Orthopedic Devices Market Report

Published Date: 31 January 2026 | Report Code: orthopedic-devices

Orthopedic Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the orthopedic devices market from 2023 to 2033, focusing on trends, market size, segmentation, and regional insights to support strategic decision-making.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

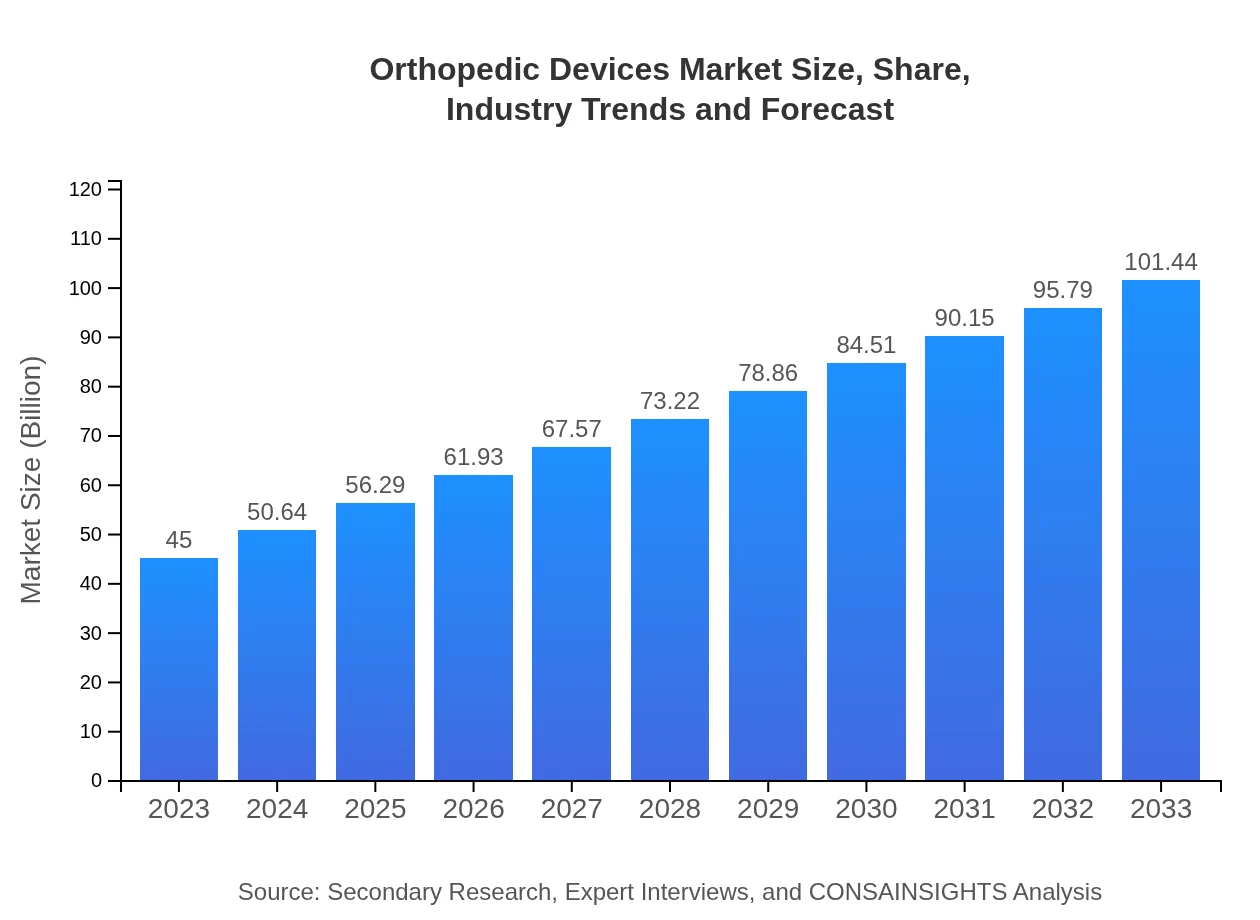

| 2023 Market Size | $45.00 Billion |

| CAGR (2023-2033) | 8.2% |

| 2033 Market Size | $101.44 Billion |

| Top Companies | Stryker Corporation, Zimmer Biomet Holdings, Inc., DePuy Synthes, Medtronic |

| Last Modified Date | 31 January 2026 |

Orthopedic Devices Market Overview

Customize Orthopedic Devices Market Report market research report

- ✔ Get in-depth analysis of Orthopedic Devices market size, growth, and forecasts.

