Orthopedic Prosthetics Market Report

Published Date: 31 January 2026 | Report Code: orthopedic-prosthetics

Orthopedic Prosthetics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Orthopedic Prosthetics market from 2023 to 2033, offering insights into market size, growth rates, industry trends, and regional performance. Key market segments and forecasts are also discussed to aid stakeholders in strategic planning.

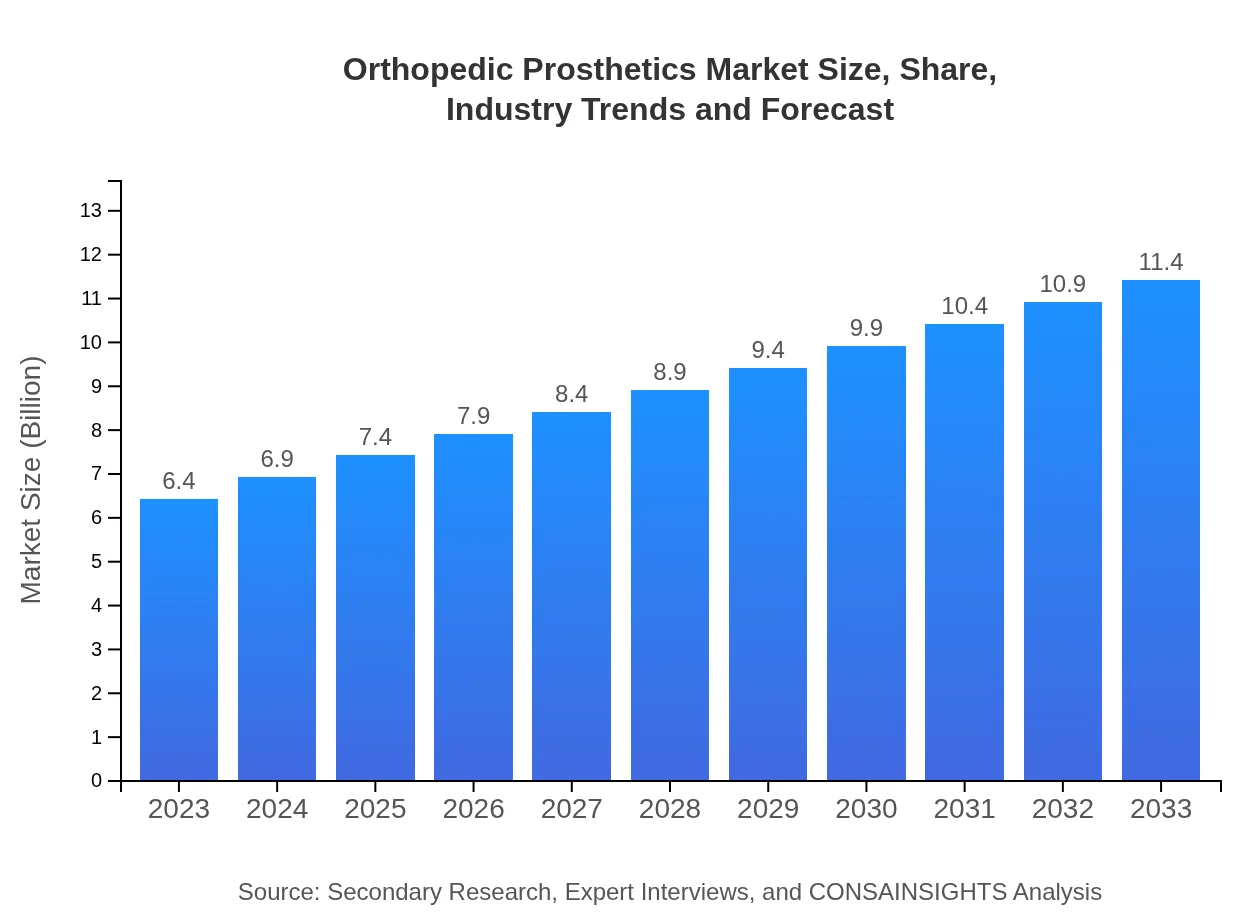

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.40 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $11.40 Billion |

| Top Companies | Össur, Hanger Inc., Stryker Corporation, Smith & Nephew |

| Last Modified Date | 31 January 2026 |

Orthopedic Prosthetics Market Overview

Customize Orthopedic Prosthetics Market Report market research report

- ✔ Get in-depth analysis of Orthopedic Prosthetics market size, growth, and forecasts.

