Packaged Food Market Report

Published Date: 31 January 2026 | Report Code: packaged-food

Packaged Food Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the Packaged Food market, offering insights on trends, market size, growth forecasts, and competitive landscape from 2023 to 2033.

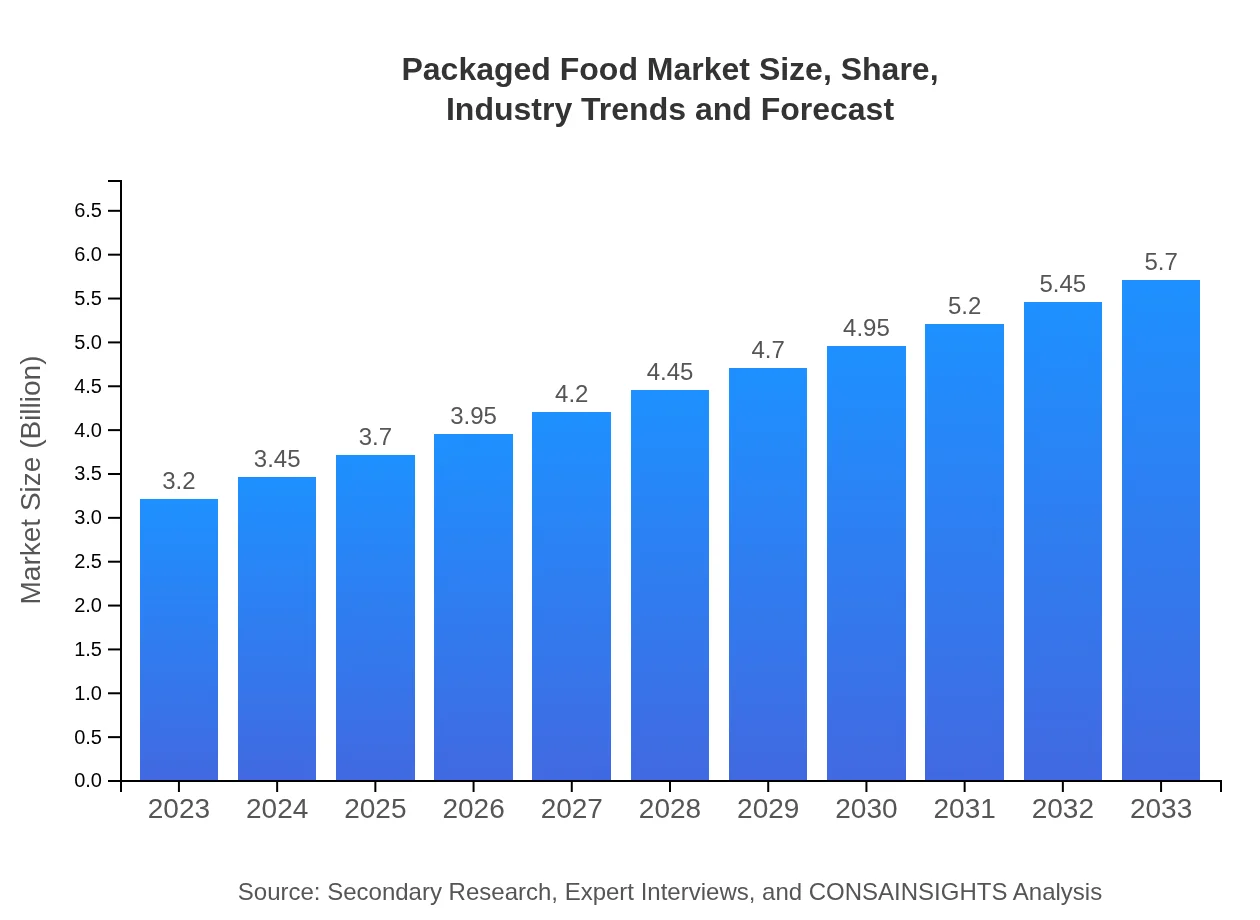

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.20 Trillion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $5.70 Trillion |

| Top Companies | Nestlé S.A., PepsiCo, Inc., Kraft Heinz Company, General Mills, Inc., Coca-Cola Company |

| Last Modified Date | 31 January 2026 |

Packaged Food Market Overview

Customize Packaged Food Market Report market research report

- ✔ Get in-depth analysis of Packaged Food market size, growth, and forecasts.

