Optoelectronic Components Market Report

Published Date: 31 January 2026 | Report Code: optoelectronic-components

Optoelectronic Components Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Optoelectronic Components market over the forecast period from 2023 to 2033, detailing market trends, size, regional insights, and growth opportunities.

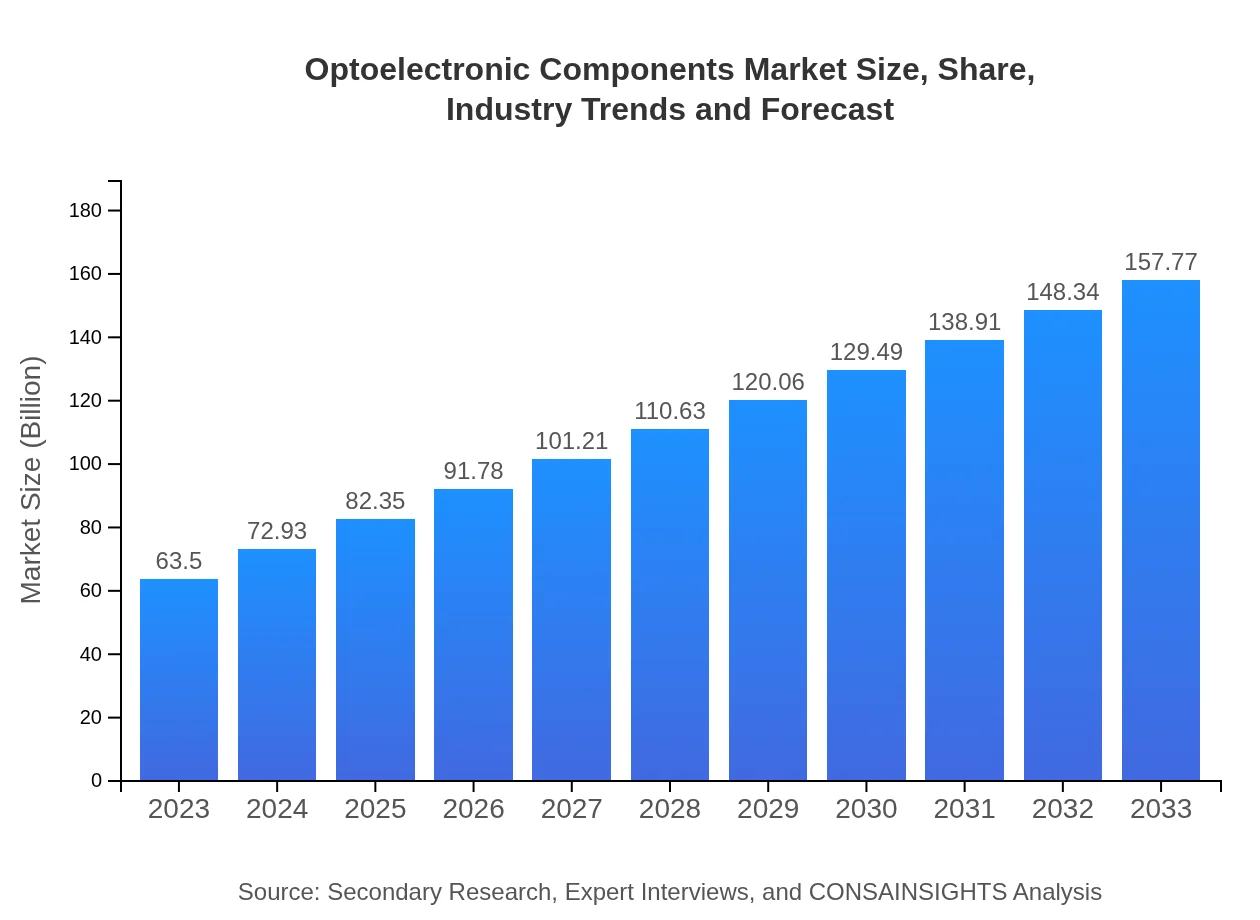

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $63.50 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $157.77 Billion |

| Top Companies | Texas Instruments, Osram Light AG, Broadcom Inc., Samsung Electronics |

| Last Modified Date | 31 January 2026 |

Optoelectronic Components Market Overview

Customize Optoelectronic Components Market Report market research report

- ✔ Get in-depth analysis of Optoelectronic Components market size, growth, and forecasts.

