Optical Film Market Report

Published Date: 31 January 2026 | Report Code: optical-film

Optical Film Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the Optical Film market from 2023 to 2033, including insights into market size, growth rate, trends, segmentation, regional performance, and leading players in the industry.

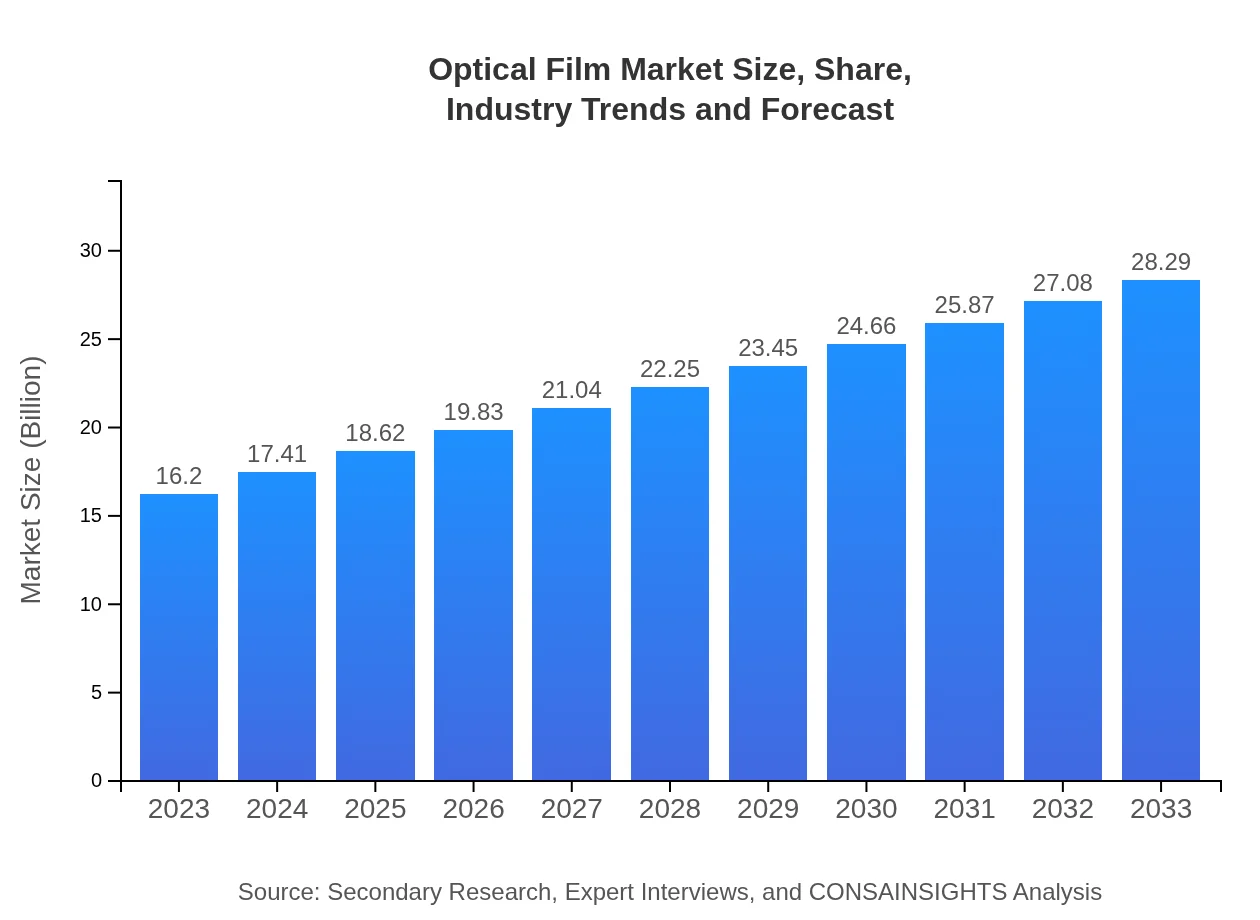

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $16.20 Billion |

| CAGR (2023-2033) | 5.6% |

| 2033 Market Size | $28.29 Billion |

| Top Companies | 3M, LG Chem, Toray Industries, Merck Group, Saint-Gobain |

| Last Modified Date | 31 January 2026 |

Optical Film Market Overview

Customize Optical Film Market Report market research report

- ✔ Get in-depth analysis of Optical Film market size, growth, and forecasts.

