Outsourced Orthopedic Manufacturing Market Report

Published Date: 31 January 2026 | Report Code: outsourced-orthopedic-manufacturing

Outsourced Orthopedic Manufacturing Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Outsourced Orthopedic Manufacturing market, covering key insights, market dynamics, trends, and a comprehensive forecast for the period 2023 to 2033.

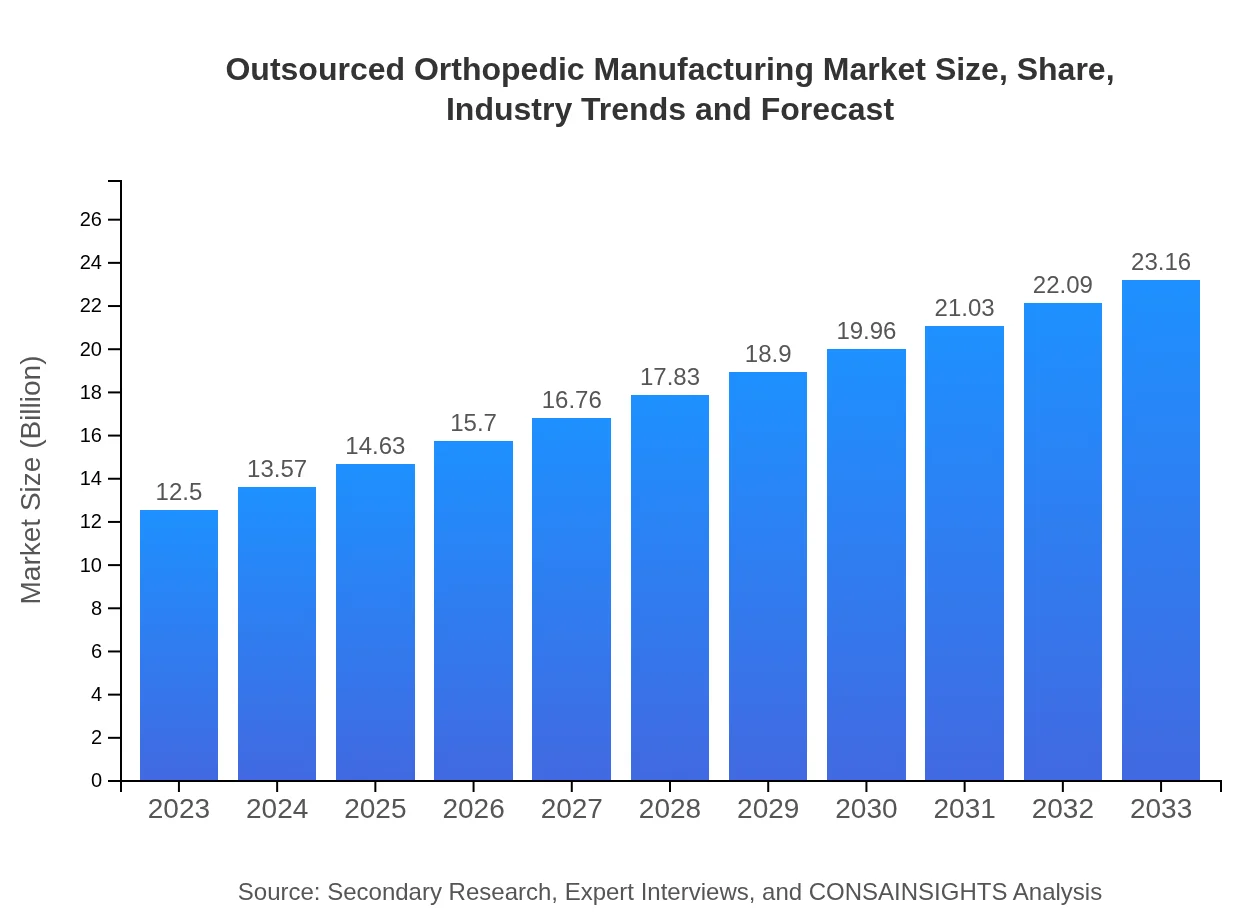

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $23.16 Billion |

| Top Companies | Stryker Corporation, Zimmer Biomet Holdings, Inc., Medtronic plc, Johnson & Johnson |

| Last Modified Date | 31 January 2026 |

Outsourced Orthopedic Manufacturing Market Overview

Customize Outsourced Orthopedic Manufacturing Market Report market research report

- ✔ Get in-depth analysis of Outsourced Orthopedic Manufacturing market size, growth, and forecasts.