- ✔ Understand Optoelectronic Components's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Optoelectronic Components

What is the Market Size & CAGR of Optoelectronic Components market in 2023?

Optoelectronic Components Industry Analysis

Optoelectronic Components Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Optoelectronic Components Market Analysis Report by Region

Europe Optoelectronic Components Market Report:

The European market is set to increase from $16.65 billion in 2023 to $41.37 billion in 2033. Factors such as stringent energy regulations and a focus on renewable energy sources are driving adoption for optoelectronic components in the region.Asia Pacific Optoelectronic Components Market Report:

In Asia Pacific, the Optoelectronic Components market is projected to grow from $12.78 billion in 2023 to $31.76 billion in 2033. This growth is driven by increasing consumer electronics demand, advancements in telecommunications, and growing industrial applications.North America Optoelectronic Components Market Report:

North America is anticipated to see market growth from $24.17 billion in 2023 to $60.05 billion in 2033, led by advancements in telecommunications, automotive applications, and significant investments in healthcare technologies.South America Optoelectronic Components Market Report:

The market in South America is expected to rise from $2.41 billion in 2023 to $5.98 billion in 2033. Key growth drivers include industrialization efforts and rising technology adoption across various sectors.Middle East & Africa Optoelectronic Components Market Report:

In the Middle East and Africa, the market is projected to grow from $7.49 billion in 2023 to $18.62 billion in 2033. Growth is attributed to government initiatives promoting technology integration in various sectors, including infrastructure and communication.Tell us your focus area and get a customized research report.

