Outpatient Surgical Procedures Market Report

Published Date: 31 January 2026 | Report Code: outpatient-surgical-procedures

Outpatient Surgical Procedures Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Outpatient Surgical Procedures market, including market size, growth projections from 2023-2033, technological advancements, and segment analysis. It aims to present data-driven insights for stakeholders in this evolving healthcare sector.

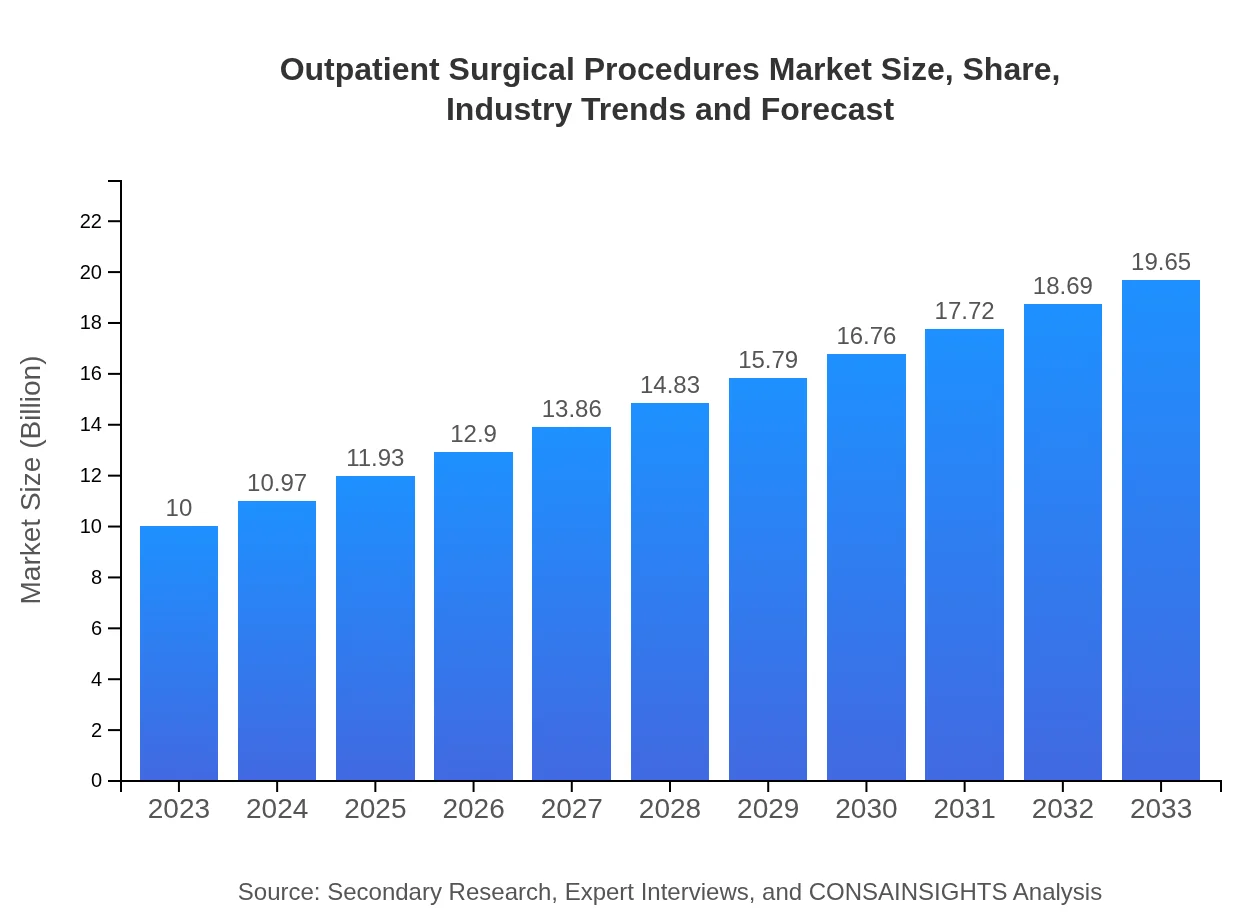

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $19.65 Billion |

| Top Companies | Medtronic , Stryker Corporation, Philips Healthcare, Boston Scientific, Johnson & Johnson |

| Last Modified Date | 31 January 2026 |

Outpatient Surgical Procedures Market Overview

Customize Outpatient Surgical Procedures Market Report market research report

- ✔ Get in-depth analysis of Outpatient Surgical Procedures market size, growth, and forecasts.

