Optical Coatings Market Report

Published Date: 02 February 2026 | Report Code: optical-coatings

Optical Coatings Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Optical Coatings market, covering key insights, market size projections, industry trends, and future forecasts from 2023 to 2033.

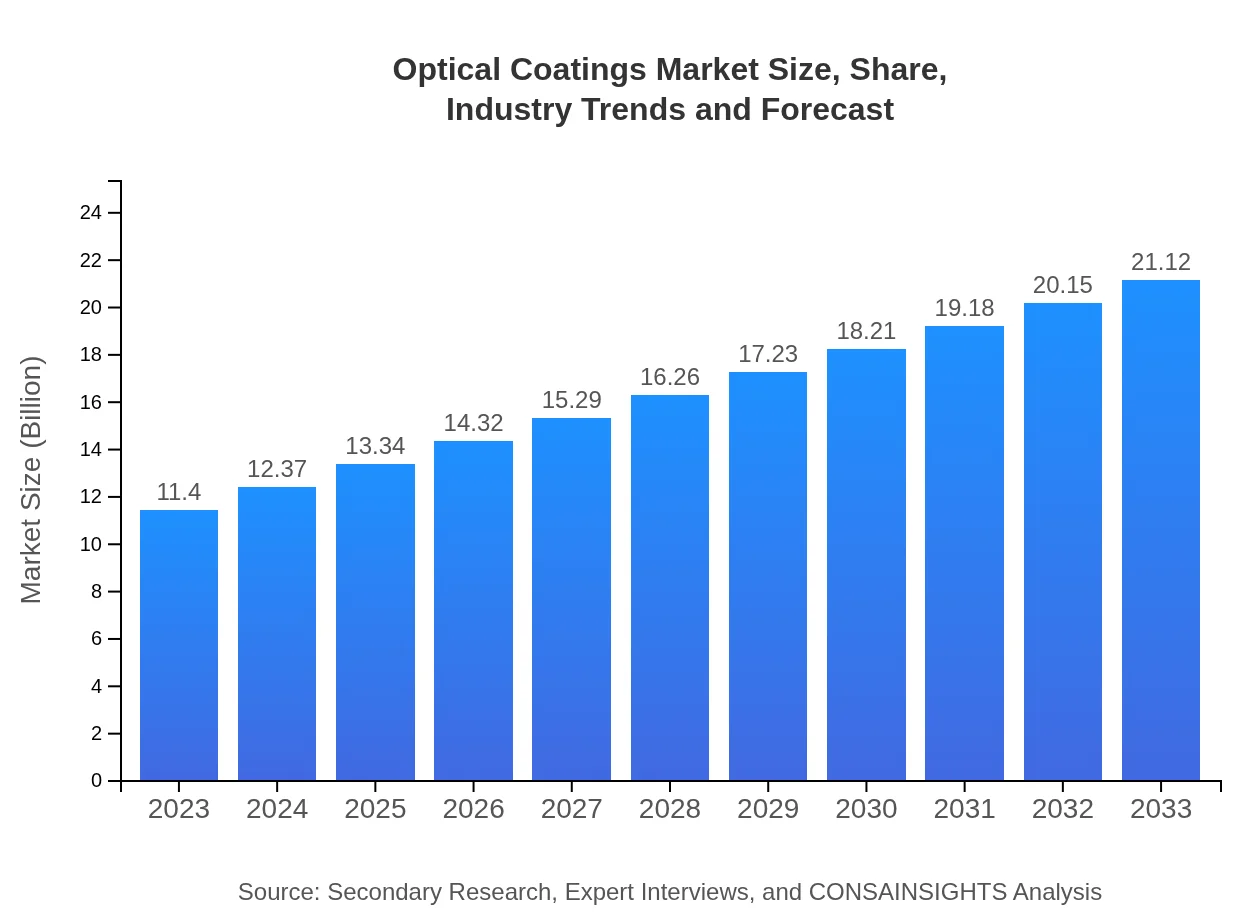

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $11.40 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $21.12 Billion |

| Top Companies | PPG Industries, Dupont, Carl Zeiss AG, Altana AG |

| Last Modified Date | 02 February 2026 |

Optical Coatings Market Overview

Customize Optical Coatings Market Report market research report

- ✔ Get in-depth analysis of Optical Coatings market size, growth, and forecasts.

