Packaging Machinery Market Report

Published Date: 31 January 2026 | Report Code: packaging-machinery

Packaging Machinery Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Packaging Machinery market from 2023 to 2033, focusing on market trends, regional insights, competitive landscape, and technological advancements that are shaping the industry.

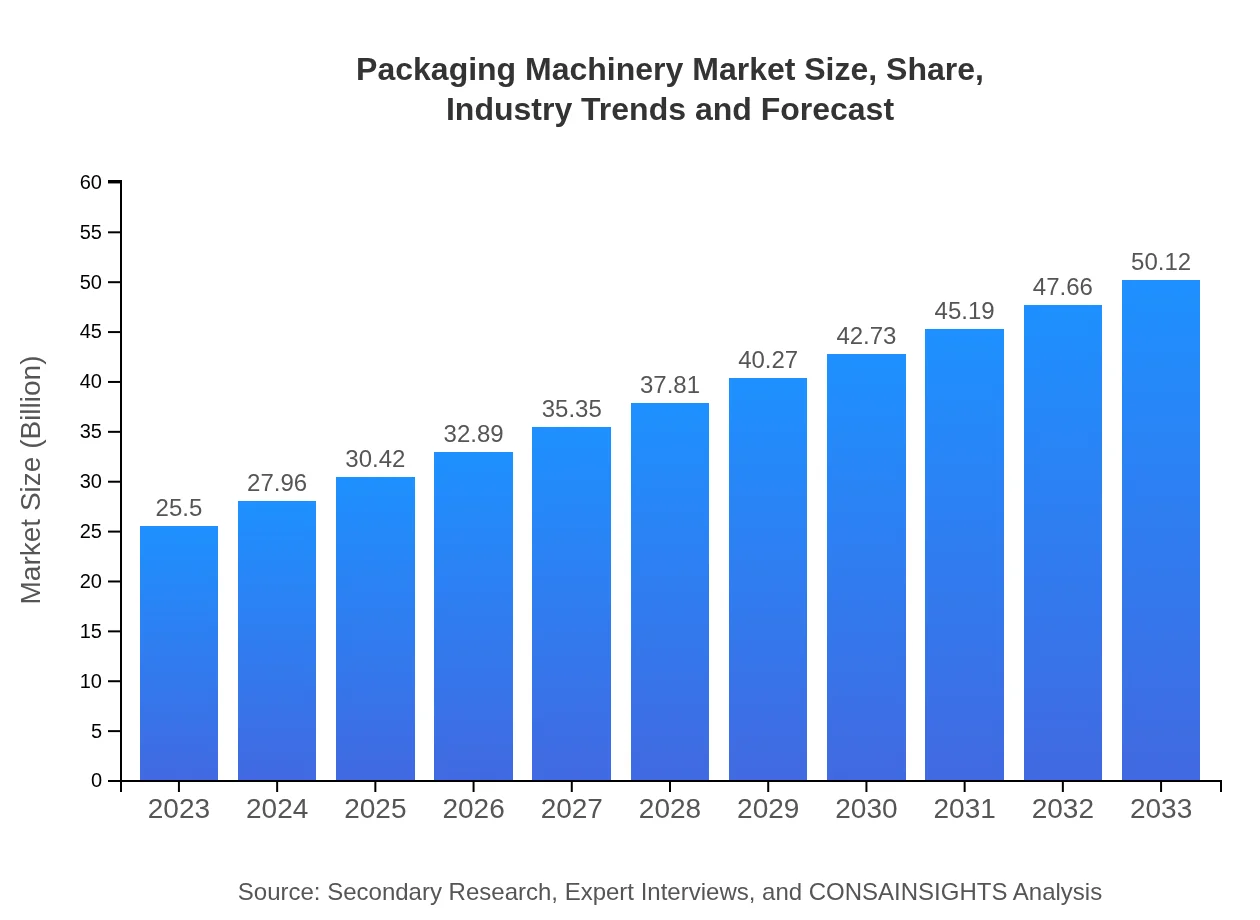

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $50.12 Billion |

| Top Companies | Krones AG, Bosch Packaging Technology, IMA Group, PACKAGE MACHINERY COMPANY Inc. |

| Last Modified Date | 31 January 2026 |

Packaging Machinery Market Overview

Customize Packaging Machinery Market Report market research report

- ✔ Get in-depth analysis of Packaging Machinery market size, growth, and forecasts.

