Orthopedic Implant Antibacterial Coatings Surface Treatment Market Report

Published Date: 31 January 2026 | Report Code: orthopedic-implant-antibacterial-coatings-surface-treatment

Orthopedic Implant Antibacterial Coatings Surface Treatment Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Orthopedic Implant Antibacterial Coatings Surface Treatment market from 2023 to 2033, highlighting market size, growth trends, regional insights, segmentation, prevailing technologies, and key players shaping the industry.

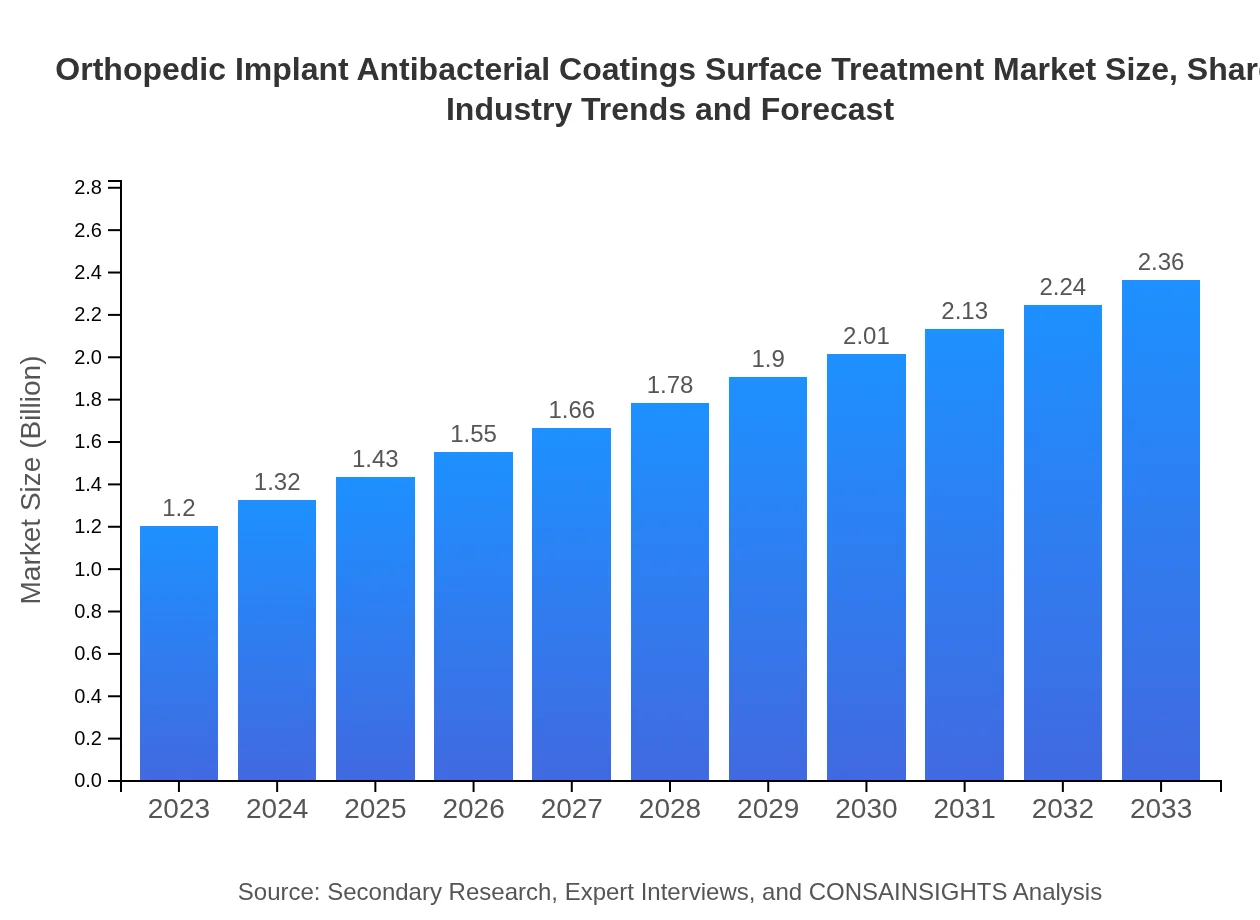

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $2.36 Billion |

| Top Companies | Stryker Corporation, Johnson & Johnson (DePuy Synthes), Medtronic , Zimmer Biomet |

| Last Modified Date | 31 January 2026 |

Orthopedic Implant Antibacterial Coatings Surface Treatment Market Overview

Customize Orthopedic Implant Antibacterial Coatings Surface Treatment Market Report market research report

- ✔ Get in-depth analysis of Orthopedic Implant Antibacterial Coatings Surface Treatment market size, growth, and forecasts.