- ✔ Understand Optical Coatings's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Optical Coatings

What is the Market Size & CAGR of Optical Coatings market in 2023?

Optical Coatings Industry Analysis

Optical Coatings Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Optical Coatings Market Analysis Report by Region

Europe Optical Coatings Market Report:

The European market, valued at USD 3.50 billion in 2023, is poised to grow to USD 6.48 billion by 2033. Strong regulations on energy efficiency and increasing investment in R&D for advanced optical applications are key growth drivers in this region.Asia Pacific Optical Coatings Market Report:

In 2023, the Asia Pacific region is expected to reach a market size of USD 2.10 billion, growing to USD 3.89 billion by 2033. This growth is driven by rapid industrialization in countries like China and India, coupled with the increasing demand for optical coatings in electronics and automotive sectors.North America Optical Coatings Market Report:

North America will remain a significant market, with a size of USD 4.11 billion expected in 2023, growing to USD 7.62 billion by 2033. The growth is fueled by technological advancements and the presence of major players focused on innovative optical solutions.South America Optical Coatings Market Report:

The South American market for optical coatings is projected to grow from USD 0.93 billion in 2023 to USD 1.72 billion by 2033. Emerging economies in this region are increasingly investing in high-tech manufacturing and renewable energy solutions, driving demand for advanced optical technologies.Middle East & Africa Optical Coatings Market Report:

This region's market is expected to grow from USD 0.76 billion in 2023 to USD 1.42 billion by 2033, with increasing investment in infrastructure and the adoption of advanced technologies boosting the demand for optical coatings.Tell us your focus area and get a customized research report.

