Optical Wavelength Services Market Report

Published Date: 31 January 2026 | Report Code: optical-wavelength-services

Optical Wavelength Services Market Size, Share, Industry Trends and Forecast to 2033

This market report evaluates the Optical Wavelength Services industry, examining trends, market size, technology insights, and regional performances from 2023 to 2033.

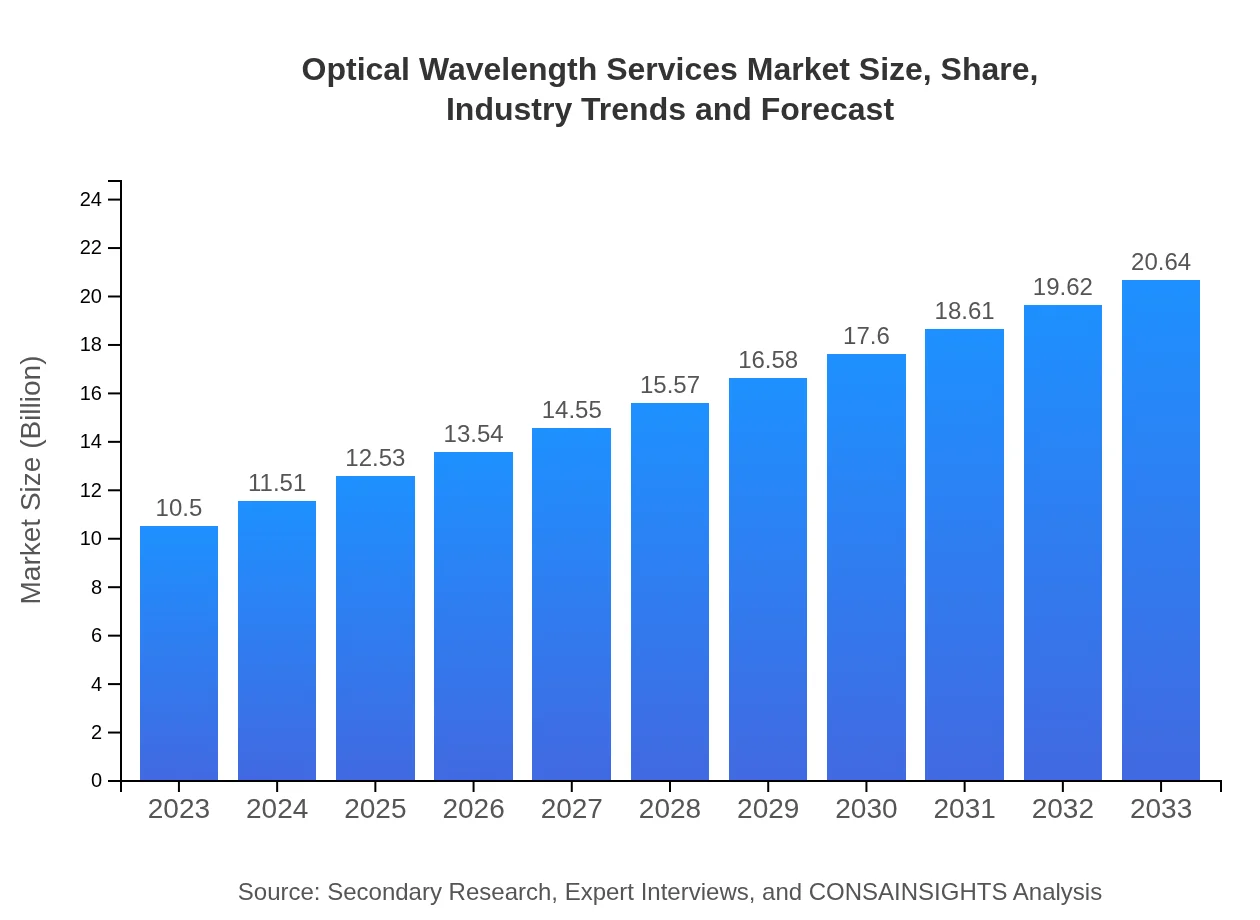

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $20.64 Billion |

| Top Companies | Cisco Systems, Inc., Juniper Networks, Inc., Ciena Corporation, NEC Corporation |

| Last Modified Date | 31 January 2026 |

Optical Wavelength Services Market Overview

Customize Optical Wavelength Services Market Report market research report

- ✔ Get in-depth analysis of Optical Wavelength Services market size, growth, and forecasts.

