Orthopedic Orthotics Market Report

Published Date: 31 January 2026 | Report Code: orthopedic-orthotics

Orthopedic Orthotics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Orthopedic Orthotics market, covering insights on market size, trends, segmentation, regional analysis, and forecasts for the period 2023-2033.

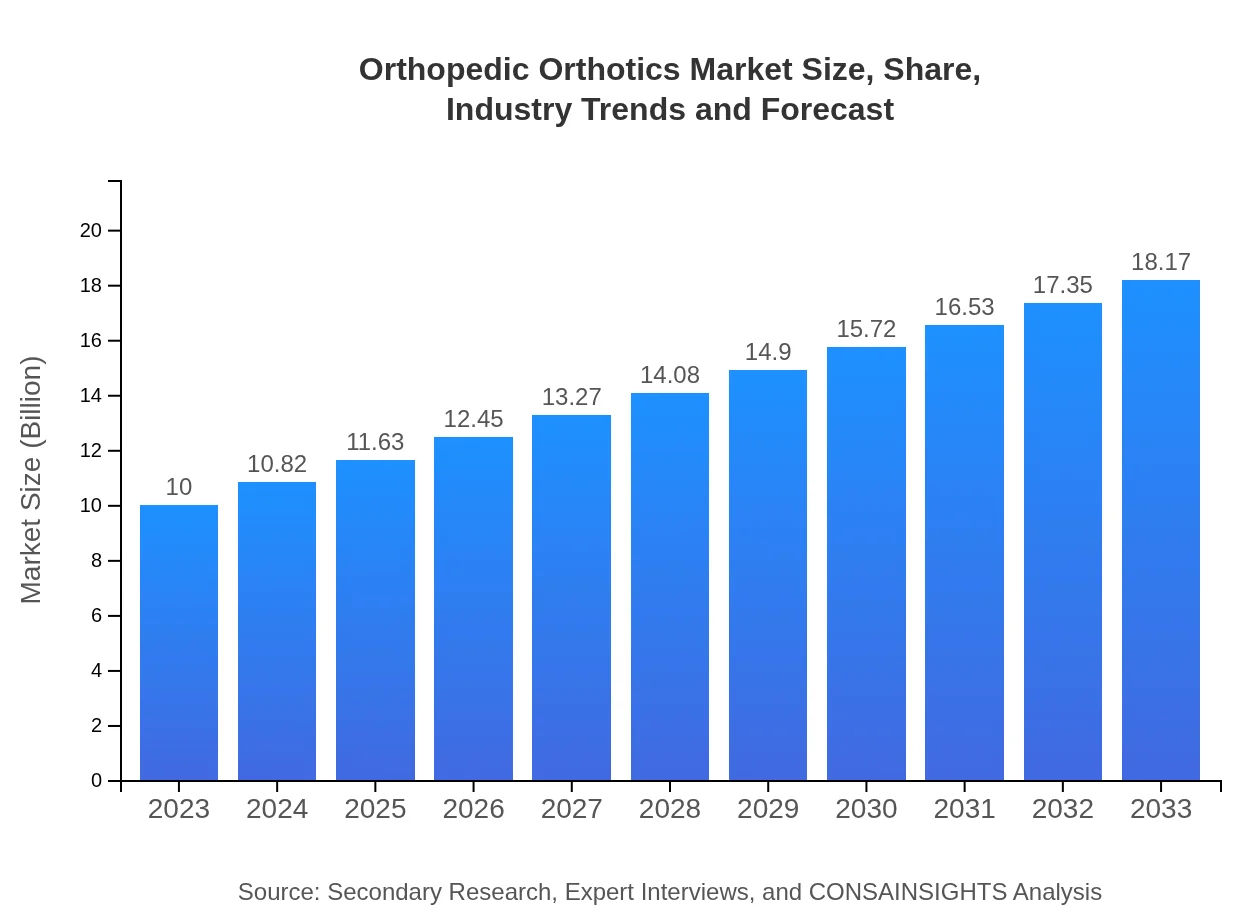

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 6% |

| 2033 Market Size | $18.17 Billion |

| Top Companies | DJO Global, Inc., Ottobock, Breg, Inc., Hanger, Inc. |

| Last Modified Date | 31 January 2026 |

Orthopedic Orthotics Market Overview

Customize Orthopedic Orthotics Market Report market research report

- ✔ Get in-depth analysis of Orthopedic Orthotics market size, growth, and forecasts.

