Oral Anti Diabetes Drugs Market Report

Published Date: 31 January 2026 | Report Code: oral-anti-diabetes-drugs

Oral Anti Diabetes Drugs Market Size, Share, Industry Trends and Forecast to 2033

This market report provides a comprehensive analysis of the Oral Anti Diabetes Drugs industry, covering market size, trends, segmentation, regional insights, and forecasts for the period 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

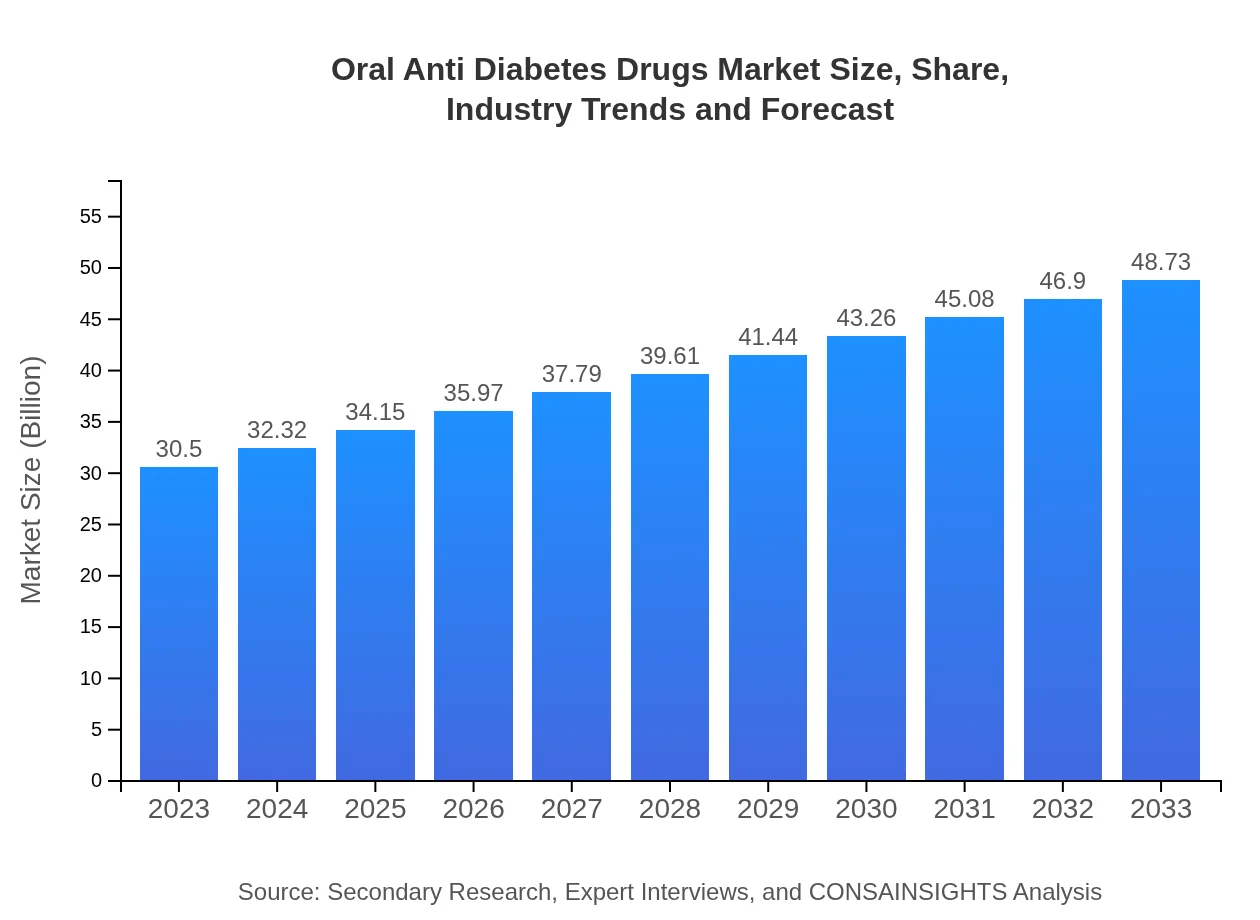

| 2023 Market Size | $30.50 Billion |

| CAGR (2023-2033) | 4.7% |

| 2033 Market Size | $48.73 Billion |

| Top Companies | Novo Nordisk, Boehringer Ingelheim, Sanofi, Merck & Co., Bristol-Myers Squibb |

| Last Modified Date | 31 January 2026 |

Oral Anti Diabetes Drugs Market Overview

Customize Oral Anti Diabetes Drugs Market Report market research report

- ✔ Get in-depth analysis of Oral Anti Diabetes Drugs market size, growth, and forecasts.

