Optical Sensor Market Report

Published Date: 31 January 2026 | Report Code: optical-sensor

Optical Sensor Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Optical Sensor market, covering key insights and data from 2023 to 2033, including market size, growth rates, and future trends across various applications and regions.

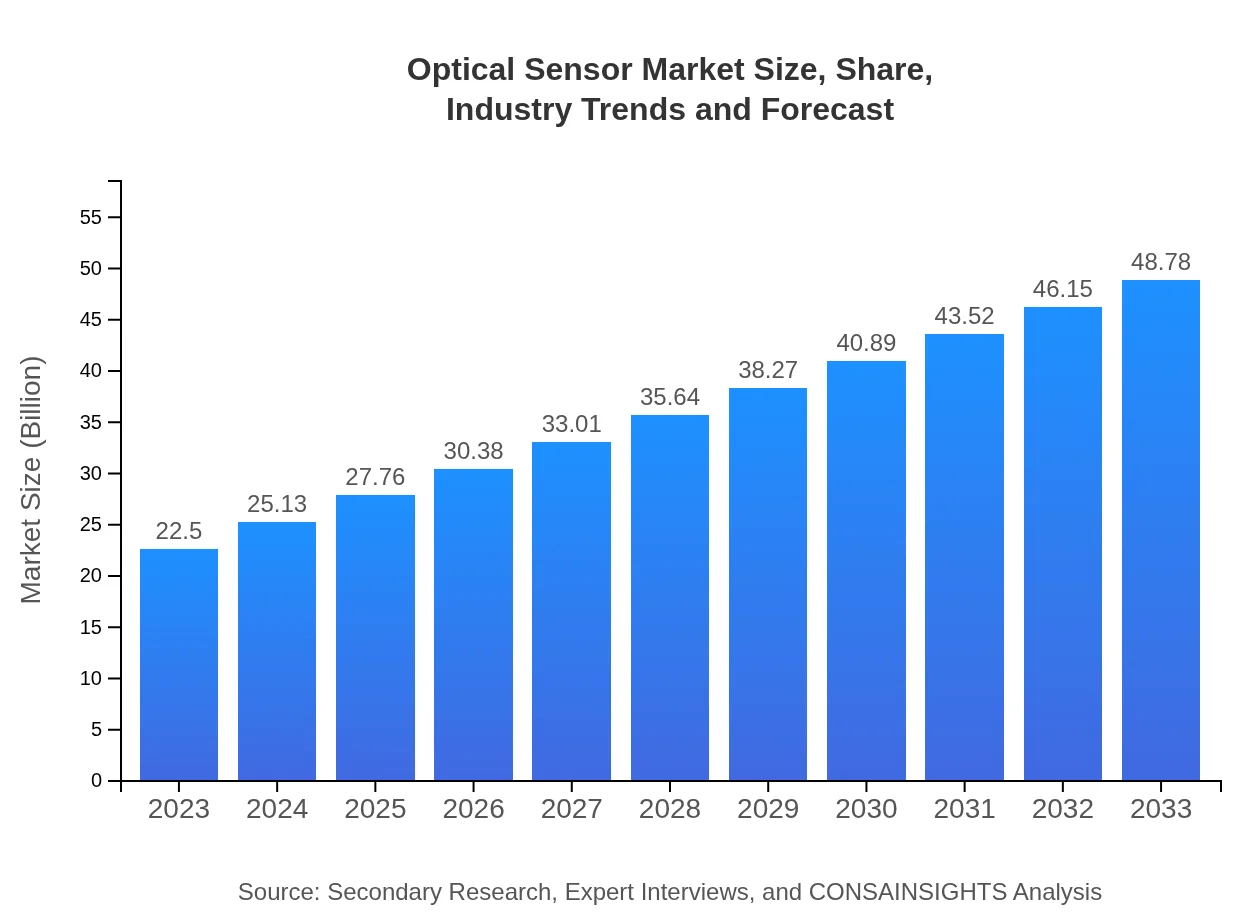

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $22.50 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $48.78 Billion |

| Top Companies | Texas Instruments, Analog Devices, STMicroelectronics, Hamamatsu Photonics |

| Last Modified Date | 31 January 2026 |

Optical Sensor Market Overview

Customize Optical Sensor Market Report market research report

- ✔ Get in-depth analysis of Optical Sensor market size, growth, and forecasts.