- ✔ Understand Orthopedic Orthotics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Orthopedic Orthotics

What is the Market Size & CAGR of Orthopedic Orthotics market in 2023?

Orthopedic Orthotics Industry Analysis

Orthopedic Orthotics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Orthopedic Orthotics Market Analysis Report by Region

Europe Orthopedic Orthotics Market Report:

In Europe, the market is estimated to grow from $3.51 billion in 2023 to $6.38 billion by 2033. The rise in the aging population, coupled with a growing emphasis on rehabilitation and recovery, fosters demand for orthopedic orthotics. Moreover, support from various health policies encourages the use of orthopedic devices.Asia Pacific Orthopedic Orthotics Market Report:

The Asia Pacific region is witnessing significant growth in the Orthopedic Orthotics market, projected to escalate from $1.74 billion in 2023 to $3.17 billion by 2033. The increase in population and rising incidences of chronic diseases contribute to this growth. Additionally, improving healthcare infrastructure and affordability of orthotic support systems are expected to enhance market presence in the region.North America Orthopedic Orthotics Market Report:

North America remains a dominant market, with the size anticipated to expand from $3.44 billion in 2023 to $6.25 billion by 2033. The growth is driven by advanced healthcare systems, high spending on orthopedic treatments, and increased awareness about orthopedic conditions. The region is also characterized by significant investments in research and technology advancements.South America Orthopedic Orthotics Market Report:

In South America, the Orthopedic Orthotics market is forecasted to decline slightly, from $-0.07 billion in 2023 to $-0.13 billion in 2033. This unconventional trend reflects challenges such as economic downturns and limitations in healthcare accessibility, which may hinder the demand for orthotic products.Middle East & Africa Orthopedic Orthotics Market Report:

The Middle East and Africa market is expected to grow from $1.37 billion in 2023 to $2.49 billion by 2033, driven by improving healthcare infrastructure and growing awareness of advanced orthopedic treatments. The demand for high-quality orthopedic devices continues to surge as the region invests in healthcare improvements.Tell us your focus area and get a customized research report.