- ✔ Understand Optical Wavelength Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Optical Wavelength Services

What is the Market Size & CAGR of Optical Wavelength Services market in 2023?

Optical Wavelength Services Industry Analysis

Optical Wavelength Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Optical Wavelength Services Market Analysis Report by Region

Europe Optical Wavelength Services Market Report:

Europe's Optical Wavelength Services market is robust, projected to grow from $3.01 billion in 2023 to $5.92 billion by 2033. The region benefits from a mature telecommunications environment and increasing government support for digital infrastructure initiatives, encouraging the adoption of advanced optical technologies.Asia Pacific Optical Wavelength Services Market Report:

The Asia Pacific region is experiencing rapid growth in the Optical Wavelength Services market, driven by digital transformation and the increasing adoption of cloud services. In 2023, the market is valued at $1.98 billion and is anticipated to reach $3.89 billion by 2033, reflecting a substantial increase in data traffic and connectivity requirements.North America Optical Wavelength Services Market Report:

North America exhibits one of the largest Optical Wavelength Services markets, expected to grow from $3.97 billion in 2023 to $7.81 billion by 2033. The region's advanced technological landscape and high demand for bandwidth-intensive applications drive this growth, with major telecom operators and service providers investing heavily in infrastructure.South America Optical Wavelength Services Market Report:

In South America, the market for Optical Wavelength Services is smaller but growing steadily. With a projected size of $0.42 billion in 2023, it is expected to double to $0.82 billion by 2033. Increasing internet penetration and the expansion of telecommunications infrastructure will be significant contributors to this growth.Middle East & Africa Optical Wavelength Services Market Report:

The Middle East and Africa market for Optical Wavelength Services, starting at $1.12 billion in 2023 and anticipated to reach $2.20 billion by 2033, is witnessing growth due to improvements in network infrastructure and rising demand for high-speed internet services in emerging economies.Tell us your focus area and get a customized research report.