- ✔ Understand Orthopedic Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Orthopedic Devices

What is the Market Size & CAGR of Orthopedic Devices market in 2023?

Orthopedic Devices Industry Analysis

Orthopedic Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Orthopedic Devices Market Analysis Report by Region

Europe Orthopedic Devices Market Report:

With the European orthopedic devices market at $12.63 billion in 2023, projected growth to $28.47 billion by 2033 underscores the region's robust healthcare framework. Increased awareness of orthopedic conditions and high disposable income levels among consumers facilitate the demand for orthopedic solutions across various European nations.Asia Pacific Orthopedic Devices Market Report:

The Asia Pacific region is expected to exhibit remarkable growth, with the market valued at $9.89 billion in 2023, anticipated to reach $22.30 billion by 2033. Driven by an aging population and increased healthcare access, orthopedic device adoption is rising, notably in countries like Japan, China, and India, where health infrastructure improvements signify a vital market opportunity.North America Orthopedic Devices Market Report:

North America dominates the orthopedic devices market, valued at $15.70 billion in 2023 with a forecasted growth to $35.40 billion by 2033. The U.S. is a key player due to advanced healthcare facilities, a high rate of orthopedic surgeries, and an emphasis on research and development in orthopedic technology, ensuring the region's sustained growth.South America Orthopedic Devices Market Report:

The South American orthopedic devices market is projected to grow from $4.31 billion in 2023 to $9.72 billion by 2033. Brazil and Argentina are leading contributors, fueled by increasing healthcare expenditure and a growing population with chronic orthopedic conditions. Innovations in surgical techniques and device technology further enhance market potential in this region.Middle East & Africa Orthopedic Devices Market Report:

The orthopedic devices market in the Middle East and Africa is expected to grow from $2.46 billion in 2023 to $5.55 billion by 2033. The rising prevalence of orthopedic conditions, coupled with improvements in healthcare infrastructure and affluent investments in medical technologies, drive market progression in this region.Tell us your focus area and get a customized research report.