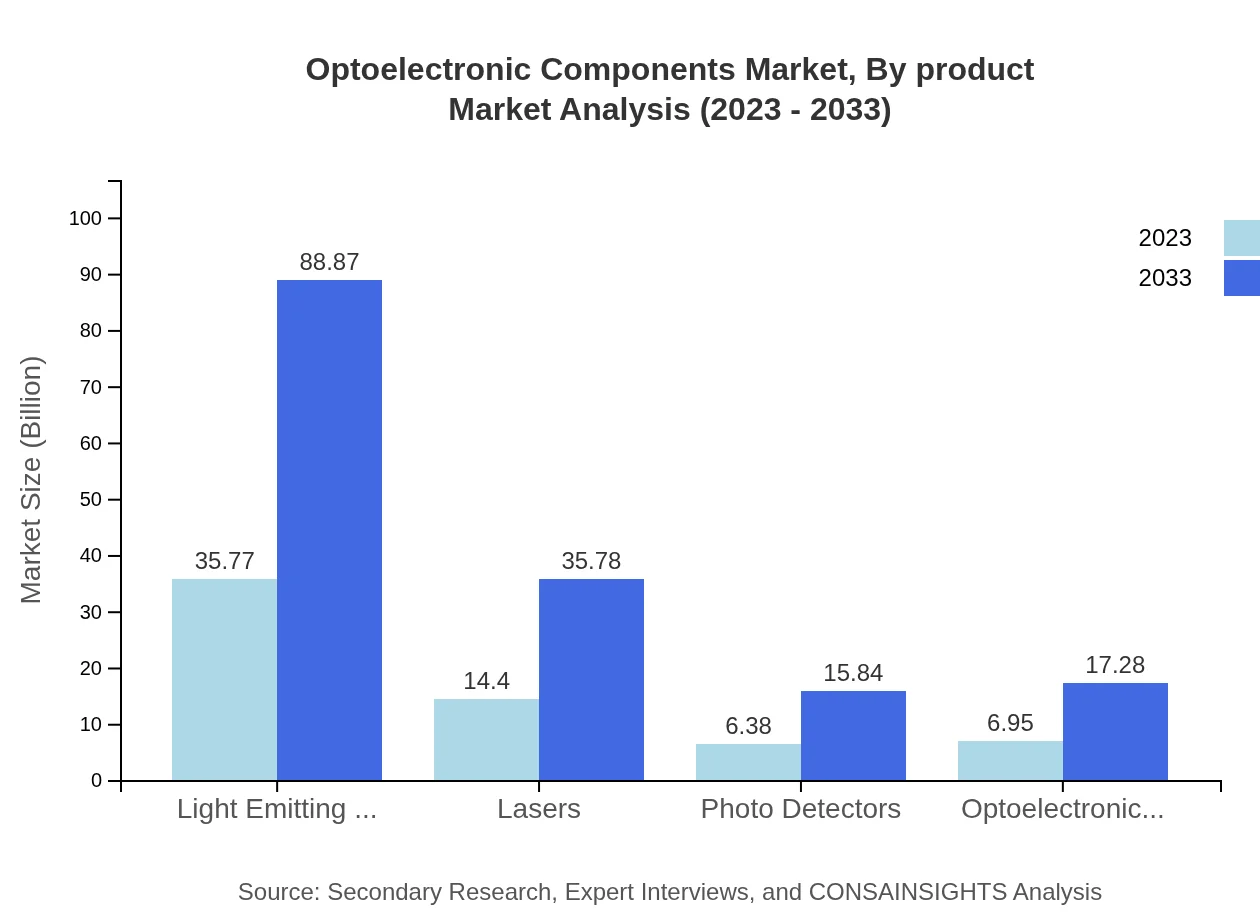

Optoelectronic Components Market Analysis By Product

The Optoelectronic Components market segments include Light Emitting Diodes (LEDs), Lasers, Photo Detectors, and Optoelectronic Sensors. In 2023, LEDs lead the market with a size of $35.77 billion and are expected to grow to $88.87 billion by 2033. Lasers capture a market size of $14.40 billion in 2023, anticipated to rise to $35.78 billion by 2033. Photodetectors and sensors are also crucial, with projected growth reflecting increasing demand in innovative applications across sectors.

