Osteoporosis Drugs Market Report

Published Date: 31 January 2026 | Report Code: osteoporosis-drugs

Osteoporosis Drugs Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive overview of the Osteoporosis Drugs market, including insights on market size, growth, key participants, and forecasts from 2023 to 2033. It analyzes regional trends, industry factors, and future growth opportunities.

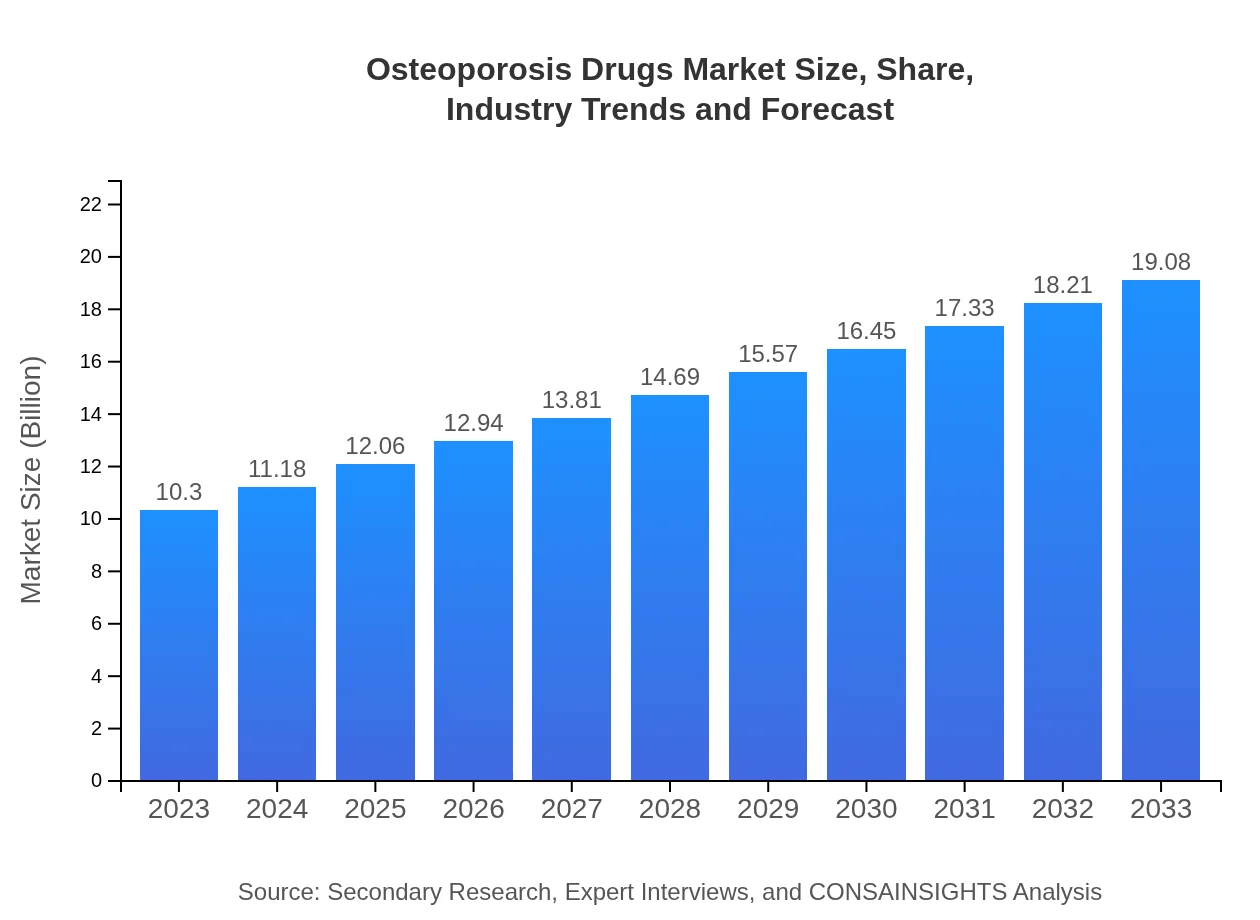

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.30 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $19.08 Billion |

| Top Companies | Amgen, Novartis, Merck & Co., Bristol-Myers Squibb |

| Last Modified Date | 31 January 2026 |

Osteoporosis Drugs Market Overview

Customize Osteoporosis Drugs Market Report market research report

- ✔ Get in-depth analysis of Osteoporosis Drugs market size, growth, and forecasts.