- ✔ Understand Outsourced Orthopedic Manufacturing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Outsourced Orthopedic Manufacturing

What is the Market Size & CAGR of Outsourced Orthopedic Manufacturing market in 2023?

Outsourced Orthopedic Manufacturing Industry Analysis

Outsourced Orthopedic Manufacturing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Outsourced Orthopedic Manufacturing Market Analysis Report by Region

Europe Outsourced Orthopedic Manufacturing Market Report:

Europe is a significant player in the Outsourced Orthopedic Manufacturing market, expected to grow from $4.37 billion in 2023 to $8.10 billion in 2033. The region's strong focus on innovative medical technologies, along with stringent regulatory requirements promoting high-quality products, supports this upward trajectory.Asia Pacific Outsourced Orthopedic Manufacturing Market Report:

The Asia-Pacific region is anticipated to show significant growth in the Outsourced Orthopedic Manufacturing market, projected to expand from $2.23 billion in 2023 to $4.13 billion by 2033. Factors contributing to this growth include a growing population, increasing healthcare expenditures, and rising incidences of orthopedic disorders. Countries like China and India are investing heavily in healthcare infrastructure, further driving demand.North America Outsourced Orthopedic Manufacturing Market Report:

North America holds a substantial share of the Outsourced Orthopedic Manufacturing market, with a valuation projected to increase from $4.10 billion in 2023 to $7.60 billion in 2033. This region benefits from advanced healthcare systems, high investments in R&D, and a higher prevalence of orthopedic surgeries, driven by an aging population.South America Outsourced Orthopedic Manufacturing Market Report:

The South American market for Outsourced Orthopedic Manufacturing is relatively small, expected to grow from $0.07 billion in 2023 to $0.13 billion in 2033. Economic development and improved access to healthcare services in countries such as Brazil and Argentina are expected to support this growth, although the market remains constrained by economic volatility.Middle East & Africa Outsourced Orthopedic Manufacturing Market Report:

The Middle East and Africa region demonstrates a growing interest in healthcare investments, with the Outsourced Orthopedic Manufacturing market projected to rise from $1.73 billion in 2023 to $3.20 billion by 2033. Increasing awareness about orthopedic health coupled with government initiatives to enhance healthcare infrastructure is expected to fuel growth in this region.Tell us your focus area and get a customized research report.