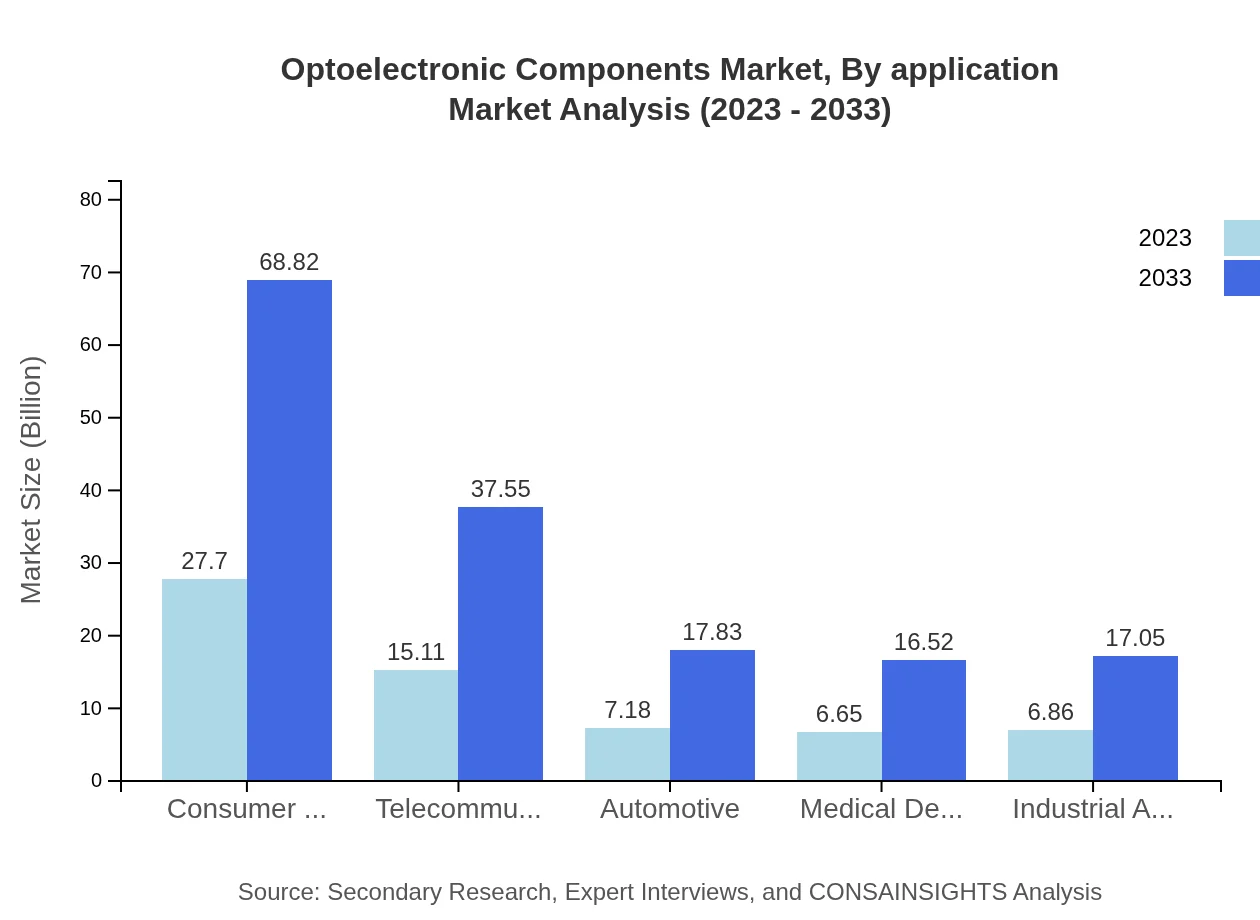

Optoelectronic Components Market Analysis By Application

Consumer electronics dominate the Optoelectronic Components market, providing a size of $27.70 billion in 2023 and anticipated to grow to $68.82 billion by 2033. Other applications include telecommunications, which saw a size of $15.11 billion in 2023, expected to reach $37.55 billion. Automotive, healthcare, and industrial applications also present substantial growth opportunities, with increasing demand for advanced technologies integrated into these sectors.