- ✔ Understand Oral Anti Diabetes Drugs's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Oral Anti Diabetes Drugs

What is the Market Size & CAGR of Oral Anti Diabetes Drugs market in 2023?

Oral Anti Diabetes Drugs Industry Analysis

Oral Anti Diabetes Drugs Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Oral Anti Diabetes Drugs Market Analysis Report by Region

Europe Oral Anti Diabetes Drugs Market Report:

Europe's market value stood at about $9.57 billion in 2023 and is expected to attain $15.29 billion by 2033. A greater focus on preventive healthcare, along with government initiatives to enhance diabetes management, is expected to propel market growth.Asia Pacific Oral Anti Diabetes Drugs Market Report:

In the Asia Pacific region, the market is valued at approximately $5.83 billion in 2023, expected to grow to $9.32 billion by 2033, driven by increasing diabetes incidences and a growing healthcare infrastructure. Countries like China and India represent significant opportunities due to their large population base and rising disease awareness.North America Oral Anti Diabetes Drugs Market Report:

North America holds a significant share of the market, estimated at $10.52 billion in 2023, with projections reaching $16.81 billion by 2033. The region's growth is fueled by high diabetes prevalence rates, access to advanced healthcare facilities, and robust pharmaceutical R&D.South America Oral Anti Diabetes Drugs Market Report:

The South American market is relatively smaller, valued at around $1.49 billion in 2023 and projected to reach $2.39 billion by 2033. Factors such as improving healthcare access and increasing prevalence of Type 2 diabetes are expected to drive growth in this region.Middle East & Africa Oral Anti Diabetes Drugs Market Report:

The Middle East and Africa market is estimated at $3.08 billion in 2023, anticipated to expand to $4.93 billion by 2033. Challenges such as economic instability in some regions may hinder growth; however, rising awareness and healthcare investments are promising signs for market potential.Tell us your focus area and get a customized research report.

