Overview Of Commercial Real Estate Market Report

Published Date: 22 January 2026 | Report Code: overview-of-commercial-real-estate

Overview Of Commercial Real Estate Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the commercial real estate market from 2023 to 2033, focusing on market trends, sizes, growth projections, and a detailed examination of regional and sectoral performance.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.20 Trillion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $1.94 Trillion |

| Top Companies | CBRE Group, Inc., JLL (Jones Lang LaSalle), Cushman & Wakefield, Colliers International |

| Last Modified Date | 22 January 2026 |

Overview Of Commercial Real Estate Market Overview

Customize Overview Of Commercial Real Estate Market Report market research report

- ✔ Get in-depth analysis of Overview Of Commercial Real Estate market size, growth, and forecasts.

- ✔ Understand Overview Of Commercial Real Estate's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Overview Of Commercial Real Estate

What is the Market Size & CAGR of Overview Of Commercial Real Estate market in 2023?

Overview Of Commercial Real Estate Industry Analysis

Overview Of Commercial Real Estate Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Overview Of Commercial Real Estate Market Analysis Report by Region

Europe Overview Of Commercial Real Estate Market Report:

Europe's commercial real estate landscape is poised for steady growth, with the market increasing from $320 billion in 2023 to $520 billion by 2033. Valued for its stability, the region sees considerable investments in office spaces, particularly in major cities like London and Berlin, as companies seek to adapt to hybrid working trends while prioritizing connectivity and sustainability.Asia Pacific Overview Of Commercial Real Estate Market Report:

The Asia-Pacific commercial real estate market is burgeoning, with growth from $230 billion in 2023 to an estimated $380 billion by 2033. Countries like China and India are seeing rapid urbanization and infrastructure development, which foster strong demand for both industrial and retail properties. Rising middle-class affluence drives retail space requirements, while logistics and warehousing gain traction from e-commerce.North America Overview Of Commercial Real Estate Market Report:

The North American commercial real estate market remains robust, expected to expand from $460 billion in 2023 to $750 billion by 2033. The U.S. and Canada are experiencing significant demand for multifamily housing and industrial properties, especially in logistics and fulfillment capacities. Sustainability trends and urban development plans are crucial aspects enhancing the market's growth trajectory.South America Overview Of Commercial Real Estate Market Report:

In South America, the commercial real estate market is expected to grow from $40 billion in 2023 to $60 billion by 2033. Brazil and Argentina are leading the growth due to improving economic conditions and foreign investments boosting infrastructure projects. Given the recent political stability, many investors are exploring the region for opportunities in retail and industrial spaces.Middle East & Africa Overview Of Commercial Real Estate Market Report:

In the Middle East and Africa, the commercial real estate market is anticipated to rise from $140 billion in 2023 to $230 billion by 2033. Fast-growing urban populations in countries such as the UAE and Nigeria are fueling investments, particularly in hospitality, retail, and logistics properties. Infrastructure developments and Expo 2020 in Dubai have sparked increased investor interest in the region.Tell us your focus area and get a customized research report.