- ✔ Understand Optical Film's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Optical Film

What is the Market Size & CAGR of Optical Film market in 2023 and 2033?

Optical Film Industry Analysis

Optical Film Market Segmentation and Scope

Tell us your focus area and get a customized research report.

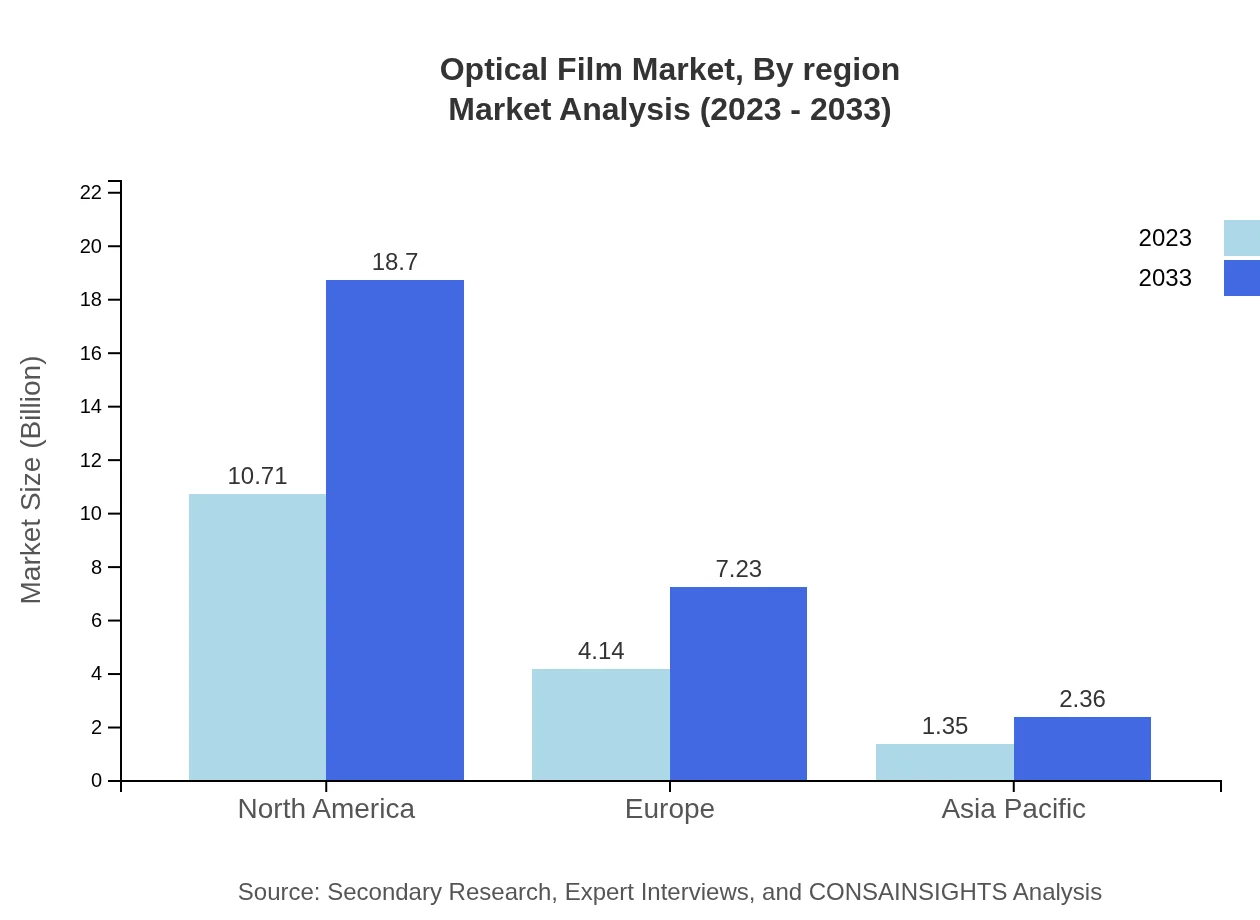

Optical Film Market Analysis Report by Region

Europe Optical Film Market Report:

The European market is projected to grow from $4.86 billion in 2023 to $8.49 billion by 2033, fueled by stringent regulations on energy efficiency and a strong focus on sustainable packaging solutions.Asia Pacific Optical Film Market Report:

In the Asia Pacific region, the Optical Film market is expected to grow from $2.99 billion in 2023 to $5.23 billion by 2033, supported by the increasing production of consumer electronics and automotive industries. Technological advancements and government initiatives promoting electronic manufacturing also contribute to market expansion.North America Optical Film Market Report:

The North American Optical Film market is forecast to increase significantly from $6.09 billion in 2023 to $10.64 billion in 2033. Key factors for growth include the region's strong consumer electronics market, ongoing innovations in display technologies, and expanding automotive applications.South America Optical Film Market Report:

The South American market, although smaller, is anticipated to grow from $0.28 billion in 2023 to $0.48 billion by 2033. The growth is driven by rising demand for consumer electronics and improvements in infrastructure, enhancing accessibility to advanced technology products.Middle East & Africa Optical Film Market Report:

In the Middle East and Africa, the Optical Film market is estimated to rise from $1.97 billion in 2023 to $3.45 billion by 2033. This growth is attributed to urbanization and increasing investments in technology across various sectors.Tell us your focus area and get a customized research report.

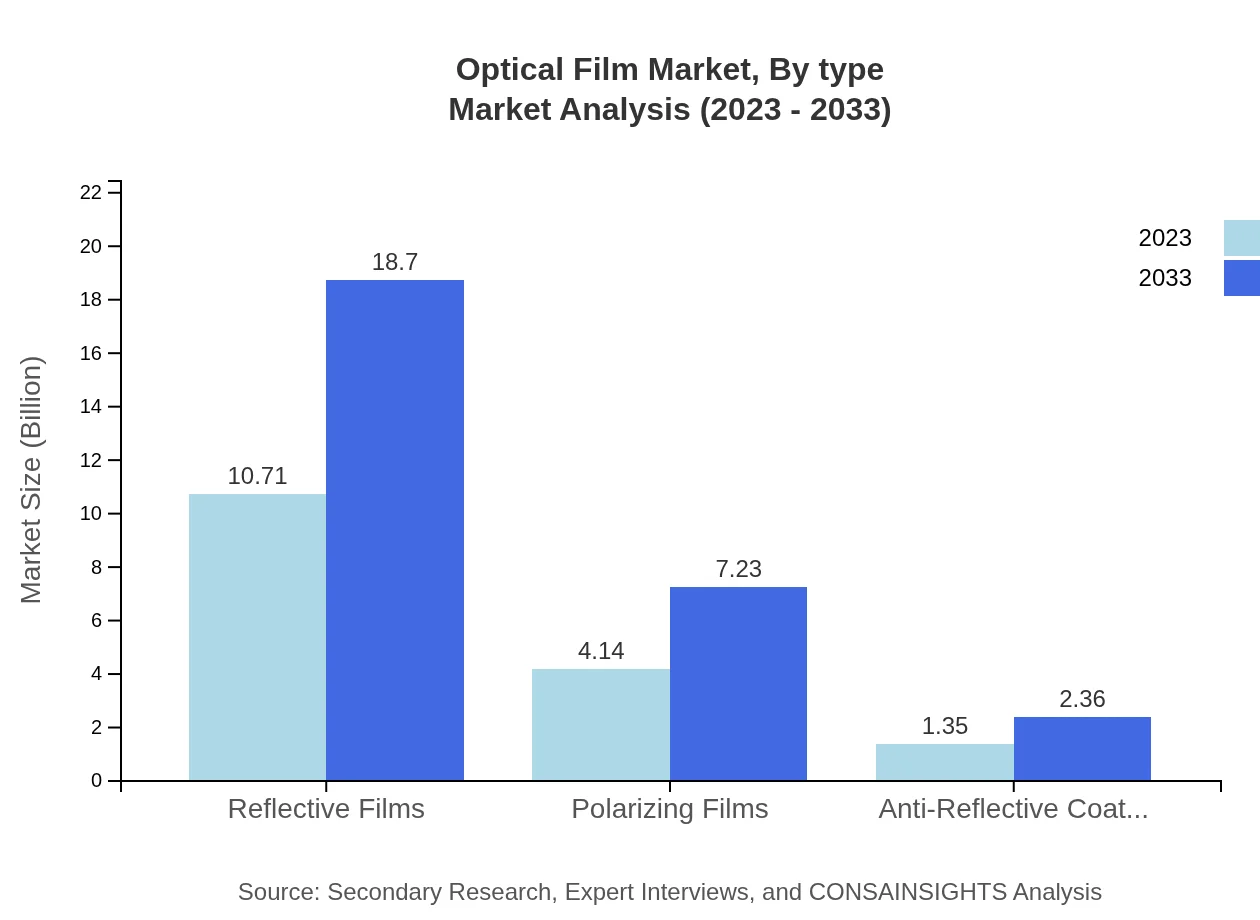

Optical Film Market Analysis By Type

Reflective films dominate the market, expected to grow from $10.71 billion in 2023 to $18.70 billion by 2033, holding a 66.1% market share. Polarizing films follow, projected to grow from $4.14 billion to $7.23 billion with a 25.56% share. Anti-reflective coatings, though smaller, are set to increase from $1.35 billion to $2.36 billion, maintaining an 8.34% share.

