Orthodontic Equipment Market Report

Published Date: 31 January 2026 | Report Code: orthodontic-equipment

Orthodontic Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Orthodontic Equipment market, covering trends, challenges, and opportunities expected from 2023 to 2033. Insights include market size, regional analysis, product performance, and forecasts to aid stakeholders in making informed decisions.

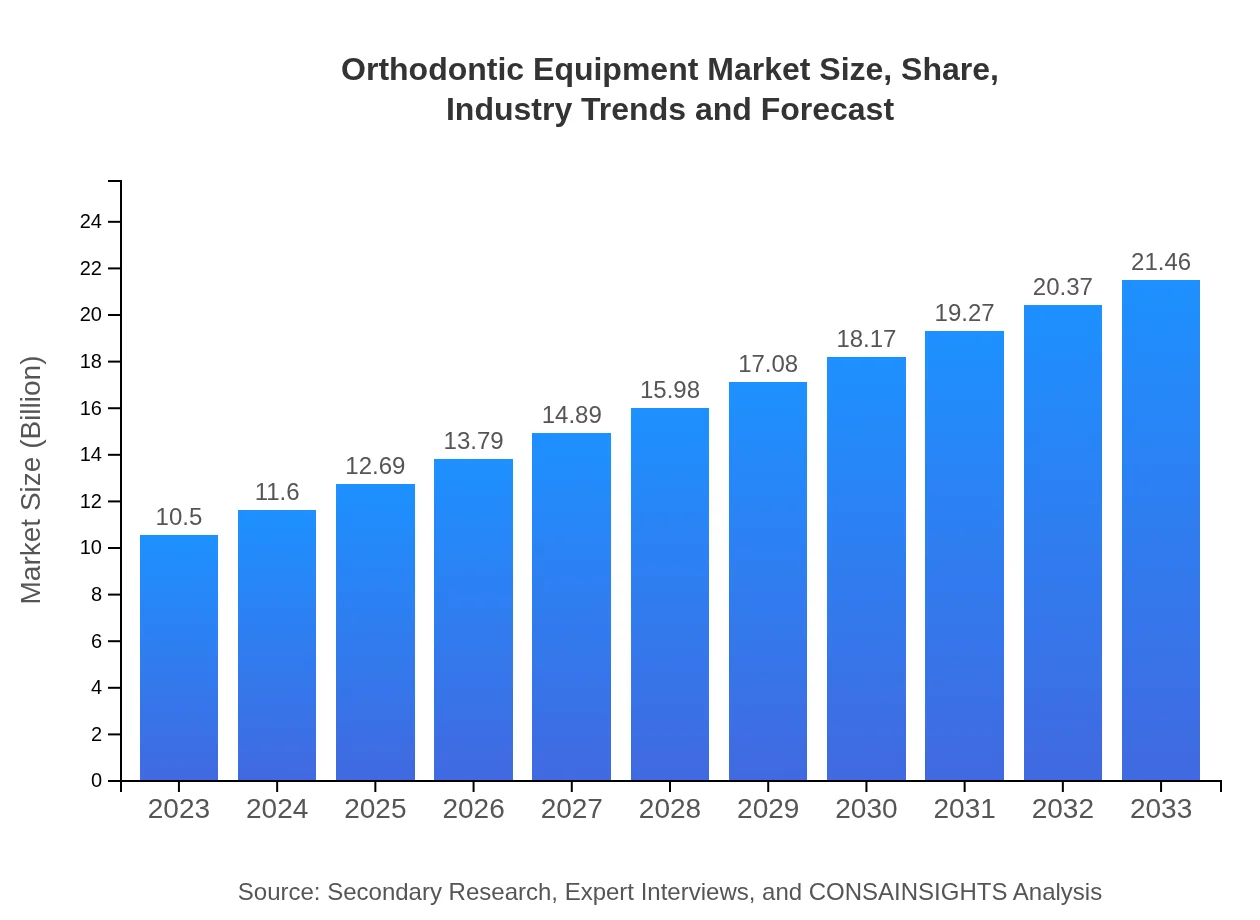

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $21.46 Billion |

| Top Companies | Align Technology, Inc., 3M Company, Dentsply Sirona, OrthoAccel Technologies, Henry Schein, Inc. |

| Last Modified Date | 31 January 2026 |

Orthodontic Equipment Market Overview

Customize Orthodontic Equipment Market Report market research report

- ✔ Get in-depth analysis of Orthodontic Equipment market size, growth, and forecasts.