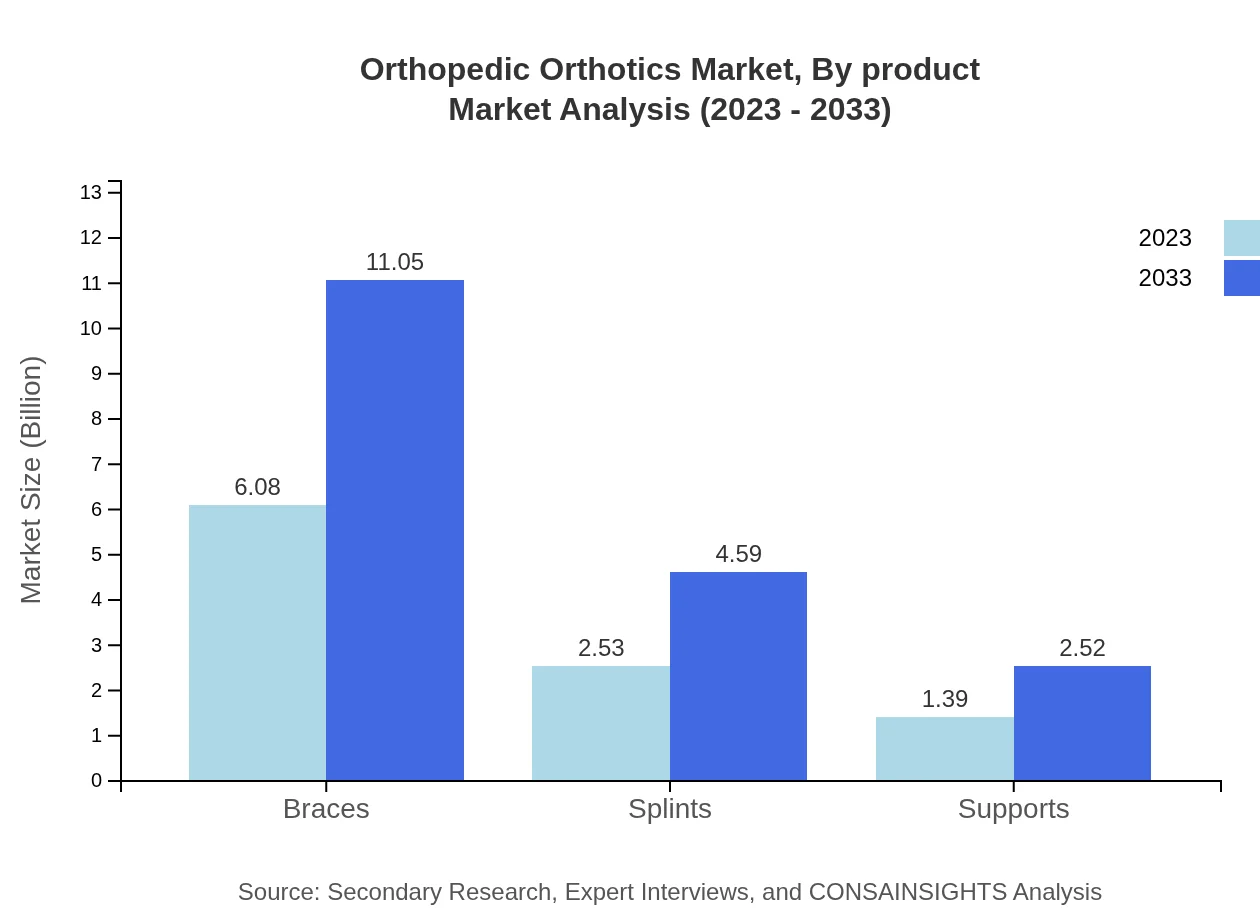

Orthopedic Orthotics Market Analysis By Product

The orthopedic orthotics market is significantly driven by the product segment, specifically braces. In 2023, braces take up a market size of $6.08 billion, growing to $11.05 billion by 2033, showing consistent demand across healthcare settings. Furthermore, splints and supports are emerging segments that contribute substantially to market dynamics.

