Oral Care Products Market Report

Published Date: 31 January 2026 | Report Code: oral-care-products

Oral Care Products Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive overview of the Oral Care Products market, encompassing market analysis, size forecasts, technological innovations, and insights from 2023 to 2033.

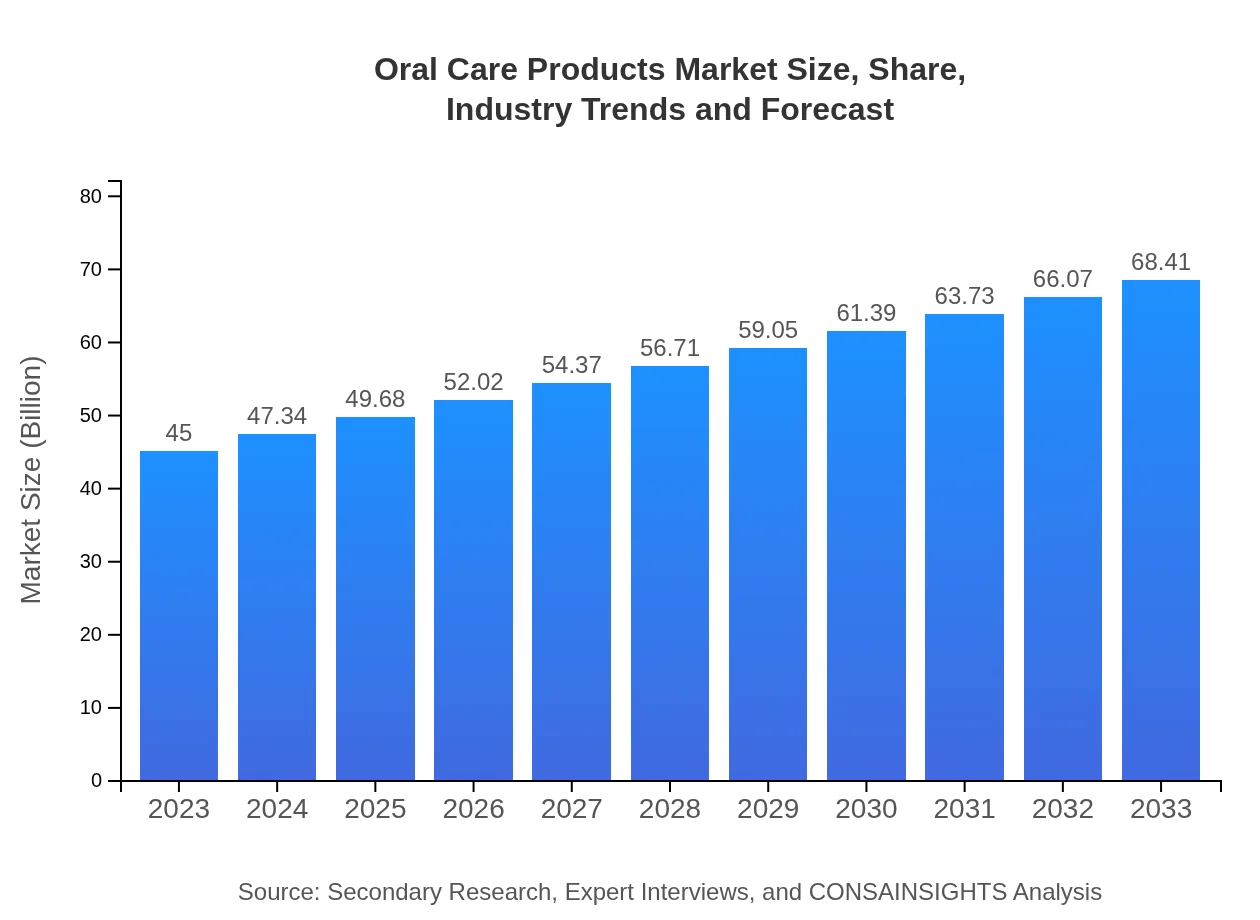

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $45.00 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $68.41 Billion |

| Top Companies | Colgate-Palmolive, Procter & Gamble, Unilever, Johnson & Johnson, GlaxoSmithKline |

| Last Modified Date | 31 January 2026 |

Oral Care Products Market Overview

Customize Oral Care Products Market Report market research report

- ✔ Get in-depth analysis of Oral Care Products market size, growth, and forecasts.