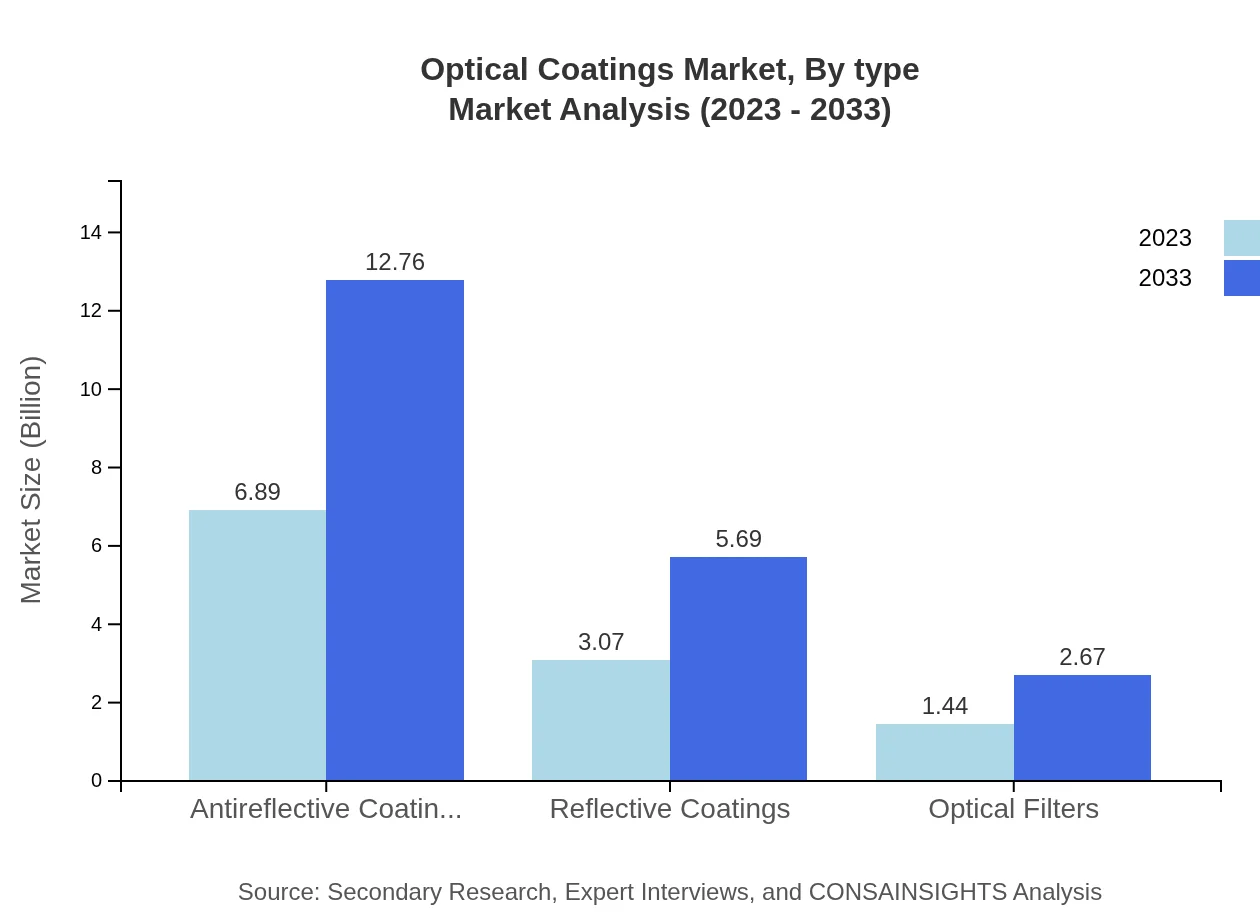

Optical Coatings Market Analysis By Type

The market is dominated by several types of coatings. Antireflective coatings are projected to grow from USD 6.89 billion in 2023 to USD 12.76 billion by 2033, capturing 60.4% market share. Reflective coatings will see growth from USD 3.07 billion to USD 5.69 billion, securing 26.96% share. Optical filters, while smaller in size at USD 1.44 billion in 2023, are expected to rise to USD 2.67 billion, holding a 12.64% market share.