- ✔ Understand Orthopedic Prosthetics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Orthopedic Prosthetics

What is the Market Size & CAGR of Orthopedic Prosthetics market in 2023?

Orthopedic Prosthetics Industry Analysis

Orthopedic Prosthetics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Orthopedic Prosthetics Market Analysis Report by Region

Europe Orthopedic Prosthetics Market Report:

Europe's Orthopedic Prosthetics market is projected to rise from $1.99 billion in 2023 to $3.55 billion by 2033. The region’s emphasis on rehabilitative care, favorable reimbursement policies, and a growing elderly population are key factors driving this growth. Germany, UK, and France are expected to remain significant contributors.Asia Pacific Orthopedic Prosthetics Market Report:

The Asia Pacific region is experiencing rapid growth in the Orthopedic Prosthetics market, predicted to rise from $1.31 billion in 2023 to $2.33 billion by 2033. The rising number of surgeries and increased healthcare investments contribute significantly to this growth. Countries like China and India are expected to lead the demand due to their large populations and progressive healthcare infrastructure.North America Orthopedic Prosthetics Market Report:

North America holds a leading market position, with market size expected to grow from $2.10 billion in 2023 to $3.74 billion in 2033. The high prevalence of obesity, diabetes, and vascular diseases leading to amputations boosts market demand, alongside advanced healthcare facilities and patient education.South America Orthopedic Prosthetics Market Report:

In South America, the market is expected to grow from $0.46 billion in 2023 to $0.82 billion by 2033. The increase in chronic diseases and accidents necessitates the demand for prosthetics, supported by improving healthcare systems in countries like Brazil and Argentina, where investments in medical technologies are on the rise.Middle East & Africa Orthopedic Prosthetics Market Report:

The market in the Middle East and Africa is anticipated to grow from $0.54 billion in 2023 to $0.97 billion by 2033. Increased health awareness, expanding healthcare infrastructure, and rising incidences of traumatic injuries contribute to market growth in this region.Tell us your focus area and get a customized research report.

