Orthopedic Biomaterials Market Report

Published Date: 31 January 2026 | Report Code: orthopedic-biomaterials

Orthopedic Biomaterials Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Orthopedic Biomaterials market, covering insights on market trends, growth drivers, and forecasts from 2023 to 2033. It offers detailed segmentation and regional analyses to aid stakeholders in making informed decisions.

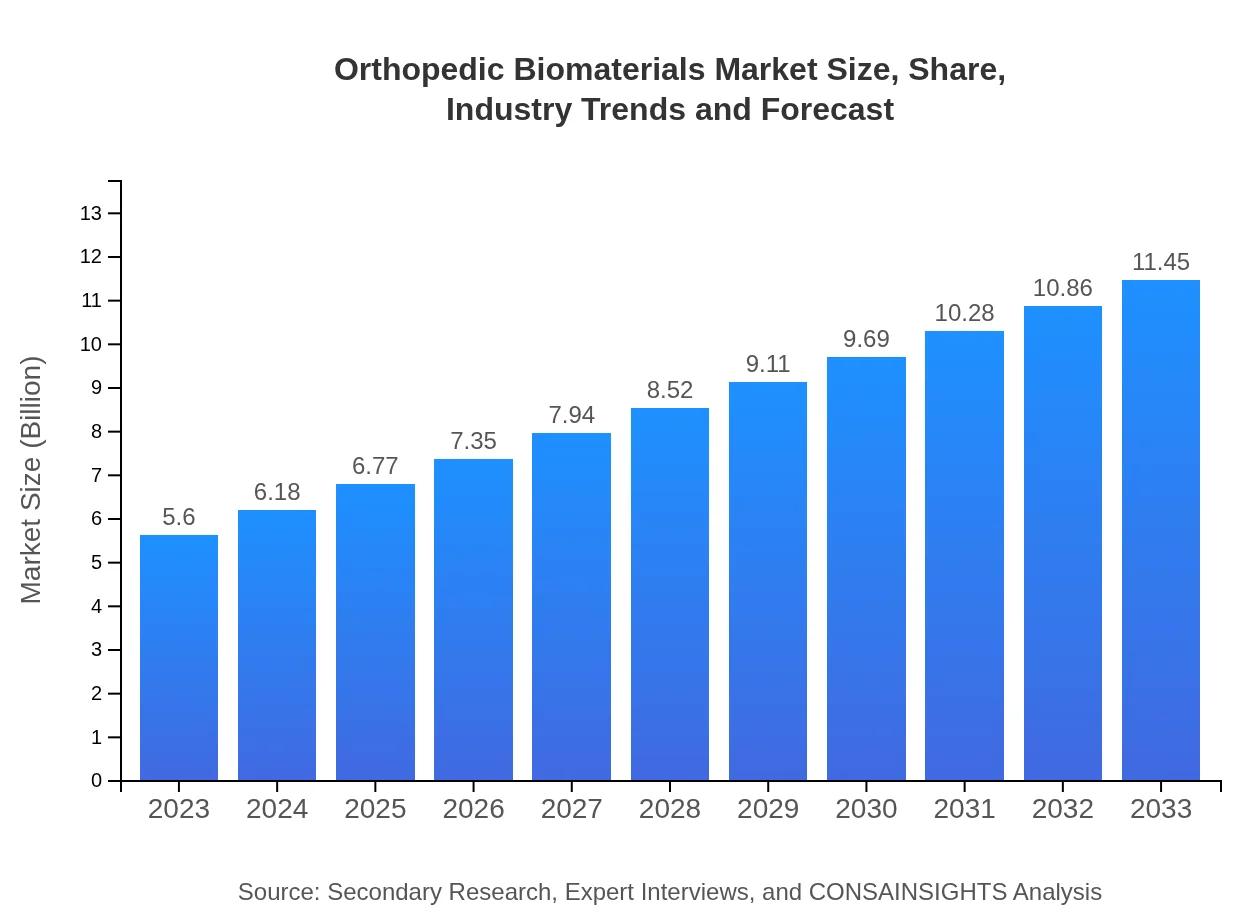

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $11.45 Billion |

| Top Companies | Zimmer Biomet, Smith & Nephew, Medtronic , Stryker Corporation, DePuy Synthes |

| Last Modified Date | 31 January 2026 |

Orthopedic Biomaterials Market Overview

Customize Orthopedic Biomaterials Market Report market research report

- ✔ Get in-depth analysis of Orthopedic Biomaterials market size, growth, and forecasts.