- ✔ Understand Packaging Machinery's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Packaging Machinery

What is the Market Size & CAGR of Packaging Machinery market in 2023?

Packaging Machinery Industry Analysis

Packaging Machinery Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Packaging Machinery Market Analysis Report by Region

Europe Packaging Machinery Market Report:

Europe is projected to grow from $7.07 billion in 2023 to $13.89 billion by 2033, supported by an increasing focus on sustainability and a robust manufacturing base. The integration of advanced technologies in packaging processes is also driving this market.Asia Pacific Packaging Machinery Market Report:

The Asia-Pacific region is anticipated to witness significant growth, with the market size projected to rise from $5.60 billion in 2023 to $11.01 billion by 2033. This growth is attributed to the increasing industrialization, rapid urbanization, and a surge in demand for packaged consumer goods.North America Packaging Machinery Market Report:

The North American market is expected to have a substantial impact, with forecasts predicting growth from $8.58 billion in 2023 to $16.86 billion by 2033. Factors such as high demand for automated solutions and stringent regulations pertaining to product safety are contributing to this growth.South America Packaging Machinery Market Report:

In South America, the Packaging Machinery market is expected to grow modestly from $0.97 billion in 2023 to $1.91 billion by 2033. The key drivers include the growth of the food and beverage sector and rising investments in manufacturing technologies.Middle East & Africa Packaging Machinery Market Report:

The Middle East and Africa region is witnessing steady growth, with the market size expected to increase from $3.28 billion in 2023 to $6.45 billion by 2033. Key growth factors include rising demand for packaged foods and beverages, alongside improving economic conditions.Tell us your focus area and get a customized research report.

