Packaging Adhesives Market Report

Published Date: 22 January 2026 | Report Code: packaging-adhesives

Packaging Adhesives Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Packaging Adhesives market, including market size, growth rates, segmentation, regional insights, and industry trends from 2023 to 2033.

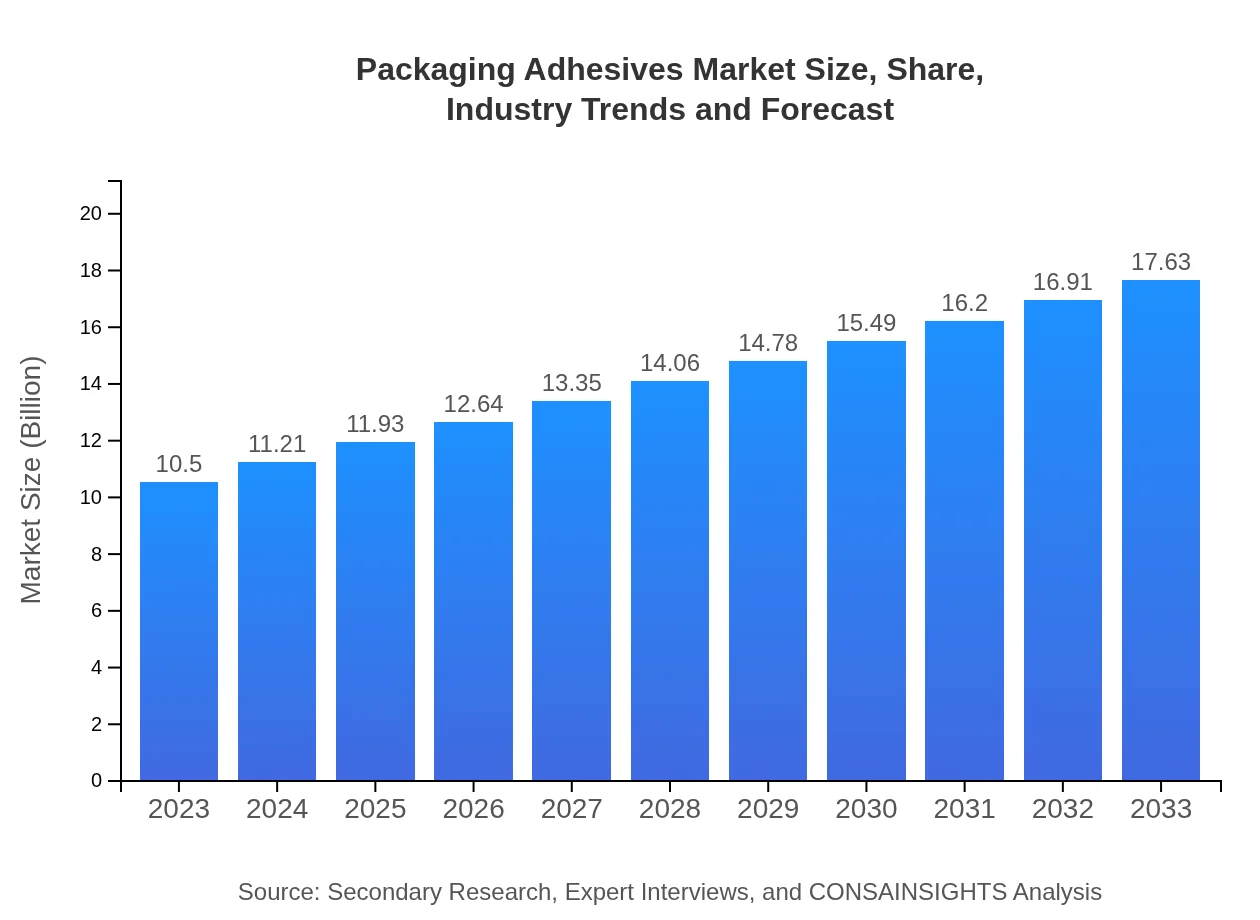

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $17.63 Billion |

| Top Companies | Henkel AG & Co., 3M Company, Dow Inc., BASF SE, Sika AG |

| Last Modified Date | 22 January 2026 |

Packaging Adhesives Market Overview

Customize Packaging Adhesives Market Report market research report

- ✔ Get in-depth analysis of Packaging Adhesives market size, growth, and forecasts.

