Optometry Equipment Market Report

Published Date: 31 January 2026 | Report Code: optometry-equipment

Optometry Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Optometry Equipment market, delivering insights into market size, trends, segmentation, regional dynamics, and growth forecasts from 2023 to 2033. It aims to equip stakeholders with valuable data for strategic decision-making.

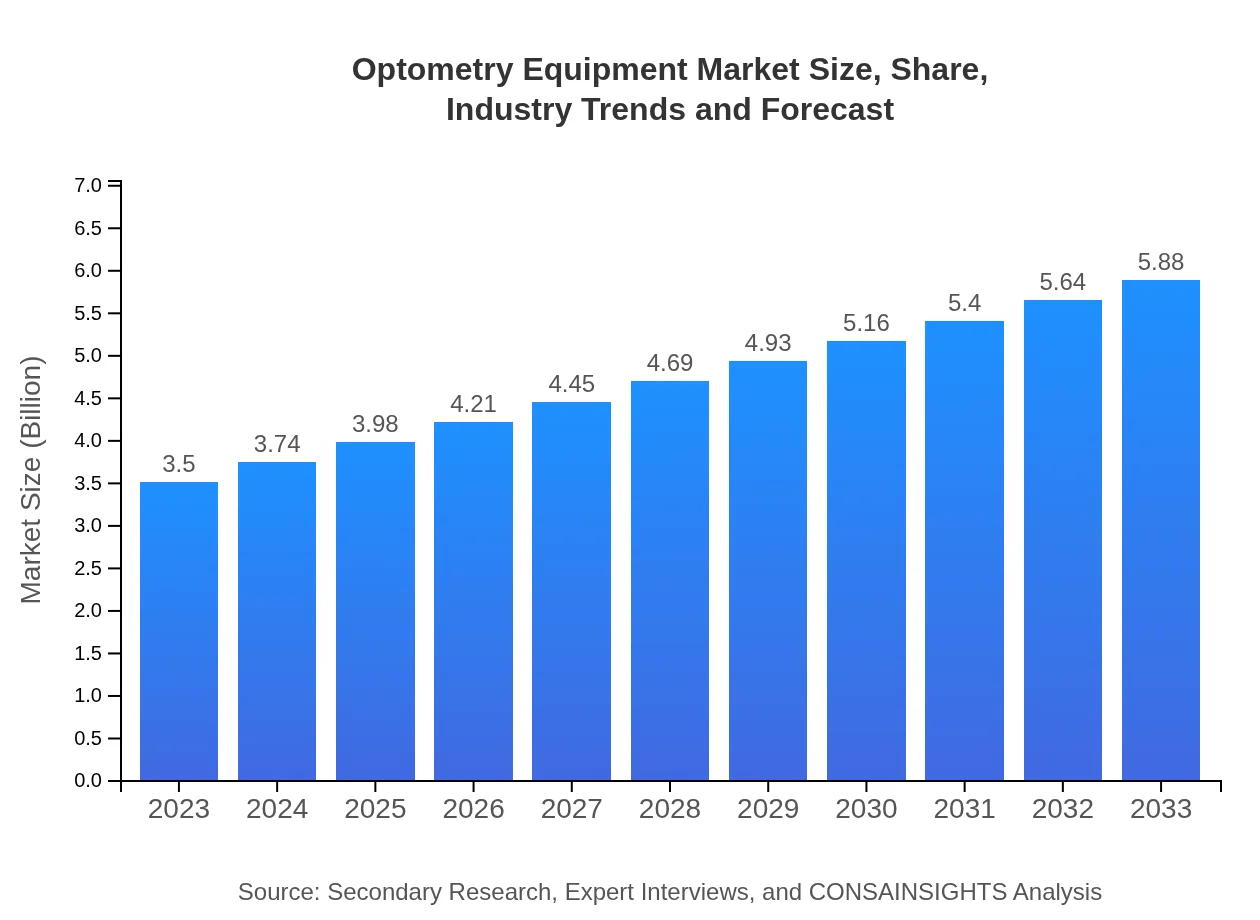

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $5.88 Billion |

| Top Companies | EssilorLuxottica, Zeiss Group, Nidek Co. Ltd., Topcon Corporation, Hoya Corporation |

| Last Modified Date | 31 January 2026 |

Optometry Equipment Market Overview

Customize Optometry Equipment Market Report market research report

- ✔ Get in-depth analysis of Optometry Equipment market size, growth, and forecasts.