- ✔ Understand Orthopedic Biomaterials's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Orthopedic Biomaterials

What is the Market Size & CAGR of Orthopedic Biomaterials market in 2023?

Orthopedic Biomaterials Industry Analysis

Orthopedic Biomaterials Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Orthopedic Biomaterials Market Analysis Report by Region

Europe Orthopedic Biomaterials Market Report:

The European market is expected to grow from USD 1.51 billion in 2023 to USD 3.09 billion by 2033, driven by advancements in technology, a strong emphasis on research development, and increasing adoption of innovative surgical techniques.Asia Pacific Orthopedic Biomaterials Market Report:

The Asia Pacific region is witnessing substantial growth, with the market size expected to increase from USD 1.16 billion in 2023 to USD 2.38 billion by 2033. Factors such as rising healthcare expenditure, demographic shifts towards an aging population, and increased surgical procedures are propelling market growth.North America Orthopedic Biomaterials Market Report:

North America holds a significant share of the Orthopedic Biomaterials market, with a market value projected to reach USD 3.93 billion by 2033, up from USD 1.92 billion in 2023. The presence of advanced healthcare infrastructure and major market players, along with high healthcare spending, are critical factors contributing to its dominance.South America Orthopedic Biomaterials Market Report:

In South America, the Orthopedic Biomaterials market is projected to grow from USD 0.31 billion in 2023 to USD 0.64 billion by 2033. The demand for better healthcare outcomes and rising awareness regarding orthopedic treatments are the key drivers in this region.Middle East & Africa Orthopedic Biomaterials Market Report:

The Middle East and Africa market is set to expand from USD 0.69 billion in 2023 to USD 1.42 billion by 2033, fueled by improving healthcare infrastructure and a growing focus on orthopedic care in emerging economies.Tell us your focus area and get a customized research report.

