Order Management Software Market Report

Published Date: 31 January 2026 | Report Code: order-management-software

Order Management Software Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Order Management Software market from 2023 to 2033, covering insights into market trends, segment performance, regional analysis, and growth forecasts.

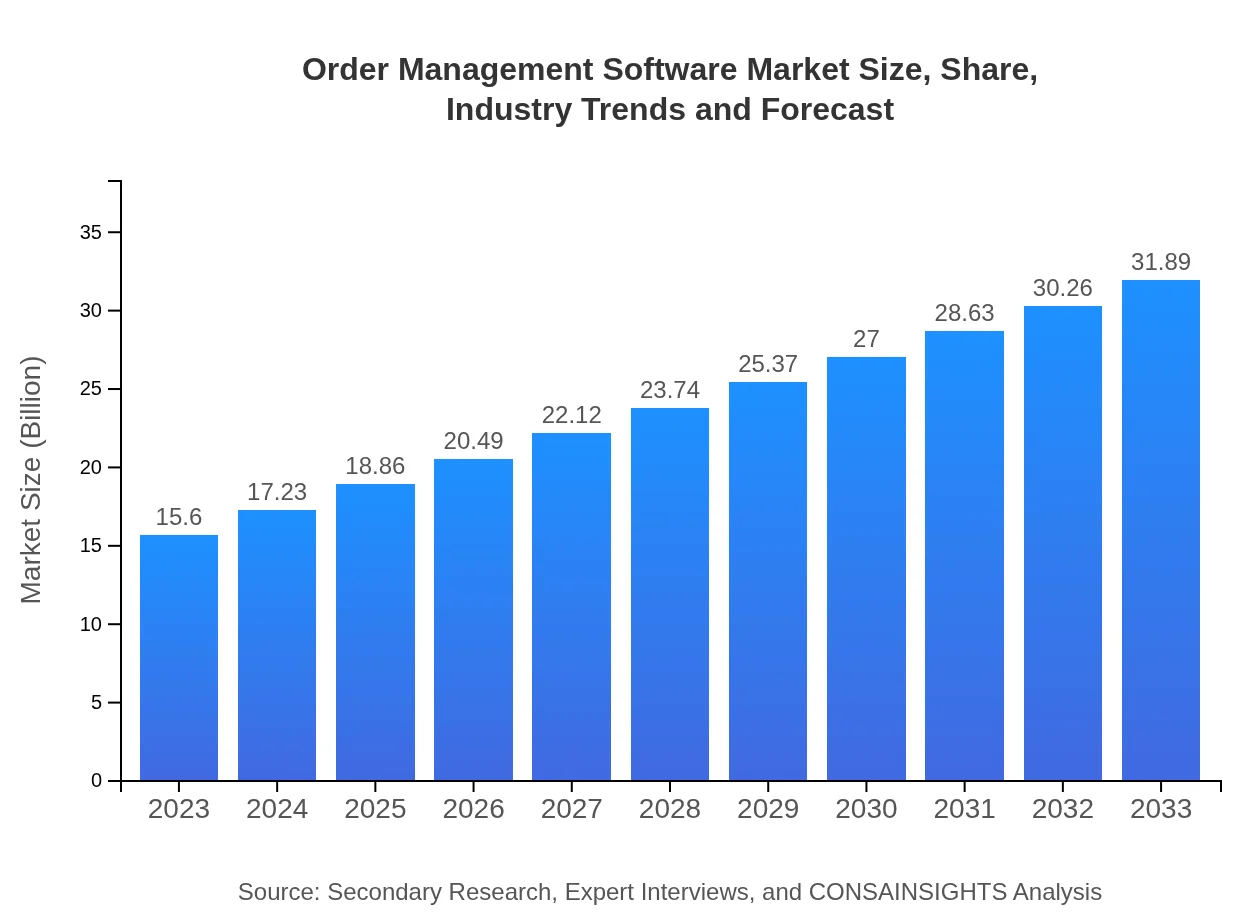

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $31.89 Billion |

| Top Companies | Oracle Corporation, SAP SE, Salesforce, IBM, Shopify |

| Last Modified Date | 31 January 2026 |

Order Management Software Market Overview

Customize Order Management Software Market Report market research report

- ✔ Get in-depth analysis of Order Management Software market size, growth, and forecasts.