- ✔ Understand Optometry Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Optometry Equipment

What is the Market Size & CAGR of Optometry Equipment market in 2023?

Optometry Equipment Industry Analysis

Optometry Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Optometry Equipment Market Analysis Report by Region

Europe Optometry Equipment Market Report:

In Europe, the optometry equipment market was valued at $1.20 billion in 2023 and is expected to reach $2.01 billion by 2033. The growth is encouraged by increasing investments in healthcare innovation and government support for enhanced eye care services.Asia Pacific Optometry Equipment Market Report:

In the Asia Pacific region, the optometry equipment market is anticipated to grow significantly, with a market size of $0.57 billion in 2023, projected to reach $0.95 billion by 2033. The growth is fueled by increasing healthcare expenditure, rising awareness about eye health, and growing geriatric demographics needing vision correction.North America Optometry Equipment Market Report:

North America remains one of the largest markets for optometry equipment, with a current size of $1.21 billion projected to grow to $2.04 billion by 2033. This growth is driven by advanced healthcare infrastructure, rising demand for innovative products, and a focus on preventive eye care treatment solutions.South America Optometry Equipment Market Report:

In South America, the market is relatively smaller with a size of $0.04 billion in 2023, growing to $0.07 billion by 2033. This region is witnessing gradual growth due to a rise in healthcare accessibility and initiatives aimed at improving eye care services.Middle East & Africa Optometry Equipment Market Report:

The Middle East and Africa market is expected to expand from $0.48 billion in 2023 to $0.81 billion by 2033. Factors contributing to this growth include improved access to healthcare facilities and an increasing prevalence of eye-related conditions.Tell us your focus area and get a customized research report.

