Organophosphate Insecticides Market Report

Published Date: 02 February 2026 | Report Code: organophosphate-insecticides

Organophosphate Insecticides Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Organophosphate Insecticides market, covering current trends, forecasts from 2023 to 2033, and insights into market dynamics, segmentation, and regional performance.

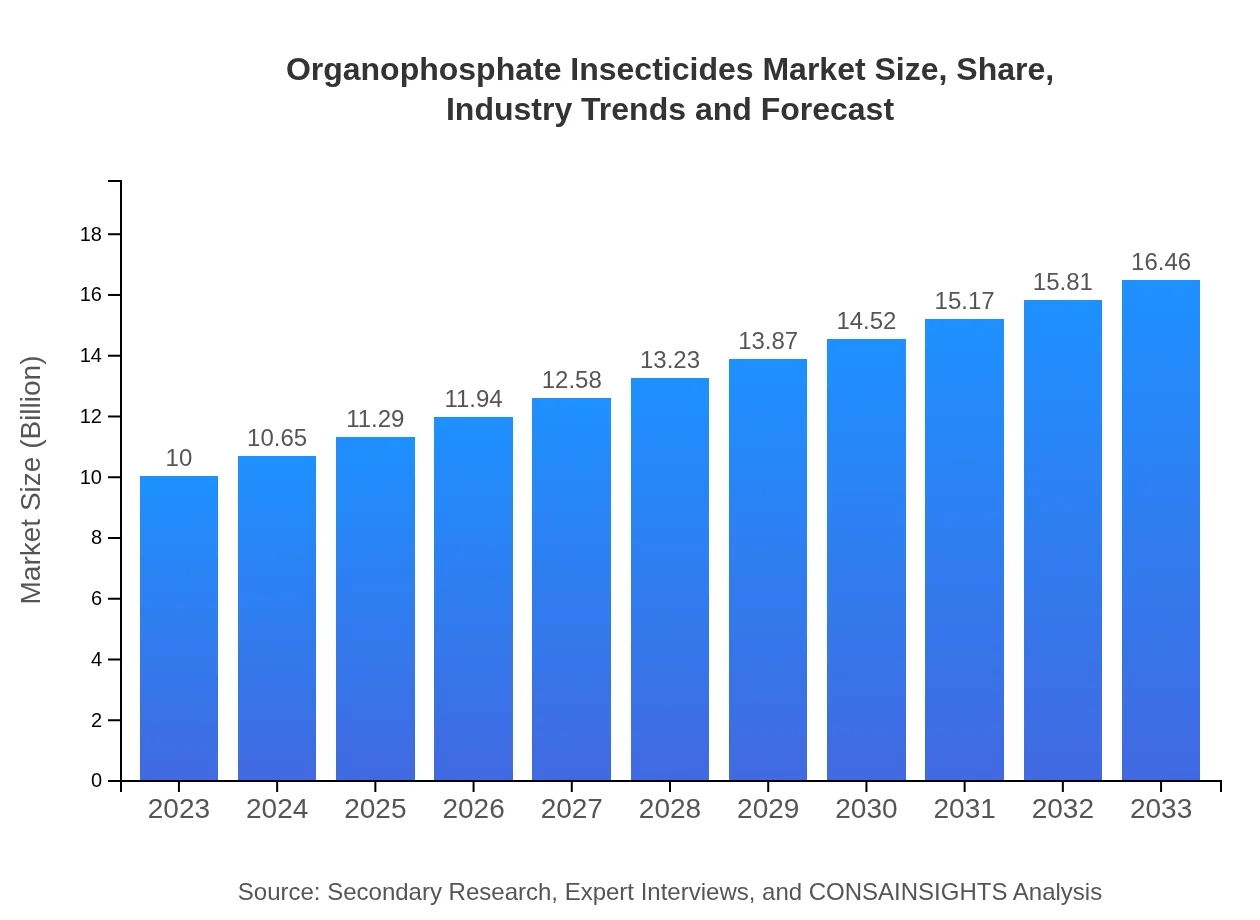

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $16.46 Billion |

| Top Companies | BASF SE, Syngenta AG, FMC Corporation, Dow AgroSciences |

| Last Modified Date | 02 February 2026 |

Organophosphate Insecticides Market Overview

Customize Organophosphate Insecticides Market Report market research report

- ✔ Get in-depth analysis of Organophosphate Insecticides market size, growth, and forecasts.