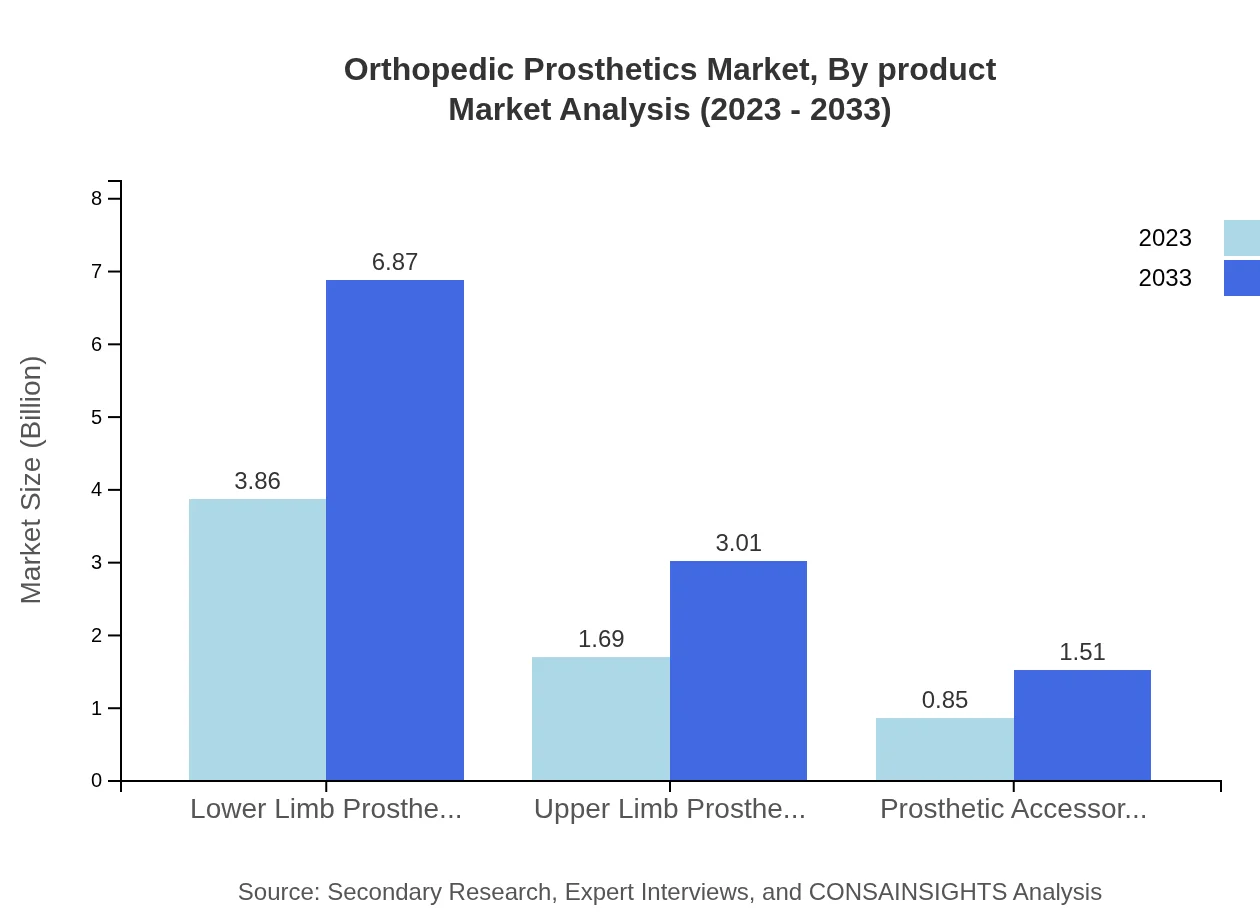

Orthopedic Prosthetics Market Analysis By Product

The Orthopedic Prosthetics market, segmented by product, emphasizes the significance of lower limb prosthetics, projected to grow from $3.86 billion in 2023 to $6.87 billion by 2033, retaining a significant market share of 60.3%. Upper limb prosthetics, while smaller, are expected to expand from $1.69 billion to $3.01 billion, holding a 26.41% market share. Prosthetic accessories, crucial for improving user experience, will see growth from $0.85 billion to $1.51 billion, representing 13.29% of the market.

