Orthopedic Consumables Market Report

Published Date: 31 January 2026 | Report Code: orthopedic-consumables

Orthopedic Consumables Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the orthopedic consumables market, including detailed insights into market size, growth projections, regional trends, and key players. The forecast period extends from 2023 to 2033, presenting a thorough examination of current and future market conditions.

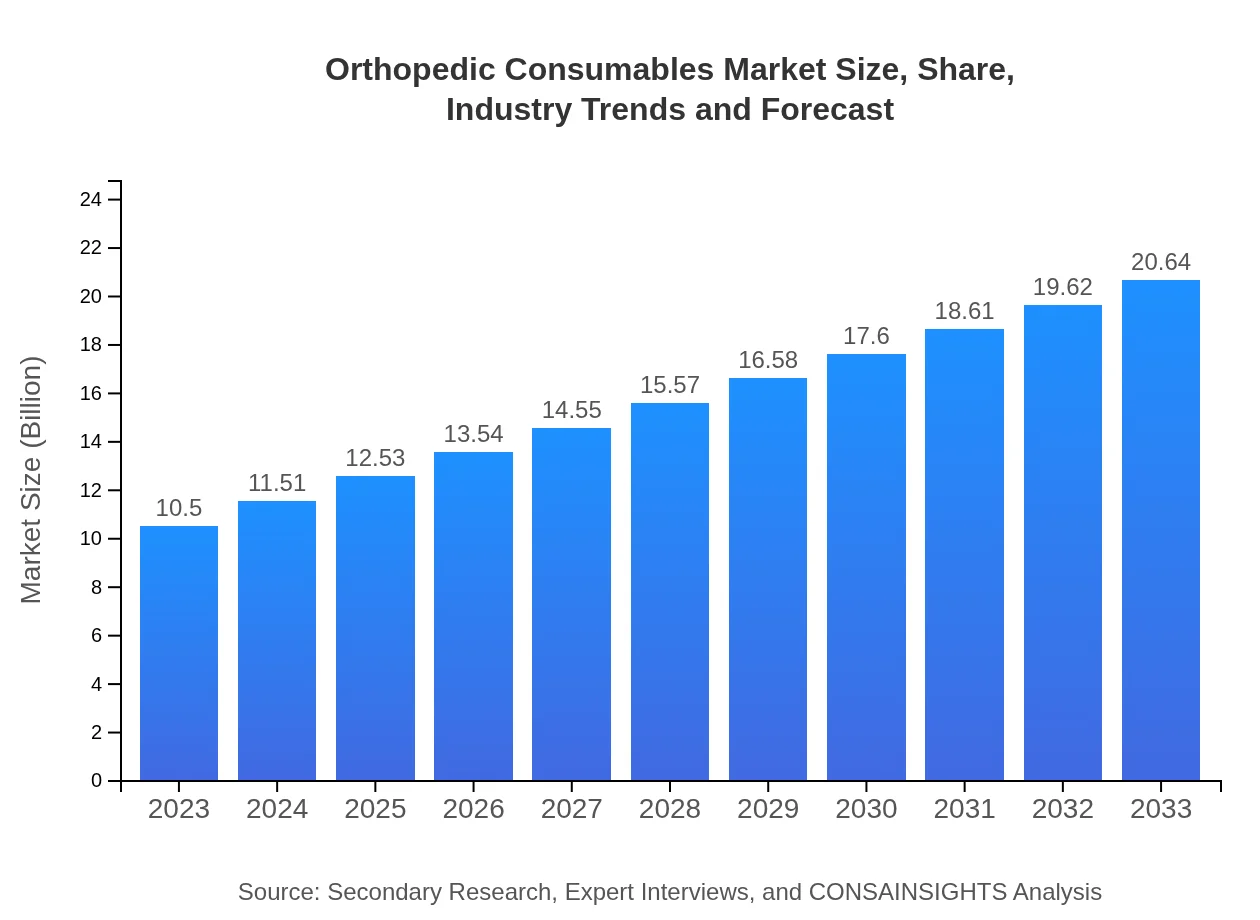

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $20.64 Billion |

| Top Companies | Johnson & Johnson, Stryker Corporation, Zimmer Biomet, Medtronic , Smith & Nephew |

| Last Modified Date | 31 January 2026 |

Orthopedic Consumables Market Overview

Customize Orthopedic Consumables Market Report market research report

- ✔ Get in-depth analysis of Orthopedic Consumables market size, growth, and forecasts.