- ✔ Understand Packaging Adhesives's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Packaging Adhesives

What is the Market Size & CAGR of Packaging Adhesives market in 2023?

Packaging Adhesives Industry Analysis

Packaging Adhesives Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Packaging Adhesives Market Analysis Report by Region

Europe Packaging Adhesives Market Report:

In Europe, the market is expected to rise from $3.50 billion in 2023 to $5.88 billion by 2033, driven by stringent regulations on packaging waste and a growing emphasis on sustainability. Countries with strong manufacturing backgrounds, such as Germany and France, are leading developers of sustainable adhesive solutions that comply with EU regulations.Asia Pacific Packaging Adhesives Market Report:

The Asia Pacific region is expected to lead the Packaging Adhesives market, with a market size predicted to grow from $1.99 billion in 2023 to $3.33 billion by 2033. The rapid industrialization and growing middle-class population in countries like India and China are driving demand. Additionally, the region’s focus on sustainable packaging aligns with global trends, encouraging growth in environmentally friendly adhesive solutions.North America Packaging Adhesives Market Report:

North America’s Packaging Adhesives market is projected to grow from $3.52 billion in 2023 to $5.92 billion in 2033. The region is characterized by a robust regulatory framework that compels manufacturers to innovate towards eco-friendly solutions. Additionally, technological advancements in adhesive formulations and a strong emphasis on food safety are expected to bolster market growth.South America Packaging Adhesives Market Report:

South America, with a projected market increase from $0.91 billion in 2023 to $1.53 billion in 2033, is witnessing rising demands in the food and beverage sector. However, growth is somewhat tempered by economic volatility in certain nations. Increased investment in manufacturing and logistics capabilities are likely to aid in expanding the market further.Middle East & Africa Packaging Adhesives Market Report:

The Middle East and Africa market will see growth from $0.57 billion in 2023 to $0.96 billion by 2033. Despite its smaller size, it presents unique opportunities through the rapid development of retail and food processing sectors. Increased investment in infrastructure and production capabilities will enhance market prospects.Tell us your focus area and get a customized research report.