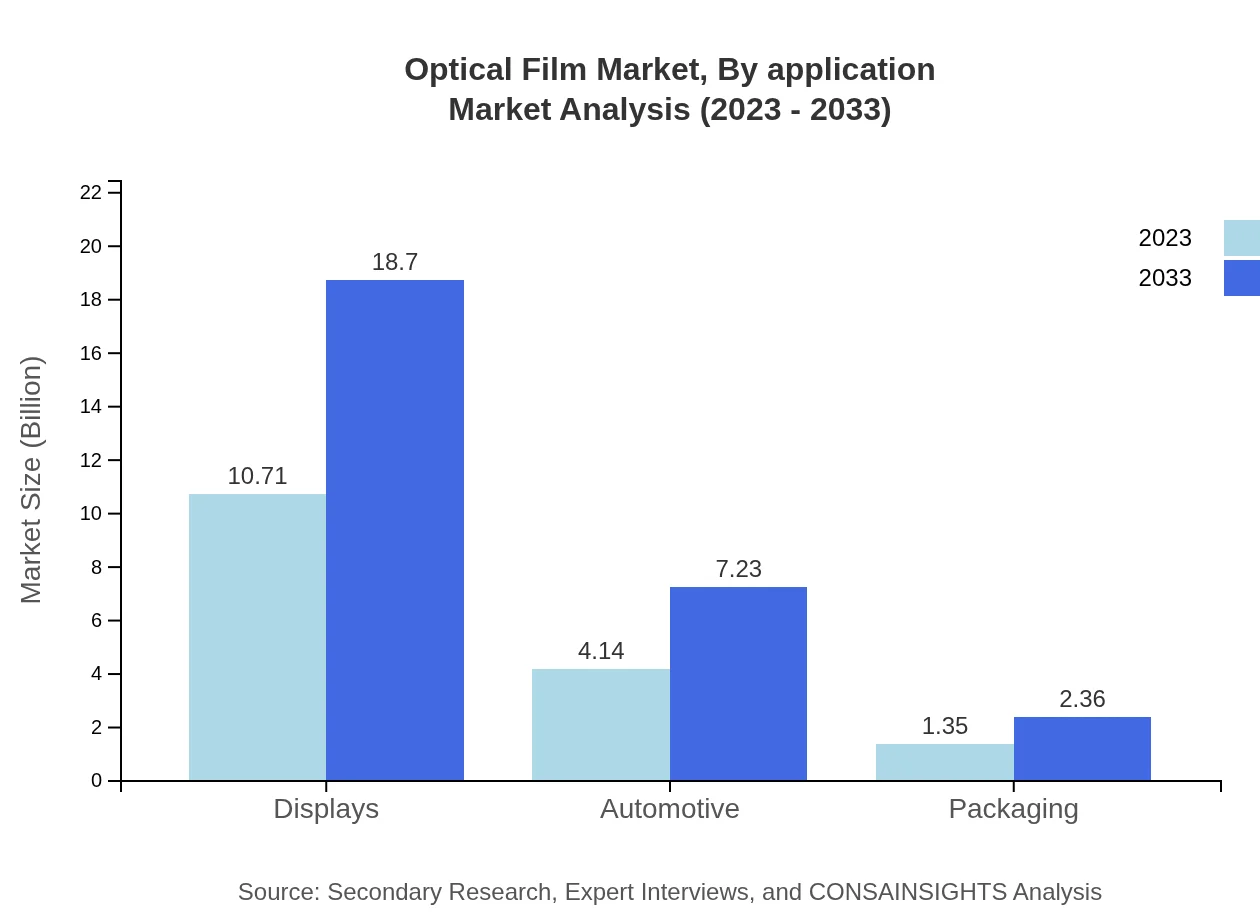

Optical Film Market Analysis By Application

Consumer electronics are the leading application for optical films, with their market size growing from $10.71 billion in 2023 to $18.70 billion by 2033. This segment represents a significant market share of 66.1%. The telecommunications segment also shows strong growth from $4.14 billion to $7.23 billion, while medical devices expand from $1.35 billion to $2.36 billion.

