Packaging Automation Solutions Market Report

Published Date: 22 January 2026 | Report Code: packaging-automation-solutions

Packaging Automation Solutions Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Packaging Automation Solutions market, exploring market size, trends, regional insights, and growth forecasts from 2023 to 2033. It discusses the impact of technology and key players shaping the industry, aiding stakeholders in informed decision-making.

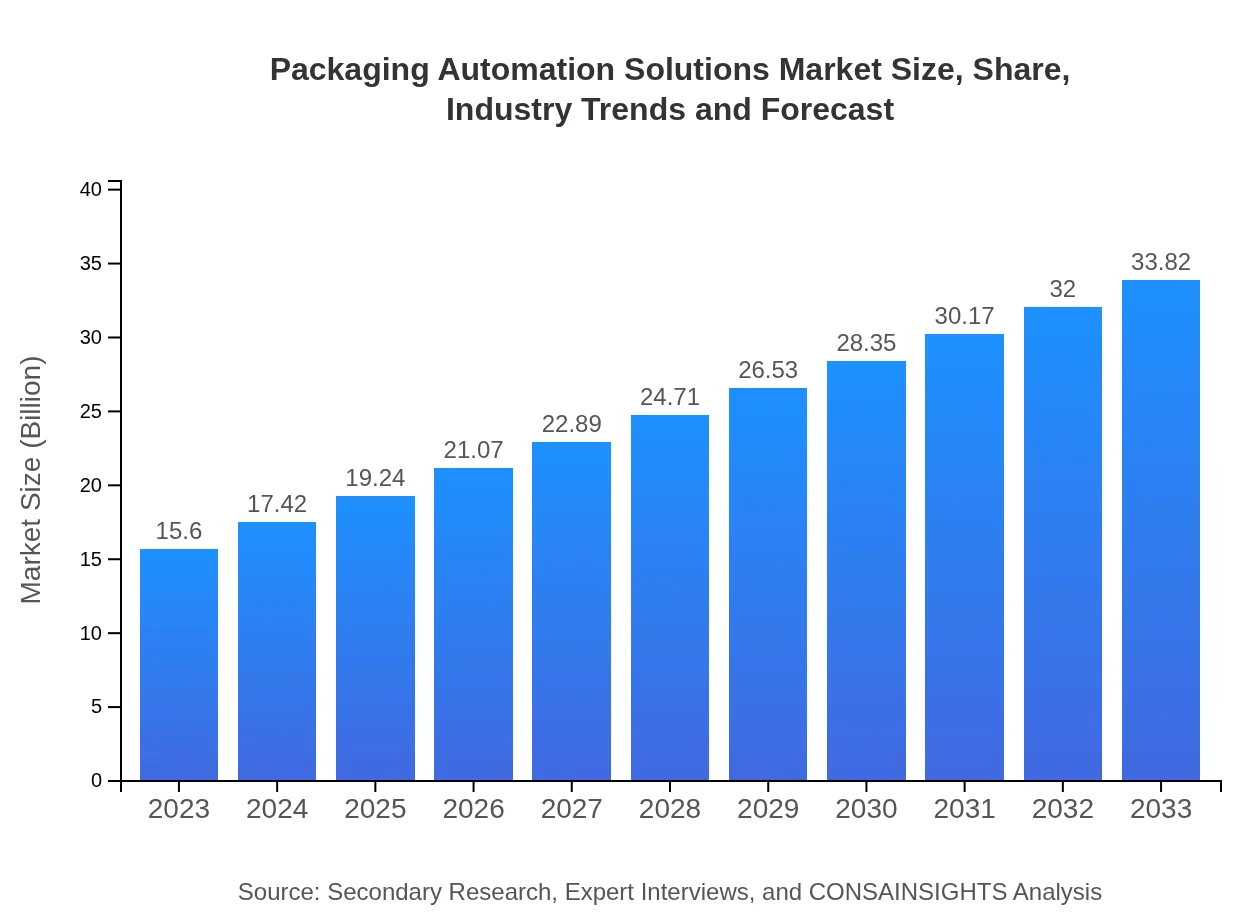

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $33.82 Billion |

| Top Companies | Siemens AG, Rockwell Automation, Inc., März Automation, Inc., Bosch Packaging Technology |

| Last Modified Date | 22 January 2026 |

Packaging Automation Solutions Market Overview

Customize Packaging Automation Solutions Market Report market research report

- ✔ Get in-depth analysis of Packaging Automation Solutions market size, growth, and forecasts.