- ✔ Understand Optical Sensor's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Optical Sensor

What is the Market Size & CAGR of Optical Sensor market in 2023?

Optical Sensor Industry Analysis

Optical Sensor Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Optical Sensor Market Analysis Report by Region

Europe Optical Sensor Market Report:

Europe's Optical Sensor market is expected to grow from $5.85 billion in 2023 to $12.67 billion by 2033, spurred by advancements in sustainable technology and increasing regulations that push for the adoption of energy-efficient devices.Asia Pacific Optical Sensor Market Report:

In 2023, the Asia Pacific Optical Sensor market is valued at approximately $4.56 billion, projected to reach $9.89 billion by 2033. This region is witnessing a surge due to booming electronics manufacturing and increased demand for automation in industries like automotive, healthcare, and smart infrastructure.North America Optical Sensor Market Report:

North America leads the market with an estimated size of $8.13 billion in 2023, projected to grow to $17.63 billion by 2033. The region benefits from significant investments in technology and innovation, particularly in automation and IoT applications.South America Optical Sensor Market Report:

The South American market showcases a steady growth trajectory, with the market size valued at around $1.95 billion in 2023, expected to grow to $4.22 billion by 2033. The increase is attributed to advancements in telecommunications and infrastructure development.Middle East & Africa Optical Sensor Market Report:

The market in the Middle East and Africa is anticipated to increase from $2.01 billion in 2023 to $4.36 billion by 2033, influenced by government investments in smart city projects and improved infrastructure.Tell us your focus area and get a customized research report.