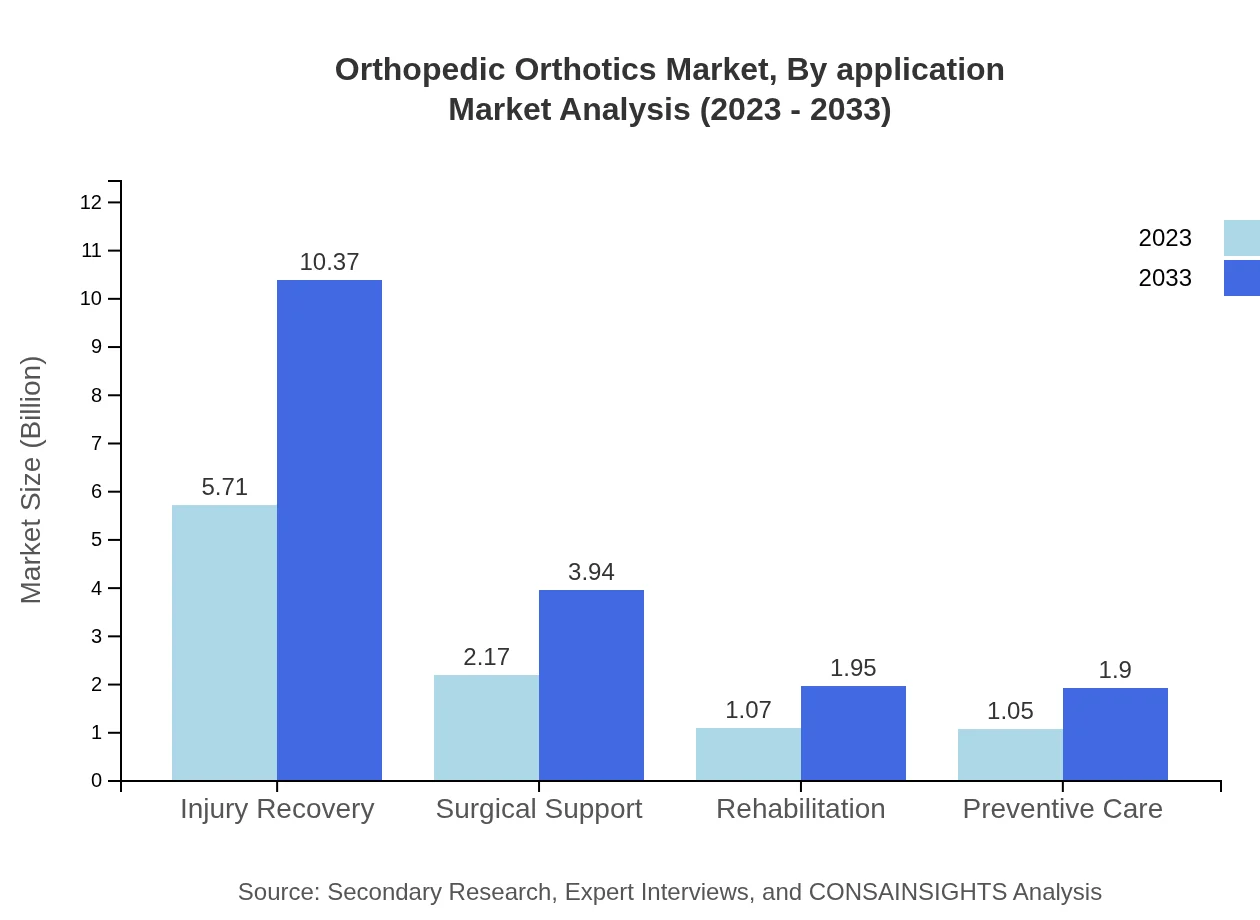

Orthopedic Orthotics Market Analysis By Application

In terms of application, the emphasis lies on injury recovery, which holds a market share of 57.09% in 2023. Additionally, sectors like rehabilitation and preventive care are critical, as they cater to the growing need for proactive health management. Rehabilitation centers and hospitals represent key users of orthotic devices.