- ✔ Understand Orthopedic Implant Antibacterial Coatings Surface Treatment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Orthopedic Implant Antibacterial Coatings Surface Treatment

What is the Market Size & CAGR of Orthopedic Implant Antibacterial Coatings Surface Treatment market in 2023?

Orthopedic Implant Antibacterial Coatings Surface Treatment Industry Analysis

Orthopedic Implant Antibacterial Coatings Surface Treatment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Orthopedic Implant Antibacterial Coatings Surface Treatment Market Analysis Report by Region

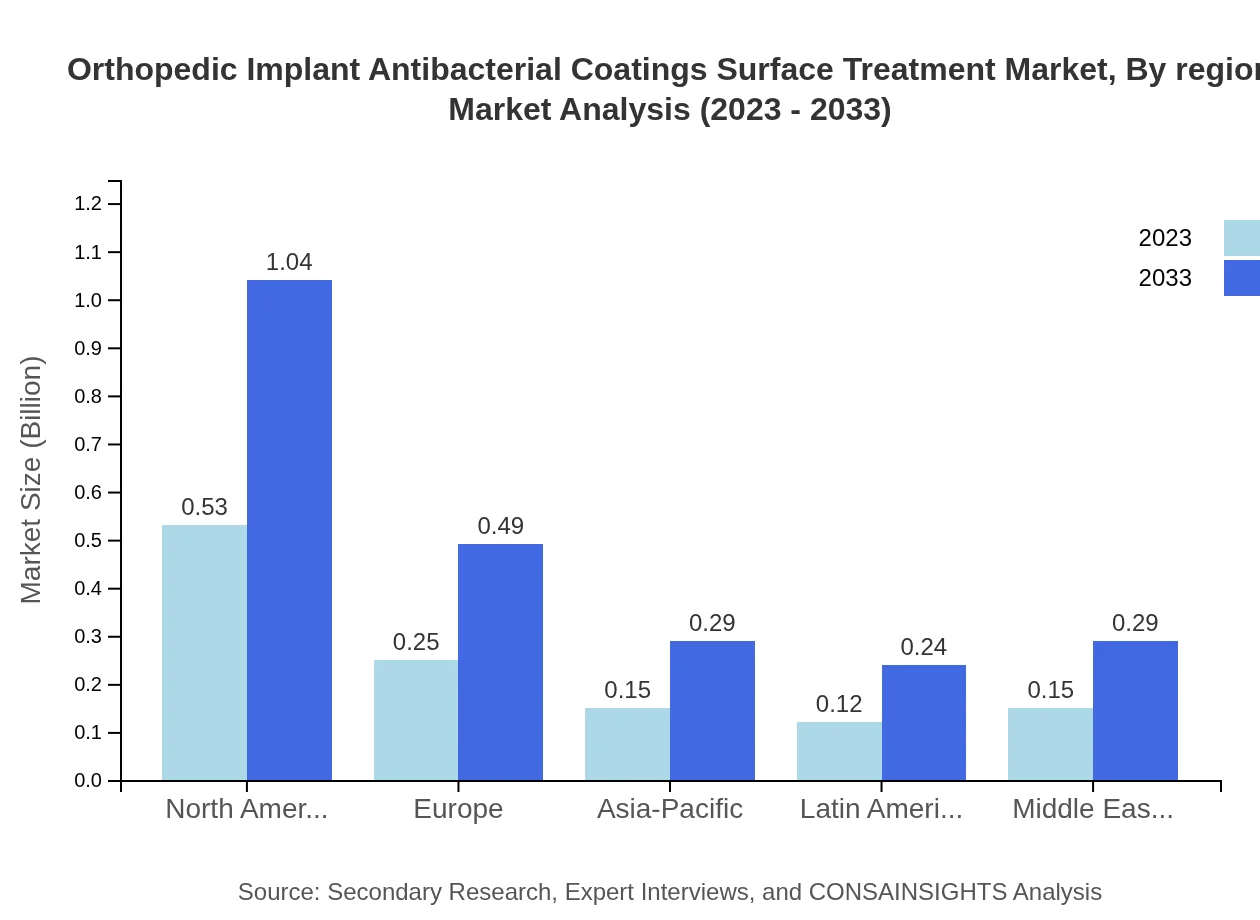

Europe Orthopedic Implant Antibacterial Coatings Surface Treatment Market Report:

The European market is positioned at $0.40 billion in 2023, with projections of $0.78 billion by 2033. Awareness of healthcare-associated infections and the regulatory framework enhancing product development foster growth in this region.Asia Pacific Orthopedic Implant Antibacterial Coatings Surface Treatment Market Report:

The Asia Pacific region is witnessing substantial growth in the orthopedic implant antibacterial coatings market, valued at $0.22 billion in 2023 and projected to achieve approximately $0.43 billion by 2033. The increased population, rising orthopedic procedures, and growing healthcare infrastructure contribute to this growth.North America Orthopedic Implant Antibacterial Coatings Surface Treatment Market Report:

North America holds the largest share of the market, with a valuation of $0.43 billion in 2023, expected to rise to approximately $0.84 billion by 2033. High prevalence of orthopedic surgeries, advanced healthcare systems, and robust research developments drive this growth.South America Orthopedic Implant Antibacterial Coatings Surface Treatment Market Report:

In South America, the market is anticipated to grow from $0.03 billion in 2023 to $0.06 billion by 2033. Surge in healthcare accessibility and consistent investments in medical technologies are driving the demand for antibacterial coatings.Middle East & Africa Orthopedic Implant Antibacterial Coatings Surface Treatment Market Report:

The Middle East and Africa market will see growth from $0.12 billion in 2023 to $0.24 billion by 2033, driven by gradual advances in healthcare technologies and increasing patient awareness about treatment options.Tell us your focus area and get a customized research report.

