Otr Tires Market Report

Published Date: 02 February 2026 | Report Code: otr-tires

Otr Tires Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the OTR Tires market, including market size, growth forecasts, technology advancements, and industry leaders for the period 2023 to 2033.

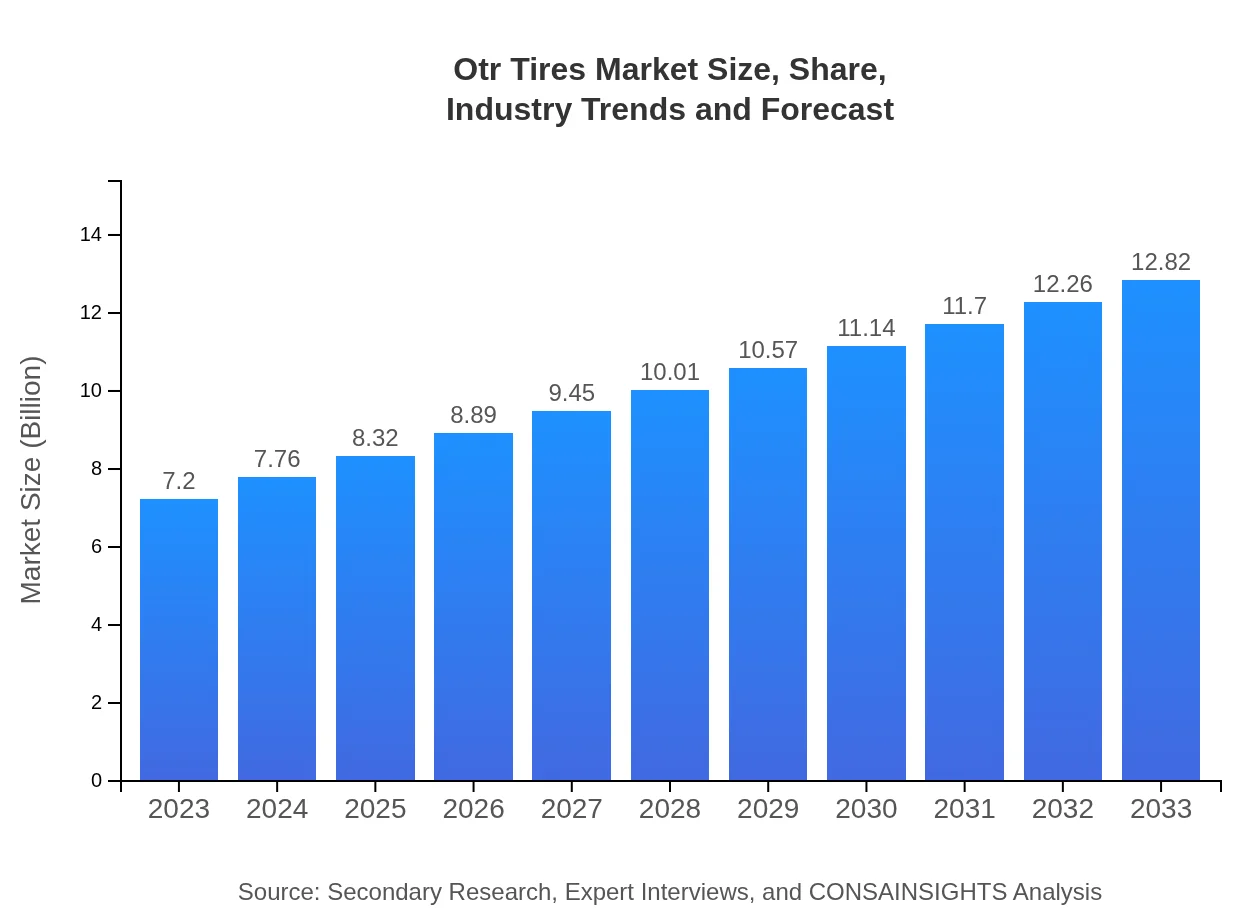

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $7.20 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $12.82 Billion |

| Top Companies | Bridgestone Corporation, Michelin, Goodyear Tire & Rubber Company, Continental AG |

| Last Modified Date | 02 February 2026 |

OTR Tires Market Overview

Customize Otr Tires Market Report market research report

- ✔ Get in-depth analysis of Otr Tires market size, growth, and forecasts.