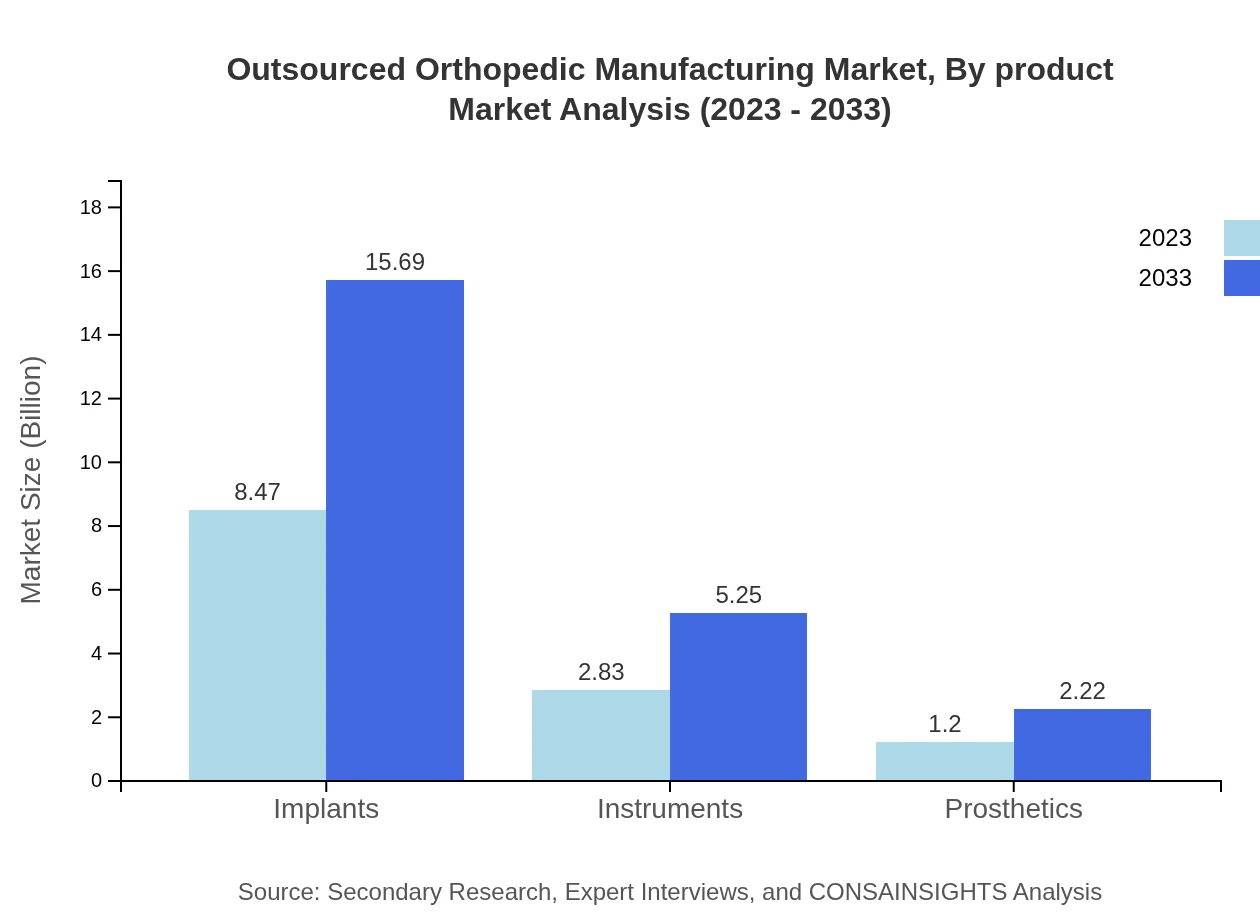

Outsourced Orthopedic Manufacturing Market Analysis By Product

The product analysis in the Outsourced Orthopedic Manufacturing sector reveals significant differences in market sizes and shares. Implants dominate the market, anticipated to grow from $8.47 billion in 2023 to $15.69 billion by 2033, capturing 67.75% of the market share. Instruments exhibit steady growth as well, from $2.83 billion to $5.25 billion, making up 22.65%. Prosthetics, with a smaller but growing segment, are expected to increase from $1.20 billion to $2.22 billion.