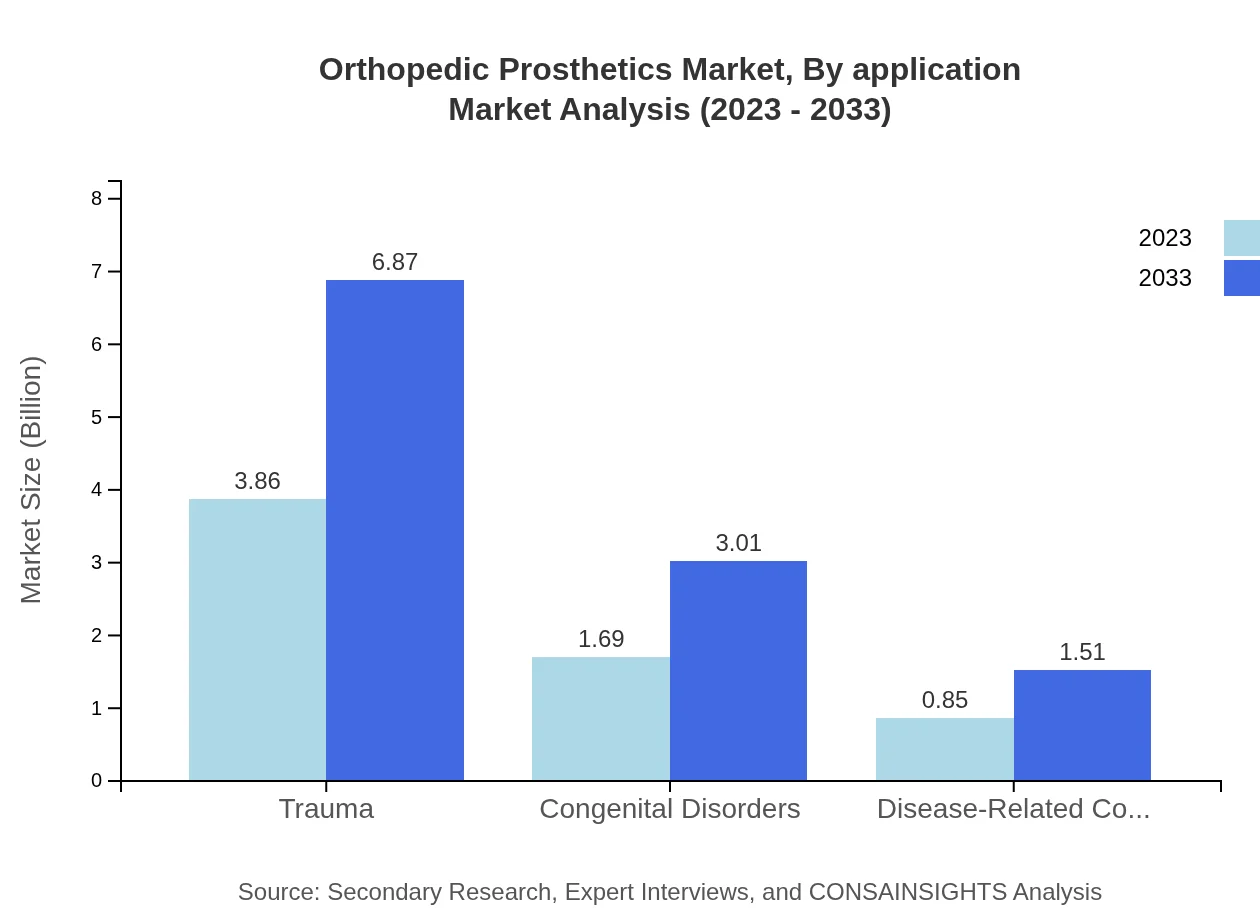

Orthopedic Prosthetics Market Analysis By Application

In terms of application, trauma continues to dominate the Orthopedic Prosthetics market, growing from $3.86 billion in 2023 to $6.87 billion by 2033, comprising 60.3% of the overall market. Congenital disorders and disease-related conditions are also significant, with shares of 26.41% and 13.29%, respectively, indicating sustained demand across various applications.