- ✔ Understand Orthopedic Consumables's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Orthopedic Consumables

What is the Market Size & CAGR of Orthopedic Consumables market in 2023?

Orthopedic Consumables Industry Analysis

Orthopedic Consumables Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Orthopedic Consumables Market Analysis Report by Region

Europe Orthopedic Consumables Market Report:

Europe's market for orthopedic consumables is expected to grow significantly, expanding from $2.66 billion in 2023 to $5.23 billion by 2033. Key drivers for this growth include the increasing prevalence of orthopedic surgeries and a rising elderly population in countries like Germany, France, and the UK.Asia Pacific Orthopedic Consumables Market Report:

In the Asia Pacific region, the orthopedic consumables market is anticipated to grow from $2.23 billion in 2023 to $4.38 billion by 2033. Factors such as increased healthcare investments, a growing elderly population, and rising awareness of orthopedic conditions drive this growth. Moreover, the expansion of the healthcare infrastructure and a surge in the number of orthopedic surgeries contribute to market demand.North America Orthopedic Consumables Market Report:

North America represents the largest market for orthopedic consumables, with size projected to grow from $3.86 billion in 2023 to $7.58 billion by 2033. This growth is fueled by high healthcare expenditures, advanced medical technology, and a well-developed distribution network, alongside significant awareness regarding orthopedic health.South America Orthopedic Consumables Market Report:

The South American orthopedic consumables market will expand from $0.86 billion in 2023 to $1.68 billion by 2033. While growth may be moderate compared to other regions, increasing healthcare access and the introduction of advanced orthopedic procedures are expected to drive market growth.Middle East & Africa Orthopedic Consumables Market Report:

The market in the Middle East and Africa is projected to grow from $0.90 billion in 2023 to $1.76 billion by 2033. Factors such as improving healthcare facilities in urban areas and increased expenditure on healthcare are anticipated to support the market's growth.Tell us your focus area and get a customized research report.