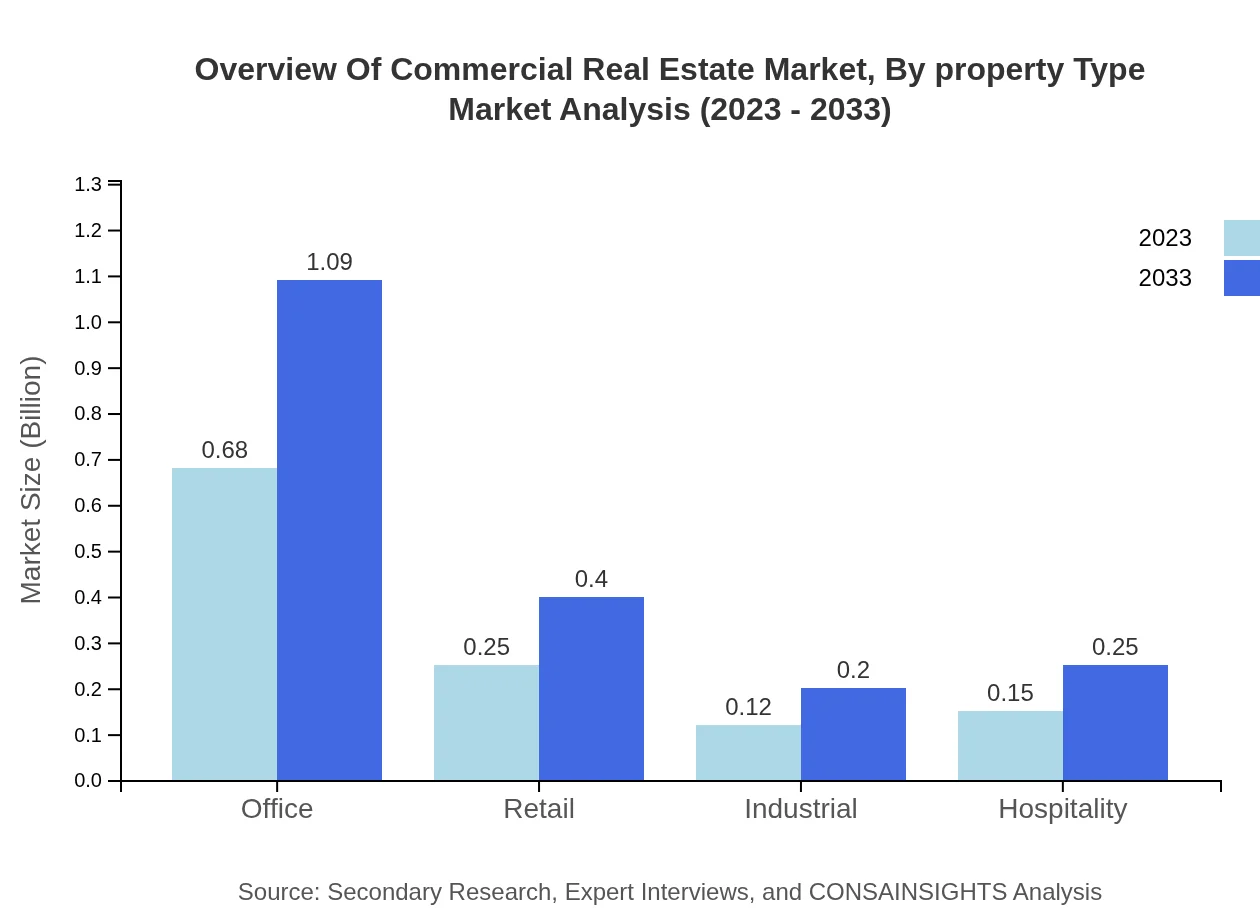

Overview Of Commercial Real Estate Market Analysis By Property Type

The commercial real estate market is divided into distinct property types, including Office, Retail, Industrial, and Hospitality. Office spaces represent a significant part, valued at $680 billion in 2023 and expected to reach $1.09 trillion by 2033. Retail remains critical with consistent demand, valued at $250 billion in 2023 forecasted to grow to $400 billion. The Industrial sector, valued at $120 billion in 2023, is projected to achieve $200 billion due to rising e-commerce logistics. Hospitality properties will also see growth from $150 billion to $250 billion as travel recovers post-pandemic.