- ✔ Understand Orthodontic Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Orthodontic Equipment

What is the Market Size & CAGR of Orthodontic Equipment market in 2023?

Orthodontic Equipment Industry Analysis

Orthodontic Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Orthodontic Equipment Market Analysis Report by Region

Europe Orthodontic Equipment Market Report:

Europe's Orthodontic Equipment market will grow from 3.62 billion USD in 2023 to 7.40 billion USD in 2033, driven by a combination of technological innovation, higher treatment costs, and a well-established healthcare system emphasizing preventive and corrective measures in dentistry.Asia Pacific Orthodontic Equipment Market Report:

The Asia Pacific market for Orthodontic Equipment is projected to grow from 1.98 billion USD in 2023 to 4.05 billion USD by 2033. Key factors driving this growth include rising disposable incomes, an increase in orthodontic procedures, and an expanding number of dental clinics across the region, particularly in countries like China and India.North America Orthodontic Equipment Market Report:

The North American region, valued at 3.53 billion USD in 2023, is projected to reach 7.22 billion USD by 2033. This growth is attributed to the high prevalence of orthodontic conditions, widespread acceptance of aesthetic dental procedures, and the strong presence of industrial leaders in the US and Canada.South America Orthodontic Equipment Market Report:

In South America, the market size is expected to increase from 0.28 billion USD in 2023 to 0.57 billion USD in 2033. Factors contributing to this growth include improving dental infrastructure and rising consumer awareness regarding orthodontic treatments, especially among the youth.Middle East & Africa Orthodontic Equipment Market Report:

In the Middle East and Africa, the market is set to expand from 1.08 billion USD in 2023 to 2.22 billion USD by 2033. Local adoption of modern orthodontic solutions and increased healthcare spending are central to this growth.Tell us your focus area and get a customized research report.