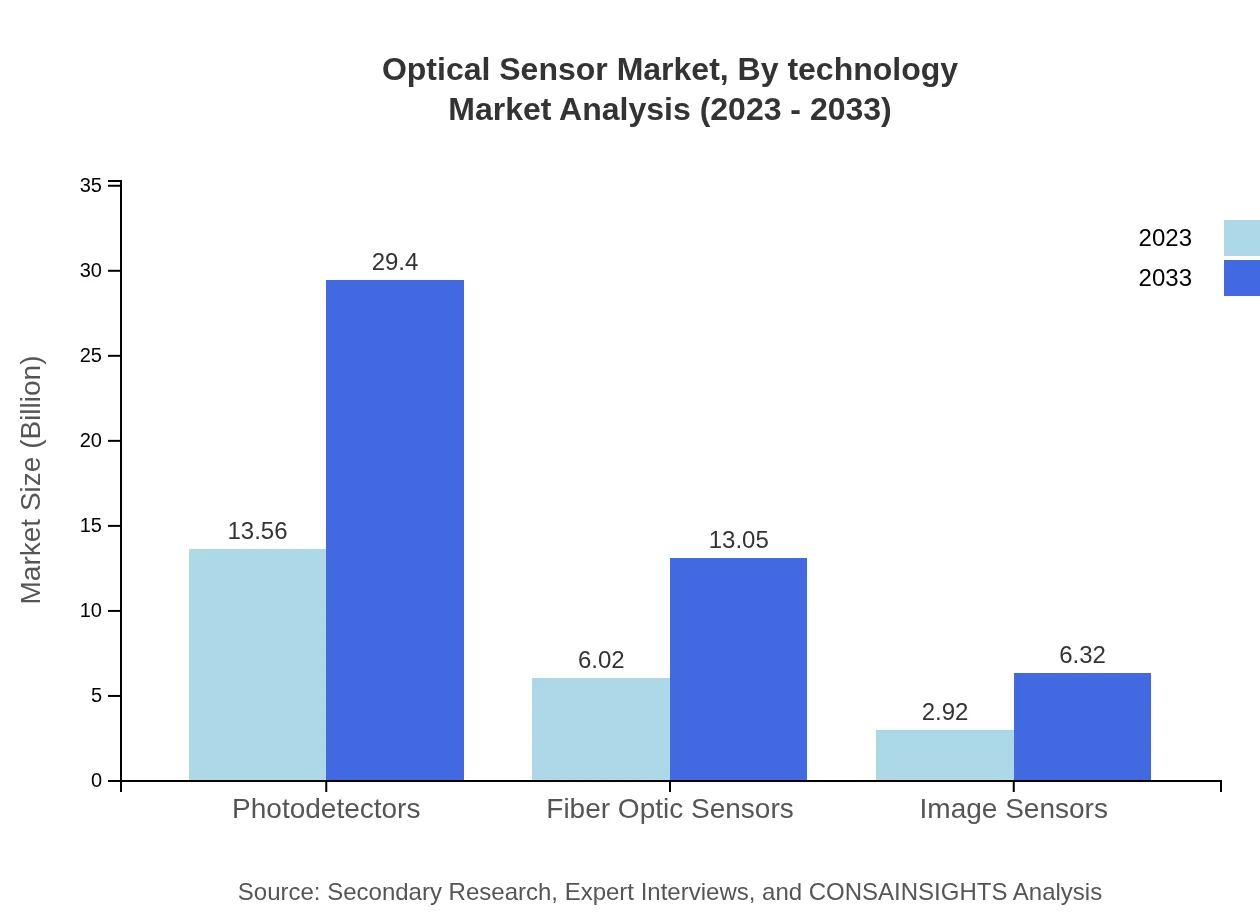

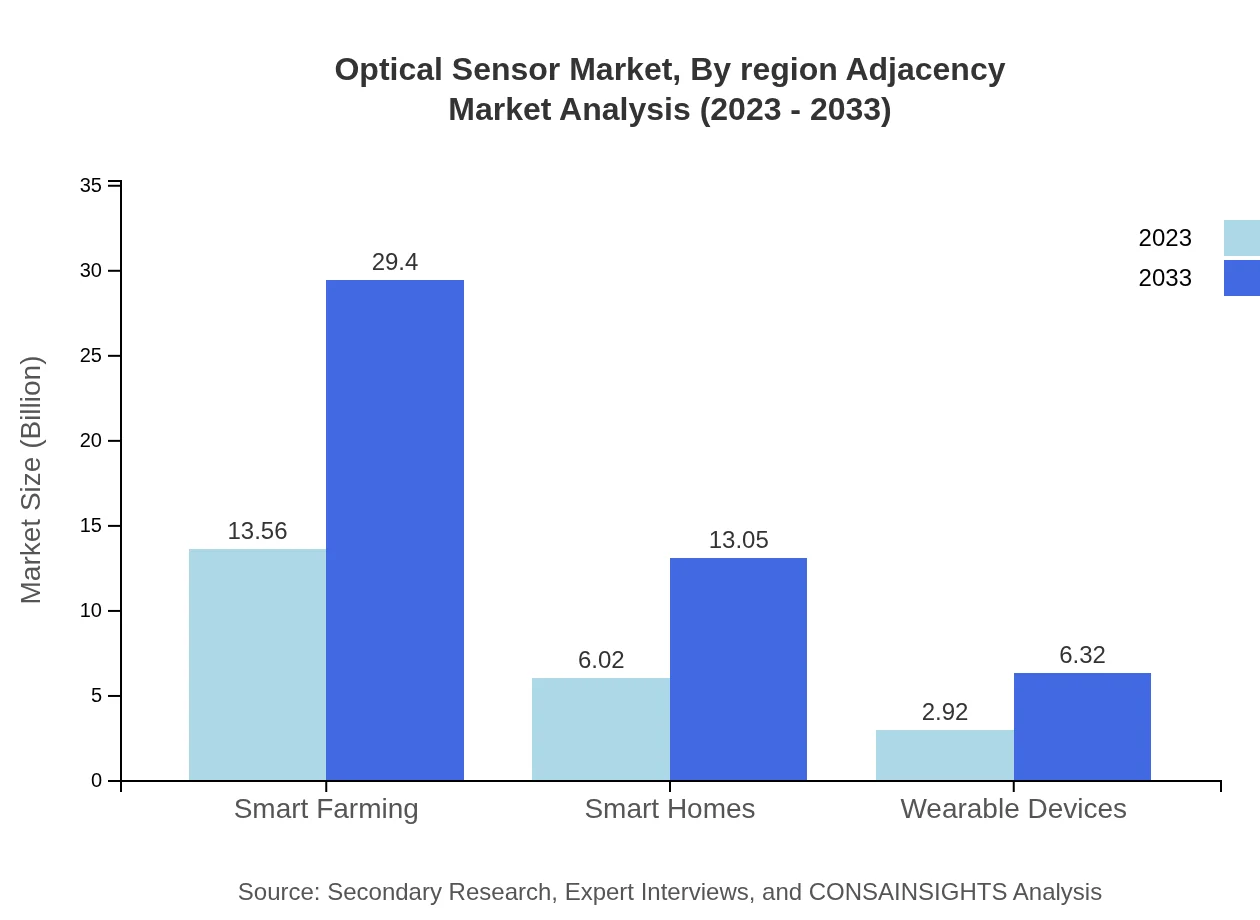

Optical Sensor Market Analysis By Technology

The market segments by technology consist of photodetectors, fiber optic sensors, and image sensors, with photodetectors holding a significant market share. In 2023, the photodetector segment is valued at $13.56 billion and is expected to reach $29.40 billion by 2033 due to its application in various fields, including smart farming and smart homes.