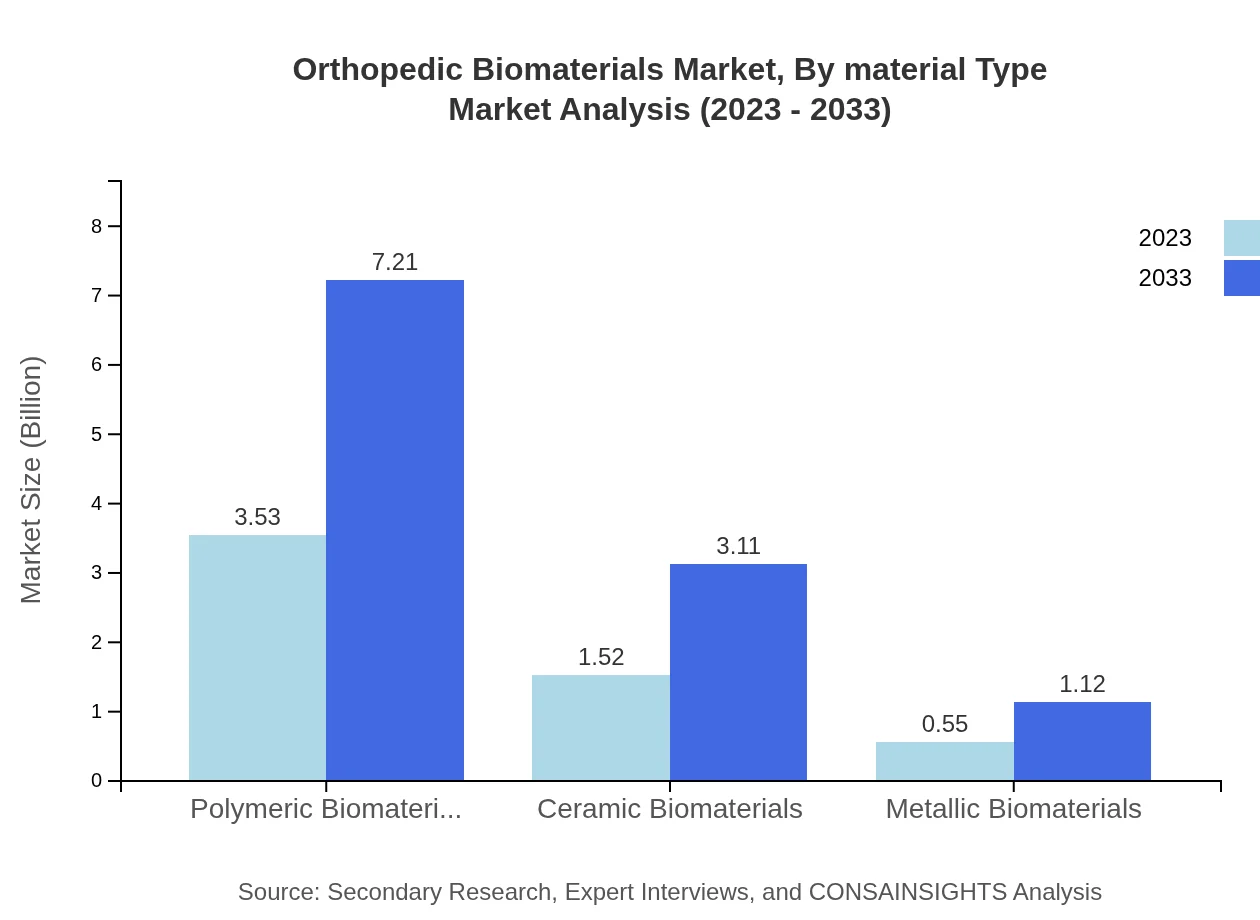

Orthopedic Biomaterials Market Analysis By Material Type

The market segments based on material type are as follows: Polymeric Biomaterials (USD 3.53 billion in 2023, projected to USD 7.21 billion by 2033, 63% share); Ceramic Biomaterials (USD 1.52 billion in 2023, expected to reach USD 3.11 billion by 2033, 27.2% share); and Metallic Biomaterials (USD 0.55 billion in 2023, increasing to USD 1.12 billion by 2033, 9.8% share). Polymeric materials dominate due to their flexibility and biocompatibility.