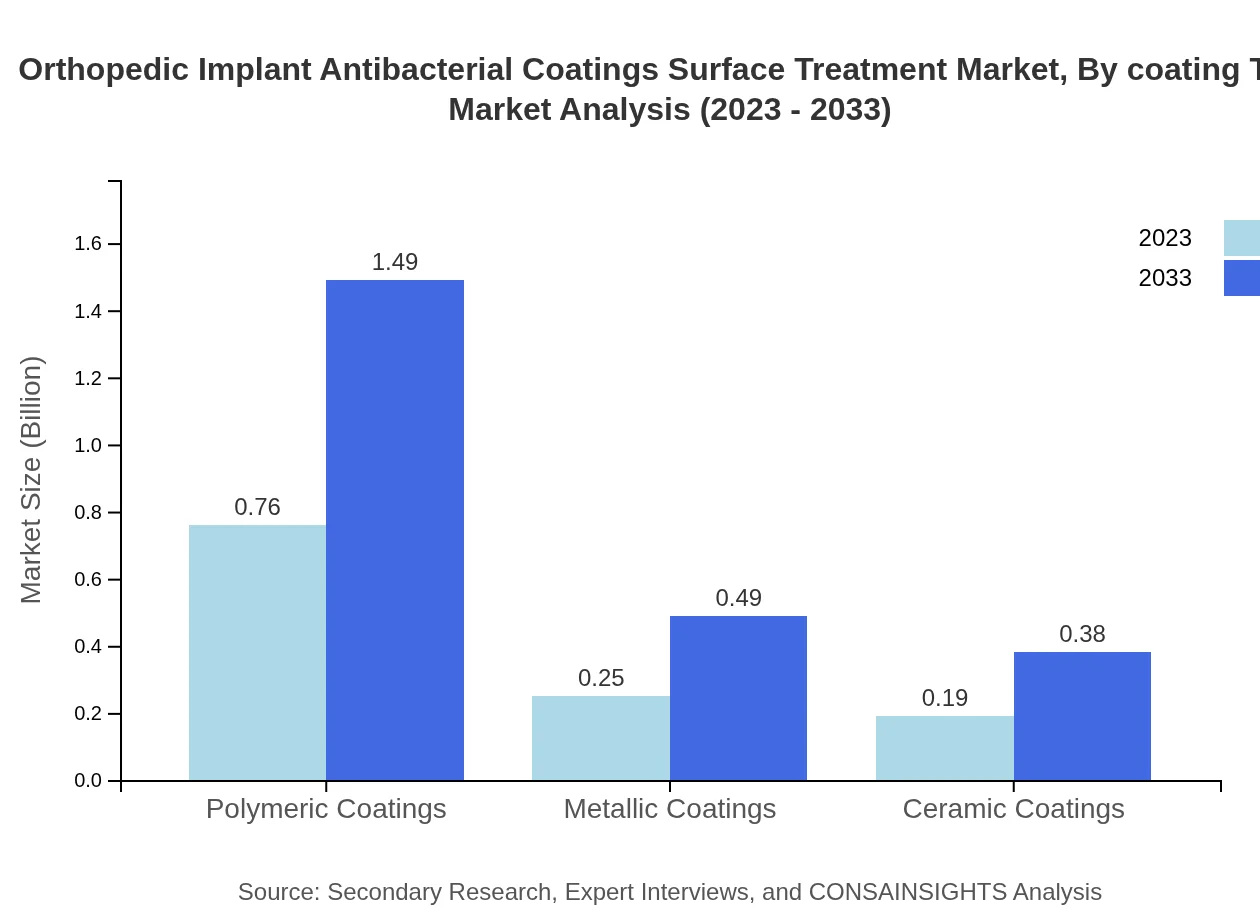

Orthopedic Implant Antibacterial Coatings Surface Treatment Market Analysis By Coating Type