- ✔ Understand Organophosphate Insecticides's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Organophosphate Insecticides

What is the Market Size & CAGR of Organophosphate Insecticides market in 2033?

Organophosphate Insecticides Industry Analysis

Organophosphate Insecticides Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Organophosphate Insecticides Market Analysis Report by Region

Europe Organophosphate Insecticides Market Report:

The European market is projected to expand from $3.00 billion in 2023 to $4.93 billion by 2033, driven by strict regulations pushing innovation in safer pesticide formulations while maintaining pest management effectiveness, along with a rise in organic farming initiatives.Asia Pacific Organophosphate Insecticides Market Report:

The Asia Pacific region is anticipated to grow from $2.03 billion in 2023 to $3.33 billion by 2033, necessitated by increasing agricultural activities and pest pressures. Countries like China and India are significant contributors, and the region's demand for organophosphate insecticides is constantly evolving due to urbanization and changing dietary preferences.North America Organophosphate Insecticides Market Report:

North America presents a robust market for organophosphate insecticides, projected to increase from $3.29 billion in 2023 to $5.42 billion in 2033. The U.S. market exhibits strong demand due to large-scale agricultural operations and technological advancements that improve pesticide efficacy.South America Organophosphate Insecticides Market Report:

In South America, the market is expected to rise from $0.80 billion in 2023 to $1.32 billion in 2033. The agricultural sector relies heavily on organophosphate insecticides for coffee, soybeans, and sugarcane crops, thus supporting growth. Brazil's adoption of modern farming techniques remains a key driver.Middle East & Africa Organophosphate Insecticides Market Report:

The Middle East and Africa market is projected to grow from $0.88 billion in 2023 to $1.45 billion by 2033, attributed to increasing agricultural production and pest issues in the region. Emerging markets are starting to adopt more advanced pest control measures as agricultural practices improve.Tell us your focus area and get a customized research report.