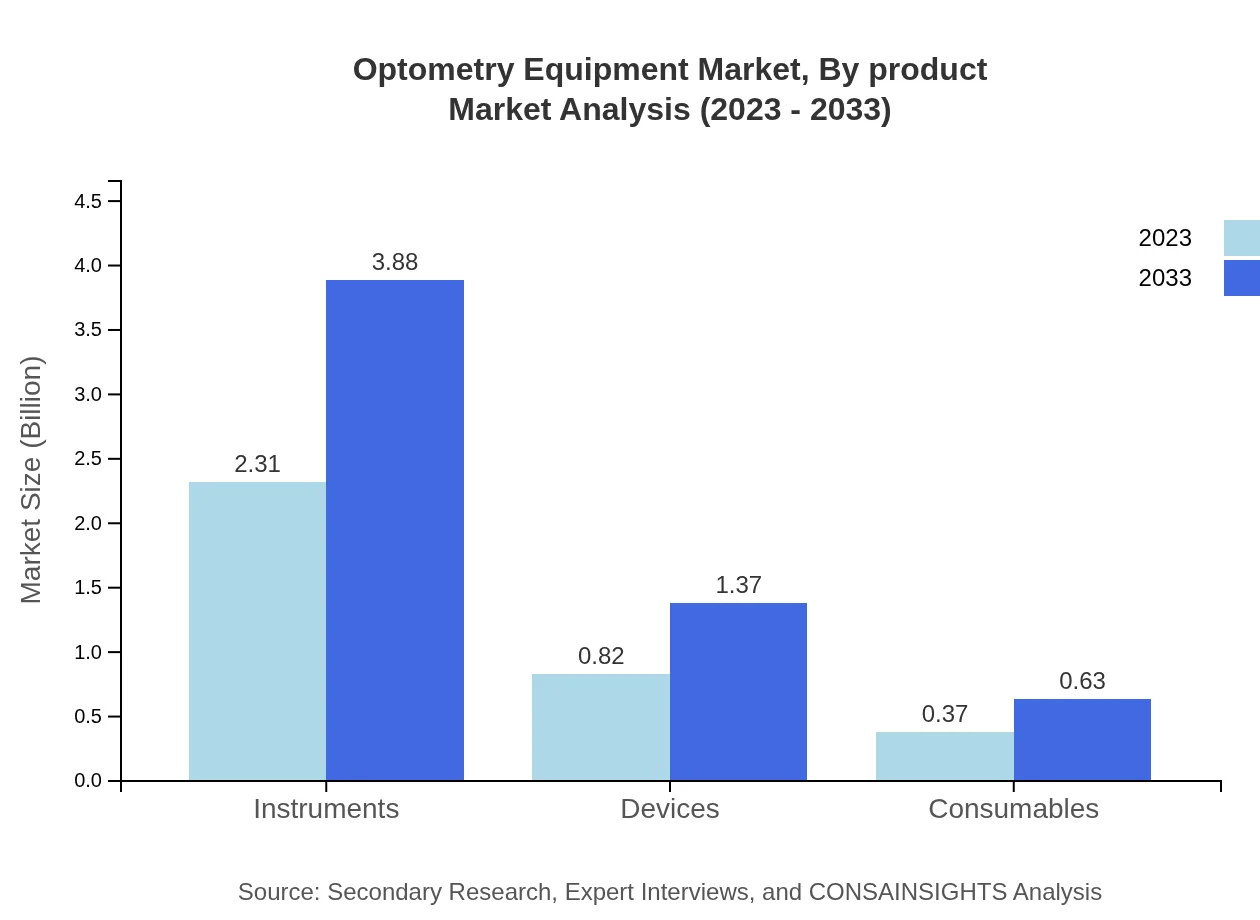

Optometry Equipment Market Analysis By Product

The Optometry Equipment market, segmented by product type, exhibits significant diversity, with instruments alone representing a considerable market share. Instruments are valued at $2.31 billion in 2023, anticipated to rise to $3.88 billion by 2033, holding a continuous share of approximately 65.99%. Devices such as fundus cameras and visual field analyzers have a market size of $0.82 billion in 2023, reaching $1.37 billion by 2033, encompassing 23.33% of the market. Consumables, including lenses and diagnostic products, display a smaller market size of $0.37 billion in 2023, increasing to $0.63 billion by 2033, representing a 10.68% share.

