Orthopedic Bone Cement Market Report

Published Date: 31 January 2026 | Report Code: orthopedic-bone-cement

Orthopedic Bone Cement Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Orthopedic Bone Cement market, including insights on market size, trends, segmentation, and regional analysis, covering the forecast period from 2023 to 2033.

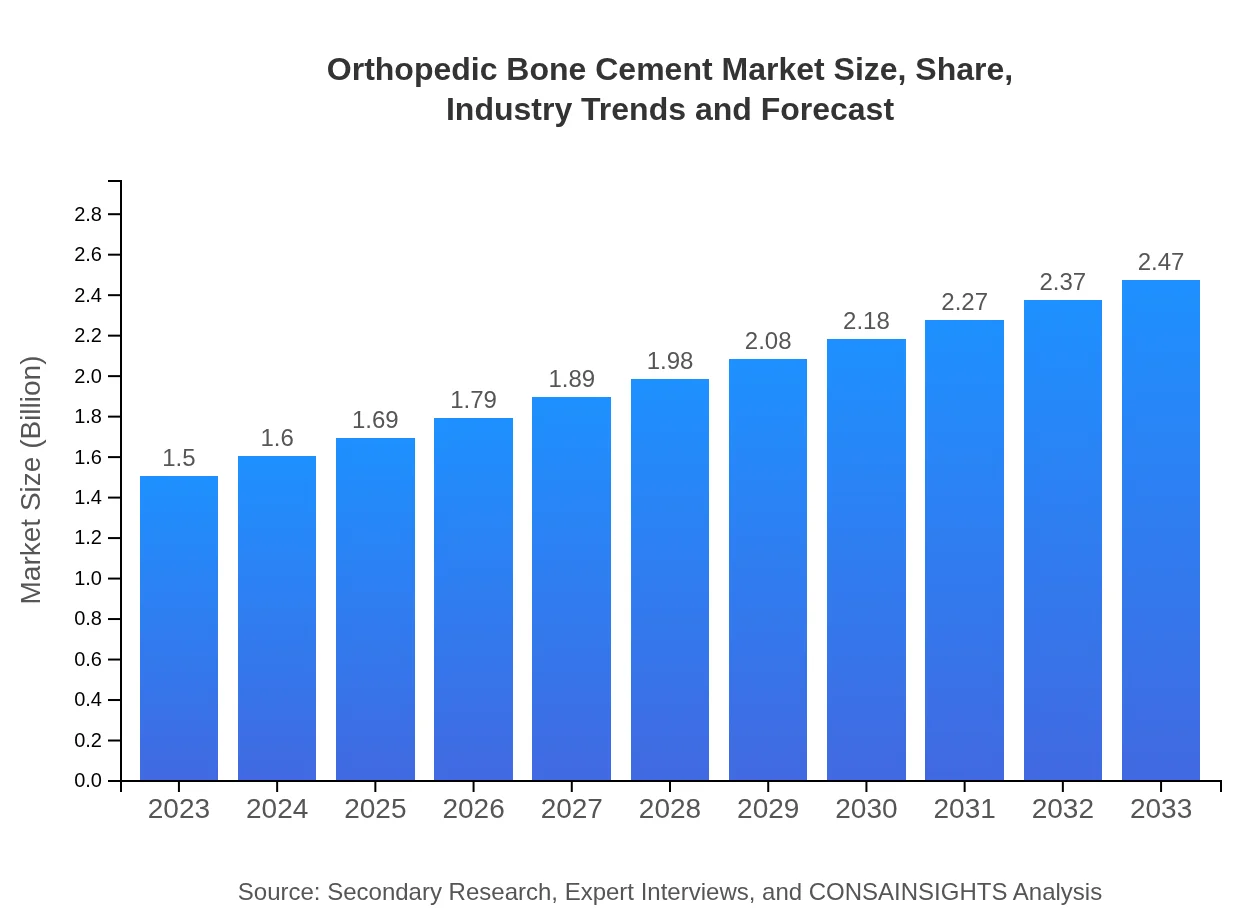

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $2.47 Billion |

| Top Companies | Stryker Corporation, Zimmer Biomet, DePuy Synthes, Medtronic , Smith & Nephew |

| Last Modified Date | 31 January 2026 |

Orthopedic Bone Cement Market Overview

Customize Orthopedic Bone Cement Market Report market research report

- ✔ Get in-depth analysis of Orthopedic Bone Cement market size, growth, and forecasts.