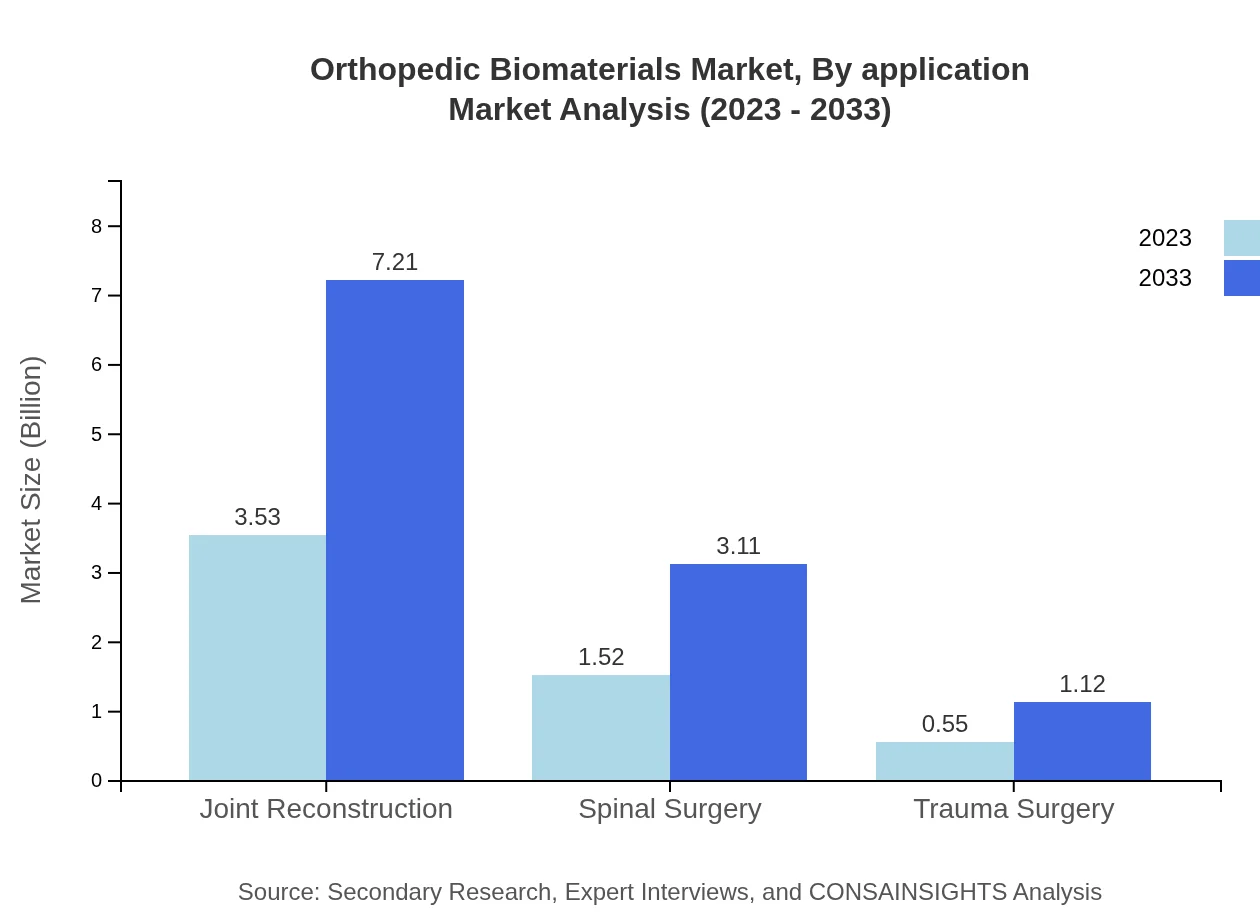

Orthopedic Biomaterials Market Analysis By Application

Key applications include Joint Reconstruction (USD 3.53 billion in 2023, aiming for USD 7.21 billion by 2033, 63% share), Spinal Surgery (USD 1.52 billion in 2023, projected to reach USD 3.11 billion by 2033, 27.2% share), and Trauma Surgery (USD 0.55 billion in 2023, anticipated to grow to USD 1.12 billion by 2033, 9.8% share). Joint Reconstruction remains the leading application due to high surgery rates globally.

