Over The Air Ota Testing Market Report

Published Date: 31 January 2026 | Report Code: over-the-air-ota-testing

Over The Air Ota Testing Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Over The Air (OTA) Testing market for the forecast period from 2023 to 2033, including market size, industry analysis, segmentation, regional insights, and future forecasts.

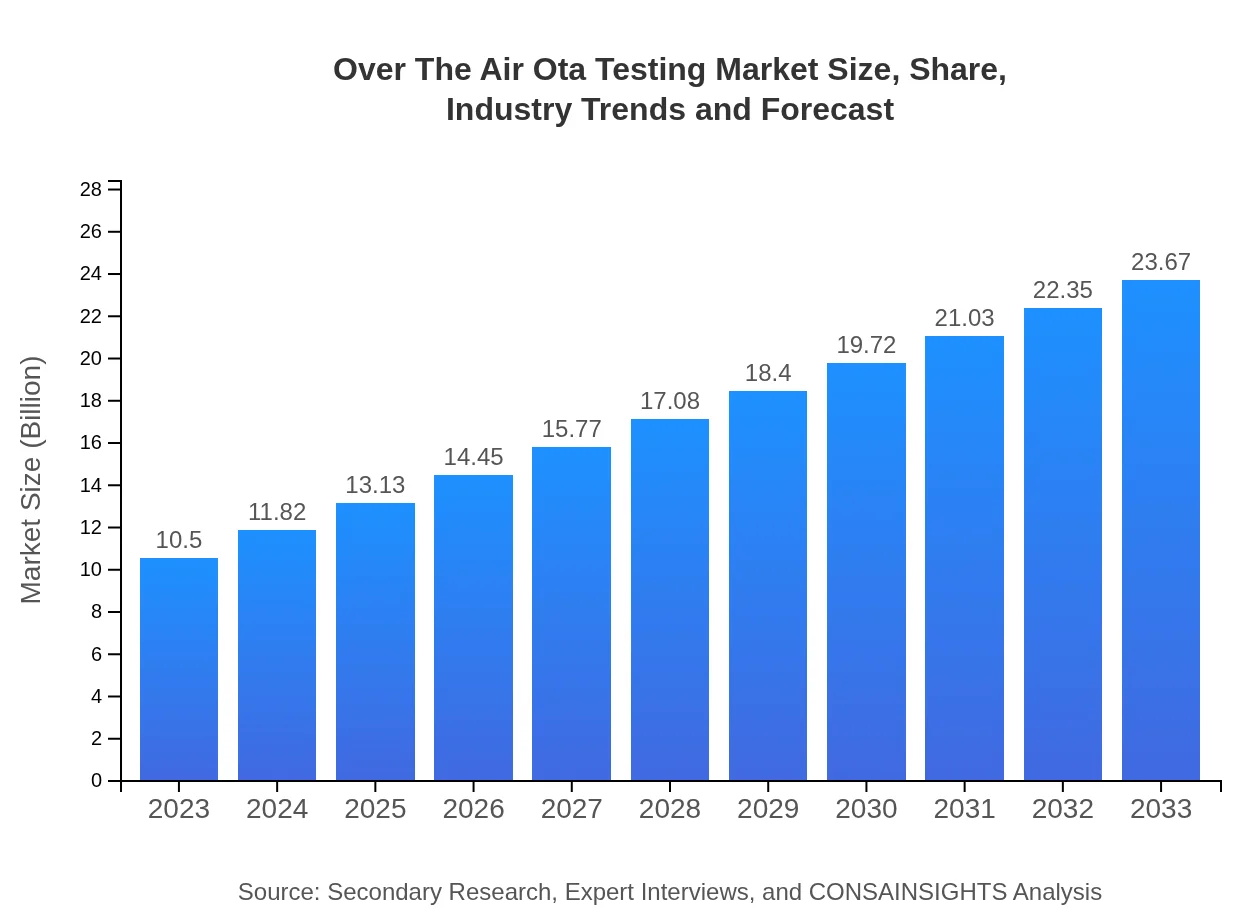

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 8.2% |

| 2033 Market Size | $23.67 Billion |

| Top Companies | Qualcomm Technologies, Inc., Amdocs, Ericsson , Keysight Technologies, Spirent Communications |

| Last Modified Date | 31 January 2026 |

Over The Air Ota Testing Market Overview

Customize Over The Air Ota Testing Market Report market research report

- ✔ Get in-depth analysis of Over The Air Ota Testing market size, growth, and forecasts.