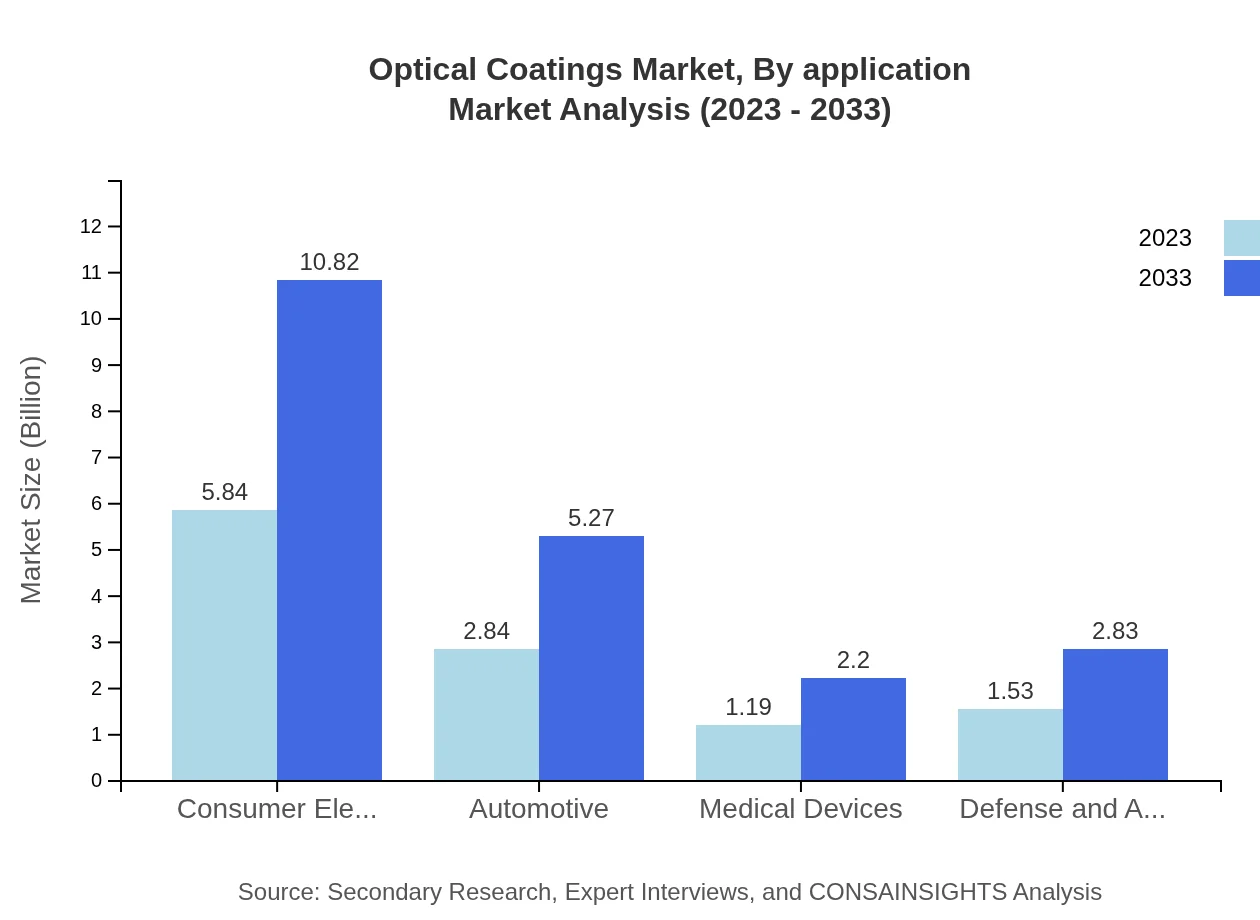

Optical Coatings Market Analysis By Application

In terms of application sectors, consumer electronics lead with a size of USD 5.84 billion in 2023, expected to grow to USD 10.82 billion by 2033, representing 51.25% share. The automotive sector is currently valued at USD 2.84 billion, with projections of reaching USD 5.27 billion and holding a 24.93% market share. Medical devices currently contribute $1.19 billion, anticipated to reach $2.20 billion. Other promising applications include defense and aerospace with current revenue of $1.53 billion projected to grow.