- ✔ Understand Orthopedic Bone Cement's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Orthopedic Bone Cement

What is the Market Size & CAGR of the Orthopedic Bone Cement market in 2033?

Orthopedic Bone Cement Industry Analysis

Orthopedic Bone Cement Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Orthopedic Bone Cement Market Analysis Report by Region

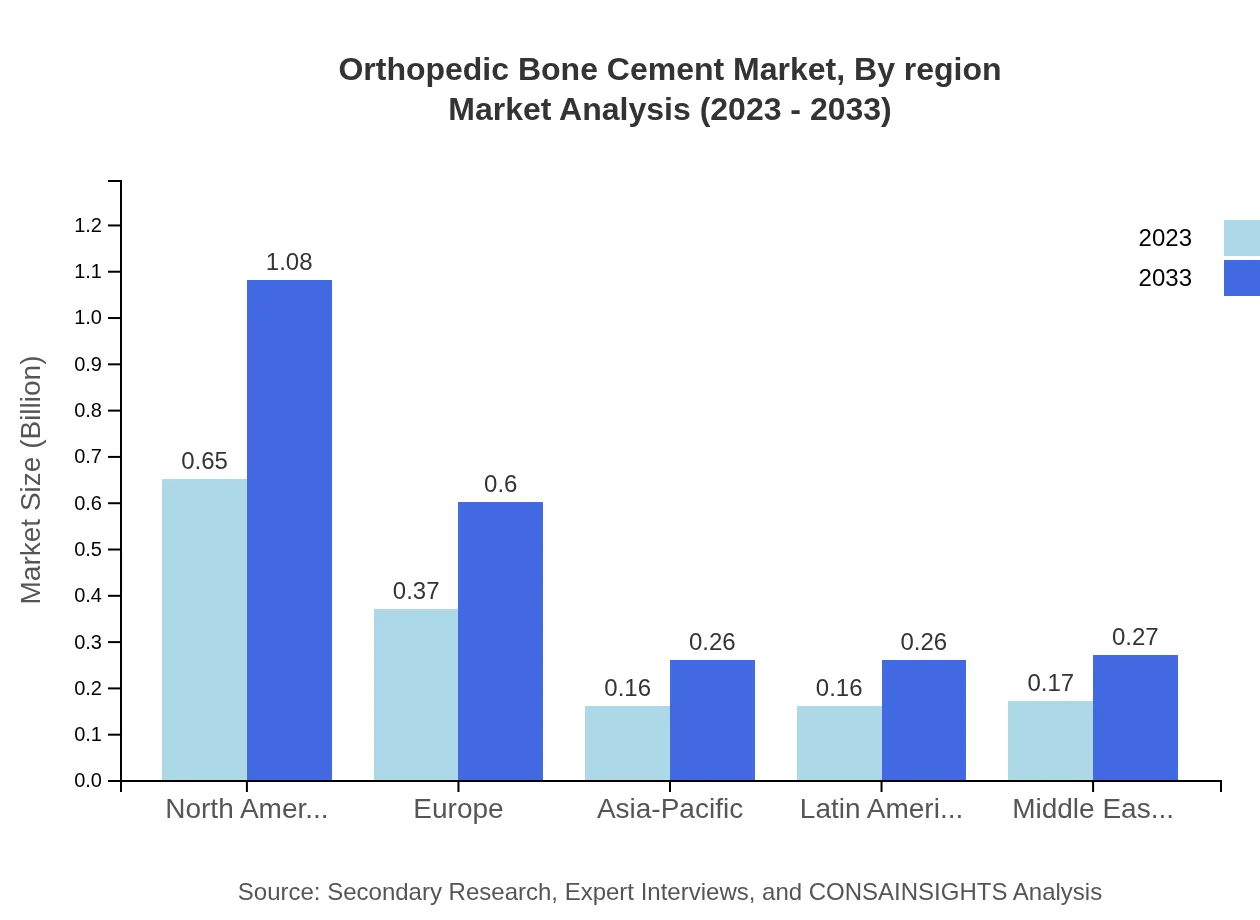

Europe Orthopedic Bone Cement Market Report:

In Europe, the market for orthopedic bone cement is projected to rise from $0.50 billion in 2023 to $0.82 billion by 2033. This growth can be attributed to a well-developed healthcare system, an increasing number of surgical procedures, and a demand for safer, more reliable products. European countries are also witnessing significant advancements in bone cement technology, which supports market growth.Asia Pacific Orthopedic Bone Cement Market Report:

The Asia-Pacific region is expected to witness a significant increase in the Orthopedic Bone Cement market, projected to grow from $0.29 billion in 2023 to $0.47 billion in 2033. Factors such as an increasing elderly population, rising healthcare expenditures, and improving healthcare infrastructure drive this growth. Additionally, growing awareness regarding orthopedic surgeries and advancements in medical technology in this region contribute to market expansion.North America Orthopedic Bone Cement Market Report:

The North American market is expected to dominate the Orthopedic Bone Cement industry, growing from $0.48 billion in 2023 to $0.80 billion by 2033. The region's established healthcare infrastructure, advanced surgical procedures, and high adoption rates of orthopedic advancements contribute to this growth. Moreover, a growing geriatric population and increased investment in healthcare technologies reinforce North America's leading position.South America Orthopedic Bone Cement Market Report:

In South America, the orthopedic bone cement market is anticipated to grow from $0.13 billion in 2023 to $0.22 billion by 2033. The growth may be attributed to the rising prevalence of orthopedic disorders in the region and increased efforts by governments and healthcare organizations to improve orthopedic care. Emerging markets within South America are expected to witness a surge in surgeries, thus boosting demand for bone cement products.Middle East & Africa Orthopedic Bone Cement Market Report:

The Middle East and Africa region are expected to see growth from $0.10 billion to $0.16 billion between 2023 and 2033. The increase can be fueled by expanding healthcare infrastructure and increasing adoption of advanced orthopedic solutions. Furthermore, regional governments are making substantial investments in healthcare, translating into improved surgical facilities and availability of orthopedic products.Tell us your focus area and get a customized research report.