- ✔ Understand Order Management Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Order Management Software

What is the Market Size & CAGR of Order Management Software market in 2023?

Order Management Software Industry Analysis

Order Management Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Order Management Software Market Analysis Report by Region

Europe Order Management Software Market Report:

Europe's Order Management Software market was valued at $5.53 billion in 2023 and is projected to grow to $11.31 billion by 2033. The demand for integrated OMS solutions in sectors such as retail and manufacturing, influenced by strict regulatory frameworks, supports robust market growth.Asia Pacific Order Management Software Market Report:

The Asia Pacific market for Order Management Software was valued at $2.89 billion in 2023 and is expected to reach $5.90 billion by 2033. The region's rapid industrialization, coupled with the growth of e-commerce platforms, is driving demand for efficient order management solutions. Countries like China and India are emerging as key markets due to their large retail sectors and increasing investment in technology.North America Order Management Software Market Report:

The North American market represents a significant share of the Order Management Software industry, valued at $5.30 billion in 2023 and expected to reach $10.84 billion by 2033. The region's advanced infrastructure, high level of technology adoption, and strong emphasis on customer experience are key drivers of market growth.South America Order Management Software Market Report:

In South America, the Order Management Software market was valued at $0.21 billion in 2023 and is forecasted to grow to $0.43 billion by 2033. The evolving digital landscape and increasing internet penetration in countries like Brazil and Argentina are fostering the adoption of OMS solutions.Middle East & Africa Order Management Software Market Report:

In the Middle East and Africa, the Order Management Software market valued at $1.67 billion in 2023 is expected to reach $3.41 billion by 2033. Investment in technology and digital transformation is on the rise, driven by a growing retail sector and increasing online trade.Tell us your focus area and get a customized research report.

