Optocouplers Market Report

Published Date: 31 January 2026 | Report Code: optocouplers

Optocouplers Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Optocouplers market from 2023 to 2033, including market size, growth potential, industry trends, and segmentation details, offering valuable insights for stakeholders and decision-makers.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $4.77 Billion |

| Top Companies | Broadcom Inc., Texas Instruments Inc., Toshiba Corporation, Mitsubishi Electric Corporation, Avago Technologies |

| Last Modified Date | 31 January 2026 |

Optocouplers Market Overview

Customize Optocouplers Market Report market research report

- ✔ Get in-depth analysis of Optocouplers market size, growth, and forecasts.

- ✔ Understand Optocouplers's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Optocouplers

What is the Market Size & CAGR of Optocouplers market in 2023?

Optocouplers Industry Analysis

Optocouplers Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Optocouplers Market Analysis Report by Region

Europe Optocouplers Market Report:

Europe's optocouplers market stands at $0.70 billion in 2023 and is expected to reach $1.34 billion by 2033. The region's strong regulatory environment around safety and performance standards promotes the use of optocouplers, particularly in automotive and industrial applications.Asia Pacific Optocouplers Market Report:

In 2023, the Asia Pacific optocouplers market size stands at approximately $0.47 billion, expected to grow to about $0.90 billion by 2033. This growth is propelled by rapid industrialization, urbanization, and a surge in the consumer electronics market. Countries like China and Japan lead in production and application of optocouplers, particularly in automotive and industrial automation.North America Optocouplers Market Report:

North America dominates the optocouplers market, with a size of $0.96 billion in 2023 projected to increase to $1.83 billion by 2033. The robust automotive and healthcare sectors contribute significantly to this growth, alongside advancements in communication technologies and energy-efficient solutions.South America Optocouplers Market Report:

The South American optocouplers market, valued at $0.10 billion in 2023, is projected to grow to $0.20 billion by 2033. Brazil and Argentina are the primary markets, driven by increasing demand in industrial and consumer applications, though growth might be slower due to economic fluctuations.Middle East & Africa Optocouplers Market Report:

The Middle East and Africa market is valued at $0.26 billion in 2023, growing to $0.50 billion by 2033. Increased investments in infrastructural development and the adoption of IoT solutions drive market growth, with key markets including the UAE and South Africa.Tell us your focus area and get a customized research report.