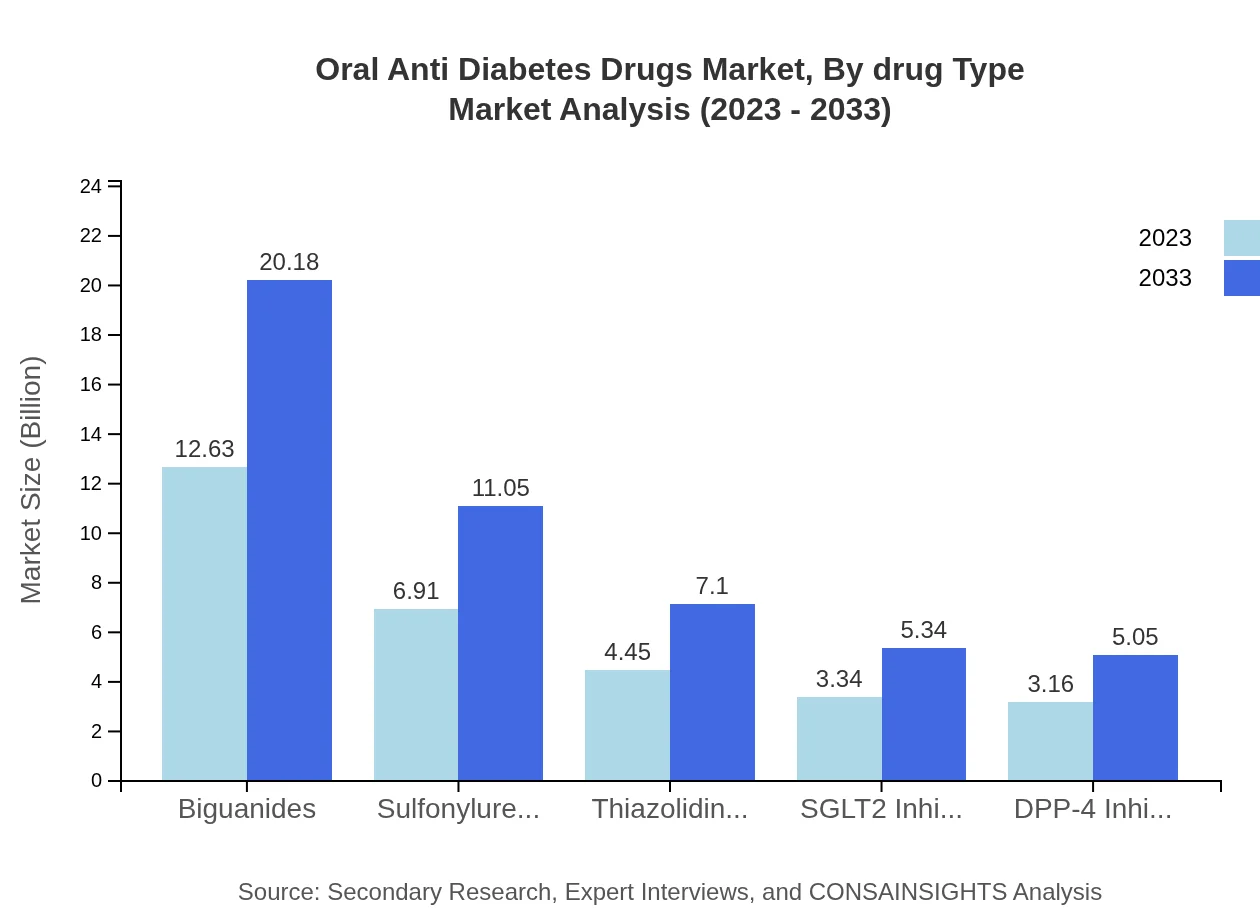

Oral Anti Diabetes Drugs Market Analysis By Drug Type

The market can be further differentiated into key drug classes. Biguanides dominate with a market size of $12.63 billion in 2023, reaching $20.18 billion in 2033, while accounting for 41.42% market share. Sulfonylureas and Thiazolidinediones, despite their smaller sizes of $6.91 billion and $4.45 billion respectively, continue to be significant players due to their established therapeutic profiles.