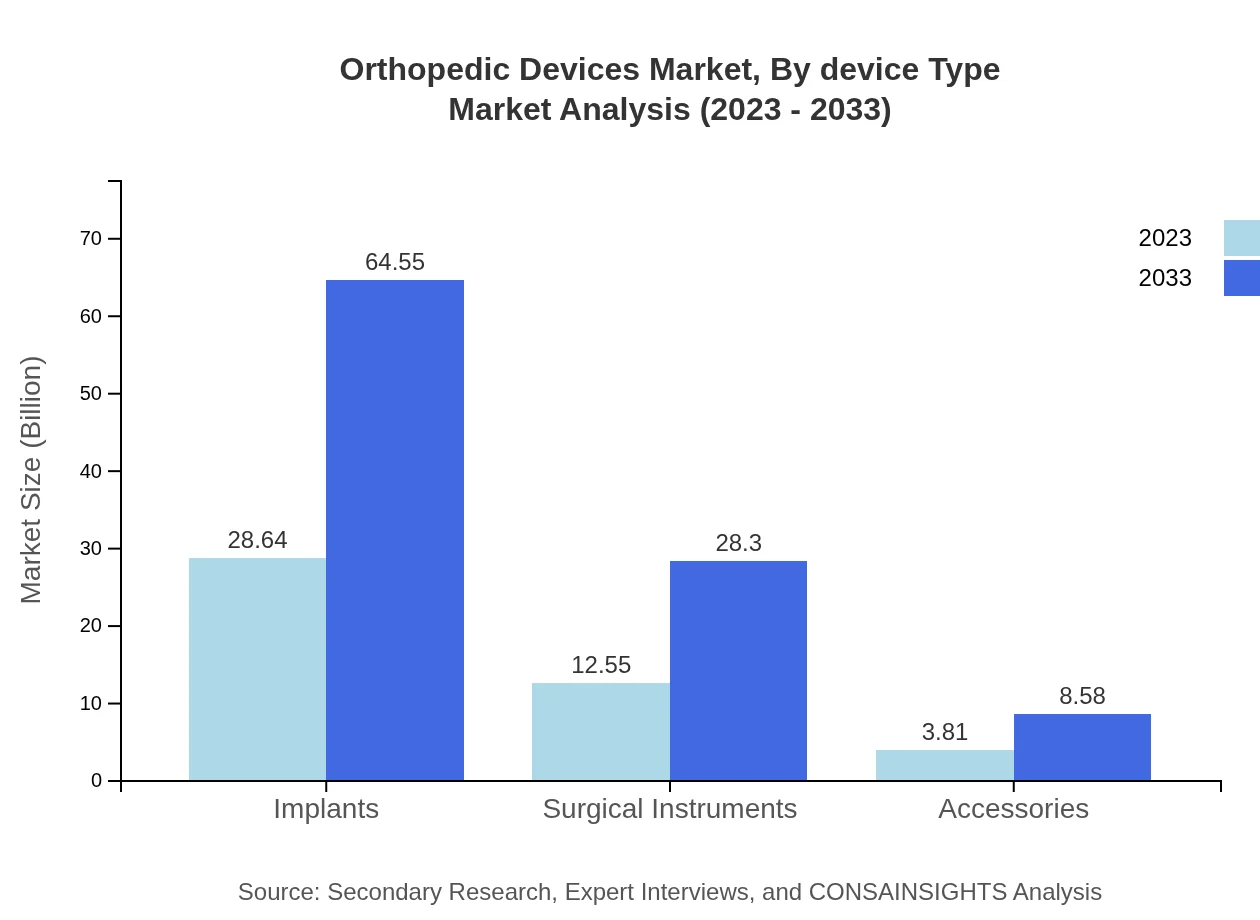

Orthopedic Devices Market Analysis By Device Type

The orthopedic devices market is primarily segmented by product type, including joint replacement devices, trauma devices, spinal products, and surgical instruments. Joint replacement devices hold a dominant share, accounting for 50.7% of the market, with a forecasted market size of $51.43 billion by 2033. Trauma devices and spinal products are also significant, reflecting a growing clinical focus on repair and reconstruction technologies.