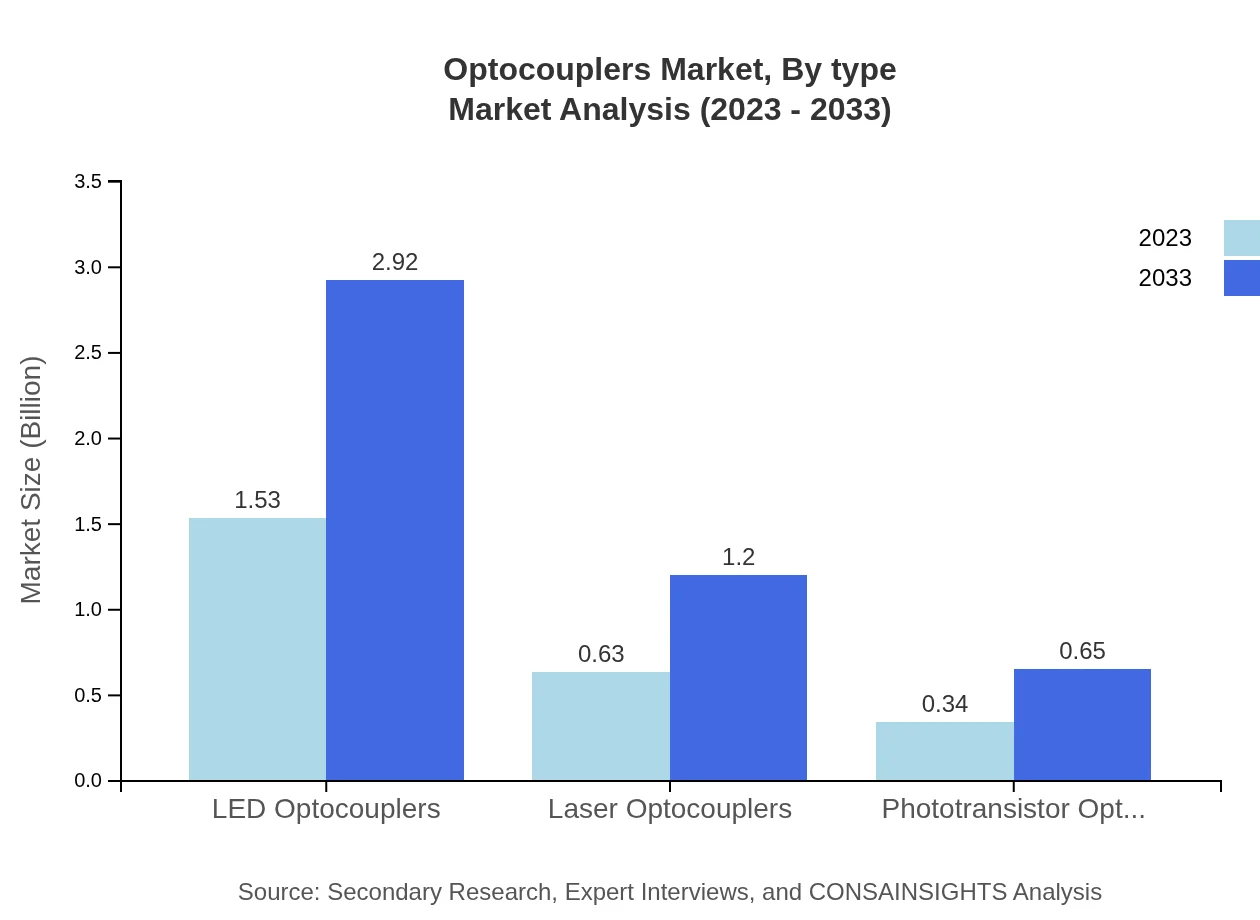

Optocouplers Market Analysis By Type

In 2023, the LED optocouplers segment dominates the market with a size of $1.53 billion, projected to grow to $2.92 billion by 2033. LED optocouplers account for a share of 61.19%. Laser optocouplers follow, with a size of $0.63 billion in 2023, expecting growth to $1.20 billion by 2033, capturing 25.09%. Phototransistor optocouplers have a smaller share, currently valued at $0.34 billion, projected to reach $0.65 billion. Significant innovation in Silicon and Gallium Arsenide optocouplers is also anticipated, showcasing their respective growth trajectories.