- ✔ Understand Outpatient Surgical Procedures's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Outpatient Surgical Procedures

What is the Market Size & CAGR of Outpatient Surgical Procedures market in 2023?

Outpatient Surgical Procedures Industry Analysis

Outpatient Surgical Procedures Market Segmentation and Scope

Tell us your focus area and get a customized research report.

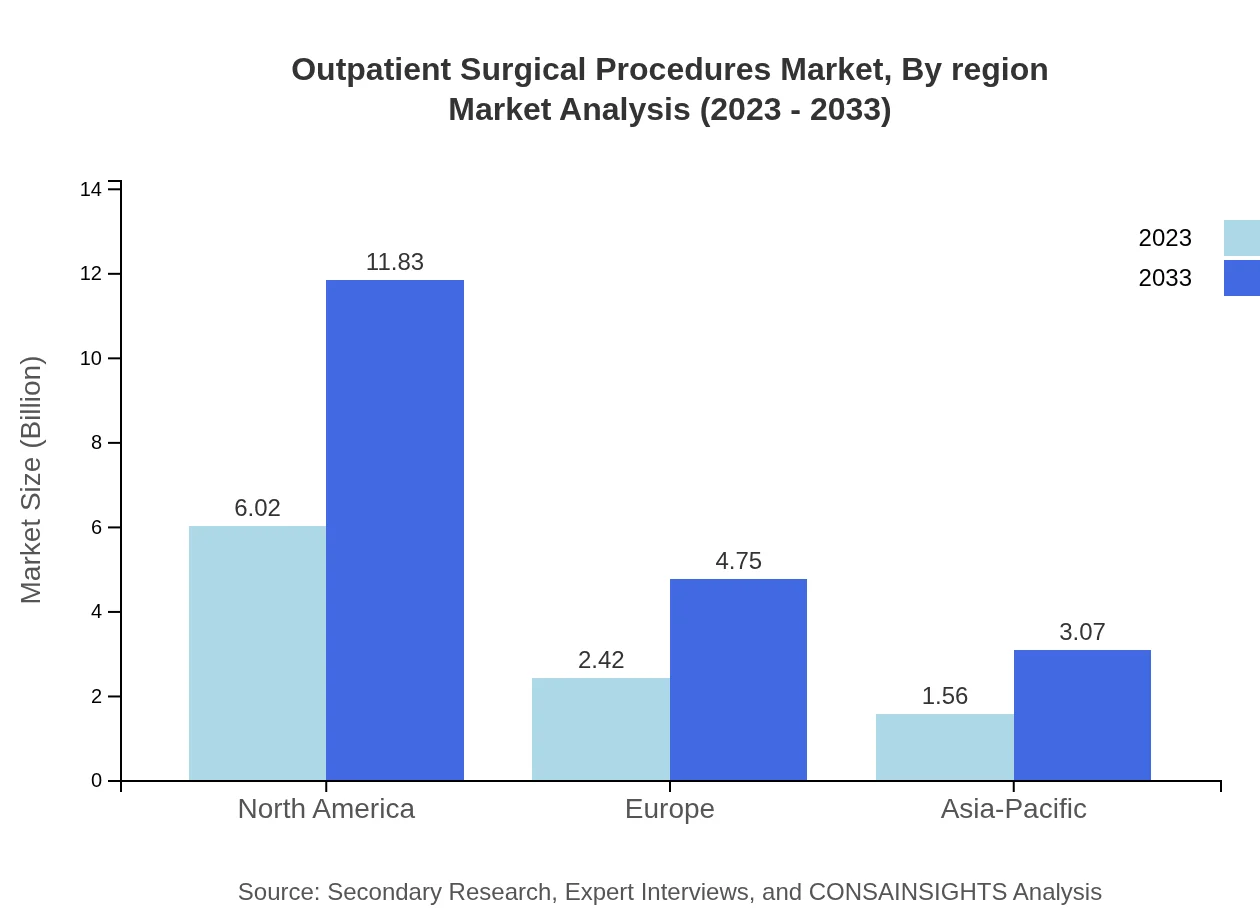

Outpatient Surgical Procedures Market Analysis Report by Region

Europe Outpatient Surgical Procedures Market Report:

The European market is valued at USD 3.01 billion in 2023, projected to reach USD 5.92 billion by 2033. Countries like Germany and the UK lead in adopting outpatient surgical procedures, facilitated by their advanced healthcare systems and growing government initiatives to enhance outpatient facilities.Asia Pacific Outpatient Surgical Procedures Market Report:

In the Asia Pacific region, the Outpatient Surgical Procedures market was valued at approximately USD 1.90 billion in 2023 and is projected to reach around USD 3.73 billion by 2033, reflecting a robust CAGR. Factors such as increasing urbanization, rising disposable incomes, and growing healthcare infrastructure contribute to this growth, particularly in countries like China and India.North America Outpatient Surgical Procedures Market Report:

North America remains the largest market for Outpatient Surgical Procedures, with a valuation of USD 3.71 billion in 2023, potentially expanding to USD 7.29 billion by 2033. The primary drivers include a well-established healthcare framework, favorable reimbursement policies, and increasing preference for outpatient care, particularly in the United States.South America Outpatient Surgical Procedures Market Report:

For South America, the market is expected to grow from USD 0.67 billion in 2023 to approximately USD 1.31 billion in 2033. The region shows promise due to growing awareness about outpatient services and advancements in healthcare delivery models, particularly in Brazil and Argentina.Middle East & Africa Outpatient Surgical Procedures Market Report:

The Middle East and Africa market is estimated at USD 0.71 billion in 2023, aiming for USD 1.40 billion by 2033. The growth is attributed to improving healthcare infrastructure, an increase in medical tourism, and rising healthcare expenditure across various countries in the region.Tell us your focus area and get a customized research report.