- ✔ Understand Osteoporosis Drugs's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Osteoporosis Drugs

What is the Market Size & CAGR of Osteoporosis Drugs market in 2023?

Osteoporosis Drugs Industry Analysis

Osteoporosis Drugs Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Osteoporosis Drugs Market Analysis Report by Region

Europe Osteoporosis Drugs Market Report:

The European Osteoporosis Drugs market is projected to grow from USD 3.68 billion in 2023 to USD 6.81 billion by 2033. The region's proactive stance on preventive care and extensive research facilities contribute to this expansion.Asia Pacific Osteoporosis Drugs Market Report:

The Asia Pacific Osteoporosis Drugs market, valued at USD 1.77 billion in 2023, is expected to grow to USD 3.28 billion by 2033. This growth is driven by rising awareness and healthcare expenditures, particularly in countries like China and India as their elderly populations expand significantly.North America Osteoporosis Drugs Market Report:

North America holds a strong position in the Osteoporosis Drugs market, with a value of USD 3.32 billion in 2023, likely increasing to USD 6.14 billion by 2033. Factors include advanced healthcare systems and a high prevalence of osteoporosis among the aging population.South America Osteoporosis Drugs Market Report:

In South America, the market is valued at USD 0.42 billion in 2023 and projected to reach USD 0.78 billion by 2033. Increased healthcare access and initiatives to combat osteoporosis are key growth factors.Middle East & Africa Osteoporosis Drugs Market Report:

In the Middle East and Africa, the market stands at USD 1.12 billion in 2023, expected to grow to USD 2.07 billion by 2033. Growing awareness and improving healthcare services are essential factors enhancing market development.Tell us your focus area and get a customized research report.