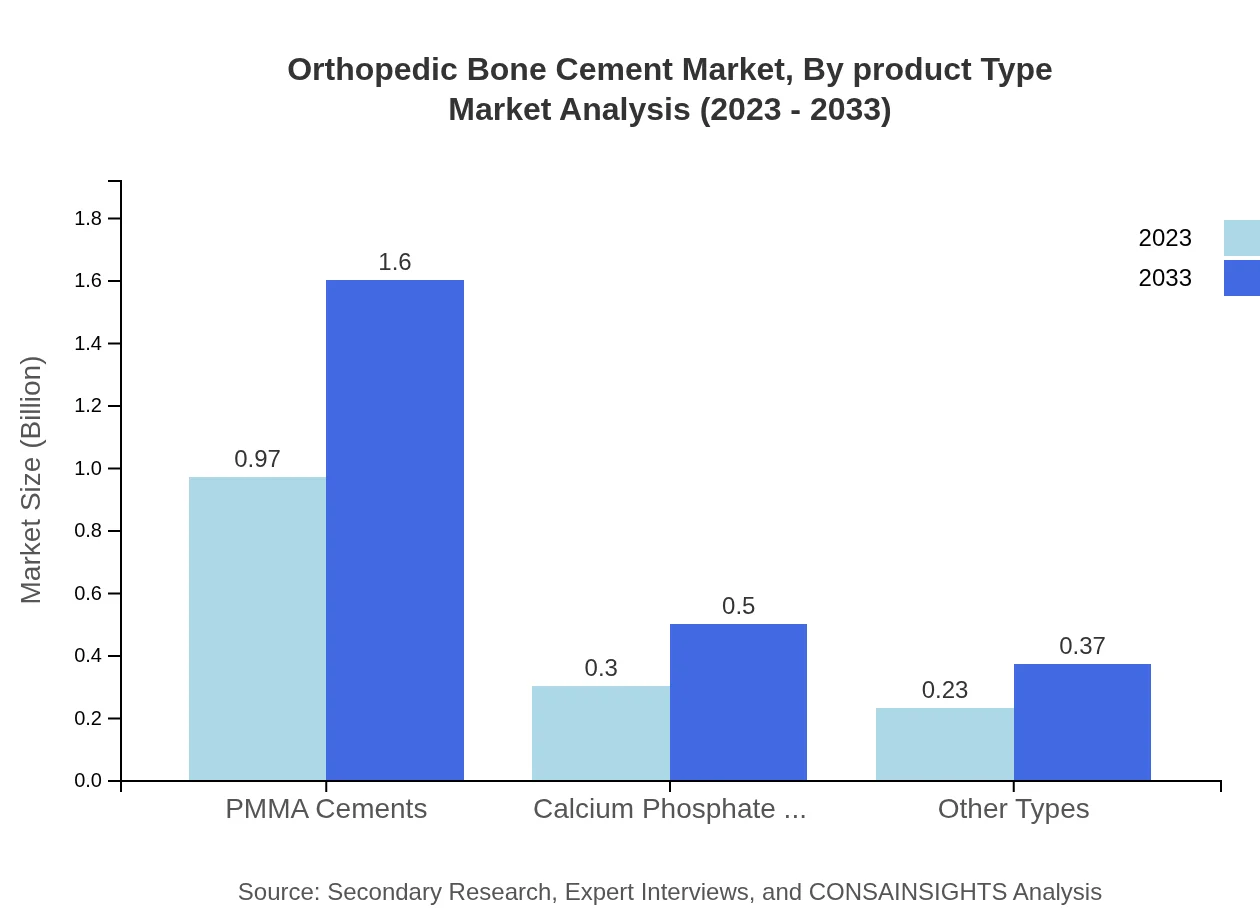

Orthopedic Bone Cement Market Analysis By Product Type

The product segmentation of the Orthopedic Bone Cement market includes PMMA cements, calcium phosphate cements, and other classifications. PMMA cements represent the largest segment due to their extensive use in joint replacement surgeries, accounting for approximately 64.85% of the market in 2023. Calcium phosphate cements are gaining traction, particularly in applications involving osteoconductive properties and bioactivity.

