Osteosynthesis Devices Market Report

Published Date: 31 January 2026 | Report Code: osteosynthesis-devices

Osteosynthesis Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Osteosynthesis Devices market, including market size, growth trends, and competitive landscape, with a forecast extending from 2023 to 2033.

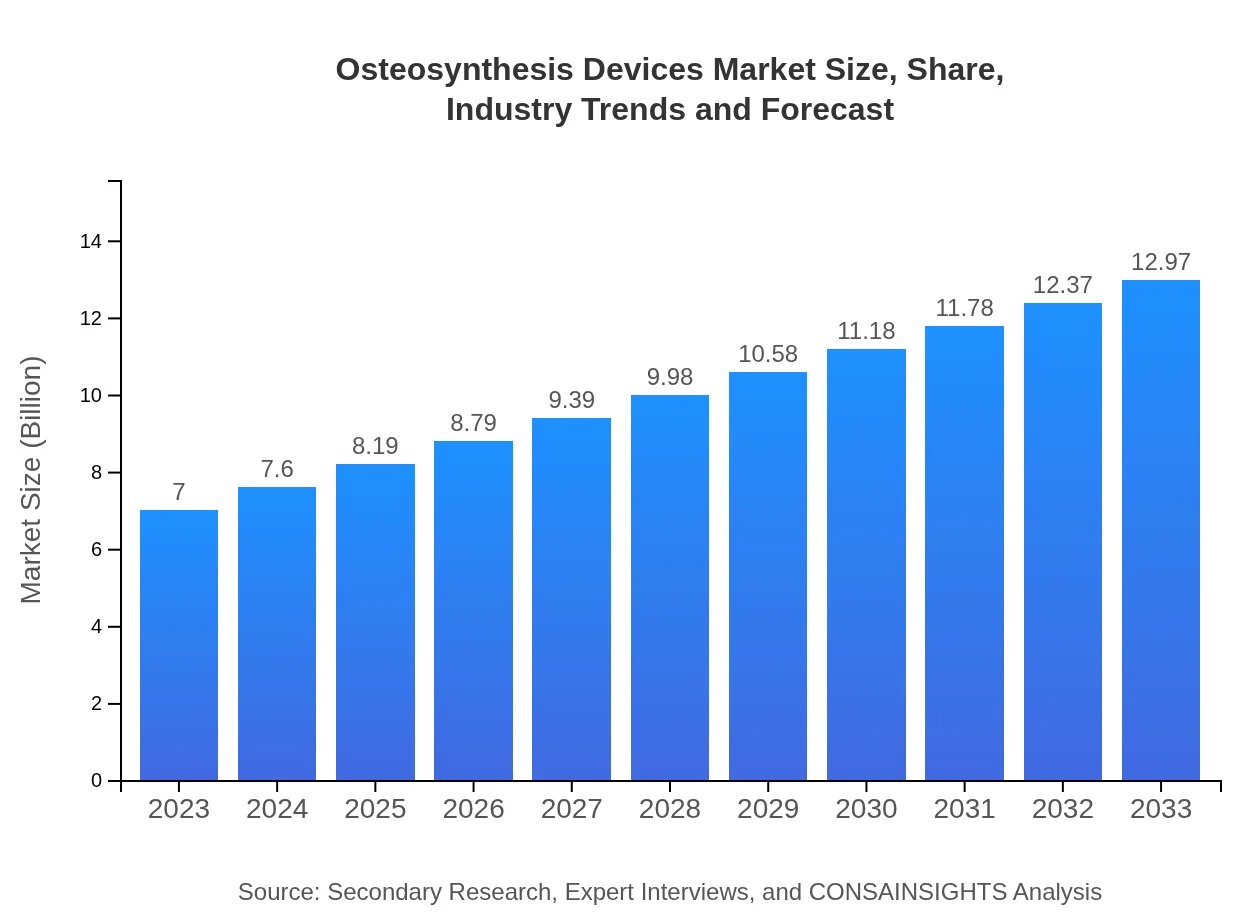

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $7.00 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $12.97 Billion |

| Top Companies | Stryker Corporation, Johnson & Johnson, Zimmer Biomet, Medtronic , DePuy Synthes |

| Last Modified Date | 31 January 2026 |

Osteosynthesis Devices Market Overview

Customize Osteosynthesis Devices Market Report market research report

- ✔ Get in-depth analysis of Osteosynthesis Devices market size, growth, and forecasts.