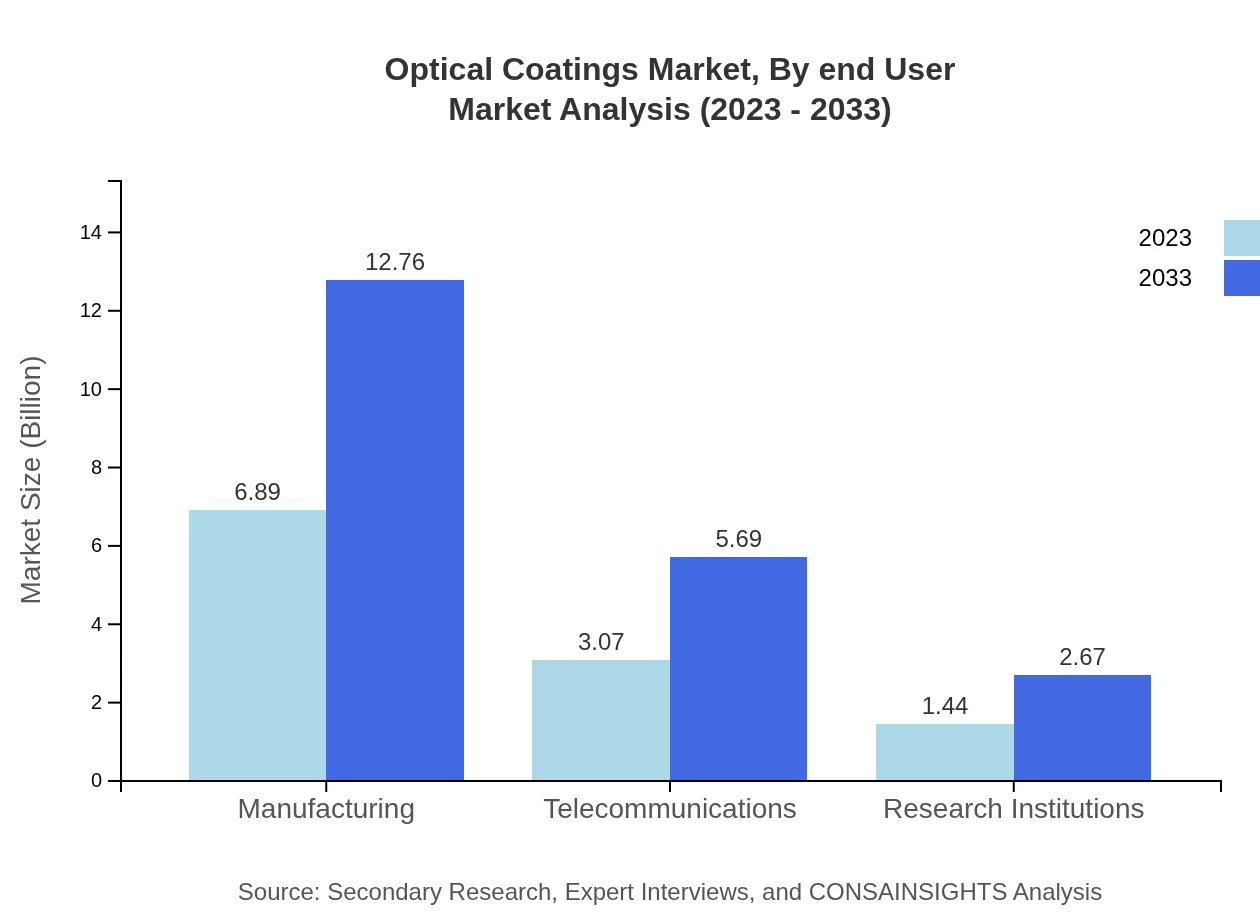

Optical Coatings Market Analysis By End User

Analysing end-user industries, the market demands reflect a significant reliance on electronic and medical applications. The consumer electronics sector, specifically, holds a dominant position, with the automotive and medical devices industries showing promising growth due to technological advancements steering innovation and quality improvement.