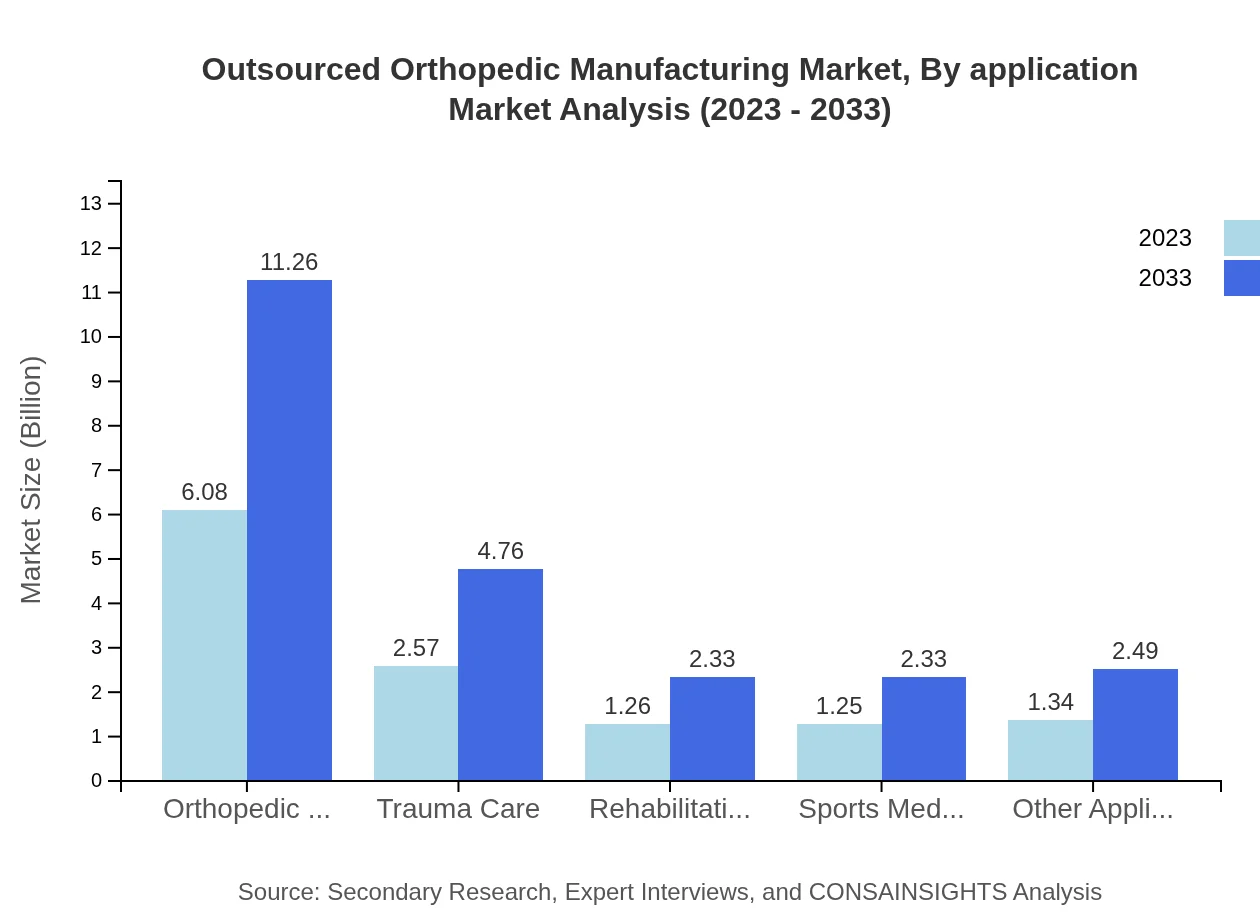

Outsourced Orthopedic Manufacturing Market Analysis By Application

In application categories, Orthopedic Surgery is the largest segment, with market size rising from $6.08 billion to $11.26 billion and maintaining a significant share at 48.62%. Trauma Care and Rehabilitation applications also reflect increases from $2.57 billion to $4.76 billion and from $1.26 billion to $2.33 billion, respectively. Sports Medicine remains stable, supported by the growing fitness trend.

