Orthopedic Implants Market Report

Published Date: 31 January 2026 | Report Code: orthopedic-implants

Orthopedic Implants Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Orthopedic Implants market, covering market size, trends, and forecasts from 2023 to 2033. It includes detailed insights into regional performance, segmentation, and the future outlook of the industry.

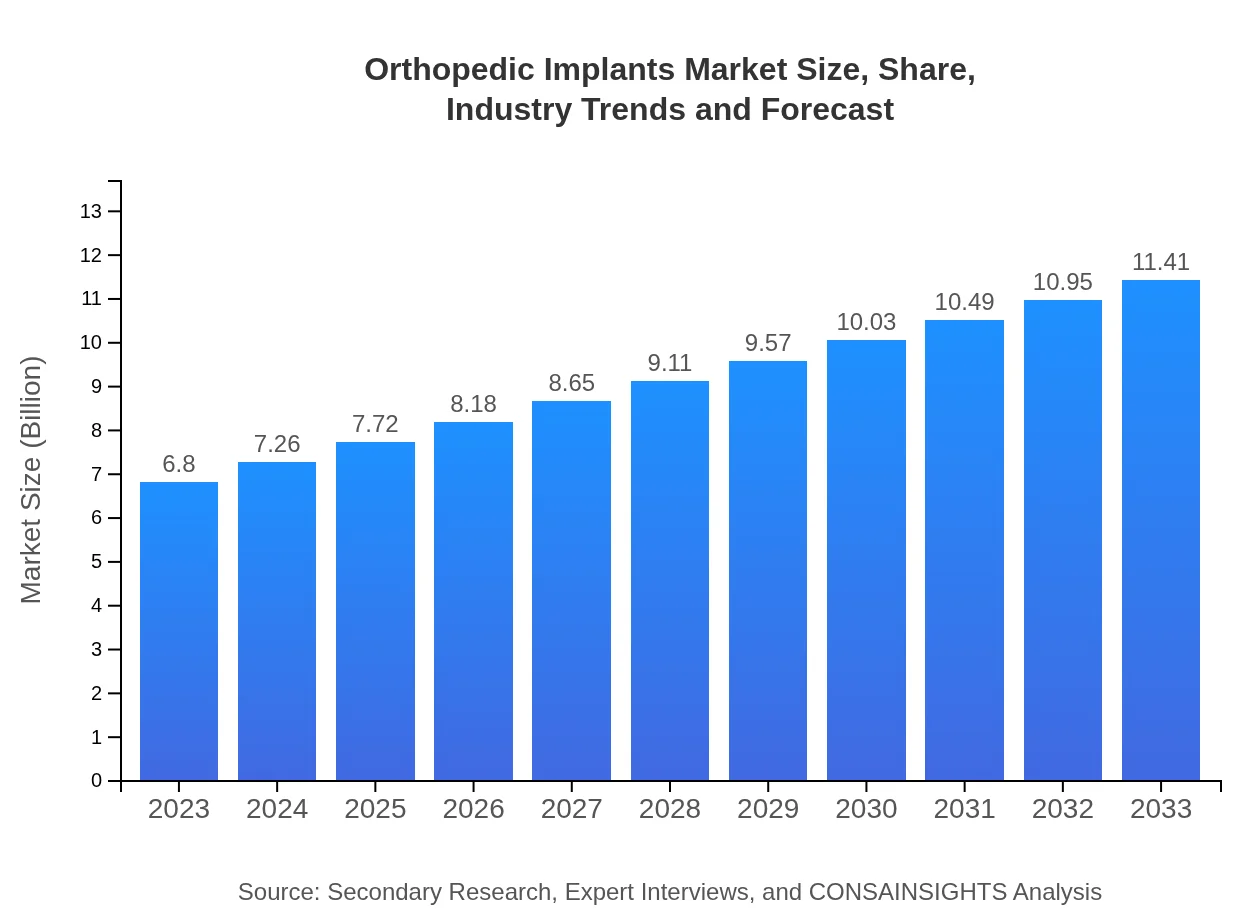

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.80 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $11.41 Billion |

| Top Companies | DePuy Synthes, Stryker Corporation, Zimmer Biomet, Smith & Nephew |

| Last Modified Date | 31 January 2026 |

Orthopedic Implants Market Overview

Customize Orthopedic Implants Market Report market research report

- ✔ Get in-depth analysis of Orthopedic Implants market size, growth, and forecasts.