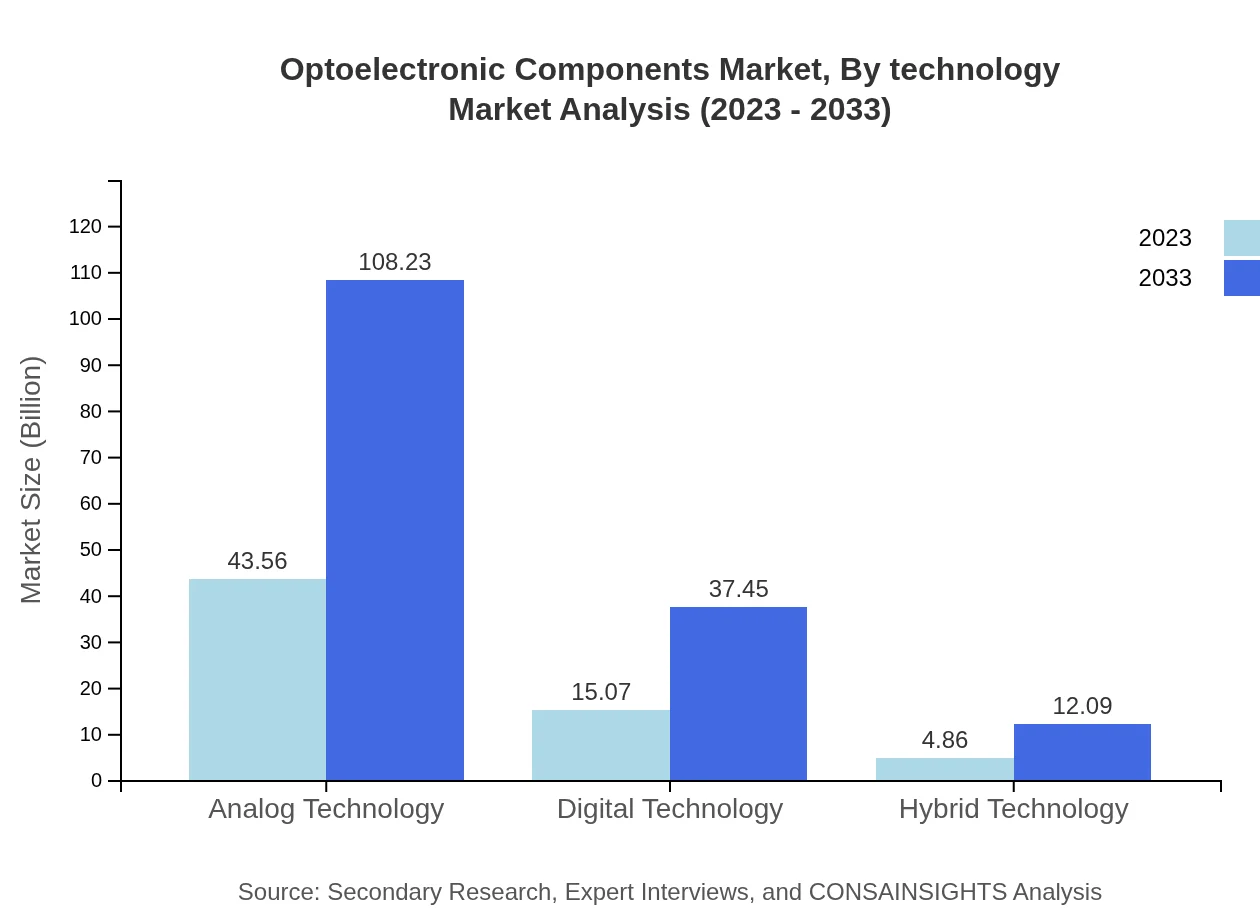

Optoelectronic Components Market Analysis By Technology

The Optoelectronic Components market is categorized into Analog, Digital, and Hybrid technologies. The Analog technology segment dominates with a size of $43.56 billion in 2023, expected to escalate to $108.23 billion. Digital technology follows, with a market size of $15.07 billion, growing to $37.45 billion by 2033. Hybrid technologies exhibit significant growth potential due to rising applications across different sectors.