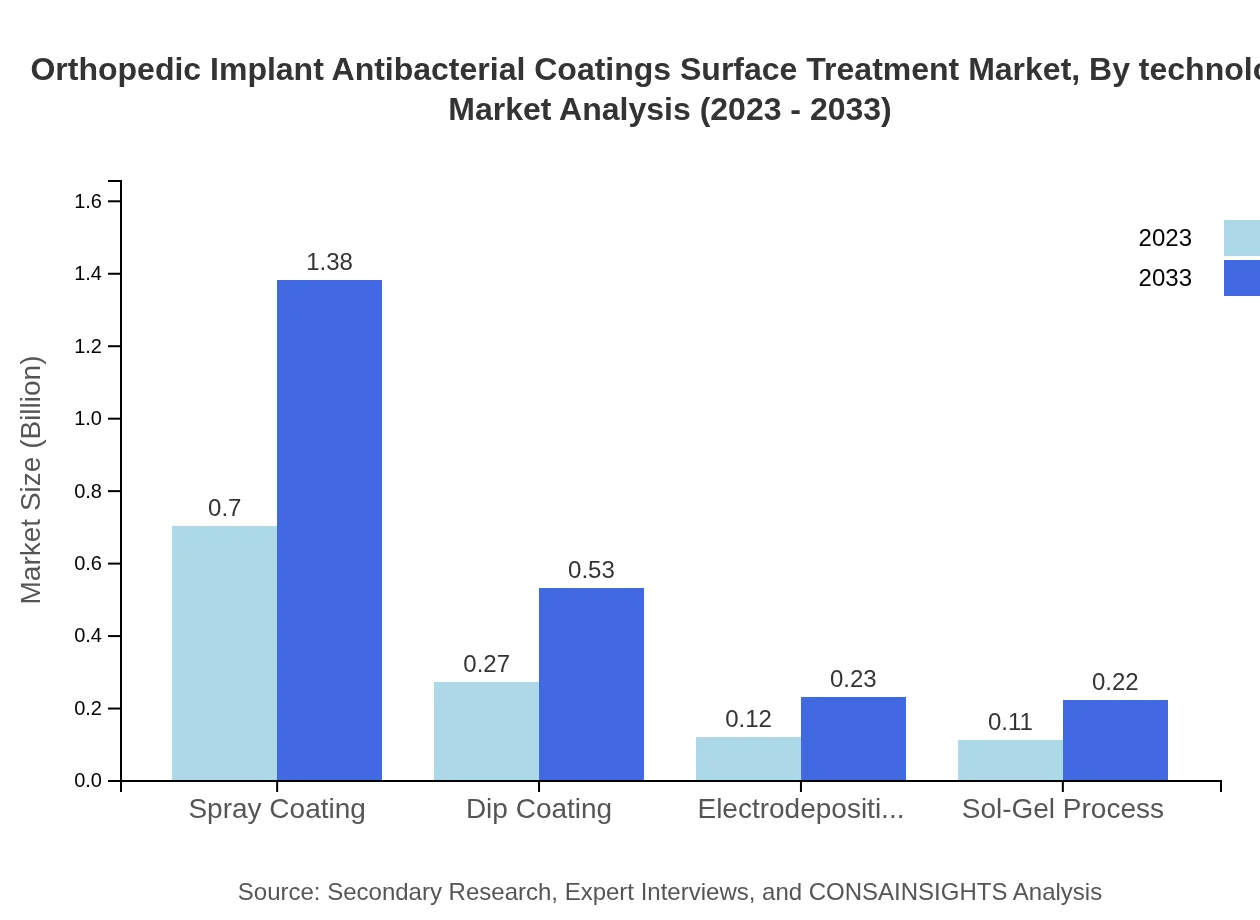

The analysis of coating types indicates that spray coatings dominate the market, valued at $0.70 billion in 2023, with projections to reach approximately $1.38 billion by 2033. Other significant types include polymeric and dip coatings, contributing 58.42% and 22.44% market shares, respectively.