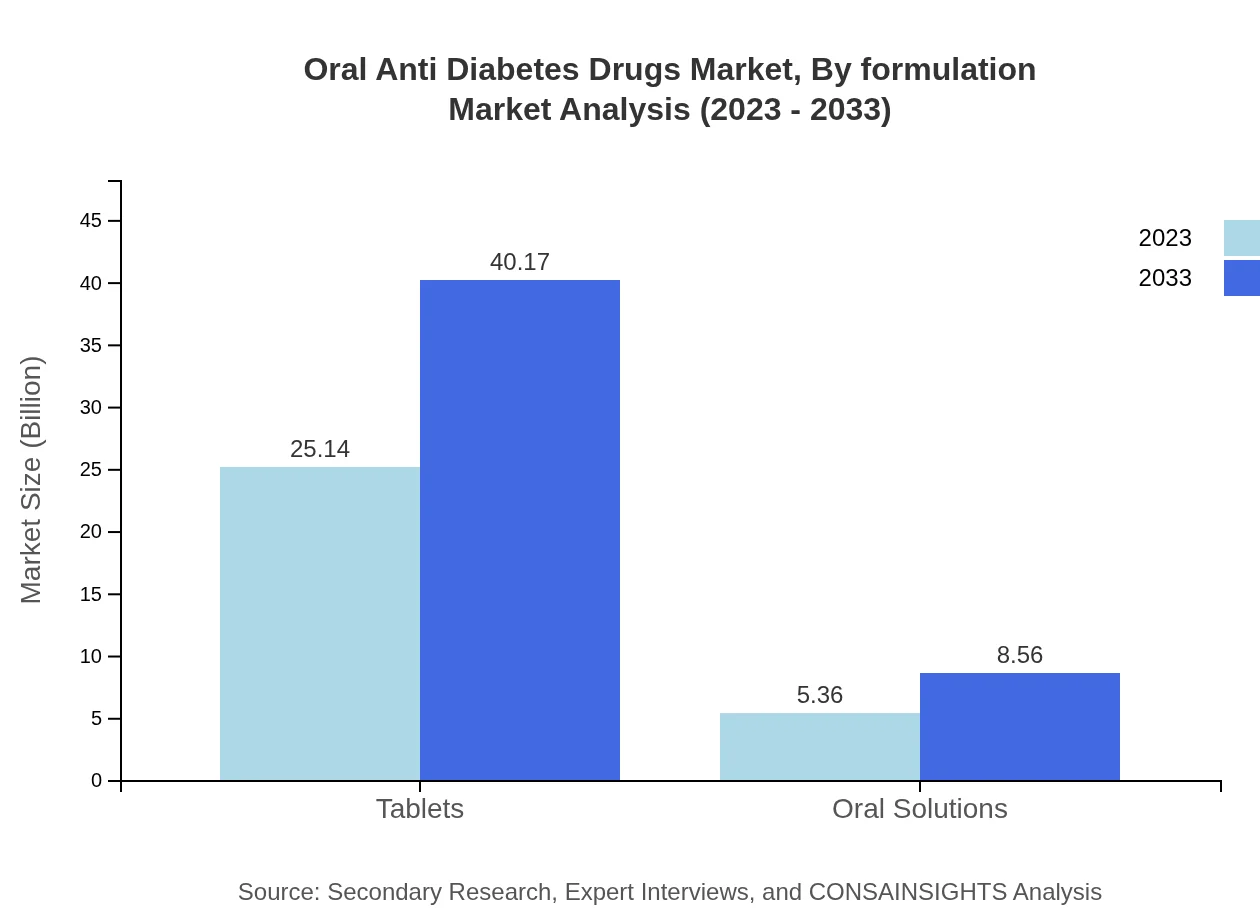

Oral Anti Diabetes Drugs Market Analysis By Formulation

The formulation segment shows a clear preference for tablets, which accounted for $25.14 billion in 2023 and is set to grow to $40.17 billion by 2033, representing 82.43% market share. Oral solutions, while less popular, show growth from $5.36 billion to $8.56 billion, indicating a niche demand.

