Orthodontic Supplies Market Report

Published Date: 31 January 2026 | Report Code: orthodontic-supplies

Orthodontic Supplies Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the orthodontic supplies market from 2023 to 2033, detailing market size, growth forecasts, trends, and key players in the industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.80 Billion |

| CAGR (2023-2033) | 7.0% |

| 2033 Market Size | $13.63 Billion |

| Top Companies | Align Technology, Inc., 3M Company, Henry Schein Inc., Dentsply Sirona Inc. |

| Last Modified Date | 31 January 2026 |

Orthodontic Supplies Market Overview

Customize Orthodontic Supplies Market Report market research report

- ✔ Get in-depth analysis of Orthodontic Supplies market size, growth, and forecasts.

- ✔ Understand Orthodontic Supplies's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Orthodontic Supplies

What is the Market Size & CAGR of Orthodontic Supplies market in 2023?

Orthodontic Supplies Industry Analysis

Orthodontic Supplies Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Orthodontic Supplies Market Analysis Report by Region

Europe Orthodontic Supplies Market Report:

Europe's orthodontic supplies market is projected to grow from $1.80 billion in 2023 to $3.62 billion by 2033. This growth is driven by increasing adoption of orthodontic procedures and high demand for cosmetic dental services.Asia Pacific Orthodontic Supplies Market Report:

The Asia Pacific region is poised for substantial growth, with the market size expected to expand from $1.37 billion in 2023 to $2.74 billion by 2033, reflecting a strong CAGR driven by increasing population, urbanization, and healthcare improvements.North America Orthodontic Supplies Market Report:

In North America, the market is anticipated to grow from $2.61 billion in 2023 to $5.22 billion by 2033, bolstered by high consumer spending in dental care and technological advancements in orthodontic treatments.South America Orthodontic Supplies Market Report:

South America is witnessing growth with a market expected to double from $0.40 billion in 2023 to $0.80 billion by 2033. Rising disposable income and growing health awareness contribute to this positive outlook.Middle East & Africa Orthodontic Supplies Market Report:

The Middle East and Africa region is expected to experience growth from $0.62 billion in 2023 to $1.25 billion by 2033. The rising prevalence of dental diseases and increasing investments in dental healthcare facilities are significant growth drivers.Tell us your focus area and get a customized research report.