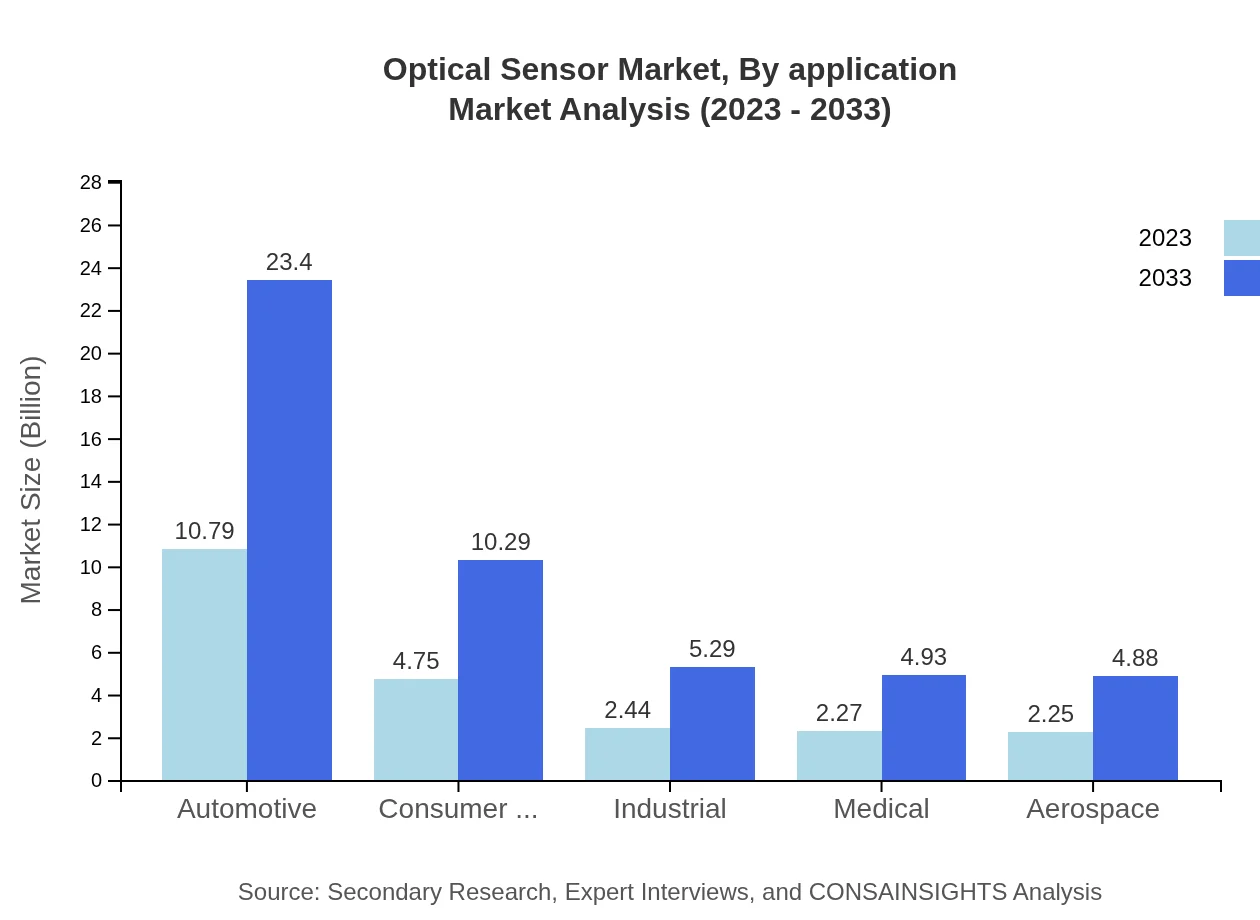

Optical Sensor Market Analysis By Application

Applications of optical sensors range across industries, with healthcare, automotive, and telecommunications exhibiting the most significant growth. The automotive segment is valued at $10.79 billion in 2023 and is anticipated to rise to $23.40 billion by 2033, driven by the demand for advanced safety systems.