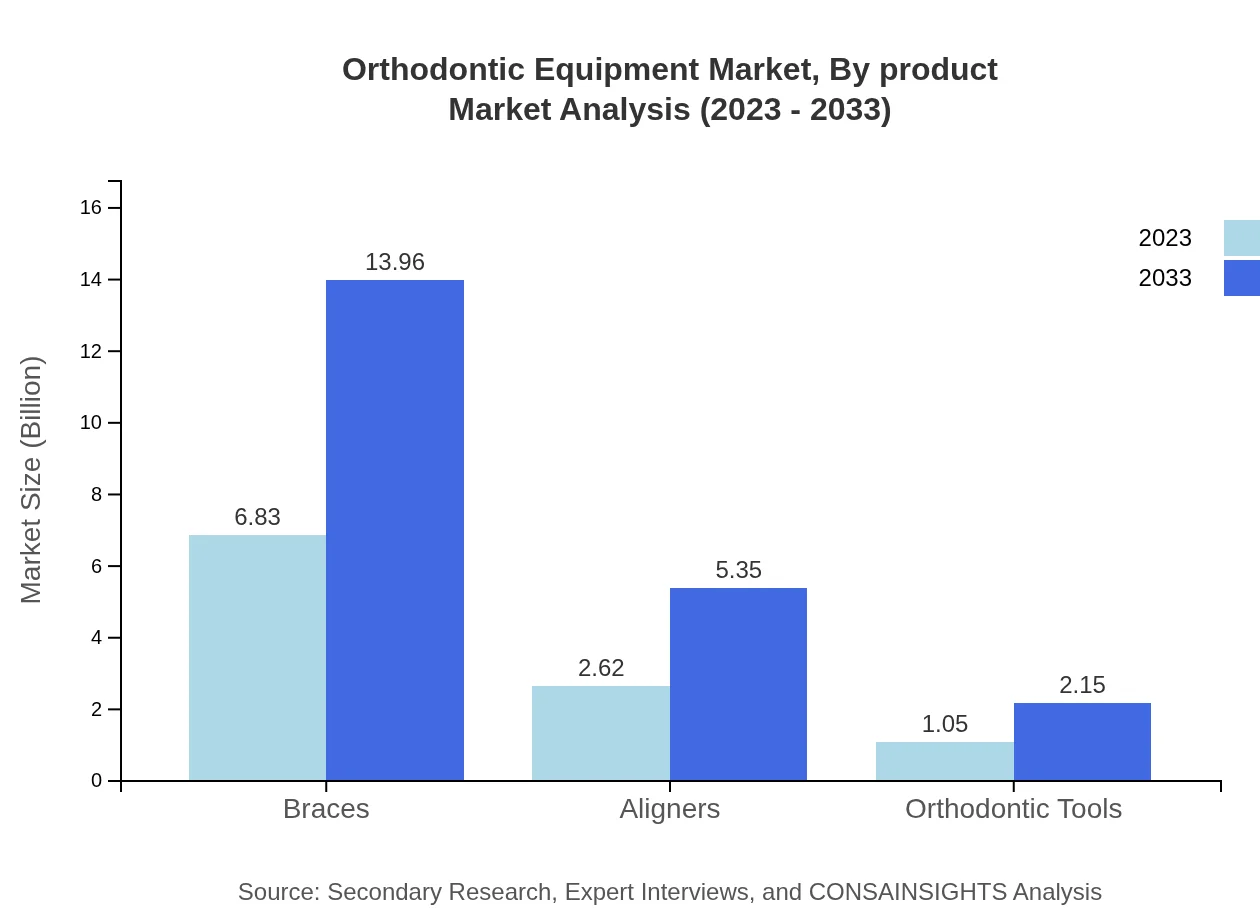

Orthodontic Equipment Market Analysis By Product

The majority of the Orthodontic Equipment market is driven by braces, which account for approximately 6.83 billion USD in 2023, projected to reach 13.96 billion USD in 2033. Aligners follow with an increasing trend, expanding from 2.62 billion USD in 2023 to 5.35 billion USD in 2033. Tools and other orthodontic devices constitute critical segments but remain secondary to braces and aligners.