- ✔ Understand Osteosynthesis Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Osteosynthesis Devices

What is the Market Size & CAGR of Osteosynthesis Devices market in 2023?

Osteosynthesis Devices Industry Analysis

Osteosynthesis Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Osteosynthesis Devices Market Analysis Report by Region

Europe Osteosynthesis Devices Market Report:

In Europe, the market size is projected to increase from $1.84 billion in 2023 to $3.40 billion in 2033. Factors contributing to this growth include the aging population, technological advancements in orthopedic devices, and widespread adoption of minimally invasive surgical techniques.Asia Pacific Osteosynthesis Devices Market Report:

In the Asia Pacific region, the market for Osteosynthesis Devices is estimated to grow from $1.48 billion in 2023 to $2.74 billion by 2033. This growth can be attributed to rising healthcare expenditure, increased road traffic injuries, and growing awareness of advanced surgical options. The booming elderly population is also a notable factor influencing market growth.North America Osteosynthesis Devices Market Report:

North America dominates the Osteosynthesis Devices market, projected to grow from $2.39 billion in 2023 to $4.42 billion by 2033. The high prevalence of orthopedic diseases, coupled with the demand for advanced surgical procedures, are key growth factors in this region.South America Osteosynthesis Devices Market Report:

The South American market is valued at $0.66 billion in 2023 and is expected to reach $1.22 billion by 2033. The improving healthcare infrastructure and increasing investments in healthcare facilities drive the demand for osteosynthesis solutions in this region.Middle East & Africa Osteosynthesis Devices Market Report:

The Middle East and Africa market is expected to grow from $0.64 billion in 2023 to $1.18 billion by 2033, driven by increased healthcare spending and awareness of modern orthopedic treatments.Tell us your focus area and get a customized research report.

