Outdoor Led Lighting Market Report

Published Date: 31 January 2026 | Report Code: outdoor-led-lighting

Outdoor Led Lighting Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Outdoor LED Lighting market, focusing on insights, market size, growth trends, technology advancements, and competitive landscape from 2023 to 2033.

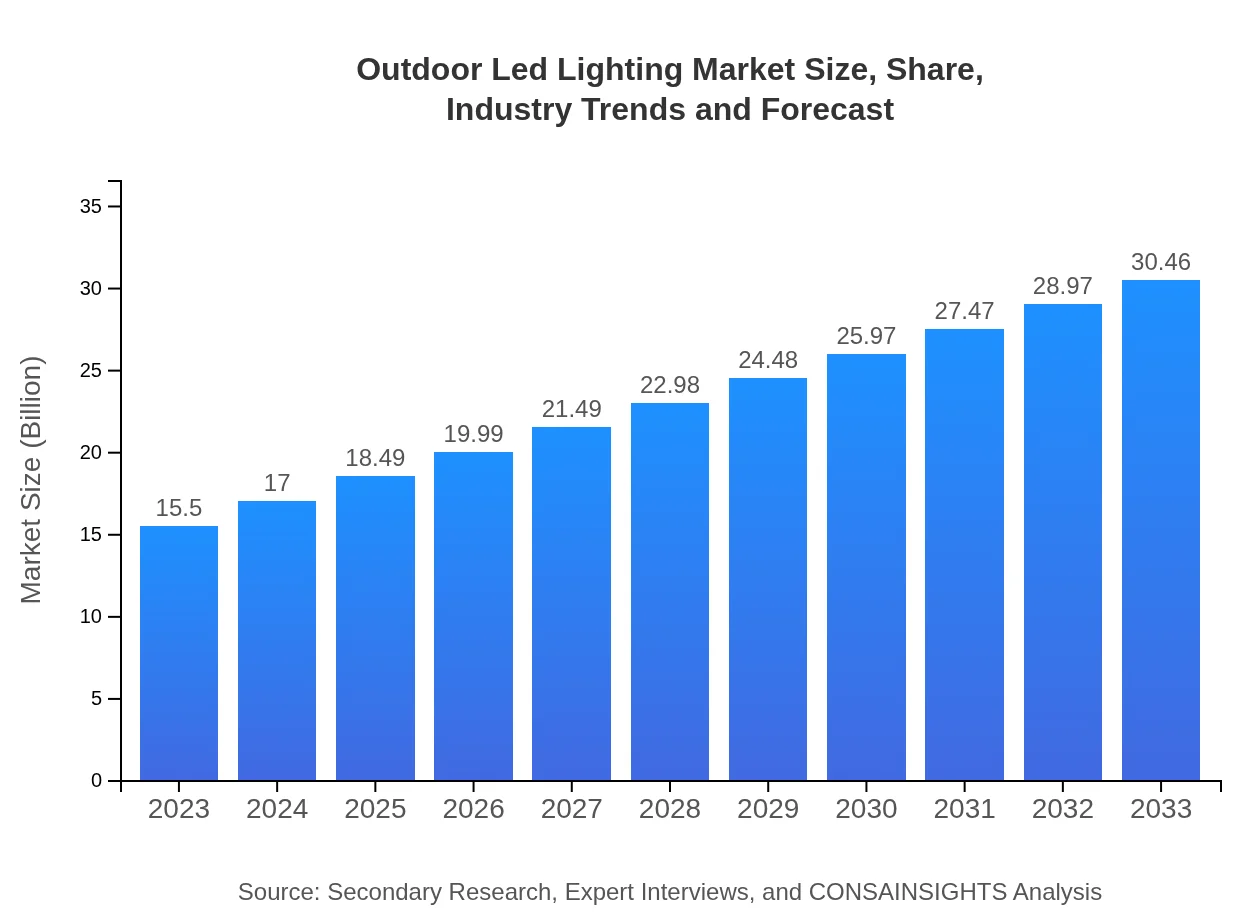

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $30.46 Billion |

| Top Companies | Philips Lighting, General Electric, Osram, Cree, Inc., Zumtobel Group |

| Last Modified Date | 31 January 2026 |

Outdoor Led Lighting Market Overview

Customize Outdoor Led Lighting Market Report market research report

- ✔ Get in-depth analysis of Outdoor Led Lighting market size, growth, and forecasts.