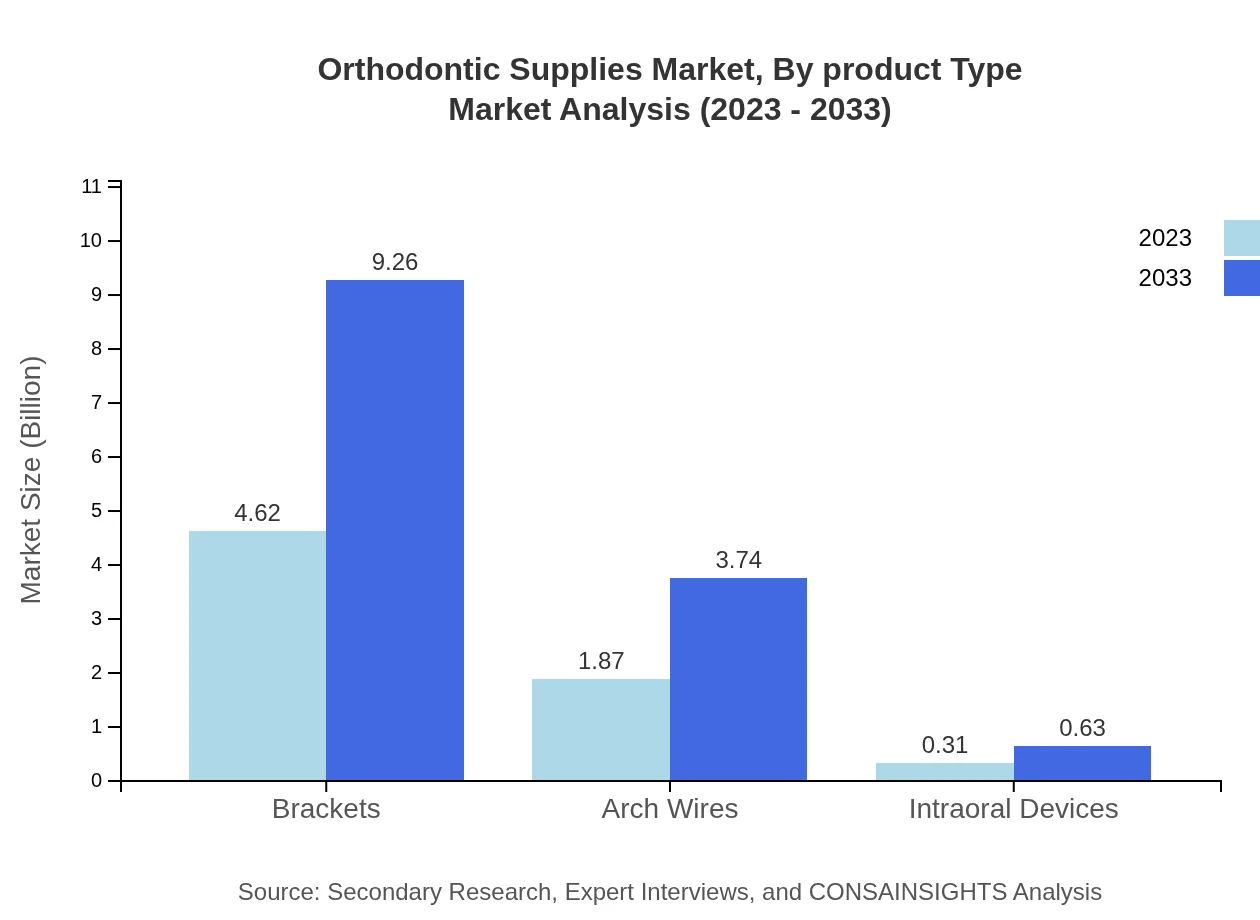

Orthodontic Supplies Market Analysis By Product Type

The product segment reveals that brackets are leading with a market size of $4.62 billion in 2023, projected to reach $9.26 billion by 2033, representing 67.95% of market share. Arch wires are second with $1.87 billion in 2023, growing to $3.74 billion by 2033, holding 27.45%. Intraoral devices are notable but smaller, with a market size of $0.31 billion, projected to grow to $0.63 billion.