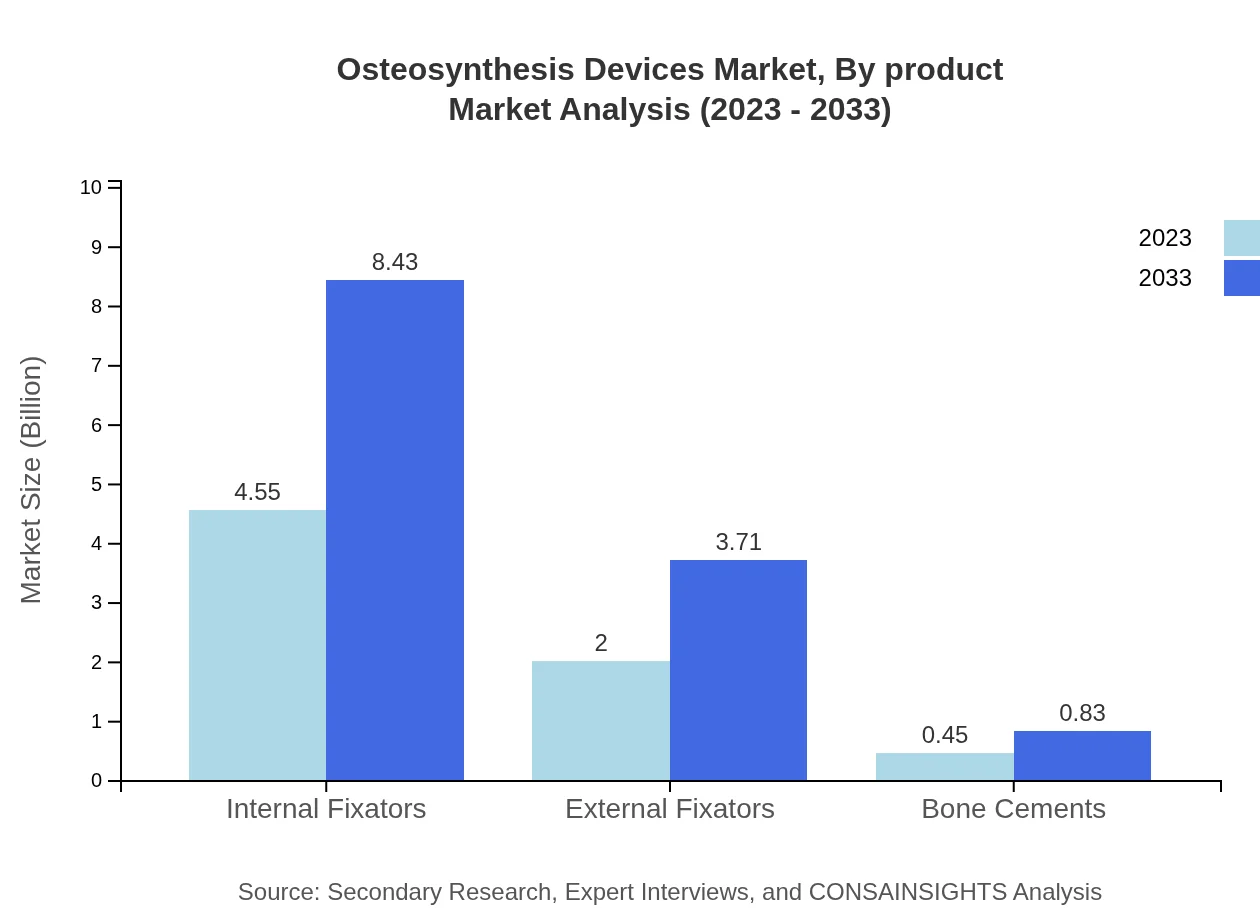

Osteosynthesis Devices Market Analysis By Product

The internal fixators segment accounts for the largest market share, valued at $4.55 billion in 2023, with expectations to rise to $8.43 billion by 2033. External fixators and bone cements also contribute significantly, valued at $2.00 billion and $0.45 billion in 2023, respectively. Each product category exhibits unique growth potential based on surgical preferences and treatment outcomes.

