Optical Coating Equipment Market Report

Published Date: 22 January 2026 | Report Code: optical-coating-equipment

Optical Coating Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Optical Coating Equipment market, focusing on trends, growth potential, and regional insights from 2023 to 2033. It highlights the industry's size, segmentation, and leading players, ensuring a valuable resource for stakeholders.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

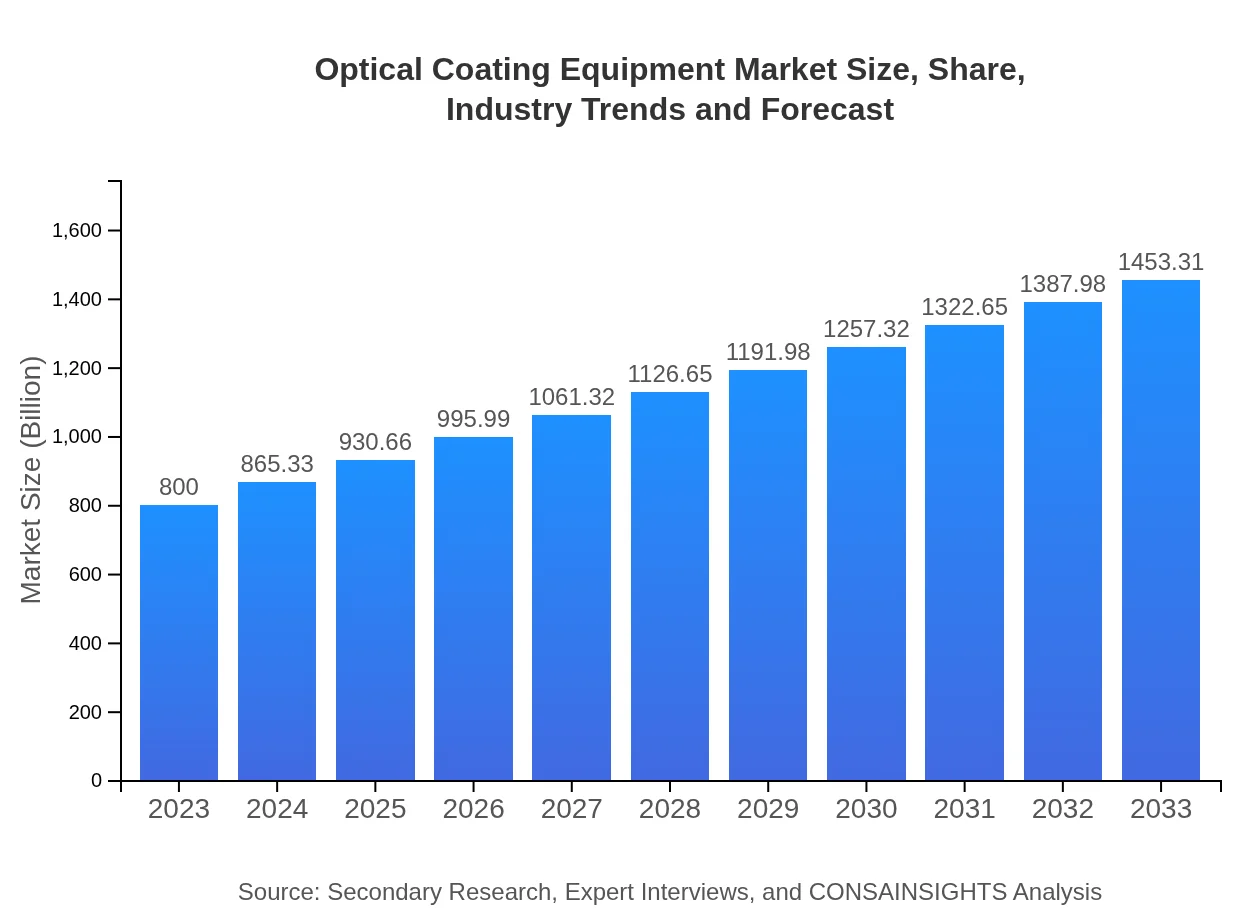

| 2023 Market Size | $800.00 Million |

| CAGR (2023-2033) | 6.0% |

| 2033 Market Size | $1453.31 Million |

| Top Companies | Optical Coating Lab, Inc., Veeco Instruments Inc., Martin Technologies, Ltd., OCLI (Optical Coating Laboratories, Inc.), M. T. W. Coating Technologies |

| Last Modified Date | 22 January 2026 |

Optical Coating Equipment Market Overview

Customize Optical Coating Equipment Market Report market research report

- ✔ Get in-depth analysis of Optical Coating Equipment market size, growth, and forecasts.