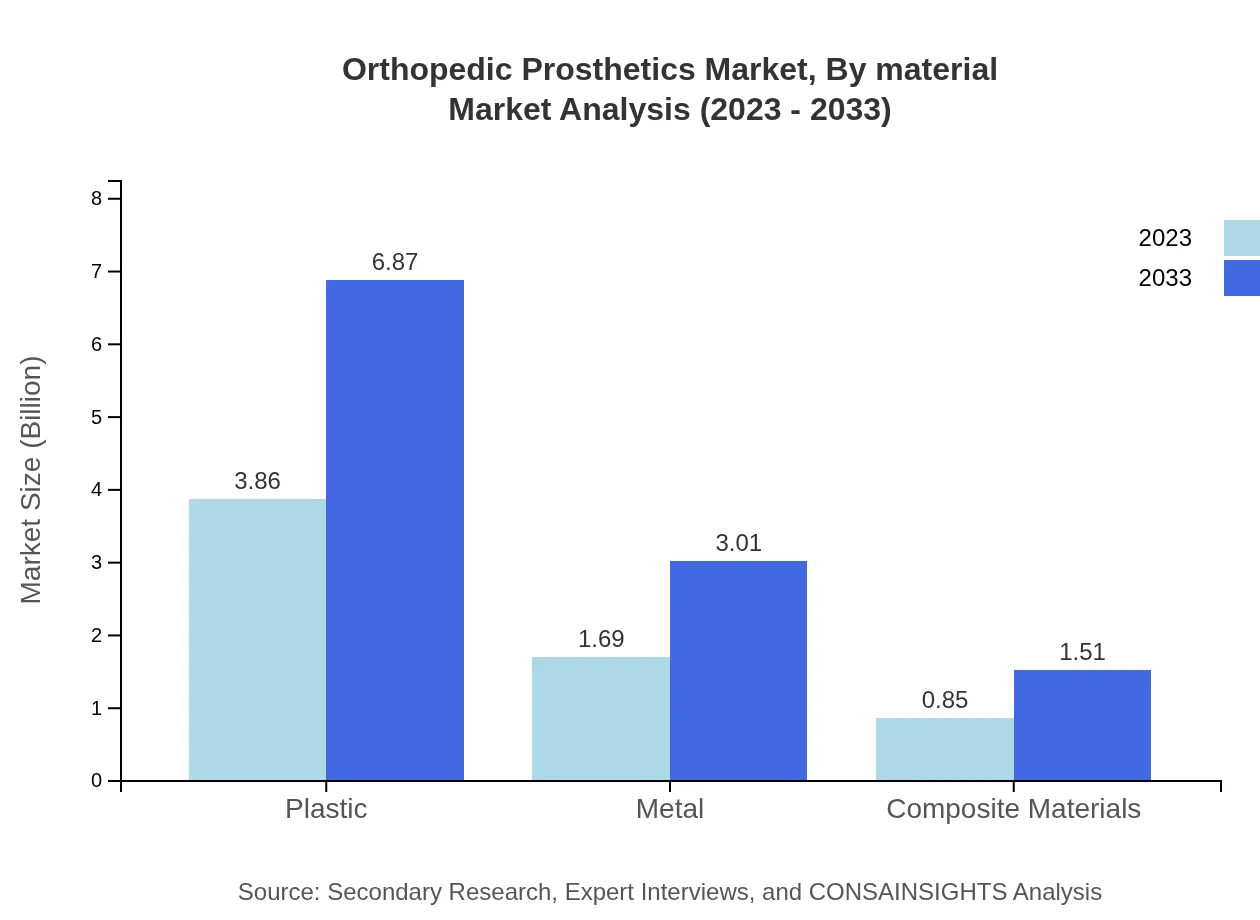

Orthopedic Prosthetics Market Analysis By Material

Analyzing the market by material reveals that plastic remains the predominant choice in prosthetic manufacturing, growing from $3.86 billion to $6.87 billion with a stable market share of 60.3%. Metal prosthetics are also prominent, expected to grow from $1.69 billion to $3.01 billion, while composite materials are less prevalent but projected to rise from $0.85 billion to $1.51 billion over the forecast period.