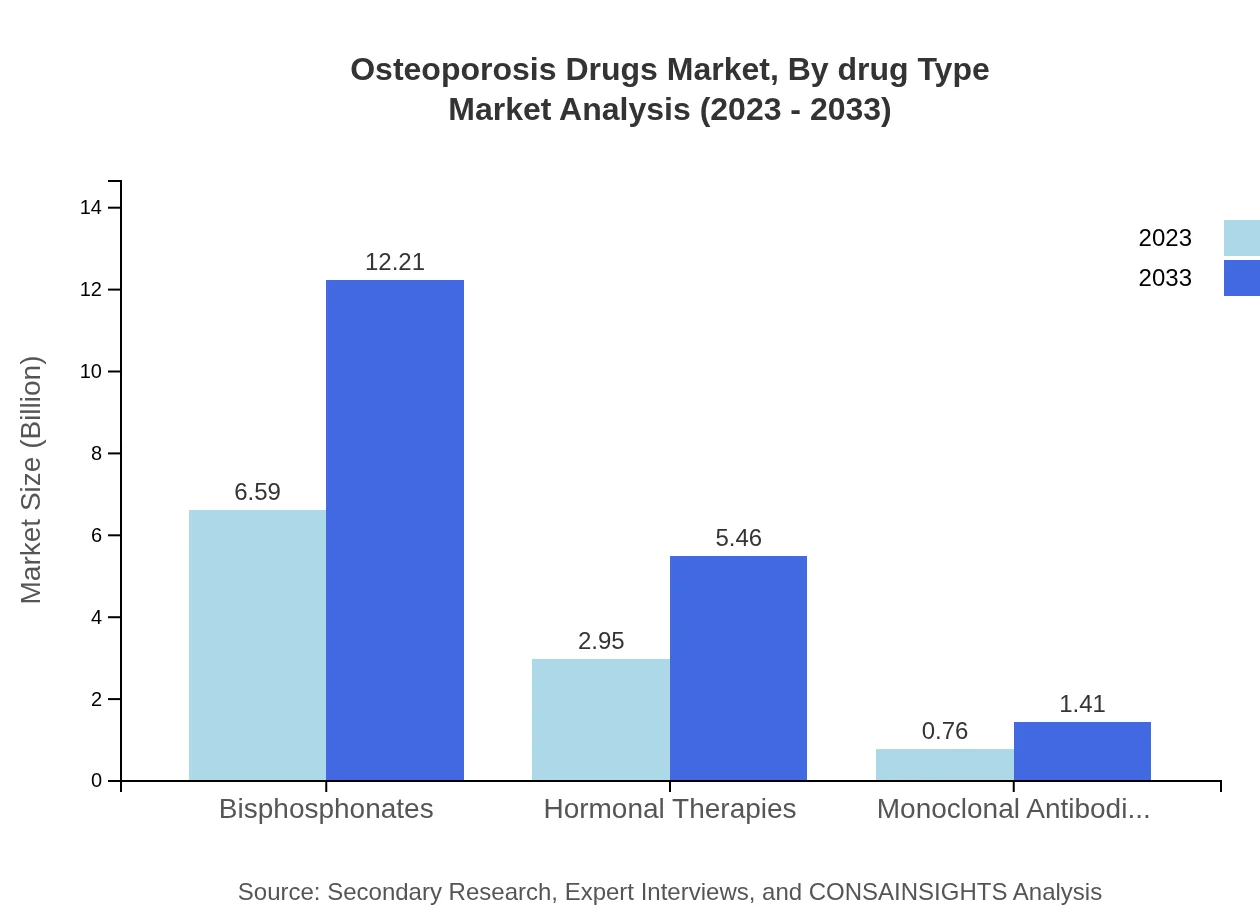

Osteoporosis Drugs Market Analysis By Drug Type

The Osteoporosis Drugs market is primarily dominated by bisphosphonates, which represent a significant share of the market and exhibit steady growth from USD 6.59 billion in 2023 to USD 12.21 billion in 2033, maintaining a share of 63.99%. Hormonal therapies follow, projected to rise from USD 2.95 billion to USD 5.46 billion. The inclusion of monoclonal antibodies continues to expand market diversity, albeit with smaller market share.