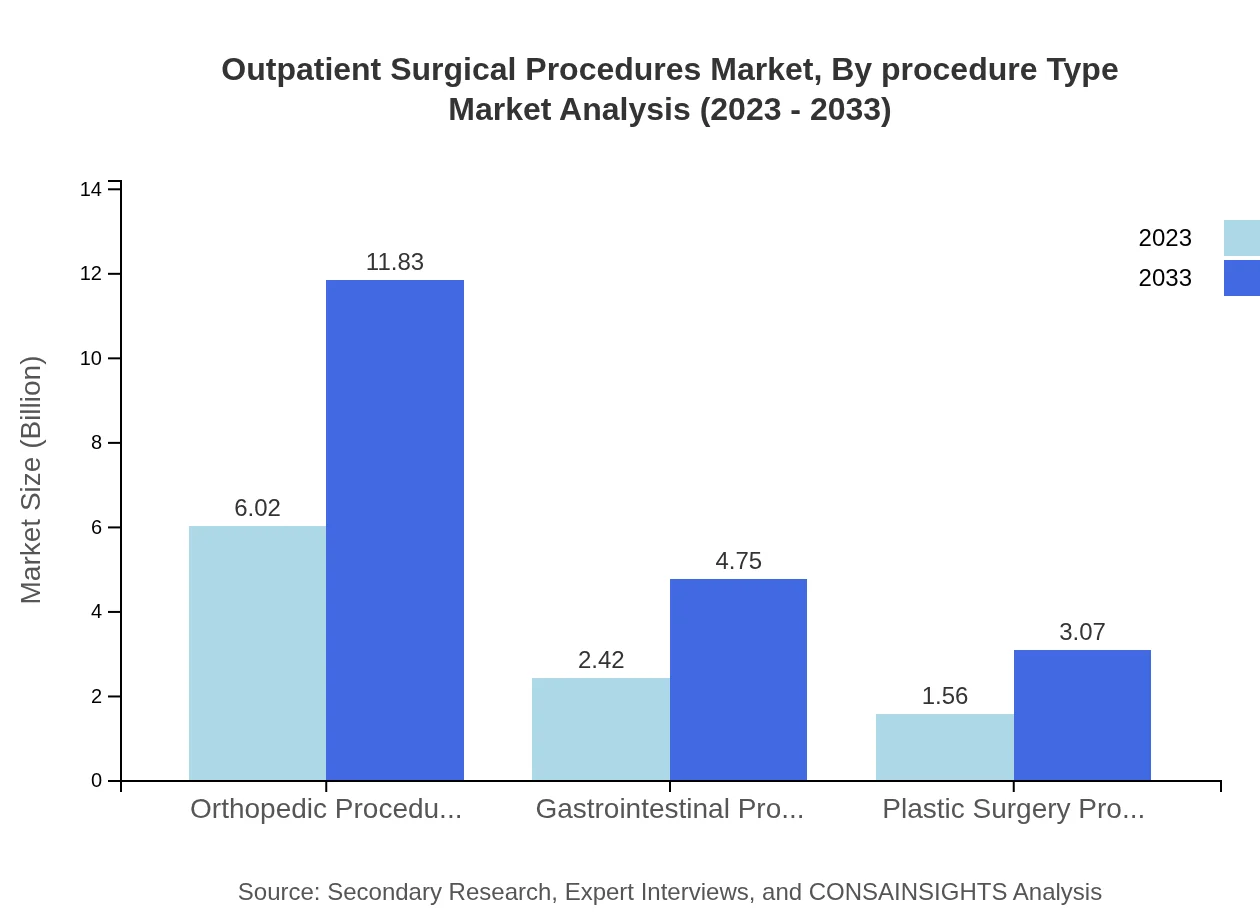

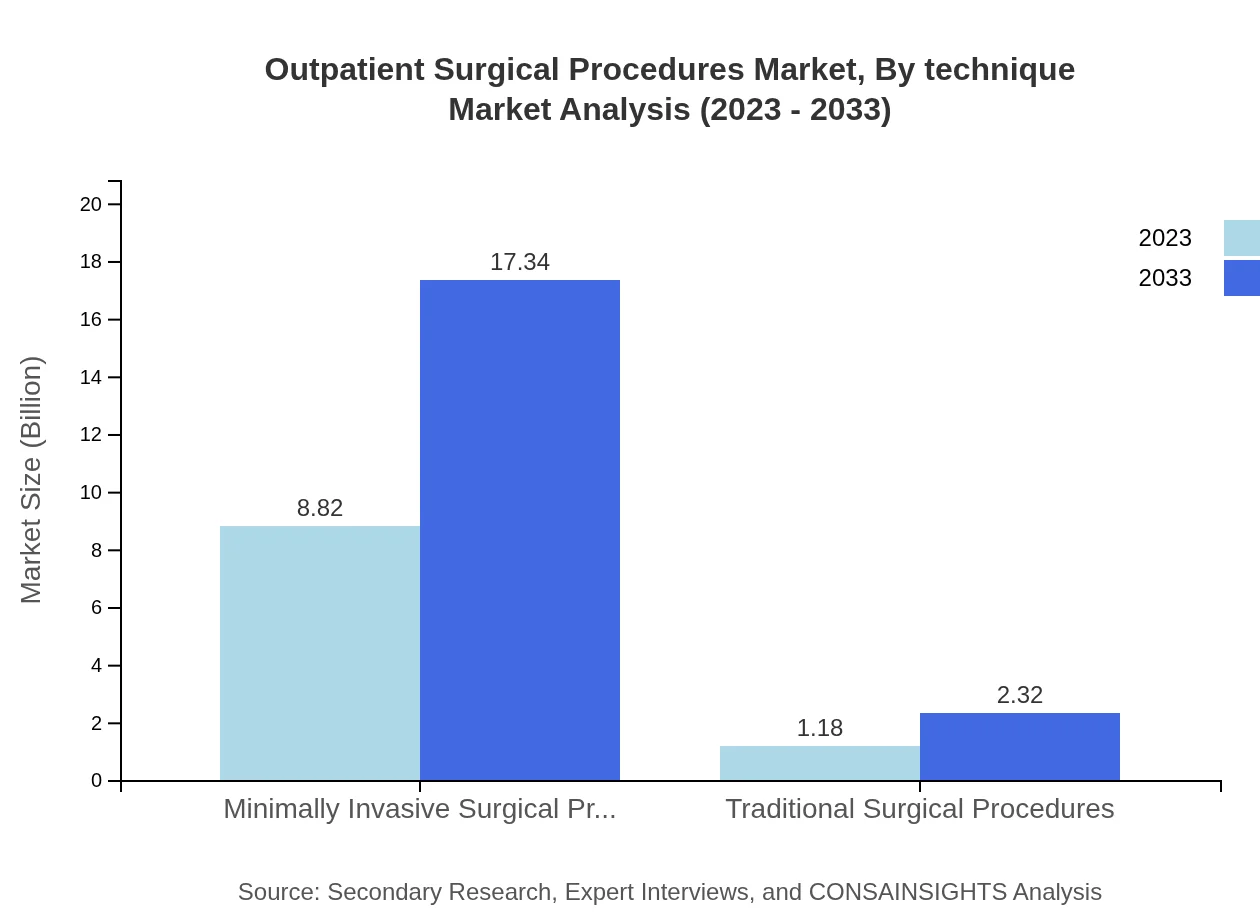

Outpatient Surgical Procedures Market Analysis By Procedure Type

The Outpatient Surgical Procedures market by procedure type is dominated by minimally invasive surgical procedures, accounting for approximately 88.22% of the total market size in 2023, valued at USD 8.82 billion. Traditional surgical procedures represent a smaller segment, making up about 11.78% of the market, with USD 1.18 billion in 2023. The preference for minimally invasive options is driven by reduced recovery time and better outcomes.