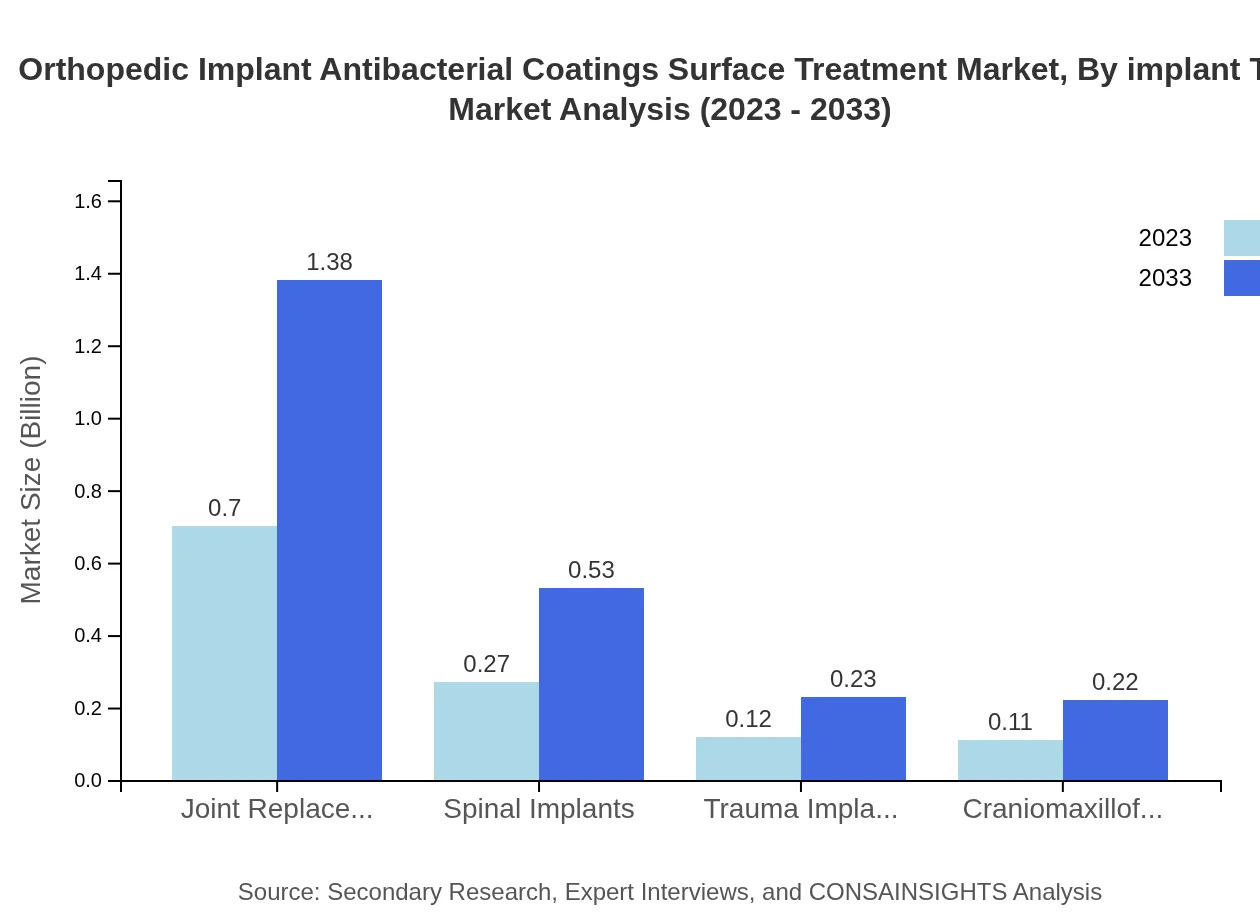

Orthopedic Implant Antibacterial Coatings Surface Treatment Market Analysis By Implant Type

Joint replacement implants represent the largest segment within the market, valued at $0.70 billion in 2023, expected to grow to $1.38 billion by 2033. Spinal and trauma implants also hold considerable shares, emphasizing the wide range of applications for antibacterial coatings.

Orthopedic Implant Antibacterial Coatings Surface Treatment Market Analysis By Technology

Technological advancements have significantly influenced market dynamics. Polymeric coatings maintain a commanding share of 63.12%, followed by dip coatings at 22.44%, indicating a preference for effective and reliable coating technologies.