- ✔ Understand Packaged Food's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Packaged Food

What is the Market Size & CAGR of Packaged Food market in 2023?

Packaged Food Industry Analysis

Packaged Food Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Packaged Food Market Analysis Report by Region

Europe Packaged Food Market Report:

The European market is set to increase from $1.11 trillion in 2023 to $1.98 trillion by 2033. European consumers are increasingly seeking organic and natural packaged food products, responding to lifestyle changes that emphasize health and sustainability.Asia Pacific Packaged Food Market Report:

In the Asia Pacific region, the Packaged Food market is projected to grow from $0.60 trillion in 2023 to $1.07 trillion by 2033, owing to increasing urbanization and consumer spending on processed foods. Growing populations and rising health consciousness are driving demand for packaged goods across countries like China and India.North America Packaged Food Market Report:

For North America, the market value is anticipated to rise from $1.12 trillion in 2023 to $1.99 trillion by 2033. This growth is propelled by a strong trend towards convenience foods, higher consumer health awareness, and robust e-commerce platforms facilitating online shopping.South America Packaged Food Market Report:

In South America, the market is expected to expand from $0.29 trillion in 2023 to $0.51 trillion in 2033. Increased adoption of packaged food products is influenced by urban migration and changes in dietary habits, with Brazilian and Argentine consumers leading the trend.Middle East & Africa Packaged Food Market Report:

The Middle East and Africa region will see an increase from $0.08 trillion in 2023 to $0.15 trillion in 2033. Economic development is fostering a growing middle class, which is driving demand for packaged food products that blend local flavors with global trends.Tell us your focus area and get a customized research report.