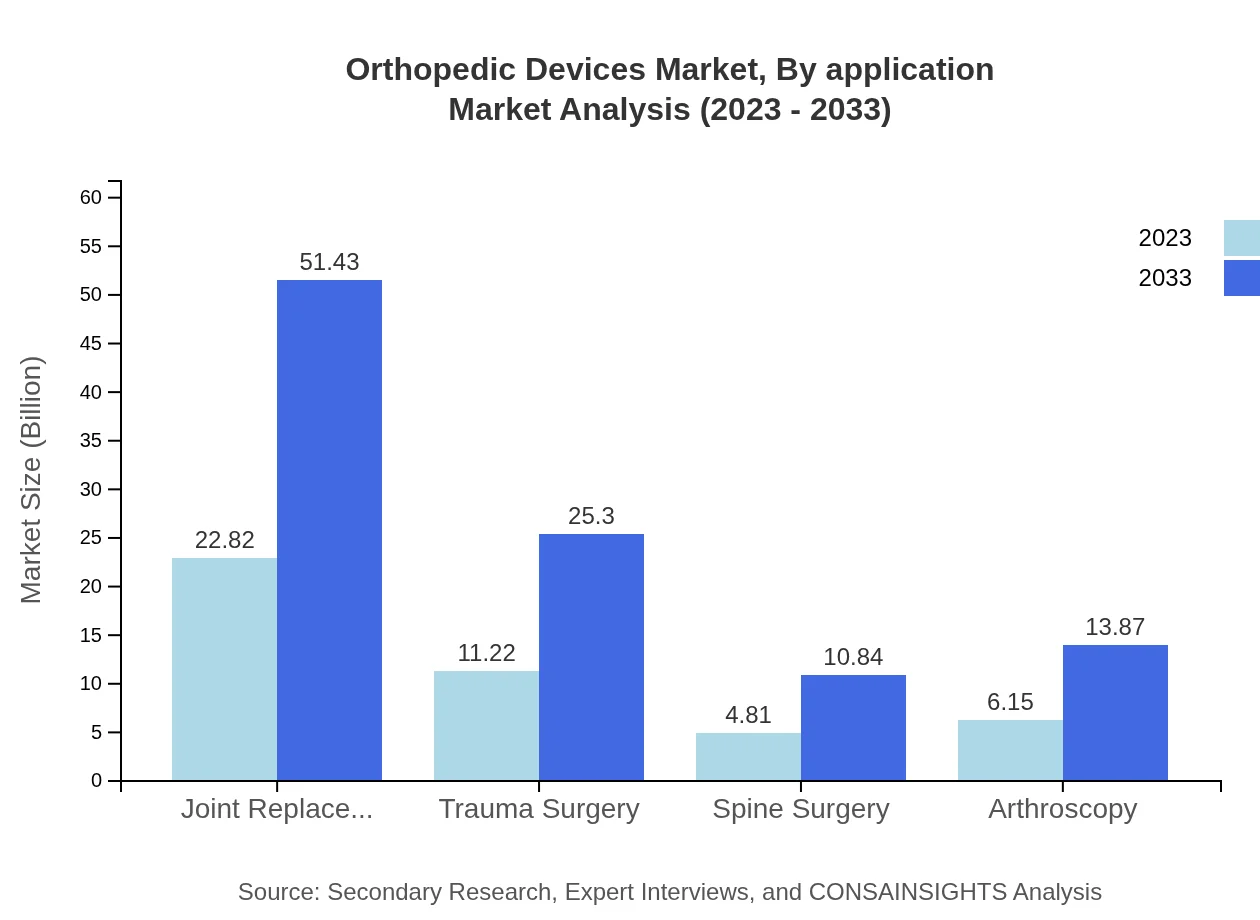

Orthopedic Devices Market Analysis By Application

The application segment encompasses joint replacement, trauma surgery, spine surgery, and arthroscopy. Joint replacement, including hip and knee implants, is a key component, expected to grow significantly due to the aging population. Trauma surgery accounts for a substantial percentage of procedures alongside increasing sports-related injuries, contributing to overall market growth.