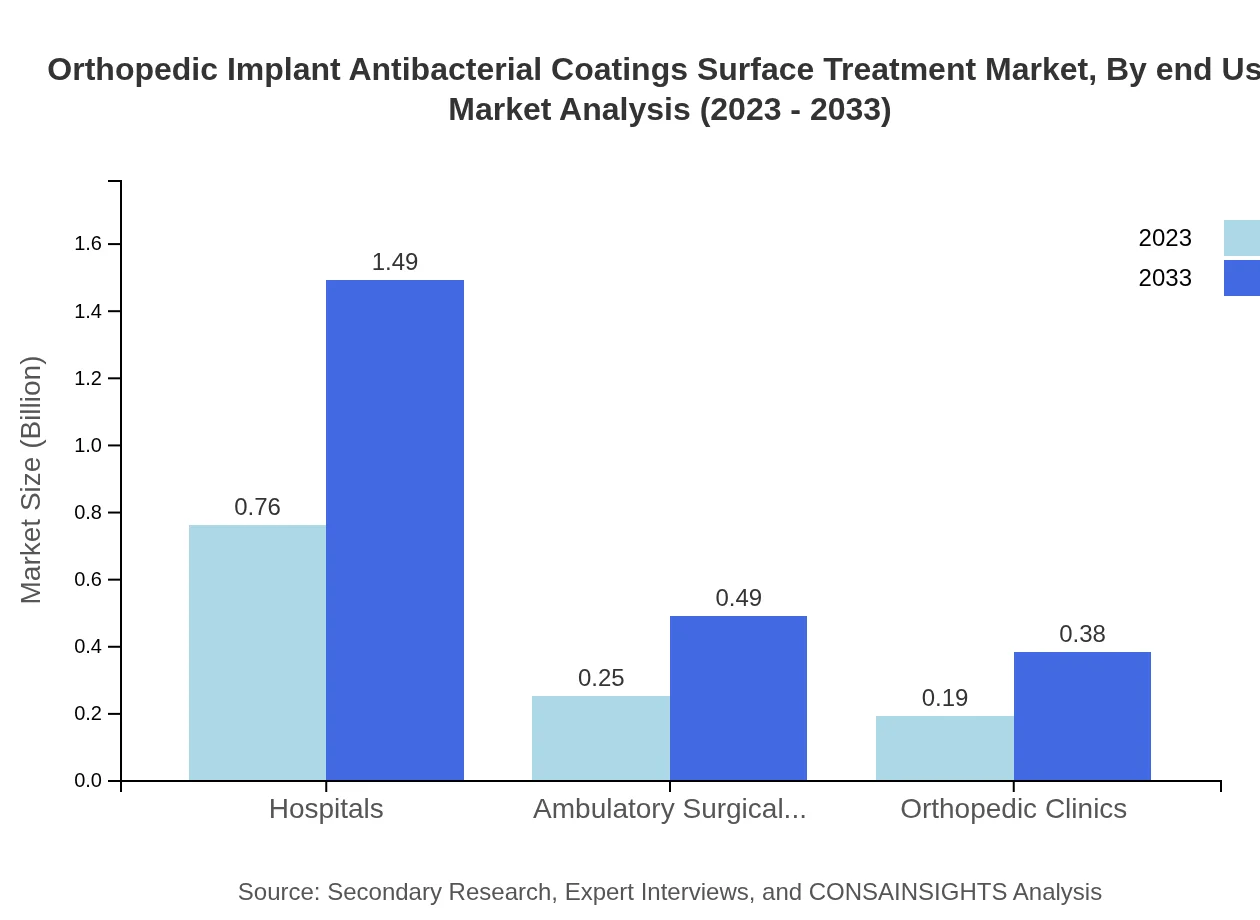

Orthopedic Implant Antibacterial Coatings Surface Treatment Market Analysis By End User

Hospitals account for the majority of the market share at 63.12%, attributed to high surgical volumes. Ambulatory surgical centers also play an essential role, contributing to the overall growth in demand for antibacterial coatings.

Orthopedic Implant Antibacterial Coatings Surface Treatment Market Analysis By Region

Regional analysis stresses how North America is the leading market player, with Europe and Asia Pacific showing rapid growth, particularly in healthcare innovation and demand for high-quality implants.

Orthopedic Implant Antibacterial Coatings Surface Treatment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Orthopedic Implant Antibacterial Coatings Surface Treatment Industry

Stryker Corporation:

A leader in medical technologies, Stryker is well known for its innovative orthopedic implants and surface treatment solutions that enhance antibacterial properties.Johnson & Johnson (DePuy Synthes):

DePuy Synthes is recognized for its groundbreaking advancements in orthopedic devices and coatings that improve patient care through reduced infection rates.Medtronic :

Medtronic specializes in medical devices and implantable solutions, with an emphasis on antibacterial coatings to prevent post-surgical infections.Zimmer Biomet:

Zimmer Biomet offers a wide range of orthopedic implants designed with advanced surface treatments to enhance antibacterial efficacy.We're grateful to work with incredible clients.

FAQs

What is the market size of orthopedic Implant Antibacterial Coatings Surface Treatment?

The global market for orthopedic implant antibacterial coatings and surface treatment was valued at approximately $1.2 billion in 2023, with a projected CAGR of 6.8% over the next decade, reaching an estimated size of around $2.5 billion by 2033.

What are the key market players or companies in this orthopedic Implant Antibacterial Coatings Surface Treatment industry?

Key players in the orthopedic implant antibacterial coatings market include major medical device manufacturers and specialized material companies. This competitive landscape features firms that invest heavily in R&D for innovative coating technologies to enhance product efficacy and patient outcomes.

What are the primary factors driving the growth in the orthopedic Implant Antibacterial Coatings Surface Treatment industry?

The growth in this industry is driven by increasing advancements in orthopedic surgeries, rising patient awareness regarding infection control, and significant investments in R&D for developing effective antibacterial coatings. Additionally, the increase in joint replacement procedures globally plays a crucial role.

Which region is the fastest Growing in the orthopedic Implant Antibacterial Coatings Surface Treatment?

The fastest-growing region in the orthopedic implant antibacterial coatings market is North America, expected to reach approximately $0.84 billion by 2033, driven by high healthcare expenditure and advanced medical infrastructure. Asia-Pacific is also notable, growing to around $0.43 billion.

Does ConsaInsights provide customized market report data for the orthopedic Implant Antibacterial Coatings Surface Treatment industry?

Yes, Consainsights offers customized market report data for the orthopedic implant antibacterial coatings industry. Clients can request tailored insights based on specific needs, enabling them to make informed decisions supported by comprehensive market analysis.

What deliverables can I expect from this orthopedic Implant Antibacterial Coatings Surface Treatment market research project?

Deliverables from the market research project include detailed market analysis, trend assessments, regional insights, competitive landscape visuals, and forecasts. You will receive actionable data that supports strategic planning and investment decisions in the antibacterial coatings market.

What are the market trends of orthopedic Implant Antibacterial Coatings Surface Treatment?

Current market trends include the growing adoption of advanced antibacterial coating technologies, a shift toward personalized and patient-specific implants, and increasing collaborations between manufacturers and healthcare providers to enhance product effectiveness in infection prevention.