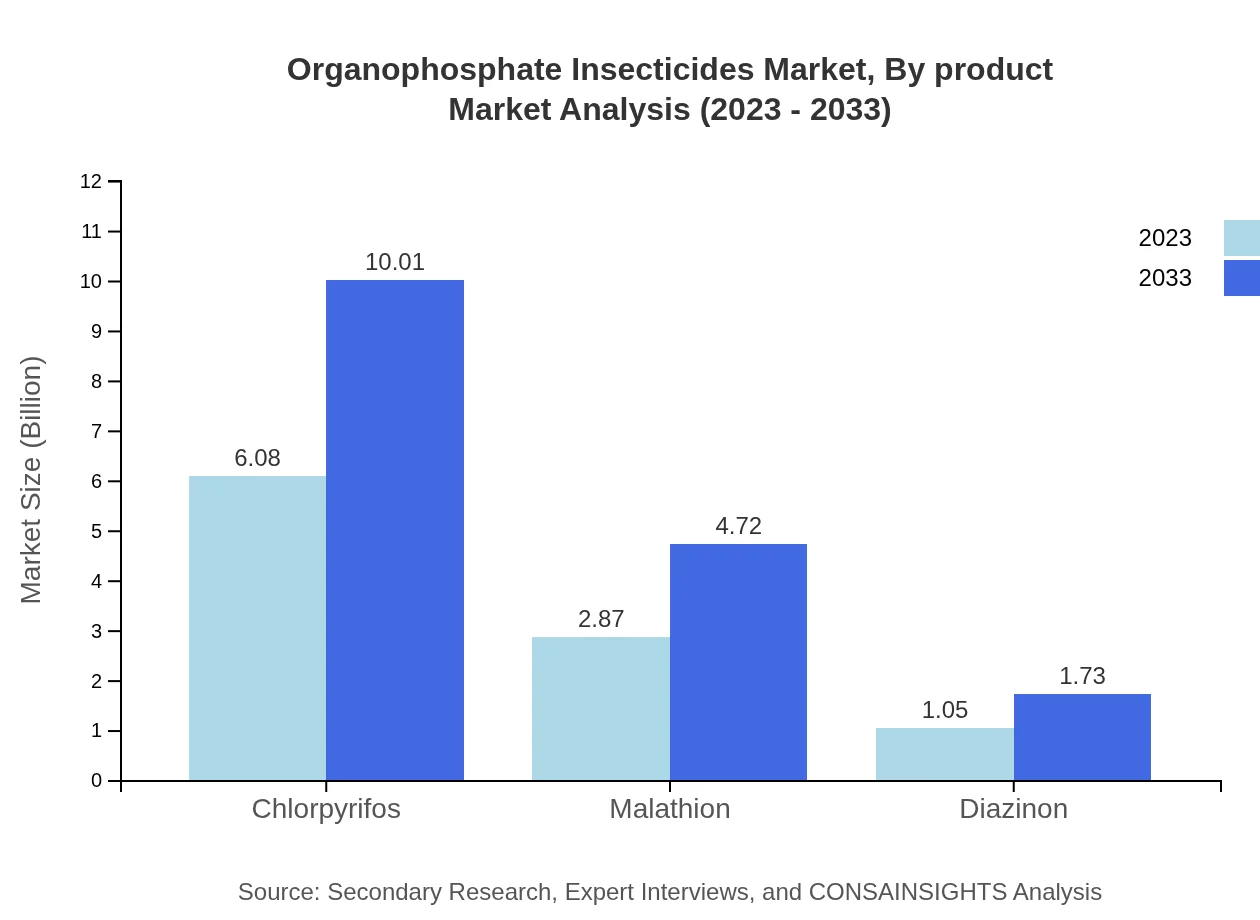

Organophosphate Insecticides Market Analysis By Product

Chlorpyrifos dominates the market, with a size of $6.08 billion in 2023 and an expected $10.01 billion in 2033, maintaining a market share of 60.8%. Malathion follows closely with a size of $2.87 billion in 2023, projected to grow to $4.72 billion by 2033 (28.66% market share). Diazinon, while smaller, shows progressive retention with figures from $1.05 billion to $1.73 billion. This segmentation underscores varied pest control approaches and the significance of product performance in addressing market needs.