Optometry Equipment Market Analysis By Application

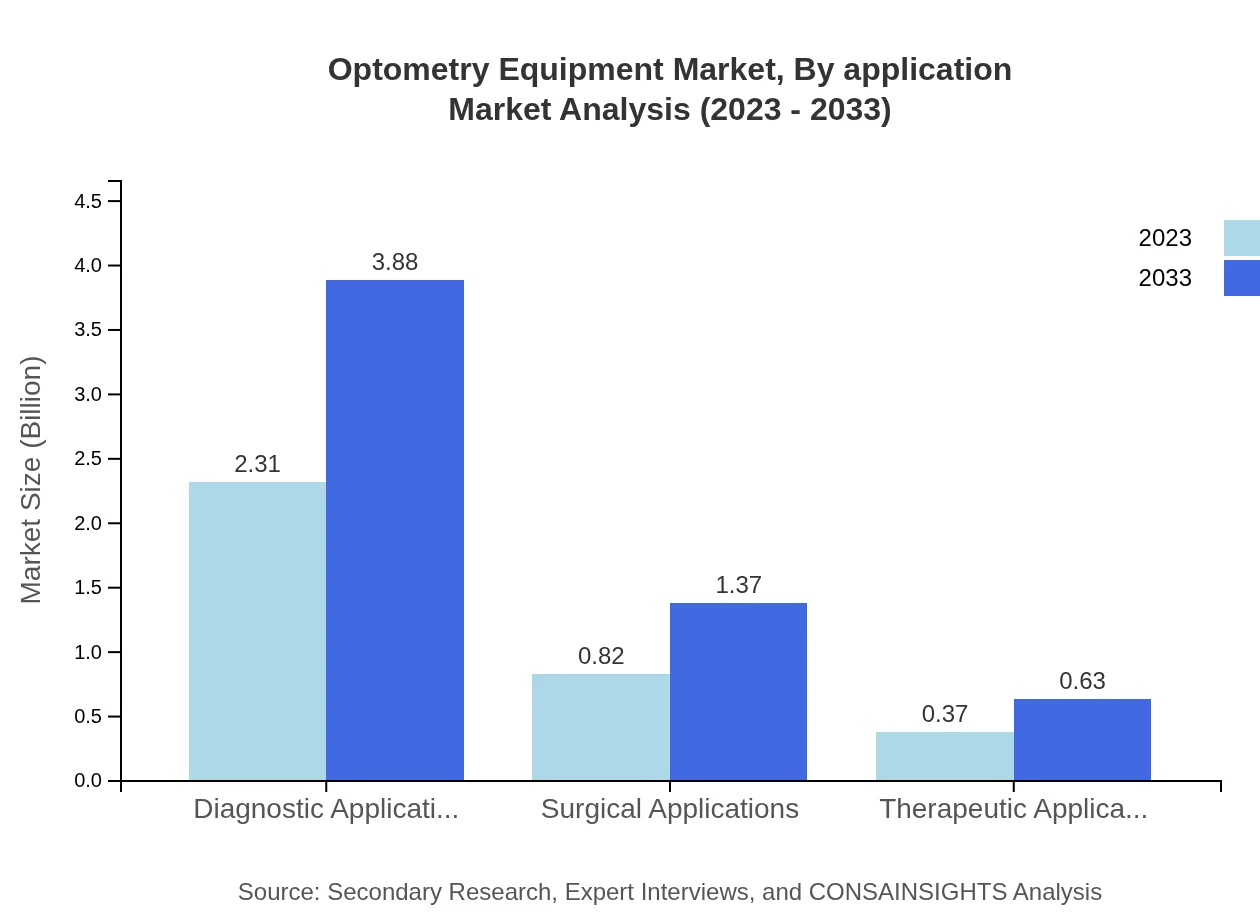

In terms of application, the optometry equipment market is predominantly divided into diagnostic, surgical, and therapeutic applications. Diagnostic applications maintain a significant market size of $2.31 billion in 2023 and are projected to reach $3.88 billion by 2033, capturing a market share of 65.99%. Surgical applications currently account for $0.82 billion, projected to grow to $1.37 billion over the same period, which equates to a 23.33% share. Therapeutic applications, while smaller in market size of $0.37 billion, are also seeing growth to $0.63 billion, representing a 10.68% share.