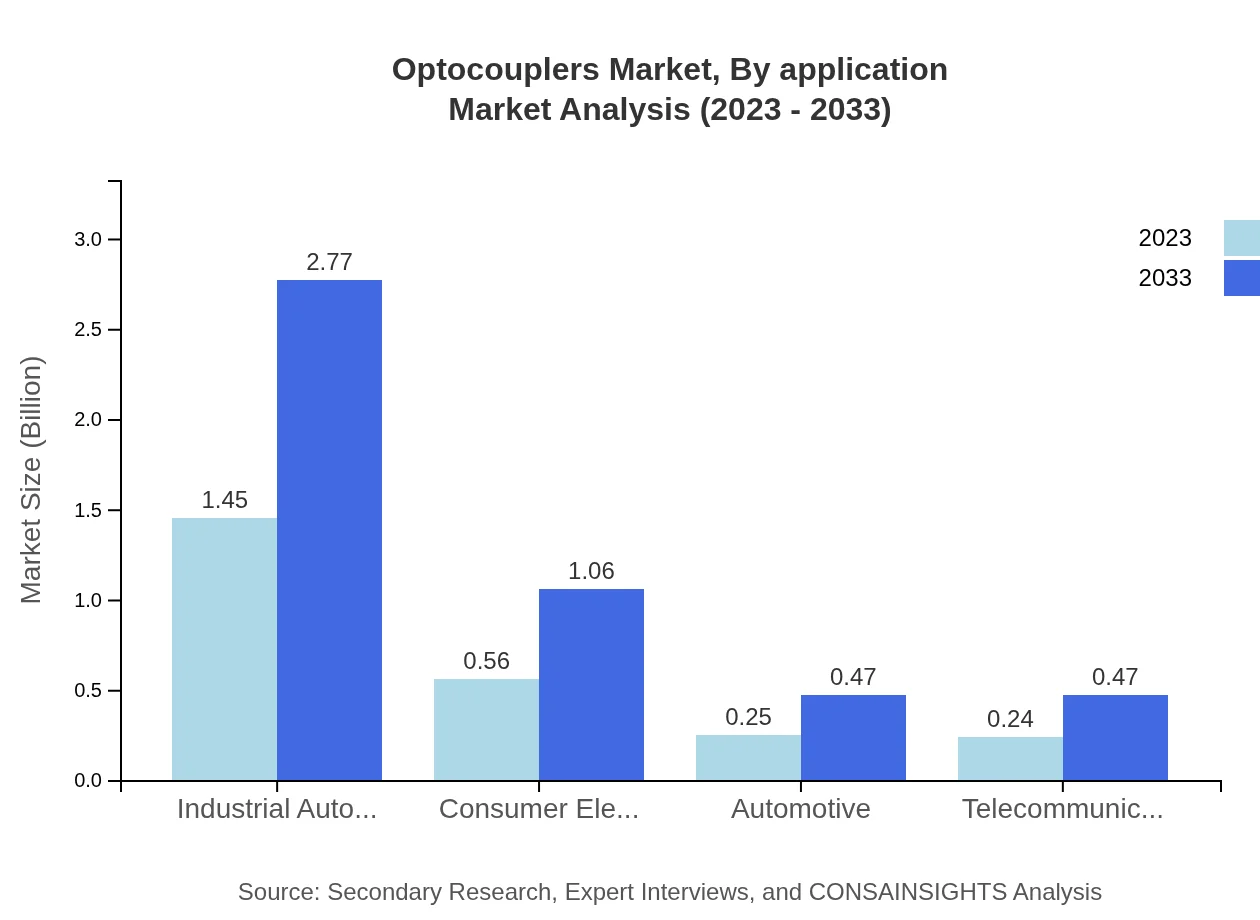

Optocouplers Market Analysis By Application

The automotive application segment leads with a market size of $1.45 billion in 2023, expected to rise to $2.77 billion by 2033, capturing 57.98% of the market. Consumer electronics follow closely, with a current size of $0.56 billion, anticipated to grow to $1.06 billion and holding a share of 22.3%. Industrial applications, including automation and control, currently valued at $0.25 billion, are projected to reach $0.47 billion. The healthcare sector, with a current market size of $0.24 billion, is also expected to see growth due to the increasing incorporation of optoelectronic sensors in medical devices.