- ✔ Understand Packaging Automation Solutions's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Packaging Automation Solutions

What is the Market Size & CAGR of Packaging Automation Solutions market in 2023?

Packaging Automation Solutions Industry Analysis

Packaging Automation Solutions Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Packaging Automation Solutions Market Analysis Report by Region

Europe Packaging Automation Solutions Market Report:

Europe's market size is approximately $5.63 billion for 2023, projected to reach $12.20 billion by 2033. Strict regulations regarding packaging sustainability and safety, along with innovation in packaging technologies, are pivotal in driving the market.Asia Pacific Packaging Automation Solutions Market Report:

In 2023, the Asia Pacific market for Packaging Automation Solutions is valued at $2.93 billion, with projections to reach $6.35 billion by 2033. The region is characterized by rapid industrialization, increasing disposable incomes, and a burgeoning e-commerce sector, pushing the demand for automated packaging solutions in various industries.North America Packaging Automation Solutions Market Report:

North America, valued at $5.25 billion in 2023, is set to expand to $11.38 billion by 2033. The region's strong manufacturing base, coupled with high investment in technology and automation, supports the growth of packaging solutions.South America Packaging Automation Solutions Market Report:

The South American market is relatively smaller, with a value of $0.35 billion in 2023, expected to grow to $0.75 billion by 2033. The region faces challenges like economic fluctuations but shows potential due to growing investments in advanced manufacturing processes.Middle East & Africa Packaging Automation Solutions Market Report:

In the Middle East and Africa, the market is estimated at $1.45 billion in 2023, with an expected growth to $3.13 billion by 2033. Factors contributing to this growth include urbanization, increasing manufacturing activities, and enhancements in logistical capabilities.Tell us your focus area and get a customized research report.