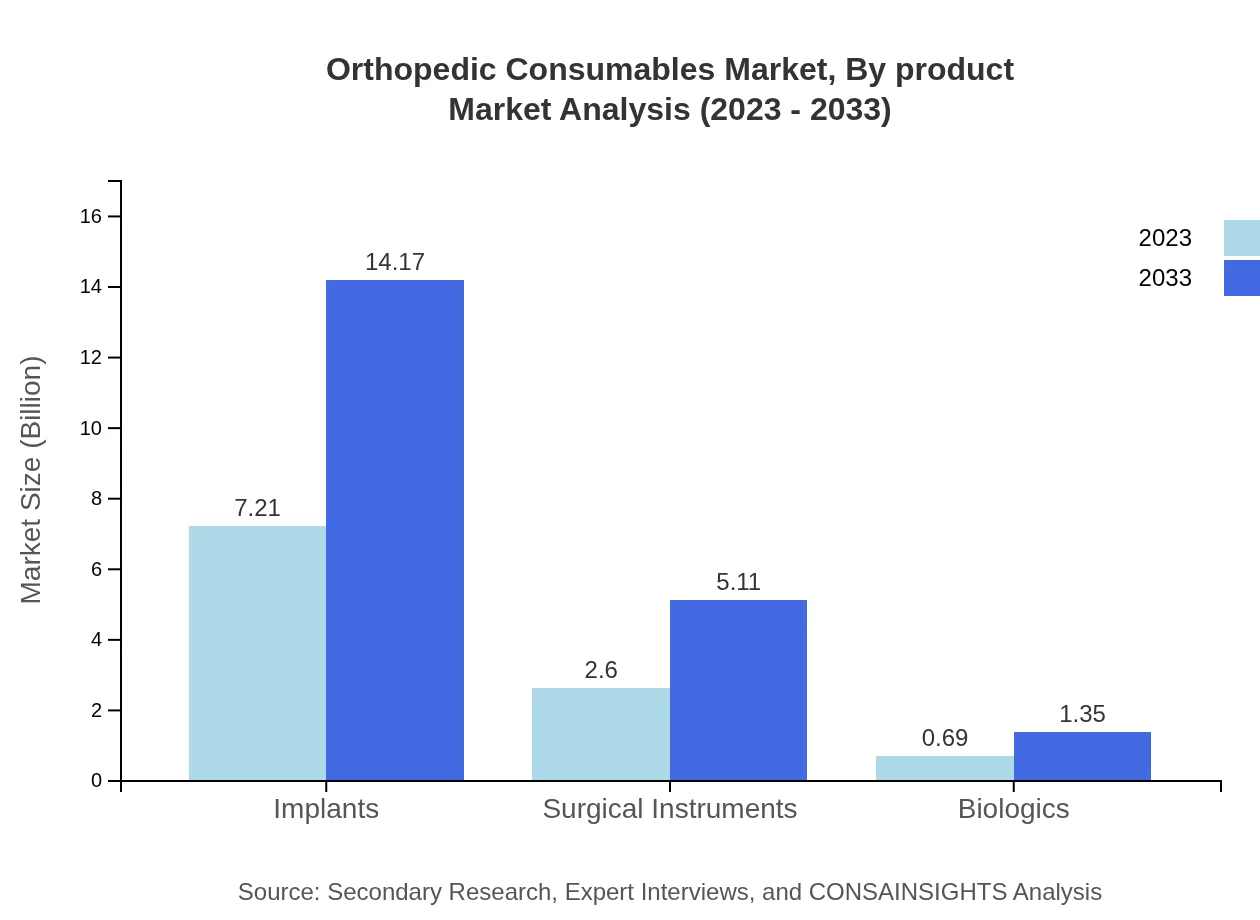

Orthopedic Consumables Market Analysis By Product

In the orthopedic consumables market, implants dominate the segment, with a market size projected to increase from $7.21 billion in 2023 to $14.17 billion by 2033, holding a share of 68.67%. Surgical instruments follow, growing from $2.60 billion to $5.11 billion, accounting for 24.77% of the market. Biologics, although smaller, are also witnessing growth, expected to rise from $0.69 billion to $1.35 billion, holding a share of 6.56%.