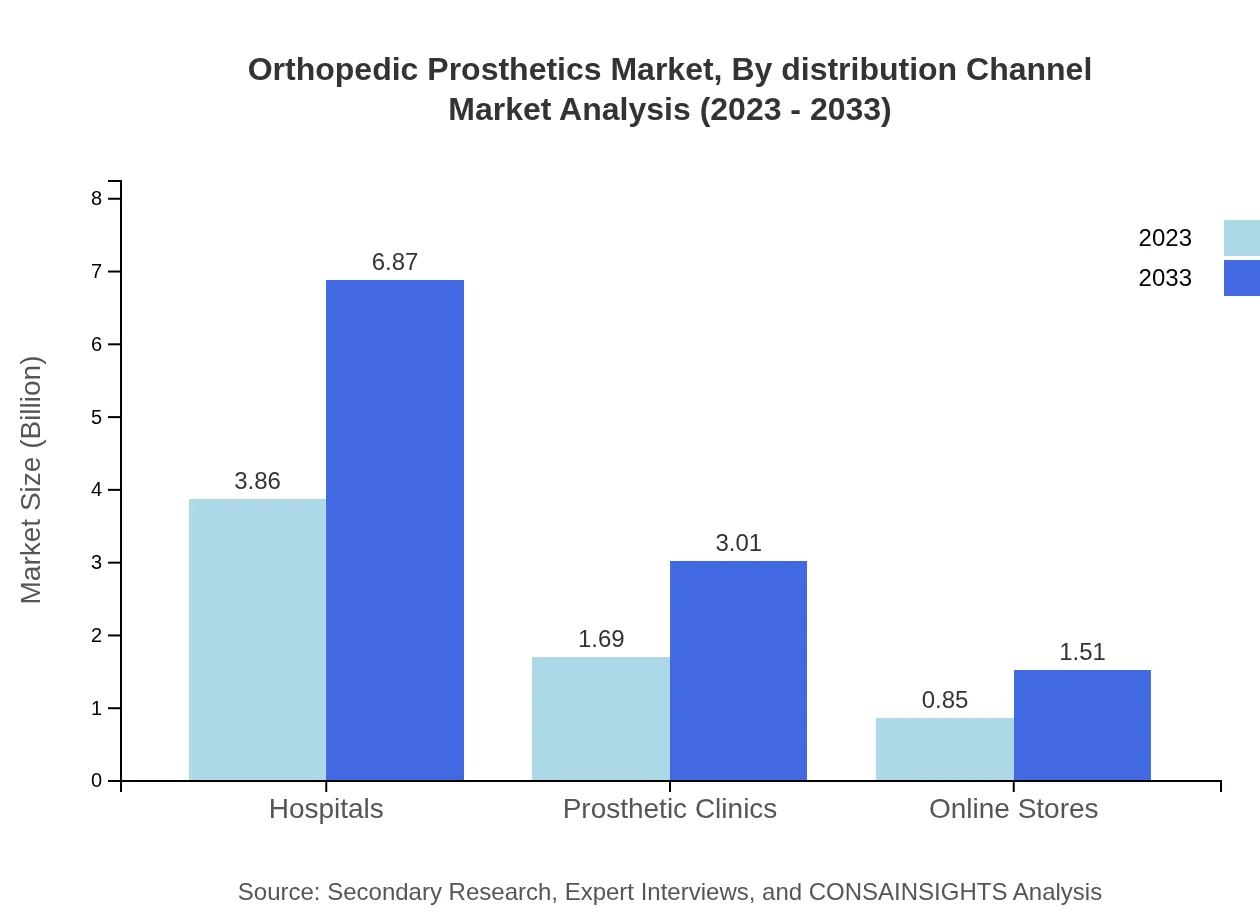

Orthopedic Prosthetics Market Analysis By Distribution Channel

The distribution landscape for Orthopedic Prosthetics is varied, with hospitals capturing 60.3% of the market share and expected to grow from $3.86 billion to $6.87 billion. Prosthetic clinics and online stores follow, with shares of 26.41% and 13.29%, respectively, reflecting the growing importance of e-commerce and specialized care centers.