- ✔ Understand Outdoor Led Lighting's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Outdoor Led Lighting

What is the Market Size & CAGR of Outdoor Led Lighting market in 2023?

Outdoor Led Lighting Industry Analysis

Outdoor Led Lighting Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Outdoor Led Lighting Market Analysis Report by Region

Europe Outdoor Led Lighting Market Report:

Europe is anticipated to see an increase from $5.39 billion in 2023 to around $10.60 billion by 2033. The region’s stringent energy regulations, commitment to reducing carbon emissions, and economic stability encourage investments in outdoor LED lighting technology.Asia Pacific Outdoor Led Lighting Market Report:

The Asia Pacific region is witnessing significant growth with a market size projected to reach $5.64 billion by 2033, up from $2.87 billion in 2023. Rapid urbanization, government initiatives for smart cities, and a growing middle class drive this demand, coupled with favorable investments in infrastructure projects.North America Outdoor Led Lighting Market Report:

North America displays a robust market, with projections of growth from $5.44 billion in 2023 to $10.70 billion by 2033. The transition towards sustainable practices in urban infrastructure, alongside the technological advancements in smart LED lighting, are further significant drivers of this growth.South America Outdoor Led Lighting Market Report:

In South America, the outdoor LED lighting market is set to grow from $1.19 billion in 2023 to $2.34 billion by 2033. This growth is supported by increasing government initiatives to improve public lighting and energy efficiency, along with the adoption of smart technologies in the region.Middle East & Africa Outdoor Led Lighting Market Report:

The Middle East and Africa market is expected to grow from $0.61 billion in 2023 to $1.19 billion by 2033. This growth can be attributed to ongoing urban development projects and the initiation of smart city projects in major cities, alongside increased investment in infrastructure.Tell us your focus area and get a customized research report.