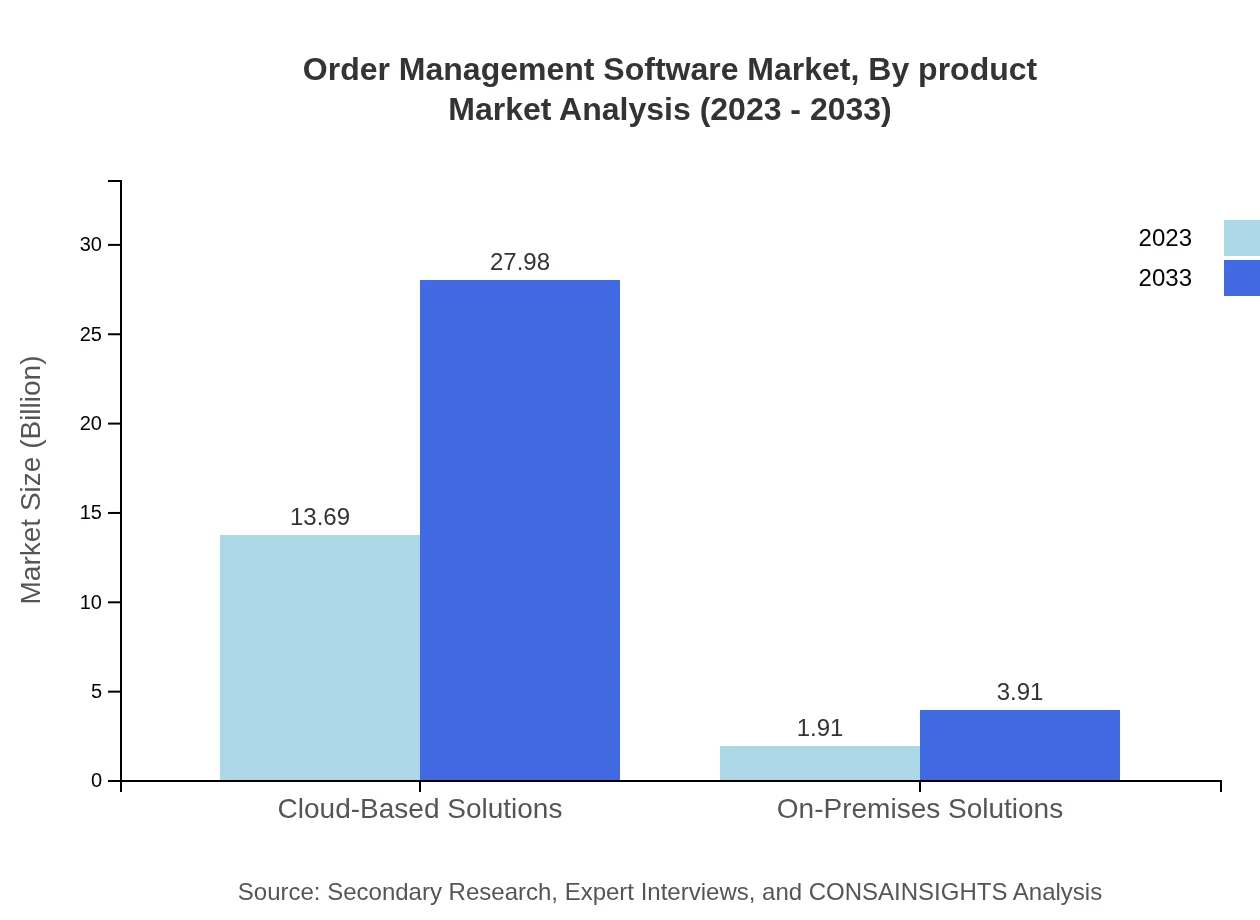

Order Management Software Market Analysis By Product

The Order Management Software market showcases varied performance across different products. The Inventory Management segment, valued at $10.72 billion in 2023, is anticipated to reach $21.92 billion by 2033, capturing 68.75% market share throughout. Customer Management solutions will grow from $3.72 billion in 2023 to $7.60 billion by 2033, maintaining a 23.84% share. Meanwhile, Shipping and Fulfillment products are projected to increase from $1.16 billion to $2.36 billion, while Cloud-Based and On-Premises solutions present contrasting trends in growth, with cloud options dominating the market.