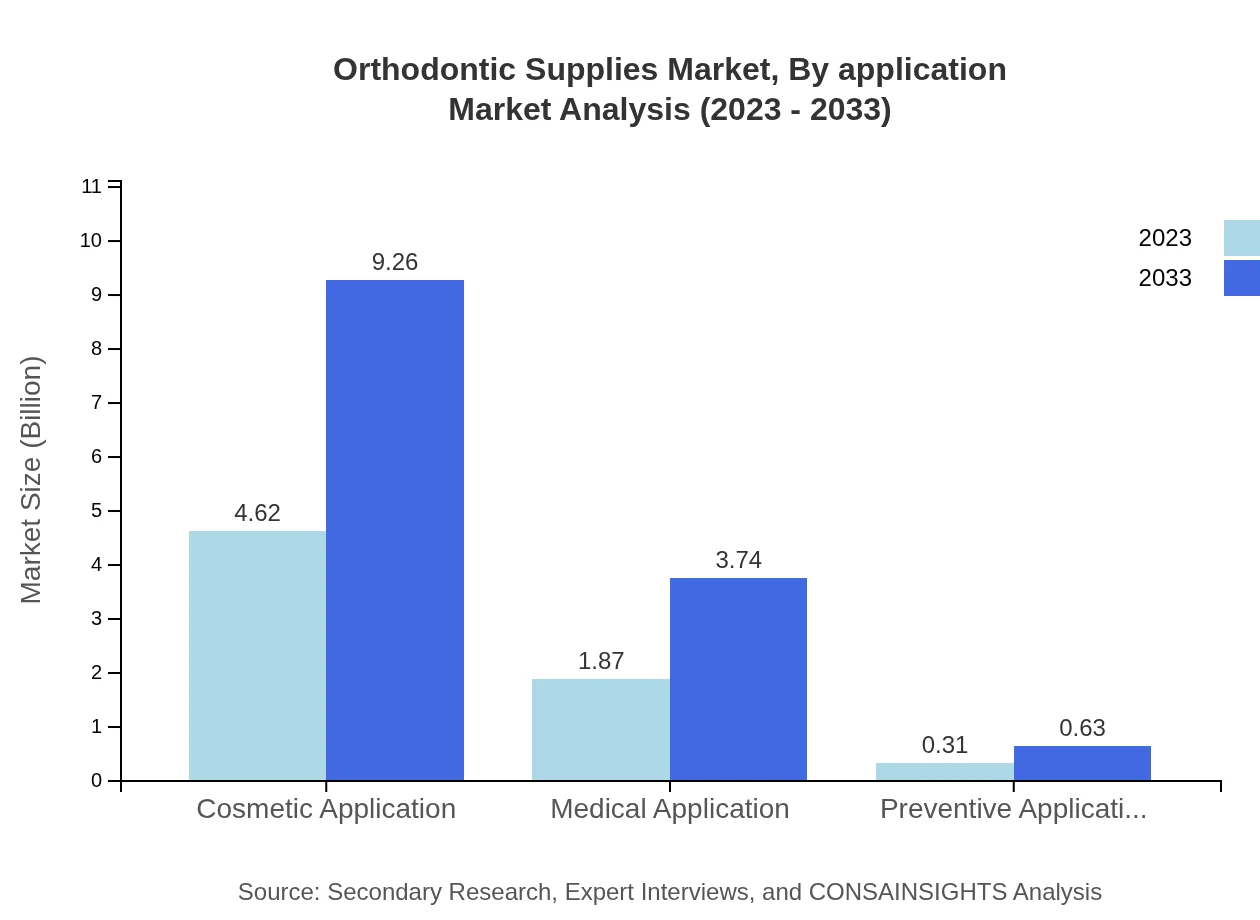

Orthodontic Supplies Market Analysis By Application

In applications, cosmetic use leads with $4.62 billion in 2023, projected growth to $9.26 billion by 2033, occupying 67.95% of the market. Medical applications account for $1.87 billion, anticipated to double to $3.74 billion, holding 27.45%. Preventive applications are smaller, growing from $0.31 billion to $0.63 billion.

