Organic Feed Market Report

Published Date: 02 February 2026 | Report Code: organic-feed

Organic Feed Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Organic Feed market, presenting insights into market size, growth projections, key players, and industry trends from 2023 to 2033. It aims to equip stakeholders with essential data for informed decision-making.

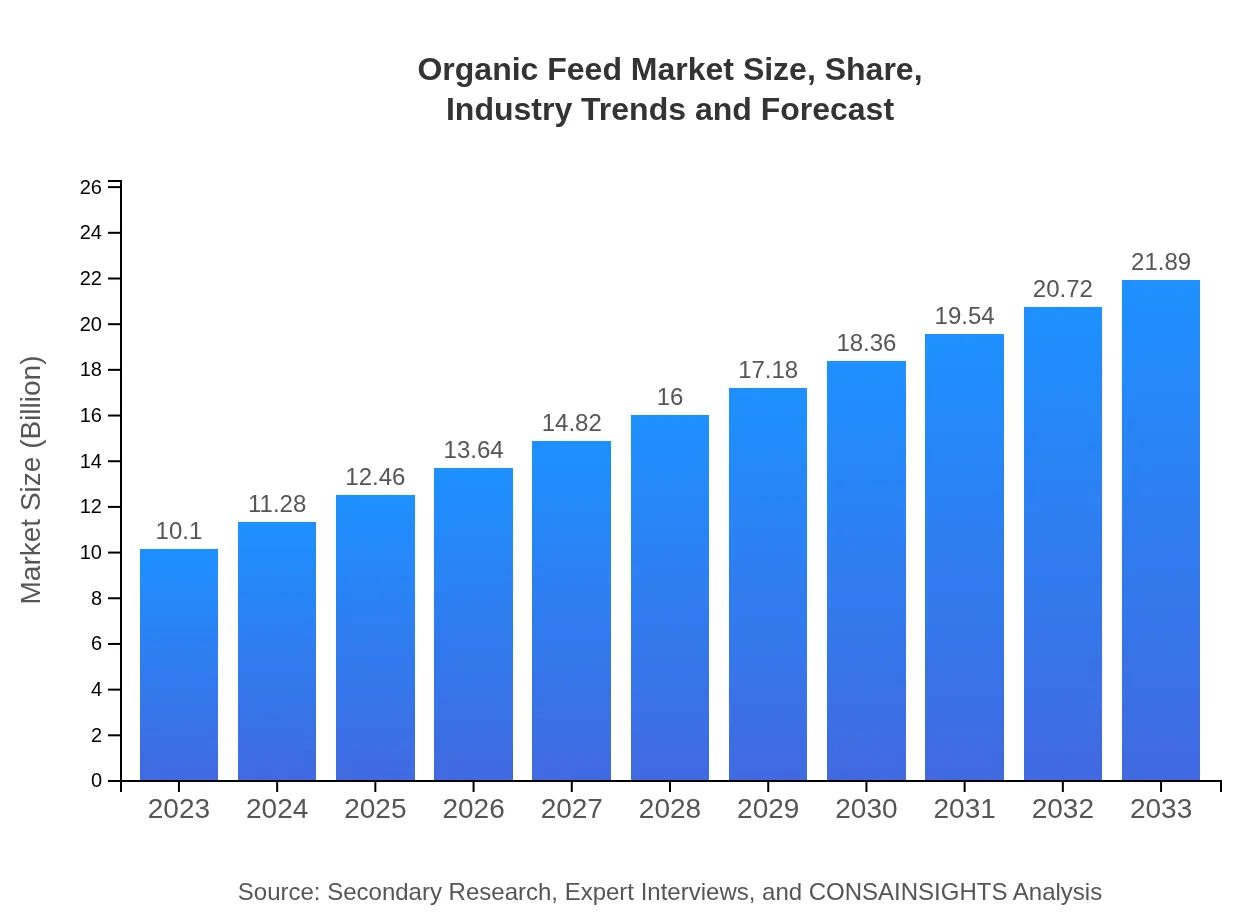

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.10 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $21.89 Billion |

| Top Companies | Cargill, Inc., Archer Daniels Midland Company (ADM), Nutreco N.V., Land O'Lakes, Inc., BASF SE |

| Last Modified Date | 02 February 2026 |

Organic Feed Market Overview

Customize Organic Feed Market Report market research report

- ✔ Get in-depth analysis of Organic Feed market size, growth, and forecasts.