- ✔ Understand Otr Tires's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Otr Tires

What is the Market Size & CAGR of OTR Tires market in 2023?

OTR Tires Industry Analysis

OTR Tires Market Segmentation and Scope

Tell us your focus area and get a customized research report.

OTR Tires Market Analysis Report by Region

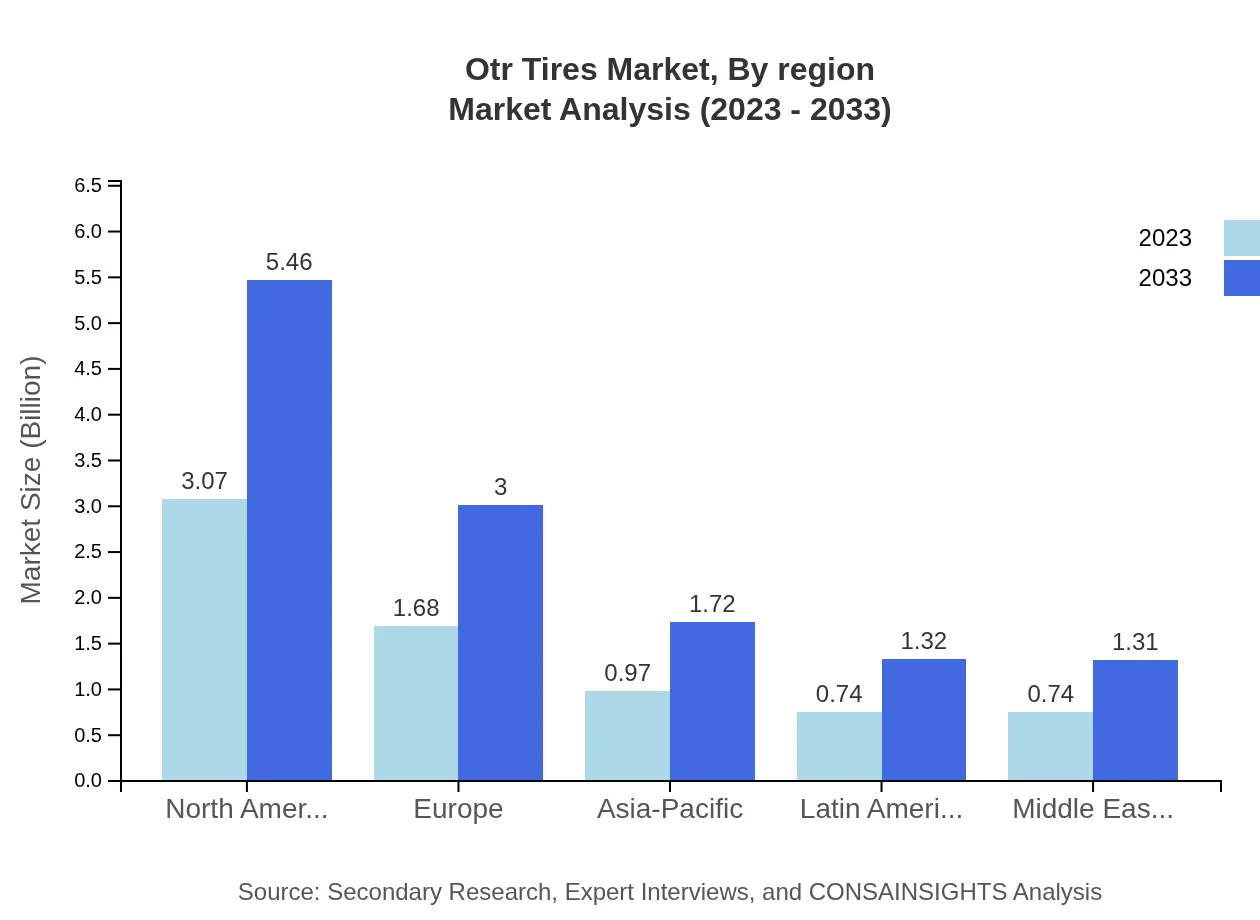

Europe Otr Tires Market Report:

Europe's OTR Tires market is expected to grow from $1.88 billion in 2023 to approximately $3.35 billion by 2033, with increasing investment in infrastructure and sustainable tire solutions driving this expansion.Asia Pacific Otr Tires Market Report:

In 2023, the Asia-Pacific region's OTR Tires market size is estimated at $1.44 billion, expected to grow to $2.57 billion by 2033. This growth is propelled by extensive mining and construction activities, especially in countries like China and India, where urbanization is accelerating.North America Otr Tires Market Report:

North America leads the OTR Tires market with a size of $2.73 billion in 2023, projected to reach $4.85 billion by 2033. This trend is attributed to ongoing construction projects, robust mining sector, and technological advancements in tire production.South America Otr Tires Market Report:

The South American market for OTR Tires is predicted to grow from $0.27 billion in 2023 to $0.48 billion by 2033. Strengthening demand in agriculture and emerging mining operations will propel growth in this region.Middle East & Africa Otr Tires Market Report:

In the Middle East and Africa, the OTR Tires market is forecasted to increase from $0.88 billion in 2023 to $1.57 billion in 2033, primarily fueled by the booming construction industry and considerable investments in mining operations.Tell us your focus area and get a customized research report.

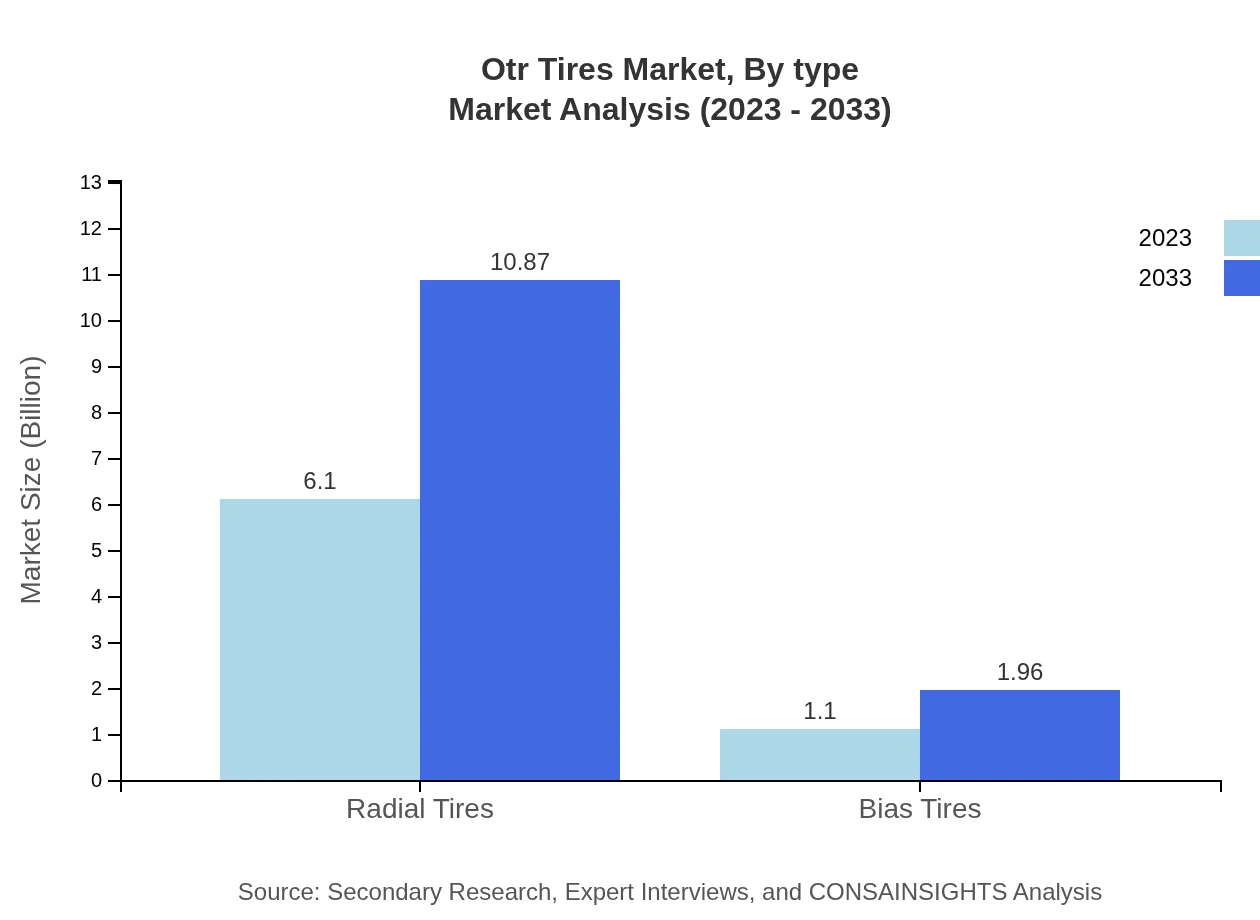

Otr Tires Market Analysis By Type

The market is divided into Radial Tires and Bias Tires. Radial Tires dominate the segment with a market size of $6.10 billion in 2023, growing to $10.87 billion by 2033, representing a consistent market share of around 84.75%. In comparison, Bias Tires account for a market size of $1.10 billion in 2023, projected to reach $1.96 billion by 2033, holding a steady share of 15.25%.