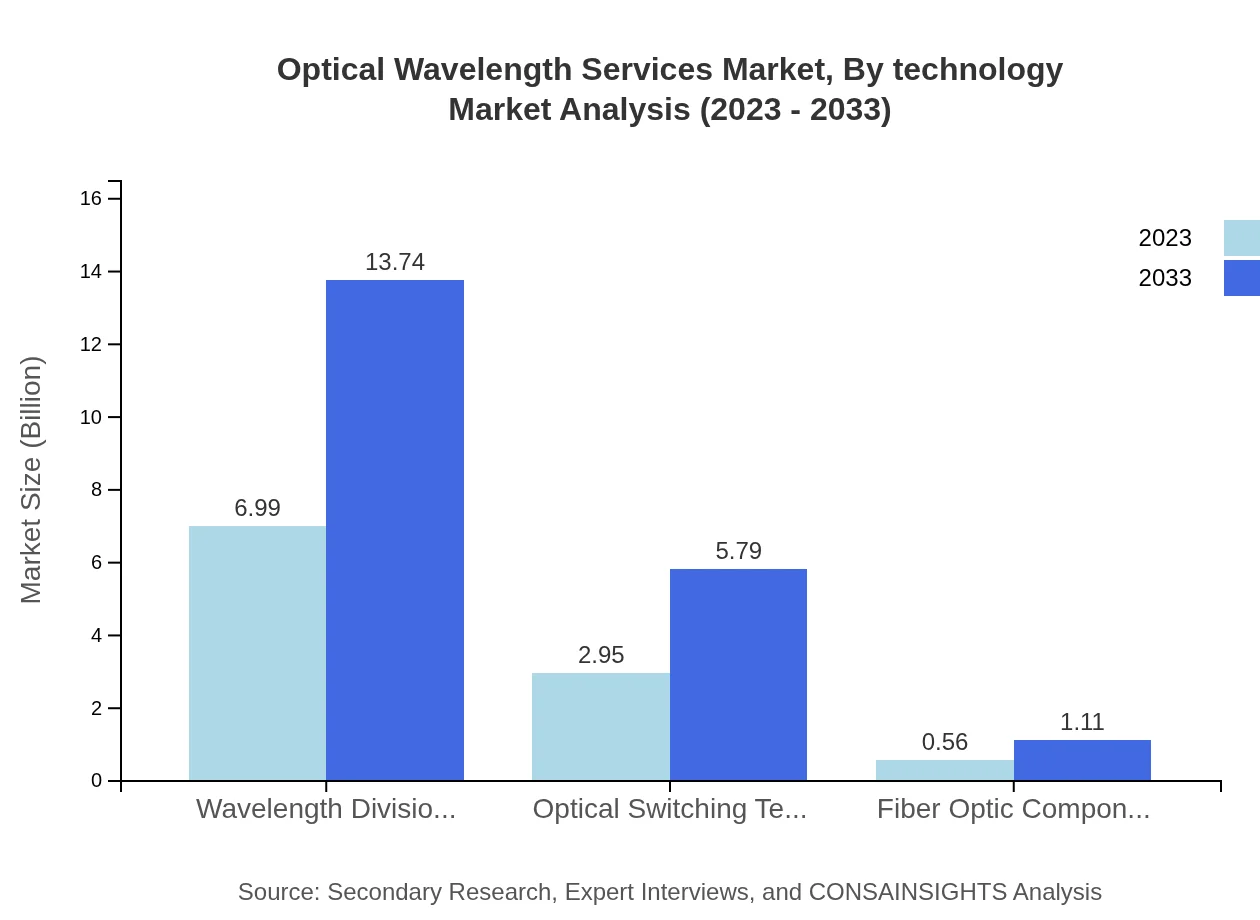

Optical Wavelength Services Market Analysis By Technology

The Optical Wavelength Services Market, segmented by technology, indicates that Wavelength Division Multiplexing (WDM) dominates, projected to grow from $6.99 billion in 2023 to $13.74 billion in 2033, making up 66.56% of the share. Optical Switching Technologies follow suit, expected to expand from $2.95 billion to $5.79 billion, capturing a share of 28.08%.