- ✔ Understand Oral Care Products's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Oral Care Products

What is the Market Size & CAGR of Oral Care Products market in 2033?

Oral Care Products Industry Analysis

Oral Care Products Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Oral Care Products Market Analysis Report by Region

Europe Oral Care Products Market Report:

The European market is slated to grow from $11.72 billion in 2023 to $17.82 billion by 2033. The shift towards premium products and rising concerns about dental aesthetics are driving demand across major markets including Germany and France.Asia Pacific Oral Care Products Market Report:

The Asia Pacific region, valued at $9.77 billion in 2023, is projected to reach $14.85 billion by 2033, driven by rising disposable incomes and an increasing emphasis on dental hygiene. The growing population and awareness of dental health are further propelling market demand in countries like China and India.North America Oral Care Products Market Report:

North America leads the Oral Care Products market, with a projected size of $16.47 billion in 2023, expanding to $25.05 billion by 2033. High consumer spending, advanced distribution networks, and a robust emphasis on oral care education contribute to this growth.South America Oral Care Products Market Report:

In South America, the market size is expected to grow from $4.13 billion in 2023 to $6.27 billion by 2033. This growth is primarily due to increased penetration of global brands and rising consumer awareness about oral health, particularly in Brazil and Argentina.Middle East & Africa Oral Care Products Market Report:

The Middle East and Africa market, although relatively smaller, will see growth from $2.91 billion in 2023 to $4.43 billion in 2033. This increase is influenced by urbanization, changing lifestyles, and an improved understanding of oral health issues.Tell us your focus area and get a customized research report.