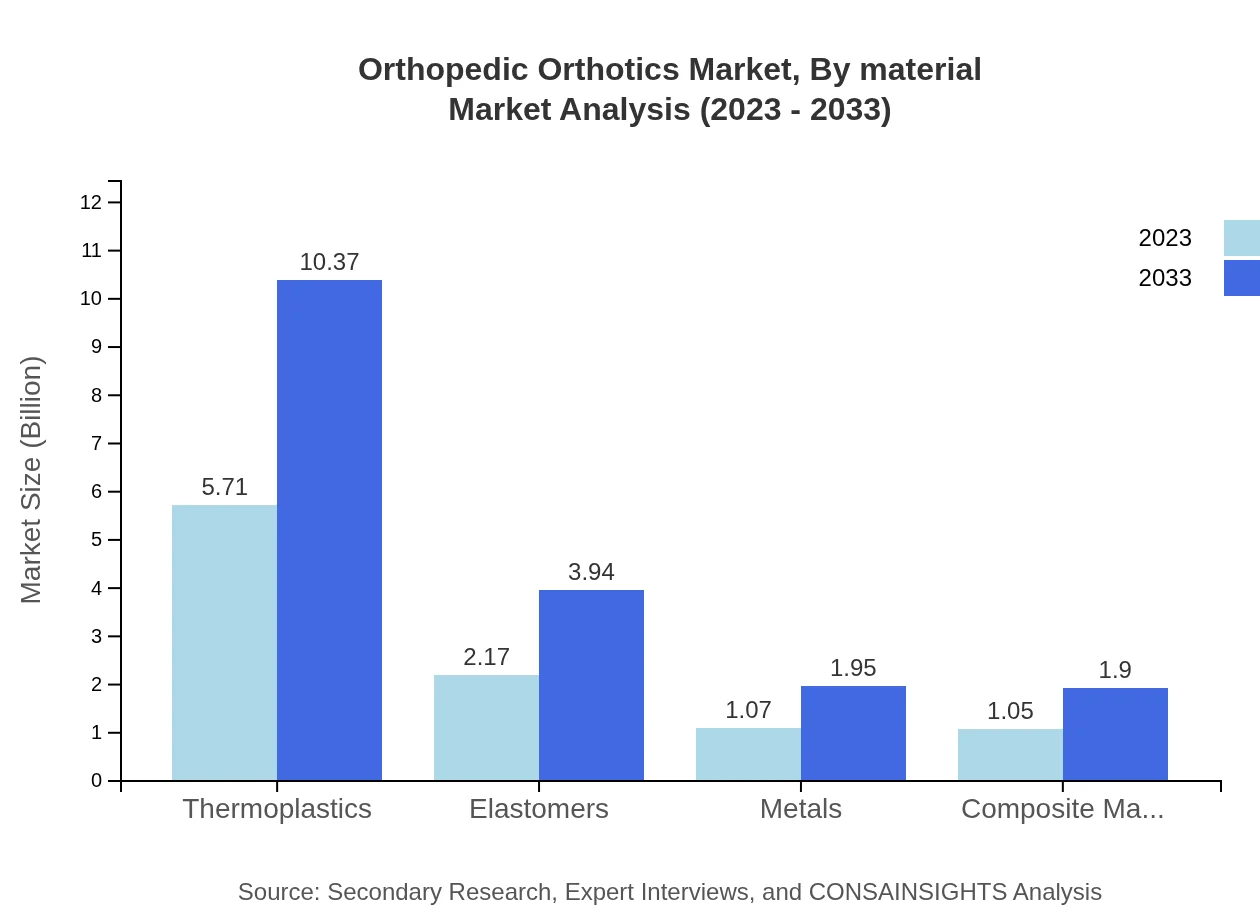

Orthopedic Orthotics Market Analysis By Material

The choice of materials directly impacts the performance of orthopedic devices. Thermoplastics dominate the market at 57.09% in terms of share, primarily due to their versatility and comfort. Other materials, including elastomers and metals, are also utilized based on specific therapeutic needs.