- ✔ Understand Optical Coating Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Optical Coating Equipment

What is the Market Size & CAGR of Optical Coating Equipment market in 2023?

Optical Coating Equipment Industry Analysis

Optical Coating Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Optical Coating Equipment Market Analysis Report by Region

Europe Optical Coating Equipment Market Report:

Europe's Optical Coating Equipment market is anticipated to grow from $215.76 million in 2023 to $391.96 million by 2033. Factors contributing to this growth include stringent regulations favoring high-quality optical products and advancements in material technologies, particularly in Germany and the UK.Asia Pacific Optical Coating Equipment Market Report:

In the Asia-Pacific region, the Optical Coating Equipment market is expected to grow from $154.16 million in 2023 to $280.05 million by 2033. This growth is driven by increasing demand for innovative optical solutions and advancements in manufacturing processes in countries like Japan, China, and India.North America Optical Coating Equipment Market Report:

North America, with a market value of $294.80 million in 2023, is expected to grow to $535.54 million by 2033. The region benefits from technological advancements and a strong focus on R&D, particularly in the United States.South America Optical Coating Equipment Market Report:

The South American market, currently valued at $36.32 million in 2023, is projected to reach $65.98 million by 2033. Key drivers include the growing electronics industry and rising investments in healthcare technologies in Brazil and Argentina.Middle East & Africa Optical Coating Equipment Market Report:

The Middle East and Africa market is projected to grow from $98.96 million in 2023 to $179.77 million by 2033. The growth is stimulated by increasing investments in infrastructure and emerging markets focusing on advanced optical technologies.Tell us your focus area and get a customized research report.