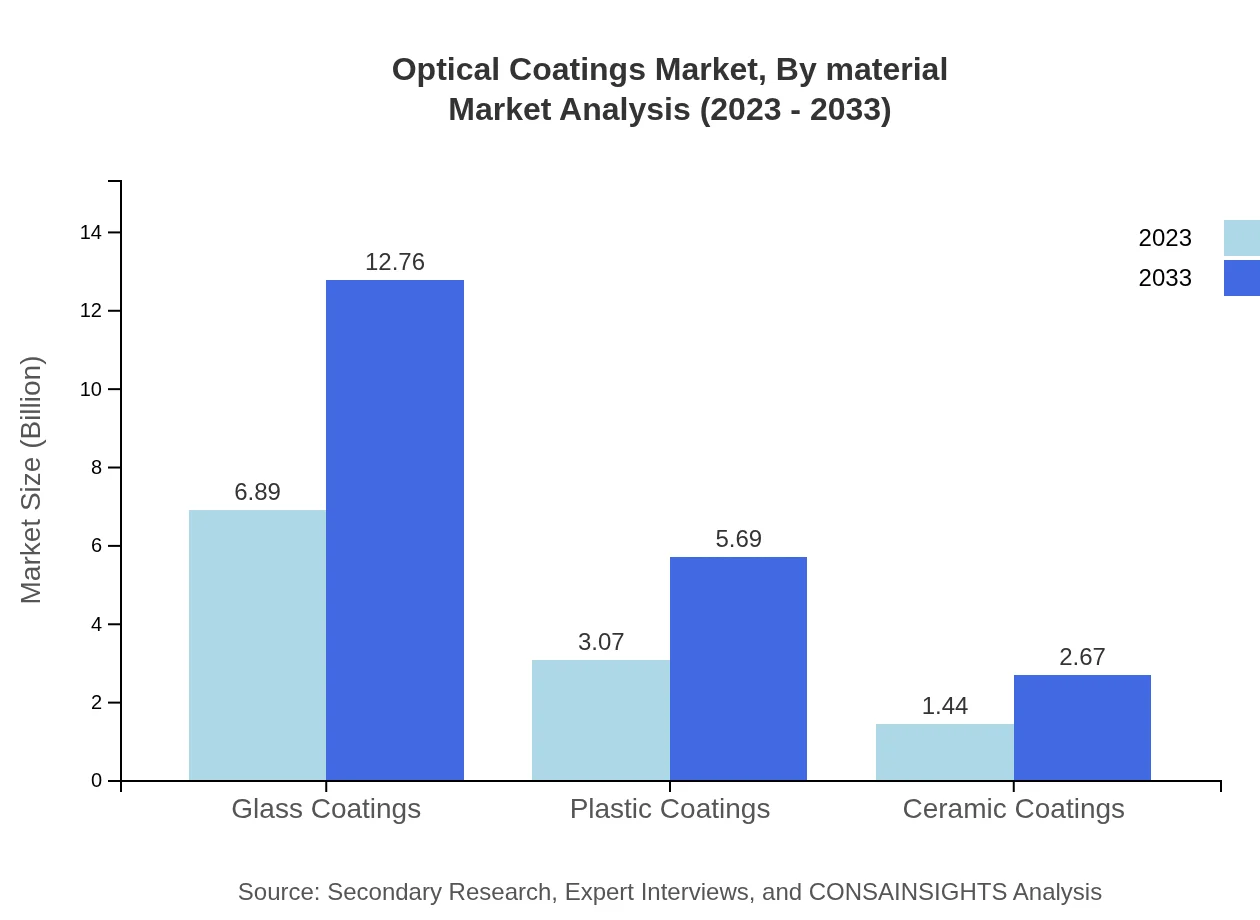

Optical Coatings Market Analysis By Material

Regarding material types, glass coatings are the leading segment, expected to remain a major contributor with substantial market shares across applications. Plastic and ceramic coatings, while having smaller shares, are witnessing growth opportunities linked to advancements in lightweight materials and nanotechnology.

Optical Coatings Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Optical Coatings Industry

PPG Industries:

A recognized leader in the coatings market, PPG Industries excels in providing performance-driven optical coating solutions for various applications including automotive and consumer electronics.Dupont:

Dupont's innovations in optical coatings focus on enhancing optical performance while promoting sustainability through eco-friendly materials.Carl Zeiss AG:

Carl Zeiss AG is renowned for its high-precision optics and coatings, setting industry standards in healthcare and technology sectors.Altana AG:

Specializing in innovative coatings, Altana AG combines advanced materials to improve product performance across diverse applications.We're grateful to work with incredible clients.

FAQs

What is the market size of optical coatings?

The global optical coatings market is projected to reach a value of $11.4 billion by 2033, growing at a CAGR of 6.2%. The market is driven by increasing demand across various industries, ensuring significant growth prospects.

What are the key market players or companies in the optical coatings industry?

Key players in the optical coatings industry include well-established companies that continuously innovate. These companies focus on integrating advanced technologies while catering to diverse applications, thereby enhancing their market position.

What are the primary factors driving the growth in the optical coatings industry?

The growth of the optical coatings industry is primarily driven by factors such as advancements in technology, increasing demand from consumer electronics, and rising applications in automotive and medical devices, contributing to greater market expansion.

Which region is the fastest Growing in the optical coatings market?

Among the key regions, North America is experiencing the fastest growth in the optical coatings market, projected to grow from $4.11 billion in 2023 to $7.62 billion by 2033, driven by technological developments and increasing market needs.

Does ConsaInsights provide customized market report data for the optical coatings industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the optical coatings industry, allowing clients to gain insights that align with their strategic objectives and business goals.

What deliverables can I expect from this optical coatings market research project?

Clients can expect comprehensive reports including market size, segmentation, forecasts, competitive analysis, and regional insights, designed to provide valuable information for informed decision-making in the optical coatings market.

What are the market trends of optical coatings?

Current trends in the optical coatings market include increasing integration of smart technologies, a surge in the demand for green coatings, and growth in the use of multilayer coatings for diverse applications across various sectors.