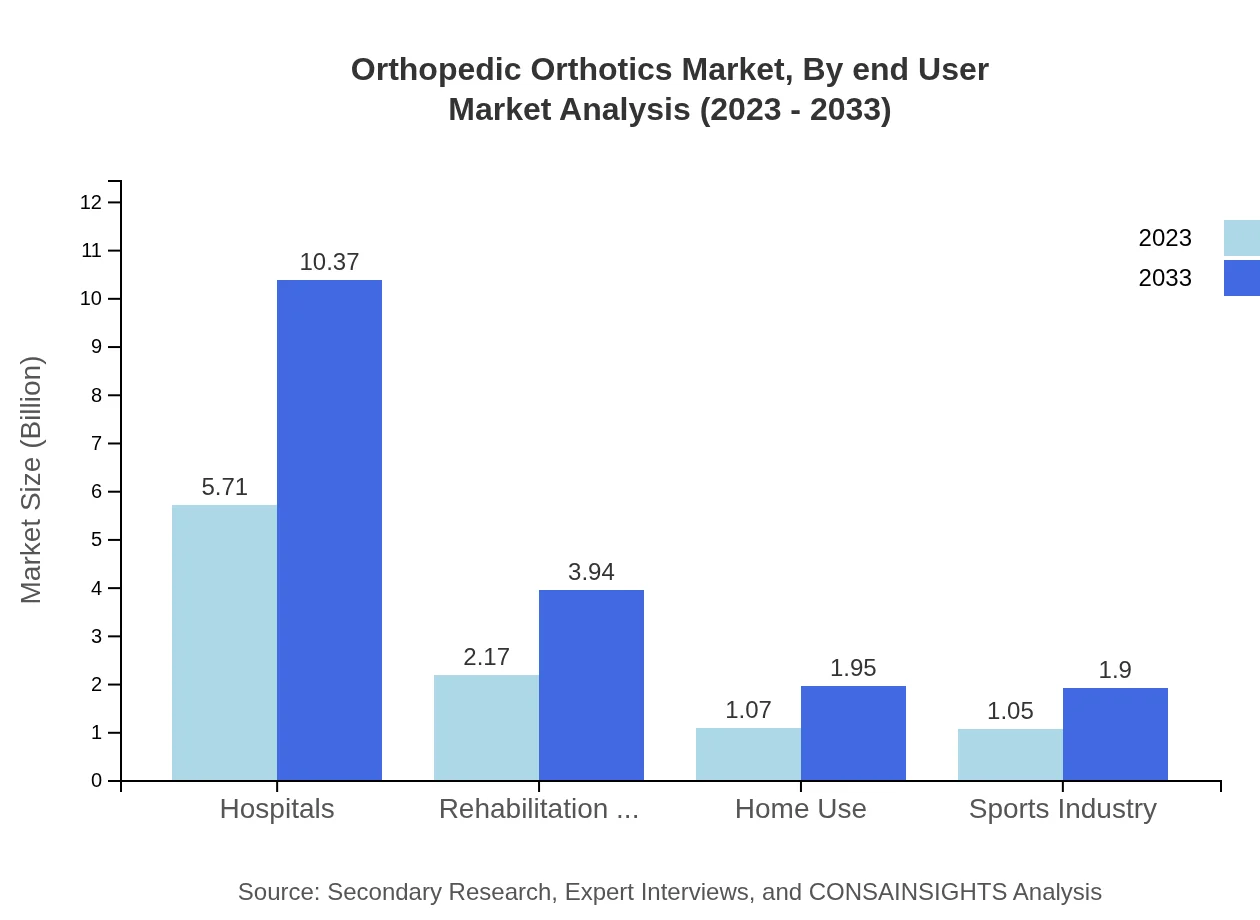

Orthopedic Orthotics Market Analysis By End User

Hospitals account for approximately 57.09% of the market share, demonstrating the crucial role of healthcare providers in distributing orthopedic orthotics. Rehabilitation centers and home care settings also show significant engagement, reflecting the diverse use across different care environments.