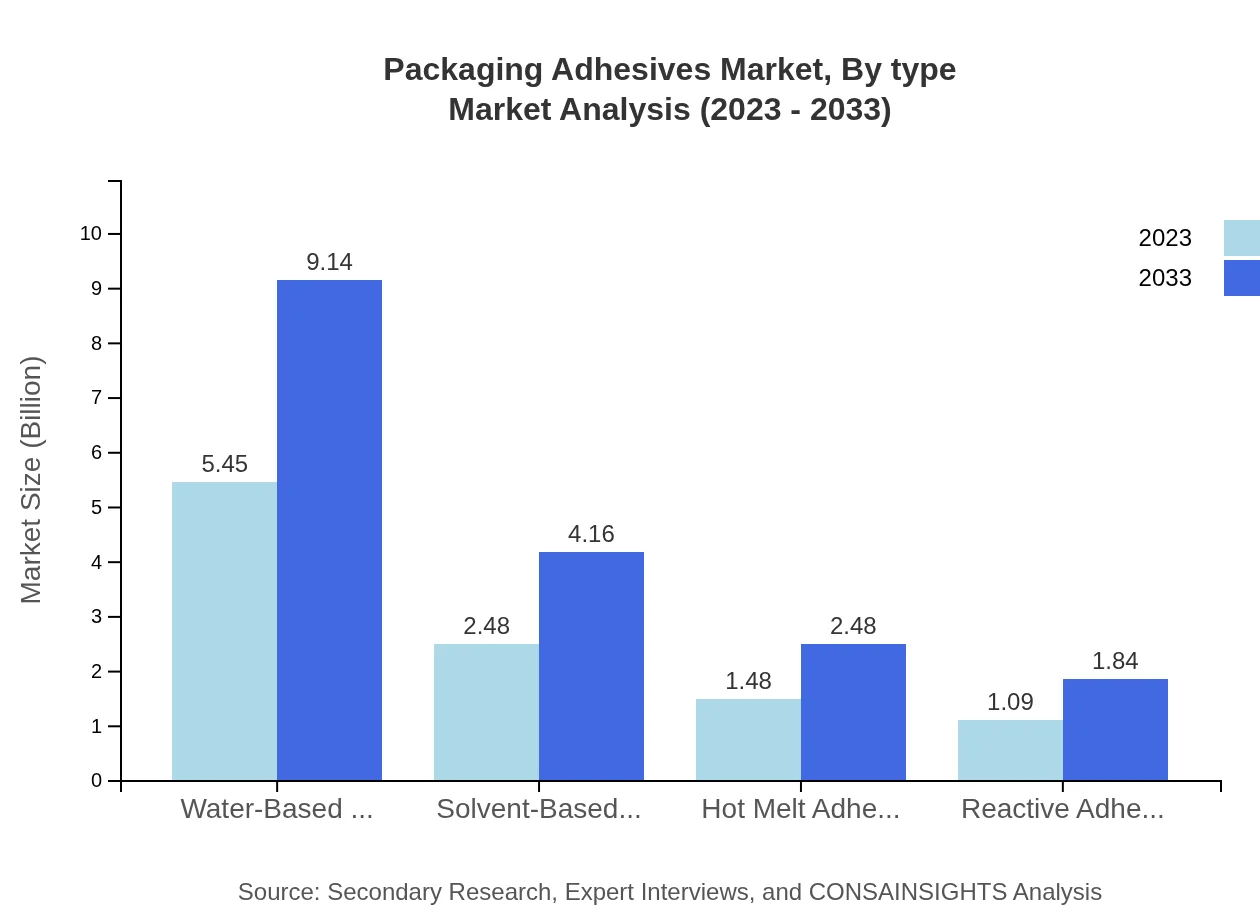

Packaging Adhesives Market Analysis By Type

Water-Based Adhesives are projected to reach $9.14 billion by 2033, maintaining a 51.87% market share, due to their eco-friendly attributes. Solvent-Based Adhesives will grow to $4.16 billion with a share of 23.63%. Hot Melt Adhesives are expected to rise to $2.48 billion while retaining a 14.08% market share. Reactive Adhesives will witness growth to $1.84 billion, encompassing a 10.42% share.