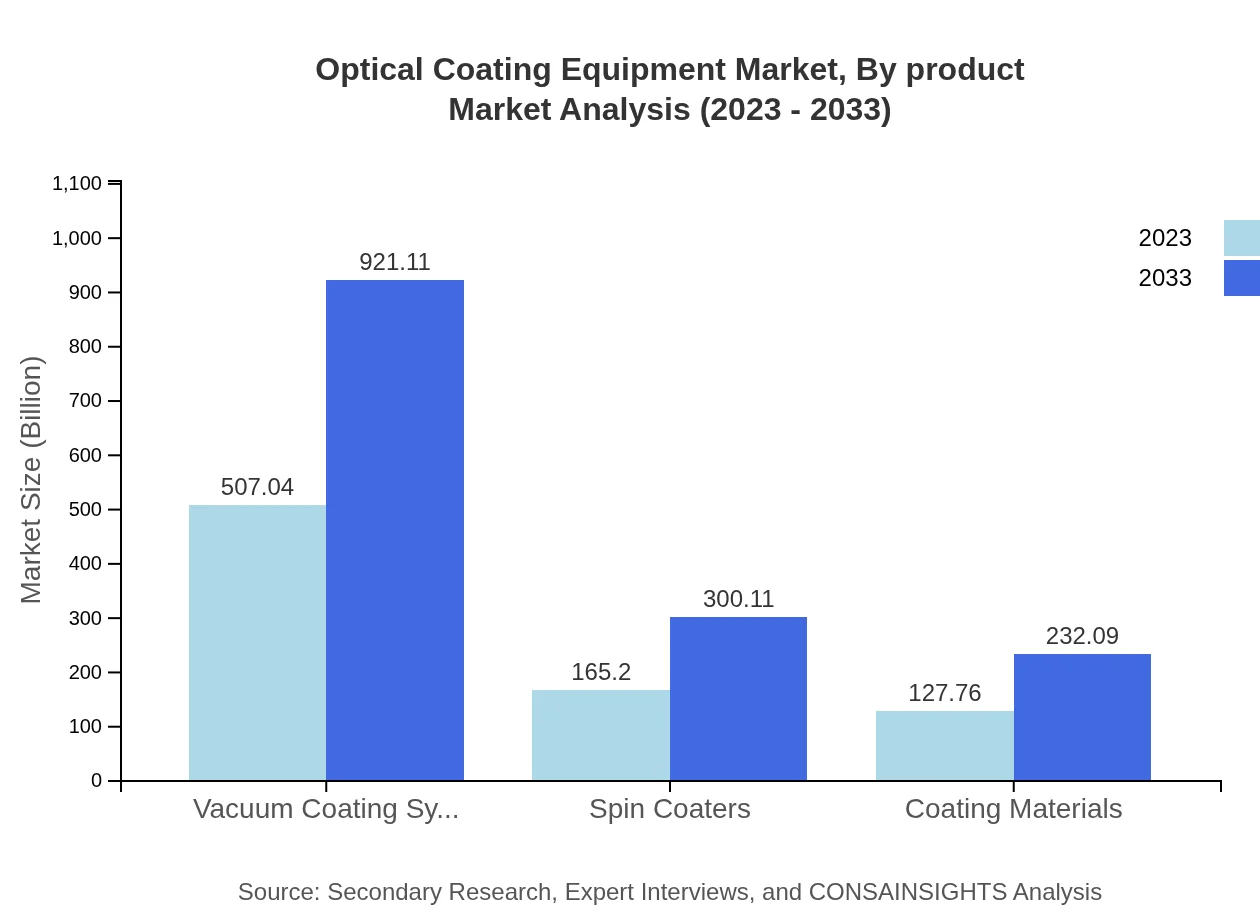

Optical Coating Equipment Market Analysis By Product

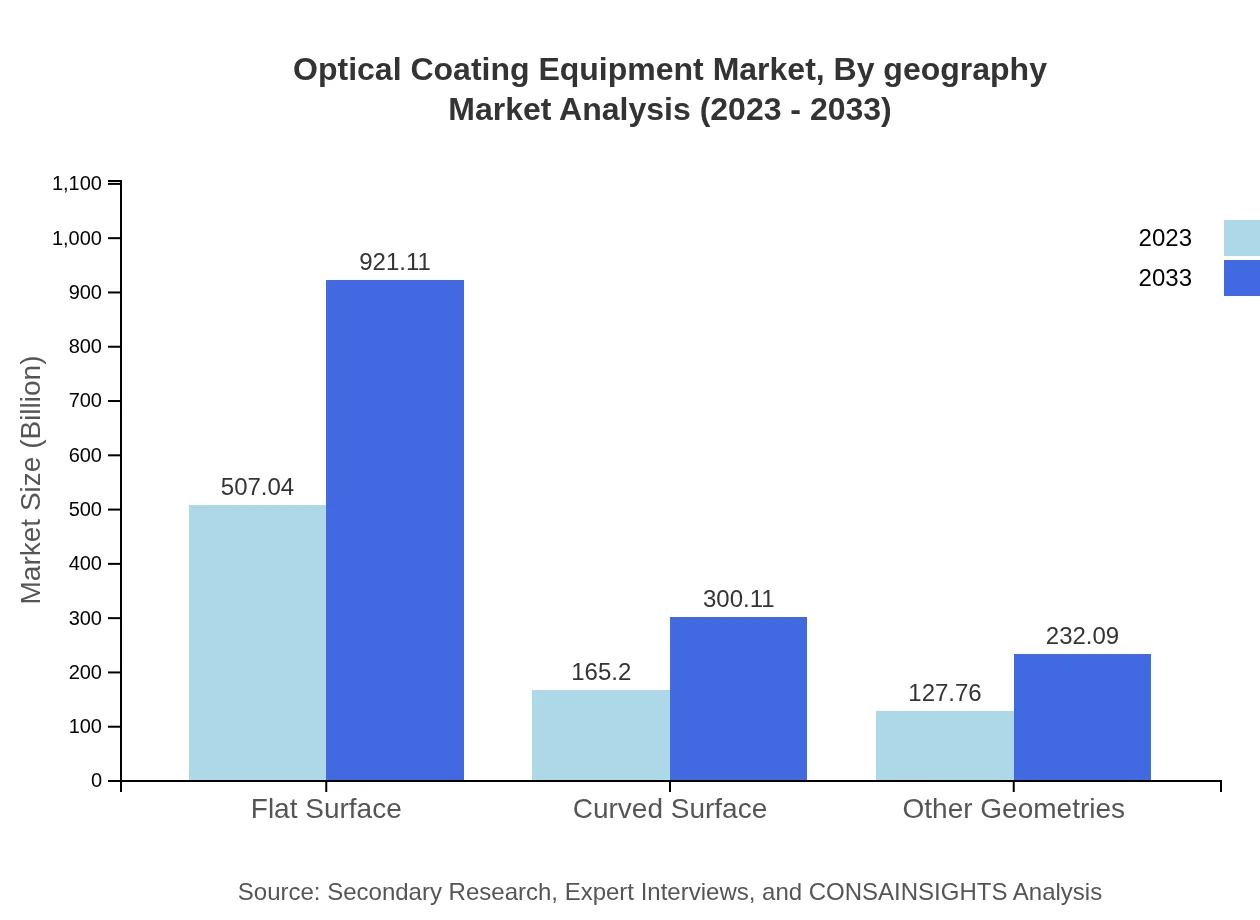

The vacuum coating systems segment leads the Optical Coating Equipment market, expanding from $507.04 million in 2023 to $921.11 million by 2033, accounting for approximately 63.38% of the total market share in both years. Spin coaters and other advanced systems also demonstrate notable growth through emerging applications.

