Orthopedic Navigation Systems Market Report

Published Date: 31 January 2026 | Report Code: orthopedic-navigation-systems

Orthopedic Navigation Systems Market Size, Share, Industry Trends and Forecast to 2033

This report examines the Orthopedic Navigation Systems market from 2023 to 2033, providing comprehensive insights into market size, trends, segmentation, regional analyses, and competitive landscape.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

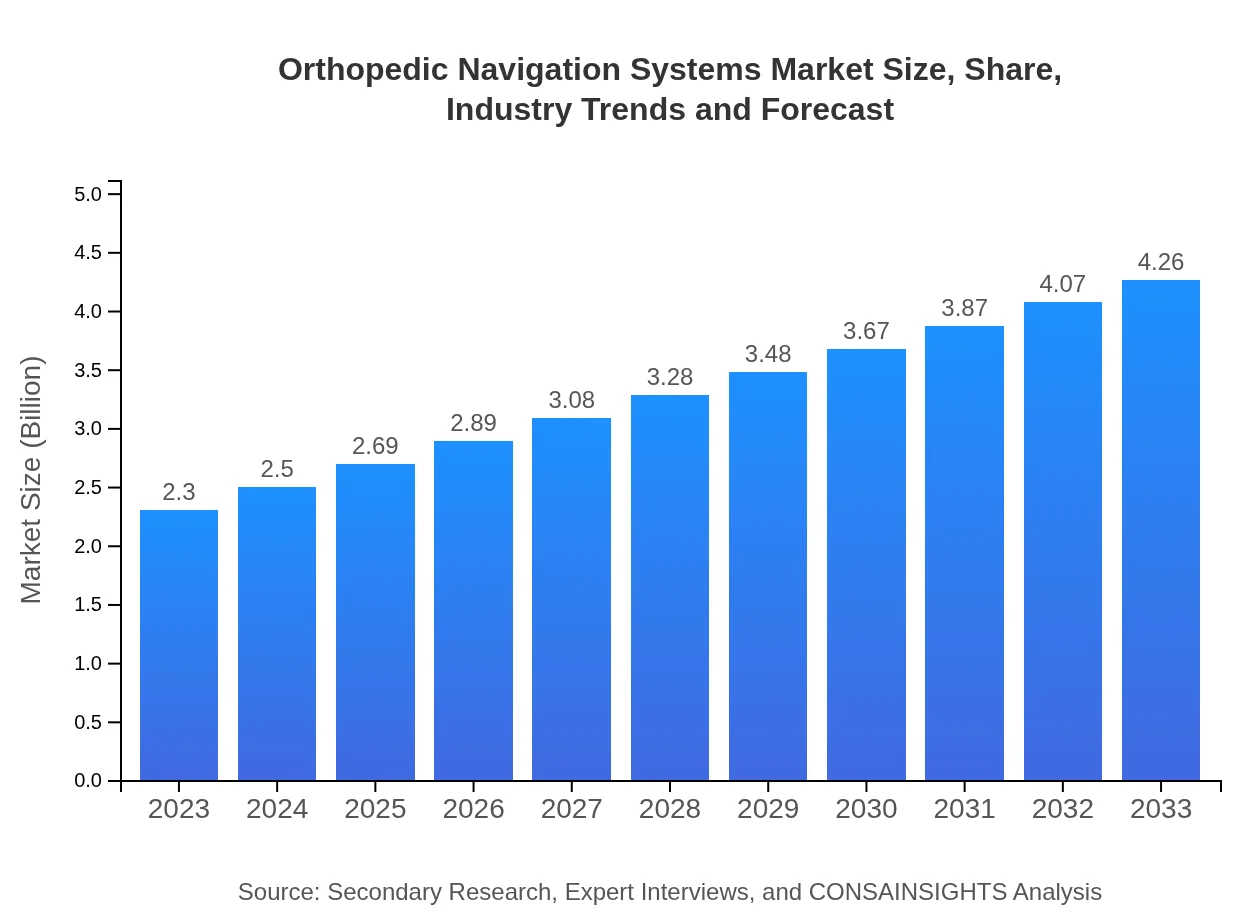

| 2023 Market Size | $2.30 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $4.26 Billion |

| Top Companies | Medtronic , Stryker , DePuy Synthes, Brainlab, Zimmer Biomet |

| Last Modified Date | 31 January 2026 |

Orthopedic Navigation Systems Market Overview

Customize Orthopedic Navigation Systems Market Report market research report

- ✔ Get in-depth analysis of Orthopedic Navigation Systems market size, growth, and forecasts.