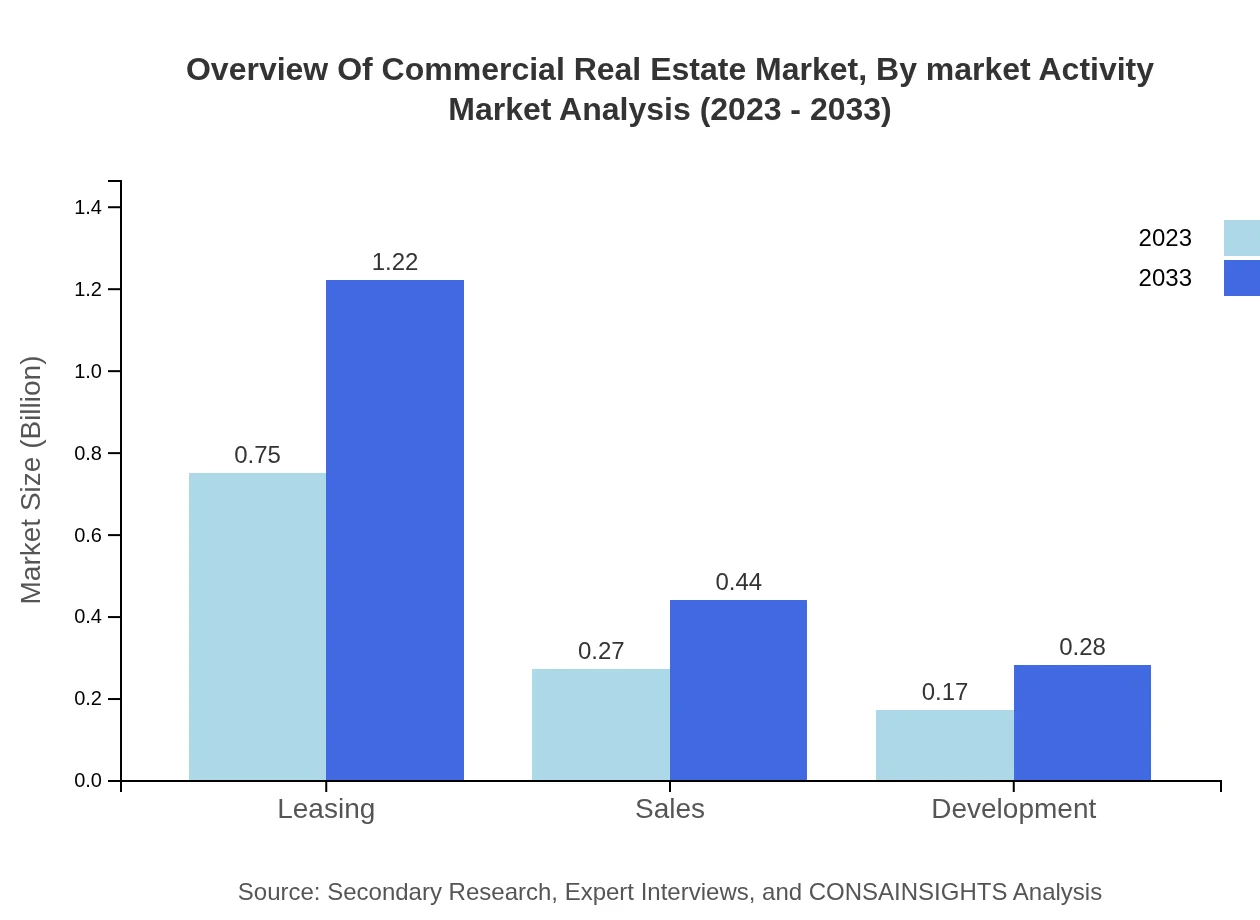

Overview Of Commercial Real Estate Market Analysis By Market Activity

By market activity, the leasing segment dominates, holding a market size of $750 billion in 2023 and estimated growth to $1.22 trillion by 2033, as businesses optimize space utilization. Sales activity, valued at $270 billion in 2023, is anticipated to grow to $440 billion fueled by increasing investor confidence. Development projects, including value-add and opportunistic acquisitions, remain key drivers in enhancing returns across different asset classes.