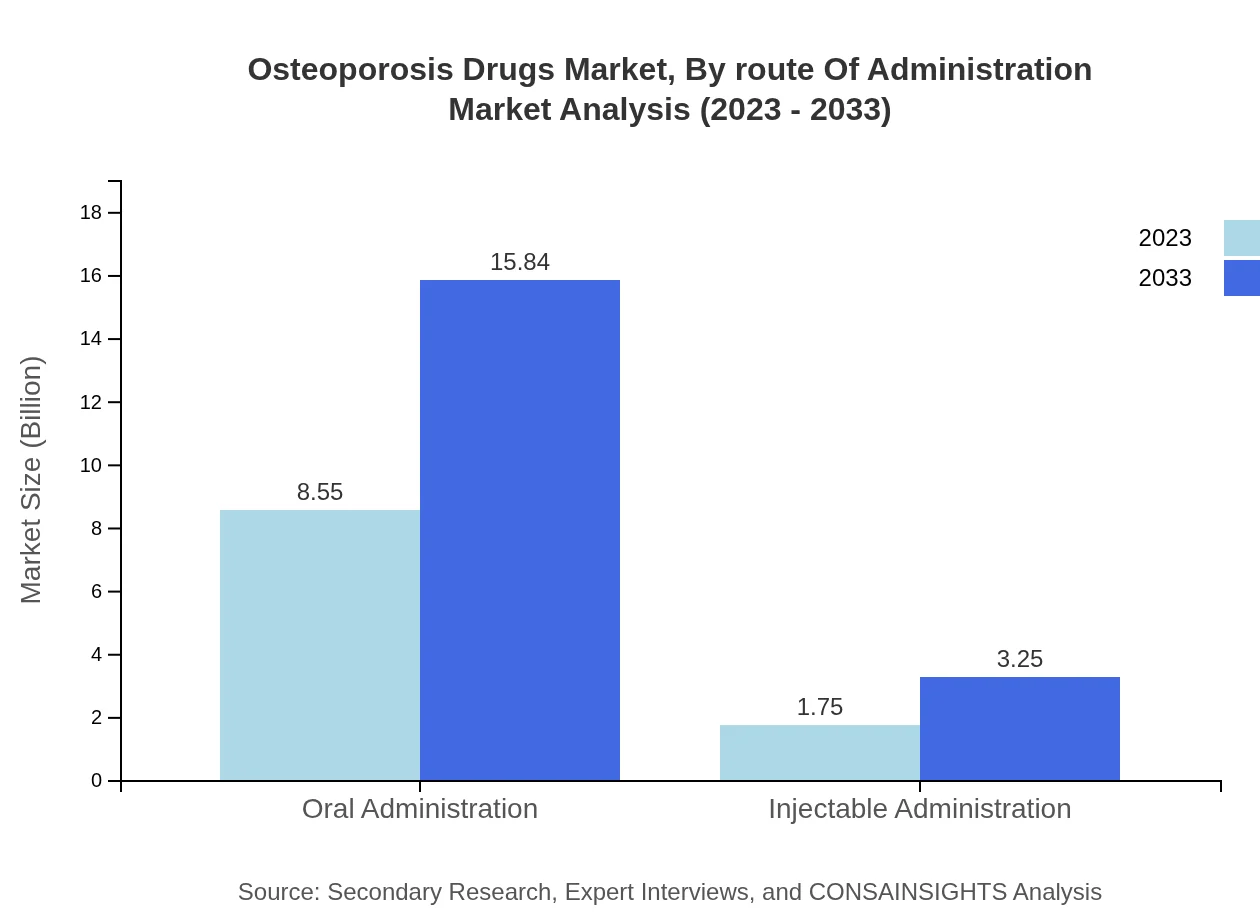

Osteoporosis Drugs Market Analysis By Route Of Administration

The Osteoporosis Drugs market reveals distinct preferences in route of administration. Oral therapies dominate, valued at USD 8.55 billion in 2023 and expected to grow to USD 15.84 billion. In contrast, injectable therapies represent USD 1.75 billion, with similar growth projected. This distinction emphasizes the importance of patient convenience in treatment adherence.