- ✔ Understand Orthopedic Implants's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Orthopedic Implants

What is the Market Size & CAGR of Orthopedic Implants market in 2023?

Orthopedic Implants Industry Analysis

Orthopedic Implants Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Orthopedic Implants Market Analysis Report by Region

Europe Orthopedic Implants Market Report:

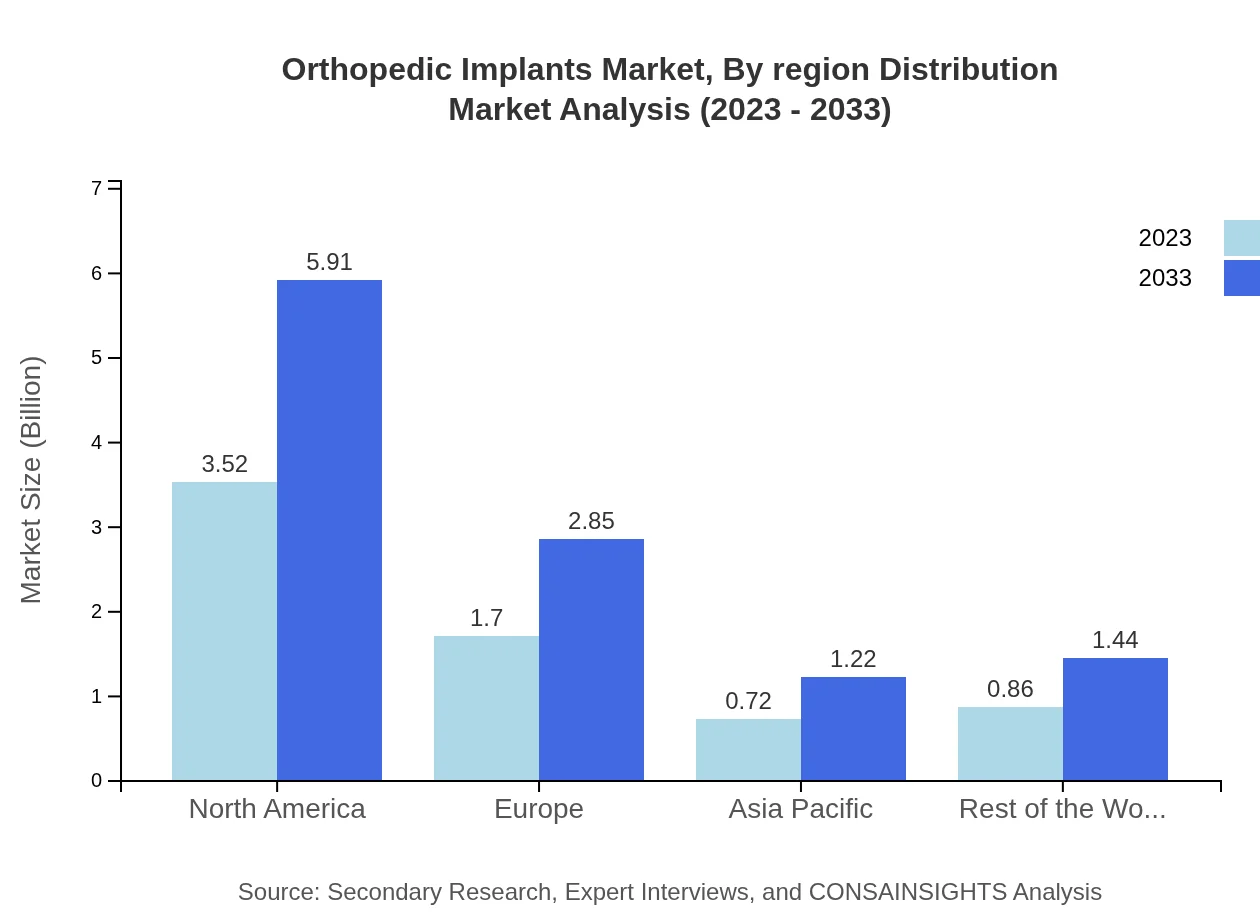

The orthopedic implants market in Europe reached $1.67 billion in 2023, projected to rise to $2.80 billion by 2033. The growth is attributed to an aging population, rising orthopedic surgeries, and increasing healthcare expenditure across major economies.Asia Pacific Orthopedic Implants Market Report:

The Asia Pacific region supports a growing demand for orthopedic implants, driven by increasing population awareness regarding orthopedic treatments and surging healthcare expenditure. In 2023, the market size was $1.33 billion and is expected to grow to $2.24 billion by 2033, reflecting a robust CAGR fueled by technological advancements and improved healthcare access.North America Orthopedic Implants Market Report:

North America remains the largest market for orthopedic implants, with a size of $2.45 billion in 2023 and expected growth to $4.11 billion by 2033. Key factors include a high incidence of orthopedic conditions, advanced healthcare infrastructure, and early adoption of innovative technologies.South America Orthopedic Implants Market Report:

The South America orthopedic implants market was valued at $0.51 billion in 2023, with a projected growth to $0.85 billion by 2033. This growth is attributed to an increase in surgical procedures and the rising prevalence of orthopedic diseases, alongside expanding healthcare facilities in the region.Middle East & Africa Orthopedic Implants Market Report:

The Middle East and Africa orthopedic implants market was valued at $0.84 billion in 2023 and is expected to grow to $1.42 billion by 2033. Enhanced healthcare infrastructure and increased awareness of orthopedic health drive market growth in this region.Tell us your focus area and get a customized research report.

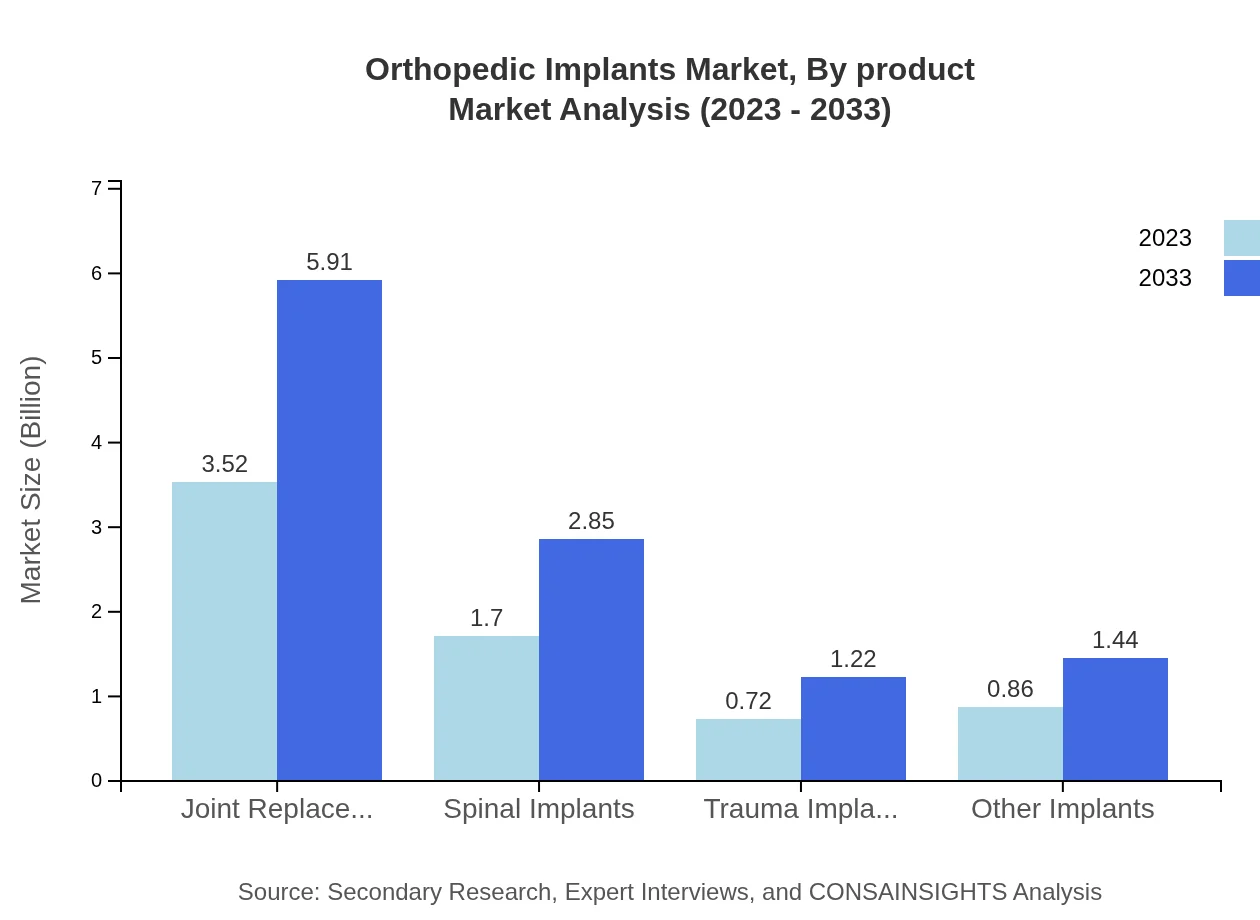

Orthopedic Implants Market Analysis By Product

The significant area of the orthopedic implants market lies in joint replacements, which accounted for $3.52 billion in 2023, with a forecast of $5.91 billion by 2033. This segment represents 51.75% of the total market. Spinal implants follow with a current value of $1.70 billion, increasing to $2.85 billion, while trauma implants and others provide substantial contributions in the growth trajectory of the market.