Optocouplers Market Analysis By Technology

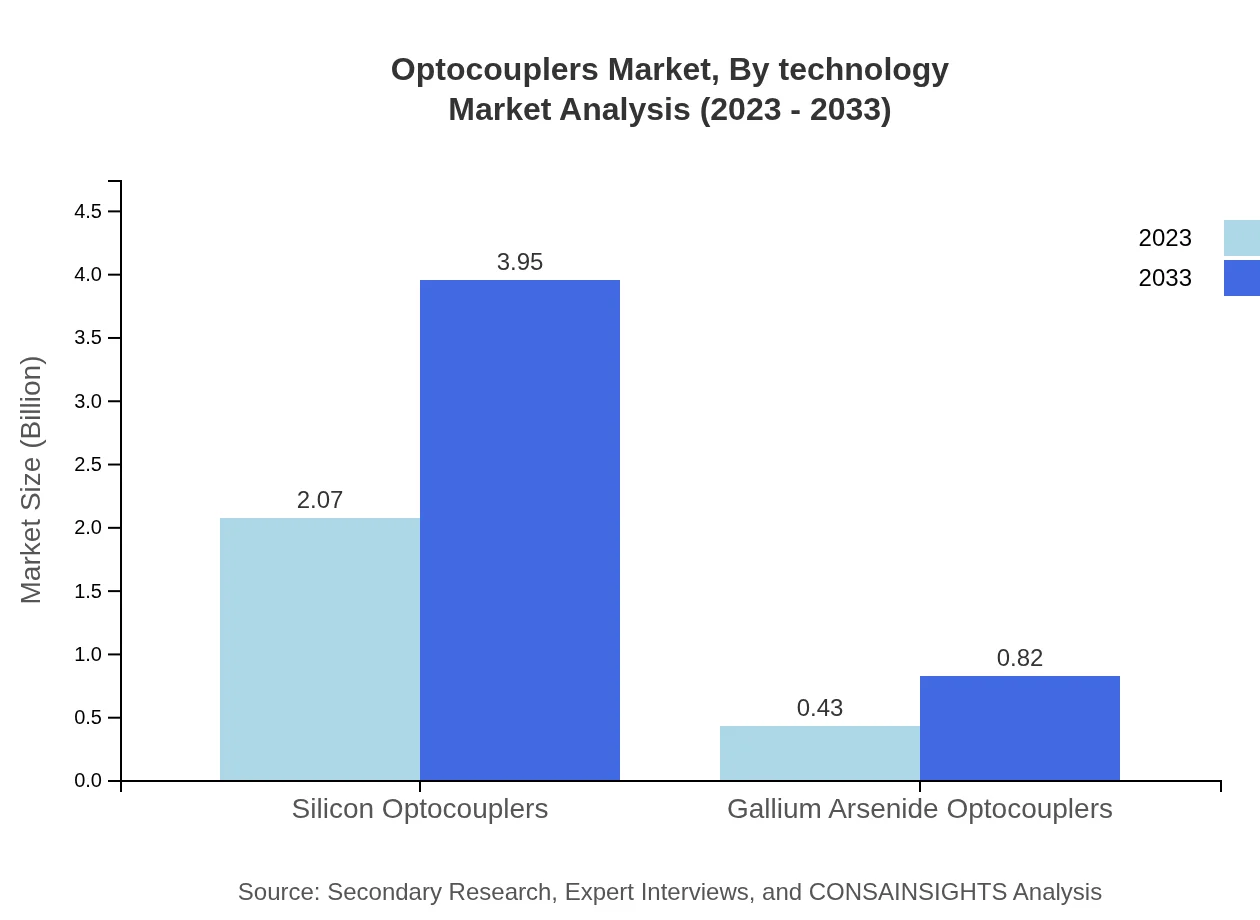

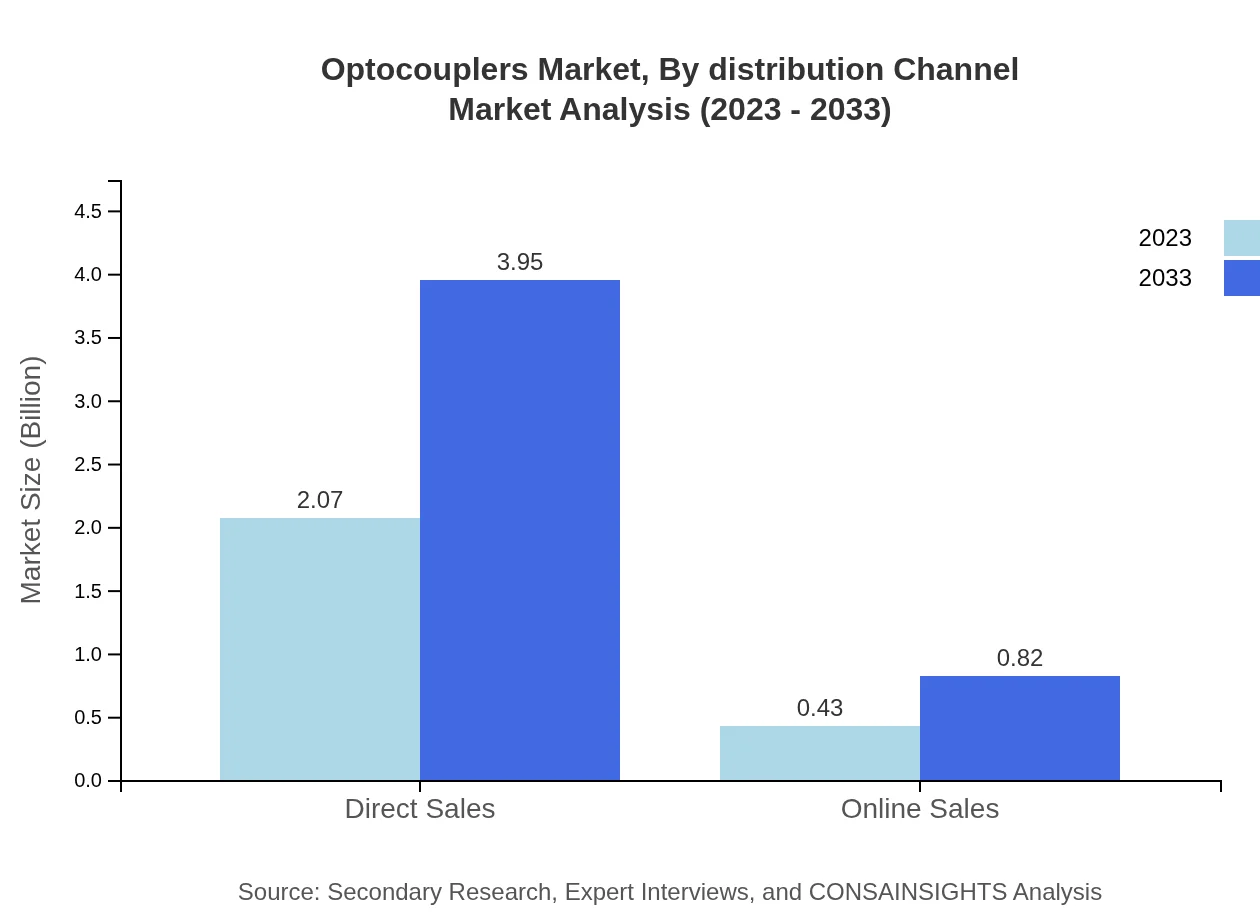

Silicon optocouplers hold a substantial market share of 82.73% in 2023, valued at $2.07 billion and projected to grow to $3.95 billion by 2033. Conversely, Gallium Arsenide optocouplers comprise 17.27% of the market, starting at $0.43 billion in 2023 and expected to reach $0.82 billion. This highlights the trend toward silicon-based technology as preferences shift towards cost-effectiveness and durability.