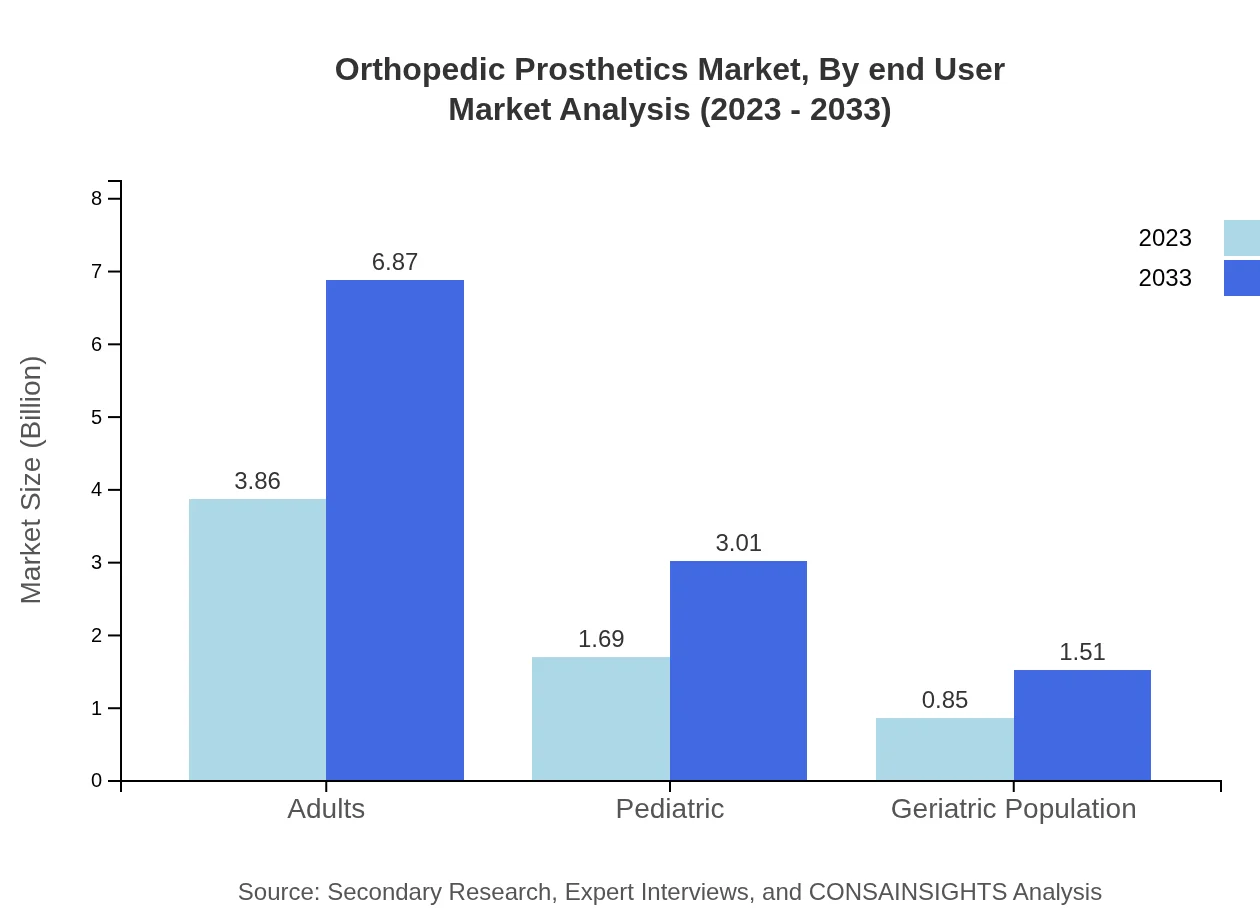

Orthopedic Prosthetics Market Analysis By End User

End-user segmentation shows that adults dominate the market, holding a substantial 60.3% share, with market growth from $3.86 billion to $6.87 billion. Pediatric use is also significant, projected to grow from $1.69 billion to $3.01 billion, while the geriatric segment, although smaller, is expected to expand from $0.85 billion to $1.51 billion.

Orthopedic Prosthetics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Orthopedic Prosthetics Industry

Össur:

Össur is a leading global provider of non-invasive orthopedics, including advanced prosthetic limbs known for their innovative designs and technologies enhancing mobility and comfort for patients.Hanger Inc.:

Hanger Inc. is a prominent player in the orthopedic prosthetics market specializing in rehabilitation services and custom prosthetics, with a strong commitment to improving patient outcomes through personalized care.Stryker Corporation:

Stryker Corporation is known for its broad portfolio in medical technology, offering state-of-the-art orthopedic products including prosthetic devices that cater to a diverse patient demographic.Smith & Nephew:

Smith & Nephew focuses on advanced surgical devices and orthopedic products, including innovative prosthetics with ergonomic designs that enhance comfort and ease of use.We're grateful to work with incredible clients.

FAQs

What is the market size of orthopedic Prosthetics?

The global orthopedic prosthetics market is currently valued at approximately $6.4 billion and is projected to grow at a CAGR of 5.8% from 2023 to 2033. This growth reflects increasing demand for advanced prosthetic solutions.

What are the key market players or companies in the orthopedic Prosthetics industry?

Key players in the orthopedic-prosthetics market include major companies like Ottobock, Össur, and Hanger, Inc., which lead in innovation and product development, thereby shaping industry standards and competition.

What are the primary factors driving growth in the orthopedic Prosthetics industry?

The growth of the orthopedic-prosthetics market is driven by an aging population leading to increased limb loss, rising incidences of trauma and congenital disorders, and advancements in prosthetic technology enhancing patient quality of life.

Which region is the fastest Growing in the orthopedic Prosthetics market?

The Asia Pacific region is the fastest-growing for orthopedic-prosthetics, expanding from $1.31 billion in 2023 to $2.33 billion by 2033. This growth is propelled by increasing healthcare accessibility and investment in medical technologies.

Does ConsaInsights provide customized market report data for the orthopedic Prosthetics industry?

Yes, ConsaInsights offers customized market report data for the orthopedic-prosthetics industry tailored to specific needs, allowing clients to access detailed insights and analyses catered to their business objectives.

What deliverables can I expect from this orthopedic Prosthetics market research project?

From the orthopedic-prosthetics market research project, expect comprehensive reports, data analytics, market forecasts, and strategic insights that help inform decision-making and strategic planning within your organization.

What are the market trends of orthopedic Prosthetics?

Current trends in orthopedic-prosthetics include advancements in 3D printing technology, increased adoption of smart prosthetics, and a focus on personalized prosthetic solutions tailored to the specific needs of patients.