Optometry Eye Exam Equipment Market Report

Published Date: 31 January 2026 | Report Code: optometry-eye-exam-equipment

Optometry Eye Exam Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Optometry Eye Exam Equipment market from 2023 to 2033, examining market size, trends, and regional dynamics to deliver actionable insights for stakeholders.

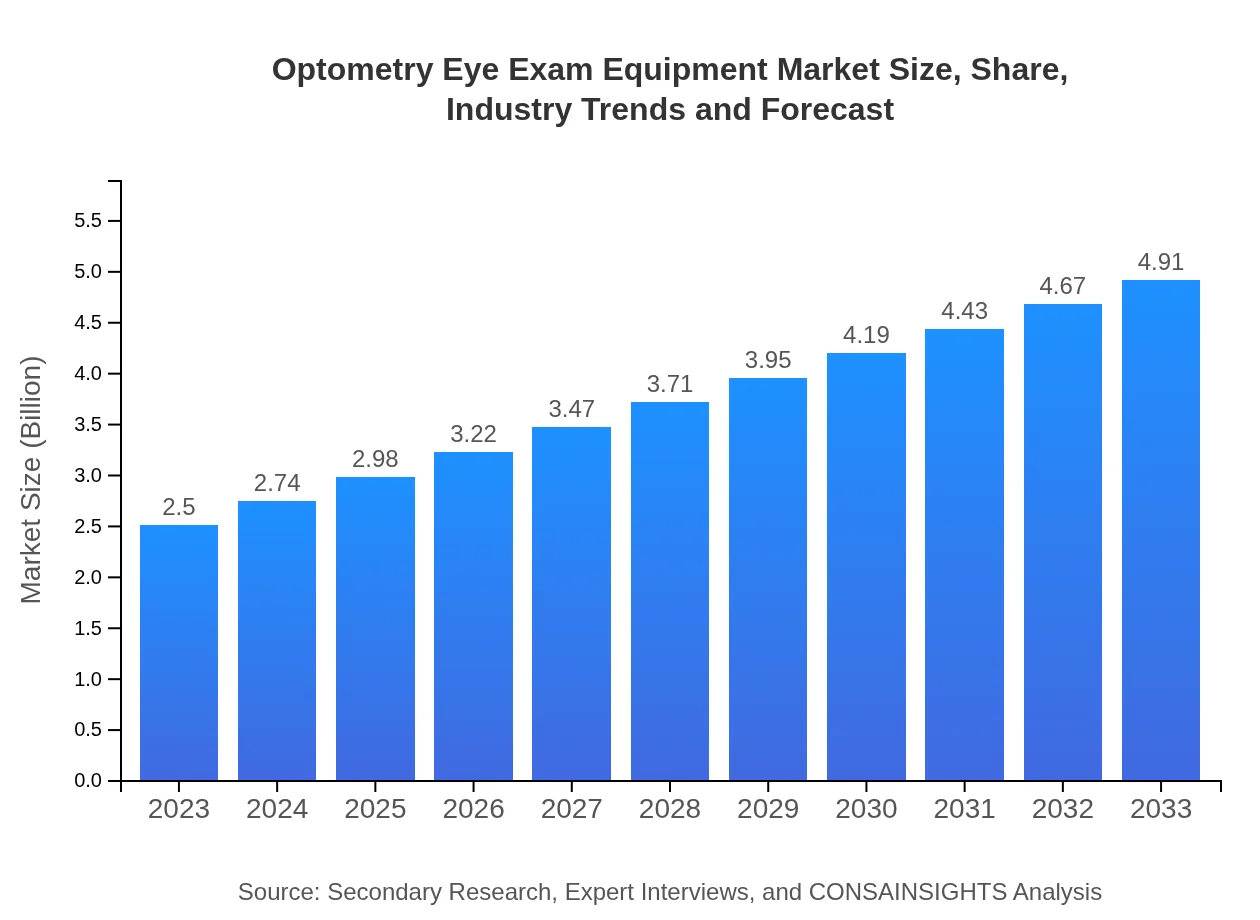

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.91 Billion |

| Top Companies | Zeiss, Topcon, Essilor, Kowa Optimed |

| Last Modified Date | 31 January 2026 |

Optometry Eye Exam Equipment Market Overview

Customize Optometry Eye Exam Equipment Market Report market research report

- ✔ Get in-depth analysis of Optometry Eye Exam Equipment market size, growth, and forecasts.