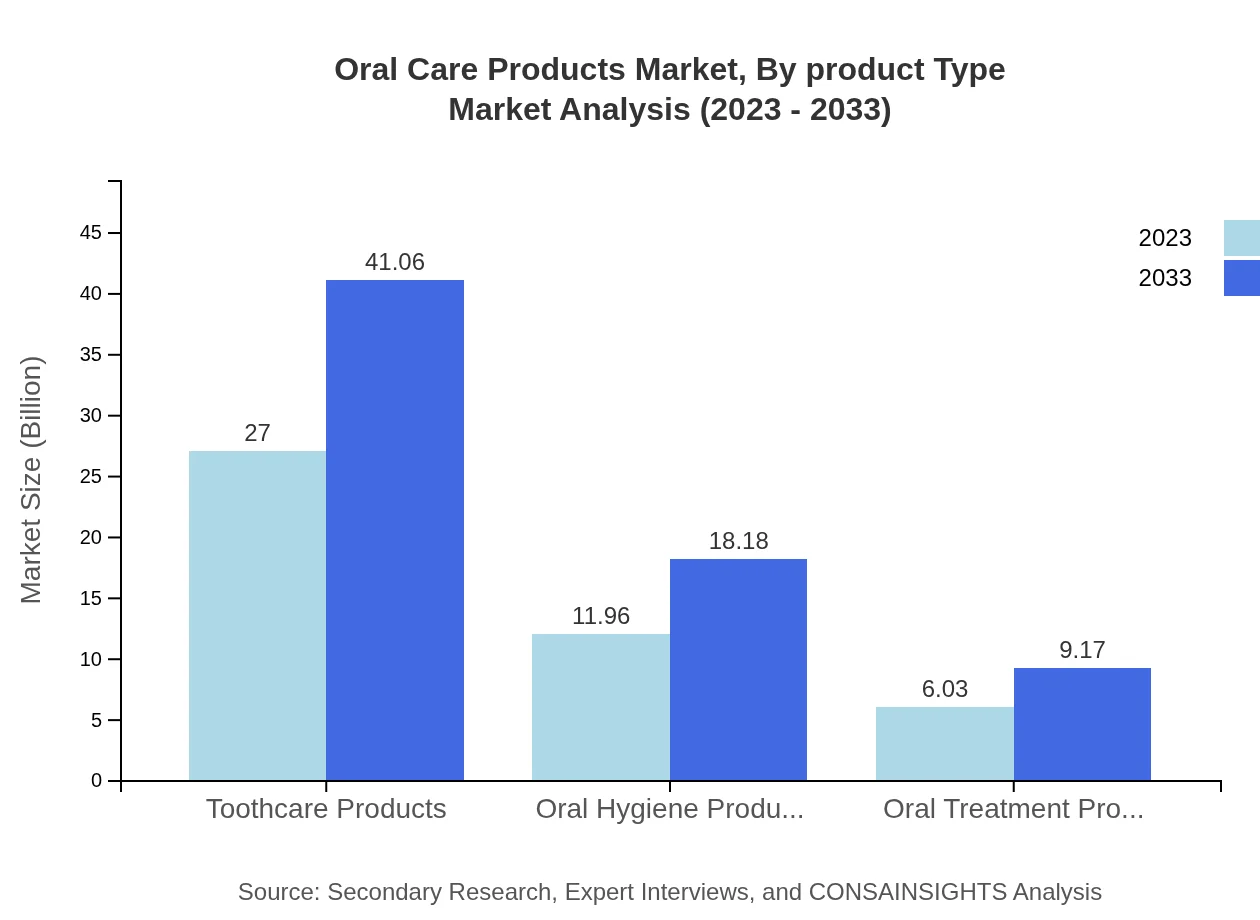

Oral Care Products Market Analysis By Product Type

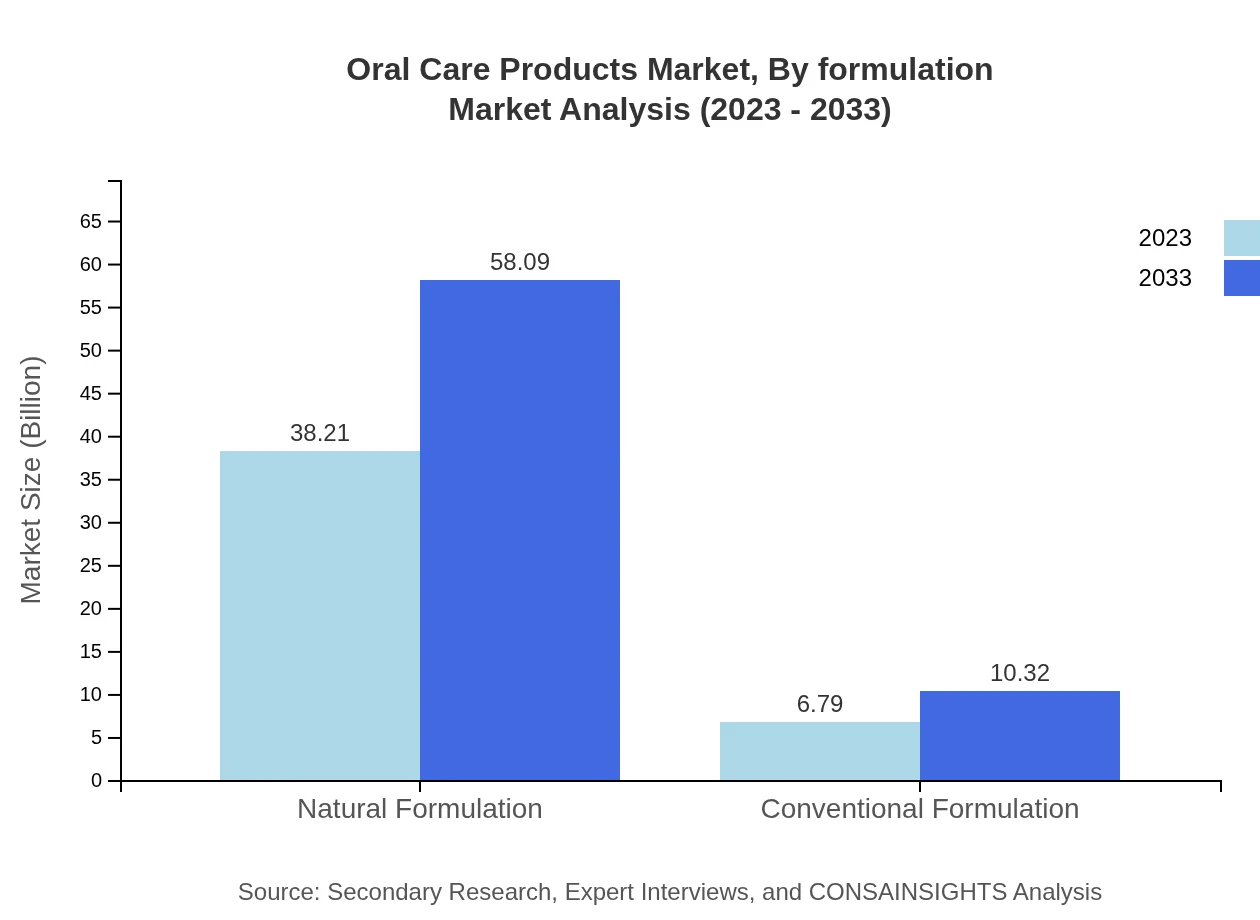

The Oral Care Products Market is significantly influenced by its product types. In 2023, Toothcare Products dominate the market with a size of $27.00 billion. By 2033, this segment is expected to grow to $41.06 billion, representing a sustained focus on dental care products. Natural Formulation products appeal to health-conscious consumers, showing growth from $38.21 billion in 2023 to $58.09 billion in 2033, securing an 84.91% market share. Conventional Formulation holds a more modest share, expected to grow from $6.79 billion to $10.32 billion.