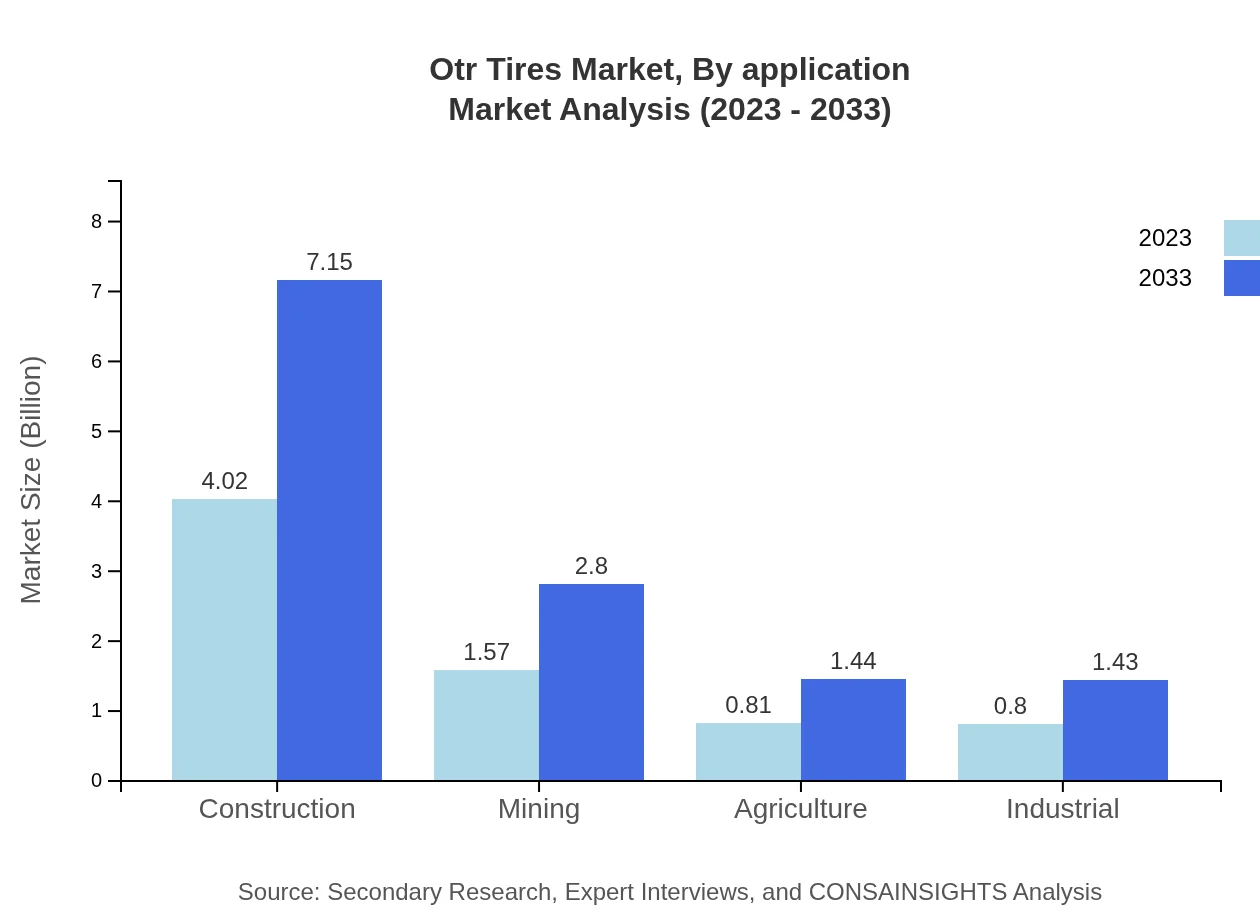

Otr Tires Market Analysis By Application

Major applications of OTR Tires include Construction Companies, Mining Companies, Agricultural Businesses, and Logistics. The construction sector has the largest share at 55.79%, with a market size of $4.02 billion in 2023, growing to $7.15 billion in 2033. Mining and Agriculture hold significant market shares of 21.84% and 11.25%, respectively, reflecting the diverse uses of OTR Tires in heavy-duty applications.