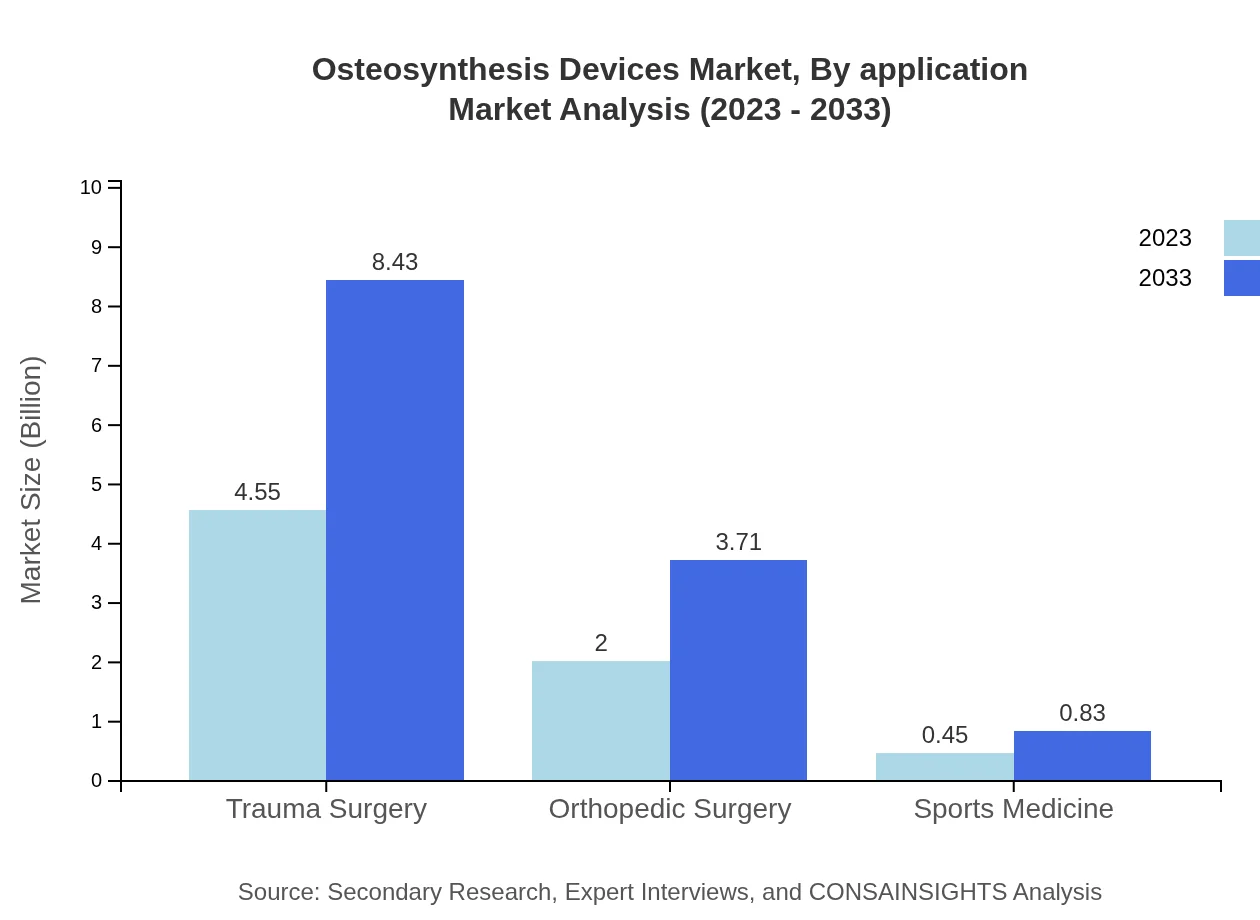

Osteosynthesis Devices Market Analysis By Application

The trauma surgery segment represents the largest application area, holding a share of 64.97% in 2023. Orthopedic surgery follows closely, capturing 28.63% of the market. The focus on trauma-related interventions and sports medicine applications showcases the importance of these segments in driving demand for osteosynthesis devices.