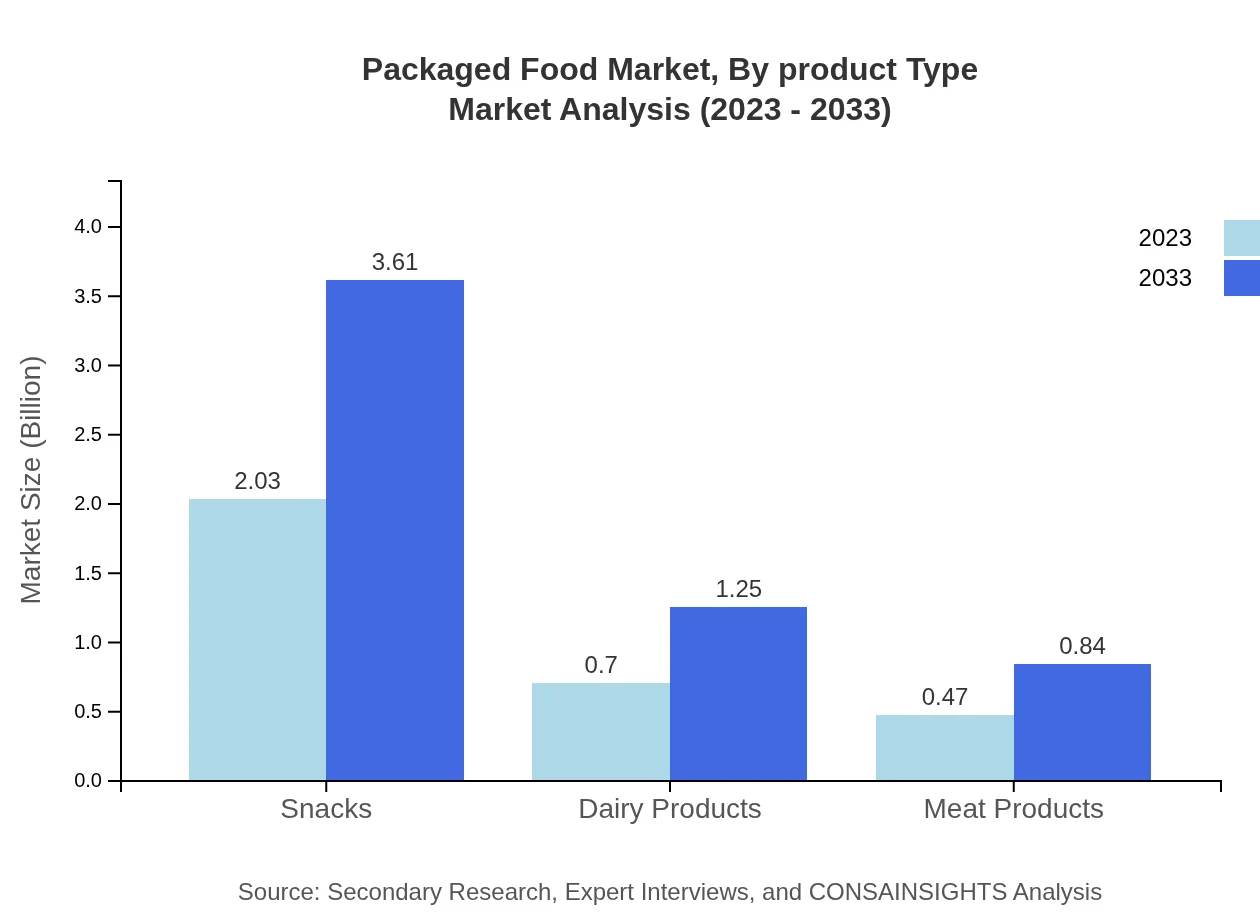

Packaged Food Market Analysis By Product Type

Snacks dominate the Packaged Food market, showing an expected growth from $2.03 trillion in 2023 to $3.61 trillion in 2033. Dairy products, valued at $0.70 trillion in 2023, are projected to increase to $1.25 trillion by 2033. Meanwhile, meat products hold a significant stand with an anticipated growth from $0.47 trillion to $0.84 trillion within the same period.