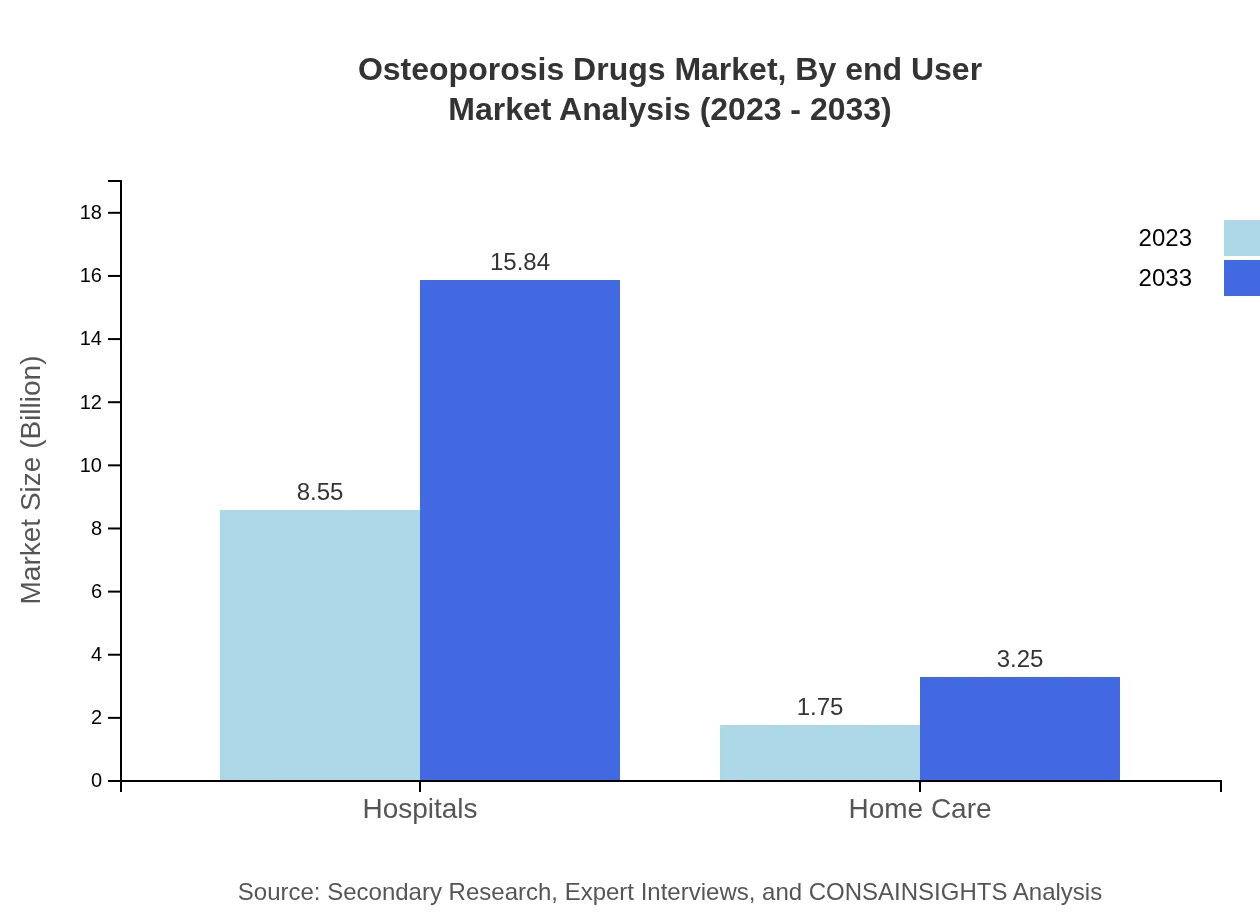

Osteoporosis Drugs Market Analysis By End User

Hospitals remain the primary end-user, representing 82.99% of the market share, with anticipated growth from USD 8.55 billion in 2023 to USD 15.84 billion in 2033. Home care settings, while a smaller segment, are expected to grow from USD 1.75 billion to USD 3.25 billion, reflecting a trend towards patient-centered care.