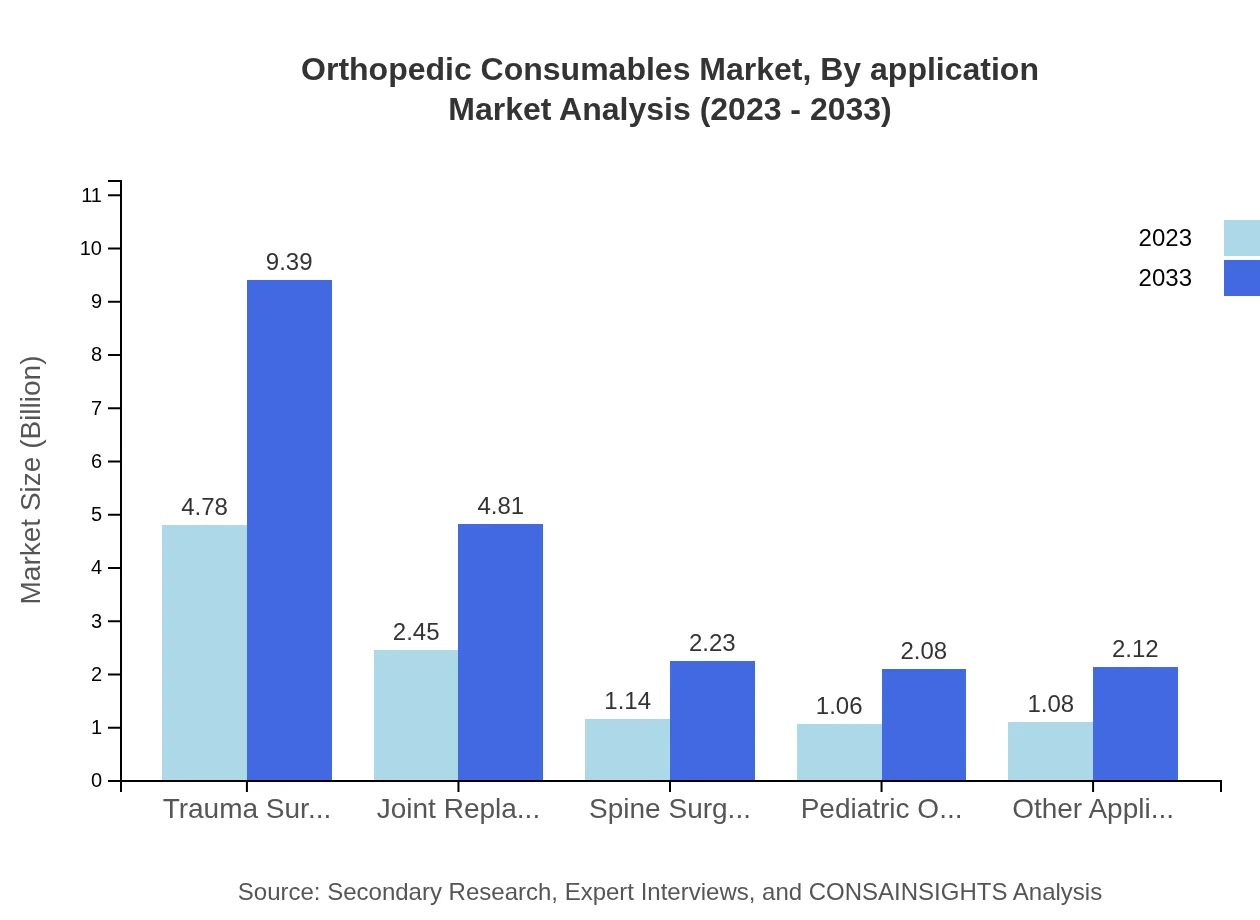

Orthopedic Consumables Market Analysis By Application

The application segment of trauma surgery takes a significant share of the market at 45.52%, translating to a market size growth from $4.78 billion in 2023 to $9.39 billion by 2033. Joint replacement procedures are expected to grow from $2.45 billion to $4.81 billion, capturing 23.3% market share. Spine surgery and pediatric orthopedics account for smaller segments but are also experiencing growth.