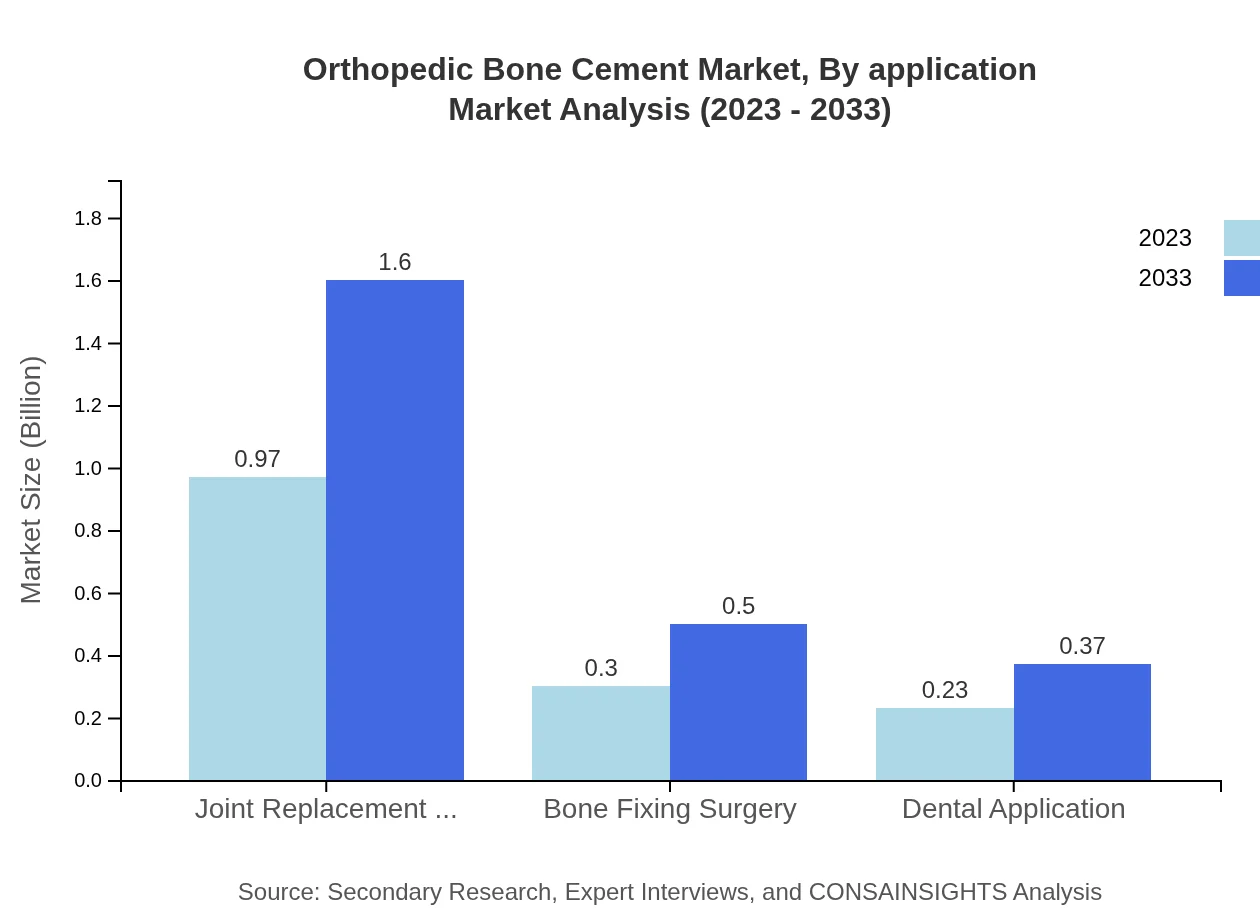

Orthopedic Bone Cement Market Analysis By Application

Applications of orthopedic bone cement comprise joint replacement surgery, bone fixing surgery, and dental applications. Joint replacement surgery dominates the application segment, holding a market share of 64.85% in 2023 due to the high frequency of procedures performed. As the demand for joint replacements grows, so does the requirement for reliable bone cement solutions.