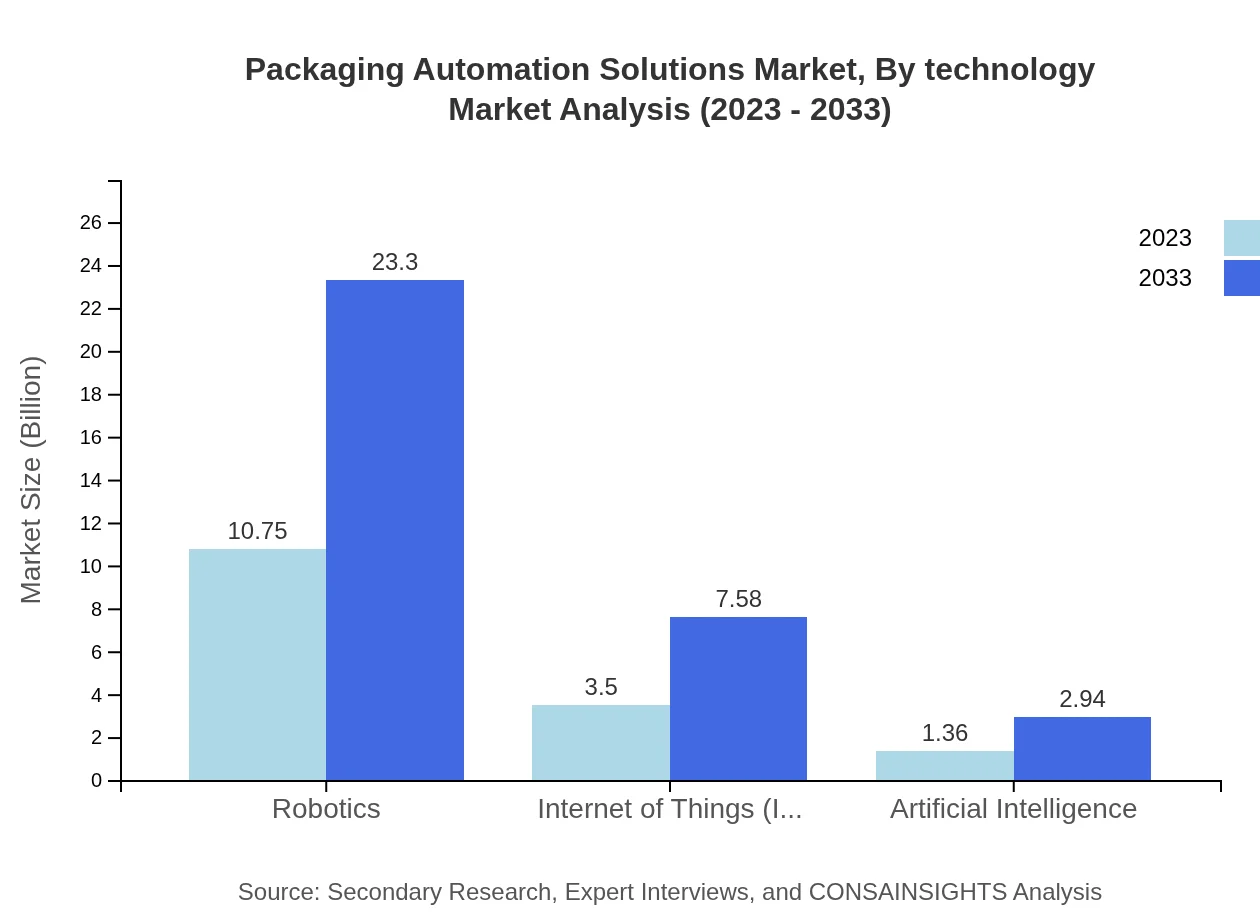

Packaging Automation Solutions Market Analysis By Technology

The technology segment is critical, with Robotics dominating the market, valued at $10.75 billion in 2023, projected to double to $23.30 billion by 2033. The Internet of Things (IoT) segment, valued at $3.50 billion in 2023, is anticipated to reach $7.58 billion by 2033, emphasizing enhanced connectivity and real-time monitoring capabilities. Artificial Intelligence's market size, though smaller at $1.36 billion, is expected to experience significant growth due to enhanced decision-making and optimization processes in packaging operations.