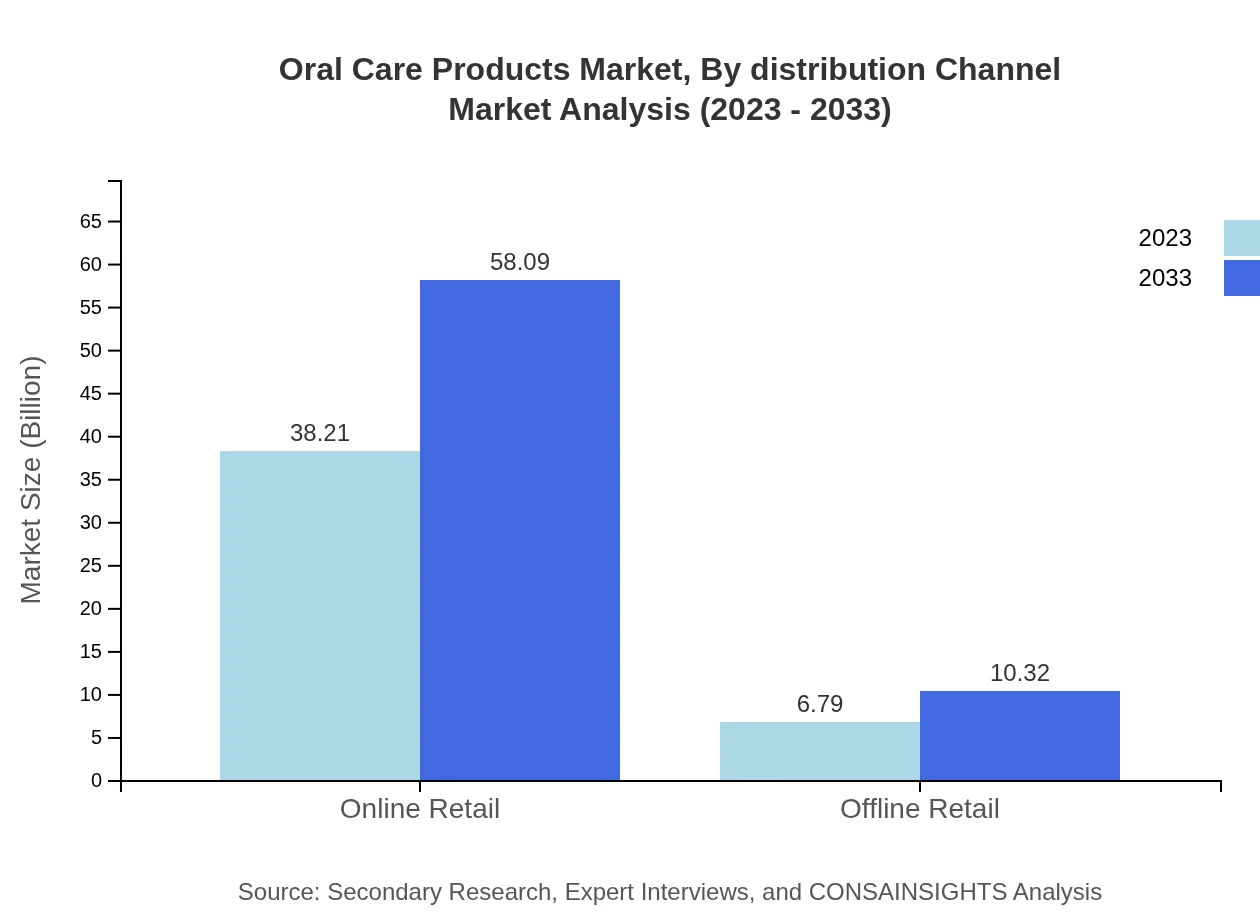

Oral Care Products Market Analysis By Distribution Channel

The distribution channels for Oral Care Products are split into online and offline retail segments. Online retail, valued at $38.21 billion in 2023, is anticipated to grow to $58.09 billion by 2033, capturing a substantial 84.91% market share. The convenience of online shopping and better access to a variety of products are driving this trend. In contrast, offline retail remains significant but is set to grow more slowly from $6.79 billion to $10.32 billion.