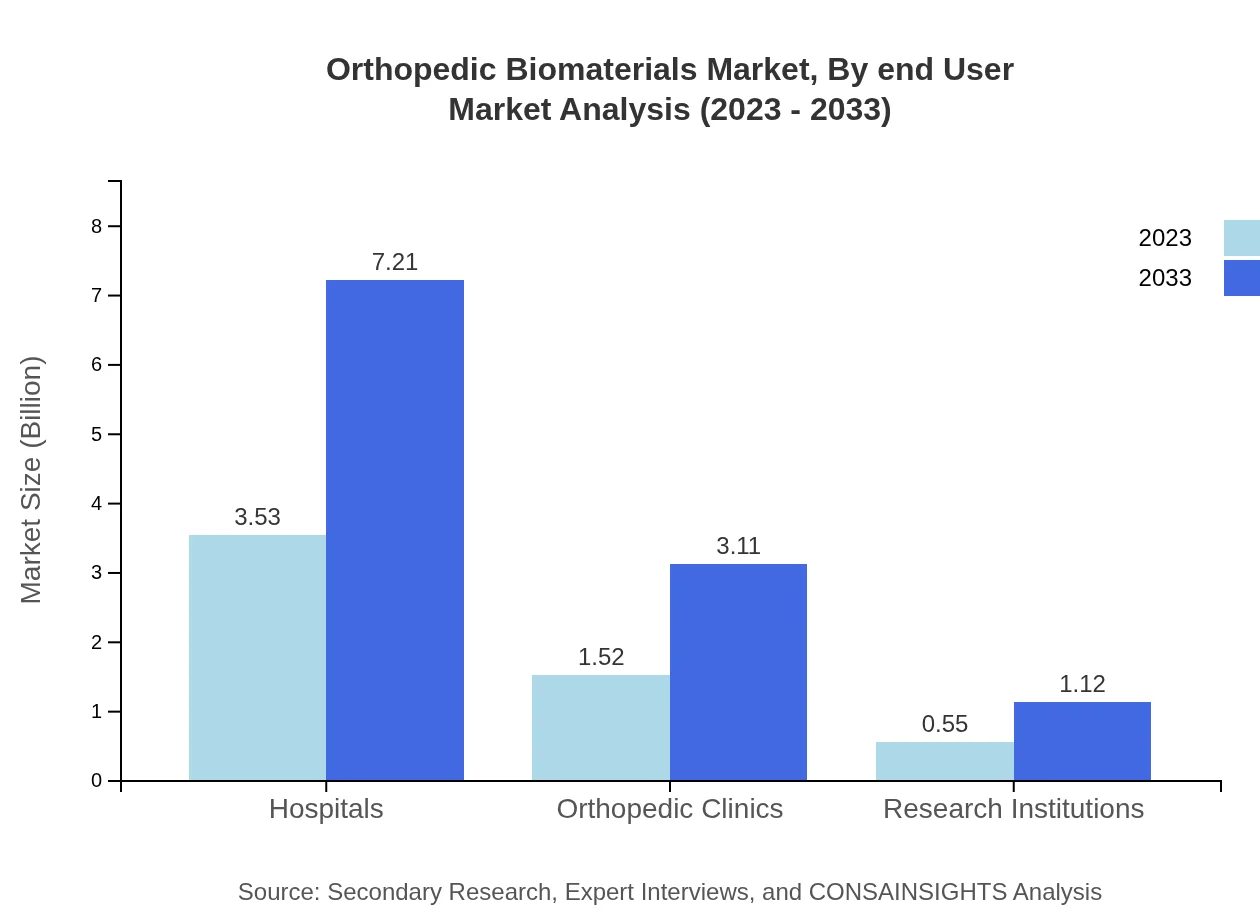

Orthopedic Biomaterials Market Analysis By End User

The market categories based on end-users include Hospitals (USD 3.53 billion in 2023, expected growth to USD 7.21 billion by 2033, maintaining a 63% share), Orthopedic Clinics (USD 1.52 billion in 2023, projected to reach USD 3.11 billion by 2033, with a 27.2% share), and Research Institutions (USD 0.55 billion in 2023, rising to USD 1.12 billion by 2033, 9.8% share). Hospitals dominate as primary settings for orthopedic procedures.