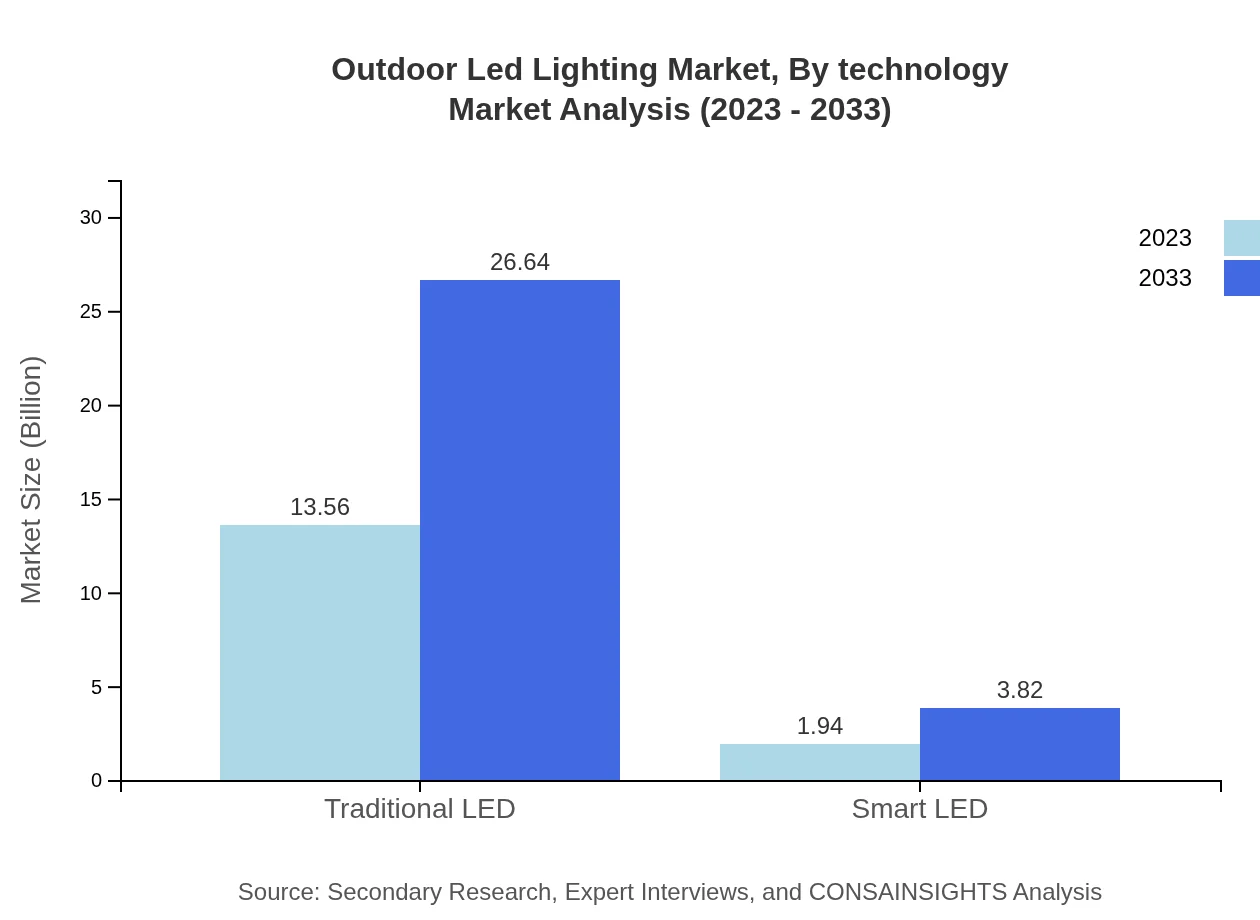

Outdoor Led Lighting Market Analysis By Technology

The Outdoor LED Lighting market is segmented into Traditional LED and Smart LED technologies. Traditional LED lighting remains the dominant technology with a market size of $13.56 billion in 2023, expected to reach $26.64 billion in 2033, representing a share of 87.46%. In contrast, Smart LED technology, although smaller, is rapidly gaining traction with its market size growing from $1.94 billion to $3.82 billion, indicating a share of 12.54% by 2033 due to advancements in IoT and smart city initiatives.