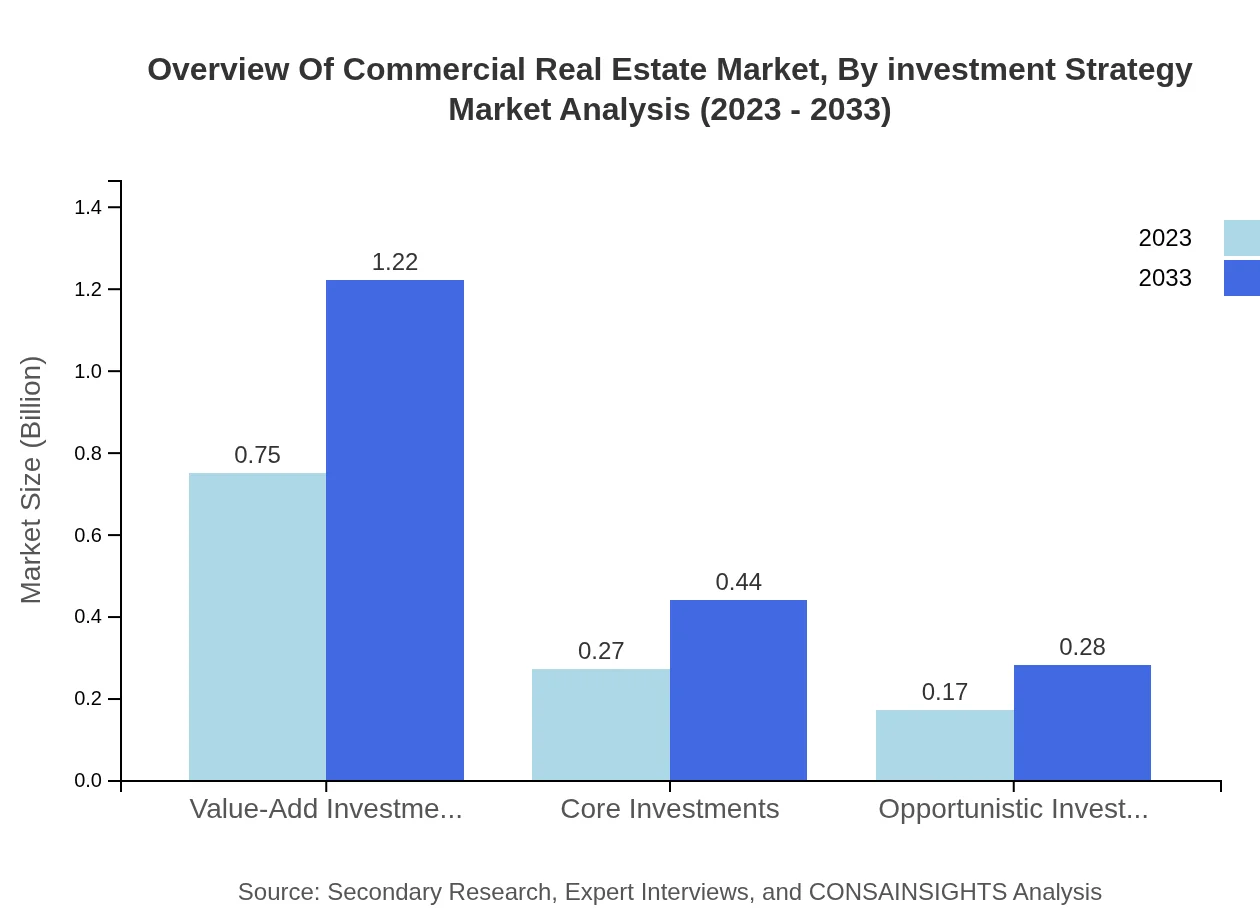

Overview Of Commercial Real Estate Market Analysis By Investment Strategy

Investment strategies like Value-Add Investments and Core Investments are pivotal in shaping market dynamics. Value-Add Investments are leading, valued at $750 billion in 2023, growing to $1.22 trillion by 2033 with strategic upgrades and repositioning. Core Investments capture a significant share, valued at $270 billion expected to reach $440 billion, focusing on stable, income-generating properties that promise lower risk profiles. Opportunistic Investments also rise from $170 billion to $280 billion as investors seek lucrative returns through riskier, high-yield properties.