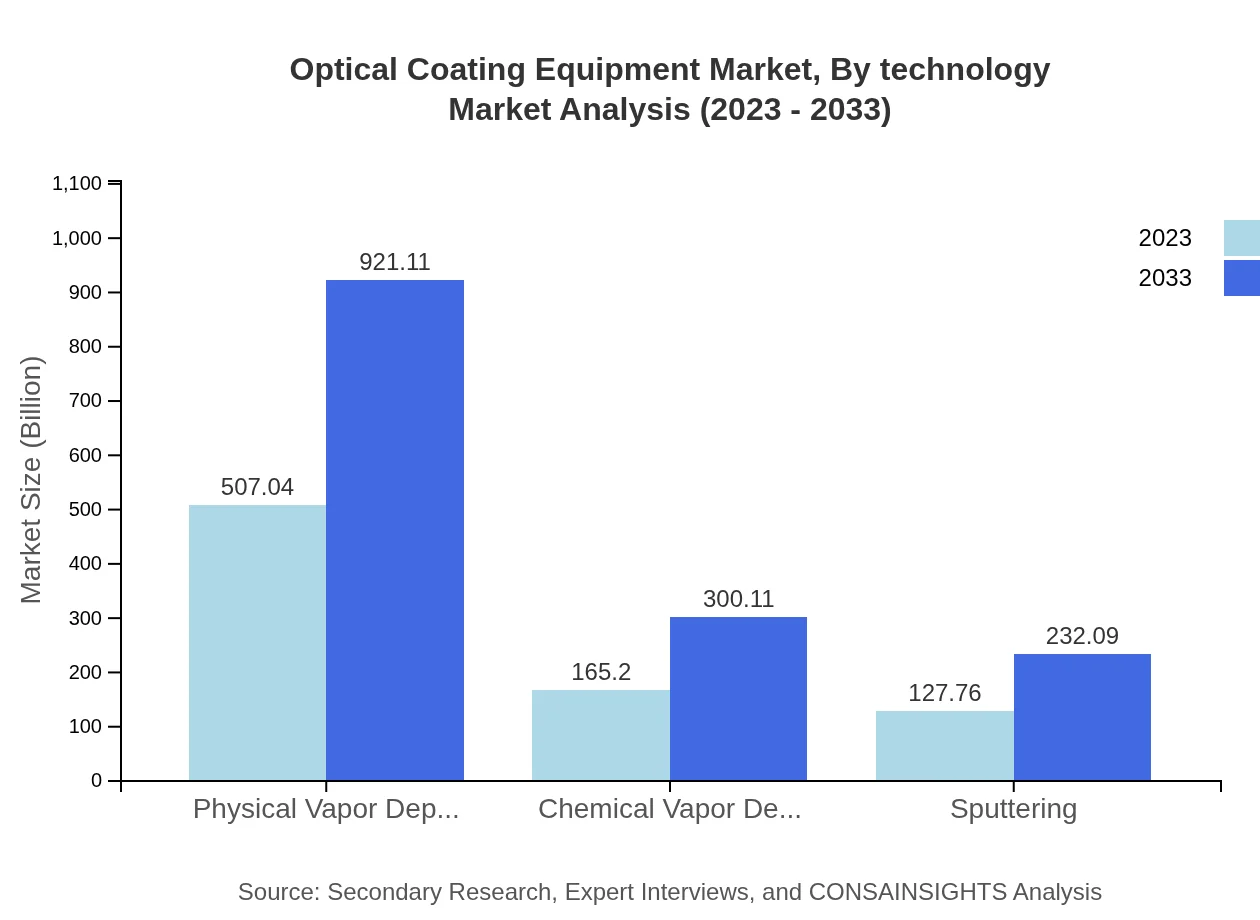

Optical Coating Equipment Market Analysis By Technology

The Physical Vapor Deposition (PVD) technique dominates the market, growing from $507.04 million in 2023 to $921.11 million by 2033, maintaining a share of 63.38% throughout. The Chemical Vapor Deposition (CVD) segment follows, with an increase from $165.20 million to $300.11 million, consistent with technological advancements.