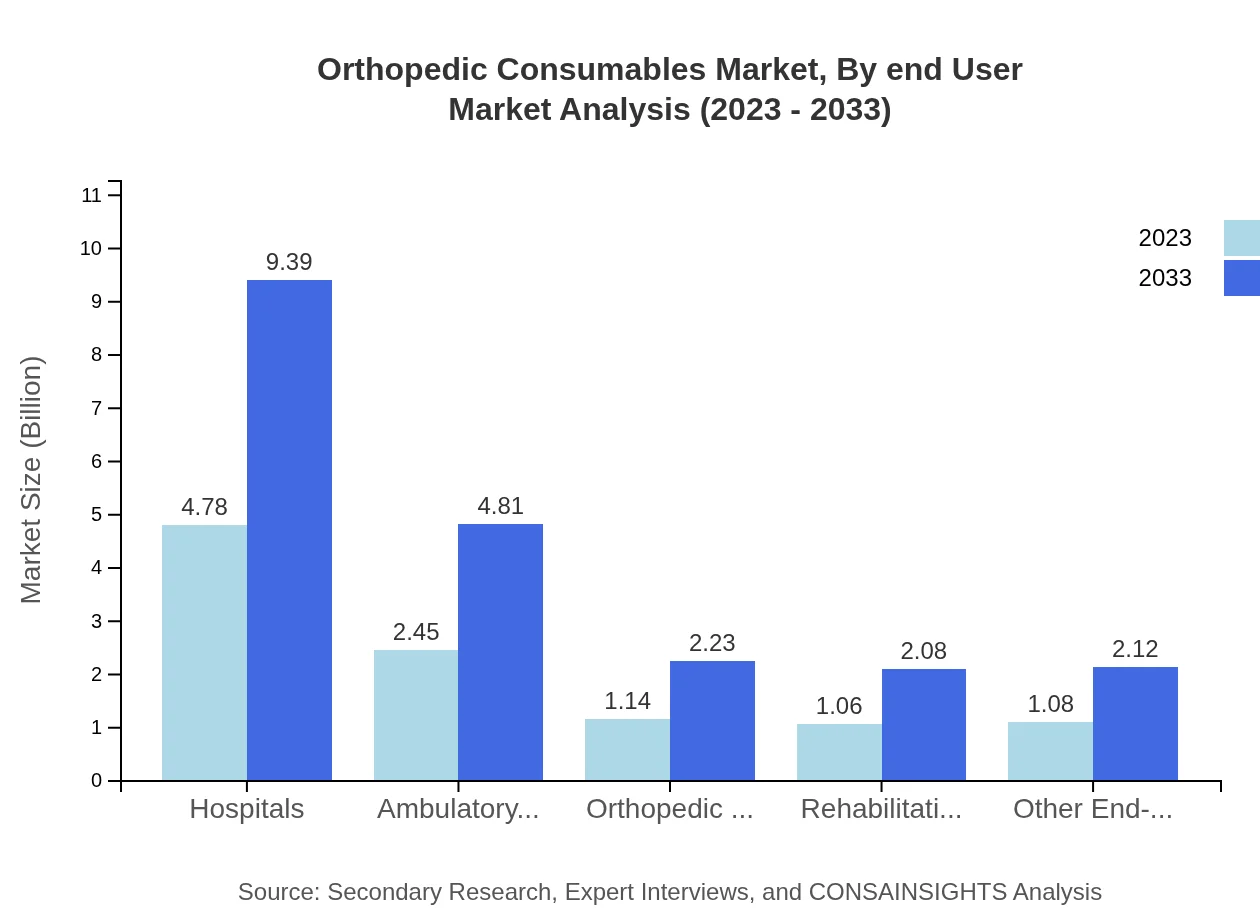

Orthopedic Consumables Market Analysis By End User

Hospitals are the primary end-users of orthopedic consumables, with a market size projected to grow from $4.78 billion in 2023 to $9.39 billion by 2033, holding a share of 45.52%. Ambulatory surgery centers follow, increasing from $2.45 billion to $4.81 billion, and orthopedic clinics account for a growing segment as well.