- ✔ Understand Organic Feed's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Organic Feed

What is the Market Size & CAGR of Organic Feed market in 2023?

Organic Feed Industry Analysis

Organic Feed Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Organic Feed Market Analysis Report by Region

Europe Organic Feed Market Report:

In Europe, the market is projected to increase from USD 2.89 billion in 2023 to USD 6.27 billion by 2033. The European Union's strong regulatory framework and consumer preference for organic food contribute to this remarkable growth trajectory.Asia Pacific Organic Feed Market Report:

In the Asia Pacific region, the Organic Feed market was valued at USD 1.92 billion in 2023 and is expected to reach USD 4.16 billion by 2033. The increasing demand for organic products and a growing population drive this growth. Rapid urbanization and rising disposable incomes further contribute to rising meat consumption and consequently organic feed demand.North America Organic Feed Market Report:

The North American Organic Feed market is anticipated to evolve significantly, rising from USD 3.78 billion in 2023 to approximately USD 8.20 billion by 2033. The heightened popularity of organic livestock products among consumers, alongside governmental initiatives to encourage organic agriculture, are major driving forces.South America Organic Feed Market Report:

In South America, the market is projected to grow from USD 0.65 billion in 2023 to USD 1.40 billion by 2033. This growth can be attributed to the expansion of organic farming practices and increasing investments in organic feed crops, largely influenced by international export demands.Middle East & Africa Organic Feed Market Report:

In the Middle East and Africa, the market size is expected to grow from USD 0.86 billion in 2023 to USD 1.87 billion by 2033. The growing need for improving livestock health through superior feed options amidst increasing meat consumption significantly boosts demand in this region.Tell us your focus area and get a customized research report.