- ✔ Understand Orthopedic Navigation Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Orthopedic Navigation Systems

What is the Market Size & CAGR of Orthopedic Navigation Systems market in 2023?

Orthopedic Navigation Systems Industry Analysis

Orthopedic Navigation Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Orthopedic Navigation Systems Market Analysis Report by Region

Europe Orthopedic Navigation Systems Market Report:

The European market size stands at approximately $700 million in 2023 and is estimated to reach $1.3 billion by 2033. The demand for precision surgery combined with robust healthcare systems in many European countries fosters this growth.Asia Pacific Orthopedic Navigation Systems Market Report:

In the Asia Pacific region, the Orthopedic Navigation Systems market was valued at approximately $410 million in 2023 and is projected to grow to $760 million by 2033. Rising healthcare infrastructure investments and increasing orthopedic procedure volumes drive this growth.North America Orthopedic Navigation Systems Market Report:

North America dominates the global market, with a valuation of $860 million in 2023, expected to rise to $1.6 billion by 2033. Contributing factors include high healthcare expenditures, technological advancements, and a substantial aging population requiring orthopedic interventions.South America Orthopedic Navigation Systems Market Report:

The South American market for Orthopedic Navigation Systems is valued at about $150 million in 2023, with expectations of reaching $280 million by 2033. Growth is driven by increasing awareness and adoption of advanced surgical technologies amidst developing healthcare sectors.Middle East & Africa Orthopedic Navigation Systems Market Report:

The market in the Middle East and Africa is valued at around $170 million in 2023, projected to grow to $320 million by 2033. This growth is supported by increasing healthcare investments and growing awareness regarding navigational systems in surgical procedures.Tell us your focus area and get a customized research report.