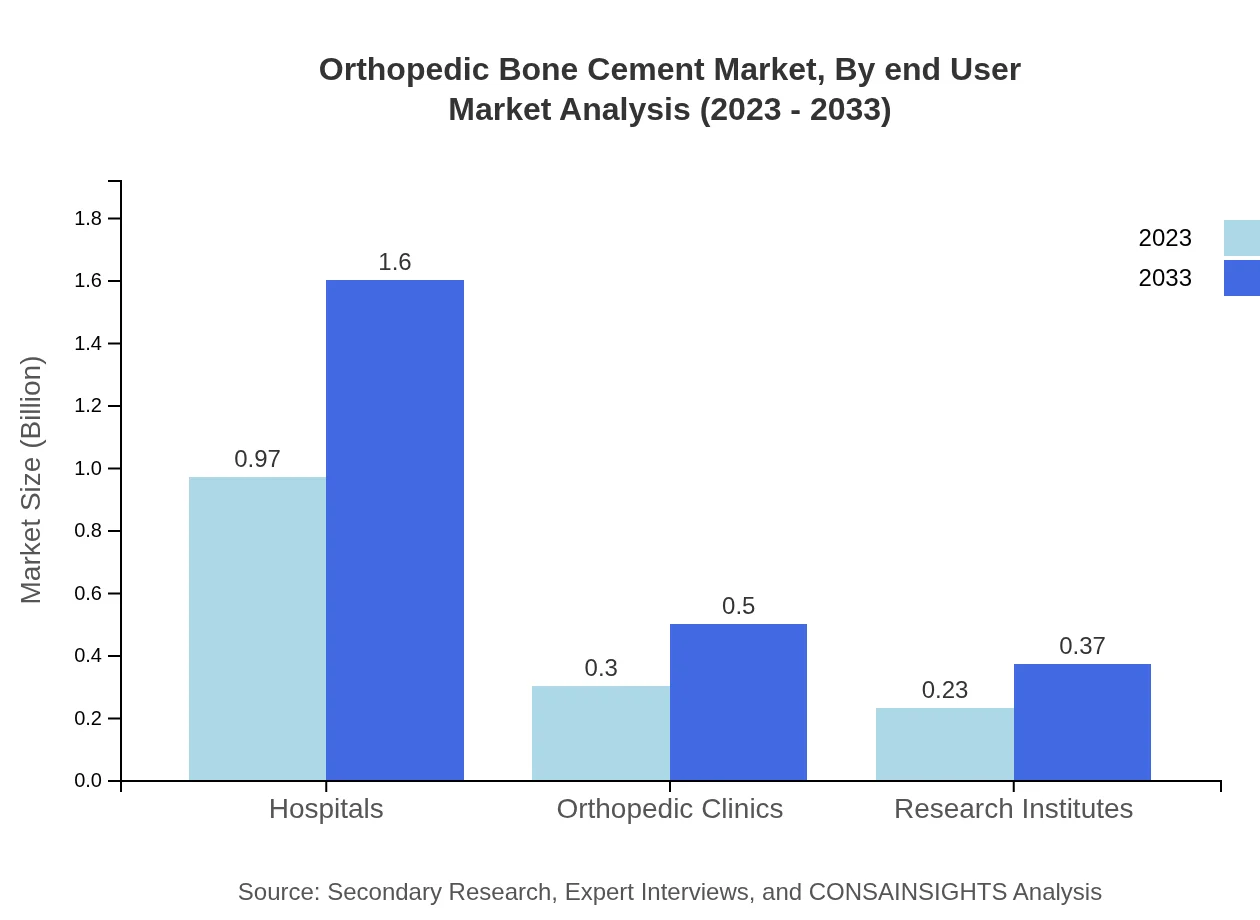

Orthopedic Bone Cement Market Analysis By End User

The end-user segmentation highlights hospitals, orthopedic clinics, and research institutes. Hospitals account for the majority share, approximately 64.85% in 2023, as they perform a significant volume of orthopedic surgeries. Orthopedic clinics follow closely, servicing outpatient needs, while research institutes contribute to product development and innovation.