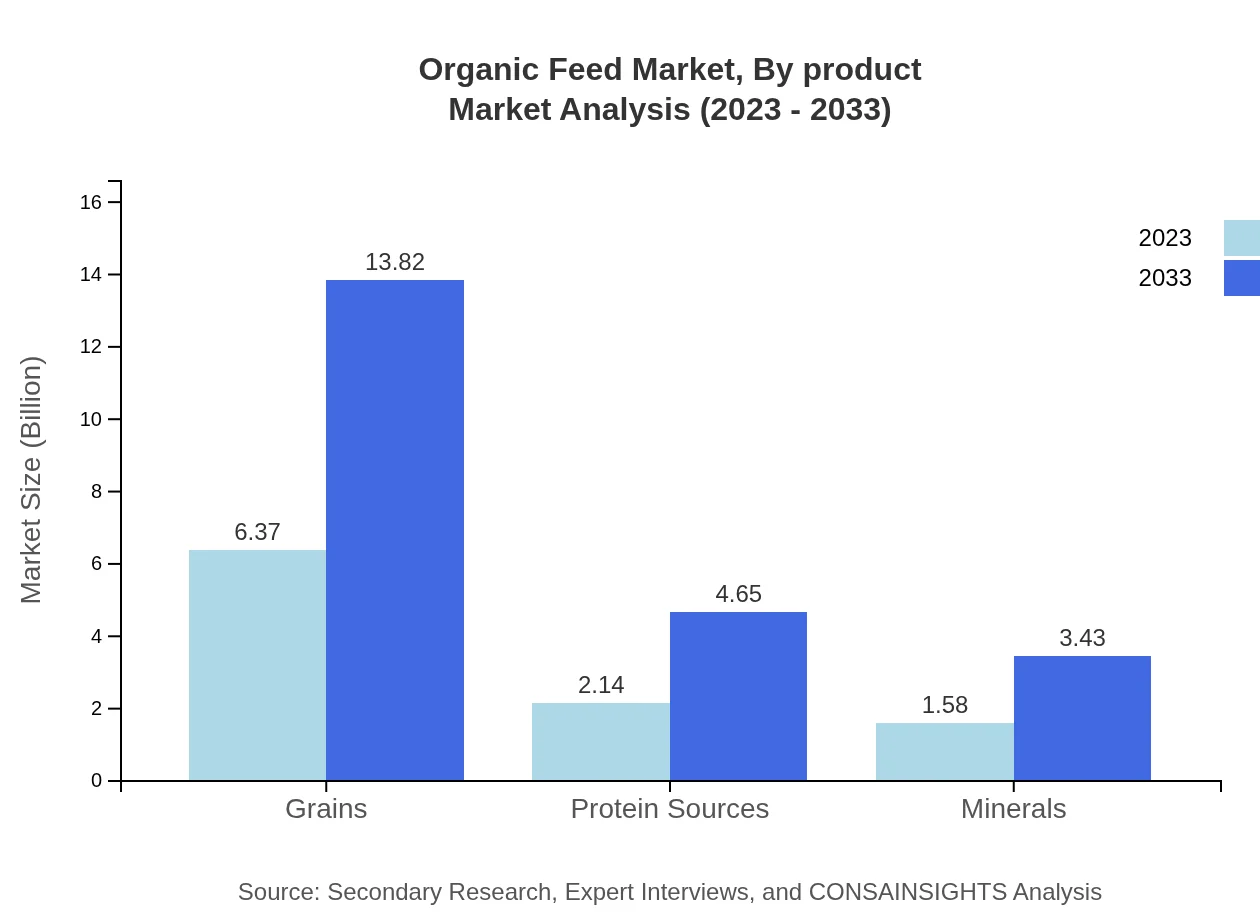

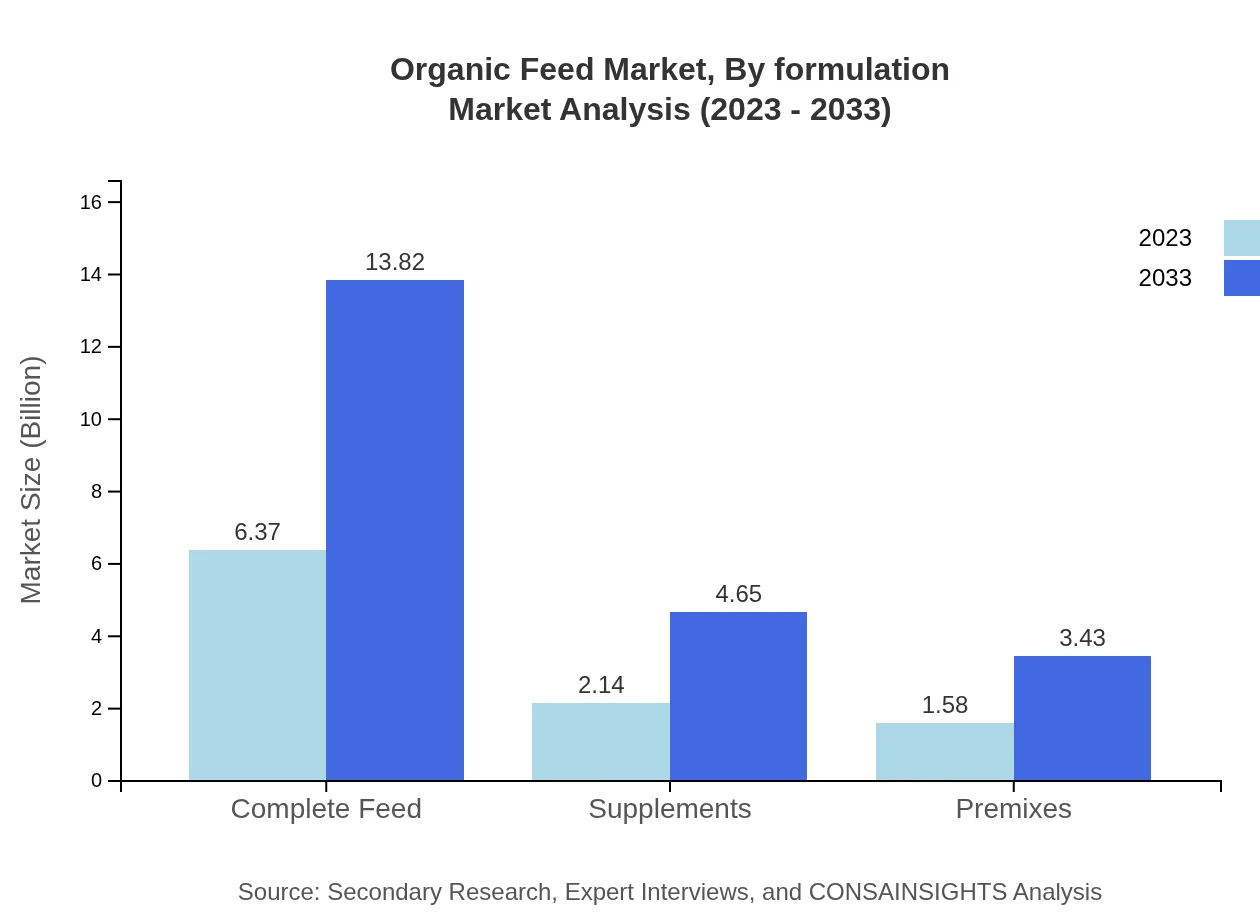

Organic Feed Market Analysis By Product

The product segmentation of the Organic Feed market reveals complete feed as the leading segment, comprising approximately 63.11% share in 2023. It is expected to maintain its dominance, growing from USD 6.37 billion in 2023 to USD 13.82 billion by 2033. Supplements and premixes also play essential roles, contributing significantly to the overall market growth.