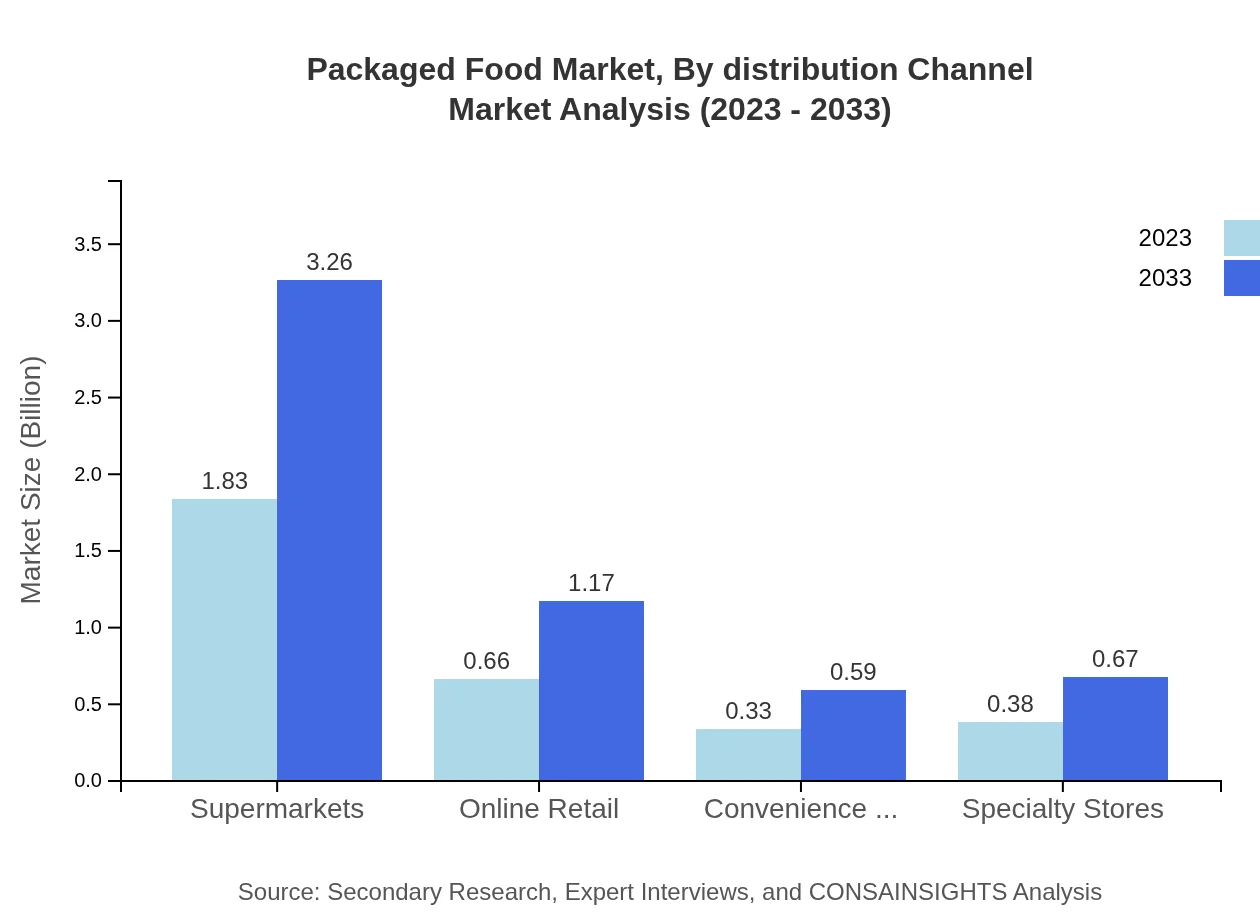

Packaged Food Market Analysis By Distribution Channel

Supermarkets remain the largest channel for Packaged Food sales in 2023 at $1.83 trillion, with projections rising to $3.26 trillion by 2033. Online retailing is also seeing growth, forecasted from $0.66 trillion to $1.17 trillion, reflecting the shift in consumer purchasing habits.