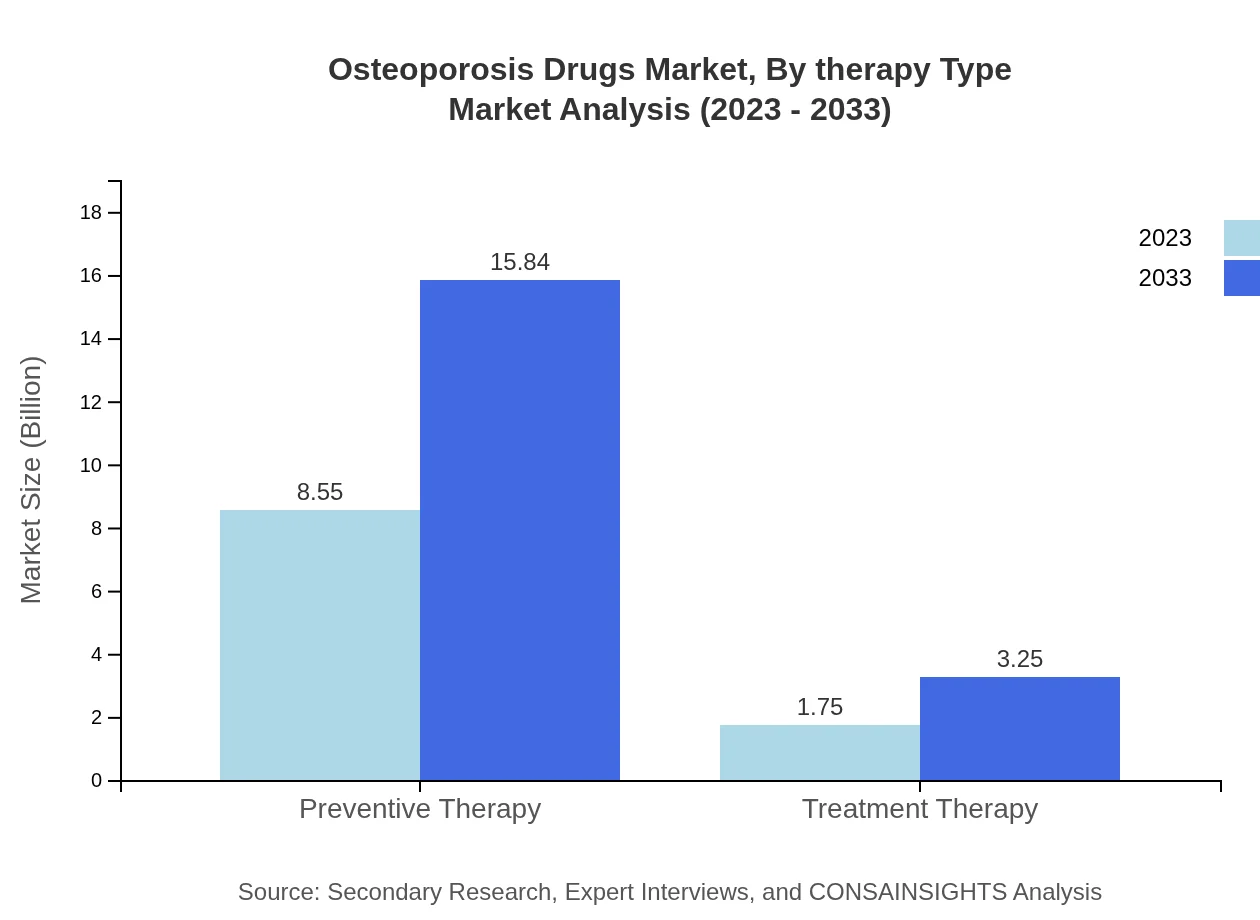

Osteoporosis Drugs Market Analysis By Therapy Type

Preventive therapies dominate the Osteoporosis Drugs market, maintaining a substantial share and projected to grow alongside treatment therapies. Preventive therapies are anticipated to expand from USD 8.55 billion to USD 15.84 billion, with treatment therapies growing from USD 1.75 billion to USD 3.25 billion, highlighting the sustained demand for preventive healthcare.

Osteoporosis Drugs Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Osteoporosis Drugs Industry

Amgen:

A leader in biotechnology, Amgen produces Prolia (denosumab), a monoclonal antibody that has revolutionized osteoporosis treatment.Novartis:

Novartis is known for its innovative therapies, including Reclast (zoledronic acid), which caters to both the treatment and prevention of osteoporosis.Merck & Co.:

Merck manufactures Fosamax (alendronate), a widely used bisphosphonate, contributing significantly to osteoporosis management.Bristol-Myers Squibb:

This company has developed numerous treatments for osteoporosis, focusing on advanced therapies that enhance patient outcomes.We're grateful to work with incredible clients.

FAQs

What is the market size of osteoporosis drugs?

The osteoporosis drugs market reached approximately $10.3 billion in 2023 and is projected to grow at a CAGR of 6.2%, indicating a robust expansion that will reach higher valuations by 2033.

What are the key market players or companies in the osteoporosis drugs industry?

Key players in the osteoporosis drugs market include pharmaceutical giants such as Amgen, Merck & Co., Eli Lilly, and GlaxoSmithKline, which dominate the sector through innovative therapies and extensive distribution networks.

What are the primary factors driving the growth in the osteoporosis drugs industry?

Growth in the osteoporosis drugs industry is driven by an aging population, increasing awareness about bone health, advances in drug development, and a rise in osteoporosis prevalence among the global population.

Which region is the fastest Growing in the osteoporosis drugs market?

The Asia Pacific region is the fastest-growing in the osteoporosis drugs market, expected to grow from $1.77 billion in 2023 to $3.28 billion by 2033, showcasing a significant increase in demand for osteoporosis treatments.

Does Consainsights provide customized market report data for the osteoporosis drugs industry?

Yes, Consainsights offers customized market report data tailored to specific needs within the osteoporosis drugs industry, ensuring relevant and detailed insights for clients seeking in-depth analysis.

What deliverables can I expect from this osteoporosis drugs market research project?

From this osteoporosis drugs market research project, clients can expect comprehensive reports, market size analysis, growth forecasts, competitive landscape reviews, and segment-wise assessments to facilitate informed business decisions.

What are the market trends of osteoporosis drugs?

Current market trends in osteoporosis drugs include increased adoption of bisphosphonates, rising demand for hormonal therapies, and shifts toward preventive therapies, reflecting growing emphasis on proactive bone health management.