- ✔ Understand Over The Air Ota Testing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Over The Air Ota Testing

What is the Market Size & CAGR of Over The Air Ota Testing market in 2023 and 2033?

Over The Air Ota Testing Industry Analysis

Over The Air Ota Testing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Over The Air Ota Testing Market Analysis Report by Region

Europe Over The Air Ota Testing Market Report:

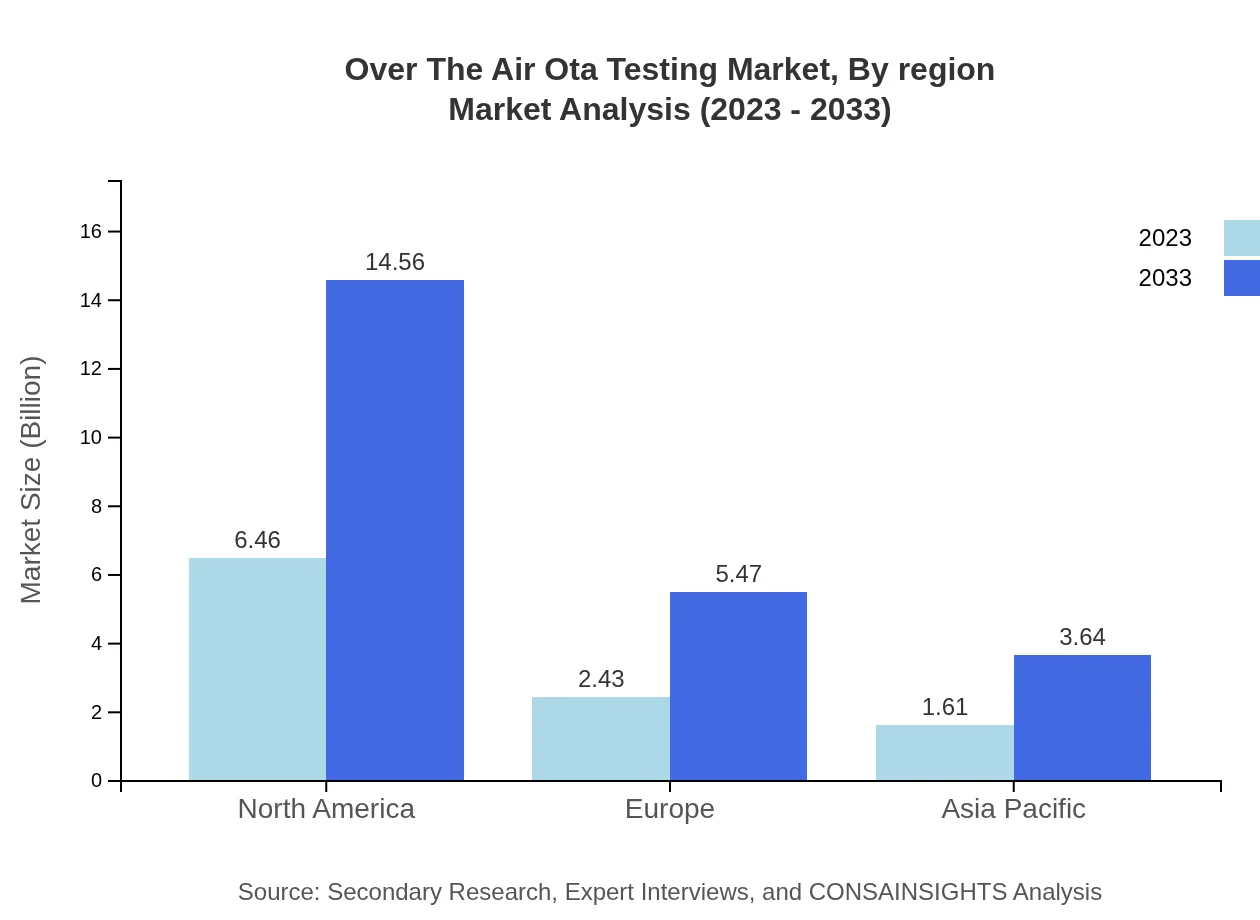

The European market, valued at USD 3.17 billion in 2023, is expected to grow to USD 7.16 billion by 2033. The region’s stringent regulatory environment and emphasis on cybersecurity lead to a significant demand for trusted OTA testing solutions.Asia Pacific Over The Air Ota Testing Market Report:

In 2023, the Asia Pacific region holds a market size of USD 2.25 billion, projected to grow to USD 5.08 billion by 2033. The rapid proliferation of smartphones and IoT devices, coupled with increasing demand for reliable software updates, is driving this growth.North America Over The Air Ota Testing Market Report:

North America features a robust OTA testing market, with a valuation of USD 3.43 billion in 2023 and projected growth to USD 7.74 billion by 2033. The region's advanced technological infrastructure and high adoption rates of connected devices underpin this expansion.South America Over The Air Ota Testing Market Report:

The South American market is valued at USD 0.59 billion in 2023, with expectations to rise to USD 1.33 billion by 2033. This growth is supported by the expansion of mobile networks and increasing smartphone penetration in the region.Middle East & Africa Over The Air Ota Testing Market Report:

The Middle East and Africa region has a market size of USD 1.05 billion in 2023, expected to grow to USD 2.37 billion by 2033. With rising investments in telecommunications and the growing integration of technology in various sectors, the demand for OTA testing is on the rise.Tell us your focus area and get a customized research report.

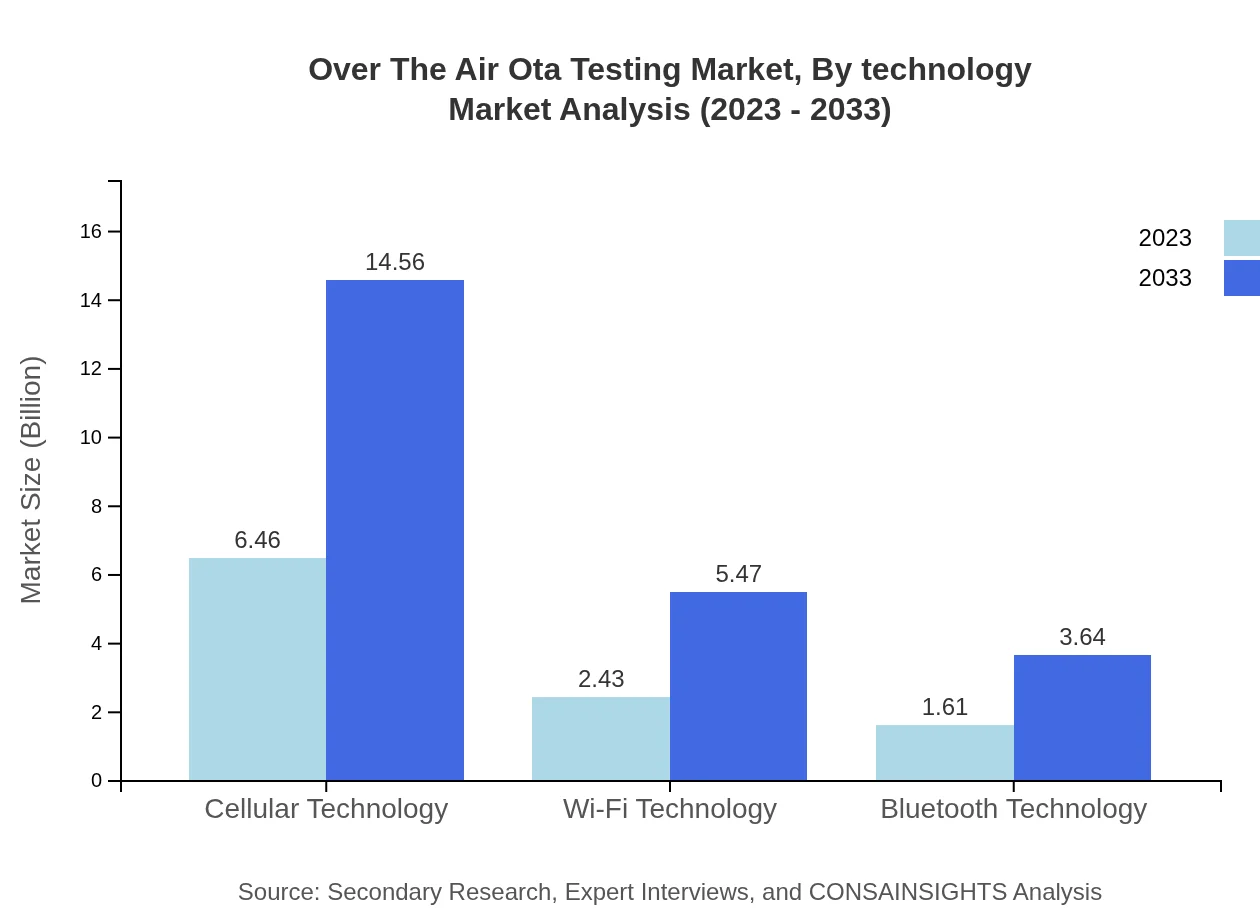

Over The Air Ota Testing Market Analysis By Technology

The OTA Testing market can be segmented into several technologies such as Cellular, Wi-Fi, and Bluetooth. Celluar technology stands out, projecting a size of USD 6.46 billion by 2033 with a market share of 61.51%. Wi-Fi technology is estimated to reach USD 2.43 billion, reflecting a share of 23.11%. Bluetooth technology is also expected to grow, with projections of USD 1.61 billion by 2033, representing 15.38% of the market.