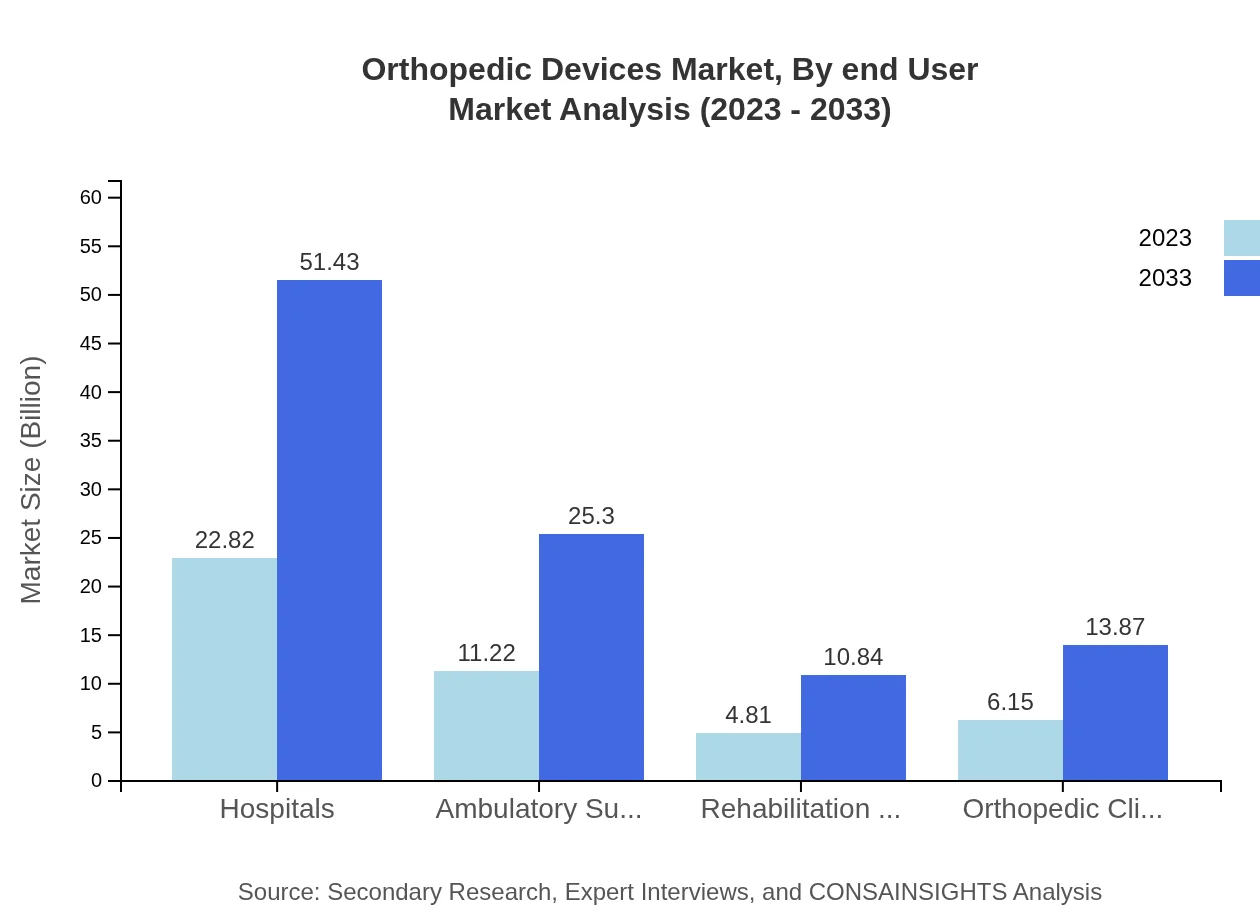

Orthopedic Devices Market Analysis By End User

Hospitals represent the largest end-user segment, making up 50.7% of the market share in 2023, and anticipated to grow substantially over the forecast period. Ambulatory Surgical Centers and orthopedic clinics are also notable segments, reflecting a shift toward outpatient surgeries and increased accessibility for patients.