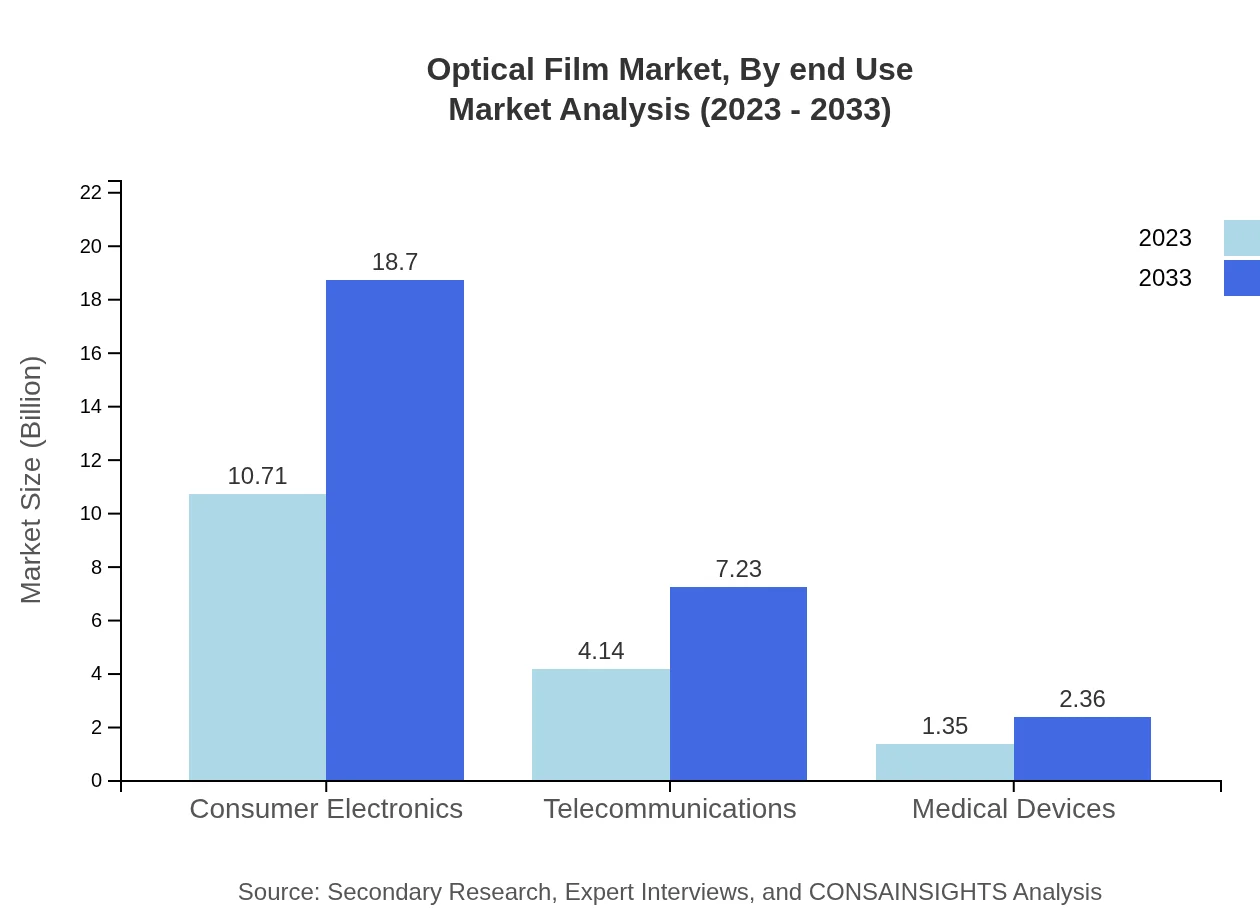

Optical Film Market Analysis By End Use

Displays remain a key end-use application, with the market expected to grow significantly from $10.71 billion in 2023 to $18.70 billion by 2033, indicating its critical role in the Optical Film market. In contrast, automotive applications are projected to grow from $4.14 billion to $7.23 billion, emphasizing the diversification of use.

Optical Film Market Analysis By Region

Regional variations are notable, with the Optical Film market in North America expected to lead in value, followed closely by Asia Pacific. Europe remains robust, driven by efficiency regulations, while the Middle East and Africa show promising growth driven by technological advancements.