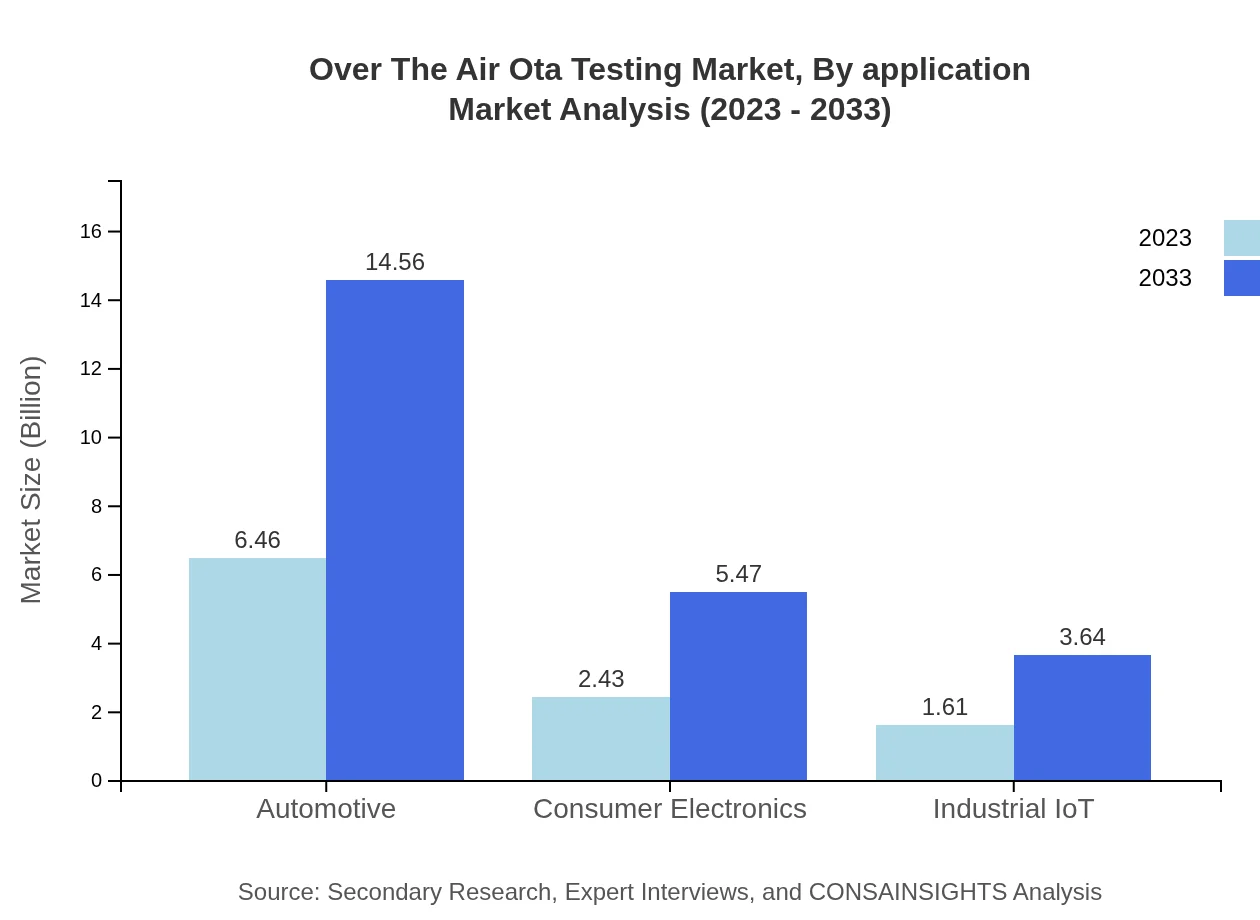

Over The Air Ota Testing Market Analysis By Application

Key applications dominating the OTA Testing market include telecommunications, automotive industries, and consumer electronics manufacturers. Telecommunications leads the market, accounting for USD 6.46 billion, while automotive and consumer electronics sectors follow suit with USD 2.43 billion and USD 1.61 billion respectively by 2033.