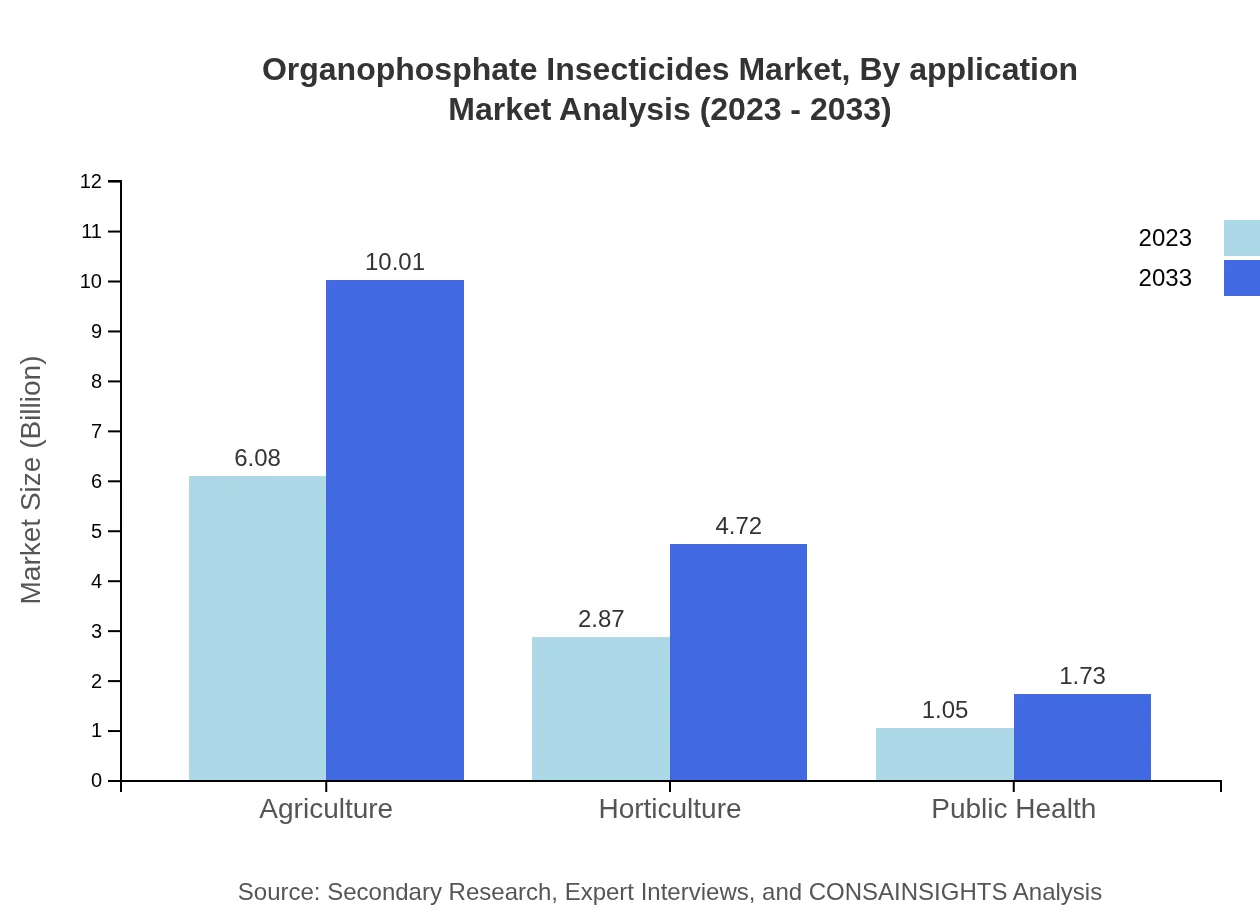

Organophosphate Insecticides Market Analysis By Application

In terms of application, agriculture retains a notable size of $6.08 billion in 2023, expected to achieve $10.01 billion by 2033, capturing 60.8% market share. Horticulture follows with $2.87 billion in 2023, projected to reach $4.72 billion by 2033 (28.66% market share). Public health applications, although smaller at $1.05 billion in 2023, are anticipated to grow modestly to $1.73 billion by 2033. This breakdown illustrates how various applications are vital in providing focus areas for product development and marketing.