- ✔ Understand Optometry Eye Exam Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Optometry Eye Exam Equipment

What is the Market Size & CAGR of Optometry Eye Exam Equipment market in 2023?

Optometry Eye Exam Equipment Industry Analysis

Optometry Eye Exam Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Optometry Eye Exam Equipment Market Analysis Report by Region

Europe Optometry Eye Exam Equipment Market Report:

Europe's market is also set for growth, increasing from $0.61 billion in 2023 to $1.21 billion by 2033, driven by strong government support for healthcare initiatives and technological innovations.Asia Pacific Optometry Eye Exam Equipment Market Report:

The Asia Pacific region is anticipated to witness significant growth, with a market size projected to increase from $0.53 billion in 2023 to $1.04 billion in 2033. The increase in disposable income, coupled with a growing elderly population, drives the demand for eye care services and technologies.North America Optometry Eye Exam Equipment Market Report:

North America is projected to maintain a strong market position, with growth anticipated from $0.96 billion in 2023 to $1.89 billion in 2033. The presence of advanced healthcare infrastructure and a high prevalence of vision disorders contribute to this expansion.South America Optometry Eye Exam Equipment Market Report:

In South America, the market size is expected to grow from $0.21 billion in 2023 to $0.42 billion by 2033, supported by increasing awareness of eye health and improvements in healthcare facilities.Middle East & Africa Optometry Eye Exam Equipment Market Report:

In the Middle East and Africa, the market is expected to expand from $0.18 billion in 2023 to $0.35 billion in 2033. Changing demographics and rising investments in healthcare are pivotal for the market's growth in this region.Tell us your focus area and get a customized research report.