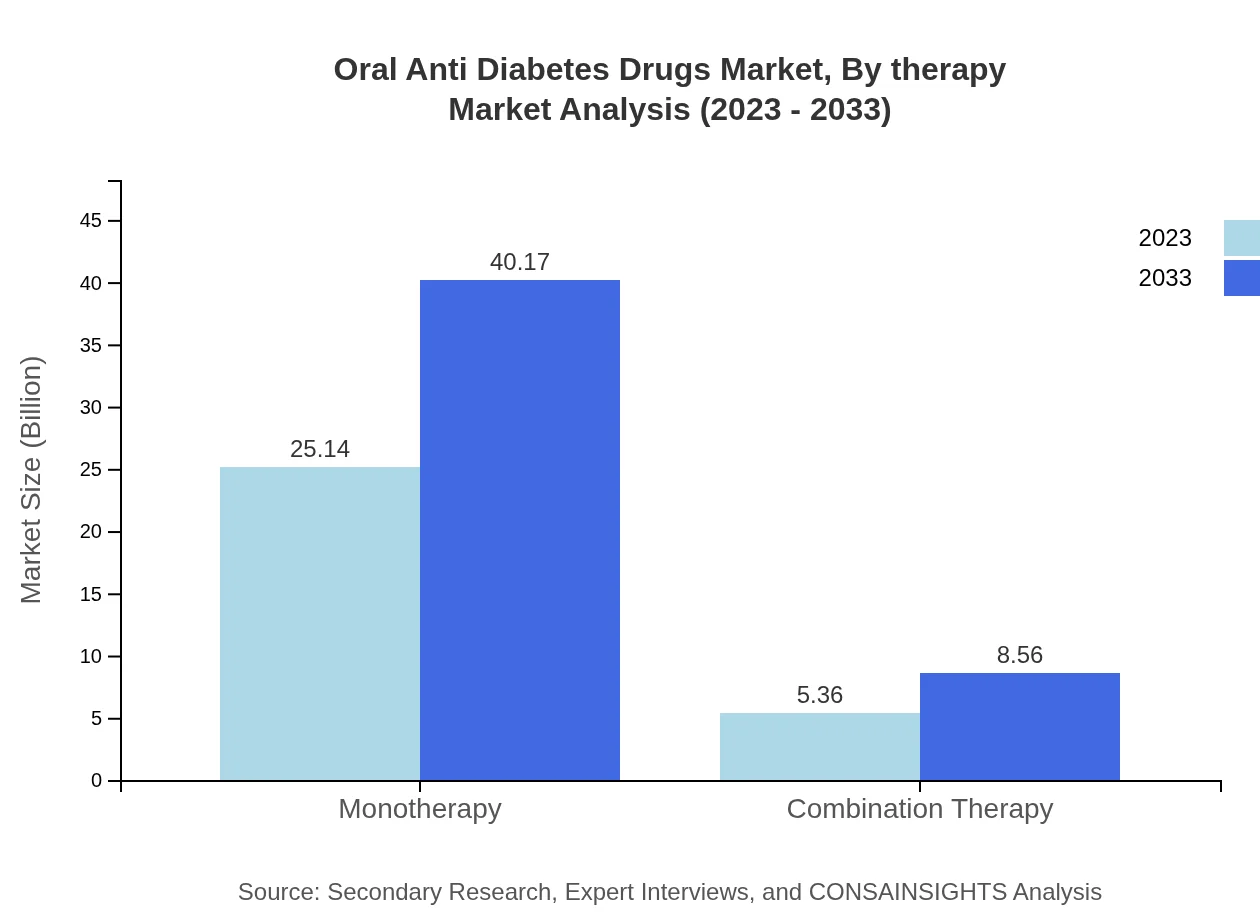

Oral Anti Diabetes Drugs Market Analysis By Therapy

Segmented into monotherapy and combination therapy, the Monotherapy sector is significantly larger, projected to grow from $25.14 billion in 2023 to $40.17 billion by 2033, while Combination Therapy shows growth from $5.36 billion to $8.56 billion.