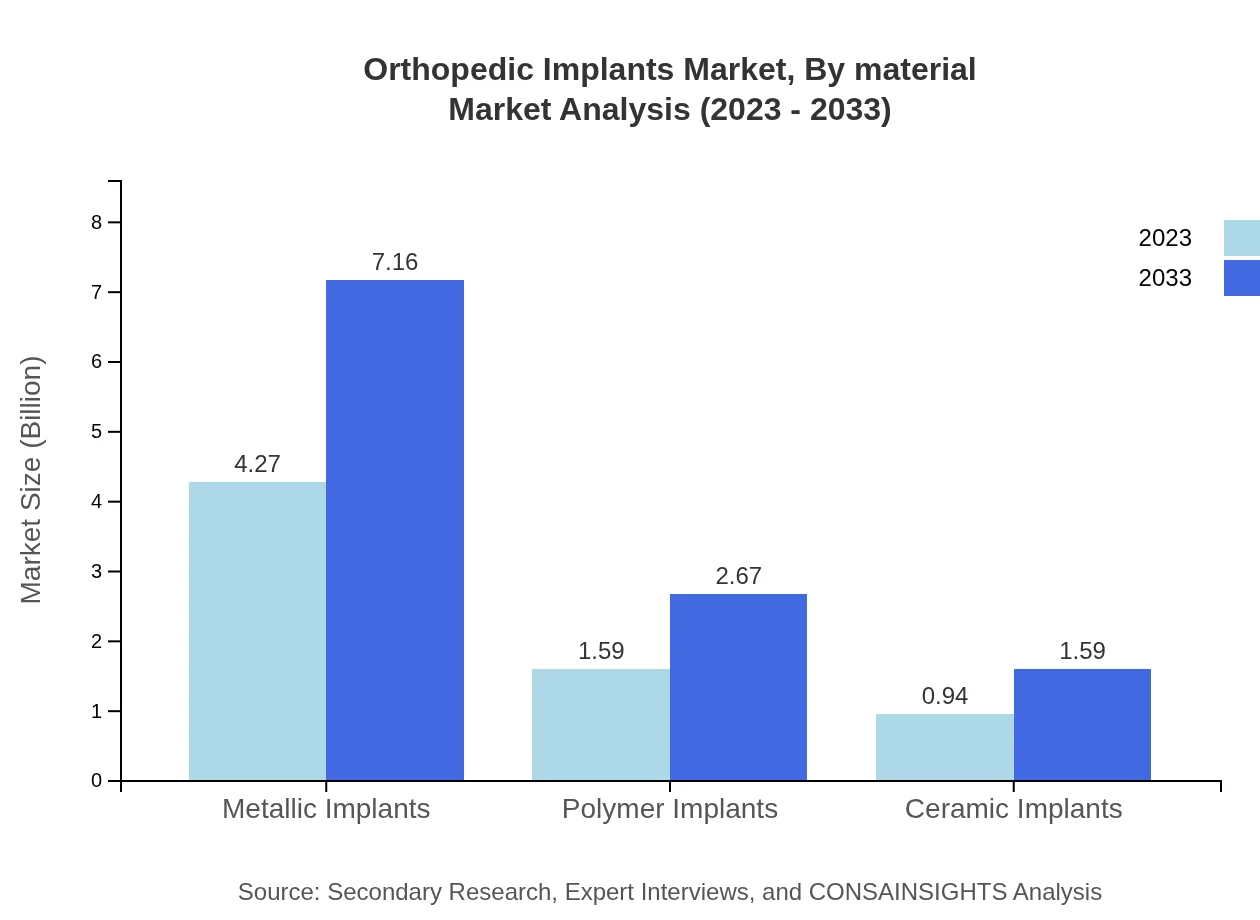

Orthopedic Implants Market Analysis By Material

The market is dominated by metallic implants, which hold a 62.75% market share currently valued at $4.27 billion, expected to reach $7.16 billion. In terms of revenue, polymer and ceramic implants also represent significant segments, valued at $1.59 billion and $0.94 billion respectively, indicating a diverse material use trend in modern orthopedic solutions.