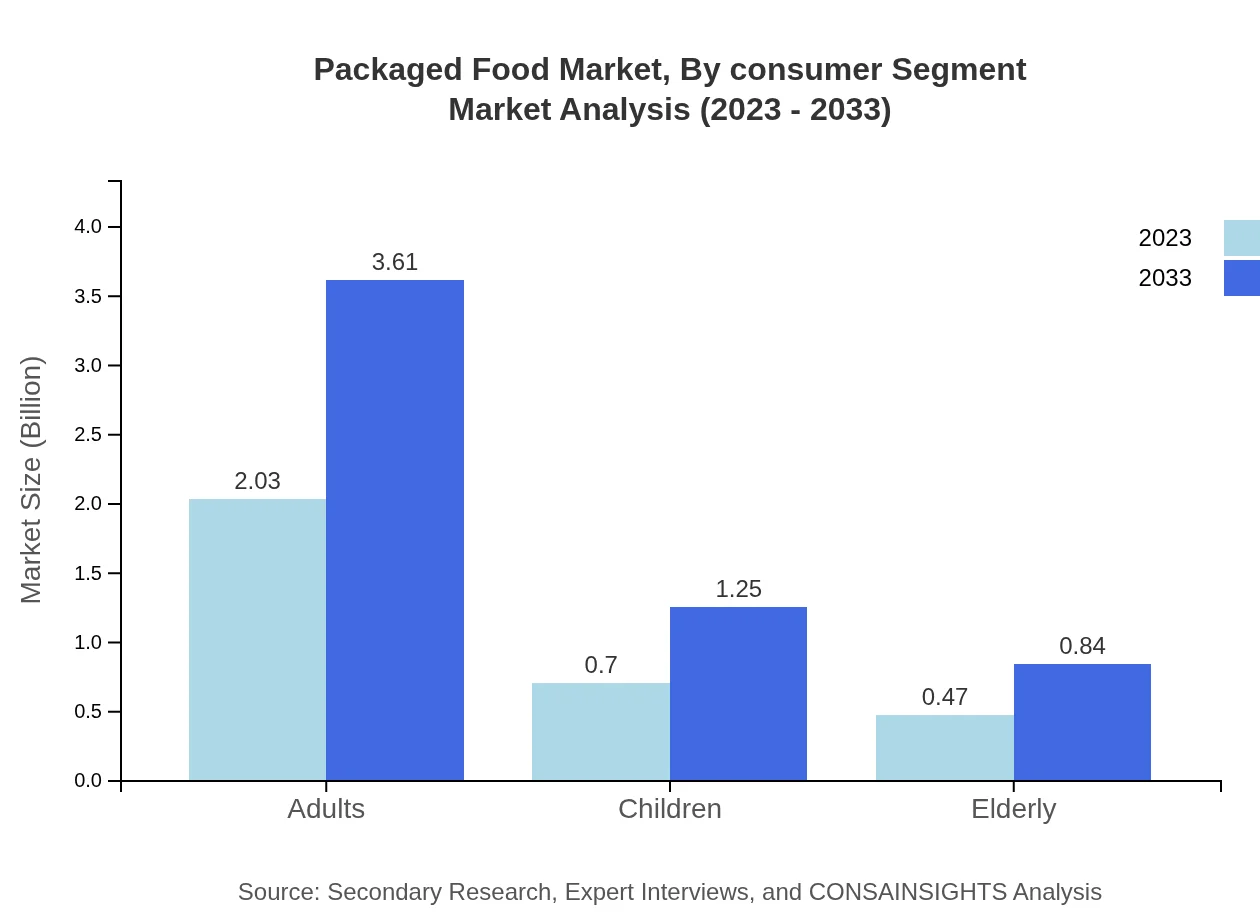

Packaged Food Market Analysis By Consumer Segment

Adults represent the largest consumer segment in the Packaged Food market, expected to grow from $2.03 trillion to $3.61 trillion over the next decade. Children’s segment, while smaller, also shows potential growth from $0.70 trillion to $1.25 trillion, driven by increasing demand for health-oriented snacks.