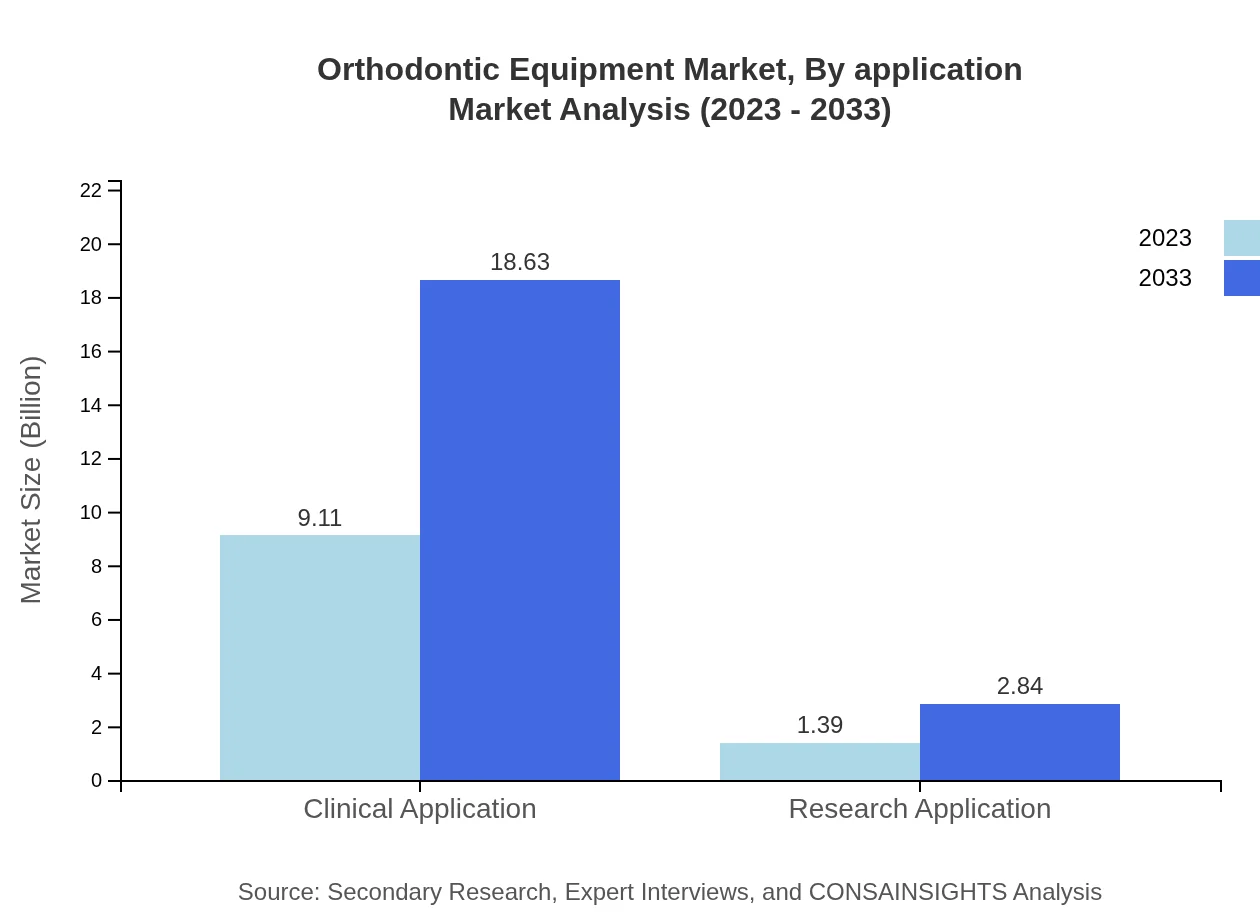

Orthodontic Equipment Market Analysis By Application

Clinical applications are the primary focus area for the market, with a size of 9.11 billion USD in 2023 anticipated to reach 18.63 billion USD by 2033. Research applications, while significantly smaller at 1.39 billion USD currently, are experiencing growth as innovation in treatment methods escalates.