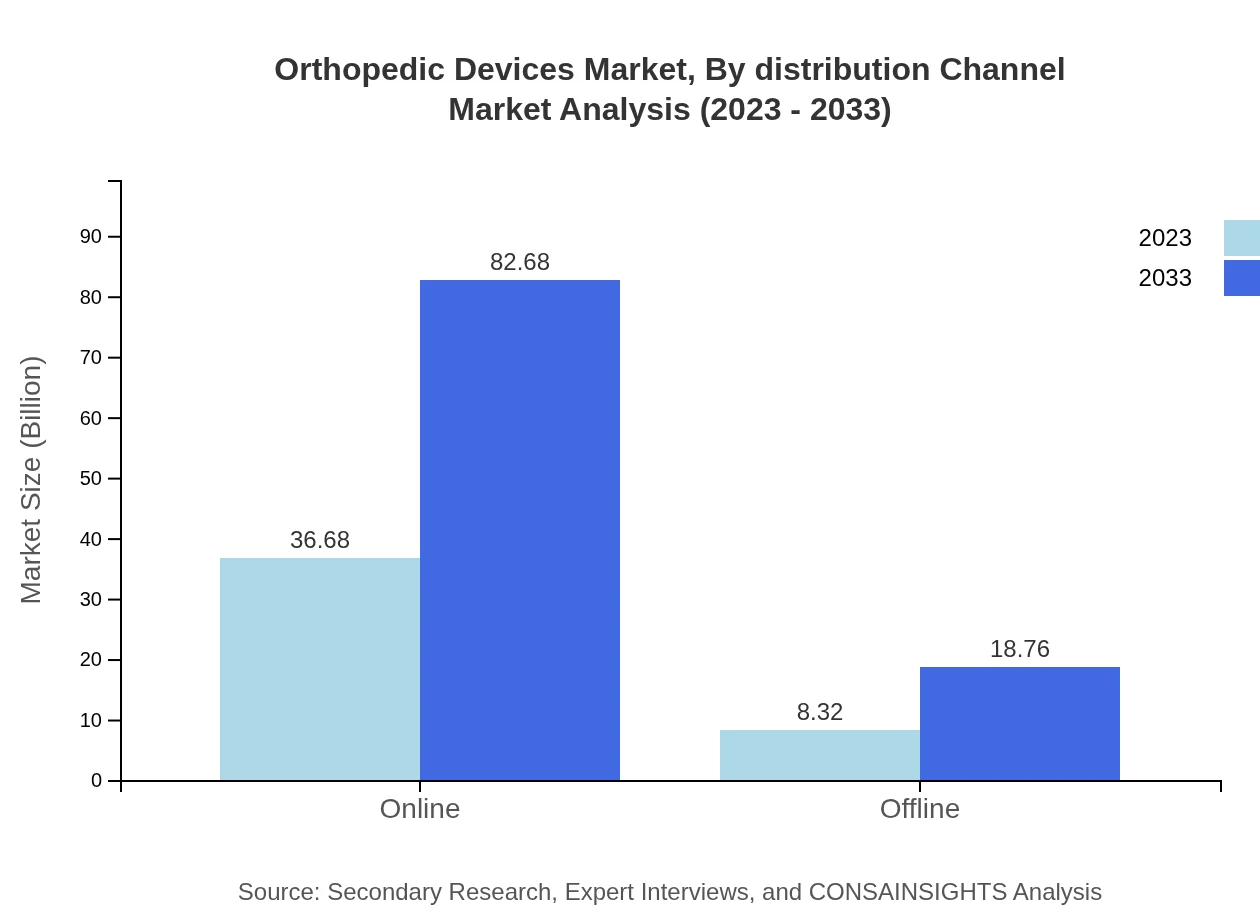

Orthopedic Devices Market Analysis By Distribution Channel

Distribution channels are segmented into online and offline provisions. Online channels are rapidly gaining traction, representing 81.51% of the market share in 2023, with expected growth driven by increased consumer access to information and services. Offline channels remain vital, particularly in established healthcare settings.