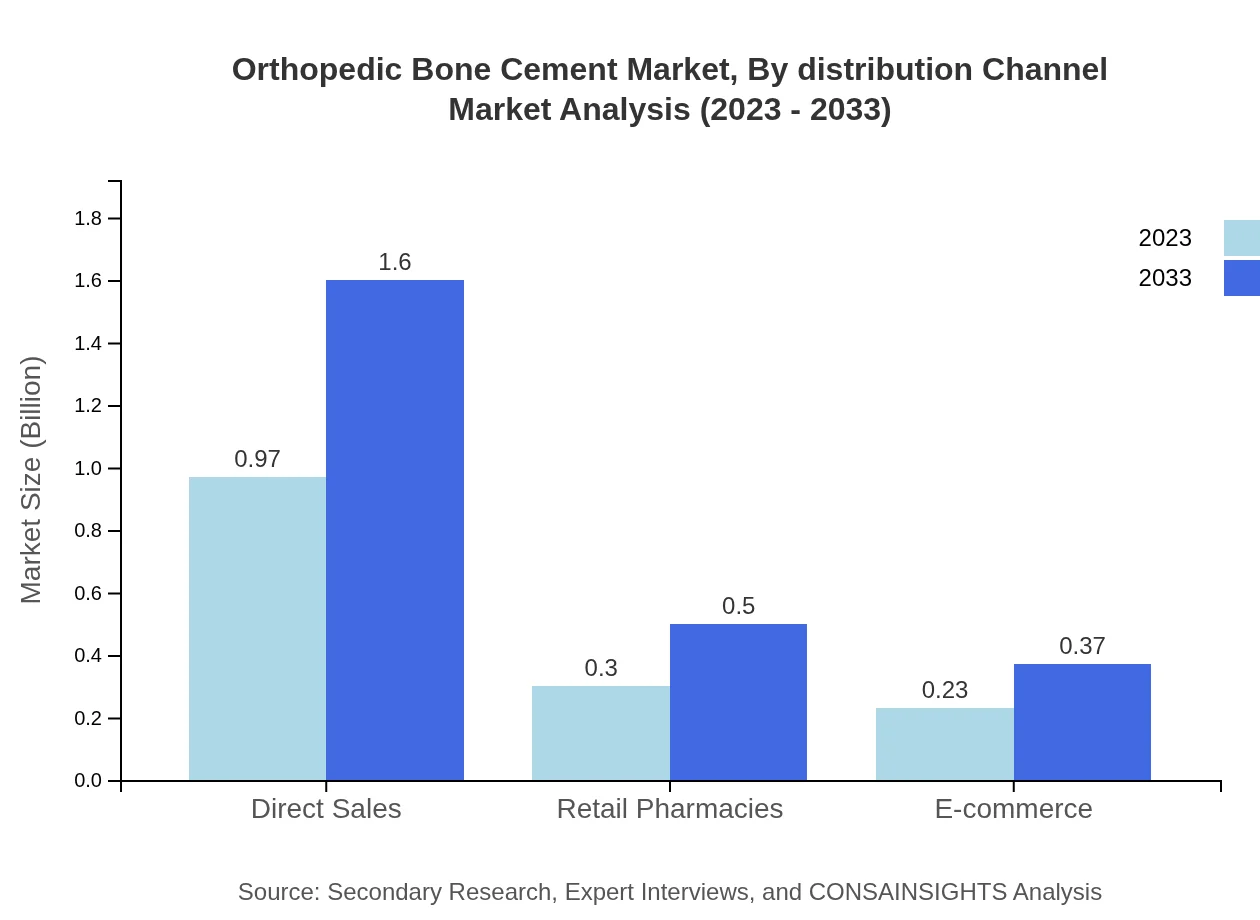

Orthopedic Bone Cement Market Analysis By Distribution Channel

Distribution channels for orthopedic bone cement include direct sales, retail pharmacies, and e-commerce. Direct sales dominate this segment at 64.85% in 2023 due to manufacturers' relationships with hospitals. E-commerce is increasingly gaining traction as it offers convenience and wider reach for customers seeking orthopedic solutions.

Orthopedic Bone Cement Market Analysis By Region

Detailed regional analysis illustrates the varying market dynamics across North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Each region exhibits unique growth patterns and opportunities driven by demographic factors, healthcare infrastructure development, and technological innovations.

Orthopedic Bone Cement Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Orthopedic Bone Cement Industry

Stryker Corporation:

Stryker Corporation specializes in medical devices and equipment, known for developing innovative orthopedic bone cement solutions that enhance surgical outcomes.Zimmer Biomet:

Zimmer Biomet is a leader in orthopedic instruments and implants, providing a range of advanced bone cements tailored for joint replacement and fixation procedures.DePuy Synthes:

Part of Johnson & Johnson, DePuy Synthes focuses on orthopedic and neuro products, offering reliable bone cement products that are widely used in surgeries.Medtronic :

Medtronic is a global healthcare solutions company, making significant advancements in orthopedic technology, including bone cements that improve patient recovery.Smith & Nephew:

Smith & Nephew specializes in advanced wound management and orthopedic products, offering innovative bone cement solutions for various surgical needs.We're grateful to work with incredible clients.

FAQs

What is the market size of orthopedic Bone Cement?

The orthopedic bone cement market size was valued at approximately $1.5 billion in 2023, with an anticipated compound annual growth rate (CAGR) of 5% projected through 2033. This growth is fueled by rising orthopedic procedures and advancements in cement formulations.

What are the key market players or companies in the orthopedic Bone Cement industry?

Key players in the orthopedic bone cement market include Stryker Corporation, DePuy Synthes, Zimmer Biomet, and B. Braun Melsungen AG. These companies dominate the market through innovation, extensive product portfolios, and focused marketing strategies.

What are the primary factors driving the growth in the orthopedic Bone Cement industry?

Growth in the orthopedic bone cement market is driven by an increasing aging population, rising instances of orthopedic surgeries, advancements in minimally invasive techniques, and the development of new products that enhance procedural outcomes.

Which region is the fastest Growing in the orthopedic Bone Cement?

The Asia-Pacific region is the fastest-growing market for orthopedic bone cement, projected to grow from $0.29 billion in 2023 to $0.47 billion by 2033. This growth is attributed to increasing healthcare expenditures and rising rates of orthopedic procedures.

Does ConsaInsights provide customized market report data for the orthopedic Bone Cement industry?

Yes, ConsaInsights offers customized market research reports tailored to specific client needs within the orthopedic bone cement industry. These reports can provide insights into niche markets, competitive landscapes, and unique consumer trends.

What deliverables can I expect from this orthopedic Bone Cement market research project?

From the orthopedic bone cement market research project, you can expect comprehensive reports detailing market dynamics, competitive landscape, segmentation analysis, regional insights, and forecasts over a specified period in formats suited to your needs.

What are the market trends of orthopedic Bone Cement?

Current trends in the orthopedic bone cement market include increasing adoption of PMMA cements, growth in e-commerce channels for distribution, and a rising focus on bio-compatible materials to enhance patient outcomes during orthopedic procedures.