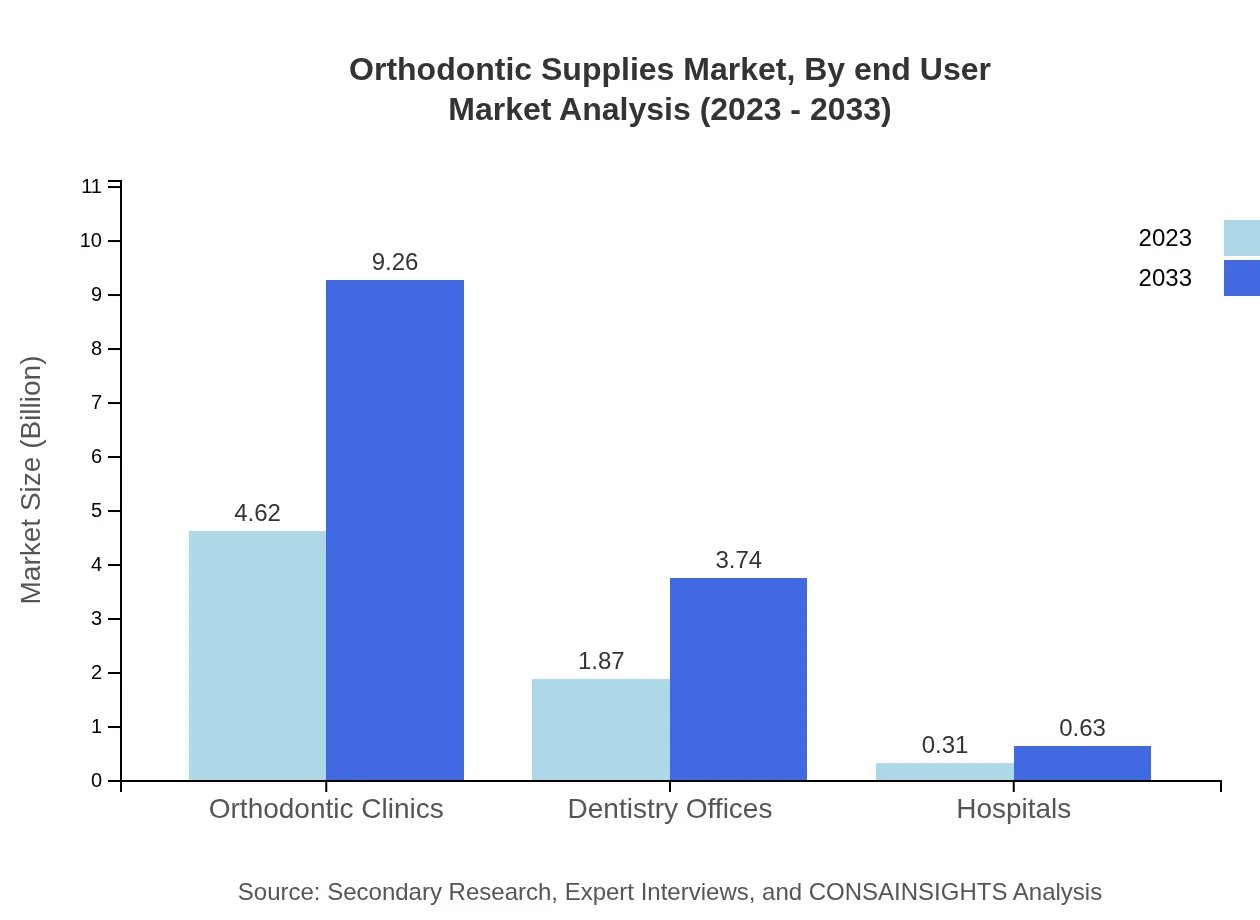

Orthodontic Supplies Market Analysis By End User

The analysis shows orthodontic clinics dominate the end-user segment with $4.62 billion in 2023 and up to $9.26 billion by 2033 at a share of 67.95%. Dentistry offices and hospitals follow, with $1.87 billion and $0.31 billion respectively, growing at a steady rate.