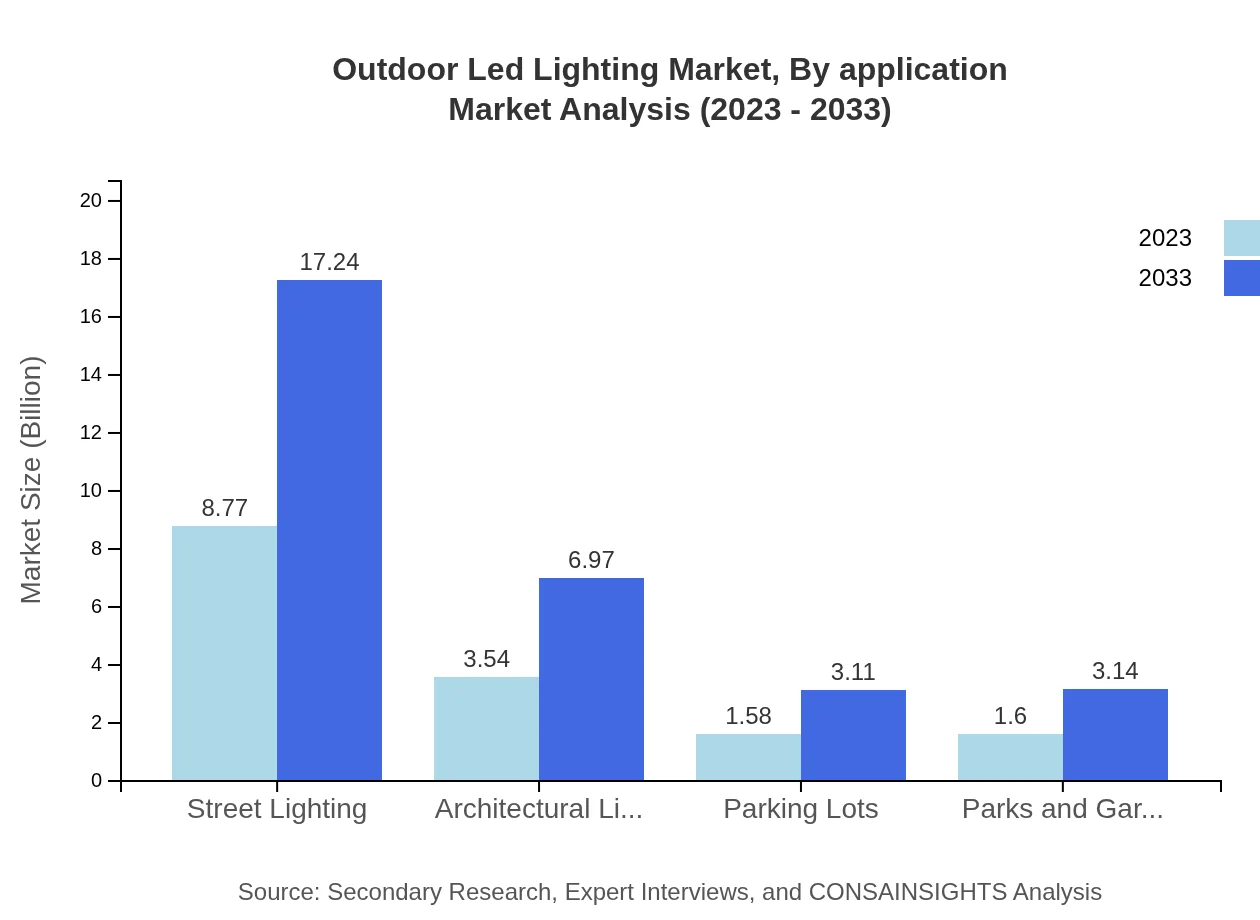

Outdoor Led Lighting Market Analysis By Application

In the application segment, Street Lighting holds the majority share with a market size of $8.77 billion in 2023 and projected growth to $17.24 billion by 2033, with a 56.6% share. Architectural and garden lighting also exhibit significant market sizes, while municipal applications are key growth areas due to urban renewal projects and smart community initiatives.