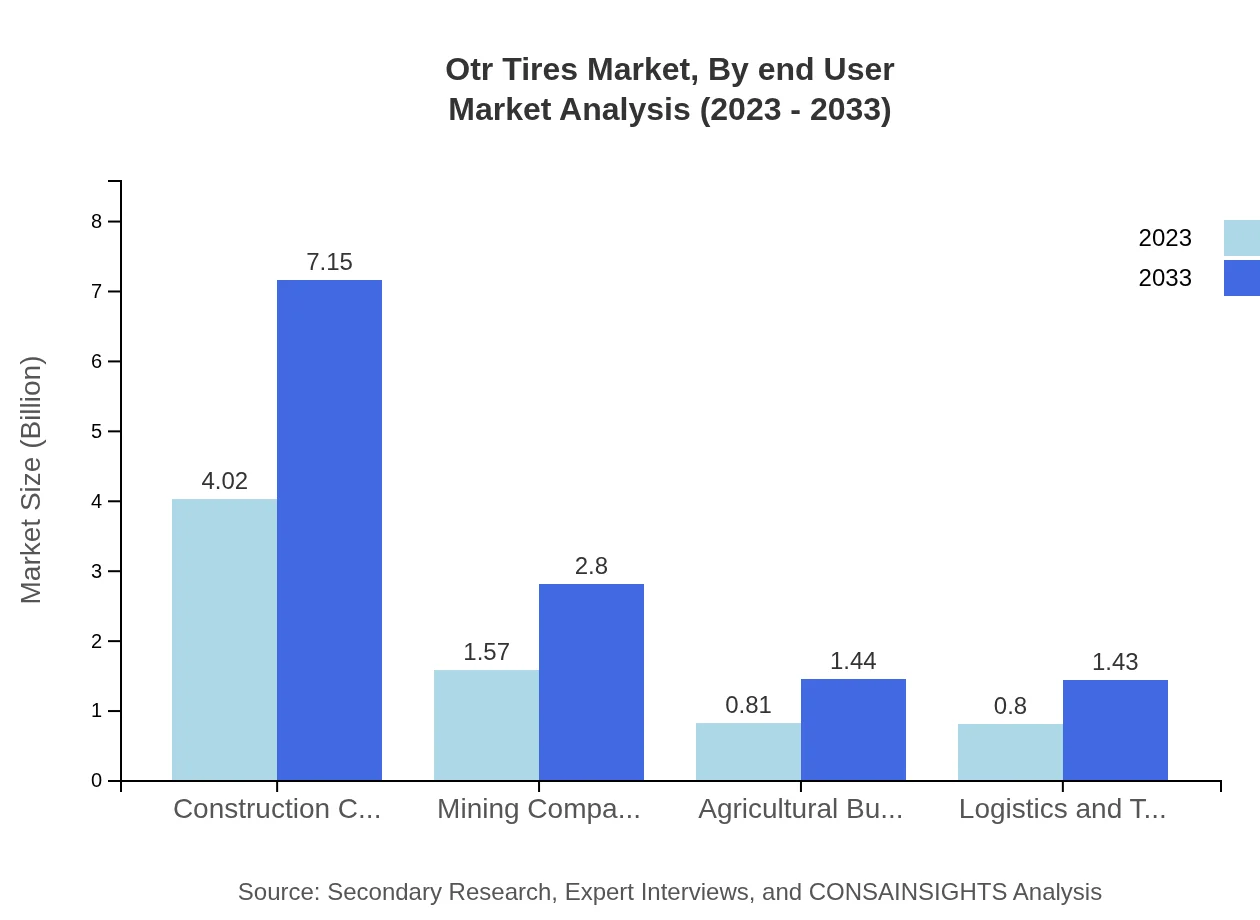

Otr Tires Market Analysis By End User

End-users of the OTR Tires market primarily include businesses in construction, mining, agriculture, and logistics. Construction companies remain the dominant end-user segment, contributing significantly to revenue due to ongoing infrastructure projects worldwide. The mining sector also presents lucrative opportunities as investments in mineral extraction continue to rise.