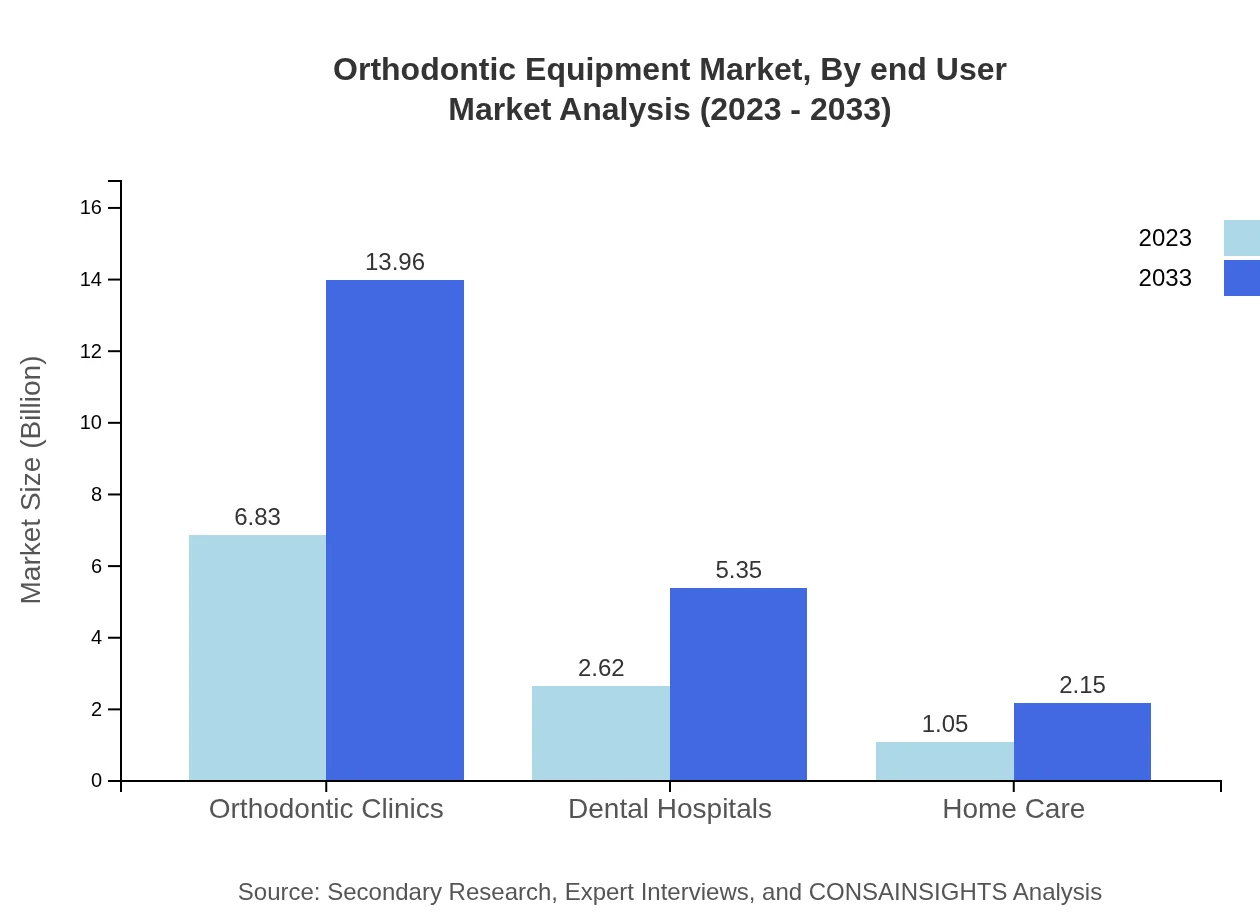

Orthodontic Equipment Market Analysis By End User

Orthodontic clinics dominate the market share, with a size of 6.83 billion USD in 2023, poised to reach 13.96 billion USD by 2033. Dental hospitals and home care markets also hold their respective shares, indicating the broader application of orthodontic devices beyond specialized clinics.