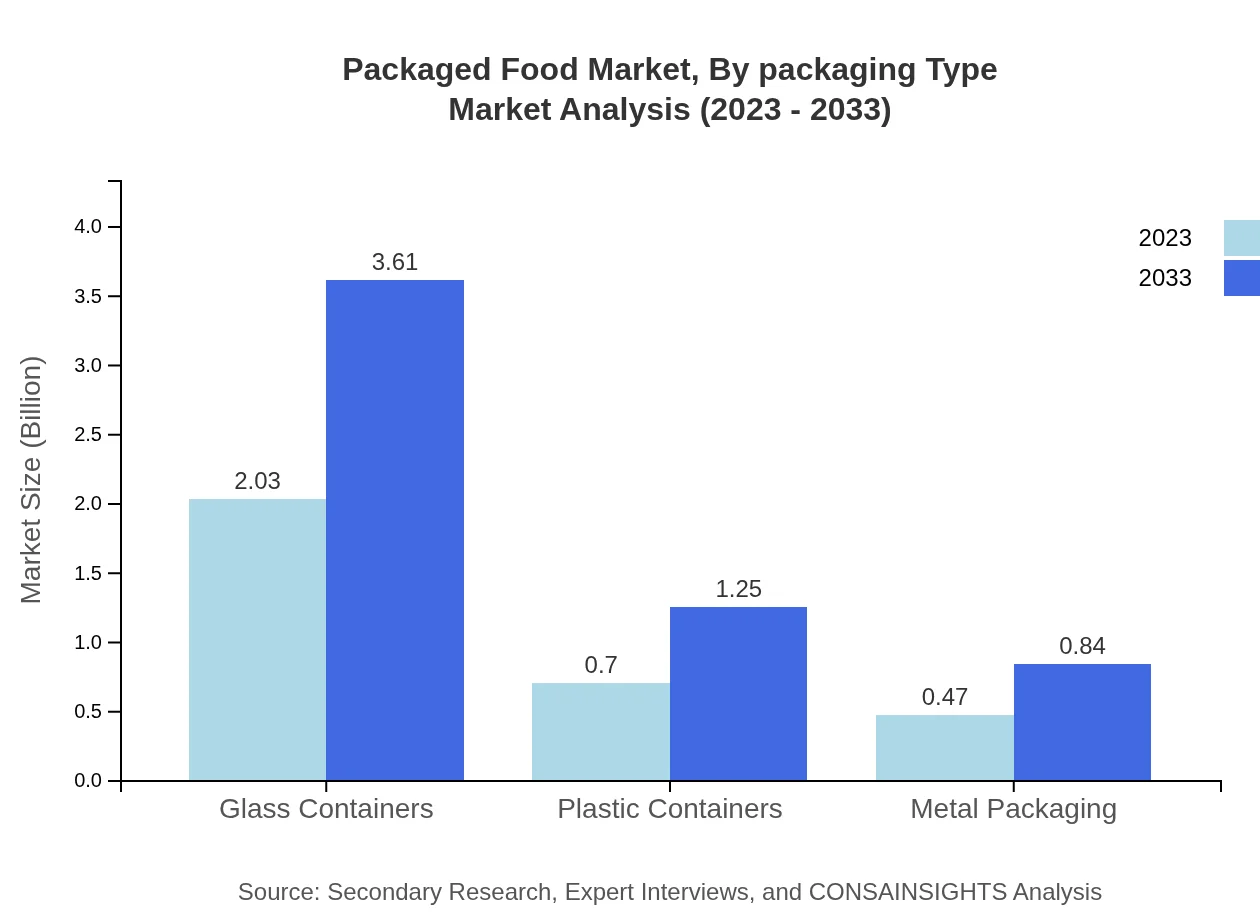

Packaged Food Market Analysis By Packaging Type

Glass containers currently dominate with market value at $2.03 trillion in 2023, expected to scale to $3.61 trillion by 2033. However, plastic packaging is also significant, with a market size from $0.70 trillion to $1.25 trillion over the same period, indicating strong consumer preferences and industry adaptation.