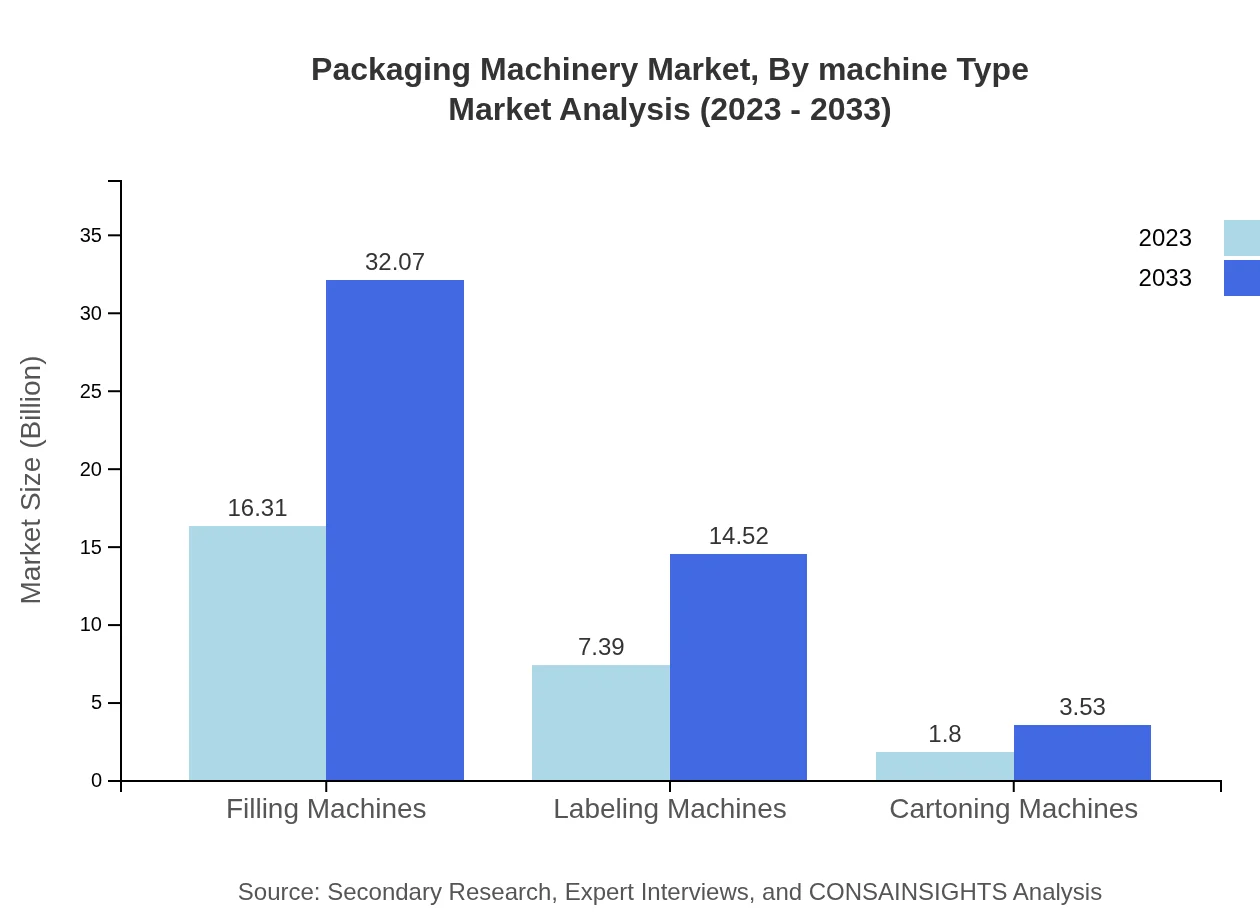

Packaging Machinery Market Analysis By Machine Type

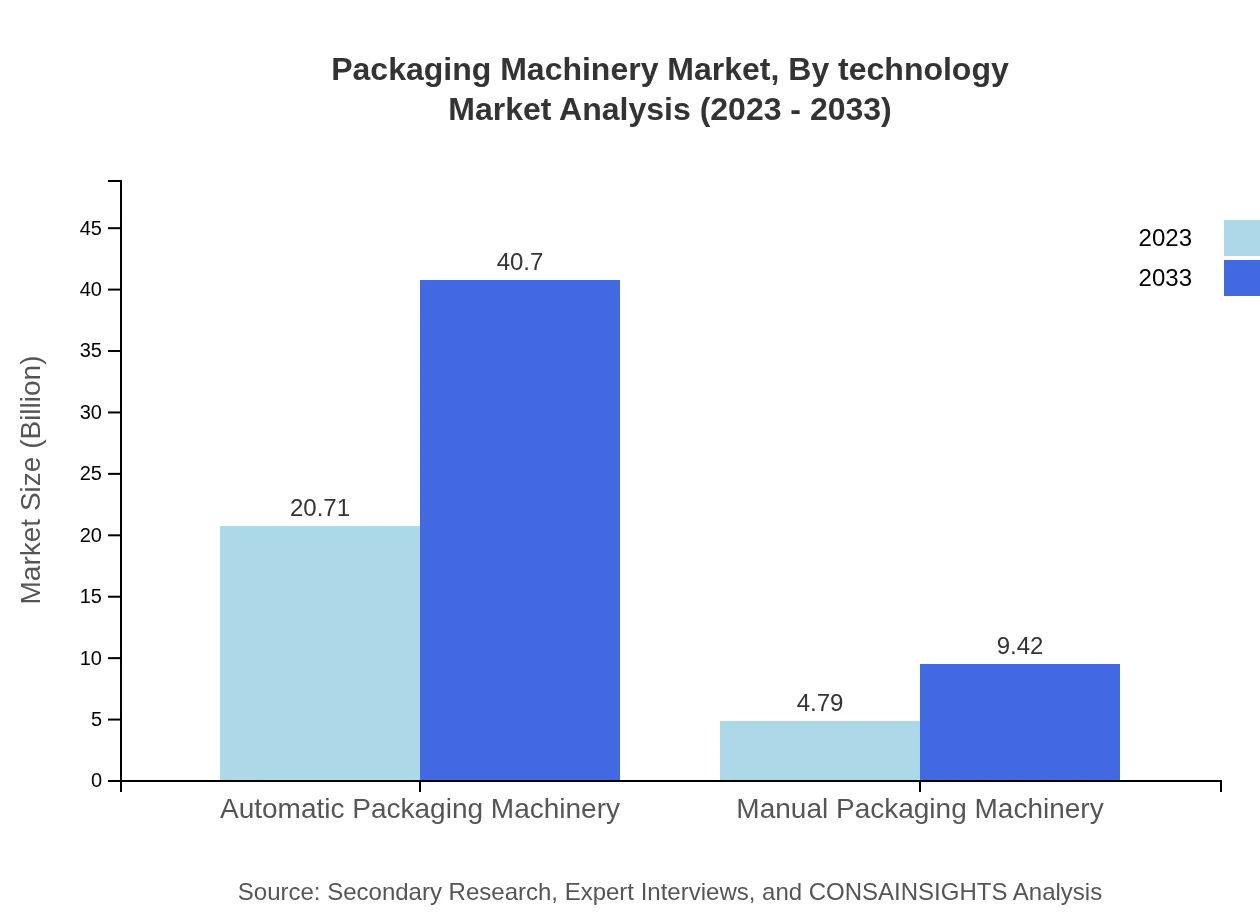

The machine type segment includes automatic and manual packaging machinery. Automatic machines dominate the market, expected to grow from $20.71 billion in 2023 to $40.70 billion by 2033, holding an 81.2% market share. Manual packaging machinery, though smaller, is also growing, with projections from $4.79 billion to $9.42 billion, retaining an 18.8% share.