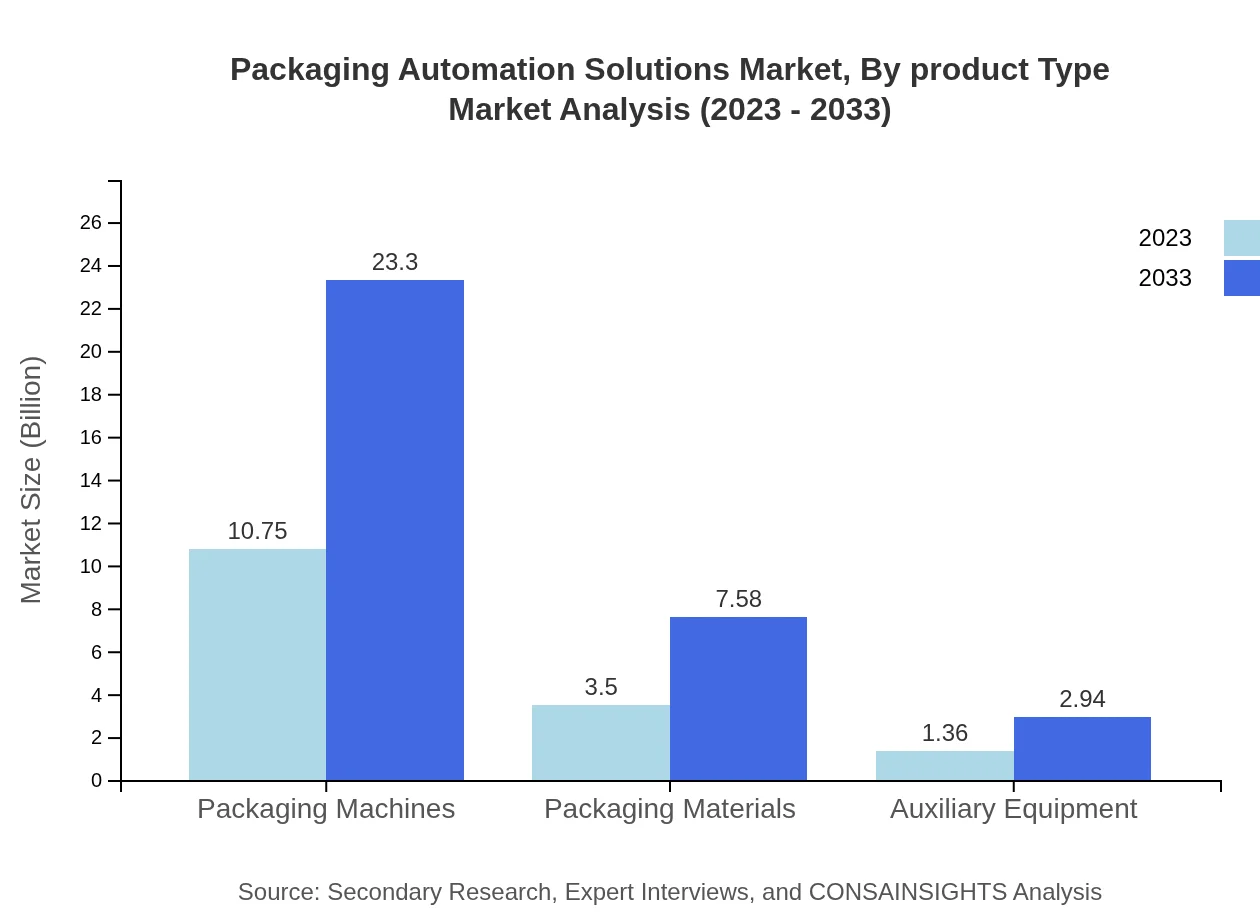

Packaging Automation Solutions Market Analysis By Product Type

Packaging Machines maintain the highest market share, valued at $10.75 billion in 2023 and expected to reach $23.30 billion by 2033. Packaging Materials follow closely with $3.50 billion in 2023, projected to grow to $7.58 billion by 2033, driven by the rising demand for eco-friendly materials. Auxiliary Equipment, though relatively smaller at $1.36 billion, is also expected to grow, reflecting innovation in supporting packaging operations.