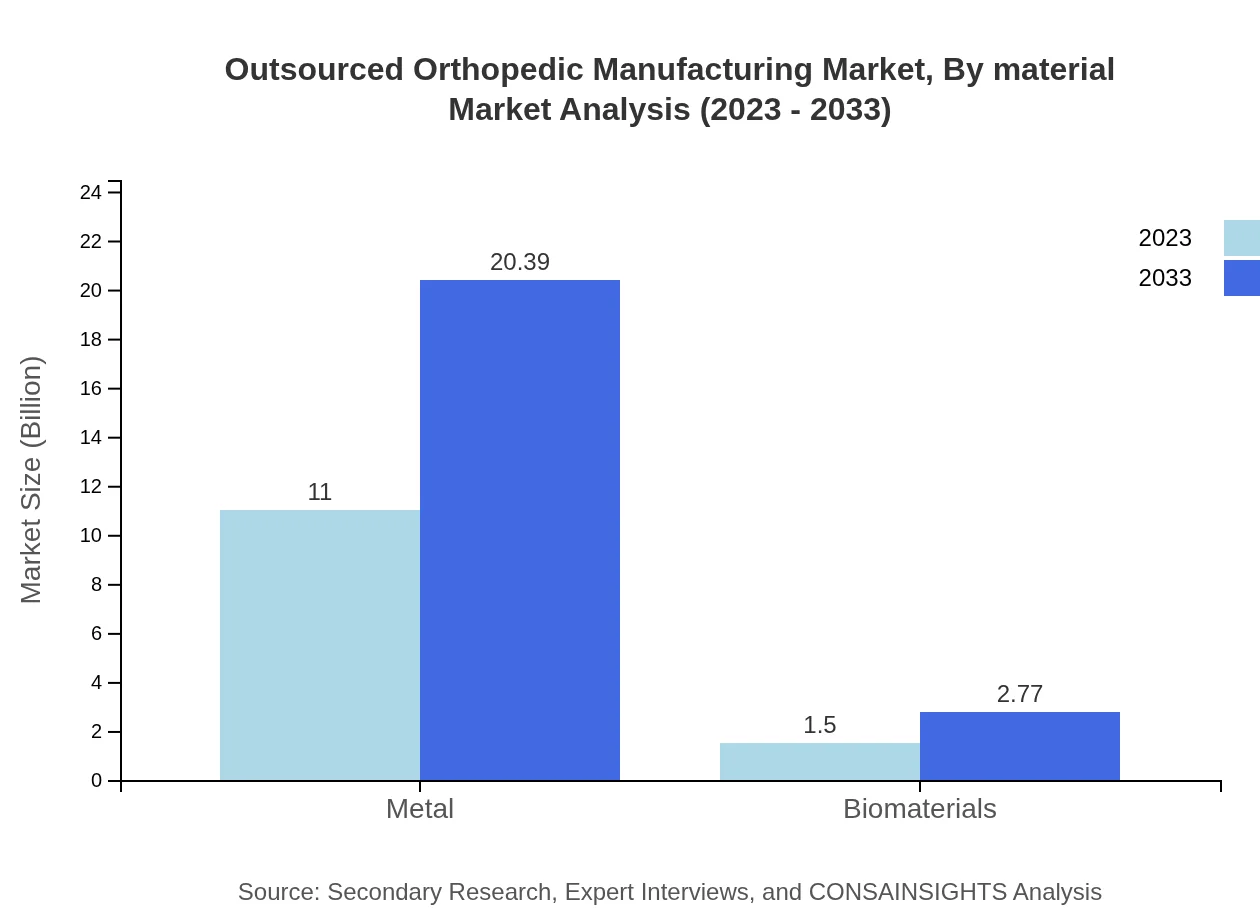

Outsourced Orthopedic Manufacturing Market Analysis By Material

Metal continues to represent the most substantial market share in outsourced orthopedic manufacturing, expected to grow significantly from $11.00 billion to $20.39 billion; it currently captures 88.03% of the market. Biomaterials are also on an upward trajectory, projected to expand from $1.50 billion to $2.77 billion, marking an increase in their relevance amid a focus on biocompatibility and patient-centered designs.