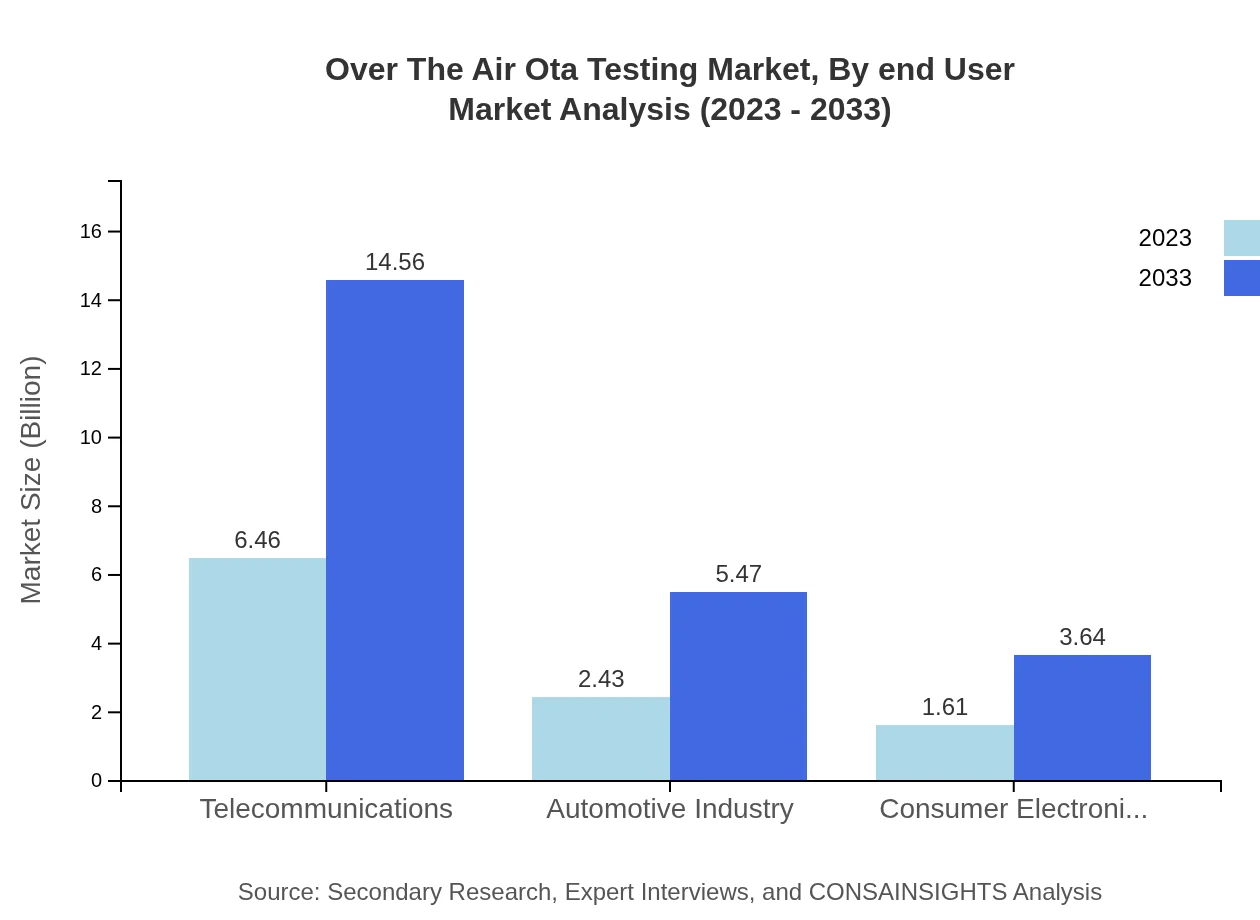

Over The Air Ota Testing Market Analysis By End User

The market is influenced heavily by end-users, predominantly in telecommunications and automotive sectors. Each industry holds significant market shares, with the telecommunications sector leading with 61.51%. Automotive and Consumer Electronics are significant, contributing approximately 23.11% and 15.38% respectively to the overall market in 2023.