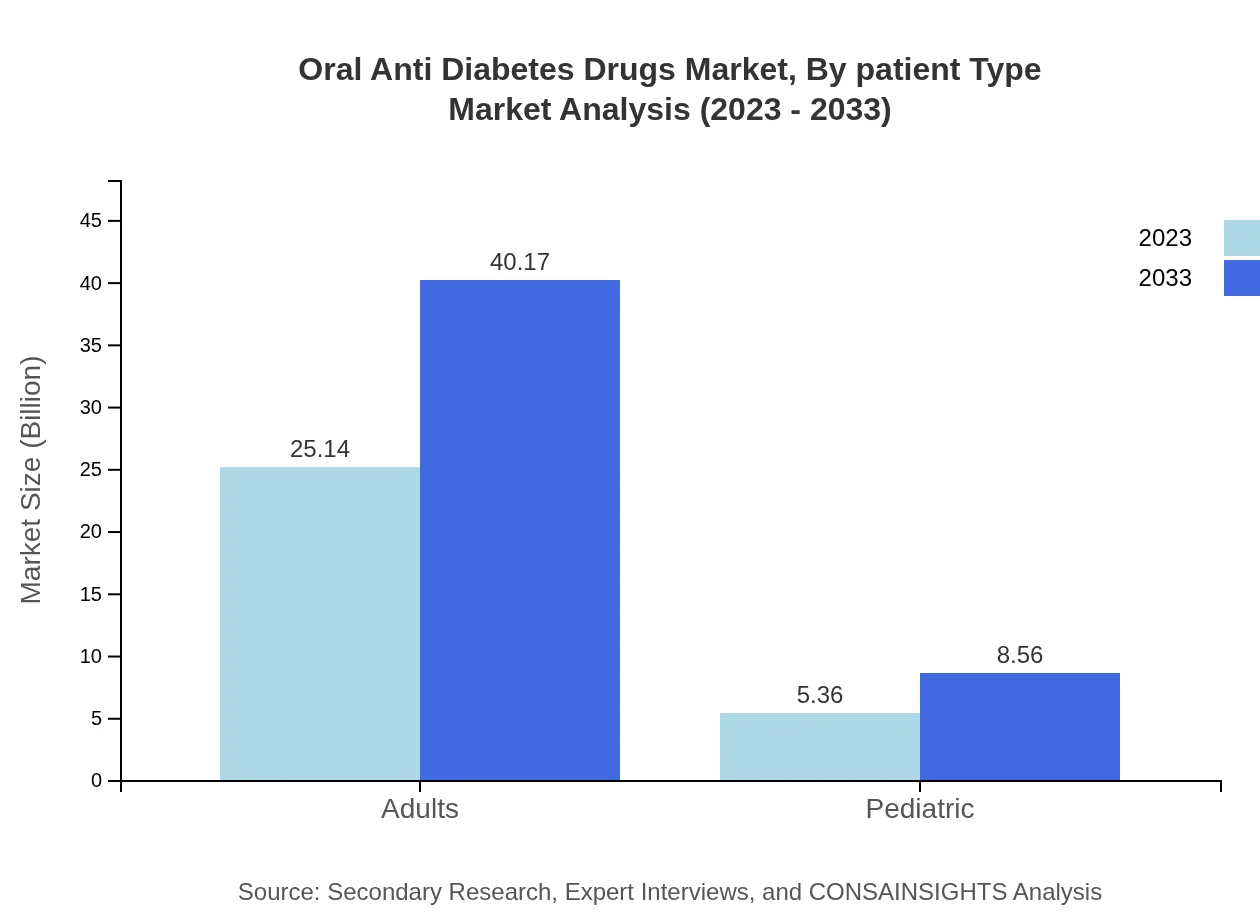

Oral Anti Diabetes Drugs Market Analysis By Patient Type

Analysis reveals that adults constitute the largest segment, accounting for $25.14 billion in 2023 and expected to reach $40.17 billion by 2033. The pediatric segment remains smaller, growing from $5.36 billion to $8.56 billion, marking a critical area for future marketing efforts.