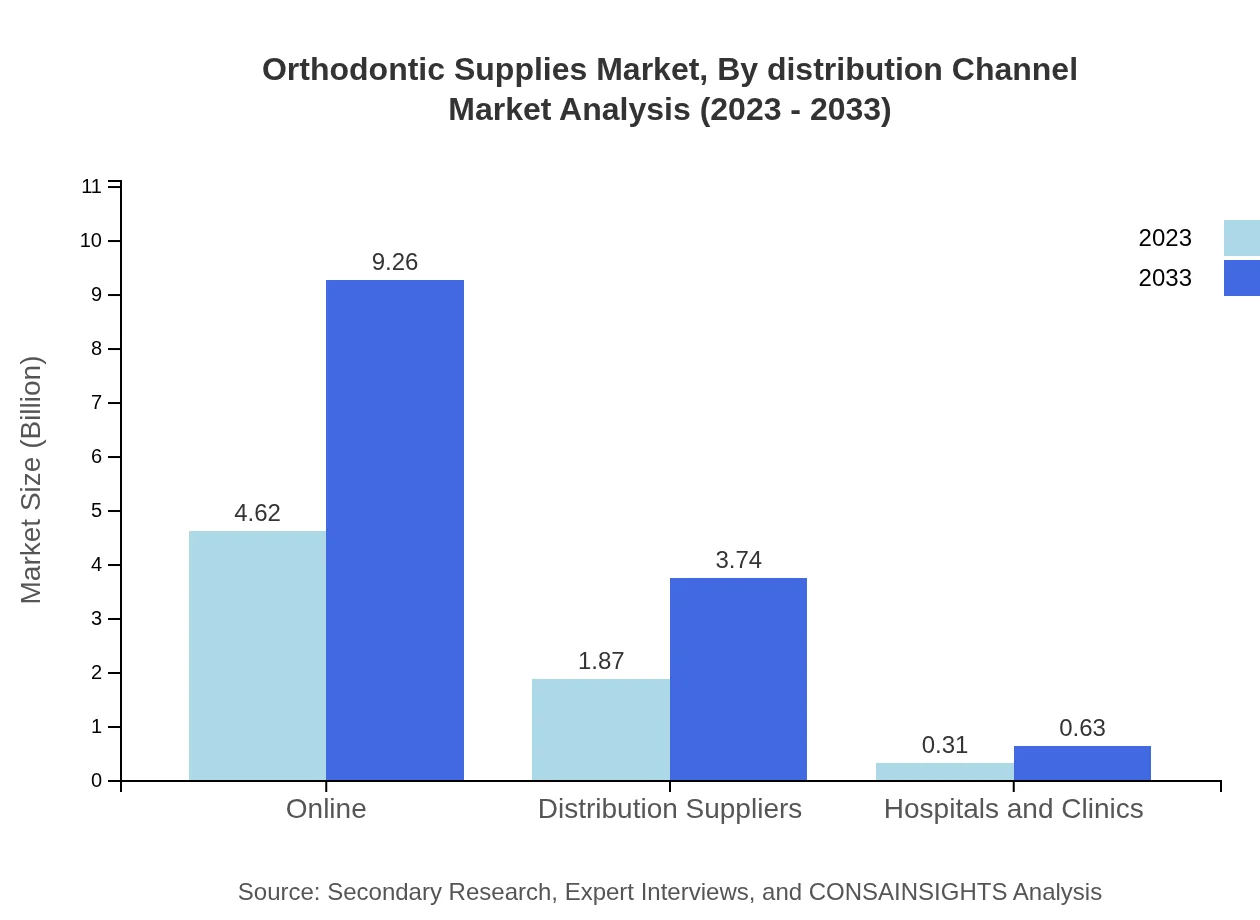

Orthodontic Supplies Market Analysis By Distribution Channel

The distribution channels indicate that online sales are flourishing, expected to grow from $4.62 billion in 2023 to $9.26 billion by 2033, while offline sales through distribution suppliers are on a parallel track from $1.87 billion to $3.74 billion, both holding respective shares of 67.95% and 27.45%.

Orthodontic Supplies Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Orthodontic Supplies Industry

Align Technology, Inc.:

Align Technology is known for its industry-leading Invisalign clear aligners, revolutionizing orthodontic treatment and expanding market access for orthodontic supplies.3M Company:

3M is a diversified technology company manufacturing orthodontic products ranging from brackets to adhesives, known for innovation and reliability in the field.Henry Schein Inc.:

Henry Schein is a global distributor of healthcare products and services, providing a wide array of orthodontic supplies to dental practices worldwide.Dentsply Sirona Inc.:

Dentsply Sirona is a leading manufacturer in the dental market offering comprehensive orthodontic solutions, including advanced imaging and CAD/CAM systems.We're grateful to work with incredible clients.

FAQs

What is the market size of orthodontic supplies?

The global orthodontic supplies market is currently valued at $6.8 billion with a projected CAGR of 7.0% from 2023 to 2033. This indicates a robust growth trajectory as demand for orthodontic products continues to rise.

What are the key market players or companies in the orthodontic supplies industry?

Key players in the orthodontic supplies market include renowned firms like Align Technology, 3M, Dentsply Sirona, Ormco Corporation, and Henry Schein. These companies lead through innovation, quality, and extensive product portfolios.

What are the primary factors driving the growth in the orthodontic supplies industry?

The growth of the orthodontic supplies market is primarily driven by rising dental disorders, increased orthodontic treatment demand, advancements in dental technology, and a growing emphasis on cosmetic dentistry, contributing to an expanding market.

Which region is the fastest Growing in the orthodontic supplies market?

The Asia Pacific region is the fastest-growing in the orthodontic supplies market, projected to grow from $1.37 billion in 2023 to $2.74 billion by 2033, indicating a significant increase in the adoption of orthodontic treatments.

Does ConsaInsights provide customized market report data for the orthodontic supplies industry?

Yes, ConsaInsights offers customized market report data for the orthodontic supplies industry, tailored to meet specific client needs, covering various parameters such as market size, trends, and competitive analysis.

What deliverables can I expect from this orthodontic supplies market research project?

Deliverables from the orthodontic supplies market research project include comprehensive reports detailing market size, trends, regional analysis, competitive insights, and forecasts that aid strategic decision-making.

What are the market trends of orthodontic supplies?

Current trends in the orthodontic supplies market include increasing demand for clear aligners, advancements in 3D printing technologies, a rise in DIY orthodontics, and heightened consumer awareness about oral health, shaping the industry’s future.