Optometry Equipment Market Analysis By End User

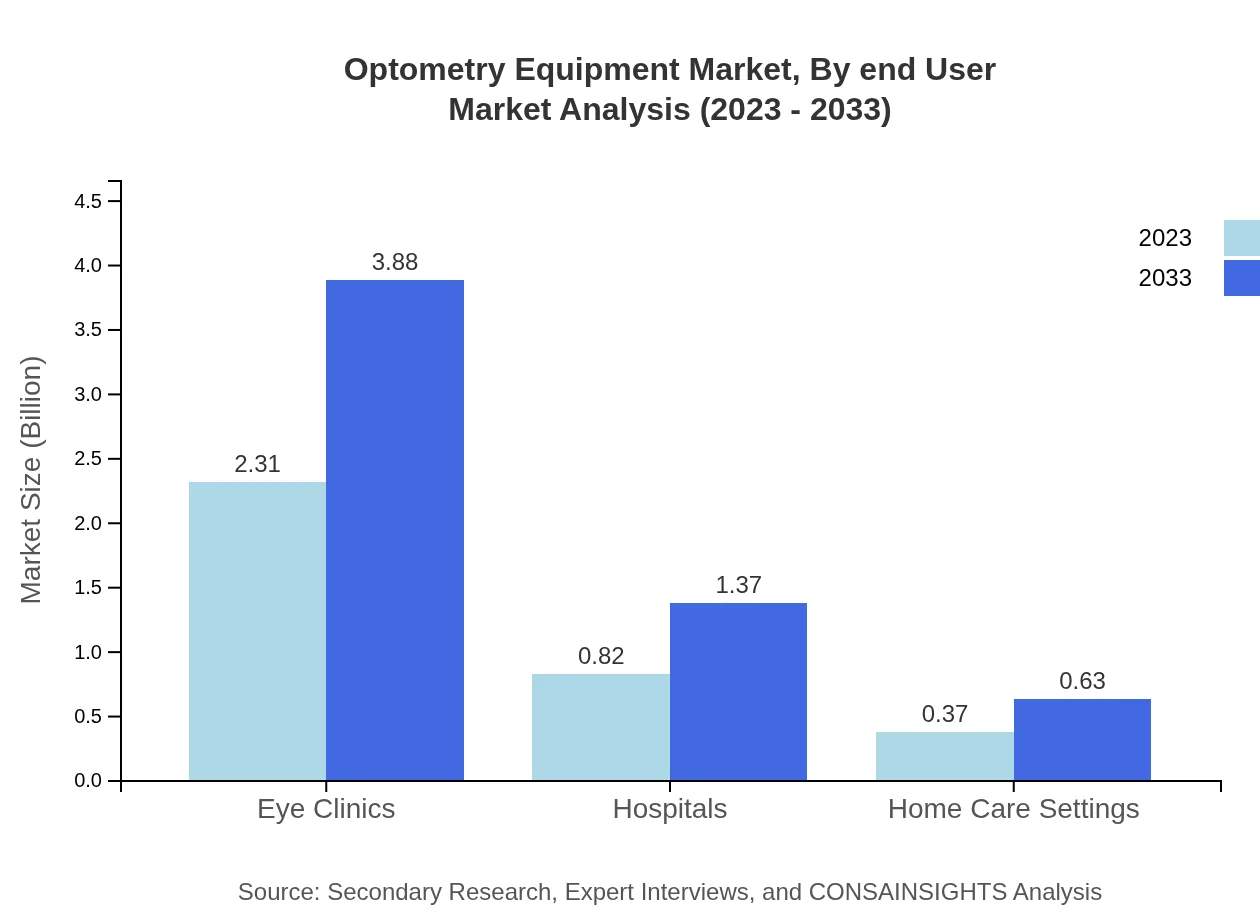

The market is segmented into various end-users including eye clinics, hospitals, and home care settings. Eye clinics dominate with a market size of $2.31 billion in 2023, expected to rise to $3.88 billion by 2033, sustaining a 65.99% market share. Hospitals follow with a size of $0.82 billion in 2023, reaching $1.37 billion in 2033, holding a 23.33% share. Home care settings account for $0.37 billion, growing to $0.63 billion by 2033, representing 10.68% of the market.