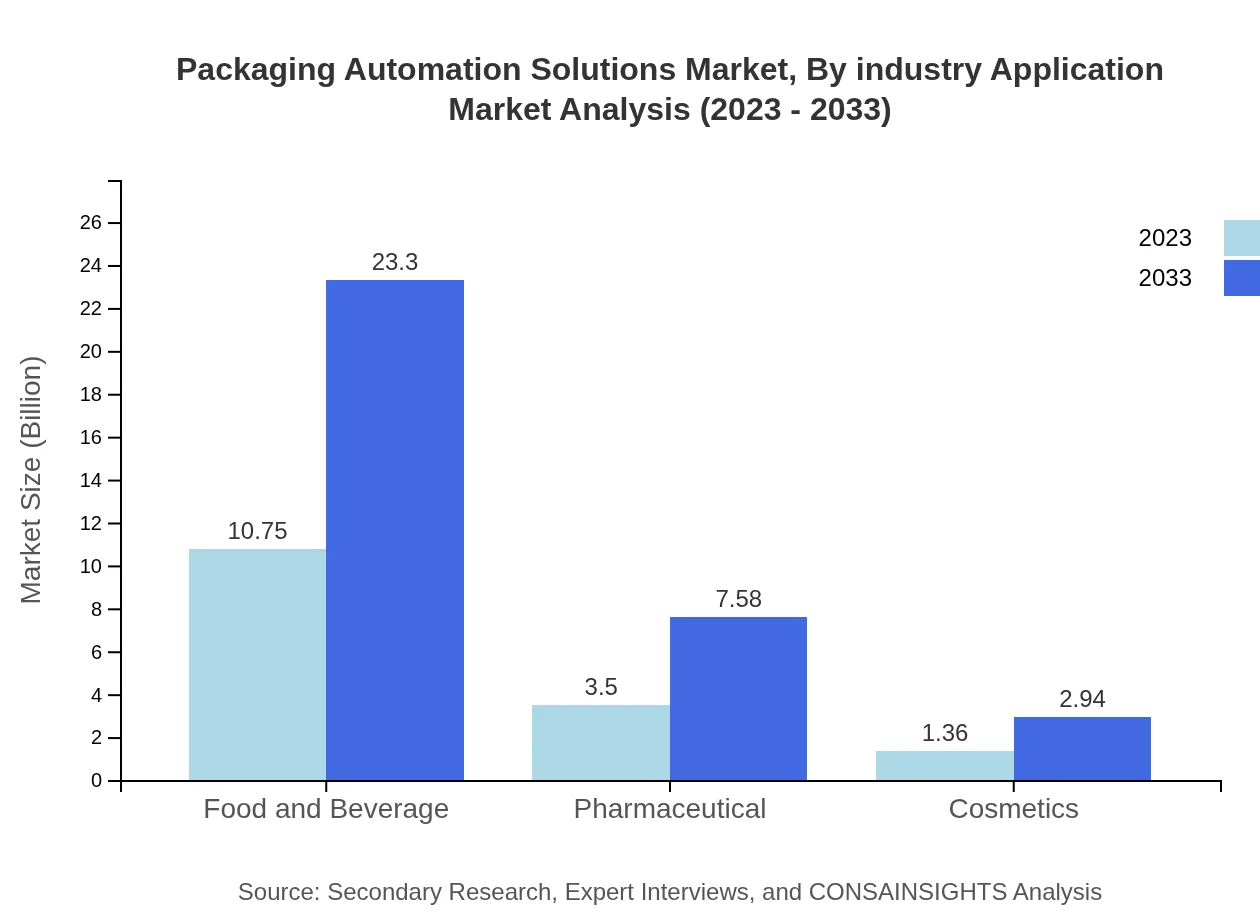

Packaging Automation Solutions Market Analysis By Industry Application

The Food and Beverage sector leads the market, with a current size of $10.75 billion, anticipated to rise to $23.30 billion by 2033, underlining its vital role in the automation of packaging tasks. The Pharmaceutical industry, valued at $3.50 billion, is also expected to witness significant growth due to stringent regulations and the need for secure packaging solutions. The Cosmetics sector, though smaller at $1.36 billion, is showing resilience and growth driven by evolving consumer trends.