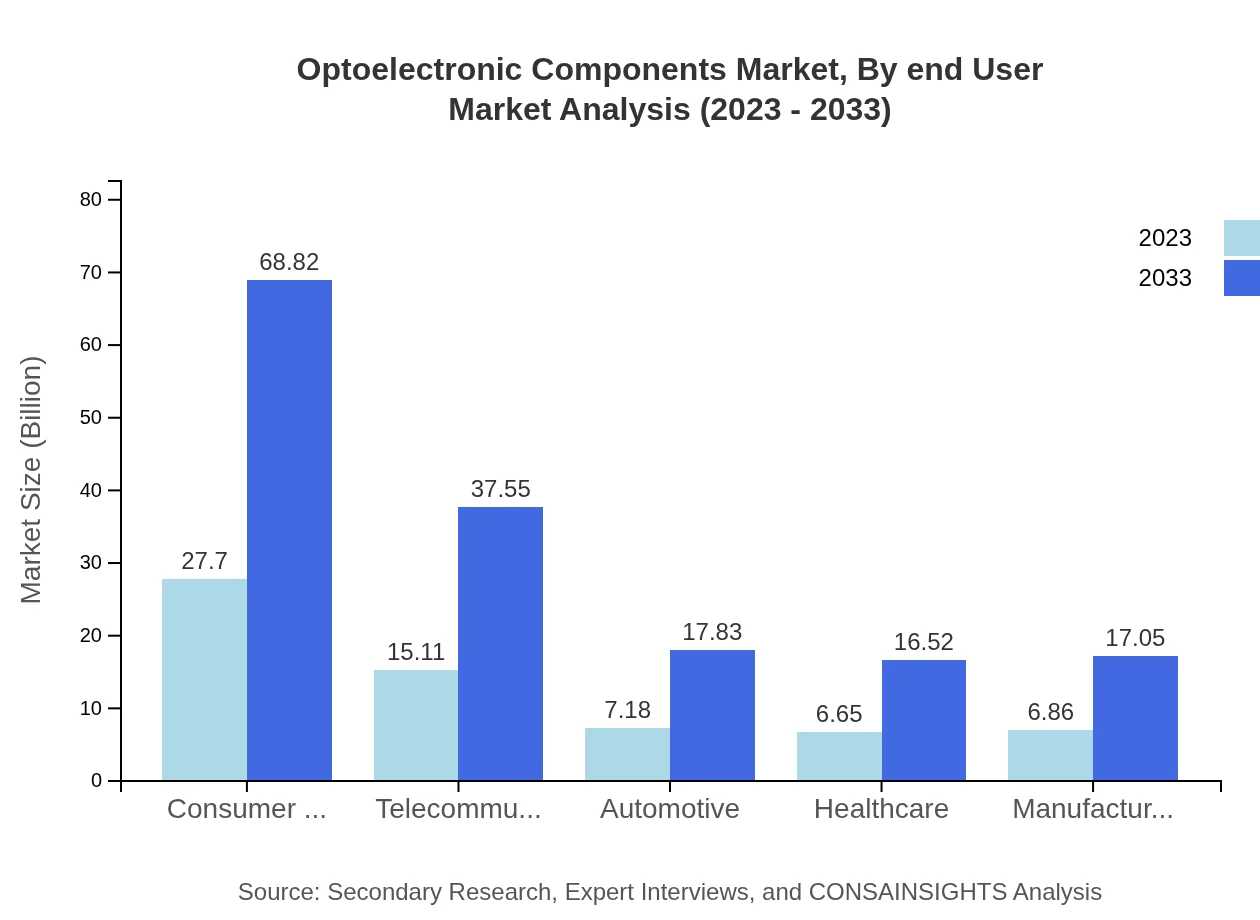

Optoelectronic Components Market Analysis By End User

End-users of optoelectronic components include consumer electronics, automotive, medical devices, and industrial applications. The consumer electronics sector holds a prominent market share, elaborating a size of $27.70 billion in 2023 and estimating to climb to $68.82 billion in 2033. This segment is closely followed by telecommunications and healthcare, which are growing due to the increasing integration of optoelectronic components in advanced technological frameworks.

Optoelectronic Components Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Optoelectronic Components Industry

Texas Instruments:

Texas Instruments is a major player in the optoelectronic components market, specializing in analog and digital semiconductors. They provide innovative solutions for various applications, significantly influencing the market's growth trajectory.Osram Light AG:

Osram Light AG is a leading manufacturer of lighting solutions, making key contributions in LED technology and solid-state lighting, which is transformative for energy-efficient solutions.Broadcom Inc.:

Broadcom Inc. provides a wide range of optoelectronic components including photodetectors and optical sensors, playing a vital role in telecommunications and networking applications.Samsung Electronics:

Samsung Electronics is a prominent player in the consumer electronics segment, incorporating advanced optoelectronic components into smart devices and displays, thereby ensuring enhanced performance.We're grateful to work with incredible clients.

FAQs

What is the market size of optoelectronic Components?

The global optoelectronic components market is valued at approximately $63.5 billion in 2023 and is projected to grow at a CAGR of 9.2%, reaching significantly higher values by 2033.

What are the key market players or companies in the optoelectronic components industry?

Key players in the optoelectronic components industry include major technology firms engaged in LED manufacturing, laser production, and sensor technology, which significantly contribute to research, development, and market expansion.

What are the primary factors driving the growth in the optoelectronic components industry?

Growth is driven by advancements in consumer electronics, telecommunications, and healthcare sectors, alongside increasing demand for energy-efficient lighting and smart technologies that require optoelectronic solutions.

Which region is the fastest Growing in the optoelectronic components market?

The Asia Pacific region is the fastest-growing, with a market size projected to reach $31.76 billion by 2033, demonstrating rapid growth driven by industrialization and rising tech adoption.

Does ConsaInsights provide customized market report data for the optoelectronic components industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the optoelectronic components sector, ensuring comprehensive insights for strategic decision-making.

What deliverables can I expect from this optoelectronic components market research project?

Expected deliverables include comprehensive market analysis reports, industry trends, competitive landscapes, segment insights, and regional data tailored to client specifications.

What are the market trends of optoelectronic components?

Emerging trends include the shift toward hybrid technologies, the increase in automation across sectors, and a growing focus on sustainability and energy-efficient solutions in global markets.