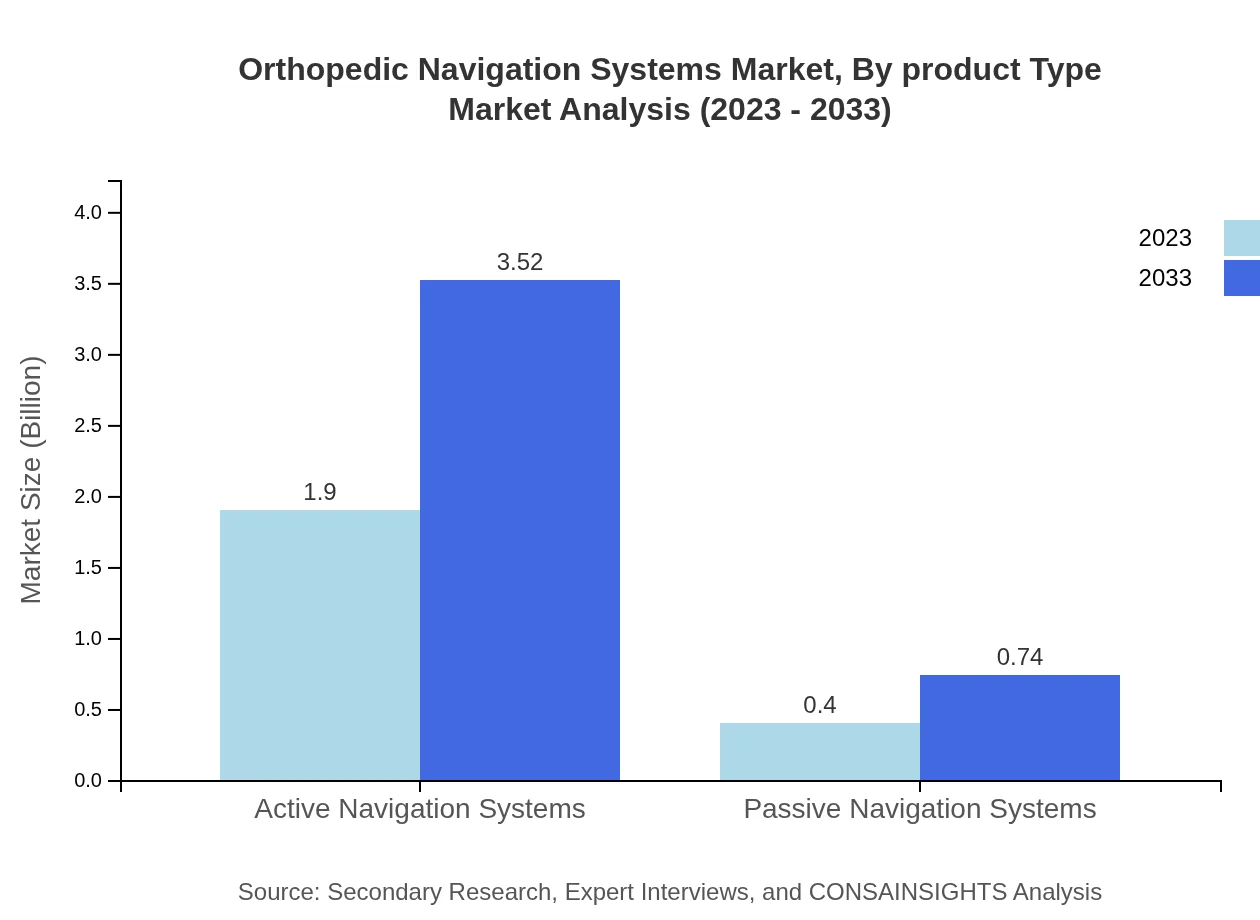

Orthopedic Navigation Systems Market Analysis By Product Type

The product types in the Orthopedic Navigation Systems market include Active Navigation Systems, which hold a significant market share of 82.61% in 2023, valued at $1.90 billion, expected to rise to $3.52 billion by 2033. Passive Navigation Systems make up the remaining share at 17.39%, currently valued at $0.40 billion with a projected growth to $0.74 billion by 2033.