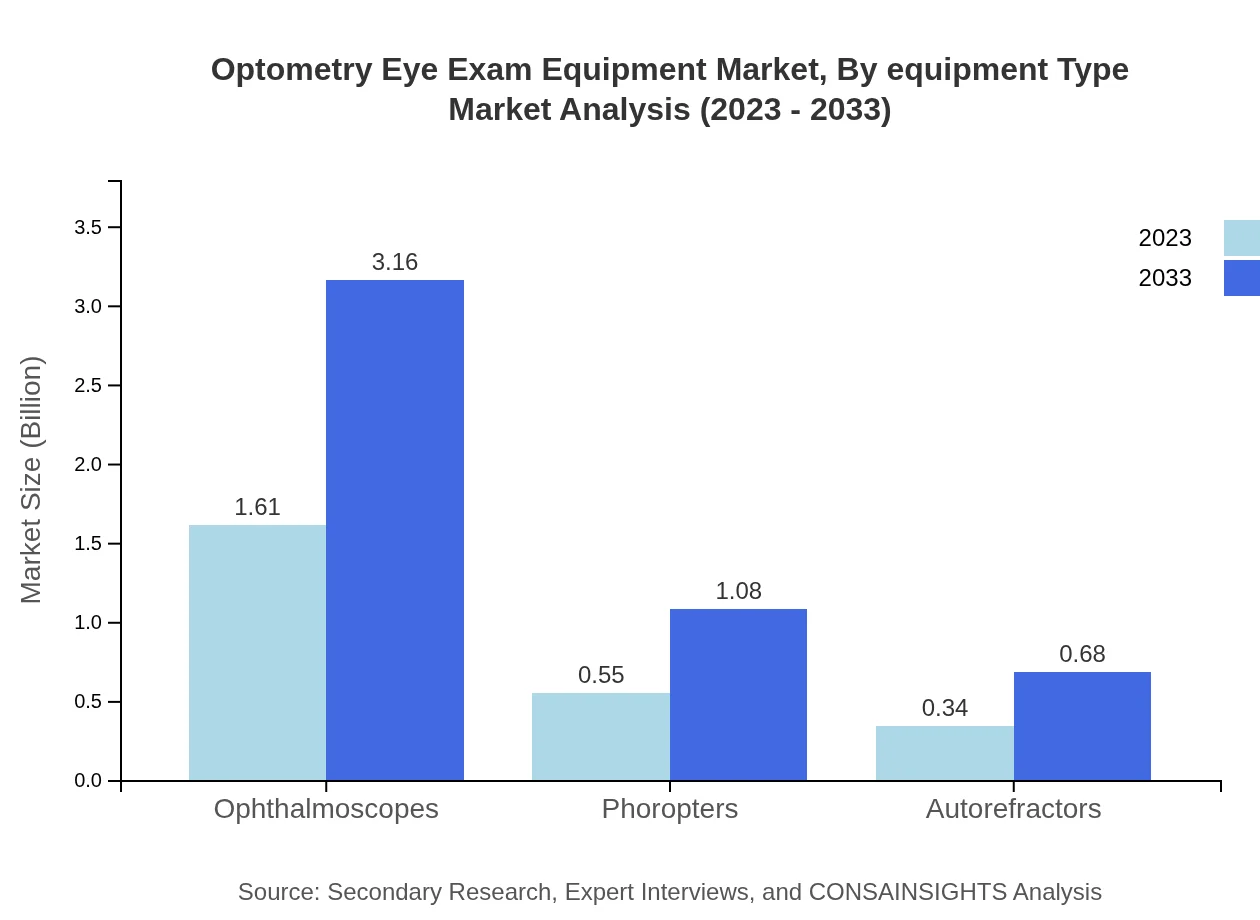

Optometry Eye Exam Equipment Market Analysis By Equipment Type

The integral equipment types in this market segment involve: 1) Diagnosis (Market Size 2023: $1.61bn; 2033: $3.16bn, Share: 64.24%), 2) Treatment (Market Size 2023: $0.55bn; 2033: $1.08bn, Share: 22.02%), 3) Monitoring (Market Size 2023: $0.34bn; 2033: $0.68bn, Share: 13.74%). Each type contributes uniquely to clinical functionalities.