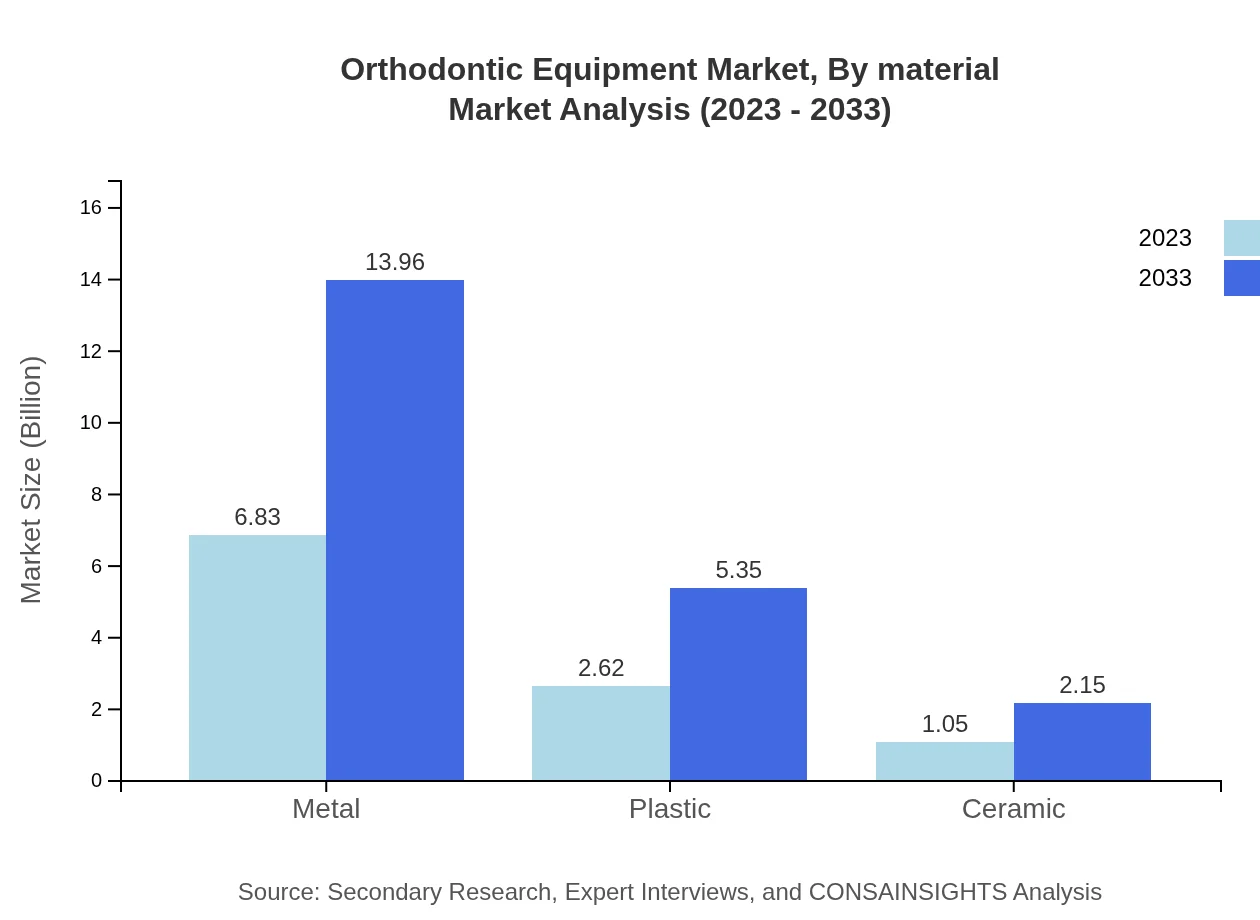

Orthodontic Equipment Market Analysis By Material

The market predominantly involves metal braces, accounting for 6.83 billion USD in 2023. Plastic and ceramic options are gaining traction due to aesthetic considerations, contributing to a diversified offering appealing to consumers.