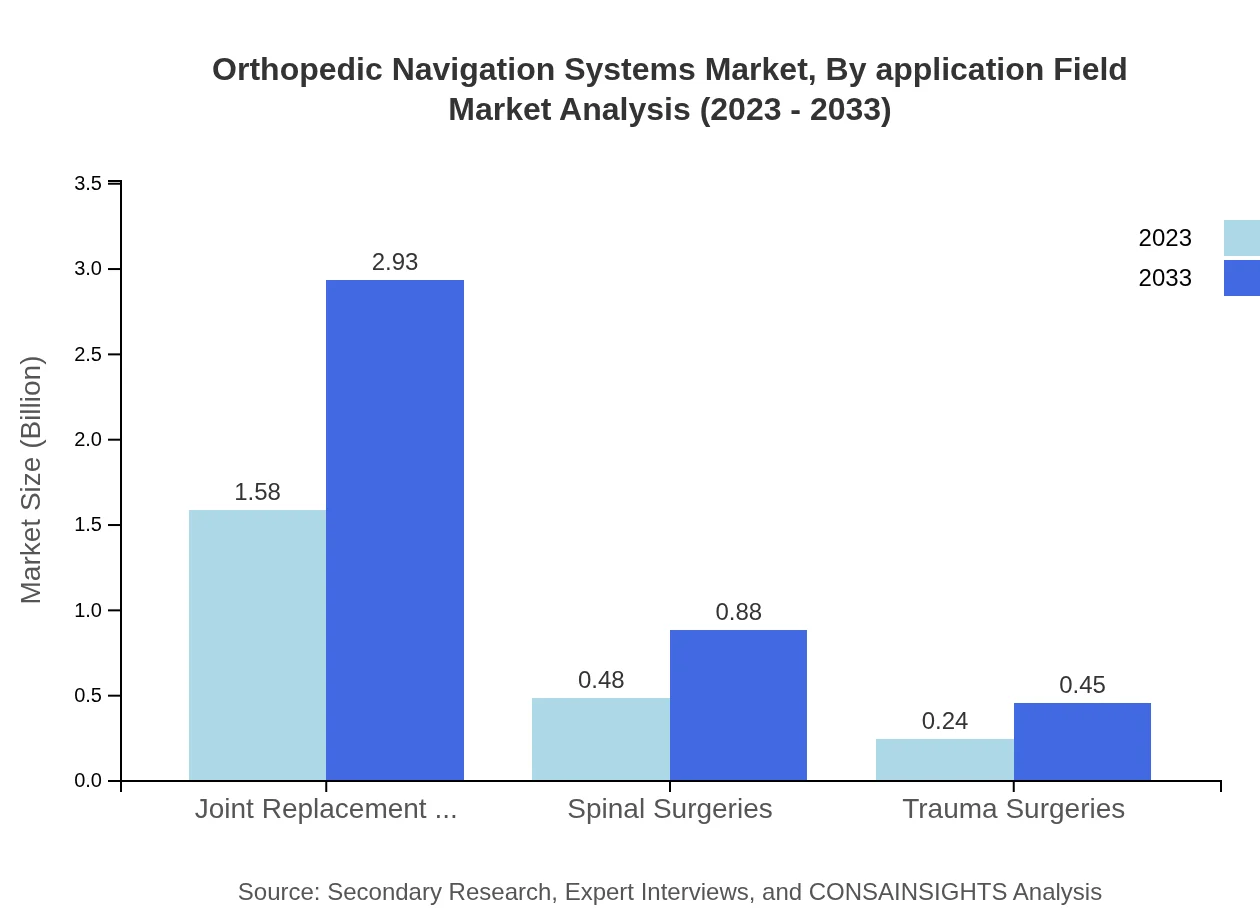

Orthopedic Navigation Systems Market Analysis By Application Field

In the application field segmentation, Joint Replacement Surgeries lead with a market share of 68.75%, valued at $1.58 billion in 2023 and anticipated to reach $2.93 billion by 2033. Following this are Spinal Surgeries and Trauma Surgeries with shares of 20.76% and 10.49%, illustrating rising demand in specialized orthopedic procedures.