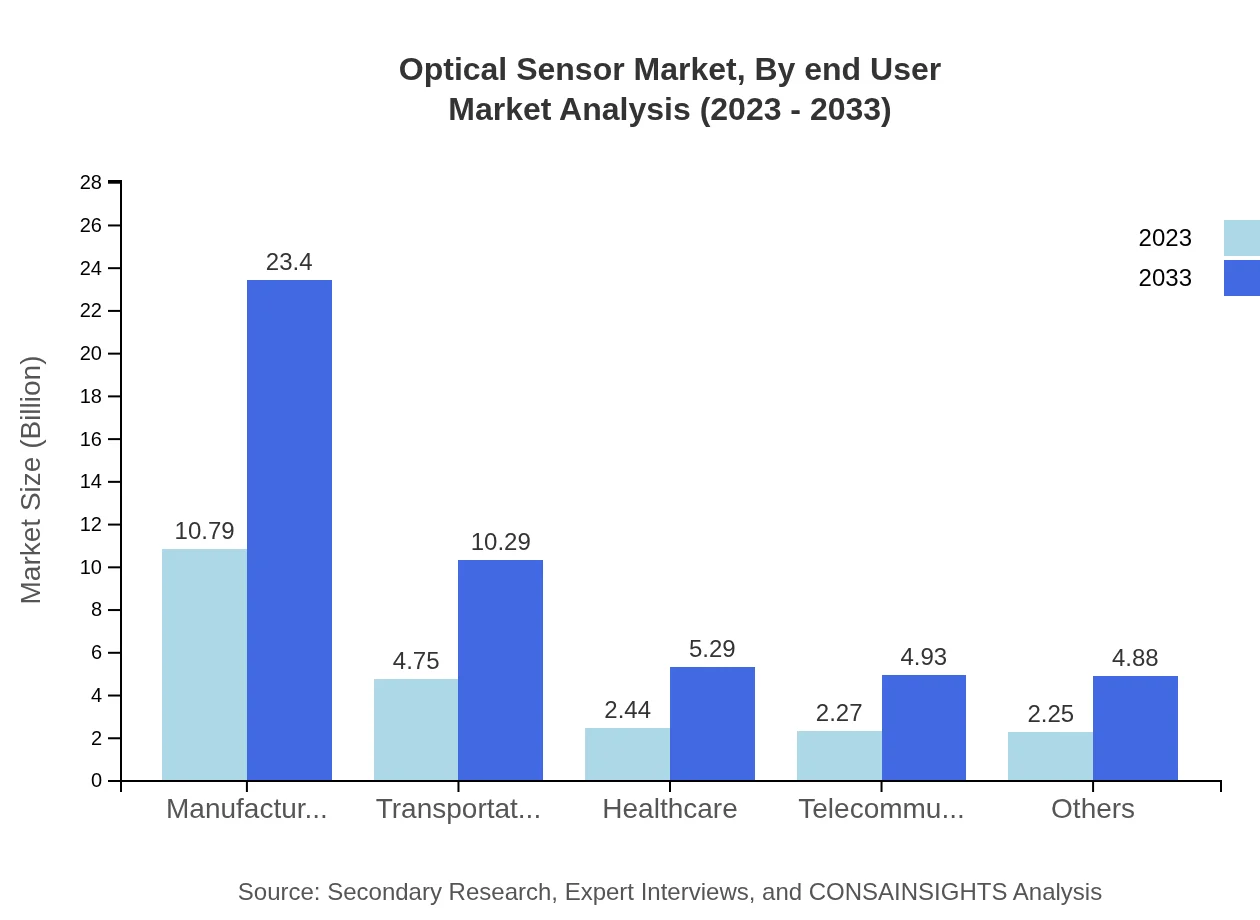

Optical Sensor Market Analysis By End User

The end-user segmentation reveals diverse applications in manufacturing, healthcare, and consumer electronics. The manufacturing sector, the largest end-user, accounts for a market size of $10.79 billion in 2023 with expectations of reaching $23.40 billion by 2033, aided by the adoption of smart manufacturing technologies.