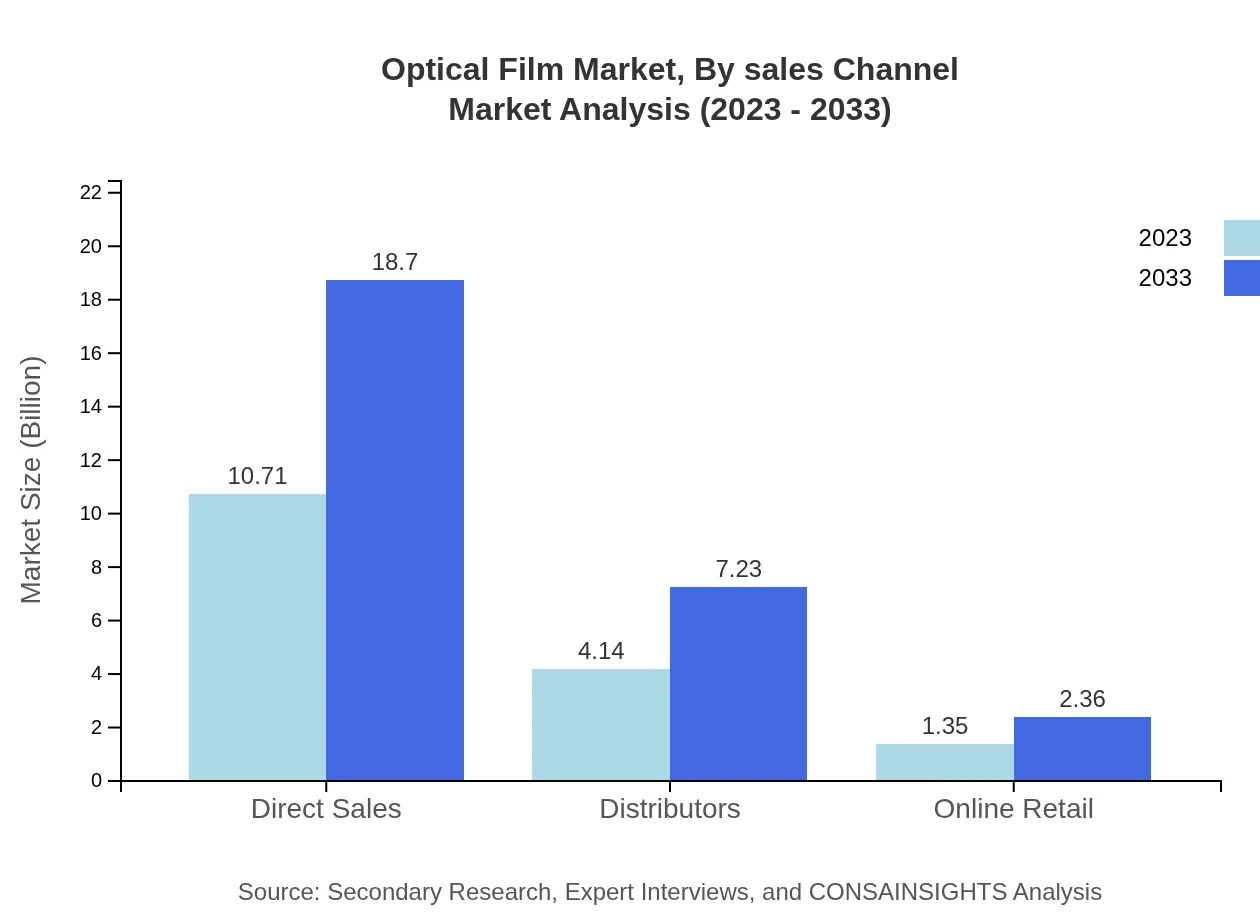

Optical Film Market Analysis By Sales Channel

Direct sales dominate the market with a size of $10.71 billion in 2023, projected to grow to $18.70 billion by 2033 and holding a consistent 66.1% market share. Distributors play a significant role as well, with the market growing from $4.14 billion to $7.23 billion, signifying their importance in the supply chain.

Optical Film Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Optical Film Industry

3M:

3M is a global leader in various industries including Optical Film, pioneering solutions in adhesive technologies and films that enhance product performance.LG Chem:

LG Chem is known for its advanced materials technology including Optical Films which are utilized in consumer electronics and automotive sectors.Toray Industries:

Toray Industries focuses on innovations in polymer films and has a strong presence in the Optical Film market, catering to diverse applications.Merck Group:

Merck Group plays a leading role in the specialty chemicals sector including Optical Films, contributing to sustainable technologies.Saint-Gobain:

Saint-Gobain, a pioneer in building materials, also specializes in advanced optical materials used in various display technologies.We're grateful to work with incredible clients.

FAQs

What is the market size of optical Film?

The global optical film market is projected to reach approximately $16.2 billion by 2033, with a CAGR of 5.6% from 2023 to 2033. This growth indicates a steady increase in demand across various applications and industries.

What are the key market players or companies in this optical Film industry?

Key players in the optical film market include prominent players like 3M Company, Daicel Corporation, and Toray Industries. Their extensive product ranges and innovative technologies play a crucial role in driving market dynamics.

What are the primary factors driving the growth in the optical Film industry?

The optical-film industry growth is driven by increasing demand for consumer electronics, advancements in display technologies, and the proliferation of portable devices that require high-performance optical films to enhance visibility and performance.

Which region is the fastest Growing in the optical Film?

The fastest-growing region in the optical film market is North America, expected to grow from $6.09 billion in 2023 to $10.64 billion by 2033, fueled by technological innovations and high consumer electronics consumption.

Does ConsaInsights provide customized market report data for the optical Film industry?

Yes, ConsaInsights offers customized market report data tailored to your specific needs in the optical-film industry, ensuring you receive relevant insights and analyses to make informed decisions.

What deliverables can I expect from this optical Film market research project?

Deliverables include comprehensive market analysis reports, detailed segmentation data, competitive landscape overview, and actionable insights specifically designed for your strategic goals in the optical-film industry.

What are the market trends of optical Film?

Current market trends in the optical film sector showcase a shift towards sustainable materials, enhanced performance features, and integration of smart technologies in displays, catering to evolving consumer preferences across sectors.