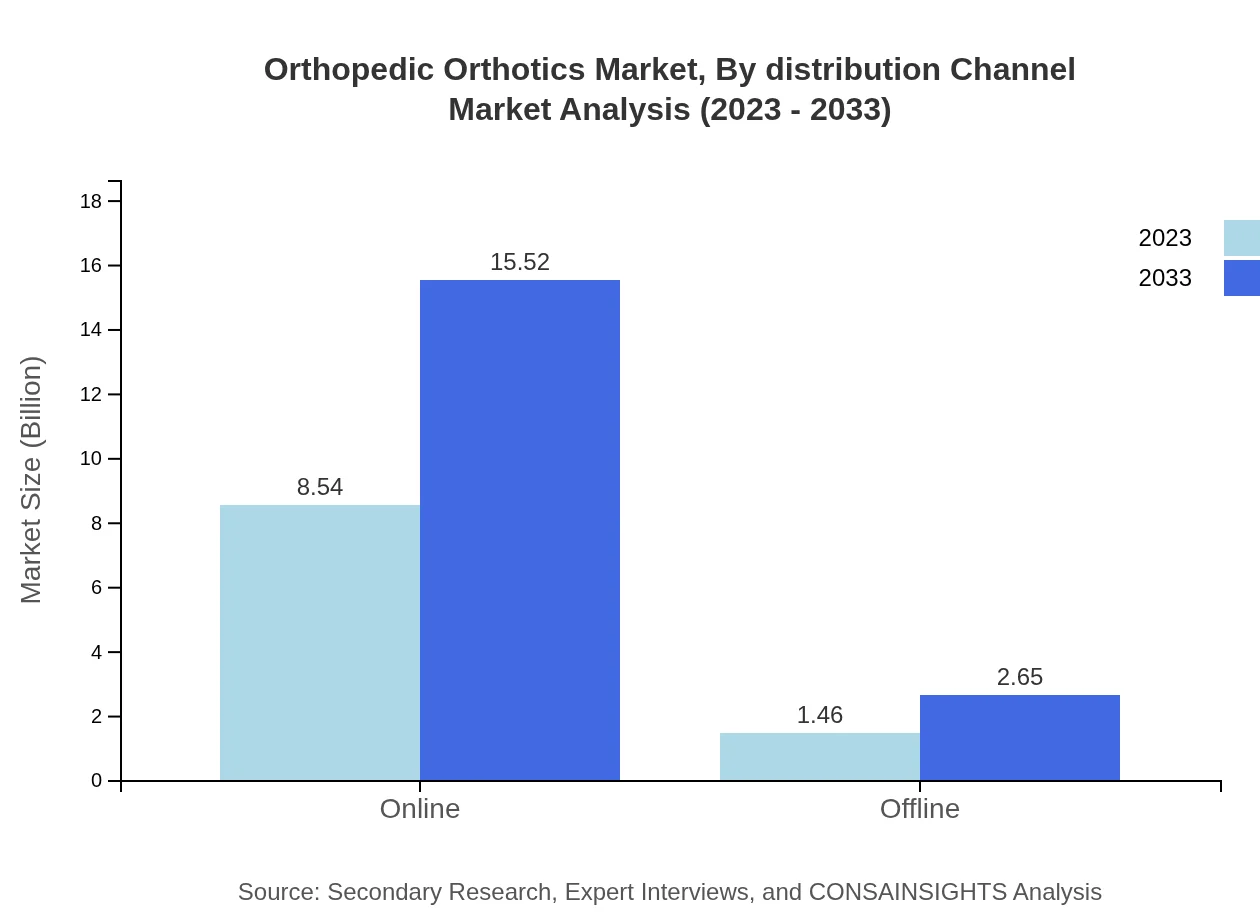

Orthopedic Orthotics Market Analysis By Distribution Channel

Distribution channels are trending toward online platforms, which comprise an impressive 85.43% market share in 2023. This shift reveals changing consumer behavior in purchasing orthopedic devices. Offline channels still maintain relevance, but there's a pressing need for companies to establish robust online strategies.

Orthopedic Orthotics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Orthopedic Orthotics Industry

DJO Global, Inc.:

DJO Global is a leading medical device company offering innovative orthopedic solutions to enhance mobility and recovery.Ottobock:

Ottobock specializes in orthopedic technology and is known for its high-quality prosthetics and orthotic solutions, focusing on innovation.Breg, Inc.:

Breg, Inc. provides a diverse range of orthopedic products and has established a reputation for quality and customer satisfaction.Hanger, Inc.:

Hanger, Inc. is a prominent provider of orthotic and prosthetic services in the USA, with a commitment to customized patient care.We're grateful to work with incredible clients.

FAQs

What is the market size of orthopedic Orthotics?

The orthopedic-orthotics market size is currently estimated at $10 billion with a projected CAGR of 6% from 2023 to 2033. This growth is driven by increasing demand for orthopedic devices and an aging population requiring orthopedic support.

What are the key market players or companies in this orthopedic Orthotics industry?

Key players in the orthopedic-orthotics market include established medical device companies such as Össur, DJO Global, and Hanger Inc., among others. These companies focus on product innovation and expanding their market reach internationally.

What are the primary factors driving the growth in the orthopedic Orthotics industry?

The growth of the orthopedic-orthotics industry is driven by factors such as the rise in injuries and disabilities, advancements in technology, increasing geriatric population, and a growing awareness of orthopedic care among consumers.

Which region is the fastest Growing in the orthopedic Orthotics?

The fastest-growing region in the orthopedic-orthotics market is Europe, where the market is expected to grow from $3.51 billion in 2023 to $6.38 billion by 2033, reflecting a significant increase in demand for orthopedic solutions.

Does ConsaInsights provide customized market report data for the orthopedic Orthotics industry?

Yes, ConsaInsights offers customized market reports tailored to specific client needs in the orthopedic-orthotics industry. This includes bespoke data analysis, insights, and forecasts suited to business objectives.

What deliverables can I expect from this orthopedic Orthotics market research project?

Expect deliverables such as comprehensive market analysis, segmented insights, growth forecasts, competitive landscape reviews, and strategic recommendations in the orthopedic-orthotics market research project.

What are the market trends of orthopedic Orthotics?

Current market trends in orthopedic-orthotics include increasing adoption of innovative materials, a shift towards online sales channels, and a growing focus on personalized orthotic devices catering to individual needs.