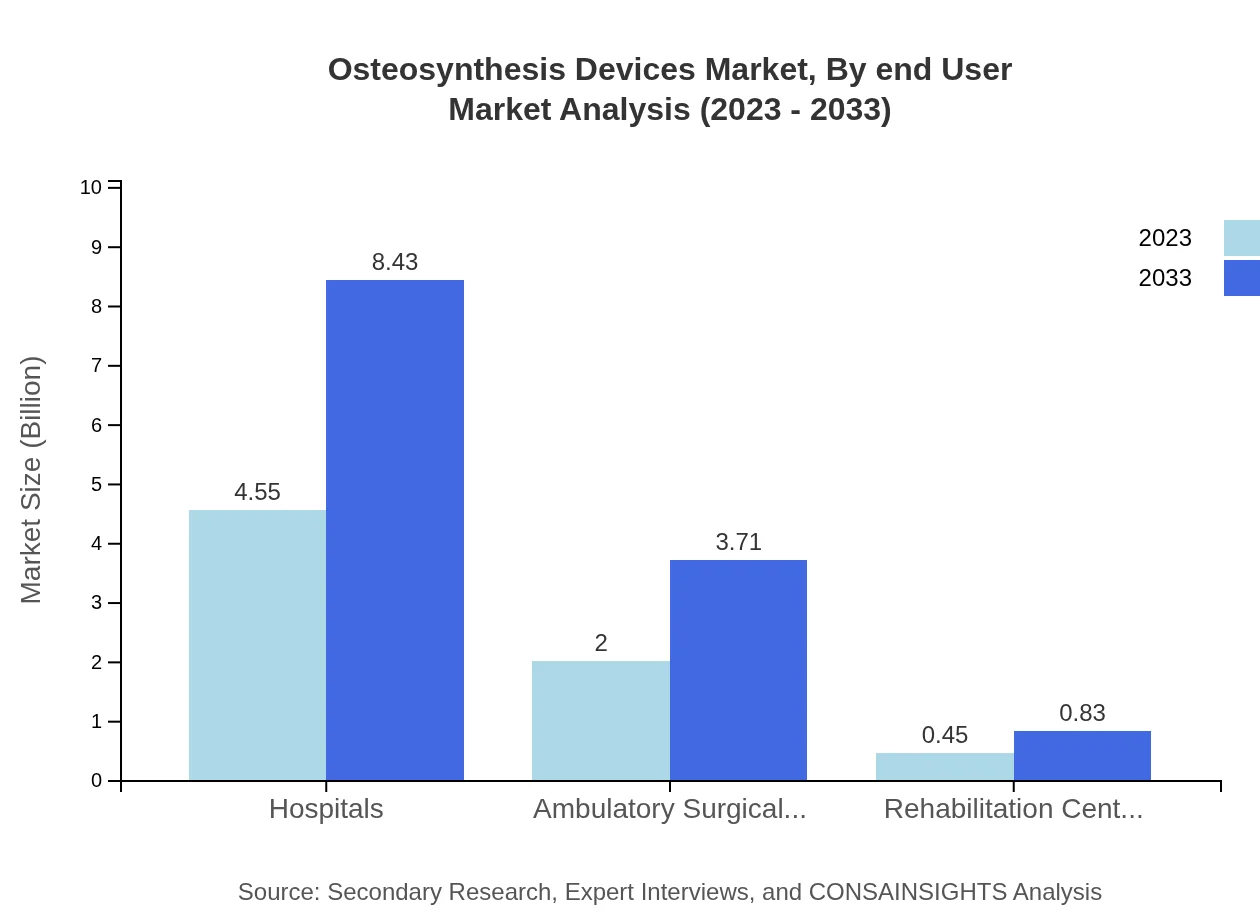

Osteosynthesis Devices Market Analysis By End User

Hospitals remain the primary end-user for osteosynthesis devices, accounting for 64.97% of the market share in 2023, followed by ambulatory surgical centers at 28.63%. The rising number of surgical procedures within hospital settings reinforces this dominance.