Oral Anti Diabetes Drugs Market Analysis By Sales Channel

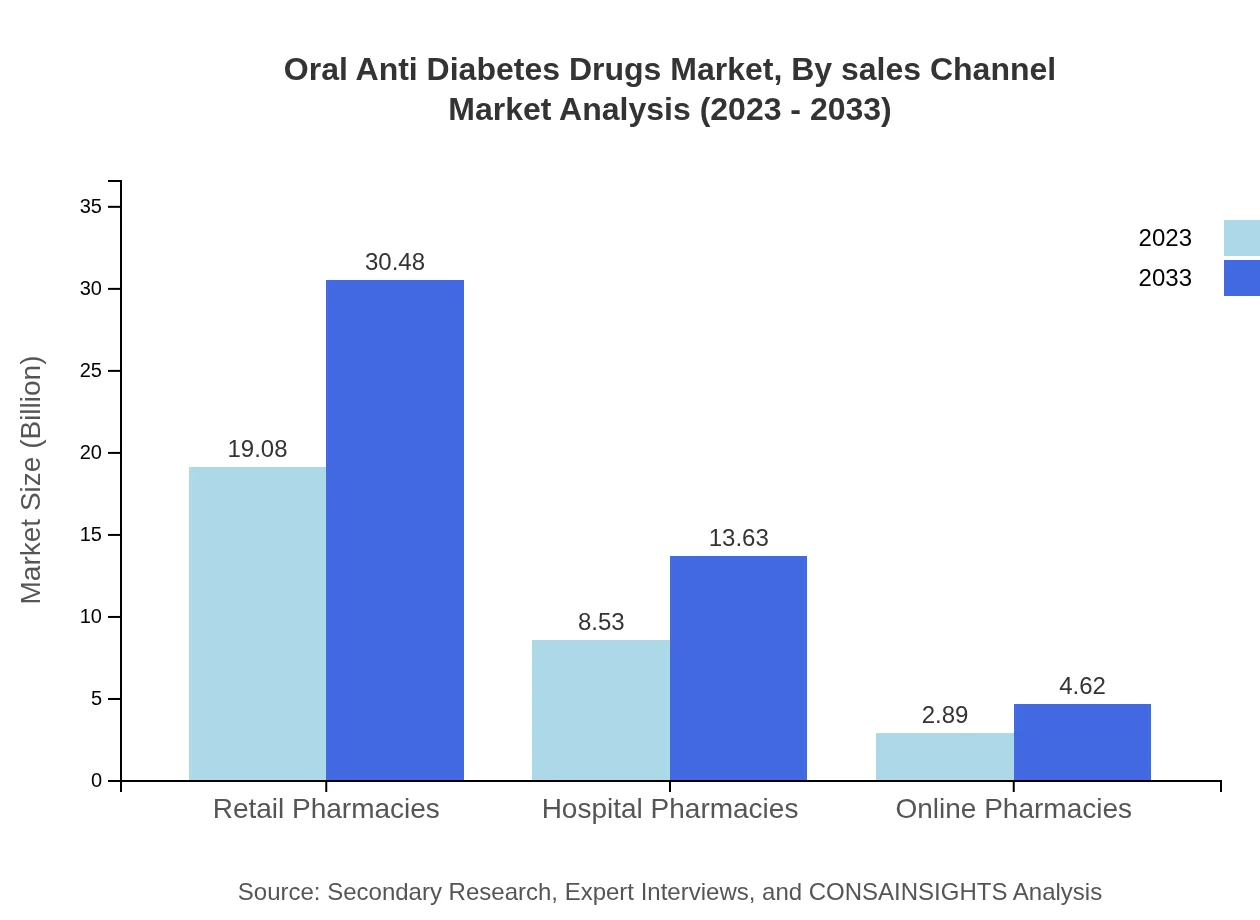

Retail pharmacies lead the market with a share of $19.08 billion in 2023, forecasted to advance to $30.48 billion. Hospital pharmacies serve an essential role ($8.53 billion to $13.63 billion), while online pharmacies, although smaller at $2.89 billion in 2023, show a notable growth trajectory.

Oral Anti Diabetes Drugs Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Oral Anti Diabetes Drugs Industry

Novo Nordisk:

A global leader in diabetes care, known for its innovative insulin therapies and oral anti-diabetic drugs.Boehringer Ingelheim:

Specializes in developing treatments for Type 2 diabetes and has a robust portfolio of DPP-4 inhibitors.Sanofi:

A leading pharmaceutical company that focuses on diabetes treatments including oral medications.Merck & Co.:

Known for its expertise in diabetes management, particularly through its DPP-4 inhibitors and SGLT2 inhibitors.Bristol-Myers Squibb:

A major player in the diabetes sector, noted for its combination therapies and research in innovative oral drugs.We're grateful to work with incredible clients.

FAQs

What is the market size of oral Anti Diabetes Drugs?

The oral anti-diabetes drugs market is valued at approximately $30.5 billion in 2023, with an expected CAGR of 4.7% leading up to 2033. This growth signifies a steady demand for innovative treatments to manage diabetes effectively.

What are the key market players or companies in this oral Anti Diabetes Drugs industry?

Key players in the oral anti-diabetes drugs market include major pharmaceutical companies that specialize in diabetes medication, particularly those focusing on innovative therapies and formulations to meet patient needs and enhance treatment efficacy.

What are the primary factors driving the growth in the oral Anti Diabetes Drugs industry?

Growth in the oral anti-diabetes drugs market is driven by rising diabetes prevalence, increased awareness of diabetes management, advancements in drug formulations, and favorable government policies promoting healthcare access and diabetes treatment options.

Which region is the fastest Growing in the oral Anti Diabetes Drugs?

The Asia Pacific region is projected to experience the fastest growth in the oral anti-diabetes drugs market, expanding from $5.83 billion in 2023 to $9.32 billion by 2033, reflecting increasing medical needs and improved healthcare infrastructure.

Does ConsaInsights provide customized market report data for the oral Anti Diabetes Drugs industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the oral anti-diabetes drugs industry, ensuring relevant insights and data that help in strategic decision-making.

What deliverables can I expect from this oral Anti Diabetes Drugs market research project?

Expect deliverables such as comprehensive market analysis reports, regional insights, segment breakdowns, competitive landscape information, and forecasts including growth trends to support your business strategies and market understanding.

What are the market trends of oral Anti Diabetes Drugs?

Key trends include a shift towards combination therapies, increased emphasis on patient adherence, growing adoption of digital health tools for diabetes management, and innovations in drug delivery methods that enhance patient convenience and outcomes.