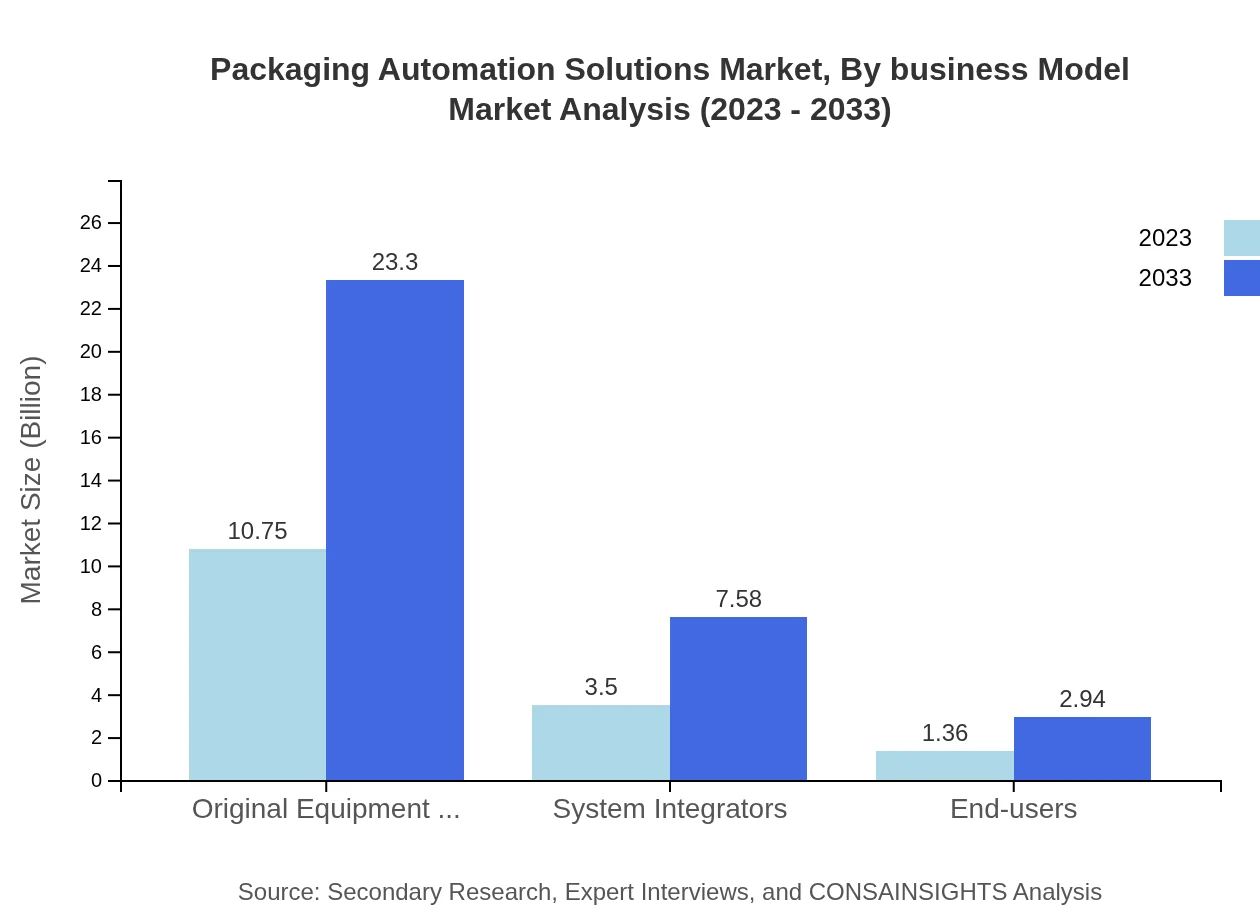

Packaging Automation Solutions Market Analysis By Business Model

The market comprises both Original Equipment Manufacturers (OEM) and System Integrators. The OEM segment is significant, with a market size of $10.75 billion in 2023, indicating its dominance in providing specialized machines. System Integrators, valued at $3.50 billion, contribute by offering comprehensive solutions, integrating various components for seamless operation.