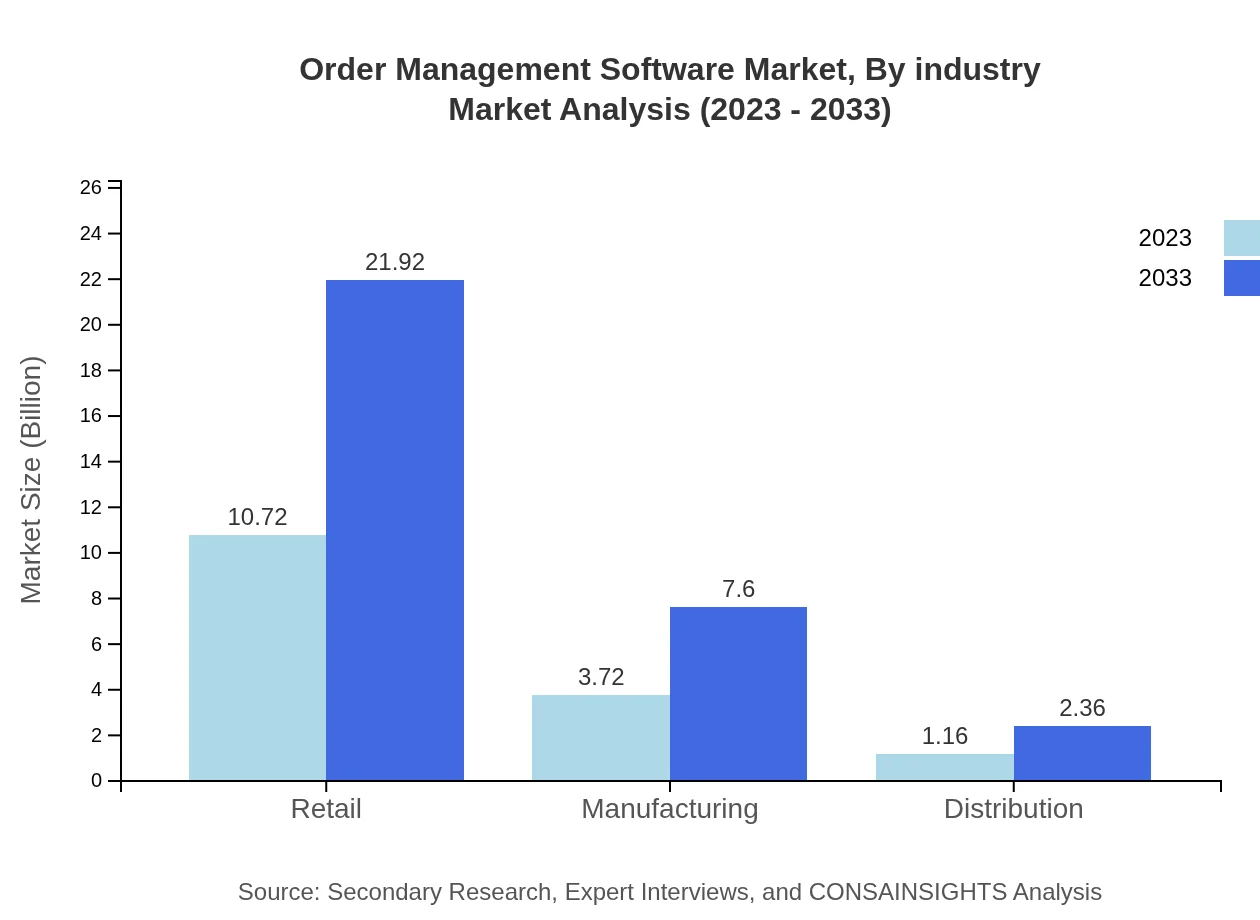

Order Management Software Market Analysis By Industry

Industries such as retail dominate the Order Management Software market, projected to grow substantially from $10.72 billion to $21.92 billion by 2033 with constant market share of 68.75%. Manufacturing sectors are also showing progress with their market size expected to shift from $3.72 billion in 2023 to $7.60 billion in 2033. Distribution, while smaller, is gaining traction, growing from $1.16 billion to $2.36 billion, suggesting that OMS solutions are becoming essential across various industry verticals.