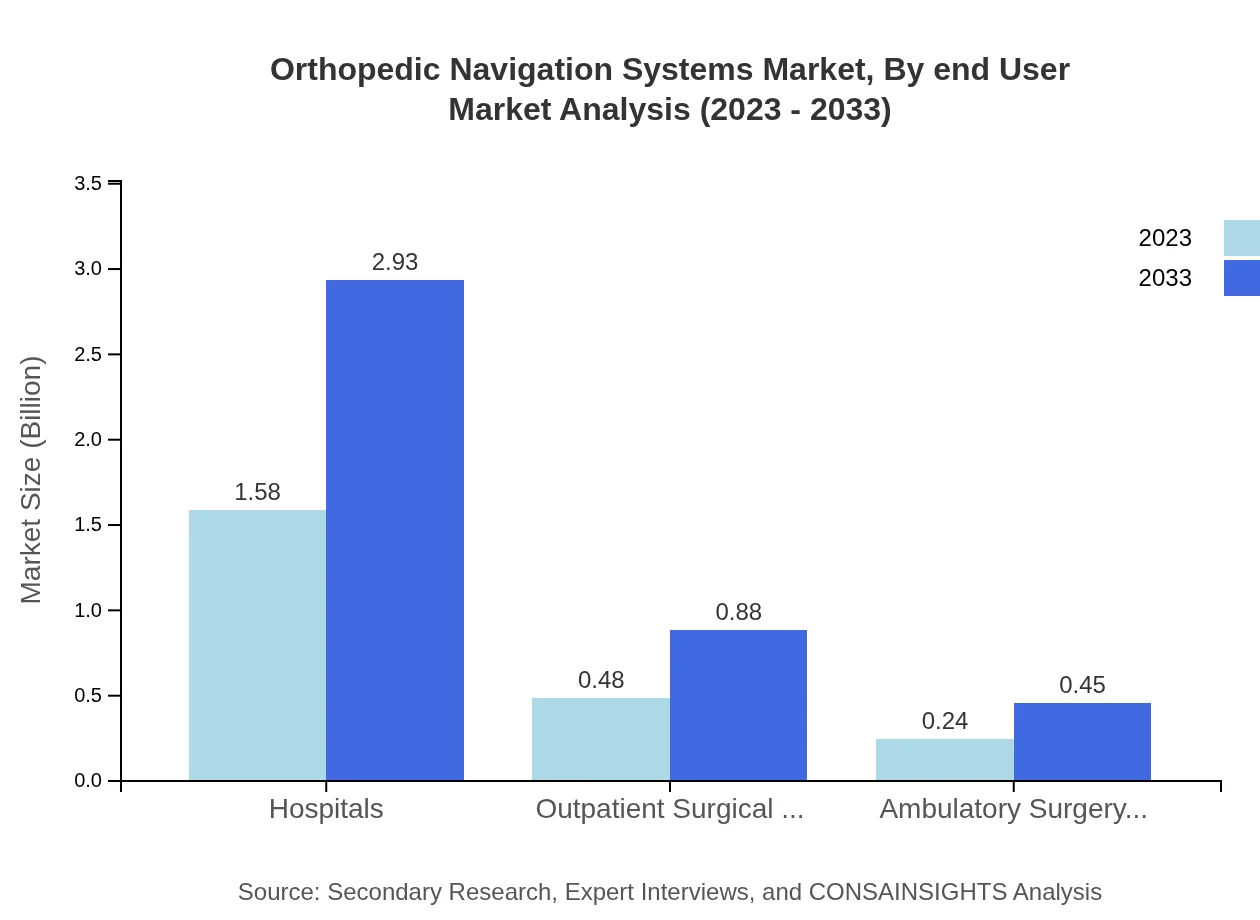

Orthopedic Navigation Systems Market Analysis By End User

The market is predominantly utilized by hospitals, accounting for 68.75% of the share, valued at approximately $1.58 billion in 2023 and expected to rise to $2.93 billion in 2033. Outpatient Surgical Centers and Ambulatory Surgery Centers follow with respective shares of 20.76% and 10.49%.