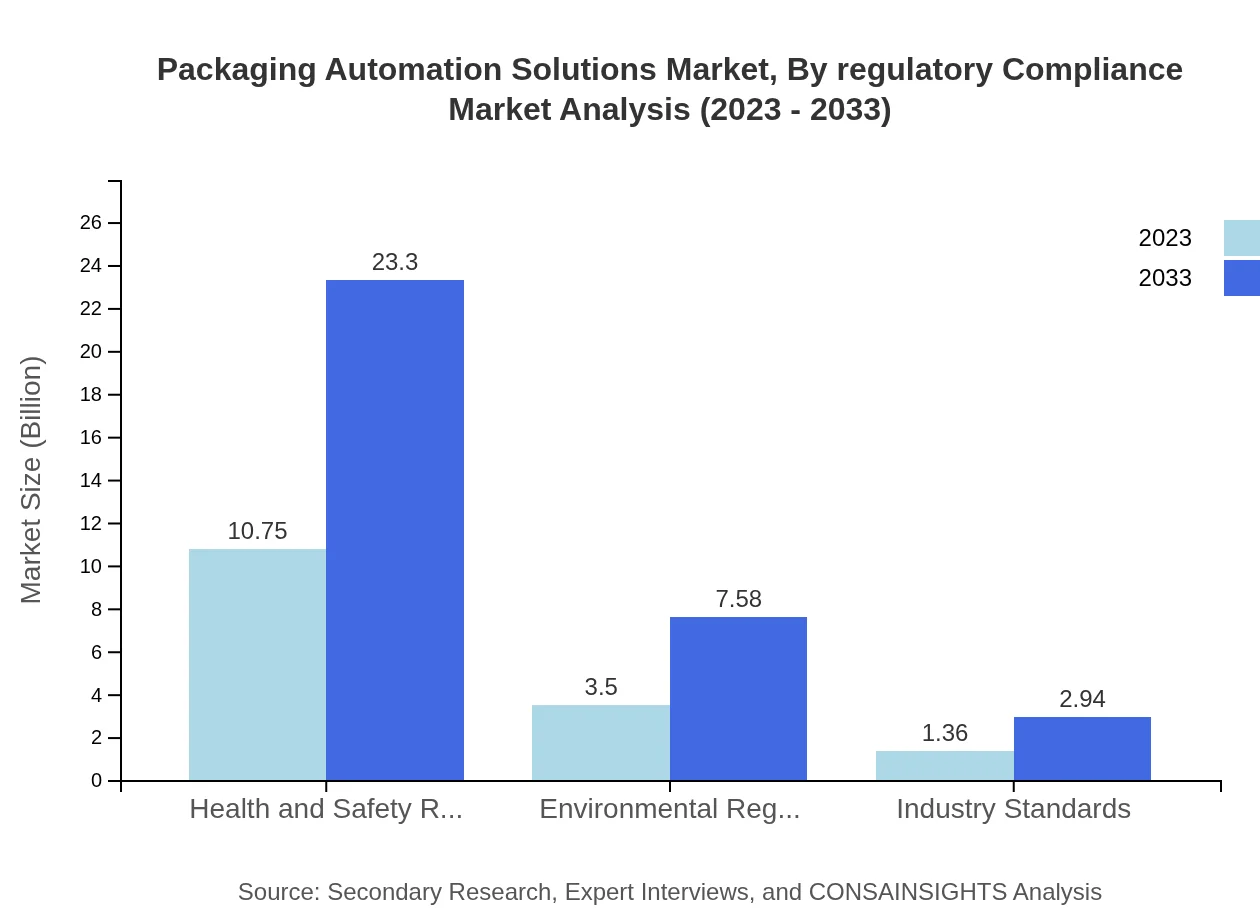

Packaging Automation Solutions Market Analysis By Regulatory Compliance

Regulatory compliance is critical in this market, with segments focusing on Health and Safety Regulations, Environmental Regulations, and Industry Standards. The importance of compliance drives demand, particularly in industries like pharmaceuticals and food and beverage, where consumer safety is paramount.

Packaging Automation Solutions Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Packaging Automation Solutions Industry

Siemens AG:

Siemens AG offers advanced automation solutions, focusing on sustainability and innovation to improve efficiency in packaging processes across various industries.Rockwell Automation, Inc.:

Rockwell Automation specializes in providing integrated architecture and software solutions, enhancing productivity and operational excellence in the packaging sector.März Automation, Inc.:

März Automation provides technologically advanced packaging solutions, concentrating on robotics and AI integration to streamline processes in manufacturing systems.Bosch Packaging Technology:

Bosch is recognized for its intelligent packaging systems that enhance packaging machinery efficiency and offer specialized solutions for food and pharmaceutical industries.We're grateful to work with incredible clients.

FAQs

What is the market size of packaging Automation Solutions?

The global packaging automation solutions market was valued at approximately $15.6 billion in 2023, with a projected CAGR of 7.8% through 2033. This growth signifies the increasing demand for efficient packaging processes in various industries.

What are the key market players or companies in this packaging Automation Solutions industry?

Key players in the packaging automation solutions industry include notable companies such as Rockwell Automation, Siemens AG, and ABB. These companies provide advanced technologies that enhance productivity and efficiency in packaging operations.

What are the primary factors driving the growth in the packaging Automation Solutions industry?

Growth factors in the packaging automation industry involve technological advancements, rising labor costs, and the need for improved production efficiency. Additionally, stringent regulations on packaging waste are encouraging businesses to adopt automated solutions.

Which region is the fastest Growing in the packaging Automation Solutions?

The fastest-growing region for packaging automation solutions is Europe, with a market value projected to increase from $5.63 billion in 2023 to $12.20 billion by 2033, fueled by increased industrial automation investments.

Does ConsaInsights provide customized market report data for the packaging Automation Solutions industry?

Yes, ConsaInsights offers tailored market report data for the packaging automation solutions industry, allowing clients to gain specific insights based on geographical focus, segment analysis, and industry trends.

What deliverables can I expect from this packaging Automation Solutions market research project?

Expect detailed market analysis reports, segmentation breakdowns, competitive landscape insights, and growth forecasts. ConsaInsights also provides graphical representations to enhance understanding of the data.

What are the market trends of packaging Automation Solutions?

Key trends in the packaging automation solutions market include increased adoption of IoT and AI technologies, a surge in demand for eco-friendly packaging solutions, and advancements in robotics driving efficiency and accuracy.