Optocouplers Market Analysis By End User

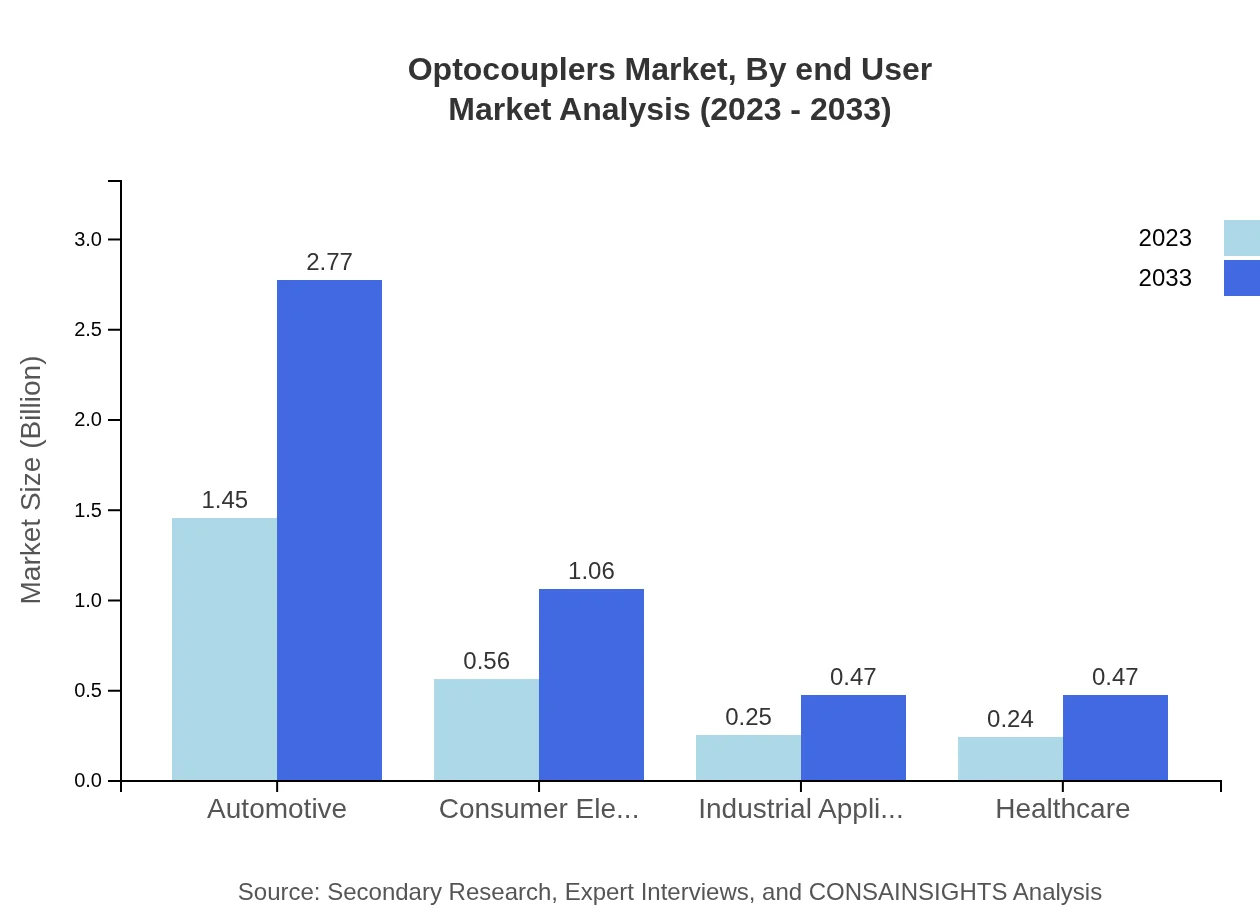

The dominance of the automotive industry showcases its size at $1.45 billion for 2023, increasing to $2.77 billion by 2033. The consumer electronics sector is significant too, with a market size of $0.56 billion, reaching $1.06 billion. Other notable industries include industrial automation, healthcare, and telecommunications, each presenting unique growth opportunities based on technological requirements.

Optocouplers Market Analysis By Distribution Channel

Direct sales channels lead in the distribution of optocouplers, representing a market size of $2.07 billion in 2023, projected to reach $3.95 billion by 2033. Online sales are also significant, with a current value of $0.43 billion, expected to rise to $0.82 billion. This illustrates a shift towards digitalization in product distribution as more customers prefer online platforms.

Optocouplers Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Optocouplers Industry

Broadcom Inc.:

Broadcom is a leading global technology company known for its comprehensive portfolio of optoelectronic products used in a diverse range of applications, including data centers, networking, and telecommunications.Texas Instruments Inc.:

Texas Instruments is at the forefront of the electronics market, providing innovative optocouplers known for their reliability and precision in signal isolation for various applications.Toshiba Corporation:

Toshiba is a pioneering company in the optoelectronics industry with a strong product portfolio of optocouplers that support high-performance applications across several industries.Mitsubishi Electric Corporation:

Mitsubishi Electric is recognized for its advanced optocouplers that enhance safety and efficiency in manufacturing automation systems and electronic devices.Avago Technologies:

Avago, now part of Broadcom, specializes in developing high-performance optocouplers, contributing significantly to telecommunication infrastructure and consumer electronics.We're grateful to work with incredible clients.

FAQs

What is the market size of optocouplers?

The global optocouplers market is valued at $2.5 billion in 2023 and is projected to grow at a CAGR of 6.5%, reaching significant market valuation by 2033.

What are the key market players or companies in the optocouplers industry?

Key players in the optocouplers market include Texas Instruments, Vishay Intertechnology, ON Semiconductor, Broadcom, and NTE Electronics, known for their innovative solutions and technological advancements.

What are the primary factors driving the growth in the optocouplers industry?

The growth of the optocouplers industry is driven by increasing demand in automotive, consumer electronics, and industrial applications, coupled with advancements in technology and the rise of automation.

Which region is the fastest Growing in the optocouplers market?

The Asia Pacific region is the fastest-growing for optocouplers, expected to expand from $0.47 billion in 2023 to $0.90 billion by 2033, highlighting strong demand in technology and manufacturing sectors.

Does ConsaInsights provide customized market report data for the optocouplers industry?

Yes, ConsaInsights offers customized market reports tailored to client needs in the optocouplers industry, ensuring relevant insights and data for strategic decision-making.

What deliverables can I expect from this optocouplers market research project?

Deliverables from the optocouplers market research project include comprehensive reports, detailed market analysis, forecasts, competitive landscape overview, and segmented data based on regions and applications.

What are the market trends of optocouplers?

Current trends in the optocouplers market include a shift towards more efficient LED efficiencies, increased use in automotive electronics, and growth in renewable energy applications, indicating a dynamic and evolving landscape.