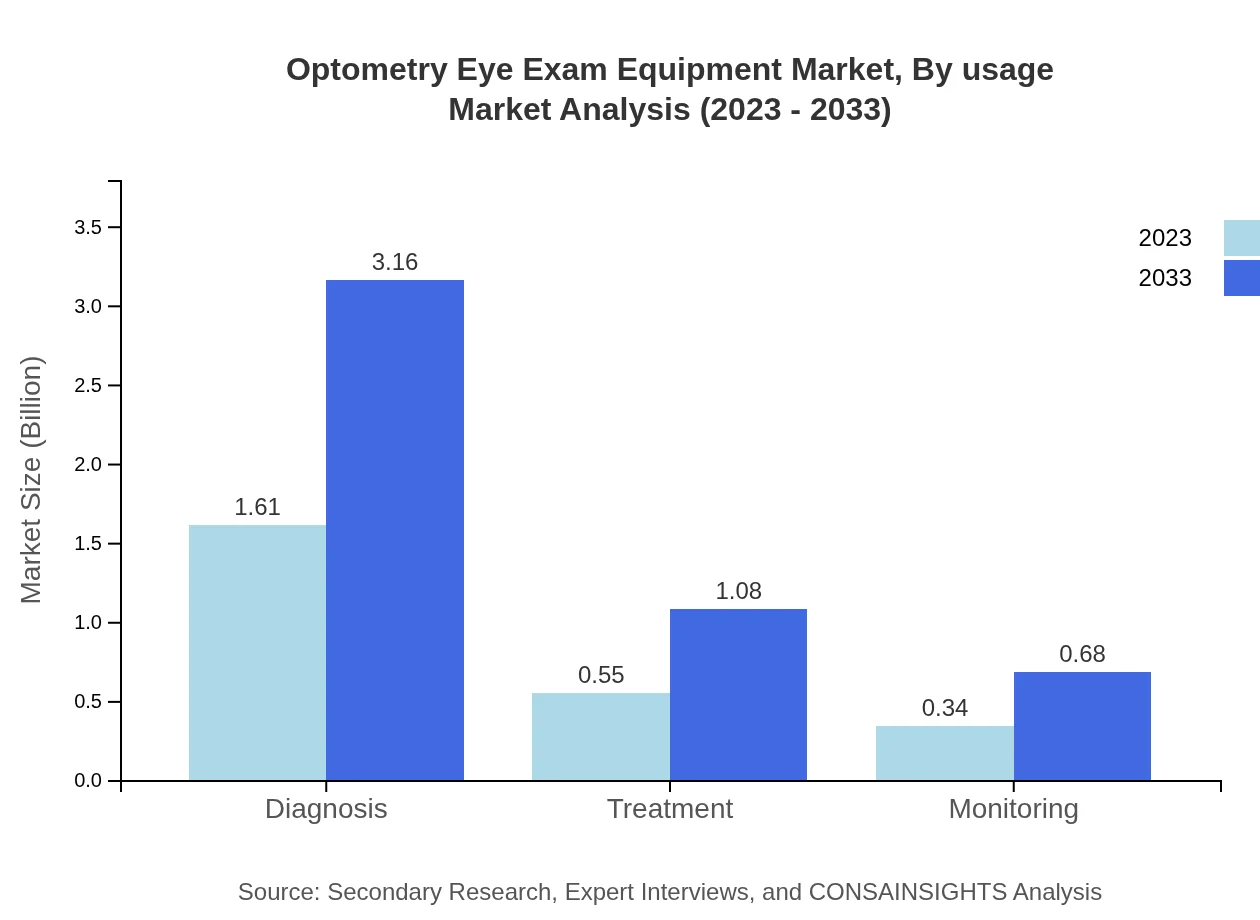

Optometry Eye Exam Equipment Market Analysis By Usage

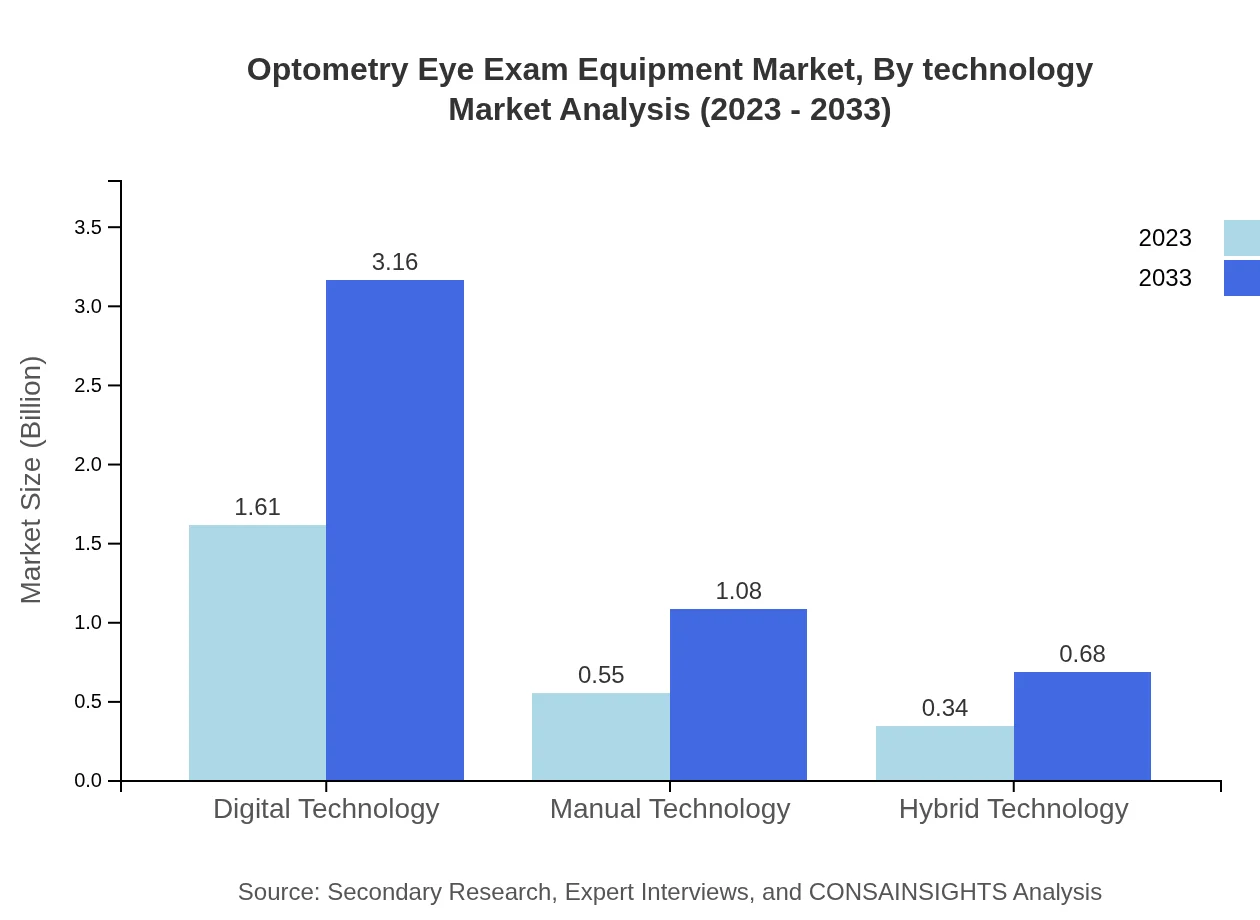

The usage segmentation reveals a preference for digital technology within the exam equipment: Digital Technology (Size 2023: $1.61bn; 2033: $3.16bn, Share: 64.24%), Manual Technology (Size 2023: $0.55bn; 2033: $1.08bn, Share: 22.02%), and Hybrid Technology (Size 2023: $0.34bn; 2033: $0.68bn, Share: 13.74%).

