant to their strategic needs.

What deliverables can I expect from the optical Ceramics market research project?

From an optical-ceramics market research project, you can expect detailed reports containing market size analysis, growth forecasts, competitive landscape, technological trends, and segment insights tailored to inform strategic decisions.

What are the market trends of optical Ceramics?

Current trends in the optical-ceramics market include increasing innovation in material development, a shift towards sustainable production methods, and growing applications in sectors like defense, healthcare, and consumer electronics.