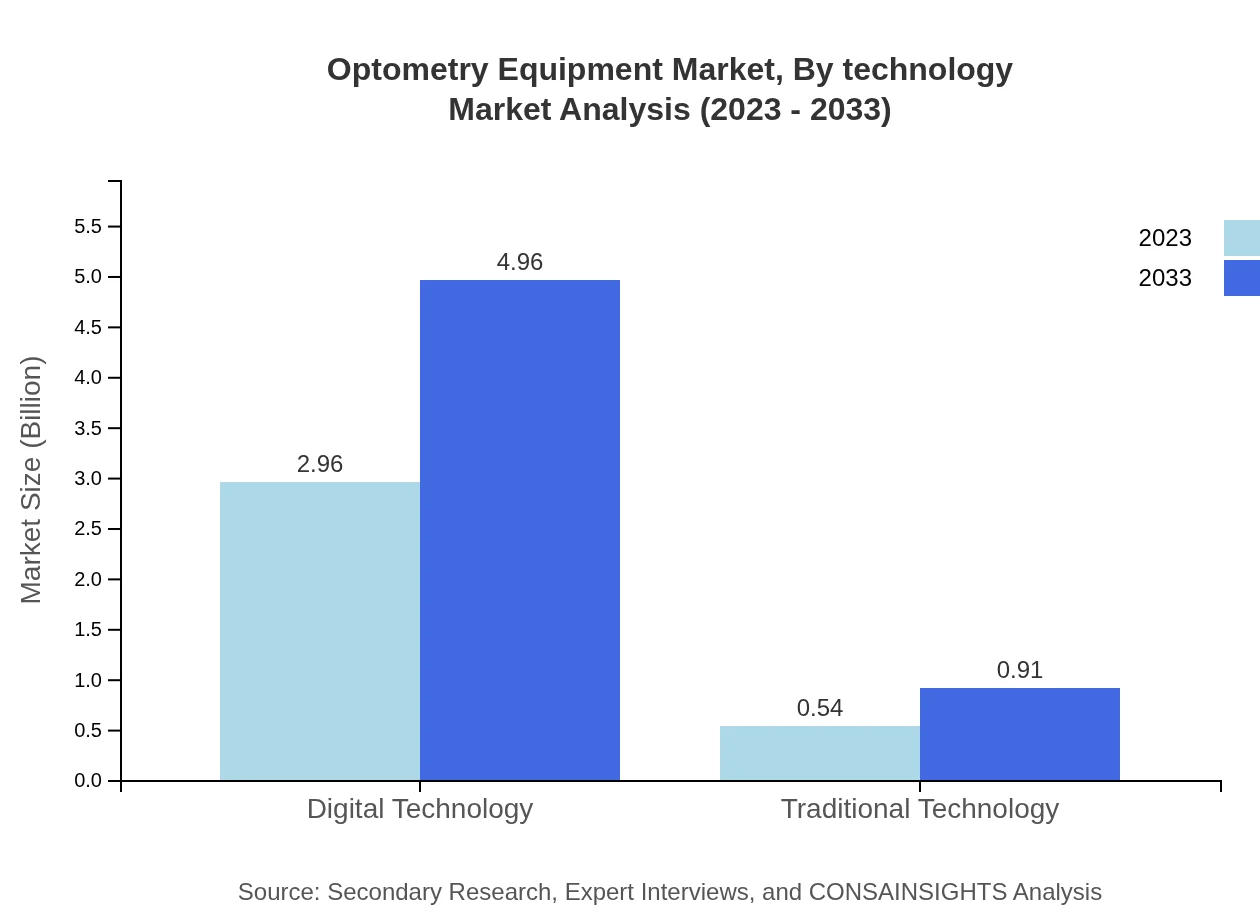

Optometry Equipment Market Analysis By Technology

The technological segmentation includes digital and traditional technologies. Digital technology is gaining momentum with a market size of $2.96 billion in 2023, climbing to $4.96 billion by 2033, comprising 84.5% of the market. Traditional technology, while still important, shows slower growth from $0.54 billion to $0.91 billion, maintaining a market share of 15.5%.