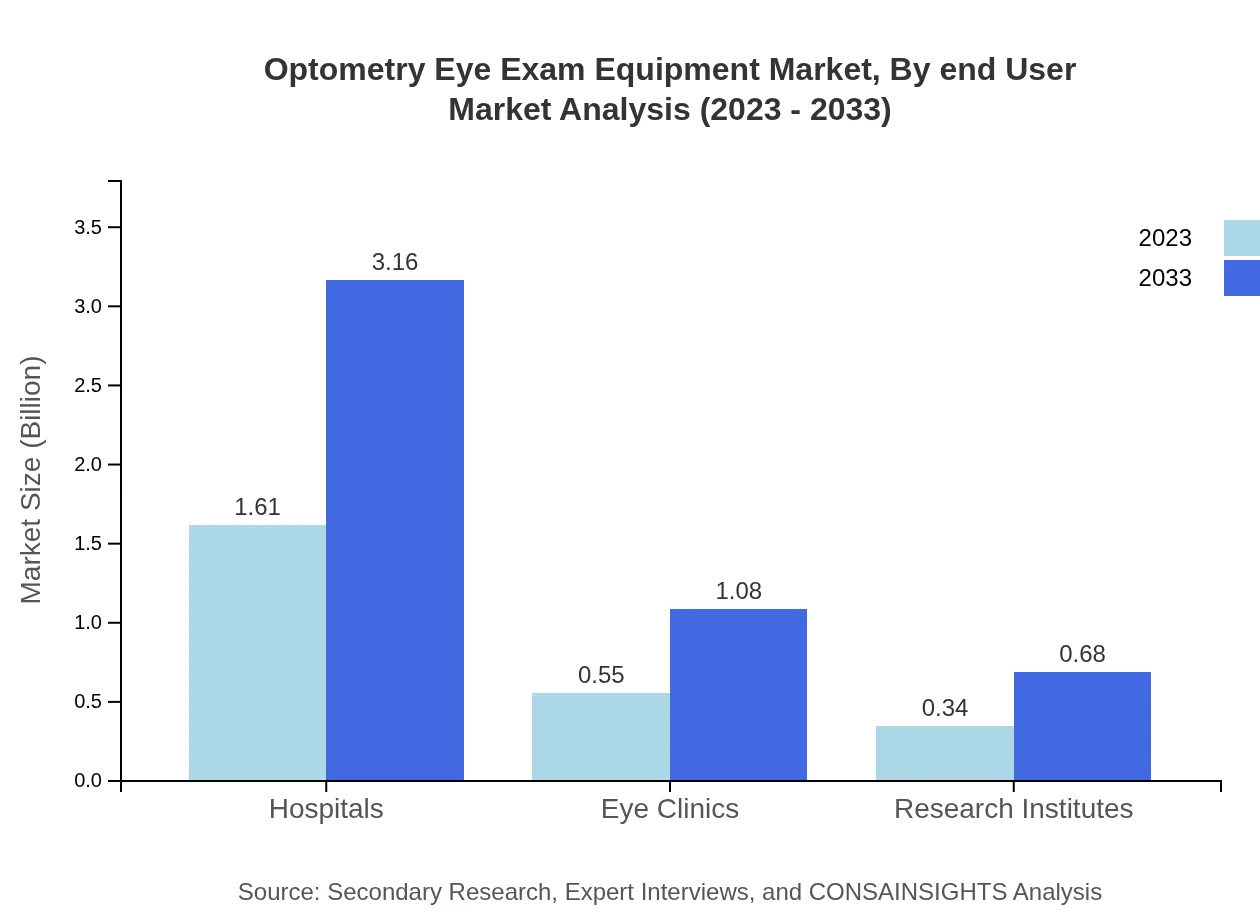

Optometry Eye Exam Equipment Market Analysis By End User

Key end-users in the market include Hospitals (Market Size 2023: $1.61bn; 2033: $3.16bn, Share: 64.24%), Eye Clinics (Market Size 2023: $0.55bn; 2033: $1.08bn, Share: 22.02%), and Research Institutes (Market Size 2023: $0.34bn; 2033: $0.68bn, Share: 13.74%).

Optometry Eye Exam Equipment Market Analysis By Technology

In terms of technology, the market is progressing with predominantly Digital Technology (Size 2023: $1.61bn; 2033: $3.16bn, Share: 64.24%), alongside Manual Technology priced at (Size 2023: $0.55bn; 2033: $1.08bn, Share: 22.02%) and Hybrid Technology (Size 2023: $0.34bn; 2033: $0.68bn, Share: 13.74%).