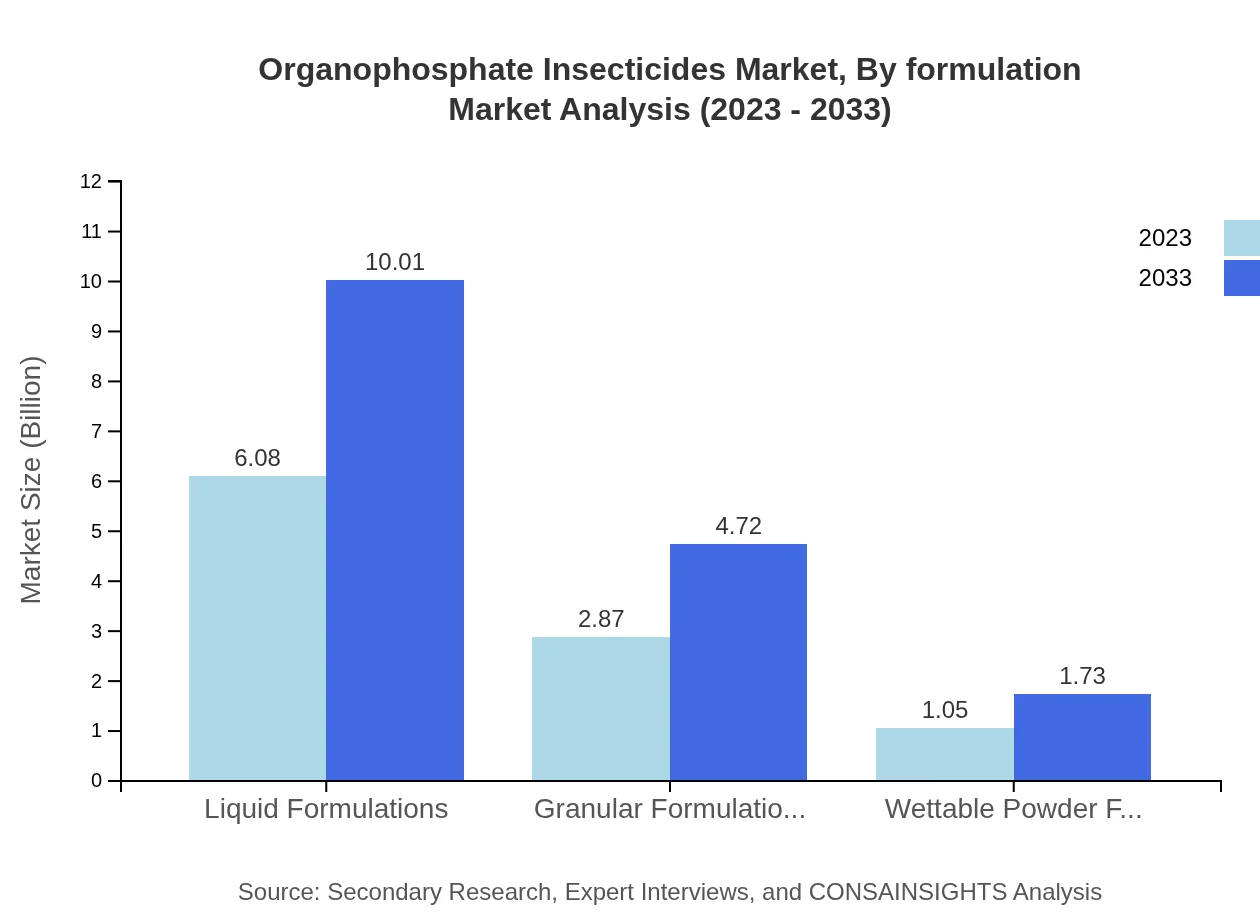

Organophosphate Insecticides Market Analysis By Formulation

Liquid formulations dominate with a market size of $6.08 billion in 2023, increasing to $10.01 billion by 2033 (60.8% share). Granular formulations hold $2.87 billion in 2023, expected at $4.72 billion by 2033 (28.66% market share). Wettable powder formulations represent a smaller but significant segment, with sizes of $1.05 billion to $1.73 billion from 2023 to 2033. The importance of formulation type in application efficiency highlights market diversification opportunities.