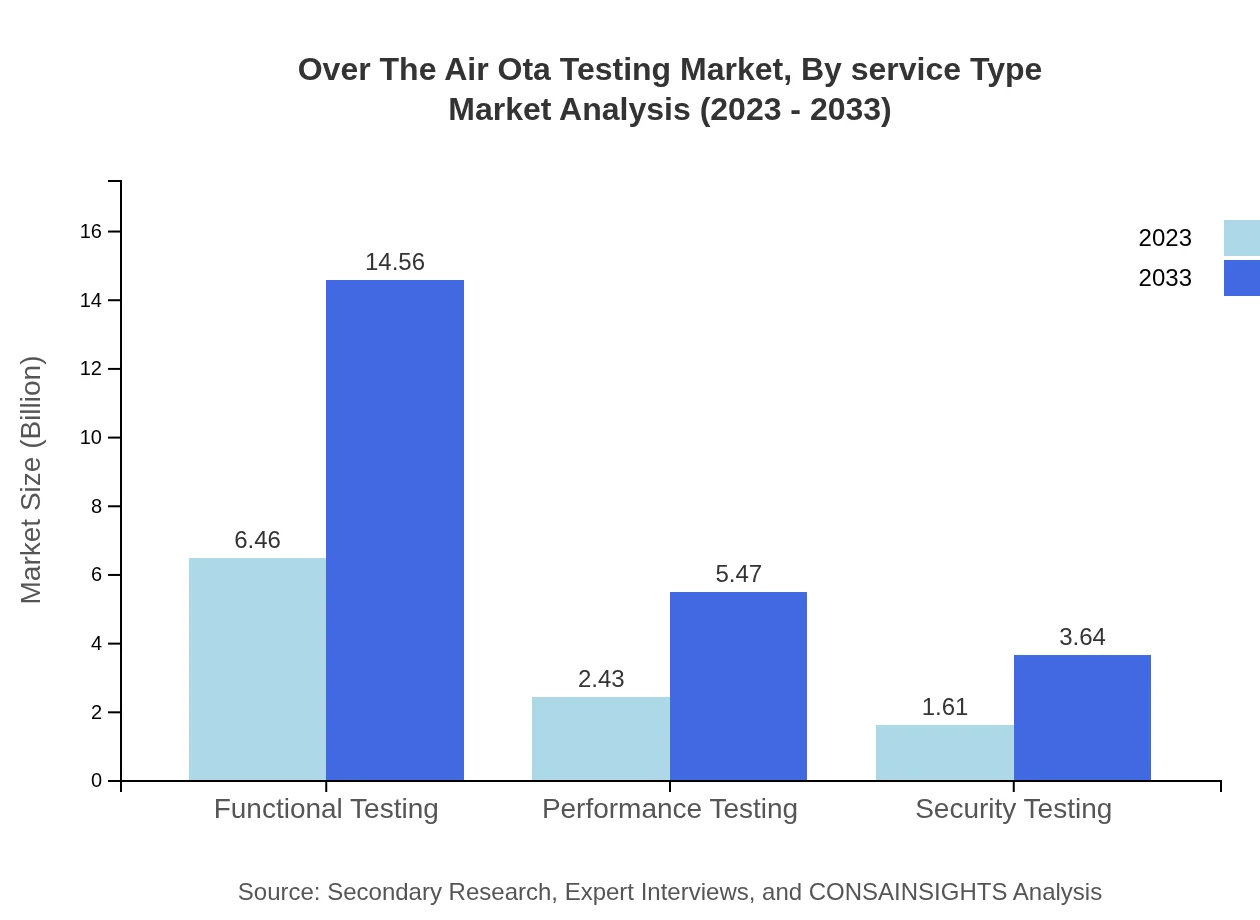

Over The Air Ota Testing Market Analysis By Service Type

Service types in the OTA Testing market encompass functional, performance, and security testing, with functional testing accounting for the largest segment at 61.51% of the market share. Performance and security testing contribute around 23.11% and 15.38% respectively, highlighting the diverse requirements across different testing needs.

Over The Air Ota Testing Market Analysis By Region

Regional analysis reveals unique characteristics in each area, with North America being the most prominent, representing approximately 61.51% of market share in 2023, while Europe and Asia Pacific contribute significantly as well. Each region shows potential for growth in the next decade, driven by technology adoption and the increasing need for OTA solutions.

Over The Air Ota Testing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Over The Air Ota Testing Industry

Qualcomm Technologies, Inc.:

A leading semiconductor company, Qualcomm specializes in wireless technology for mobile and IoT devices, playing a crucial role in OTA testing through innovative solutions that facilitate smooth software updates.Amdocs:

A prominent player in the telecommunications market, Amdocs provides specialized solutions for service providers, including comprehensive OTA testing services that enhance operational efficiencies and customer service.Ericsson :

An established leader in telecommunications technology, Ericsson offers OTA testing services that ensure robust and secure software updates across networks, further enhancing communication efficiency.Keysight Technologies:

Keysight Technologies is known for its expertise in electronic design automation solutions and testing technologies, providing crucial OTA testing solutions that optimize product performance across all sectors.Spirent Communications:

Spirent offers renowned solutions for testing and assurance in communication networks, providing essential OTA testing tools that equip clients to manage and streamline software updates efficiently.We're grateful to work with incredible clients.

FAQs

What is the market size of over The Air Ota Testing?