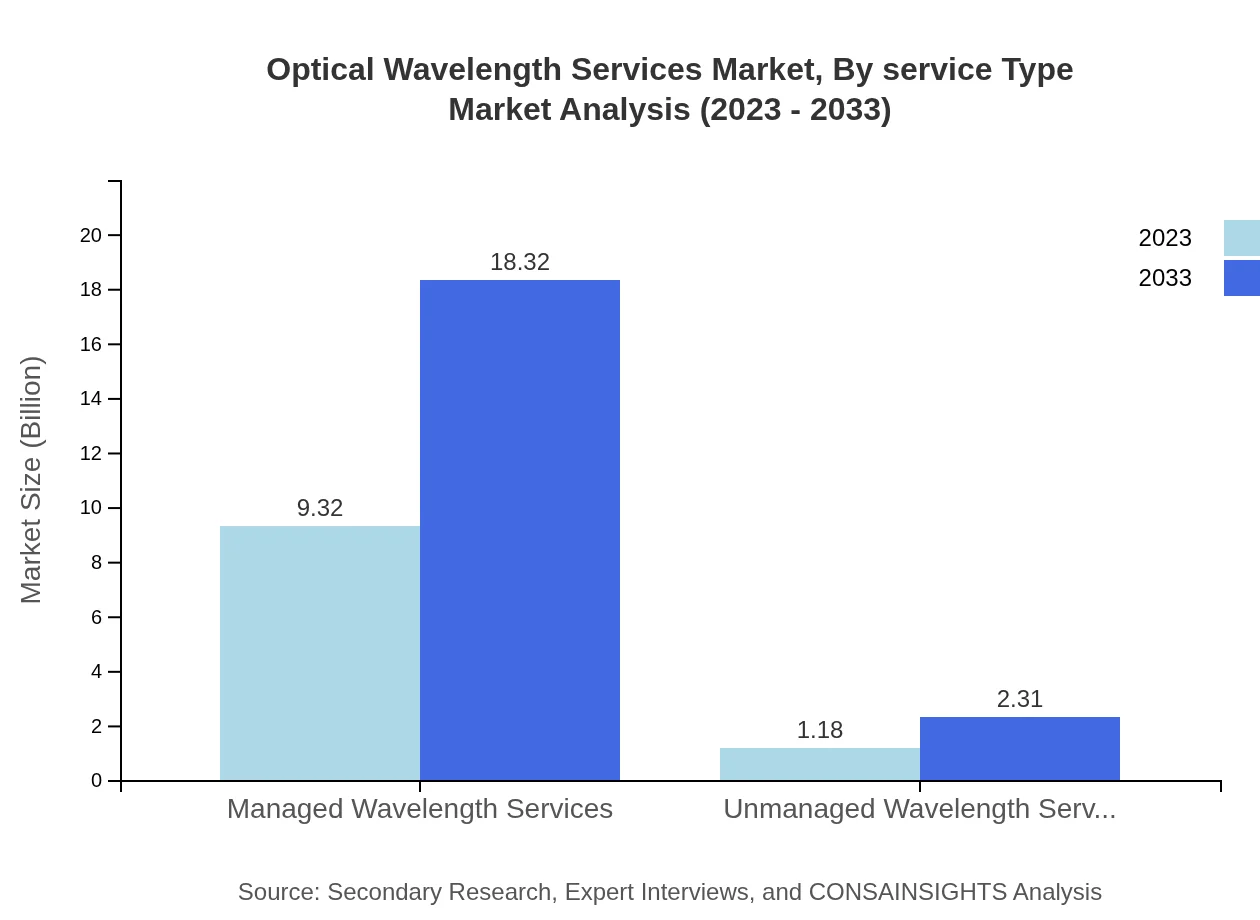

Optical Wavelength Services Market Analysis By Service Type

Service type segmentation reflects Managed Wavelength Services taking lead, projected to grow from $9.32 billion in 2023 to $18.32 billion by 2033, holding a substantial share of 88.79%. Unmanaged Wavelength Services remains significantly smaller, showing growth from $1.18 billion to $2.31 billion, with a share of 11.21%.