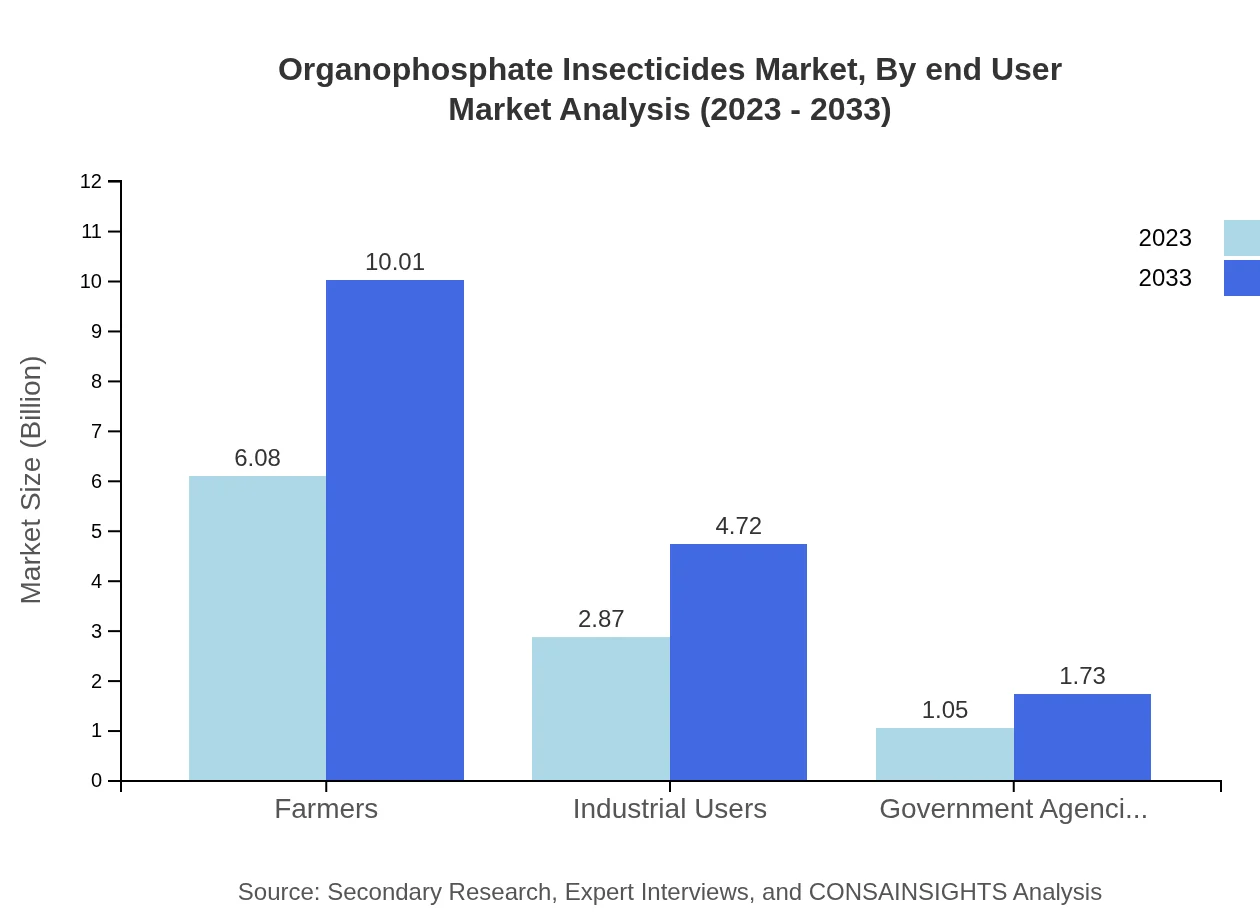

Organophosphate Insecticides Market Analysis By End User

Farmers represent a substantial market segment with figures of $6.08 billion in 2023, reaching $10.01 billion by 2033 (60.8% market share). Industrial users follow with $2.87 billion expected to grow to $4.72 billion (28.66% share), while government agencies stand at $1.05 billion in 2023, predicted to increase to $1.73 billion. Understanding end-user needs is crucial for tailored marketing strategies and product development.