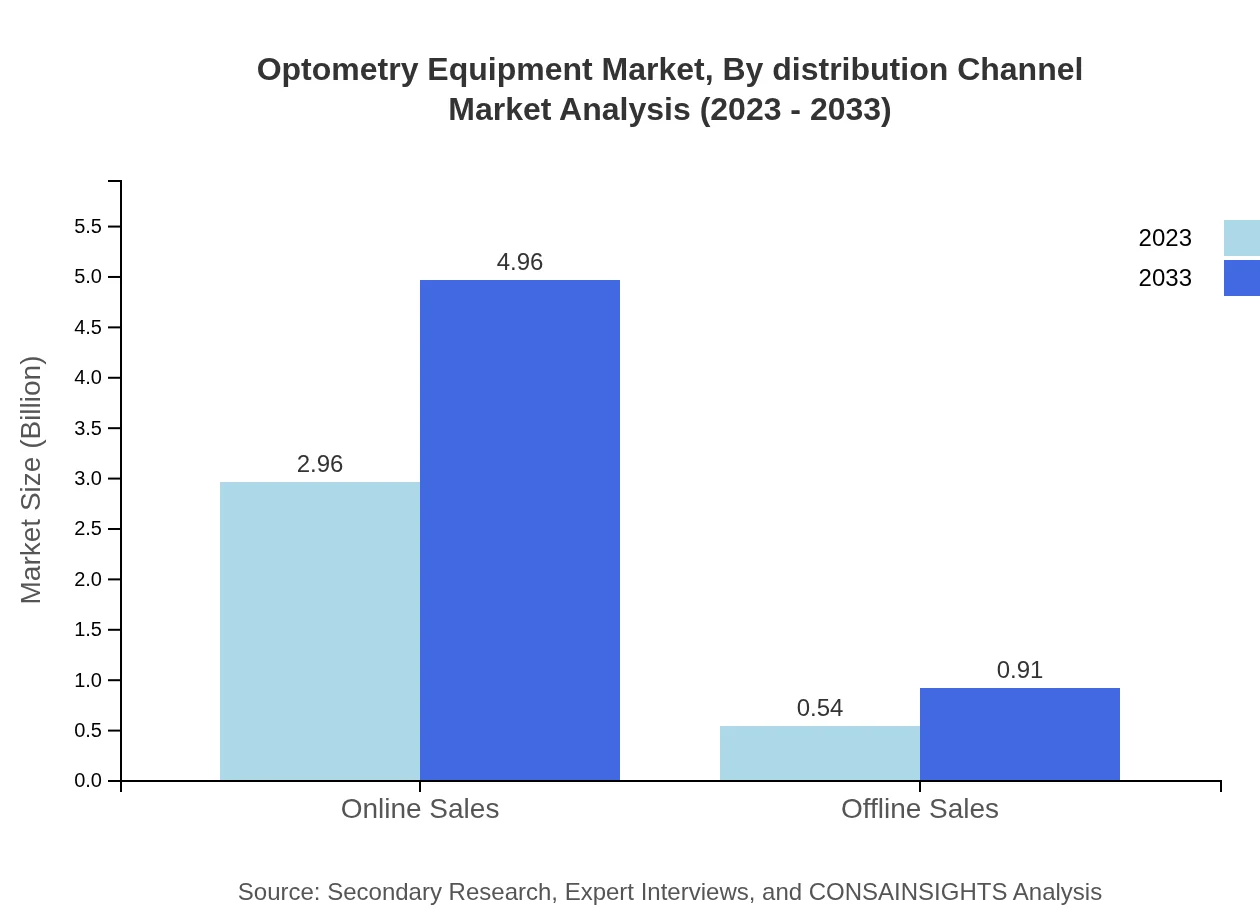

Optometry Equipment Market Analysis By Distribution Channel

The distribution channels for optometry equipment consist of online and offline sales. Online sales dominate with a 2023 market value of $2.96 billion, expected to rise to $4.96 billion by 2033, representing 84.5% of the market share. Offline sales, while necessary, account for $0.54 billion in 2023, with a projected growth to $0.91 billion, securing a 15.5% share.

Optometry Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Optometry Equipment Industry

EssilorLuxottica:

A leading global eyewear company, recognized for its innovative optical lenses and eyewear brands, significantly contributing to the evolution of the optometry equipment market.Zeiss Group:

Prominent for its precision optics, the Zeiss Group leads in producing state-of-the-art diagnostic equipment for eye care professionals across the globe.Nidek Co. Ltd.:

Known for its highly regarded ophthalmic equipment, Nidek plays a pivotal role in offering technological solutions for vision care systems.Topcon Corporation:

A key player in providing advanced ophthalmic instruments, Topcon specializes in diagnostic and therapeutic devices, enhancing eye care services worldwide.Hoya Corporation:

Hoya is at the forefront of innovating optical products and technologies, contributing significantly to the optometry equipment sector.We're grateful to work with incredible clients.

FAQs

What is the market size of optometry equipment?

The optometry equipment market is valued at approximately $3.5 billion in 2023 and is projected to grow at a CAGR of 5.2%, reaching new heights by 2033, significantly enhancing market prospects.

What are the key market players or companies in the optometry equipment industry?

Key players in the optometry equipment industry include leading companies specializing in diagnostic instruments, surgical technologies, and therapy devices. These firms continually innovate to enhance service delivery in eye care.

What are the primary factors driving the growth in the optometry equipment industry?

Growth in the optometry equipment sector is primarily driven by increasing digital technology adoption, rising eye health concerns, and a growing elderly population, alongside innovative treatment technologies in eye care.

Which region is the fastest Growing in the optometry equipment?

Europe is the fastest-growing region in the optometry equipment market, expanding from $1.20 billion in 2023 to approximately $2.01 billion by 2033, indicating robust demand in eye care solutions.

Does ConsaInsights provide customized market report data for the optometry equipment industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the optometry equipment industry, ensuring clients receive relevant and actionable insights for decision-making.

What deliverables can I expect from this optometry equipment market research project?

Deliverables from the optometry equipment market research project include comprehensive market analysis reports, detailed segmentation, competitive landscape assessments, and future projections to guide strategic planning.

What are the market trends of optometry equipment?

Current market trends include the shift towards digital technologies in optometry, increasing online sales channels, and a rise in patient-centric services, all contributing to the growth of the industry.