The global over-the-air (OTA) testing market is valued at approximately $10.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 8.2%. This growth reflects increasing demand for remote software updates and testing solutions in various industries.

What are the key market players or companies in the over The Air Ota Testing industry?

Key players in the OTA testing market include major companies like Qualcomm, Harman, LG Electronics, and Tesla. These firms drive innovation and maintain competitive advantages through advanced technologies tailored for efficient OTA solutions in automotive and consumer electronics.

What are the primary factors driving the growth in the over The Air Ota Testing industry?

Growth in the OTA testing market is driven by the increasing need for seamless software updates and security features in connected devices, escalating demand for remote diagnostics, and a significant rise in the adoption of IoT technologies across various sectors.

Which region is the fastest Growing in the over The Air Ota Testing market?

The Asia Pacific region is expected to be the fastest-growing market for OTA testing, with its size projected to increase from $2.25 billion in 2023 to $5.08 billion by 2033, driven by rapid technological advancements and high mobile device penetration.

Does ConsaInsights provide customized market report data for the over The Air Ota Testing industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the OTA testing industry. Clients can request reports that focus on particular regions, company performances, or emerging technologies to gain a competitive edge.

What deliverables can I expect from this over The Air Ota Testing market research project?

Deliverables typically include comprehensive market analysis reports, detailed segmentation data, competitive landscape insights, and forecasts for growth. Clients also receive visual aids such as charts and graphs to support data interpretation and strategic planning.

What are the market trends of over The Air Ota Testing?

Trends in OTA testing include increased focus on security testing, growing investment in cloud-based solutions, and expansion in automotive applications. Innovations in AI and machine learning are also enhancing testing methodologies and accelerating deployment processes.