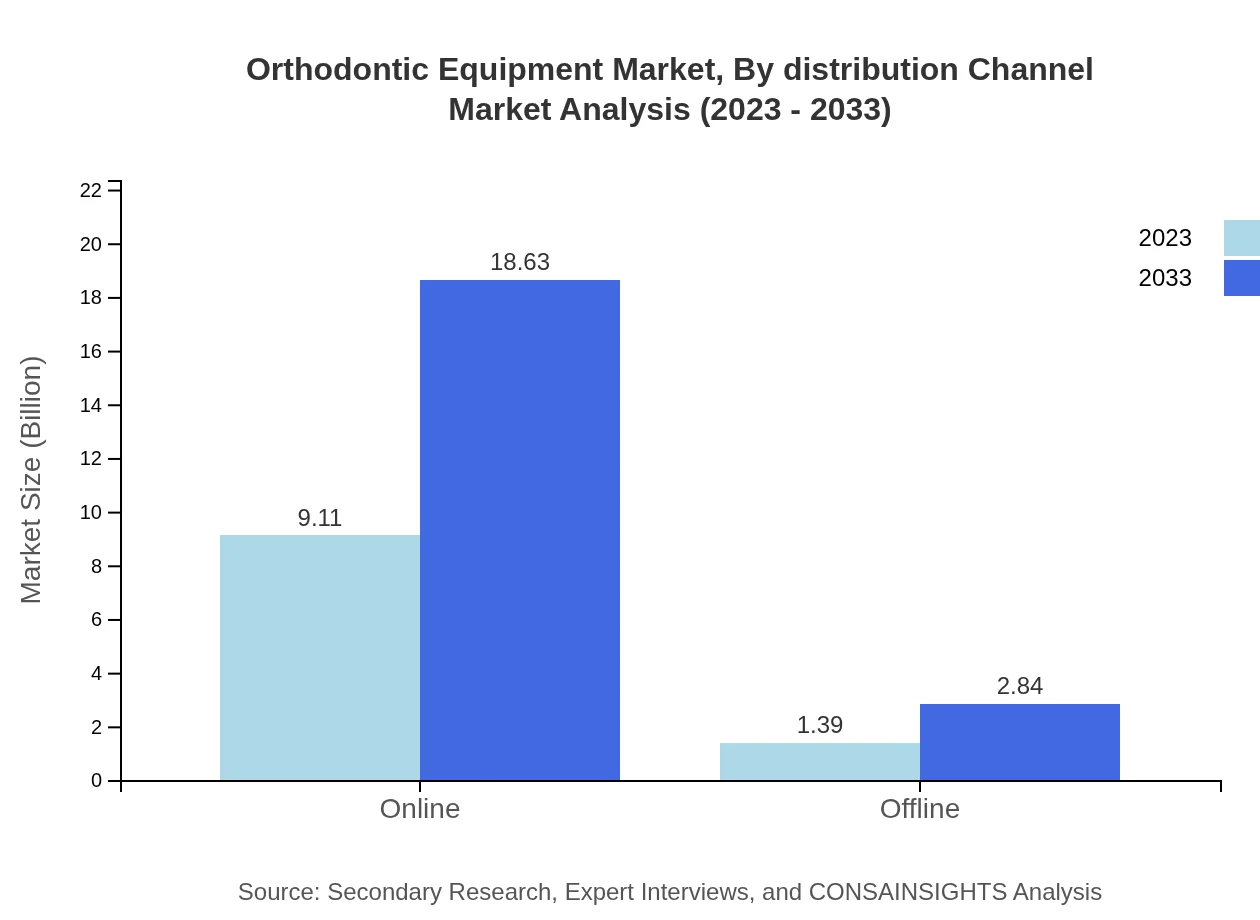

Orthodontic Equipment Market Analysis By Distribution Channel

Online sales are emerging as a significant category in the distribution of orthodontic products, reflecting changing consumer preferences toward e-commerce. Offline sales continue to represent strong traditional retail channels although trending slightly downward.

Orthodontic Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Orthodontic Equipment Industry

Align Technology, Inc.:

Align Technology, Inc. is a leader in the development of 3D digital treatment planning and the manufacture of clear aligners through its flagship product, Invisalign.3M Company:

3M Company specializes in a broad spectrum of orthodontic products and is known for high-quality materials and innovative solutions.Dentsply Sirona:

A key player in dental technology, Dentsply Sirona offers a range of orthodontic products and solutions designed for comprehensive oral care.OrthoAccel Technologies:

Specializing in innovative orthodontic tools, OrthoAccel is known for its AcceleDent product which enhances orthodontic treatment efficiency.Henry Schein, Inc.:

A leading distributor of healthcare products, Henry Schein also provides a robust array of orthodontic equipment and solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of orthodontic equipment?

The orthodontic equipment market is valued at $10.5 billion in 2023, with a projected CAGR of 7.2%. By 2033, the market is expected to continue expanding, driven by increasing orthodontic treatment demand.

What are the key market players or companies in this orthodontic equipment industry?

Key players in the orthodontic equipment industry include Align Technology, 3M, Dentsply Sirona, and Ormco. These companies dominate through innovation, a diverse product portfolio, and robust distribution networks.

What are the primary factors driving the growth in the orthodontic equipment industry?

Growth in the orthodontic equipment industry is mainly driven by rising awareness of dental aesthetics, technological advancements like 3D printing, increasing disposable income, and a growing population seeking orthodontic treatments.

Which region is the fastest Growing in the orthodontic equipment market?

The fastest-growing region in the orthodontic equipment market is Europe, with projected growth from $3.62 billion in 2023 to $7.40 billion by 2033, reflecting increased investment in dental health infrastructure.

Does ConsaInsights provide customized market report data for the orthodontic equipment industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the orthodontic equipment industry, enabling stakeholders to gain insights relevant to their business strategies and market conditions.

What deliverables can I expect from this orthodontic equipment market research project?

Expected deliverables from the orthodontic equipment market research project include comprehensive market reports, competitor analyses, growth forecasts, segment insights, and strategic recommendations based on current trends.

What are the market trends of orthodontic equipment?

Current trends in the orthodontic equipment market include the popularity of clear aligners, increasing use of digital orthodontics, emphasis on patient-centered care, and the growing role of e-commerce in dental product sales.