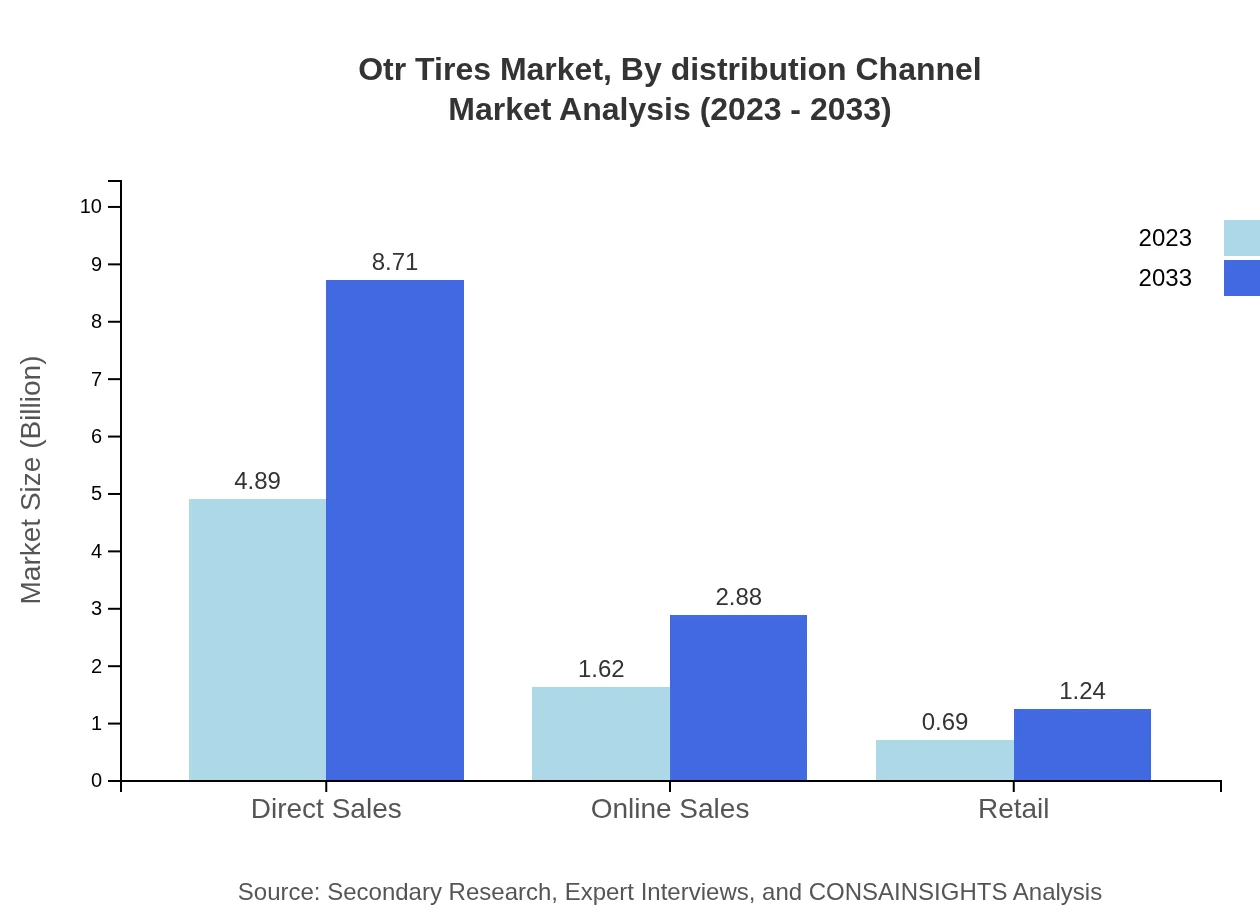

Otr Tires Market Analysis By Distribution Channel

Distribution channels for OTR Tires include Direct Sales, Online Sales, and Retail. Direct Sales account for 67.91% market share in 2023, indicating a preference among buyers for direct transactions with manufacturers. Online Sales are an emerging channel, anticipated to grow from a size of $1.62 billion in 2023 to $2.88 billion by 2033, appealing to tech-savvy customers.

Otr Tires Market Analysis By Region

The regional analysis reinforces the segmentation outlined above, with North America leading in both revenue and demand driven by technological advancements and industrial growth, while regions like Asia-Pacific and South America are emerging as critical markets due to their industrialization and urbanization.

OTR Tires Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in OTR Tires Industry

Bridgestone Corporation:

Bridgestone is the world's largest tire manufacturer, known for its extensive portfolio of OTR Tires, including innovative products tailored for various industrial applications.Michelin:

Michelin is renowned for its high-performance tires and is a leader in tire technology, focusing on sustainable manufacturing practices and enhanced tire longevity.Goodyear Tire & Rubber Company:

Goodyear offers a comprehensive range of OTR Tires and is recognized for its commitment to quality and technological advancements in tire design and safety features.Continental AG:

Continental is a prominent tire manufacturer supplying OTR Tires for diverse industries, leveraging advanced technology to improve performance and sustainability.We're grateful to work with incredible clients.

FAQs

What is the market size of OTR Tires?