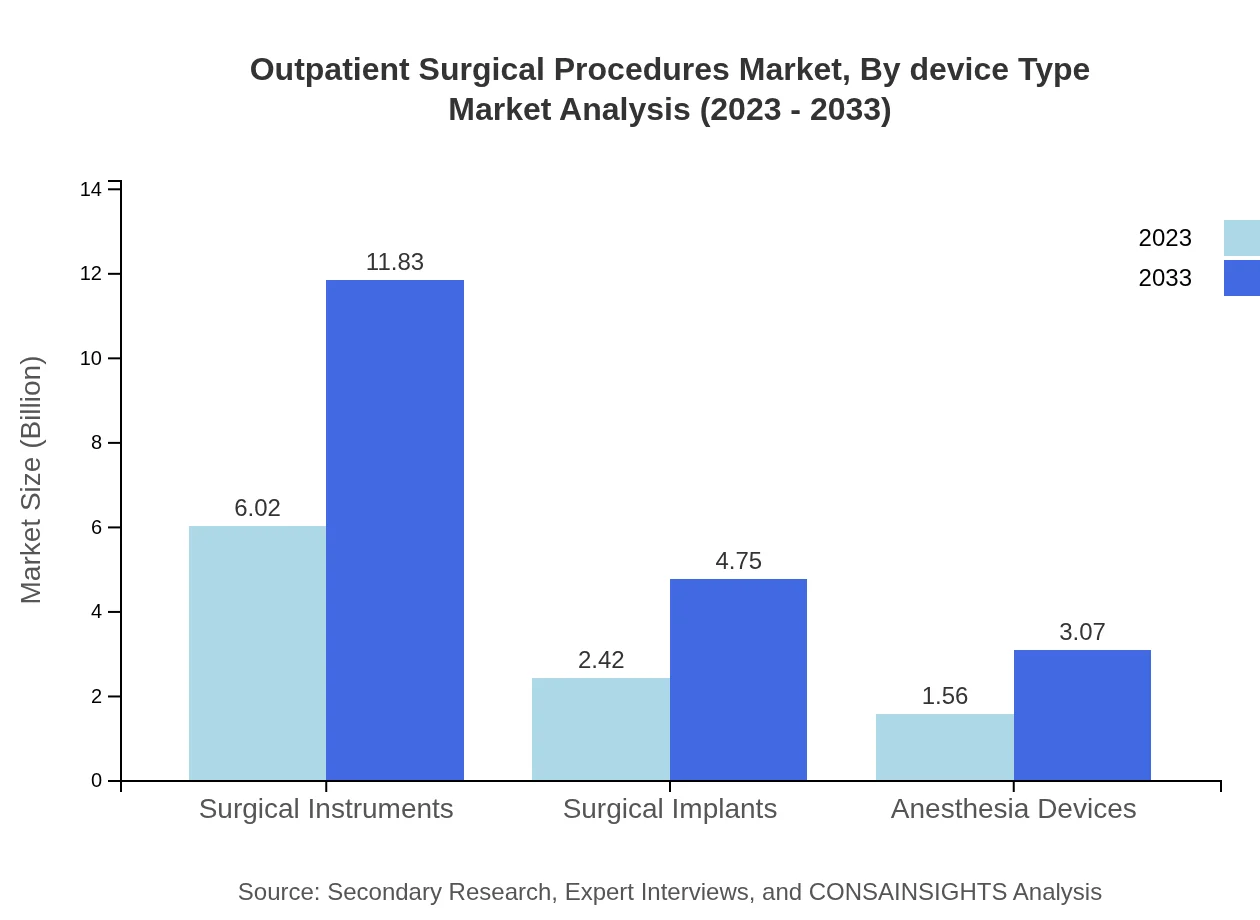

Outpatient Surgical Procedures Market Analysis By Device Type

Surgical instruments hold the highest share in the market at 60.21%, valued at USD 6.02 billion in 2023. This is followed by surgical implants at 24.18%, with a market size of USD 2.42 billion. Anesthesia devices contribute 15.61%, valued at USD 1.56 billion. The surge in demand for high-quality instruments and implants supports the growth of this segment.