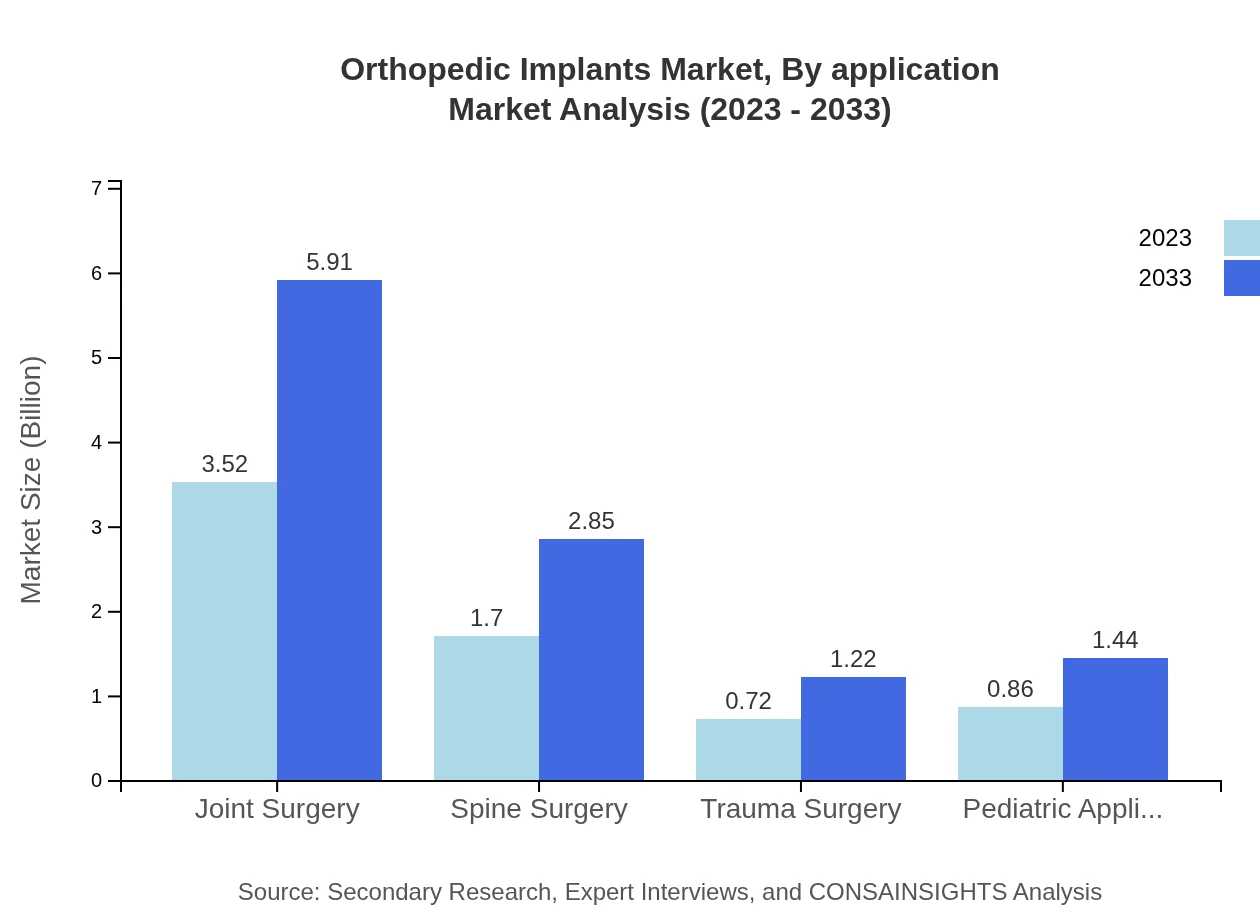

Orthopedic Implants Market Analysis By Application

The application of orthopedic implants is primarily categorized into joint surgery, spine surgery, trauma surgery, and pediatric applications. Joint surgery remains the largest segment at $3.52 billion. Each application has distinct contributions reflecting the broader trends in orthopedic healthcare.