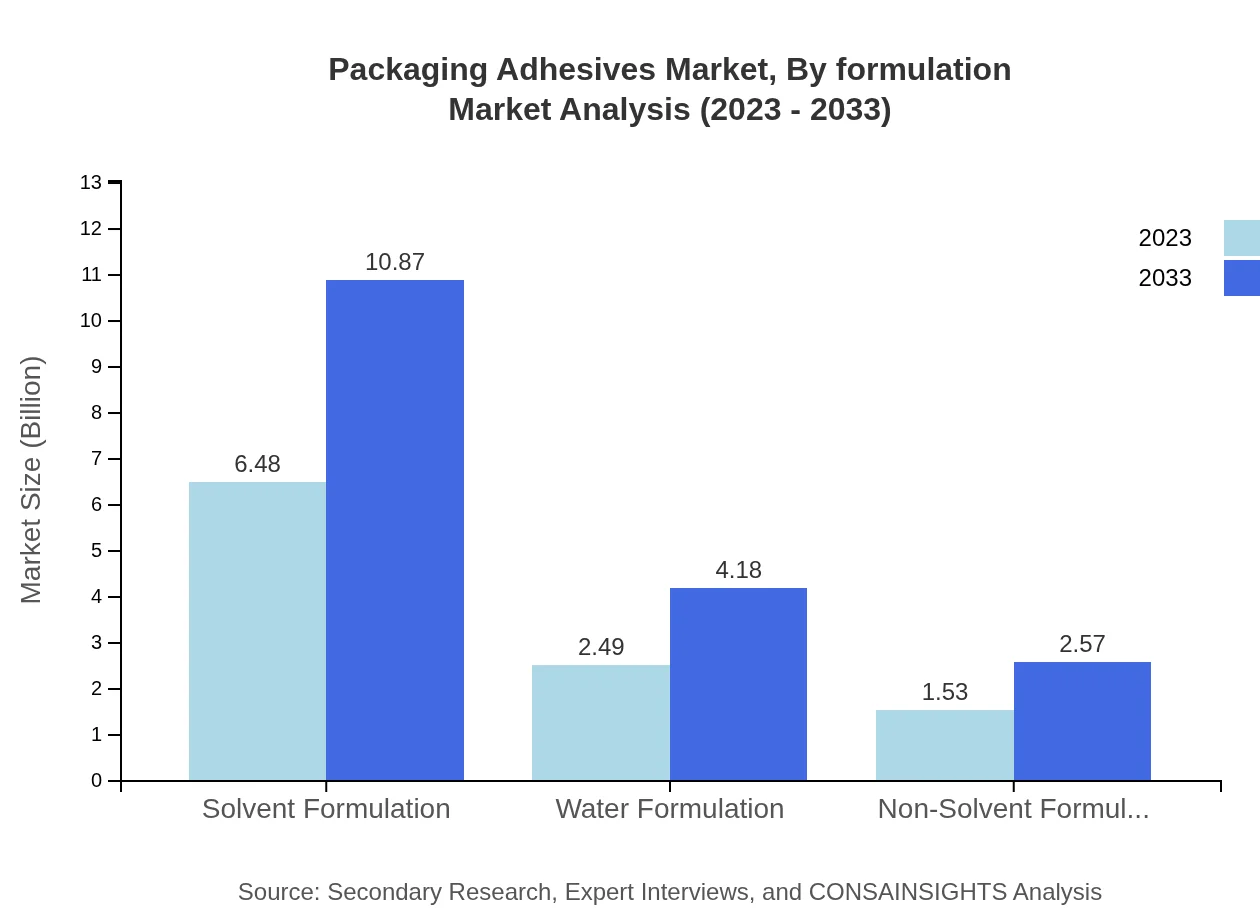

Packaging Adhesives Market Analysis By Formulation

In terms of formulation, Solvent Formulation dominates the market at $10.87 billion by 2033, representing 61.69% market share. Water Formulation is expected to grow to $4.18 billion while maintaining a 23.73% share; Non-Solvent Formulation will reach $2.57 billion with 14.58% share.