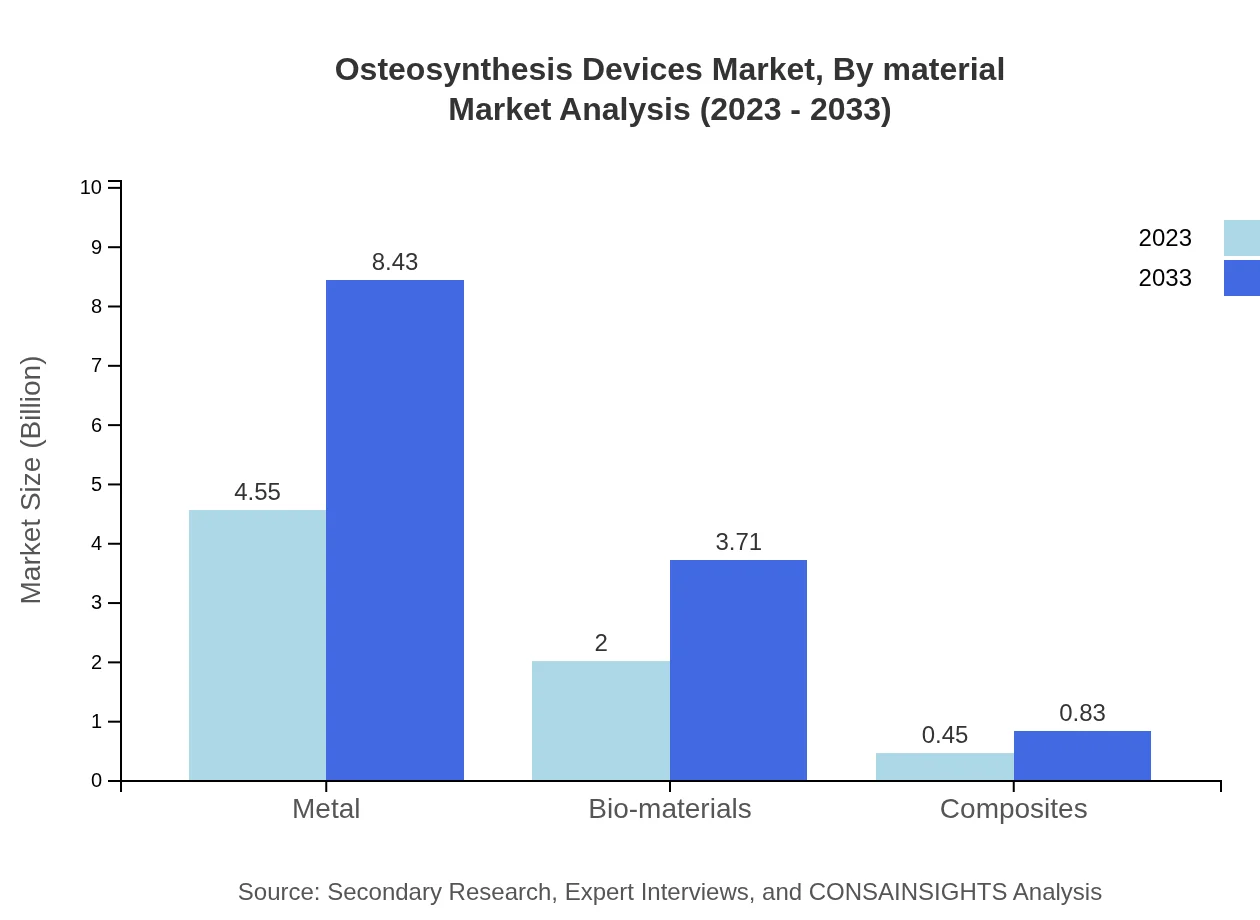

Osteosynthesis Devices Market Analysis By Material

Metal implants dominate the material segment, with a size of $4.55 billion in 2023, while biomaterials and composites make significant contributions due to their advanced biocompatibility and mechanical properties.