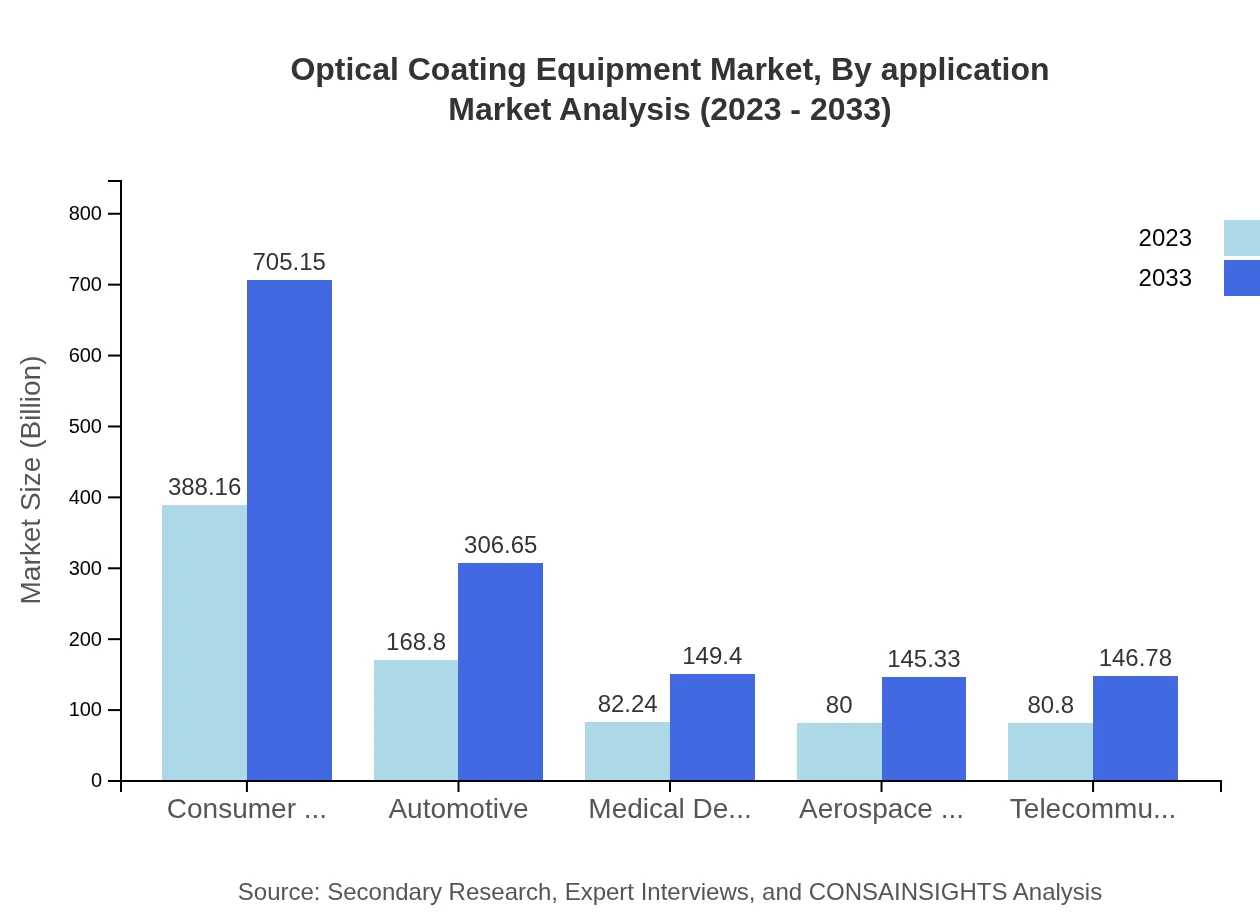

Optical Coating Equipment Market Analysis By Application

Consumer electronics represent the largest application segment, growing from $388.16 million in 2023 to $705.15 million by 2033, capturing nearly 48.52% of the market. The automotive market also shows substantial growth potential due to increasing electronic applications in vehicles.