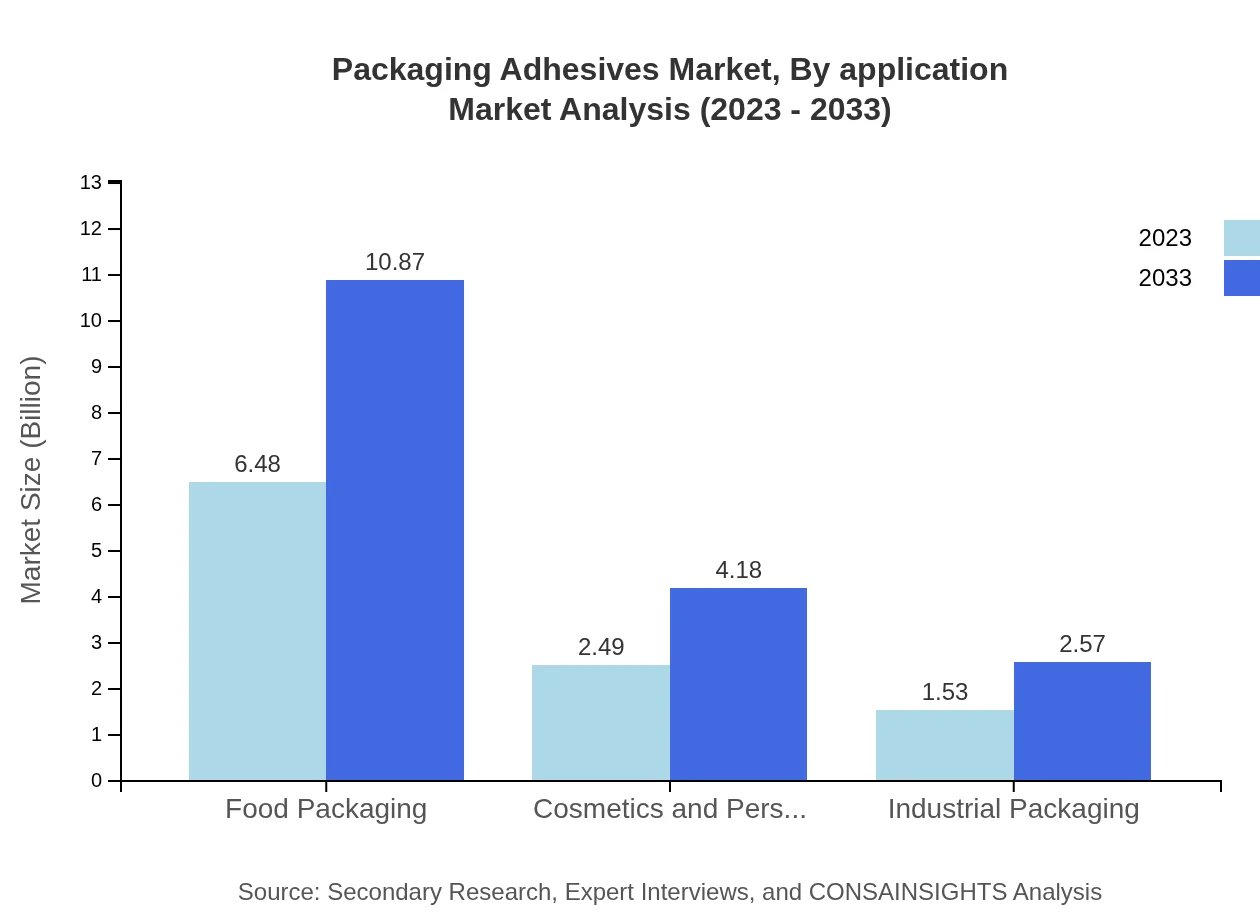

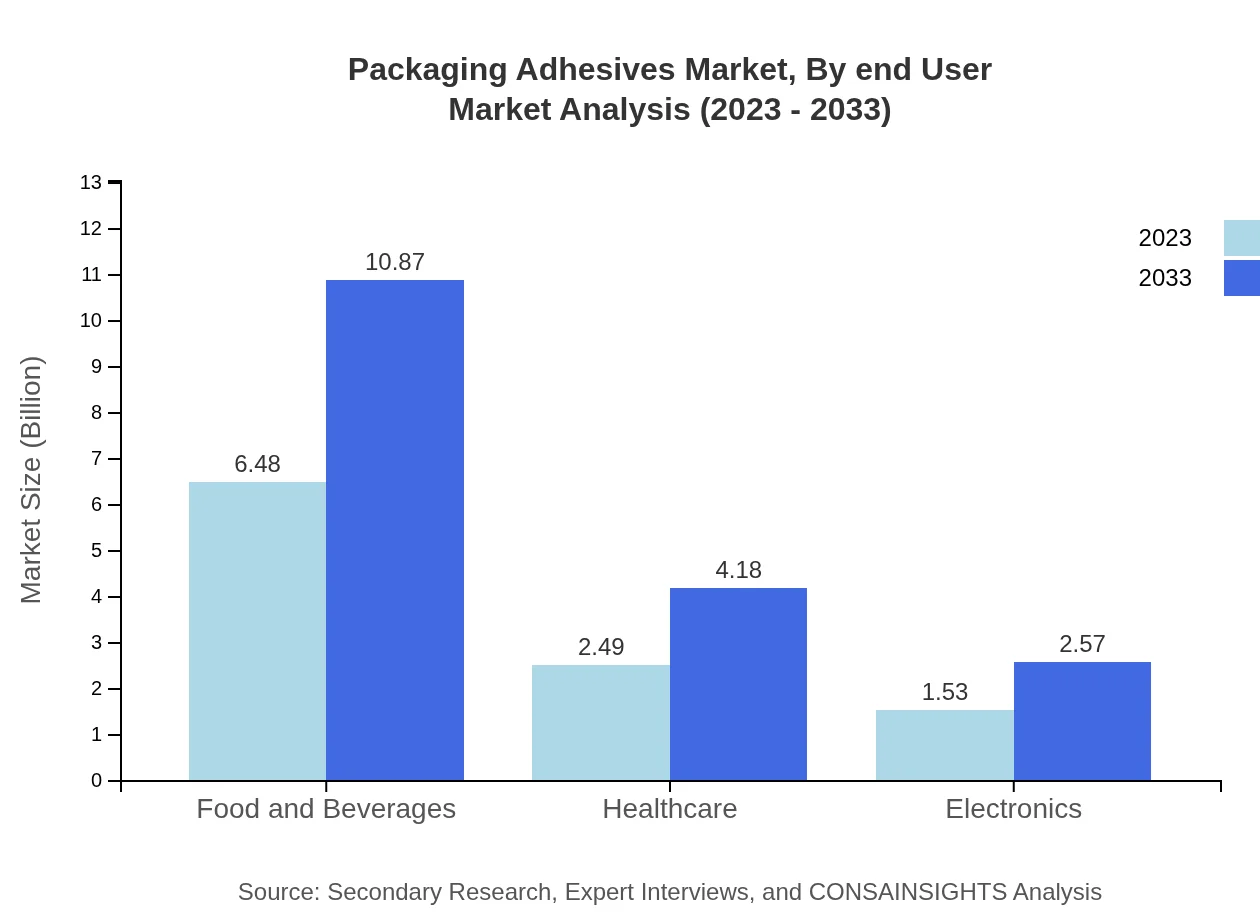

Packaging Adhesives Market Analysis By Application

The Food and Beverages sector leads in market share, projected to grow to $10.87 billion by 2033, holding 61.69%. Healthcare follows, targeted to reach $4.18 billion with a 23.73% share, while Electronics and other applications evolve but maintain a smaller market presence due to demand specificity.

Packaging Adhesives Market Analysis By End User

Food Packaging will dominate the market with a size increase to $10.87 billion at a 61.69% share by 2033. Cosmetics and Personal Care will follow at $4.18 billion, while Industrial Packaging rises to $2.57 billion, making a notable yet comparatively smaller impact.

Packaging Adhesives Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Packaging Adhesives Industry

Henkel AG & Co.:

A leading global provider of adhesives, Henkel focuses on innovative packaging adhesive solutions, emphasizing sustainability and performance.3M Company:

Known for its technological advancements, 3M offers a diverse portfolio of adhesives that cater to various industries, ensuring application-specific effectiveness.Dow Inc.:

Dow produces a range of packaging adhesives focusing on polymer-based technologies, driving innovation conducive to environmental sensitivity.BASF SE:

As one of the largest chemical producers, BASF specializes in high-performance packaging adhesives across multiple applications, bolstering sustainability.Sika AG:

Sika excels in providing innovative bonding and sealing solutions, significantly contributing to the packaging adhesives landscape.We're grateful to work with incredible clients.

FAQs

What is the market size of packaging Adhesives?