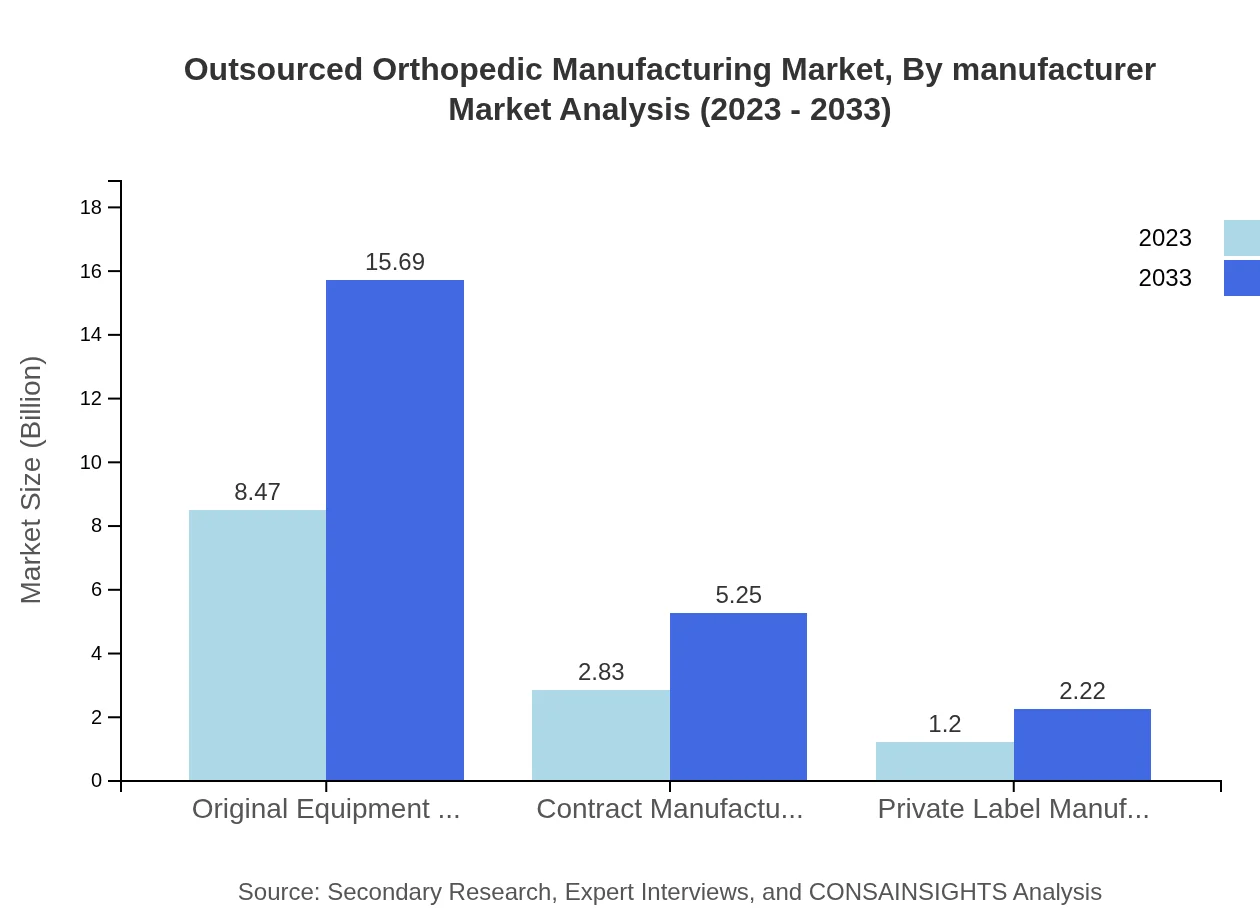

Outsourced Orthopedic Manufacturing Market Analysis By Manufacturer

The market is divided among Original Equipment Manufacturers (OEMs), Contract Manufacturers, and Private Label Manufacturers. OEMs dominate, growing from $8.47 billion to $15.69 billion, with a solid share of 67.75%. Contract Manufacturers, although fewer, show a marked increase in market size from $2.83 billion to $5.25 billion, capturing 22.65% of the market.