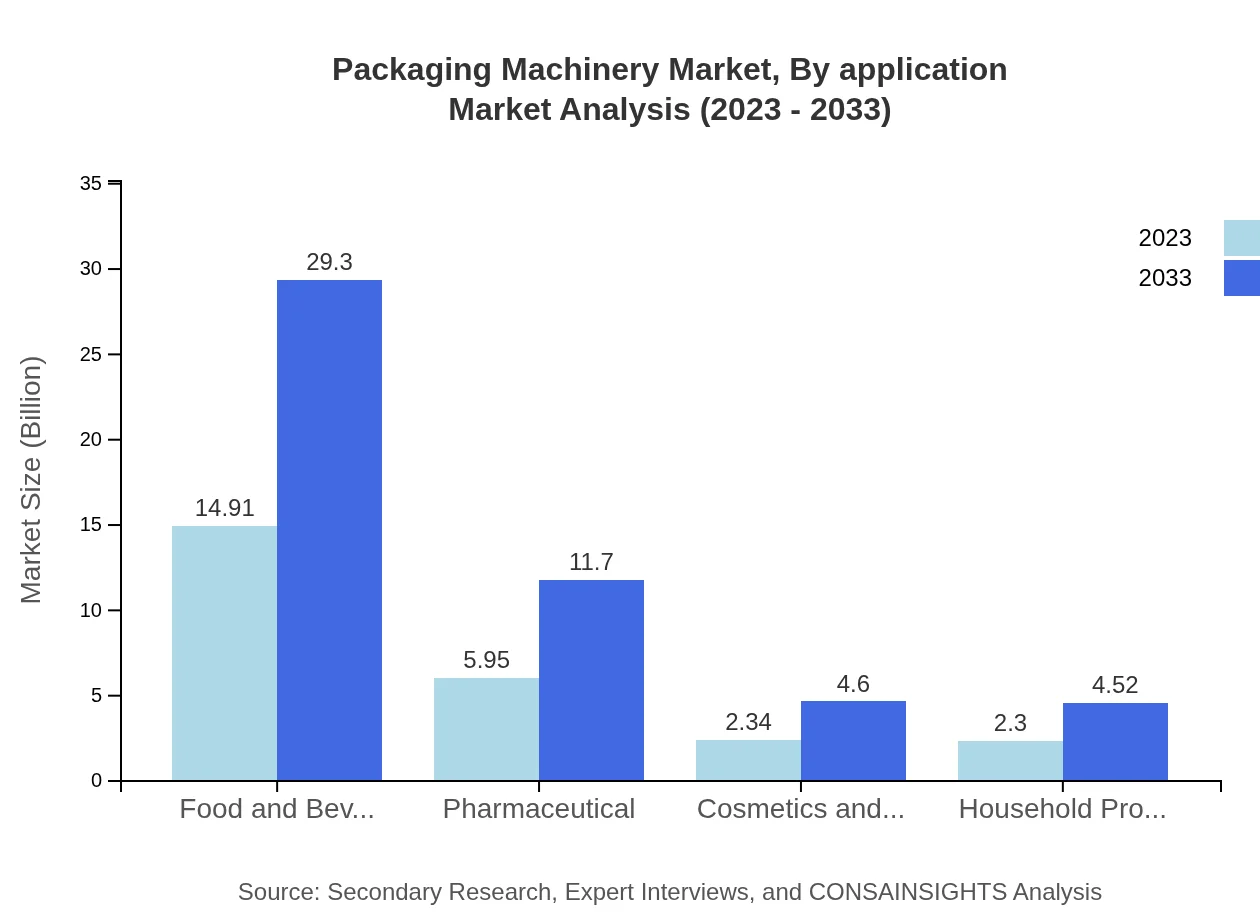

Packaging Machinery Market Analysis By Application

In terms of application, the food and beverage sector leads, growing from $14.91 billion in 2023 to $29.30 billion by 2033, accounting for 58.47% of the market. Pharmaceuticals and cosmetics follow, with pharmaceuticals increasing from $5.95 billion to $11.70 billion and cosmetics from $2.34 billion to $4.60 billion.