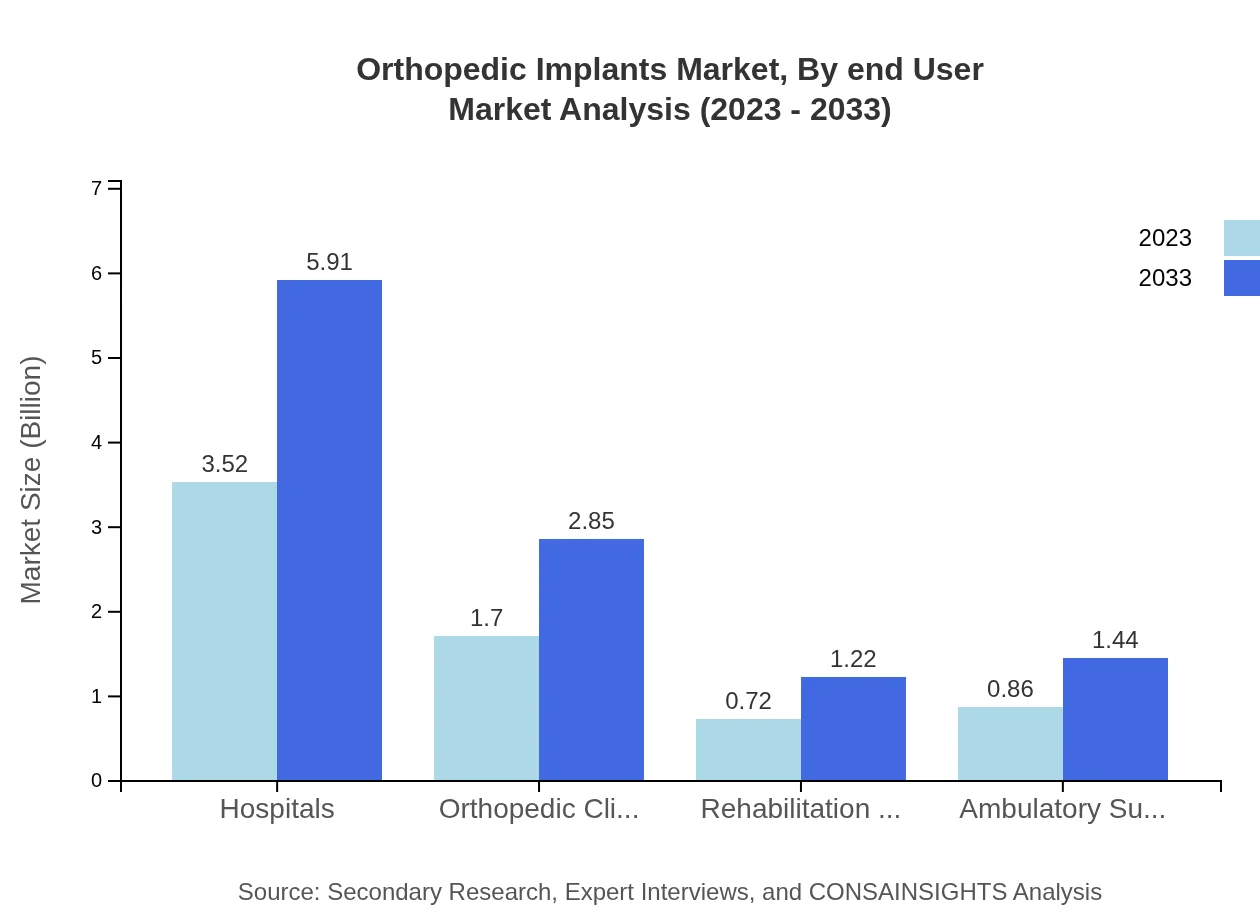

Orthopedic Implants Market Analysis By End User

End-user segmentation includes hospitals, orthopedic clinics, rehabilitation centers, and ambulatory surgical centers. Hospitals take a majority share at 51.75%, targeting a larger volume of surgical procedures. This highlights the demand for orthopedic implants in these settings as hospitals increasingly invest in advanced surgical solutions.

Orthopedic Implants Market Analysis By Region Distribution

Regionally, North America leads the market share followed by Europe and Asia Pacific. The distribution depicts varying growth rates and investment levels into healthcare technologies across regions, reflecting global disparities in orthopedic care accessibility.

Orthopedic Implants Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Orthopedic Implants Industry

DePuy Synthes:

A leader in orthopedic devices, DePuy Synthes focuses on joint reconstruction and trauma care, driving innovation through research and development.Stryker Corporation:

Renowned for its advanced orthopedic implants and surgical techniques, Stryker Corporation continually invests in new technologies to gain competitive advantage.Zimmer Biomet:

Specializes in musculoskeletal health solutions, Zimmer Biomet offers a wide range of orthopedic implants embraced worldwide for their quality.Smith & Nephew:

With a strong focus on innovation, Smith & Nephew develops state-of-the-art orthopedic products, addressing complex orthopedic challenges.We're grateful to work with incredible clients.

FAQs

What is the market size of orthopedic implants?

The orthopedic implants market is currently valued at approximately $6.8 billion and is expected to grow at a CAGR of 5.2% over the next decade, reaching significant milestones by 2033.

What are the key market players or companies in the orthopedic implants industry?

Key players in the orthopedic implants industry include Johnson & Johnson, Stryker Corporation, Zimmer Biomet, Medtronic, and Smith & Nephew, dominating the market with innovative product offerings.

What are the primary factors driving the growth in the orthopedic implants industry?

Growth in the orthopedic implants market is driven by an aging population, increasing prevalence of orthopedic diseases, and advancements in implant technology, including minimally invasive techniques and biocompatibility.

Which region is the fastest Growing in the orthopedic implants market?

Asia Pacific is the fastest-growing region in the orthopedic implants market, with a growth from $1.33 billion in 2023 to $2.24 billion by 2033, highlighting rapid healthcare advancements and increasing market demands.

Does ConsaInsights provide customized market report data for the orthopedic implants industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the orthopedic implants industry, providing detailed insights and data analysis.

What deliverables can I expect from this orthopedic implants market research project?

Expect deliverables like a comprehensive market report with segmented data, growth forecasts, competitive landscape analysis, and regional insights specifically designed for the orthopedic implants industry.

What are the market trends of orthopedic implants?

Trends include a shift towards minimally invasive surgeries, increased adoption of robotic-assisted procedures, and a rising preference for biologically-inspired materials in implant manufacturing.