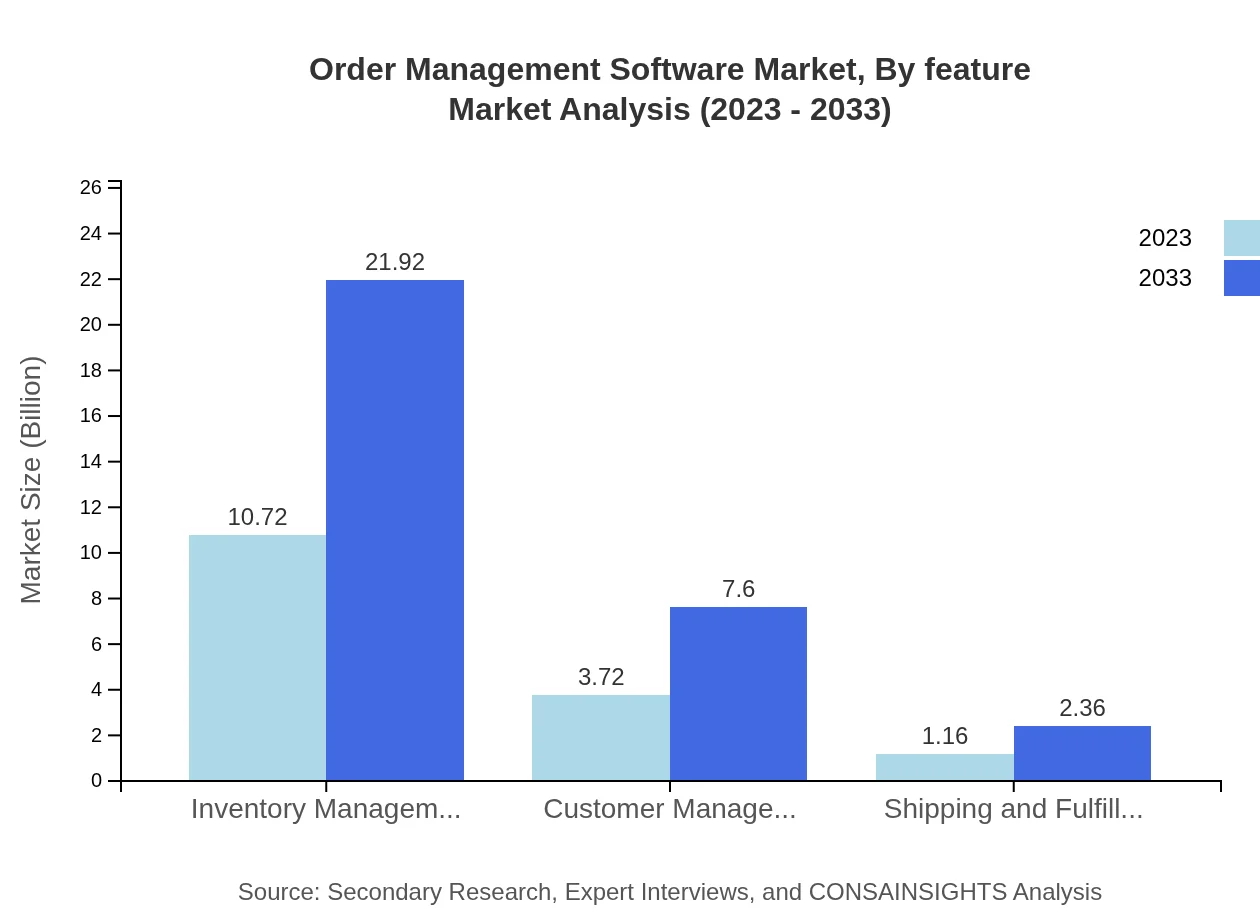

Order Management Software Market Analysis By Feature

The market is subdivided based on various features such as inventory tracking, order processing, and reporting capabilities. Inventory tracking remains a crucial feature, significantly contributing to the overall market size. With businesses emphasizing operational efficiency, all features are expected to see impressive growth, particularly in cloud-based solutions that provide flexibility and accessibility across various business operations.