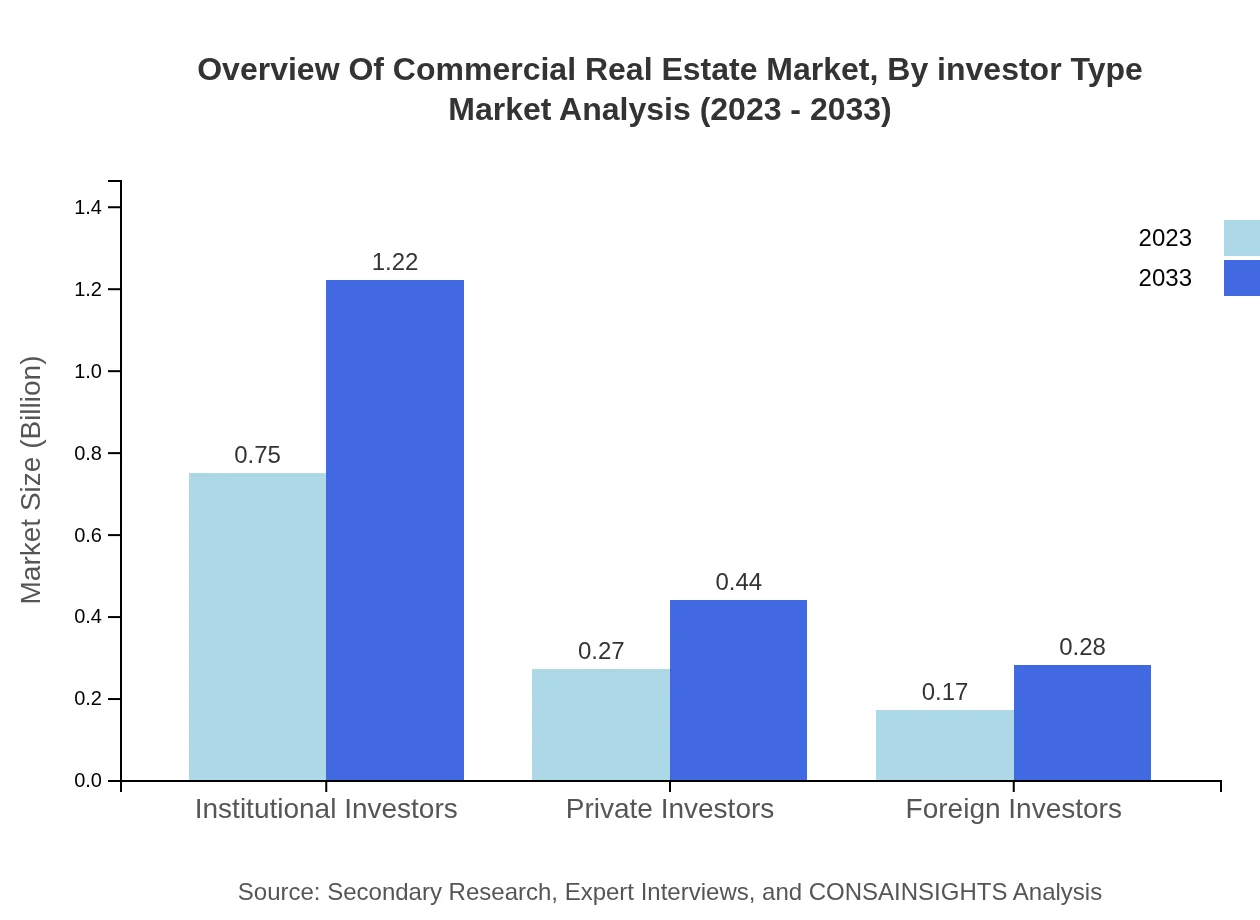

Overview Of Commercial Real Estate Market Analysis By Investor Type

Investor types include Institutional, Private, and Foreign Investors. Institutional Investors dominate with a market size of $750 billion in 2023, estimated to grow to $1.22 trillion, representing 62.88% of market share. Private Investors capture approximately 22.8%, growing from $270 billion to $440 billion by 2033. Foreign Investors contribute around 14.32%, expanding from $170 billion to $280 billion as international markets become more accessible.

Overview Of Commercial Real Estate Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Overview Of Commercial Real Estate Industry

CBRE Group, Inc.:

As one of the world's largest commercial real estate services firms, CBRE provides advisory and management services, along with an extensive range of solutions to real estate investors and occupiers.JLL (Jones Lang LaSalle):

With a global presence, JLL specializes in investment management and commercial real estate services, focusing on sustainable property practices and helping clients maximize returns.Cushman & Wakefield:

Cushman & Wakefield is a global leader in commercial real estate services that partners with clients to deliver exceptional market knowledge and unique solutions tailored to their needs.Colliers International:

Colliers provides expert real estate management, investment services, and property services, recognized for its strong focus on customer service and effective advisory solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of overview Of Commercial Real Estate?

The commercial real estate market is valued at approximately $1.2 trillion in 2023, with an expected CAGR of 4.8% from 2023 to 2033. This steady growth indicates a robust demand for commercial properties across various segments.

What are the key market players or companies in this overview Of Commercial Real Estate industry?

Key players in the commercial real estate industry include major firms such as CBRE, JLL, Cushman & Wakefield, and Colliers International. These companies dominate through extensive portfolios, technology integration, and comprehensive service offerings across various property types.

What are the primary factors driving the growth in the overview Of Commercial Real Estate industry?

Growth in the commercial real estate market is driven by factors like urbanization, the rise in e-commerce, low interest rates, and technological advancements in property management. The increasing demand for logistics and retail spaces further catalyzes market expansion.

Which region is the fastest Growing in the overview Of Commercial Real Estate?

North America is projected to be the fastest-growing region, with market size increasing from $0.46 trillion in 2023 to $0.75 trillion by 2033. Growth in other regions like Europe and Asia-Pacific also contributes significantly to the global landscape.

Does ConsaInsights provide customized market report data for the overview Of Commercial Real Estate industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the commercial real estate industry. This allows for comprehensive insights that address unique business challenges and opportunities.

What deliverables can I expect from this overview Of Commercial Real Estate market research project?

Deliverables include market analysis reports, segmentation data, trend forecasts, competitive landscape assessments, and actionable insights designed to facilitate informed decision-making for stakeholders in the commercial real estate sector.

What are the market trends of overview Of Commercial Real Estate?

Current trends in commercial real estate include a shift towards sustainability, increased investment in logistics and e-commerce spaces, and a rise in remote work driving demand for flexible office arrangements. Adapting to these changes is critical for future growth.