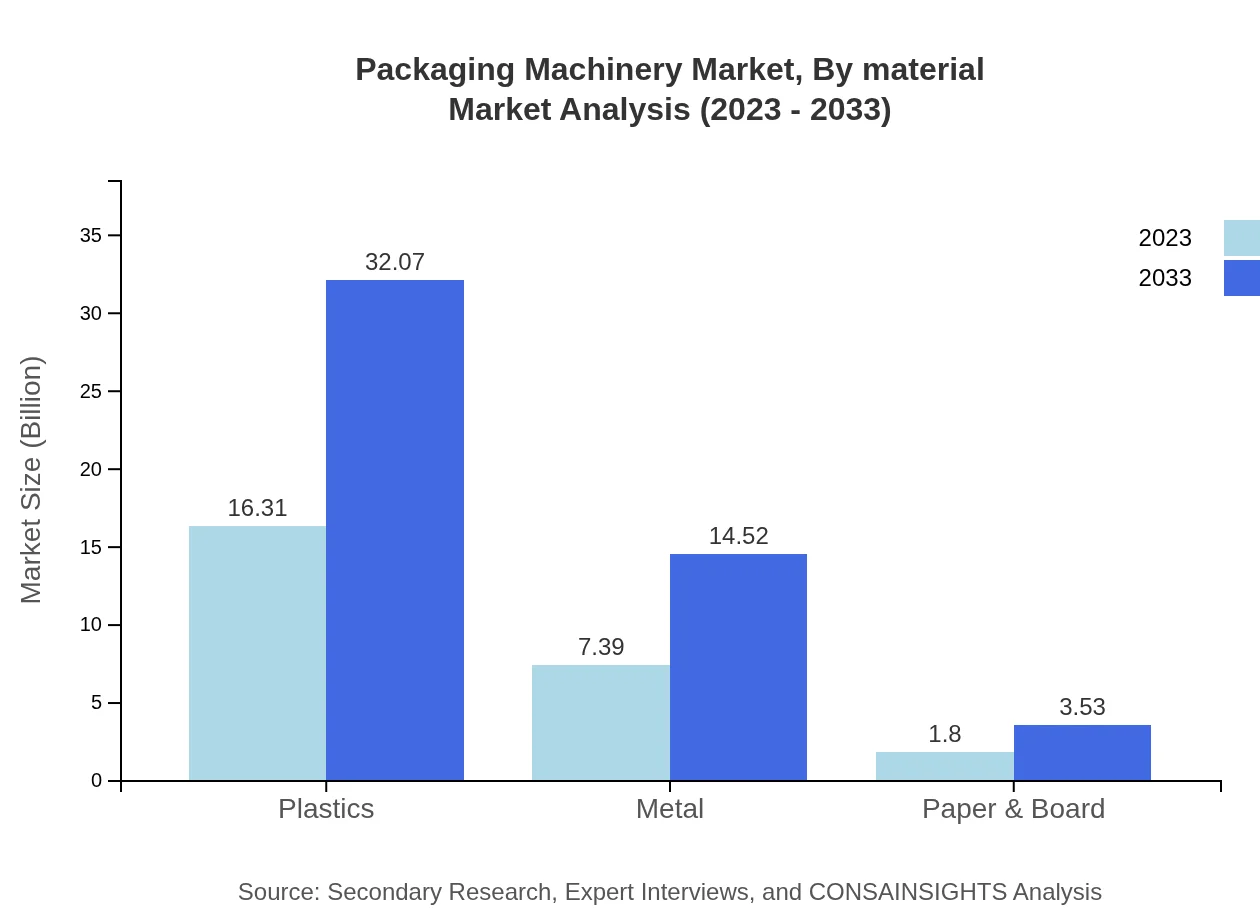

Packaging Machinery Market Analysis By Material

The materials segment highlights significant growth in plastics, expected to increase from $16.31 billion in 2023 to $32.07 billion by 2033, holding a 63.98% market share. Metal and paper & board materials are also growing, with metal rising from $7.39 billion to $14.52 billion and paper & board from $1.80 billion to $3.53 billion.

Packaging Machinery Market Analysis By Technology

Technology trends in the packaging machinery market include automation, IoT integration, and environmentally-friendly packaging solutions. The shift towards digital technologies is accelerating, with companies investing in smart packaging that enhances consumer engagement and reduces costs.

Packaging Machinery Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Packaging Machinery Industry

Krones AG:

Krones AG specializes in production and filling technology for the beverage industry, known for innovations in sustainable packaging solutions.Bosch Packaging Technology:

Bosch Packaging Technology offers a wide range of packaging solutions, focusing on intelligent and efficient machines that enhance productivity.IMA Group:

IMA Group designs and manufactures packaging machinery across various sectors, including pharmaceuticals and food, with a strong emphasis on automation.PACKAGE MACHINERY COMPANY Inc.:

A leader in the design and manufacture of packaging machinery, known for its innovative solutions and customer-centric approach.We're grateful to work with incredible clients.

FAQs

What is the market size of packaging machinery?

The packaging machinery market is projected to reach $25.5 billion in 2023, with an expected CAGR of 6.8% from 2023 to 2033, indicating strong growth driven by innovations and increasing demand in various sectors.

What are the key market players or companies in the packaging machinery industry?

Key players in the packaging machinery market include industry leaders such as Bosch Packaging Technology, Krones AG, and multipack machinery companies. Their strong presence enhances competition and drives innovation.

What are the primary factors driving the growth in the packaging machinery industry?

Growth drivers include increasing automation in manufacturing, rising e-commerce, and sustainability concerns. Innovations in packaging technology and the demand for efficient and safe packaging solutions further propel market expansion.

Which region is the fastest Growing in the packaging machinery market?

The Asia Pacific region exhibits the fastest growth, with market size expected to increase from $5.60 billion in 2023 to $11.01 billion by 2033, reflecting rising industrialization and consumer demand.

Does ConsaInsights provide customized market report data for the packaging machinery industry?

Yes, ConsaInsights offers tailored market report data, allowing clients to gain specific insights aligned with their business needs. Customized reports can address unique market dynamics and regional specifics.

What deliverables can I expect from this packaging machinery market research project?

Expect comprehensive deliverables including detailed market analysis, competitive landscape assessments, and segment performance insights, providing a holistic view of the packaging machinery landscape.

What are the market trends of packaging machinery?

Market trends indicate a shift towards automatic machinery, increasing use of smart technologies such as IoT in packaging, and an emphasis on sustainable packaging solutions, reflecting evolving consumer preferences.