As of 2023, the global OTR tires market is valued at $7.2 billion, projected to grow with a CAGR of 5.8% reaching new heights by 2033. This reflects increased demand across multiple industries including construction and agriculture.

What are the key market players or companies in the OTR Tires industry?

Key players in the OTR tires market include major tire manufacturers like Michelin, Bridgestone, Goodyear, Continental, and Yokohama. These companies hold substantial market shares and play a critical role in driving innovation within the industry.

What are the primary factors driving the growth in the OTR Tires industry?

The growth of the OTR tires industry is fueled by several factors including increased construction activities, mining expansion, infrastructure improvements, and demand for advanced tire technology to enhance efficiency and durability.

Which region is the fastest Growing in the OTR Tires market?

North America is identified as the fastest-growing region in the OTR tires market, with market size increasing from $2.73 billion in 2023 to $4.85 billion by 2033, driven by heavy investments in infrastructure and mining.

Does Consainsights provide customized market report data for the OTR Tires industry?

Yes, Consainsights offers customized market reports tailored to specific needs in the OTR tires industry. Clients can request detailed insights including specific segments and regional forecasts.

What deliverables can I expect from this OTR Tires market research project?

Deliverables from the OTR tires market research project include comprehensive market analysis reports, detailed regional breakdowns, competitor analysis, growth forecasts, and segmented market insights.

What are the market trends of OTR Tires?

Current market trends in the OTR tires industry include a shift towards sustainable tire materials, increasing adoption of radial tires, and a growing focus on enhancing tire performance for heavy machinery applications.