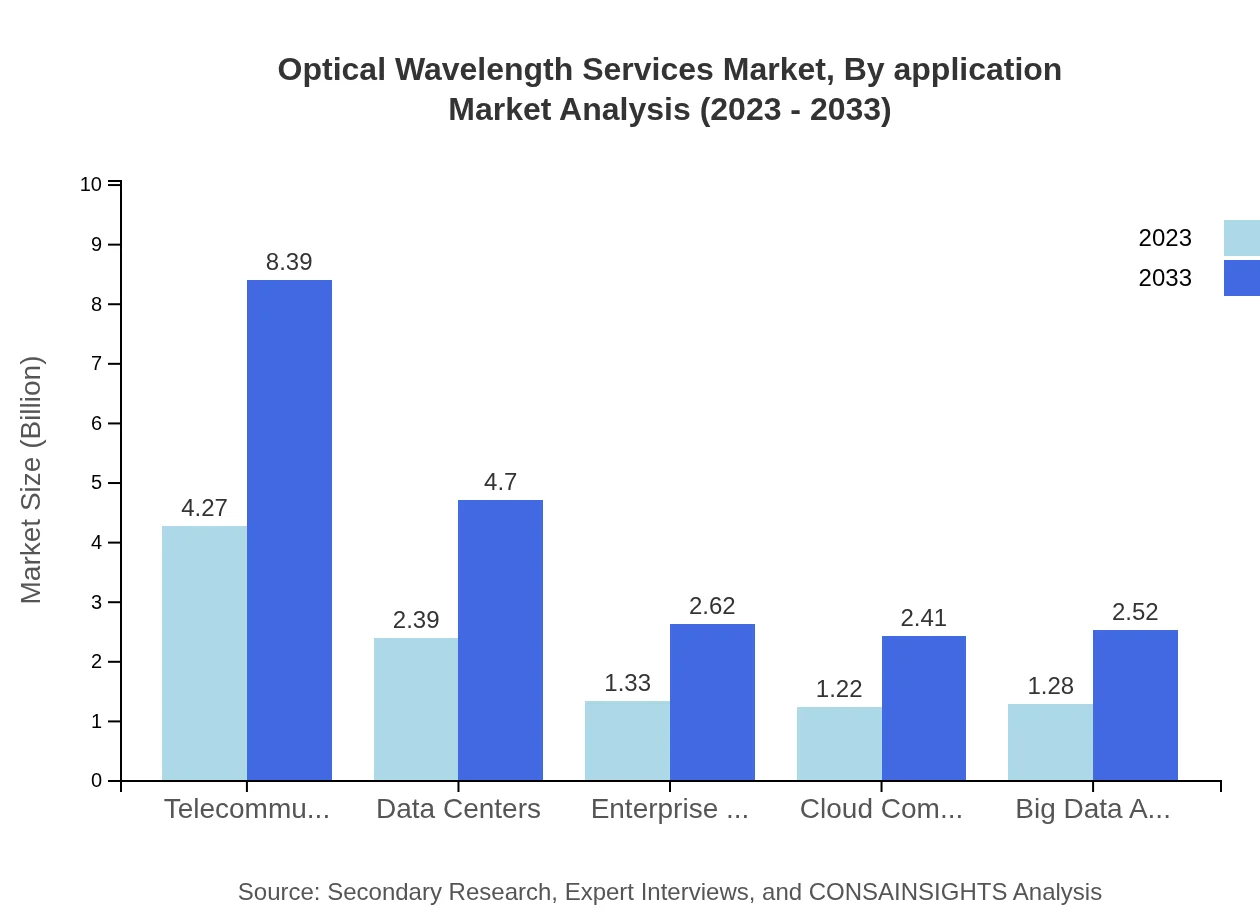

Optical Wavelength Services Market Analysis By Application

In application segmentation, Telecommunications is the largest sector, with market size expanding from $4.27 billion in 2023 to $8.39 billion in 2033, accounting for 40.64% share. Other crucial applications include Data Centers and Enterprise Networking, demonstrating consistency in performance due to the increasing need for effective data management solutions.