The global packaging adhesives market is valued at approximately $10.5 billion in 2023 and is projected to grow at a CAGR of 5.2%, indicating a robust growth trajectory driven by increasing demand across various sectors.

What are the key market players or companies in the packaging Adhesives industry?

Key players in the packaging adhesives market include companies such as Henkel AG, 3M Company, Sika AG, and H.B. Fuller. Their innovations and market strategies significantly influence the industry landscape and competitive dynamics.

What are the primary factors driving the growth in the packaging Adhesives industry?

Growth drivers include rising demand from the food and beverage sector, increased consumer focus on sustainable packaging solutions, and technological advancements in adhesive formulations enhancing performance and environmental compliance.

Which region is the fastest Growing in the packaging Adhesives?

Asia Pacific is the fastest-growing region in the packaging adhesives market, projected to expand from $1.99 billion in 2023 to $3.33 billion by 2033, driven by economic growth and urbanization.

Does ConsaInsights provide customized market report data for the packaging Adhesives industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements and insights for the packaging adhesives industry, ensuring businesses receive relevant and actionable data.

What deliverables can I expect from this packaging Adhesives market research project?

Deliverables include comprehensive reports containing market size, growth projections, competitive landscape, segment analysis, and insights on emerging trends within the packaging adhesives industry.

What are the market trends of packaging Adhesives?

Trends include increasing adoption of eco-friendly adhesives, a shift towards high-performance formulations, and the integration of smart technology in packaging, enhancing functionality and user experience.