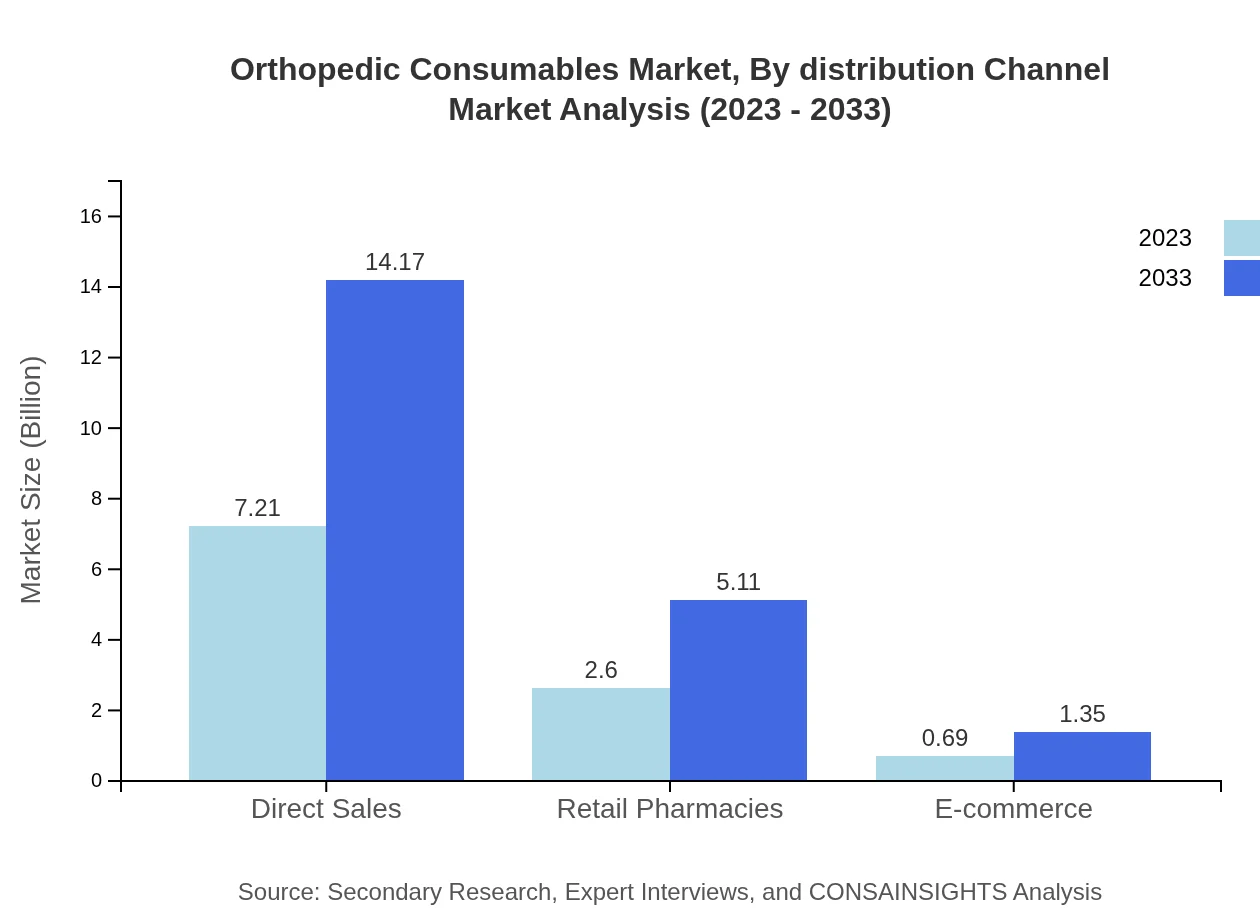

Orthopedic Consumables Market Analysis By Distribution Channel

Direct sales hold the largest share in distribution channels at 68.67%, growing from $7.21 billion in 2023 to $14.17 billion. Retail pharmacies and e-commerce are also significant, expected to grow from $2.60 billion to $5.11 billion and $0.69 billion to $1.35 billion, respectively.

Orthopedic Consumables Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Orthopedic Consumables Industry

Johnson & Johnson:

A leading global healthcare company, Johnson & Johnson develops innovative orthopedic products, particularly in the implant and surgical instruments segments, focusing on orthopedic trauma and joint reconstruction.Stryker Corporation:

Stryker is renowned for its cutting-edge orthopedic solutions, specifically in joint replacement and surgical instruments, recognized for enhancing surgical efficiency and outcomes.Zimmer Biomet:

Zimmer Biomet specializes in musculoskeletal healthcare, providing comprehensive orthopedic consumables, including biologics and implant products, supporting better recovery for patients.Medtronic :

Medtronic is a global leader in medical device innovation, offering various orthopedic consumables with a focus on spinal surgery and minimally invasive techniques.Smith & Nephew:

Smith & Nephew is a global medical technology company that specializes in joint reconstruction, wound management, and other advanced orthopedic solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of orthopedic consumables?

The orthopedic consumables market is valued at approximately $10.5 billion in 2023 and is expected to grow at a CAGR of 6.8%, reaching significant market increases by 2033.

What are the key market players or companies in the orthopedic consumables industry?

Key players in the orthopedic consumables market include major corporations such as Medtronic, Stryker Corporation, Johnson & Johnson, Zimmer Biomet, and Smith & Nephew, driving innovation and quality in orthopedic products.

What are the primary factors driving the growth in the orthopedic consumables industry?

Growth in the orthopedic consumables industry is driven by an aging population, rising incidences of orthopedic disorders, advancements in surgical techniques, and increasing demand for minimally invasive procedures, enhancing recovery times and patient outcomes.

Which region is the fastest Growing in the orthopedic consumables?

The North American region is the fastest-growing market for orthopedic consumables, with market size projected to grow from $3.86 billion in 2023 to $7.58 billion in 2033, reflecting a strong demand for advanced orthopedic solutions.

Does ConsaInsights provide customized market report data for the orthopedic consumables industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the orthopedic consumables industry, providing detailed insights and analysis based on unique market requirements.

What deliverables can I expect from this orthopedic consumables market research project?

Deliverables include comprehensive market analysis reports, regional market insights, competitive landscape evaluation, segment-wise growth forecasts, and tailored recommendations to support strategic decision-making in the orthopedic consumables market.

What are the market trends of orthopedic consumables?

Key trends in the orthopedic consumables market include increased adoption of biologics, growth in minimally invasive procedures, advancements in implant technologies, and a rising focus on patient-centric health services, enhancing recovery and procedural efficacy.