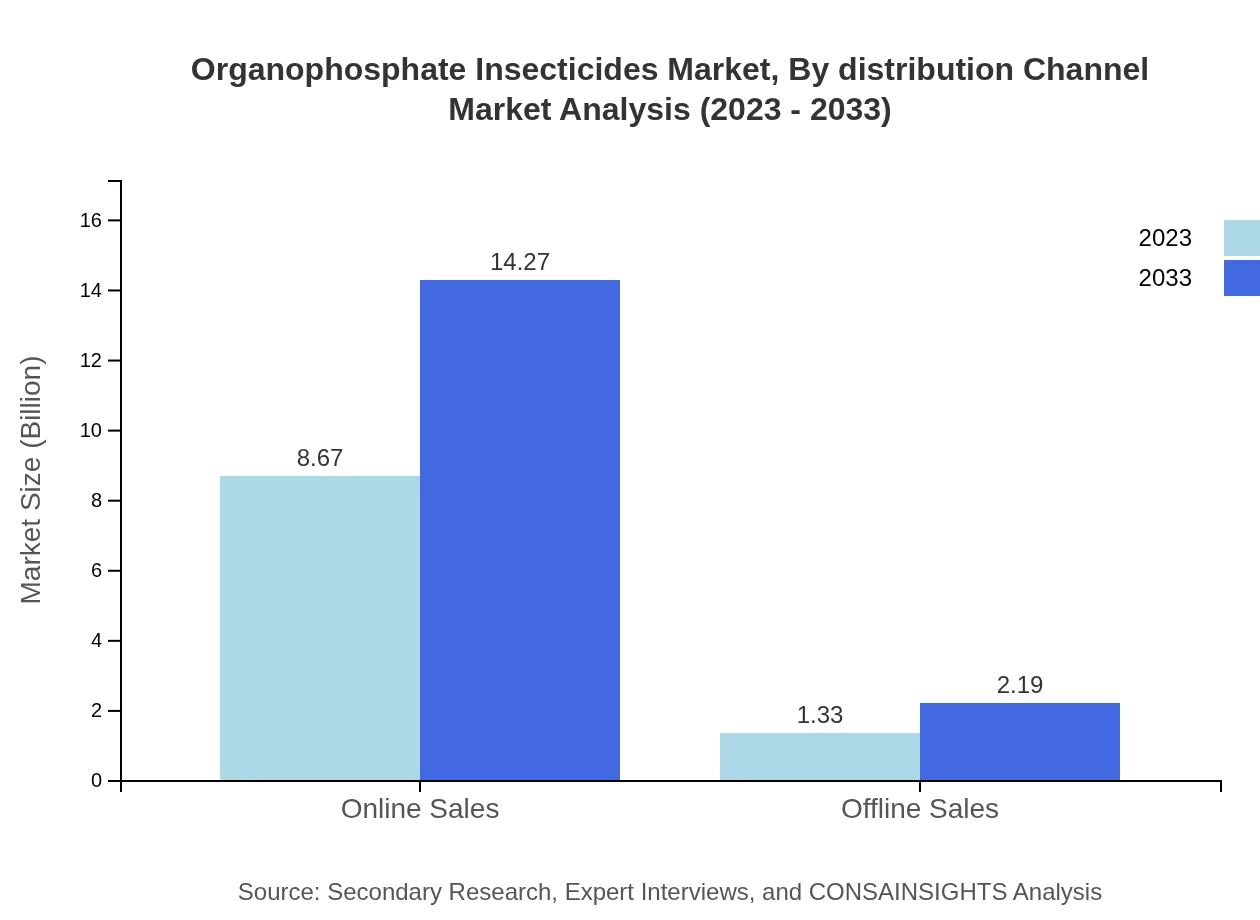

Organophosphate Insecticides Market Analysis By Distribution Channel

Online sales channels exhibit robust growth, moving from $8.67 billion in 2023 to $14.27 billion by 2033, capturing 86.71% of the market, reflecting a shift towards digital purchasing trends. Offline sales remain pertinent with expected growth from $1.33 billion to $2.19 billion (13.29% share). The distinction between online and offline platforms illustrates evolving consumer preferences and retail engagement.

Organophosphate Insecticides Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Organophosphate Insecticides Industry

BASF SE:

A leading chemical company that develops innovative crop protection solutions, including organophosphate insecticides, contributing significantly to sustainable agriculture.Syngenta AG:

Specializes in crop protection and seeds, providing agronomic solutions that integrate organophosphate insecticides to enhance productivity and sustainability.FMC Corporation:

Offers an extensive range of pest control products, including organophosphate insecticides, focused on sustainable agricultural practices and high product efficacy.Dow AgroSciences:

A key player in the agricultural sector that emphasizes R&D in pest management solutions, including advanced formulations of organophosphate insecticides.We're grateful to work with incredible clients.

FAQs

What is the market size of organophosphate Insecticides?

The global organophosphate insecticides market is valued at approximately $10 billion in 2023, with a compound annual growth rate (CAGR) of 5%. This steady growth reflects the enduring demand for effective pest control solutions.

What are the key market players or companies in the organophosphate Insecticides industry?

Prominent companies in the organophosphate insecticides market include Syngenta AG, BASF SE, Bayer AG, and Dow AgroSciences. These firms lead in innovation and product development, catering to agricultural and pest management needs.

What are the primary factors driving the growth in the organophosphate insecticides industry?

Key drivers for market growth include the increasing demand for food production, the necessity for pest control in agriculture, and the rise in vector-borne diseases, necessitating effective insecticides for crop protection and health safety.

Which region is the fastest Growing in the organophosphate Insecticides market?

Asia Pacific is anticipated to be the fastest-growing region for organophosphate insecticides, projected to expand from $2.03 billion in 2023 to $3.33 billion by 2033, driven by agricultural advancements and pest management demands.

Does ConsaInsights provide customized market report data for the organophosphate Insecticides industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the organophosphate insecticides industry, providing insights that align with particular business interests and regional analyses.

What deliverables can I expect from this organophosphate Insecticides market research project?

Expect comprehensive reports outlining market size, CAGR, competitive analysis, forecasts, segment data, regional insights, and emerging trends. These deliverables support strategic planning and decision-making for stakeholders.

What are the market trends of organophosphate Insecticides?

Current market trends include a shift towards integrated pest management (IPM), increasing usage of online sales channels, and a growing focus on environmentally friendly formulations. Innovations in delivery mechanisms also influence the market's trajectory.