Optometry Eye Exam Equipment Market Analysis By Distribution Channel

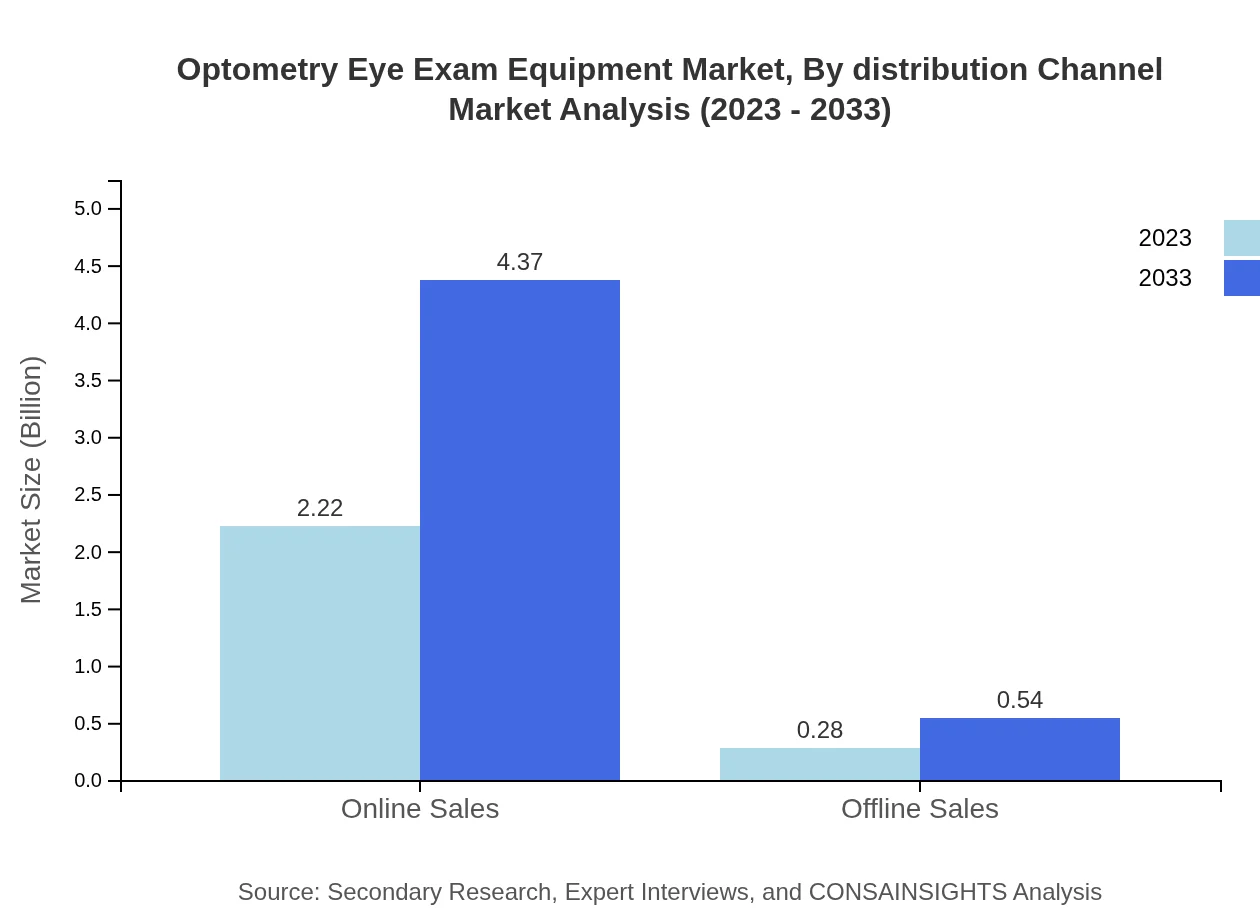

The distribution channels indicate a preferring shift towards Online Sales (Size 2023: $2.22bn; 2033: $4.37bn, Share: 88.94%) over Offline Sales (Size 2023: $0.28bn; 2033: $0.54bn, Share: 11.06%), driven by the convenience and accessibility of making purchases over the internet.

Optometry Eye Exam Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Optometry Eye Exam Equipment Industry

Zeiss:

Carl Zeiss AG is a leading provider of medical technology, known for their precision optics and groundbreaking eye diagnostic instruments that significantly enhance eye care.Topcon:

Topcon Corporation specializes in advanced eye care equipment, focusing on providing innovative diagnostic solutions tailored for eye care professionals.Essilor:

Essilor International is a prominent player in the lens manufacturing market but also invests in developing superior optometry exam equipment aimed at enhancing patient experience.Kowa Optimed:

Kowa Optimed manufactures high-quality ophthalmic diagnostic equipment, providing tools that substantially improve diagnostic accuracy.We're grateful to work with incredible clients.

FAQs

What is the market size of optometry Eye Exam Equipment?

The Optometry Eye Exam Equipment market is valued at approximately $2.5 billion in 2023 and is projected to grow at a CAGR of 6.8%, indicating increasing demand for eye examination technologies.

What are the key market players or companies in the optometry Eye Exam Equipment industry?

Key players in the optometry eye exam equipment market include global manufacturers and healthcare technology companies. These players drive innovations, enhance product offerings, and expand access to eye care worldwide.

What are the primary factors driving the growth in the optometry Eye Exam Equipment industry?

Growth is primarily driven by increasing eye disorders, technological advancements in diagnostic tools, an aging population, and rising awareness about eye health leading to higher demand for regular eye examinations.

Which region is the fastest Growing in the optometry Eye Exam Equipment?

Asia Pacific emerges as the fastest-growing region, expected to grow from $0.53 billion in 2023 to $1.04 billion by 2033. This growth is fueled by rising eye care needs and improvements in healthcare infrastructure.

Does ConsaInsights provide customized market report data for the optometry Eye Exam Equipment industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the optometry eye exam equipment industry, helping businesses make informed decisions tailored to market dynamics.

What deliverables can I expect from this optometry Eye Exam Equipment market research project?

Deliverables include comprehensive market analysis reports, regional insights, competitive landscape details, segment assessments, and trend forecasts, providing a holistic view of the optometry eye exam equipment market.

What are the market trends of optometry Eye Exam Equipment?

Market trends include increasing adoption of digital technologies, growth in online sales channels, rising focus on preventive eye care, and advancements in diagnostic techniques reshaping the future of eye examinations.