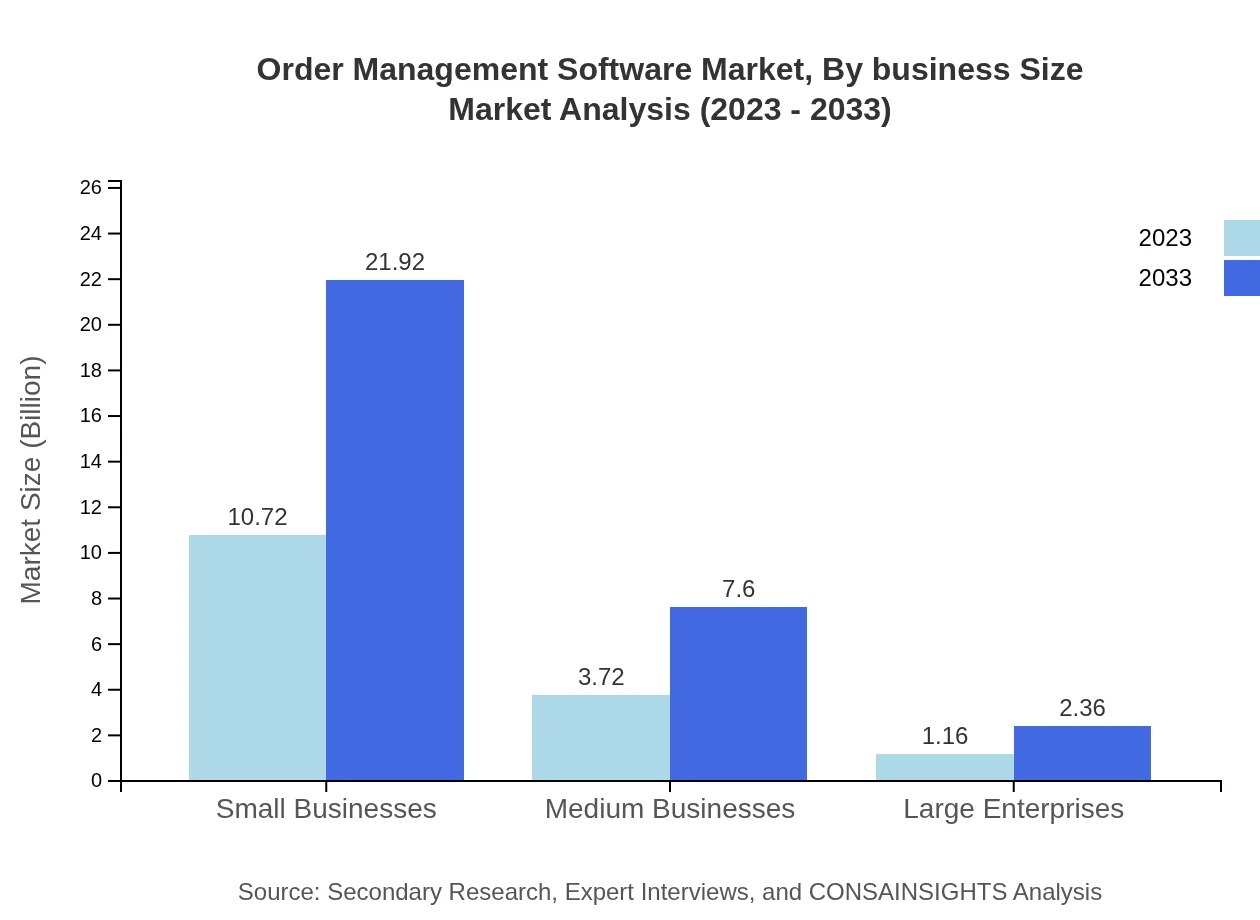

Order Management Software Market Analysis By Business Size

Focusing on business size, the Order Management Software market exhibits strong demand across small, medium, and large enterprises. Small businesses lead with a market size of $10.72 billion in 2023, projected to double by 2033. Medium businesses will grow from $3.72 billion to $7.60 billion, while large enterprises present modest growth from $1.16 billion to $2.36 billion, indicating that OMS is crucial for scalable growth across the business spectrum.

Order Management Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Order Management Software Industry

Oracle Corporation:

Oracle offers a comprehensive suite of cloud-based order management solutions that integrate with ERP systems to streamline processes and improve operational efficiency.SAP SE:

SAP SE is known for its advanced OMS platforms that support multi-channel retailing, ensuring a seamless customer experience across all channels.Salesforce:

Salesforce provides powerful order management tools embedded within its CRM solutions, enhancing customer relationships and facilitating real-time order processing.IBM:

IBM delivers OMS solutions that leverage AI and machine learning to optimize supply chains and improve demand forecasting.Shopify:

Shopify offers e-commerce-focused order management solutions designed specifically for small and medium-sized businesses, simplifying the fulfillment process.We're grateful to work with incredible clients.

FAQs

What is the market size of order Management Software?

The global order management software market is currently valued at approximately $15.6 billion, projected to grow at a CAGR of 7.2% from 2023 to 2033, indicating a robust demand for efficient order processing solutions.

What are the key market players or companies in the order Management Software industry?

Key players in the order management software sector include renowned companies such as Oracle Corporation, SAP SE, and IBM, alongside emerging firms that are innovating technology solutions to capture market share.

What are the primary factors driving the growth in the order management software industry?

Major growth drivers include the increasing e-commerce sector, heightened customer expectations for timely deliveries, and businesses seeking efficiency in inventory and order fulfillment processes, alongside technological advancements in software solutions.

Which region is the fastest Growing in the order management software market?

The fastest-growing region in the order management software market is Europe, expected to expand from $5.53 billion in 2023 to $11.31 billion by 2033, fueled by rising digital transformation among enterprises.

Does ConsaInsights provide customized market report data for the order management software industry?

Yes, ConsaInsights offers customized market reports tailored to the order management software industry, allowing businesses to gain deeper insights and strategic knowledge specific to their needs and market dynamics.

What deliverables can I expect from this order management software market research project?

Deliverables from the order management software market research project typically include detailed reports, data analytics, market forecasts, competitive analysis, and strategic recommendations tailored to business objectives.

What are the market trends of order management software?

Trends in the order management software market include a significant shift towards cloud-based solutions, increased integration with AI and machine learning technologies, and the emphasis on automating supply chain processes for enhanced operational efficiency.