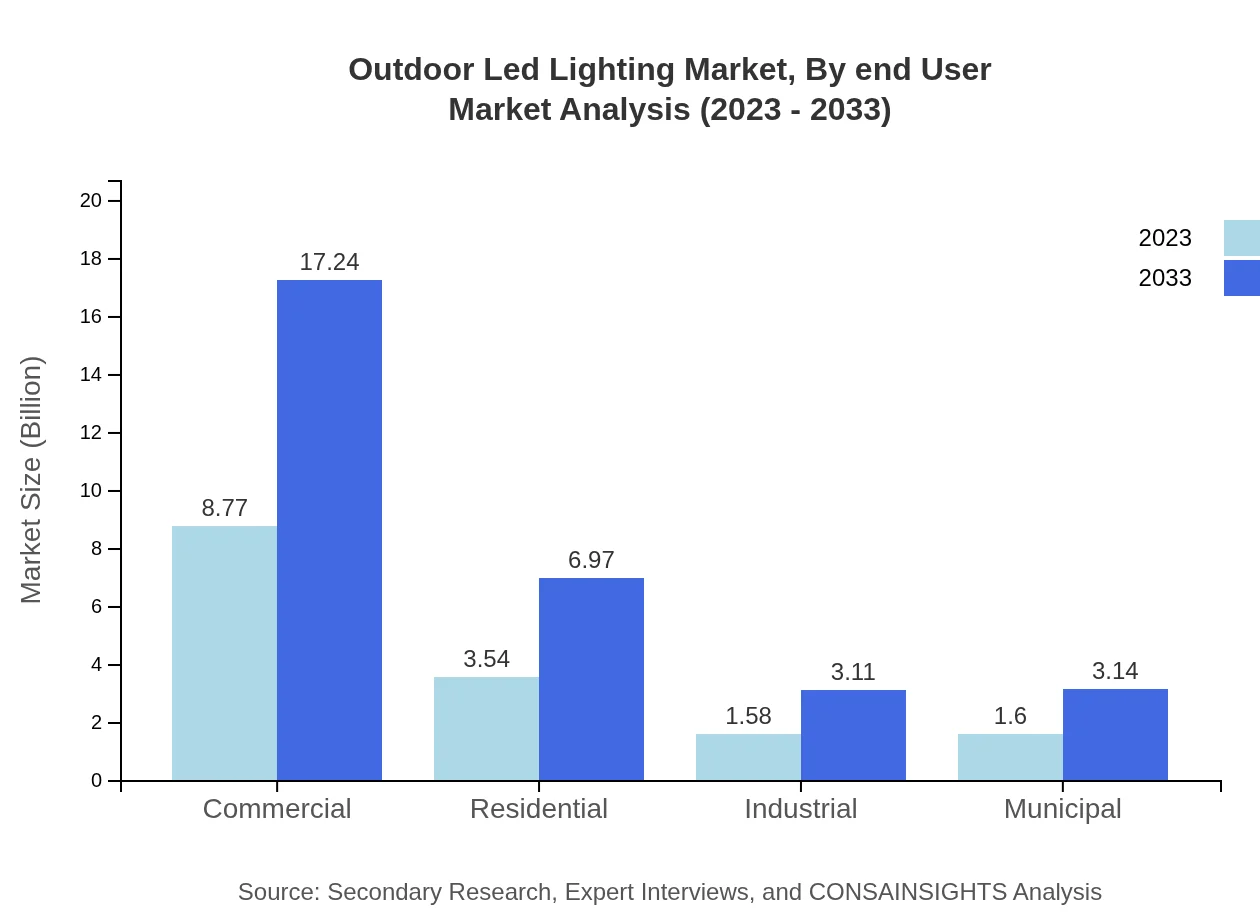

Outdoor Led Lighting Market Analysis By End User

The end-user segment is dominated by the commercial sector, with a projected market size of $8.77 billion in 2023, estimated to reach $17.24 billion by 2033, holding a 56.6% market share. Residential and industrial applications also hold significant shares, with increasing demand for energy-efficient lighting solutions.