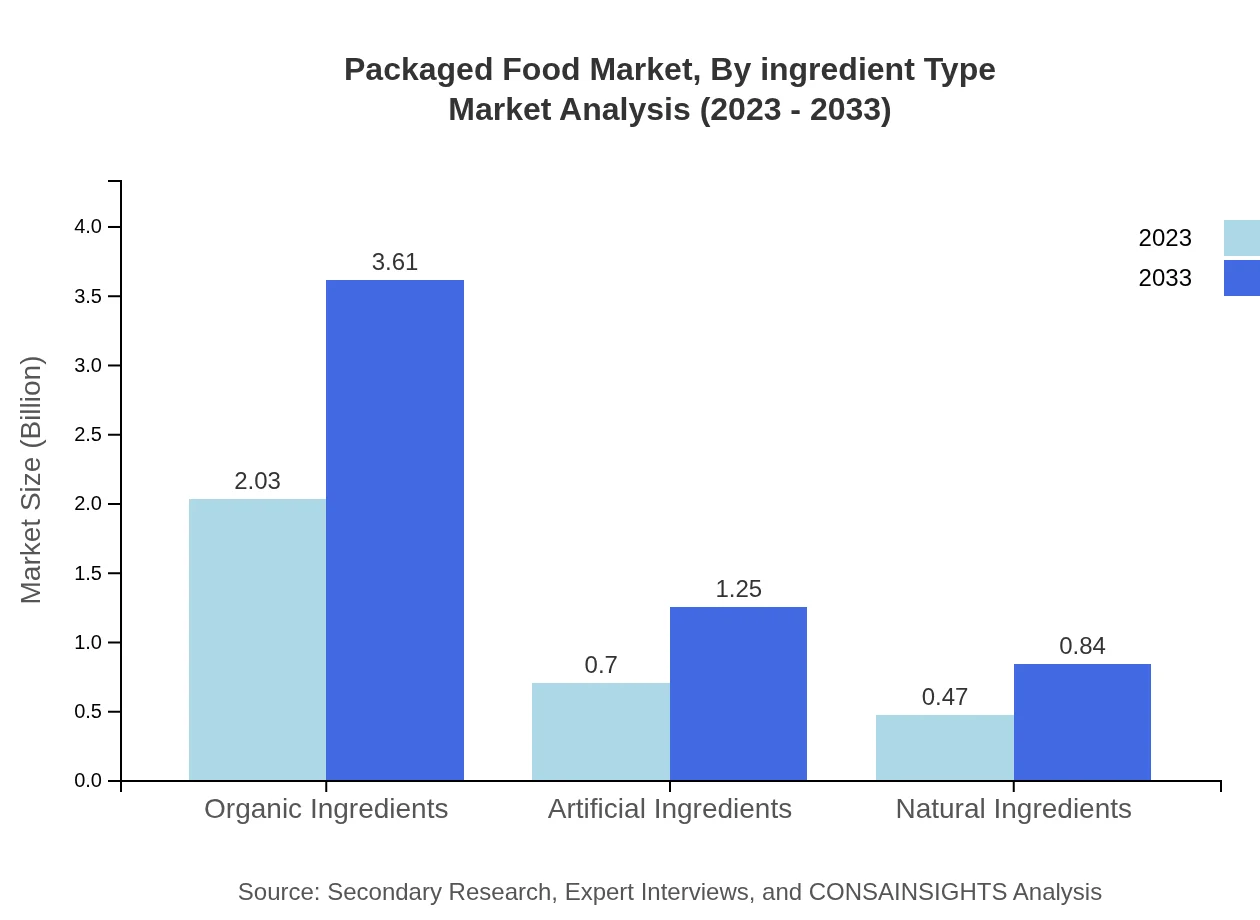

Packaged Food Market Analysis By Ingredient Type

The market for organic ingredients is set to grow from $2.03 trillion in 2023 to $3.61 trillion by 2033, indicating the increasing consumer demand for clean and natural products. In contrast, artificial ingredients, while less popular, continue to maintain a segment with growth from $0.70 trillion to $1.25 trillion.

Packaged Food Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Packaged Food Industry

Nestlé S.A.:

A global leader in packaged food and beverages, known for its diverse product range from infant foods to nutritional supplements.PepsiCo, Inc.:

Recognized for its wide array of snack foods and beverages, PepsiCo continues to innovate with healthier offerings.Kraft Heinz Company:

A major player in the food industry, Kraft Heinz specializes in packaged foods, including condiments, meals, and snacks.General Mills, Inc.:

Known for its cereals and snacks, General Mills embraces health and wellness trends in its product lines.Coca-Cola Company:

Beyond beverages, Coca-Cola is expanding its footprint in the packaged food sector, focusing on its snack brands.We're grateful to work with incredible clients.

FAQs

What is the market size of packaged Food?

The packaged food market is currently valued at approximately $3.2 trillion, with a compound annual growth rate (CAGR) of 5.8% expected through 2033, indicating a robust growth trend in demand and consumption.

What are the key market players or companies in this packaged Food industry?

Key players in the packaged food industry include major corporations like Nestlé, PepsiCo, and Kraft Heinz, each contributing significantly to market share through innovation, marketing strategies, and efficiency in supply chain management.

What are the primary factors driving the growth in the packaged Food industry?

Reasons boosting growth in the packaged food industry include increasing consumer demand for convenience, rising population figures, a growing preference for ready-to-eat meals, and expanding retail distribution channels worldwide.

Which region is the fastest Growing in the packaged Food?

Among the various regions, Asia Pacific is the fastest-growing area for the packaged food market, with projected growth from $600 billion in 2023 to $1.07 trillion by 2033, showcasing remarkable expansion in consumer spending.

Does ConsaInsights provide customized market report data for the packaged Food industry?

Yes, ConsaInsights offers customizable market report data tailored specifically to the needs of clients in the packaged food sector, ensuring that businesses can access relevant and precise insights.

What deliverables can I expect from this packaged Food market research project?

Deliverables from the packaged-food market research project will include detailed reports on market size, regional analysis, trends, competitive landscape, consumer insights, and segmented growth forecasts.

What are the market trends of packaged Food?

Current market trends in packaged food include a rising emphasis on health-conscious options, increasing demand for organic and natural ingredients, growing online retail sales, and sustainability in packaging choices.