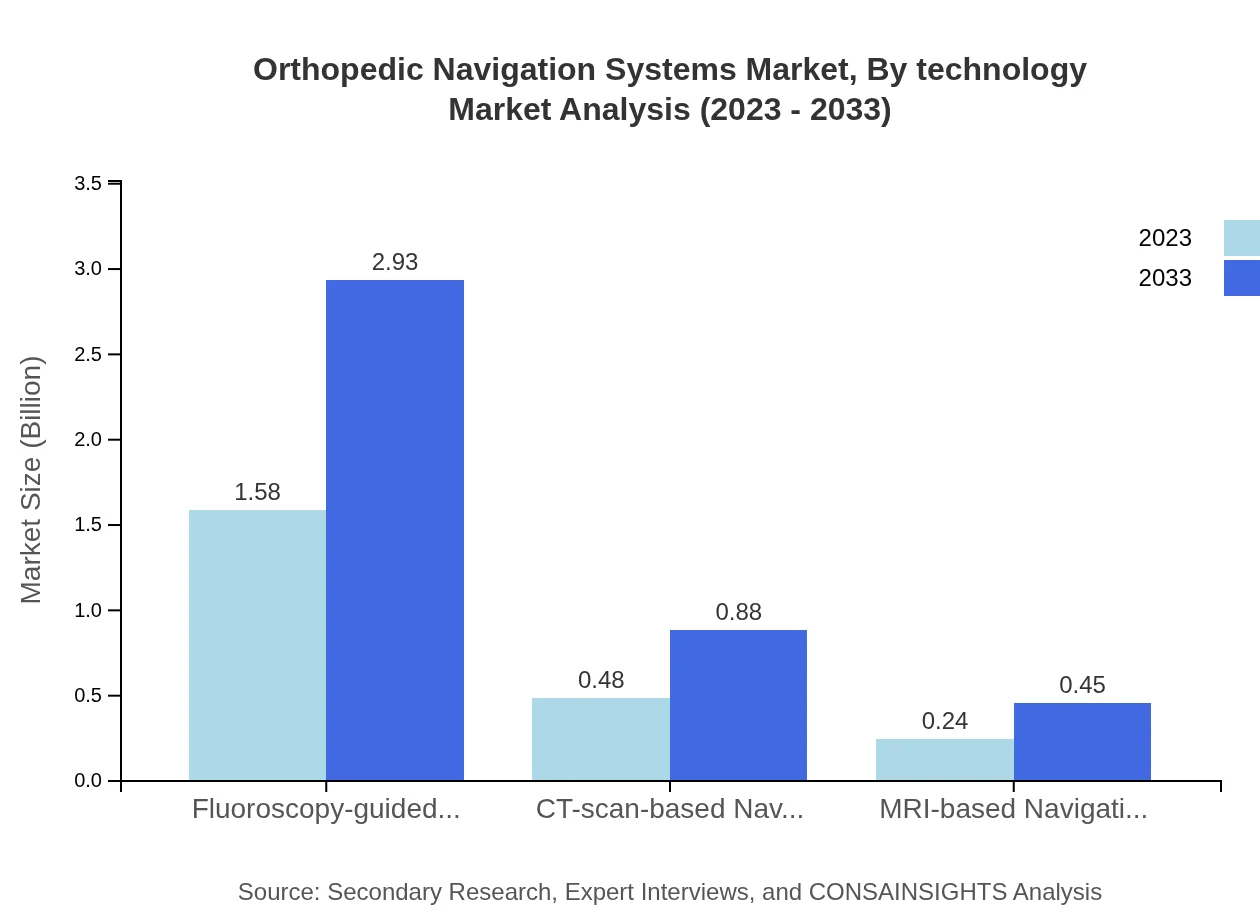

Orthopedic Navigation Systems Market Analysis By Technology

Fluoroscopy-guided Navigation continues to dominate the technology segment, holding a market share of 68.75% in 2023, valued at $1.58 billion, forecasted to increase to $2.93 billion by 2033. CT-scan-based Navigation and MRI-based Navigation contribute to 20.76% and 10.49% of the share respectively, indicating a diversified technological landscape.

Orthopedic Navigation Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Orthopedic Navigation Systems Industry

Medtronic :

A leader in medical technology, Medtronic provides innovative orthopedic navigation systems that enhance surgical precision.Stryker :

Known for its advanced surgical technologies, Stryker's navigation systems are widely adopted in orthopedic surgeries for better outcomes.DePuy Synthes:

A subsidiary of Johnson & Johnson, DePuy Synthes focuses on creating solutions for orthopedic surgeries, including navigation systems.Brainlab:

Specializing in digital surgery, Brainlab's navigation and imaging technologies aid in precision orthopedic surgeries.Zimmer Biomet:

Zimmer Biomet offers a range of orthopedic solutions including advanced navigation systems that improve surgical accuracy.We're grateful to work with incredible clients.

FAQs

What is the market size of orthopedic Navigation Systems?

The orthopedic navigation systems market is valued at $2.3 billion in 2023, with an anticipated CAGR of 6.2% through 2033. This growth reflects increased demand for advanced surgical navigation solutions to improve patient outcomes and surgical precision.

What are the key market players or companies in this orthopedic Navigation Systems industry?

Key players include Medtronic, Stryker Corporation, Smith & Nephew, Zimmer Biomet, and Brainlab. These companies are pivotal in driving innovation, creating advanced navigation systems used in orthopedic surgeries.

What are the primary factors driving the growth in the orthopedic Navigation Systems industry?

Key growth drivers include the rising demand for minimally invasive surgeries, technological advancements in navigation systems, increasing prevalence of orthopedic disorders, and growing geriatric population contributing to higher surgical rates.

Which region is the fastest Growing in the orthopedic Navigation Systems?

North America is the fastest-growing region, projected to reach $1.60 billion by 2033, reflecting a robust healthcare infrastructure and high adoption of advanced surgical technologies across hospitals and surgical centers.

Does ConsaInsights provide customized market report data for the orthopedic Navigation Systems industry?

Yes, ConsaInsights offers tailored market report data, allowing clients to receive specialized insights and analytics that align with their specific business needs and objectives in the orthopedic navigation systems market.

What deliverables can I expect from this orthopedic Navigation Systems market research project?

Deliverables from this research project include a comprehensive market report, detailed competitor analysis, segment data, regional insights, growth forecasts, and actionable recommendations for market entry strategies.

What are the market trends of orthopedic Navigation Systems?

Current trends include an increase in the adoption of robotic-assisted surgeries, integration of AI in navigation systems, and a shift towards outpatient surgical centers, enhancing patient recovery and reducing costs.