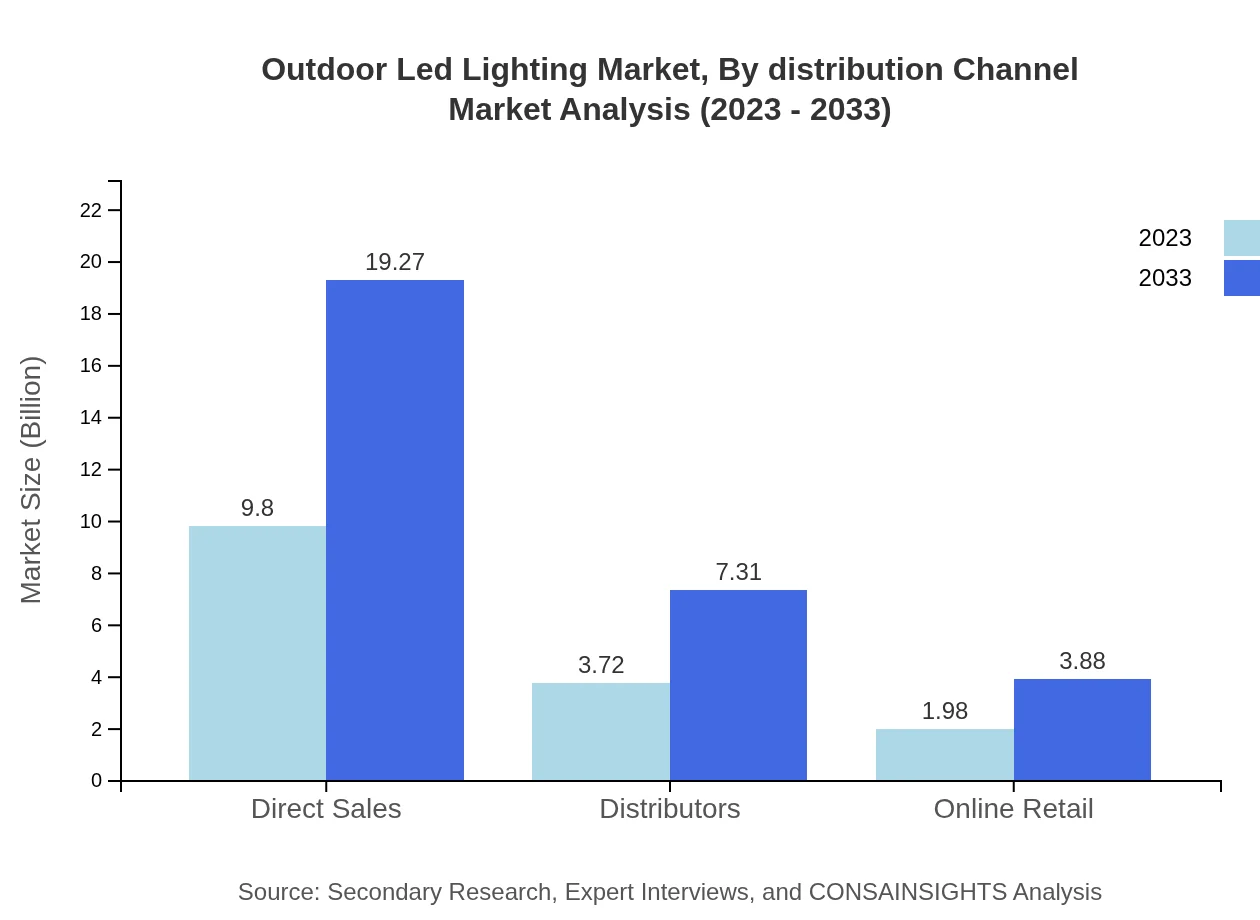

Outdoor Led Lighting Market Analysis By Distribution Channel

The distribution channel analysis shows direct sales as the foremost channel with a market size of $9.80 billion in 2023, anticipated to grow to $19.27 billion by 2033, capturing a 63.24% share. Distributors and online retail channels contribute significantly but at a lower growth rate.