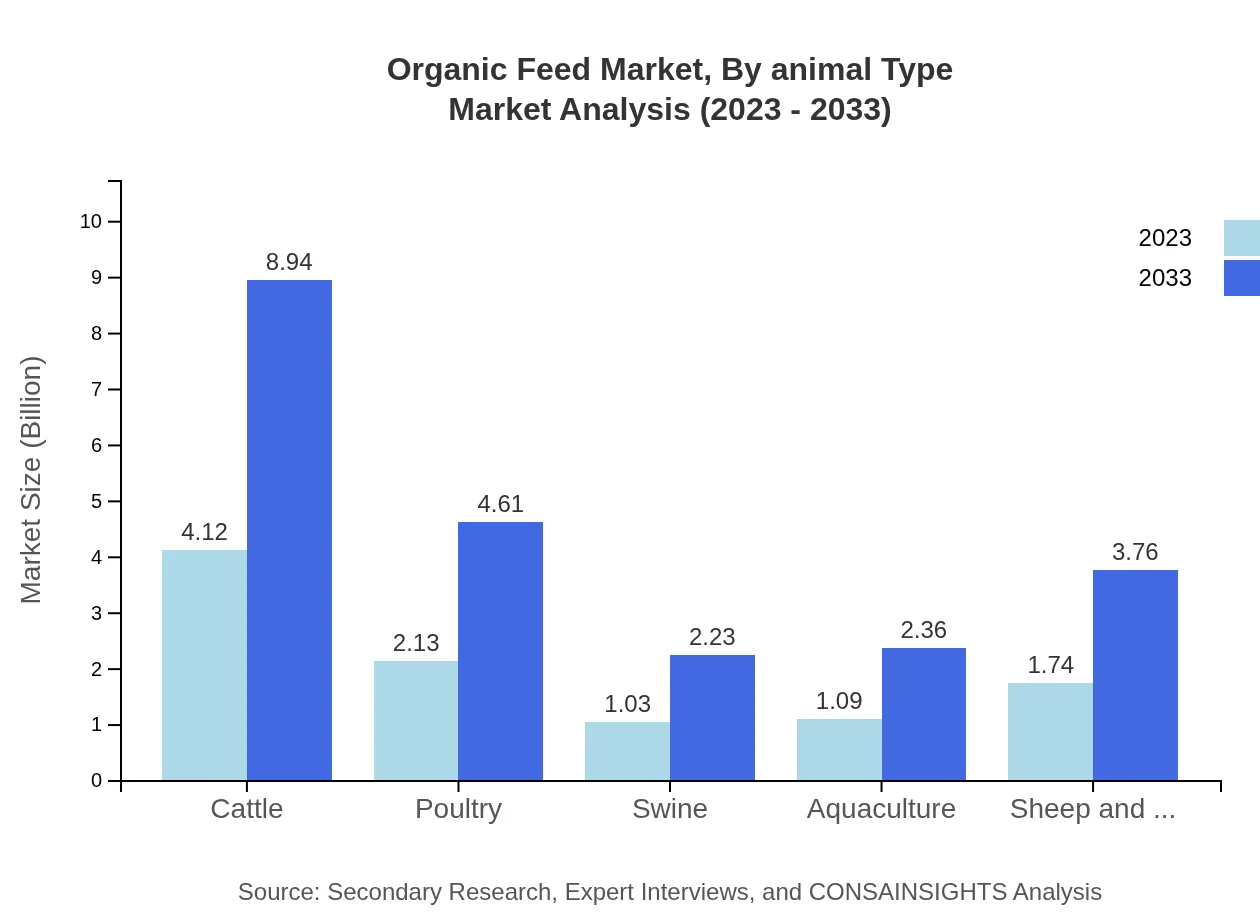

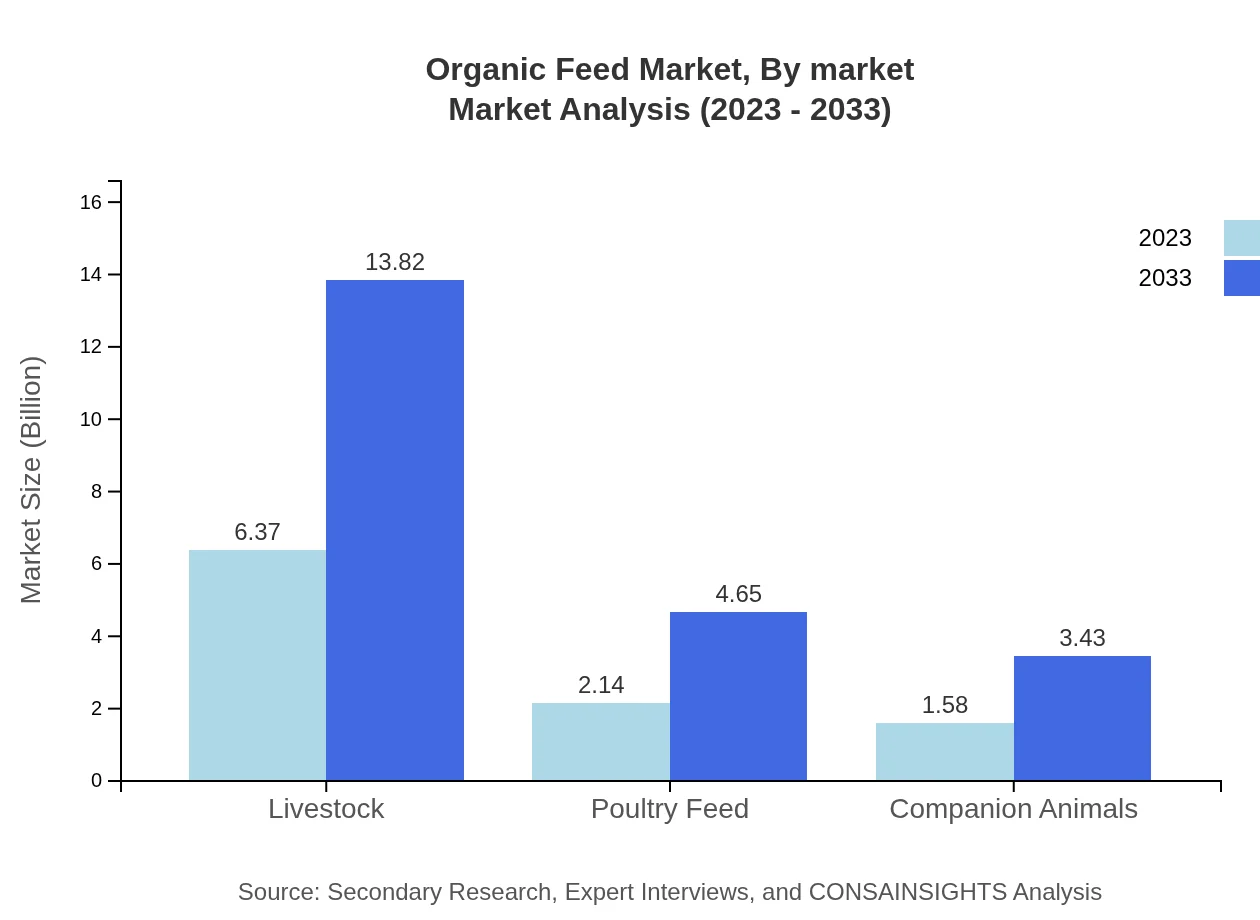

Organic Feed Market Analysis By Animal Type

The livestock segment commands the largest share of the Organic Feed market, contributing to 63.11% in 2023 and expected to reach USD 13.82 billion by 2033. Cattle feed remains the largest sub-segment, followed by poultry, swine, and aquaculture categories, emphasizing the importance of tailored feed formulations for different livestock species.