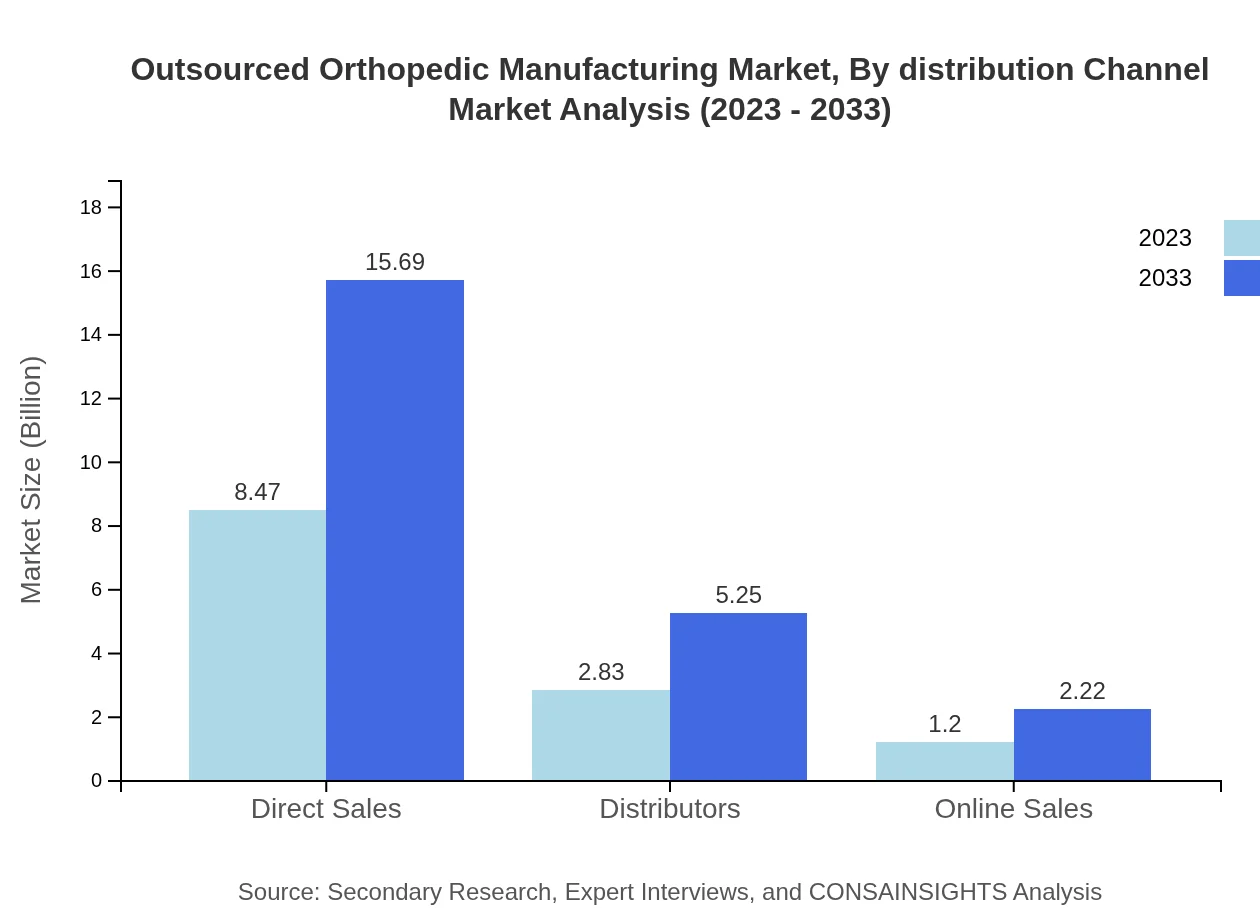

Outsourced Orthopedic Manufacturing Market Analysis By Distribution Channel

Distribution channels include Direct Sales, Distributors, and Online Sales, with Direct Sales leading at $8.47 billion, projected to reach $15.69 billion. Distributors follow with a growth from $2.83 billion to $5.25 billion while Online Sales, though smaller at $1.20 billion to $2.22 billion, are gaining traction due to increasing digitalization in healthcare.

Outsourced Orthopedic Manufacturing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Outsourced Orthopedic Manufacturing Industry

Stryker Corporation:

Stryker is a global leader in medical technology, specializing in orthopedic devices, surgical equipment, and other healthcare products, known for its innovative approaches and quality manufacturing.Zimmer Biomet Holdings, Inc.:

Zimmer Biomet is renowned for its comprehensive portfolio of orthopedic reconstructive products, focusing on patient satisfaction through innovative orthopedic solutions.Medtronic plc:

Medtronic is a key player in the orthopedic segment, offering a range of technologies and devices focused on improving patient outcomes and advancing surgical practices.Johnson & Johnson:

Johnson & Johnson, through its subsidiary DePuy Synthes, plays a significant role in the orthopedic market with its wide range of products for trauma, joint reconstruction, and spine care.We're grateful to work with incredible clients.

FAQs

What is the market size of outsourced orthopedic manufacturing?

The outsourced orthopedic manufacturing market is valued at approximately $12.5 billion in 2023, with a projected CAGR of 6.2%, reaching significant growth by 2033. This market encompasses various segments, including implants, instruments, and prosthetics.

What are the key market players or companies in this outsourced orthopedic manufacturing industry?

Key players in the outsourced orthopedic manufacturing industry include prominent Original Equipment Manufacturers (OEMs), contract manufacturers, and private label manufacturers, contributing significantly to market growth and innovations within the sector.

What are the primary factors driving the growth in the outsourced orthopedic manufacturing industry?

Driving factors for market growth include technological advancements, increased demand for orthopedic surgeries, the aging population, and rising incidences of orthopedic disorders, fortifying the requisites for outsourced manufacturing solutions.

Which region is the fastest Growing in the outsourced orthopedic manufacturing?

The Asia-Pacific region is experiencing rapid growth in the outsourced orthopedic manufacturing market, projected to increase from $2.23 billion in 2023 to $4.13 billion by 2033, representing a significant expansion and investment opportunity.

Does ConsaInsights provide customized market report data for the outsourced orthopedic manufacturing industry?

Yes, ConsaInsights offers customized market report data, tailoring insights and analysis specific to clients' needs within the outsourced orthopedic manufacturing space, ensuring comprehensive and relevant market intelligence.

What deliverables can I expect from this outsourced orthopedic manufacturing market research project?

Deliverables from this market research project include detailed reports on market size, segmentation analysis, competitive landscape, trends, growth drivers, and regional insights, providing a comprehensive overview of the outsourced orthopedic manufacturing landscape.

What are the market trends of outsourced orthopedic manufacturing?

Current trends include growing automation in manufacturing processes, a shift towards personalized orthopedic solutions, increased collaborations between companies, and an emphasis on sustainable materials, reflecting the innovative trajectory of the industry.