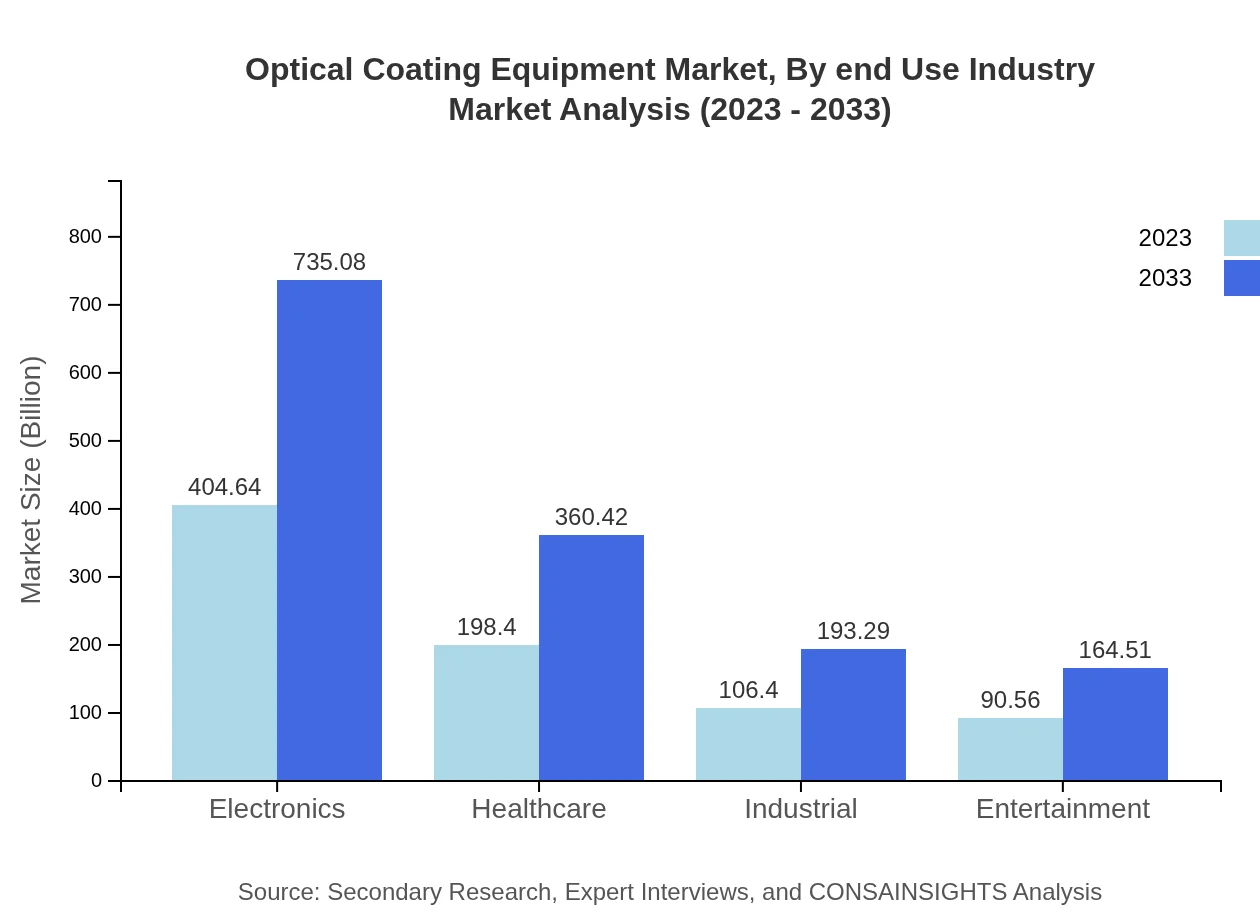

Optical Coating Equipment Market Analysis By End Use Industry

In the healthcare sector, the market is expected to grow from $198.40 million in 2023 to $360.42 million by 2033, largely due to advancements in optical technologies in medical devices. Other notable sectors include aerospace and defense, showing significant development in optical communications.

Optical Coating Equipment Market Analysis By Geography

The market is segmented into flat, curved, and other geometries, with flat surfaces leading at a share of 63.38% in both 2023 and 2033. This growth is driven by increasing applications in consumer electronics and telecommunications.

Optical Coating Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Optical Coating Equipment Industry

Optical Coating Lab, Inc.:

A leading provider of optical coating technologies and equipment, known for high-performance vacuum coating services and custom solutions.Veeco Instruments Inc.:

Specializes in advanced thin film equipment and technologies used in the production of various optical components and devices.Martin Technologies, Ltd.:

Focuses on providing innovative optical coating systems with extensive experience in R&D and manufacturing.OCLI (Optical Coating Laboratories, Inc.):

Recognized for its comprehensive range of coating services and solutions tailored to client specificationsM. T. W. Coating Technologies:

A pioneer in developing cutting-edge optical coating solutions and equipment.We're grateful to work with incredible clients.

FAQs

What is the market size of Optical Coating Equipment?

The global Optical Coating Equipment market is valued at approximately $800 million in 2023, with a projected CAGR of 6.0% expected to drive growth through 2033.

What are the key market players or companies in the Optical Coating Equipment industry?

Key players in the Optical Coating Equipment industry include major manufacturers and technology providers. These companies are recognized for their cutting-edge technologies and extensive product portfolios that cater to diverse applications in various sectors.

What are the primary factors driving the growth in the Optical Coating Equipment industry?

The growth in the Optical Coating Equipment industry is primarily driven by advancements in technology, increasing demand from consumer electronics, automotive, and healthcare sectors, and the rising need for high-performance optical coatings.

Which region is the fastest Growing in the Optical Coating Equipment?

The fastest-growing region in the Optical Coating Equipment market is North America, projected to expand from $294.80 million in 2023 to $535.54 million by 2033, driven by technological innovations and increased demand across sectors.

Does ConsaInsights provide customized market report data for the Optical Coating Equipment industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements in the Optical Coating Equipment industry, ensuring stakeholders receive insights relevant to their unique business needs.

What deliverables can I expect from this Optical Coating Equipment market research project?

Expect comprehensive deliverables, including detailed market analysis, growth projections, competitive landscape, and segment-wise insights, along with region-wise breakdowns to inform strategic decision-making.

What are the market trends of Optical Coating Equipment?

Current market trends include increasing integration of automation technologies in coating processes, a shift towards sustainable materials, and a growing emphasis on developing coatings for advanced applications across various industries.