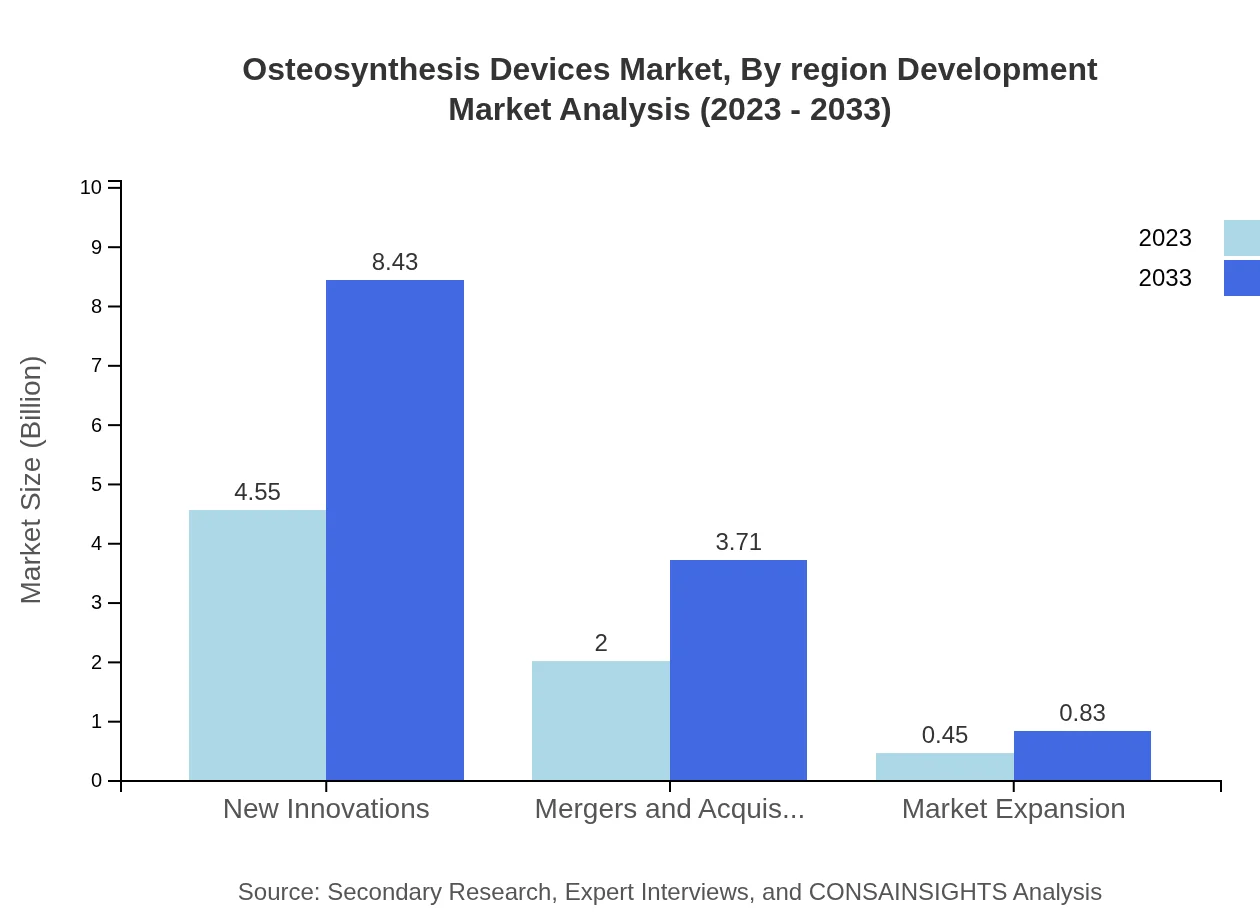

Osteosynthesis Devices Market Analysis By Region Development

In each region, companies adopt specific development strategies to tap into local market potential. For example, in North America, players emphasize technological innovation, while in Europe, partnerships with healthcare providers are key for market penetration.

Osteosynthesis Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Osteosynthesis Devices Industry

Stryker Corporation:

A leader in orthopedic products, Stryker provides innovative solutions and technologies in surgical implants and instruments.Johnson & Johnson:

Offers a diverse range of medical devices, including orthopedic solutions designed for trauma and reconstructive surgery.Zimmer Biomet:

Known for its advanced orthopedic devices, Zimmer Biomet specializes in manufacturing knee, hip, and trauma-focused surgical offerings.Medtronic :

Provides a range of surgical solutions, including spinal and orthopedic devices, with a focus on improving surgical outcomes.DePuy Synthes:

A division of Johnson & Johnson, DePuy Synthes focuses on trauma, orthopedic, and craniomaxillofacial devices.We're grateful to work with incredible clients.

FAQs

What is the market size of osteosynthesis Devices?

The osteosynthesis devices market is valued at $7 billion in 2023, with a projected CAGR of 6.2% up to 2033. This growth reflects the increasing demand for innovative surgical solutions in orthopedic and trauma surgeries.

What are the key market players or companies in this osteosynthesis Devices industry?

Prominent companies in the osteosynthesis devices market include leading orthopedic manufacturers and medical technology firms, leveraging innovative solutions and continuous advancements to capture market share and enhance surgical outcomes.

What are the primary factors driving the growth in the osteosynthesis Devices industry?

Key growth factors include an aging population prone to fractures, technological advancements in surgical devices, and an increase in trauma cases requiring surgical intervention, supporting market expansion through innovation.

Which region is the fastest Growing in the osteosynthesis Devices?

The North America region is the fastest-growing market, projected to grow from $2.39 billion in 2023 to $4.42 billion by 2033, driven by advanced healthcare infrastructure and a high prevalence of orthopedic conditions.

Does ConsaInsights provide customized market report data for the osteosynthesis Devices industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs, ensuring comprehensive insights and analytics for stakeholders in the osteosynthesis devices market.

What deliverables can I expect from this osteosynthesis Devices market research project?

Expect detailed market analysis, segmentation insights, competitive landscape assessments, growth forecasts, and strategic recommendations, encapsulated in a comprehensive report tailored for informed decision-making.

What are the market trends of osteosynthesis Devices?

Emerging trends include the integration of smart technology in surgical devices, a shift towards minimally invasive procedures, and increasing investments in research and development for innovative osteosynthesis solutions.