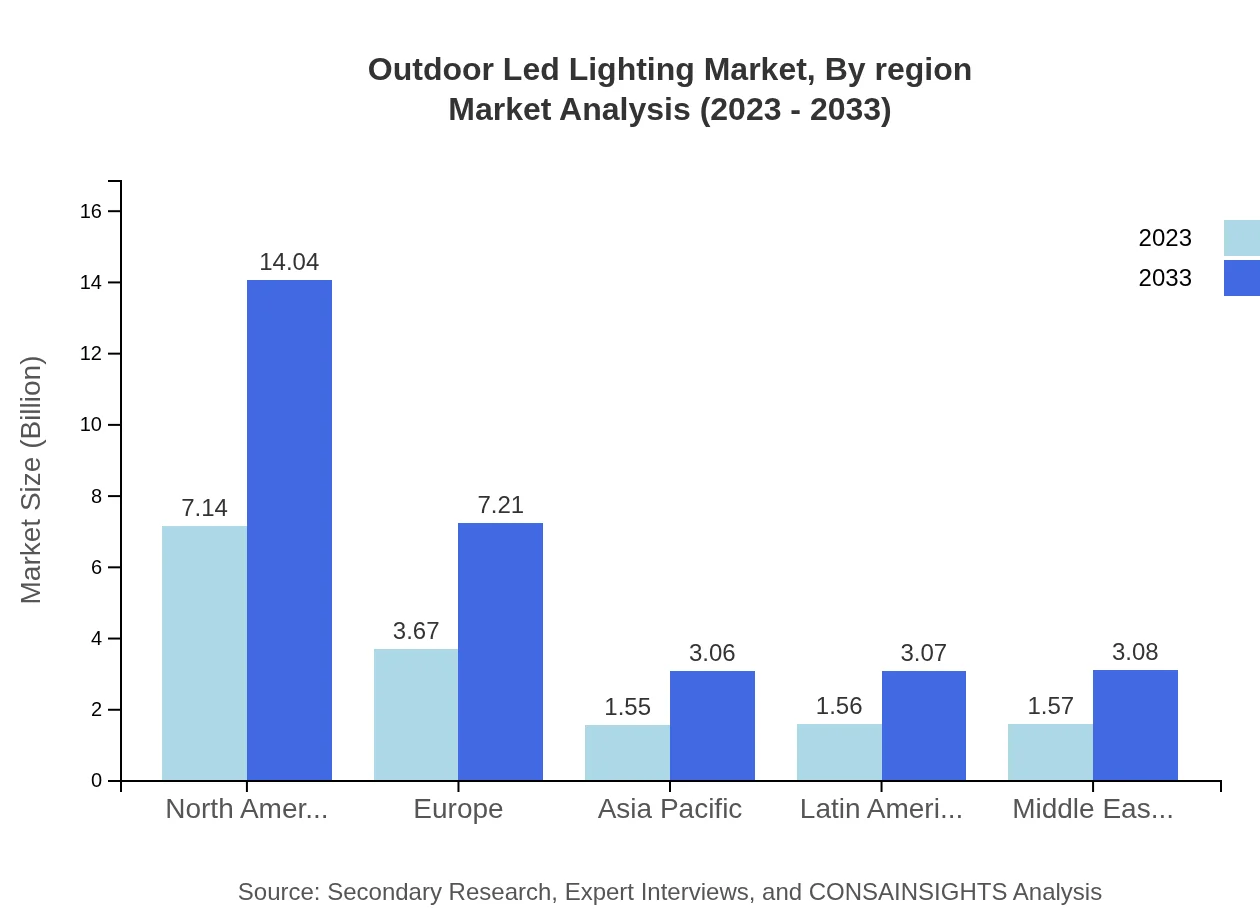

Outdoor Led Lighting Market Analysis By Region

Regionally, North America leads with a market size of $7.14 billion expected to grow to $14.04 billion by 2033. Europe follows closely with strong regulatory support for energy-efficient solutions. The Asia Pacific region also showcases promising growth, particularly in smart technologies.

Outdoor Led Lighting Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Outdoor Led Lighting Industry

Philips Lighting:

Philips is a global leader in lighting solutions, with a strong focus on sustainability and innovation in LED technology.General Electric:

General Electric is known for its diverse lighting portfolio, including advanced outdoor LED lighting solutions designed for both urban and rural settings.Osram:

Osram is a key player in the LED market, offering a broad range of lighting products including outdoor systems with integrated smart technology capabilities.Cree, Inc.:

Cree specializes in innovation in LED technology, particularly for outdoor applications designed to enhance performance and energy savings.Zumtobel Group:

The Zumtobel Group is known for sustainability-focused lighting solutions and plays a significant role in the European market for outdoor lighting.We're grateful to work with incredible clients.

FAQs

What is the market size of outdoor Led Lighting?

The outdoor LED lighting market is valued at approximately $15.5 billion in 2023 and is projected to grow at a CAGR of 6.8%. By 2033, this market is expected to expand significantly, driven by increased demand for energy-efficient illumination.

What are the key market players or companies in this outdoor Led Lighting industry?

Key players in the outdoor LED lighting industry include major manufacturers and suppliers known for their innovative lighting solutions. These companies emphasize sustainability and are continually enhancing product features to meet evolving consumer expectations and industry standards.

What are the primary factors driving the growth in the outdoor Led Lighting industry?

Significant growth drivers for the outdoor LED lighting market include increasing energy efficiency requirements, government initiatives promoting green technologies, urbanization, and the rise in outdoor public infrastructure projects. Additionally, advancements in smart lighting technologies enhance growth prospects.

Which region is the fastest Growing in the outdoor Led Lighting?

Asia Pacific is the fastest-growing region for outdoor LED lighting, projected to rise from a market size of $2.87 billion in 2023 to $5.64 billion by 2033. This surge is attributed to rapid urbanization and technological advancements in lighting solutions.

Does ConsaInsights provide customized market report data for the outdoor Led Lighting industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the outdoor LED lighting industry. Clients can request insights focusing on particular segments, regions, or trends to aid in strategic decision-making.

What deliverables can I expect from this outdoor Led Lighting market research project?

Clients can expect comprehensive deliverables, including an in-depth market analysis, forecasts, competitive landscape reviews, segmentation insights, and actionable recommendations tailored to the outdoor LED lighting sector.

What are the market trends of outdoor Led Lighting?

Market trends include a transition towards smart LED technologies, increasing adoption in urban and commercial settings, and a growing focus on sustainability. Innovations in design and energy efficiency continue to shape the outdoor LED lighting landscape.