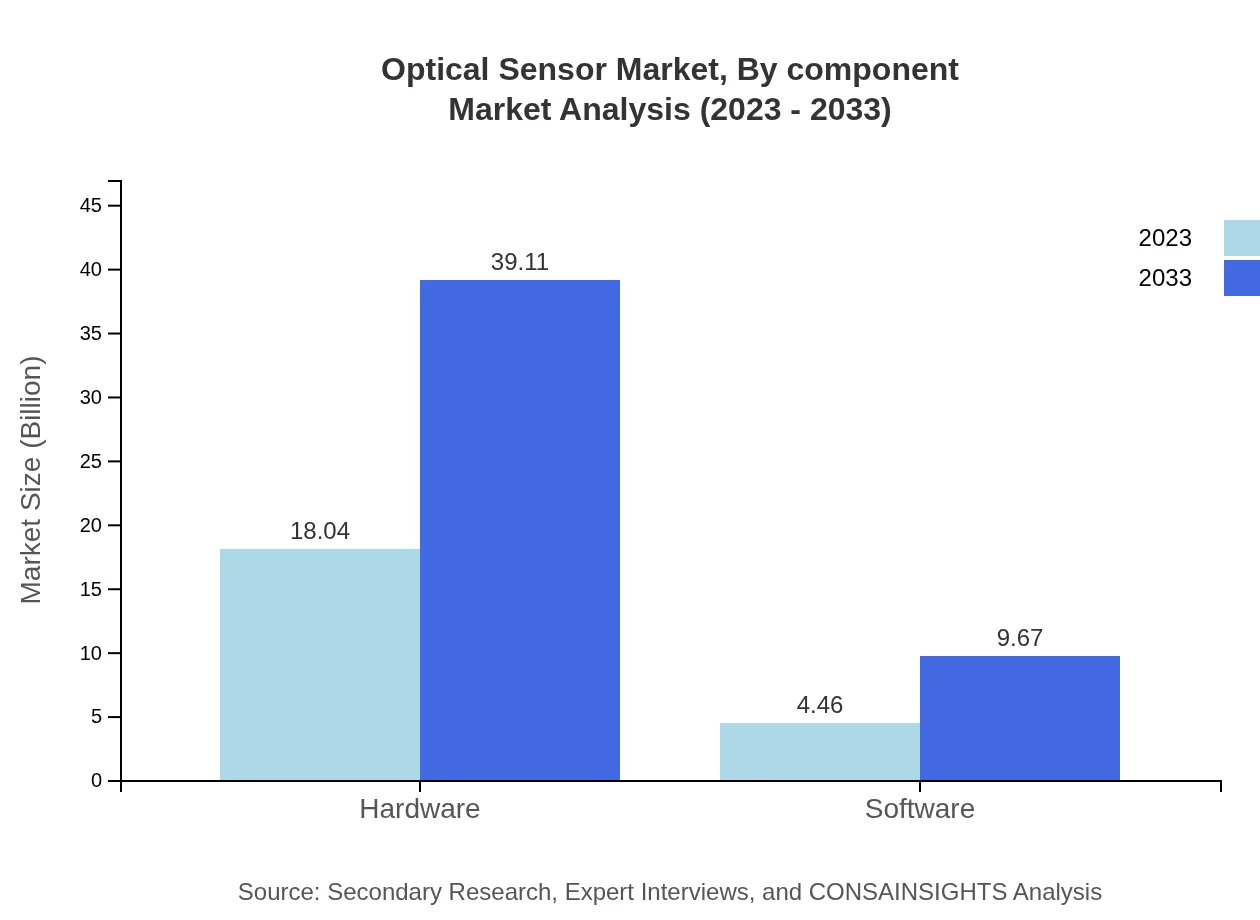

Optical Sensor Market Analysis By Component

The component segmentation is categorized into hardware and software. The hardware segment dominates the market with a valuation of $18.04 billion in 2023 and predicted growth to $39.11 billion by 2033, thanks to ongoing investments in sensor-heavy applications.

Optical Sensor Market Analysis By Region Adjacency

Emerging technologies such as AI integration are gaining traction, impacting growth in the optical sensor market. Innovation in sensor functionalities is expected to create new avenues and applications, advancing market dynamics in the coming years.

Optical Sensor Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Optical Sensor Industry

Texas Instruments:

A leading semiconductor company providing a wide array of sensor technologies including optical sensors, driving innovation in various industries.Analog Devices:

Known for its high-performance analog, mixed-signal, and digital signal processing solutions, including advanced optical sensor technologies.STMicroelectronics:

STMicroelectronics develops cutting-edge optical sensors, contributing to the advancement of industries like automotive and telecommunications.Hamamatsu Photonics:

Specializes in photonic devices and optical sensors, offering solutions that meet the demands for precision and sensitivity across various applications.We're grateful to work with incredible clients.

FAQs

What is the market size of optical Sensor?

The global optical sensor market is valued at \$22.5 billion in 2023, projected to grow at a CAGR of 7.8%, reflecting significant expansion up to 2033 as technology advances and applications proliferate.

What are the key market players or companies in this optical Sensor industry?

Key players in the optical sensor market include major technology firms such as Hamamatsu Photonics, STMicroelectronics, and Texas Instruments, alongside regional manufacturers focused on specialized applications.

What are the primary factors driving the growth in the optical sensor industry?

Factors propelling the growth of the optical sensor market include increasing demand for advanced imaging systems, enhancements in telecommunications, and the rise of smart devices and IoT applications, influencing various sectors.

Which region is the fastest Growing in the optical Sensor market?

The fastest-growing region in the optical sensor market is North America, expected to move from \$8.13 billion in 2023 to \$17.63 billion by 2033, driven by technological innovations and robust demand in various sectors.

Does ConsaInsights provide customized market report data for the optical Sensor industry?

Yes, ConsaInsights offers customized market report data tailored to the optical sensor industry, helping clients with specific insights and data needed for strategic decision-making.

What deliverables can I expect from this optical Sensor market research project?

Clients can expect detailed market analysis reports, segmentation data, regional growth forecasts, and actionable insights tailored to specific optical sensor applications and market trends.

What are the market trends of optical sensors?

Current trends in the optical sensor market include increased integration in consumer electronics, advancements in photodetector technology, and the growing role of optical sensors in automation and smart technology applications.