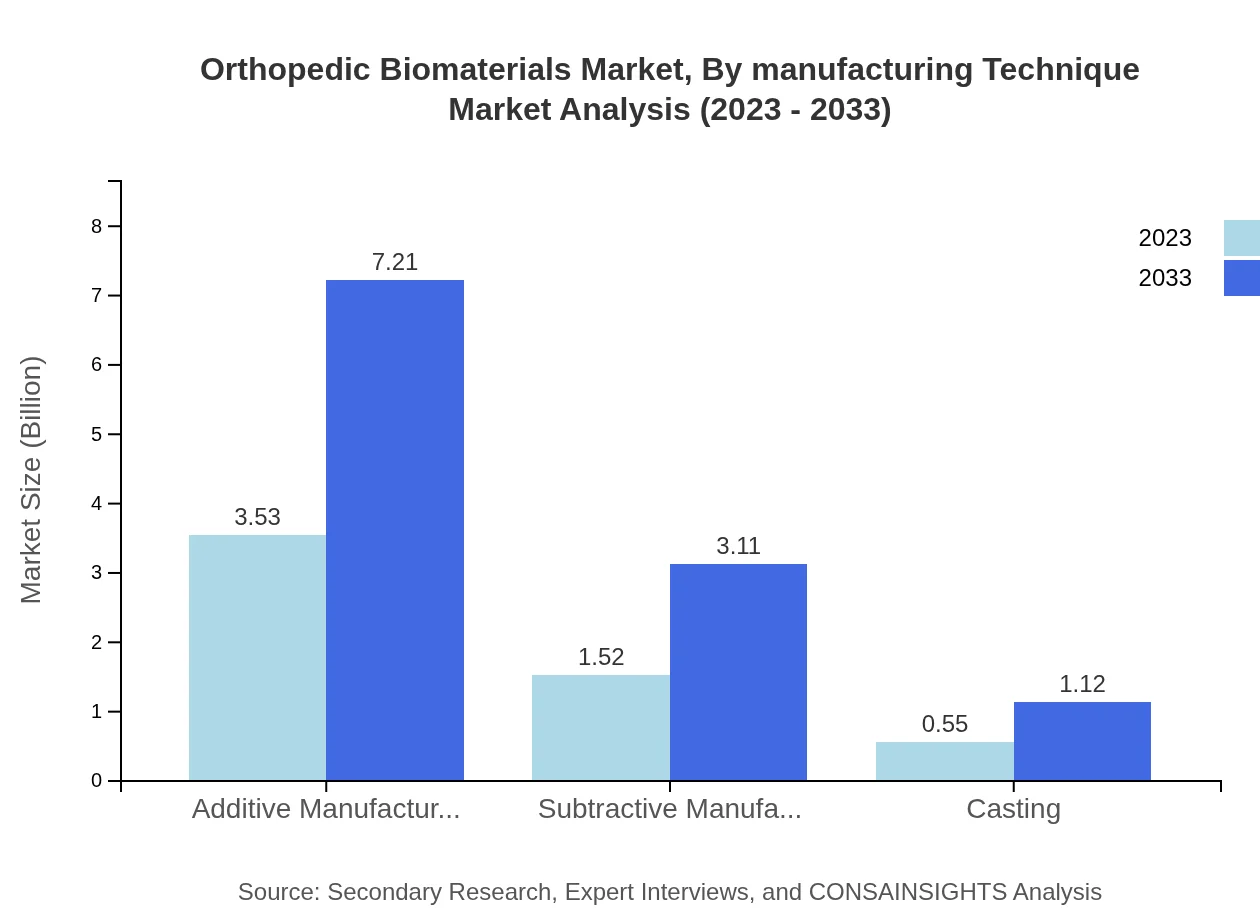

Orthopedic Biomaterials Market Analysis By Manufacturing Technique

Manufacturing techniques comprise Additive Manufacturing (USD 3.53 billion in 2023, projected to grow to USD 7.21 billion by 2033, holding 63% share), Subtractive Manufacturing (USD 1.52 billion in 2023, expected to reach USD 3.11 billion by 2033, 27.2% share), and Casting (USD 0.55 billion in 2023, expected to grow to USD 1.12 billion by 2033, 9.8% share). Additive manufacturing is leading due to advancements in rapid prototyping and customization.

Orthopedic Biomaterials Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Orthopedic Biomaterials Industry

Zimmer Biomet:

A leader in musculoskeletal healthcare, Zimmer Biomet develops innovative orthopedic biomaterials and implants focusing on enhancing patient outcomes.Smith & Nephew:

Smith & Nephew specializes in advanced wound management and minimally invasive surgery, providing cutting-edge orthopedic biomaterials.Medtronic :

Medtronic is instrumental in the spinal and orthopedic markets, offering innovative biomaterials that improve surgical efficacy.Stryker Corporation:

A prominent player in orthopedic technology, Stryker focuses on precision and quality across its range of biomaterials and orthopedic products.DePuy Synthes:

A subsidiary of Johnson & Johnson, DePuy Synthes leads in developing advanced orthopedic solutions including biomaterials for various applications.We're grateful to work with incredible clients.

FAQs

What is the market size of orthopedic Biomaterials?

The orthopedic biomaterials market is projected to reach $5.6 billion by 2033, growing at a CAGR of 7.2% from 2023. This growth is driven by increasing demand for advanced materials in orthopedic surgeries and innovations in biomaterials technology.

What are the key market players or companies in the orthopedic Biomaterials industry?

Key players in the orthopedic biomaterials market include companies specializing in innovative biomaterials and surgical solutions. Major companies drive advancements to meet the rising demand for joint reconstruction and spinal surgery, positioning them as industry leaders.

What are the primary factors driving the growth in the orthopedic Biomaterials industry?

Growth in the orthopedic biomaterials market is mainly driven by an aging population that necessitates joint surgeries, advances in biomaterials research, and an increase in sports-related injuries. Technological innovations also contribute to enhanced surgical outcomes.

Which region is the fastest Growing in the orthopedic Biomaterials?

The fastest-growing region in the orthopedic biomaterials market is Europe, with a projected growth from $1.51 billion in 2023 to $3.09 billion in 2033. Asia Pacific also shows significant growth potential, growing from $1.16 billion to $2.38 billion.

Does ConsaInsights provide customized market report data for the orthopedic Biomaterials industry?

Yes, ConsaInsights offers customized market reports for the orthopedic biomaterials industry. Businesses and researchers can request tailored insights and data to meet specific needs and facilitate strategic decision-making.

What deliverables can I expect from this orthopedic Biomaterials market research project?

Deliverables from the orthopedic biomaterials market research project include comprehensive market analysis, segmented data (by region and type), competitive landscape overview, and insights into emerging trends, ensuring in-depth industry understanding.

What are the market trends of orthopedic Biomaterials?

Current trends in the orthopedic biomaterials market highlight an increase in additive manufacturing techniques, a focus on biodegradable materials, and growth in minimally invasive surgical procedures. These trends signal an evolving landscape in orthopedic healthcare solutions.