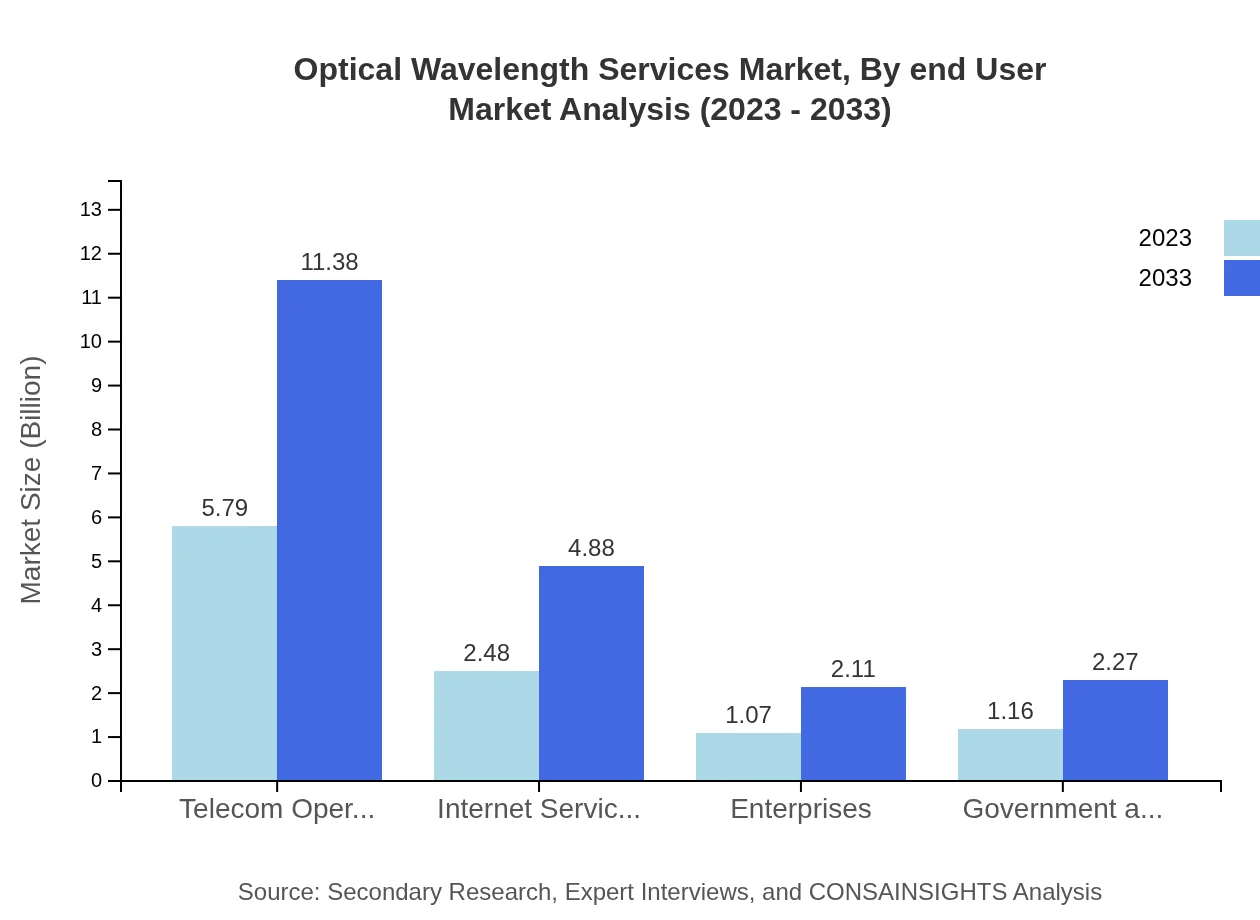

Optical Wavelength Services Market Analysis By End User

End-user analysis shows Telecom Operators leading with a significant market size estimated at $5.79 billion in 2023 and projected to rise to $11.38 billion by 2033, holding a steady share of 55.12%. Internet Service Providers and Enterprises are also growing segments, driven by the need for reliable connectivity and bandwidth.

Optical Wavelength Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Optical Wavelength Services Industry

Cisco Systems, Inc.:

Cisco is a leading provider of networking hardware and telecommunications equipment, offering advanced optical networking solutions that enhance communication efficiency and reliability.Juniper Networks, Inc.:

Juniper Networks specializes in high-performance networking and security solutions, delivering optical wavelength services that support demanding data traffic needs across industries.Ciena Corporation:

Ciena provides innovative networking solutions and is a leader in optical networking technology, particularly in wavelength division multiplexing (WDM), supporting extensive data transmission.NEC Corporation:

NEC is a global leader in telecommunications infrastructure, offering a range of optical networking products designed for enhanced wavelength services to facilitate digital transformation.We're grateful to work with incredible clients.

FAQs

What is the market size of optical Wavelength Services?

The optical wavelength services market is projected to reach approximately $10.5 billion by 2033, exhibiting a robust CAGR of 6.8% from its 2023 valuation. Major growth factors include increased demand for high-speed data transfer.

What are the key market players or companies in this optical Wavelength Services industry?

Key players in the optical wavelength services industry include major telecommunications companies and internet service providers. These companies are pivotal in delivering advanced optical network solutions and enhancing connectivity.

What are the primary factors driving the growth in the optical Wavelength Services industry?

Growth drivers include the surge in internet data traffic, advancements in optical technology, and increased enterprise investments in high-speed networks. These factors collectively are transforming the optical wavelength services landscape.

Which region is the fastest Growing in the optical Wavelength Services?

The North America region stands out as the fastest-growing market within the optical wavelength services sector, projected to grow from $3.97 billion in 2023 to $7.81 billion by 2033, highlighting its robust expansion.

Does ConsaInsights provide customized market report data for the optical Wavelength Services industry?

Yes, ConsaInsights offers tailored market report data specific to the optical wavelength services industry, accommodating various client needs and providing insights that align perfectly with unique business strategies.

What deliverables can I expect from this optical Wavelength Services market research project?

Expect comprehensive reports detailing market trends, competitive analyses, growth drivers, and regional insights. Deliverables may include executive summaries, in-depth market segmentation data, and forecasts.

What are the market trends of optical Wavelength Services?

Current trends indicate a shift towards increased reliance on cloud computing and data centers, along with a growing preference for managed wavelength services. This reflects a dynamic response to evolving technological demands in connectivity.