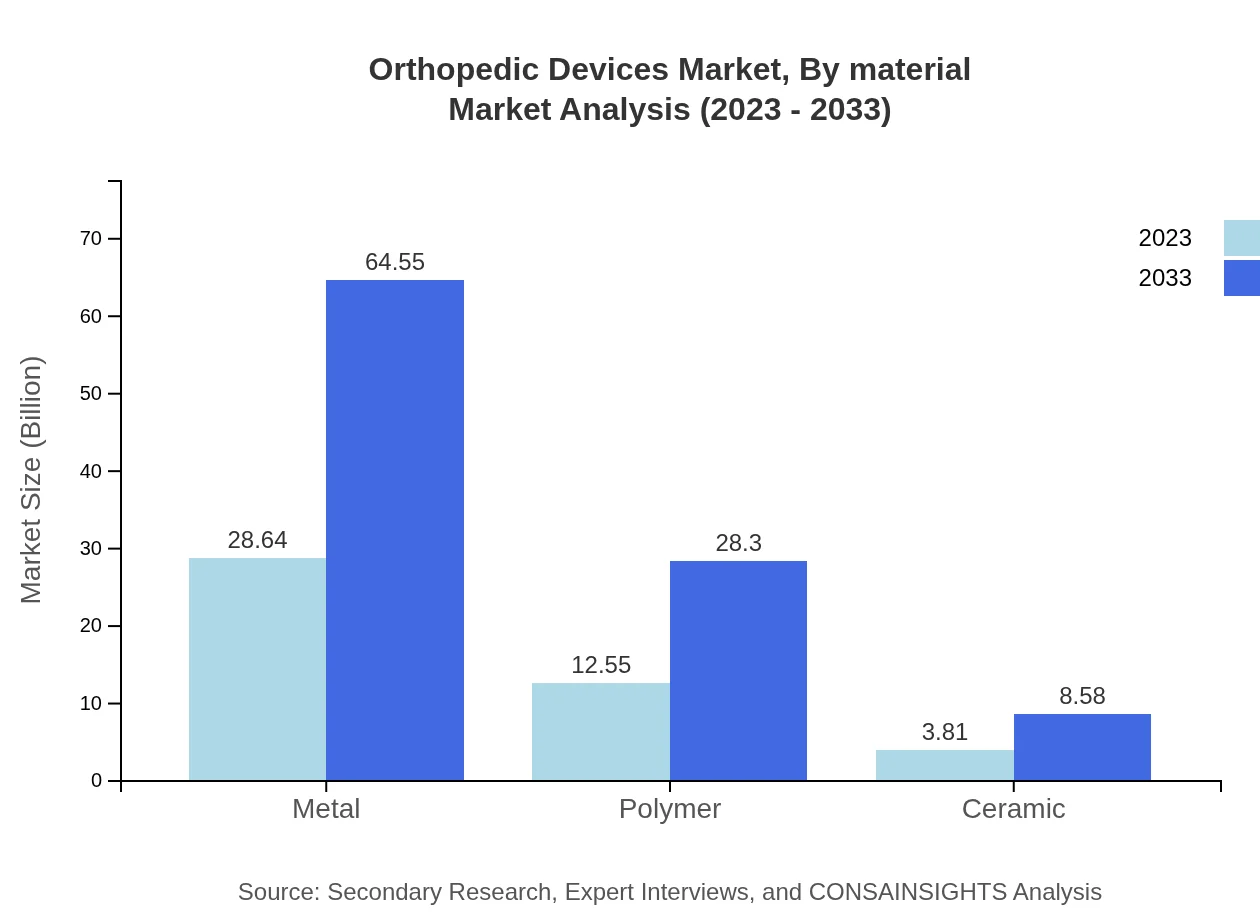

Orthopedic Devices Market Analysis By Material

The material segment comprises metal, polymer, and ceramic products. Metal remains the leading material used in orthopedic devices, representing 63.64% of the market in 2023. Polymers are increasingly utilized for their lightweight and biocompatible properties, driving innovations in newer orthopedic device designs.

Orthopedic Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Orthopedic Devices Industry

Stryker Corporation:

Stryker is a leading medical technology company specializing in orthopedic devices, including joint replacement products and surgical equipment. Their innovative approach and advanced technologies have set benchmarks in orthopedic surgeries.Zimmer Biomet Holdings, Inc.:

Zimmer Biomet focuses on orthopedic and musculoskeletal health, offering a comprehensive portfolio of products, including implants and surgical tools. Their commitment to research and patient-focused solutions drives significant growth in the orthopedic market.DePuy Synthes:

As part of Johnson & Johnson, DePuy Synthes is at the forefront of orthopedic innovation, providing comprehensive solutions for joint reconstruction, trauma, and spinal surgery, and enhancing surgical outcomes through state-of-the-art technology.Medtronic :

Medtronic is known for its leadership in spinal surgery products and innovative therapies aimed at treating musculoskeletal disorders, providing patients with safer and more effective recovery solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of orthopedic Devices?

The global orthopedic devices market is valued at approximately $45 billion in 2023, with a compound annual growth rate (CAGR) of 8.2%. By 2033, the market is projected to expand significantly, indicating robust growth in this industry.

What are the key market players or companies in this orthopedic Devices industry?

Key players in the orthopedic devices market include leading medical device manufacturers like Johnson & Johnson, Stryker Corporation, Medtronic, and Zimmer Biomet. These companies are pivotal in driving innovation and market expansion through cutting-edge products.

What are the primary factors driving the growth in the orthopedic Devices industry?

The orthopedic devices industry is primarily driven by an aging global population, rising obesity rates, increased incidence of orthopedic diseases, and advancements in technology. These factors collectively boost demand for orthopedic solutions.

Which region is the fastest Growing in the orthopedic Devices?

The Asia Pacific region is emerging as the fastest-growing market for orthopedic devices, projected to grow from $9.89 billion in 2023 to $22.30 billion by 2033. This growth is fueled by increasing healthcare investments and rising population.

Does ConsaInsights provide customized market report data for the orthopedic Devices industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the orthopedic devices industry. Clients can request focused analyses based on particular segments, regions, or market trends.

What deliverables can I expect from this orthopedic Devices market research project?

Clients can expect comprehensive deliverables including detailed market analysis, segment reports, competitive landscape insights, regional breakdowns, and forecasts. These insights assist in strategic decision-making and market positioning.

What are the market trends of orthopedic Devices?

Current trends in the orthopedic devices market include increasing adoption of minimally invasive surgical procedures, advancements in implant technology, and a shift towards personalized medicine. These trends are shaping the future of orthopedic care.