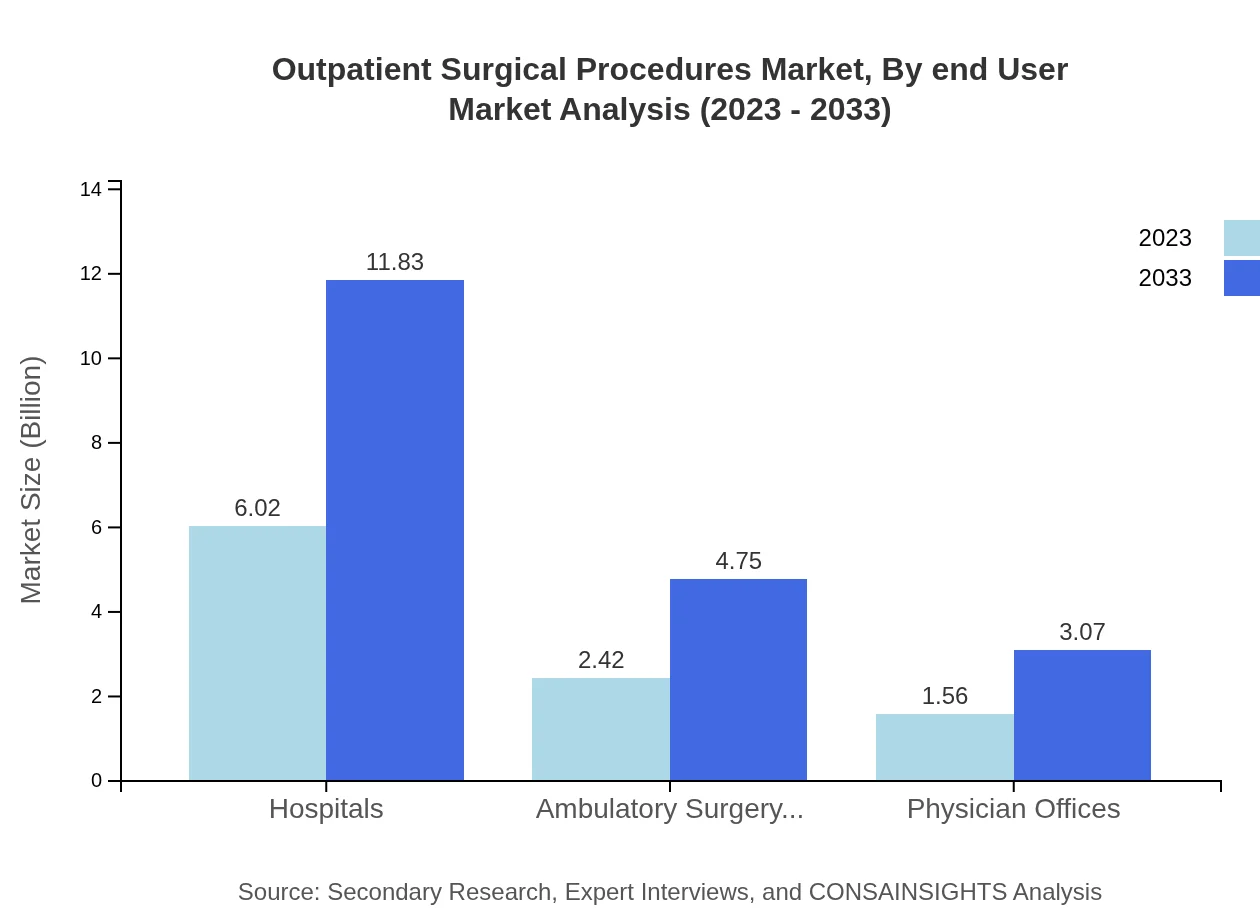

Outpatient Surgical Procedures Market Analysis By End User

The outpatient surgical procedures market primarily comprises hospitals, which dominate the segment with a 60.21% share and USD 6.02 billion in 2023. Ambulatory surgery centers and physician offices account for 24.18% and 15.61% respectively, with corresponding values of USD 2.42 billion and USD 1.56 billion. The shift towards outpatient care is seeing increasing utilization of these facilities due to their capacity to handle a higher volume of minor surgeries.

Outpatient Surgical Procedures Market Analysis By Region

Geographically, North America leads the way, accounting for a significant 60.21% share of the total market in 2023, highlighting the high adoption rates of outpatient procedures. Europe's market share stands at 24.18%, while Asia Pacific holds about 15.61%. This distribution underscores the growing recognition of outpatient surgical care across various regions.

Outpatient Surgical Procedures Market Analysis By Technique

Current trends in surgical techniques emphasize the rise of minimally invasive surgeries which are significantly reshaping the outpatient procedures landscape. This technique is not only improving patient outcomes but also expanding the range of procedures performed outpatiently, allowing for more complex surgeries to be conducted in less invasive ways.

Outpatient Surgical Procedures Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Outpatient Surgical Procedures Industry

Medtronic :

Medtronic is a leading global medical technology company that provides innovative therapies and services, including advanced surgical solutions aimed at improving patient outcomes and minimizing recovery times.Stryker Corporation:

Stryker Corporation specializes in medical devices, including surgical instruments and implants, and is recognized for its commitment to innovative healthcare solutions that enhance surgical efficiency.Philips Healthcare:

Philips is a major player in healthcare technologies, focusing on diagnostic imaging, patient monitoring, and surgical devices, improving overall surgical procedures and patient care.Boston Scientific:

Boston Scientific develops and manufactures devices that support a wide range of minimally invasive procedures, contributing to the rise of outpatient surgical options.Johnson & Johnson:

Johnson & Johnson, through its Ethicon brand, provides a broad spectrum of surgical products that streamline outpatient surgeries, emphasizing on quality and patient safety.We're grateful to work with incredible clients.

FAQs

What is the market size of Outpatient Surgical Procedures?

The Outpatient Surgical Procedures market is currently valued at approximately $10 billion with a projected CAGR of 6.8% over the next decade, indicating robust growth as the industry adapts to increasing patient demand and innovation in healthcare.

What are the key market players or companies in the Outpatient Surgical Procedures industry?

Key players in the Outpatient Surgical Procedures industry include major healthcare companies and surgical instrument manufacturers providing innovative solutions and services aligned with evolving patient needs and evolving outpatient care models.

What are the primary factors driving the growth in the Outpatient Surgical Procedures industry?

The growth in this industry is driven by factors such as advancements in minimally invasive surgical techniques, increasing patient preferences for outpatient care, a focus on cost-effective healthcare solutions, and technological innovations in surgical instruments and procedures.

Which region is the fastest Growing in the Outpatient Surgical Procedures?

North America is anticipated to be the fastest-growing region, expanding from $3.71 billion in 2023 to an estimated $7.29 billion by 2033, supported by a robust healthcare infrastructure and high demand for outpatient services.

Does ConsaInsights provide customized market report data for the Outpatient Surgical Procedures industry?

Yes, ConsaInsights offers tailored market reports that cater to specific needs within the Outpatient Surgical Procedures industry, providing detailed data and insights that help organizations make informed strategic decisions.

What deliverables can I expect from this Outpatient Surgical Procedures market research project?

Expect comprehensive deliverables including market size assessments, growth forecasts, segment analysis, competitive landscape insights, and actionable recommendations tailored to the Outpatient Surgical Procedures market.

What are the market trends of Outpatient Surgical Procedures?

Current market trends include a significant shift towards minimally invasive techniques, technological advancements in surgical tools, and increasing patient focus on faster recovery times, influencing the scope of outpatient surgical procedures across the globe.