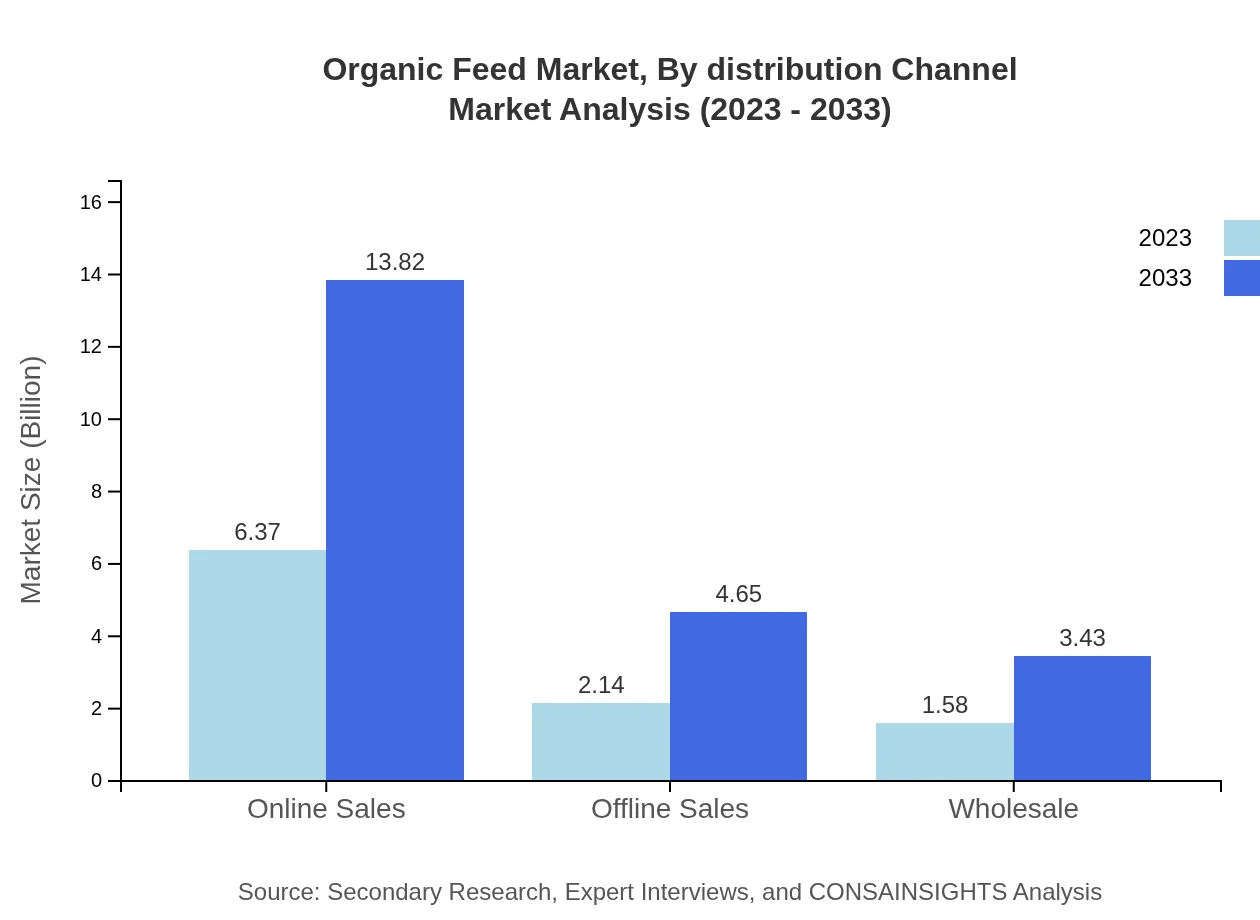

Organic Feed Market Analysis By Distribution Channel

The market distribution channels are segmented into online and offline categories. Online sales are increasingly preferred due to their convenience, comprising 63.11% of the market in 2023, growing to USD 13.82 billion by 2033. Offline sales remain vital but are witnessing a relative decline as digital platforms evolve and enhance accessibility.

Organic Feed Market Analysis By Formulation

The formulation segment showcases a diversity of offerings, with complete feed formulations leading the market. The complete feed category maintains a significant portion of the market due to its comprehensive nutrient profile, essential for optimal livestock growth and production.

Organic Feed Market Analysis By Market

This analysis indicates vigorous growth in organic feed markets across various animal production segments, demonstrating a collective market size of USD 19.07 billion in 2023. The increasing focus on organic livestock rearing practices significantly impacts market dynamics.

Organic Feed Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Organic Feed Industry

Cargill, Inc.:

Cargill is a global leader in nutrition and agricultural products, with a substantial portion of its business focused on organic feed production, offering a range of organic feed solutions across various animal types.Archer Daniels Midland Company (ADM):

ADM is a renowned player in the agricultural industry known for its sustainable organic feed formulations and significant investments in research to enhance feed efficiency.Nutreco N.V.:

Nutreco is committed to sustainable animal nutrition, providing innovative organic feed products that aim to improve the health and welfare of livestock.Land O'Lakes, Inc.:

Land O'Lakes operates as an agricultural cooperative with a growing portfolio of organic feed offerings, focusing on enhancing livestock nutrition and promoting sustainable practices.BASF SE:

BASF is involved in producing feed additives and organic feed products, emphasizing nutrition and health optimization in livestock diets.We're grateful to work with incredible clients.

FAQs

What is the market size of organic Feed?

The organic feed market is valued at approximately $10.1 billion in 2023, with an expected CAGR of 7.8% through 2033. This growth signifies increasing consumer preference for organic products and a shift towards sustainable agricultural practices.

What are the key market players or companies in the organic Feed industry?

Key players in the organic feed industry include major agricultural and feed manufacturing companies known for developing sustainable products. These companies focus on organic certification, innovation in feed formulations, and meeting the demand for healthier livestock and aquaculture solutions.

What are the primary factors driving the growth in the organic feed industry?

The growth of the organic feed industry is driven by rising health consciousness among consumers, a surge in organic farming practices, government regulations favoring sustainable agriculture, and increasing demand for organic meat and dairy products as consumers become more environmentally conscious.

Which region is the fastest Growing in the organic Feed?

The North American region is the fastest-growing market, projected to increase from $3.78 billion in 2023 to $8.20 billion by 2033. This growth is propelled by a strong demand for organic products and advances in organic farming practices.

Does ConsaInsights provide customized market report data for the organic Feed industry?

Yes, ConsaInsights offers customized market report data for the organic feed industry. Clients can request tailored insights and analysis specific to their business needs, allowing for a more informed decision-making process.

What deliverables can I expect from this organic Feed market research project?

Deliverables from the organic feed market research project include comprehensive market analysis reports, segmented data on growth trends, competitive landscape assessments, regional insights, and forecasts for product demand and revenue generation.

What are the market trends of organic feed?

Market trends in organic feed indicate a shift towards sustainable production practices, increased investment in research and development for organic formulations, and rising consumer demand for transparency in sourcing and manufacturing processes.