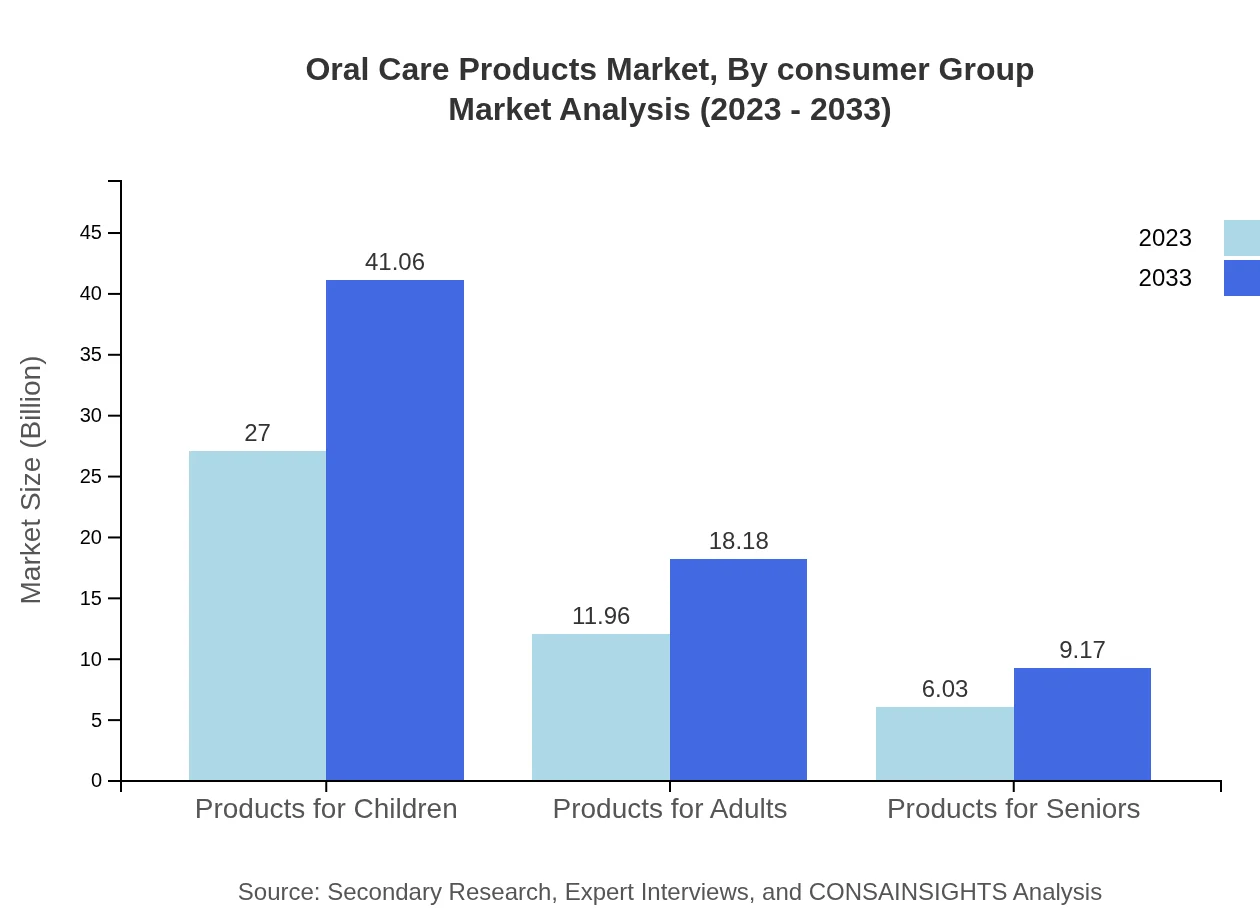

Oral Care Products Market Analysis By Consumer Group

The Oral Care Products market is segmented by consumer group into products for children, adults, and seniors. Products for children and adults each account for approximately $27 billion and $11.96 billion in 2023, projected to grow to $41.06 billion and $18.18 billion, respectively, by 2033, maintaining a consistent 60.01% and 26.58% share. Products for seniors are expected to grow steadily, from $6.03 billion to $9.17 billion, indicating a growing focus on oral care in older demographics.

Oral Care Products Market Analysis By Formulation

The formulation segment shows growing preference toward Natural Formulations, which are projected to grow from $38.21 billion in 2023 to $58.09 billion by 2033. This segment represents a significant commitment to health-conscious consumers who seek safer and more effective products. Conventional Formulation's growth from $6.79 billion to $10.32 billion further demonstrates the diversity in consumer preferences.

Oral Care Products Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Oral Care Products Industry

Colgate-Palmolive:

Colgate-Palmolive is a globally recognized brand known for its extensive range of oral care products, including toothpaste and mouthwash, emphasizing dental health awareness.Procter & Gamble:

Procter & Gamble, the maker of Crest and Oral-B, leads the market with innovative products that combine technology with effective oral care solutions.Unilever:

Unilever's brand, Signal, and its commitment to sustainable and effective oral care products have positioned it as a significant player in the global market.Johnson & Johnson:

Johnson & Johnson offers a diverse range of oral care products, focusing on sensitivity and specific oral health needs across multiple demographics.GlaxoSmithKline:

Known for Sensodyne, GSK focuses on products that address specific dental issues, particularly sensitivity, thereby catering to a large consumer base.We're grateful to work with incredible clients.

FAQs

What is the market size of oral Care Products?

The global oral care products market size is projected at approximately $45 billion in 2023, with a compound annual growth rate (CAGR) of 4.2%, expected to experience steady growth over the next decade.

What are the key market players or companies in this oral Care Products industry?

Key players in the oral care products industry include Colgate-Palmolive, Procter & Gamble, Unilever, GlaxoSmithKline, and Johnson & Johnson, which dominate the market with their diverse product offerings and strong brand presence.

What are the primary factors driving the growth in the oral care products industry?

Major factors driving growth in the oral care products industry include increasing awareness about oral hygiene, a rise in dental issues, and consumer preference for natural formulations that are perceived as safer and healthier.

Which region is the fastest Growing in the oral care products?

The fastest-growing region in the oral care products market is expected to be Asia Pacific, with a projected increase from $9.77 billion in 2023 to $14.85 billion by 2033, reflecting a robust demand for oral health products.

Does ConsaInsights provide customized market report data for the oral care products industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the oral care products industry, helping businesses make informed decisions based on comprehensive analysis.

What deliverables can I expect from this oral care products market research project?

Deliverables include detailed market analysis reports, segment breakdowns, regional insights, competitive landscape, and forecasts, which collectively provide a comprehensive overview of the oral care products market.

What are the market trends of oral care products?

Current market trends in oral care products indicate a shift towards natural formulations, an increase in online retail sales, and innovations in product offerings to cater to specific consumer demographics such as children and seniors.