Packaging Testing Market Report

Published Date: 22 January 2026 | Report Code: packaging-testing

Packaging Testing Market Size, Share, Industry Trends and Forecast to 2033

This report delivers an extensive analysis of the Packaging Testing market, covering insights on various segments, regional performance, market trends, and forecasts for the years 2023 to 2033.

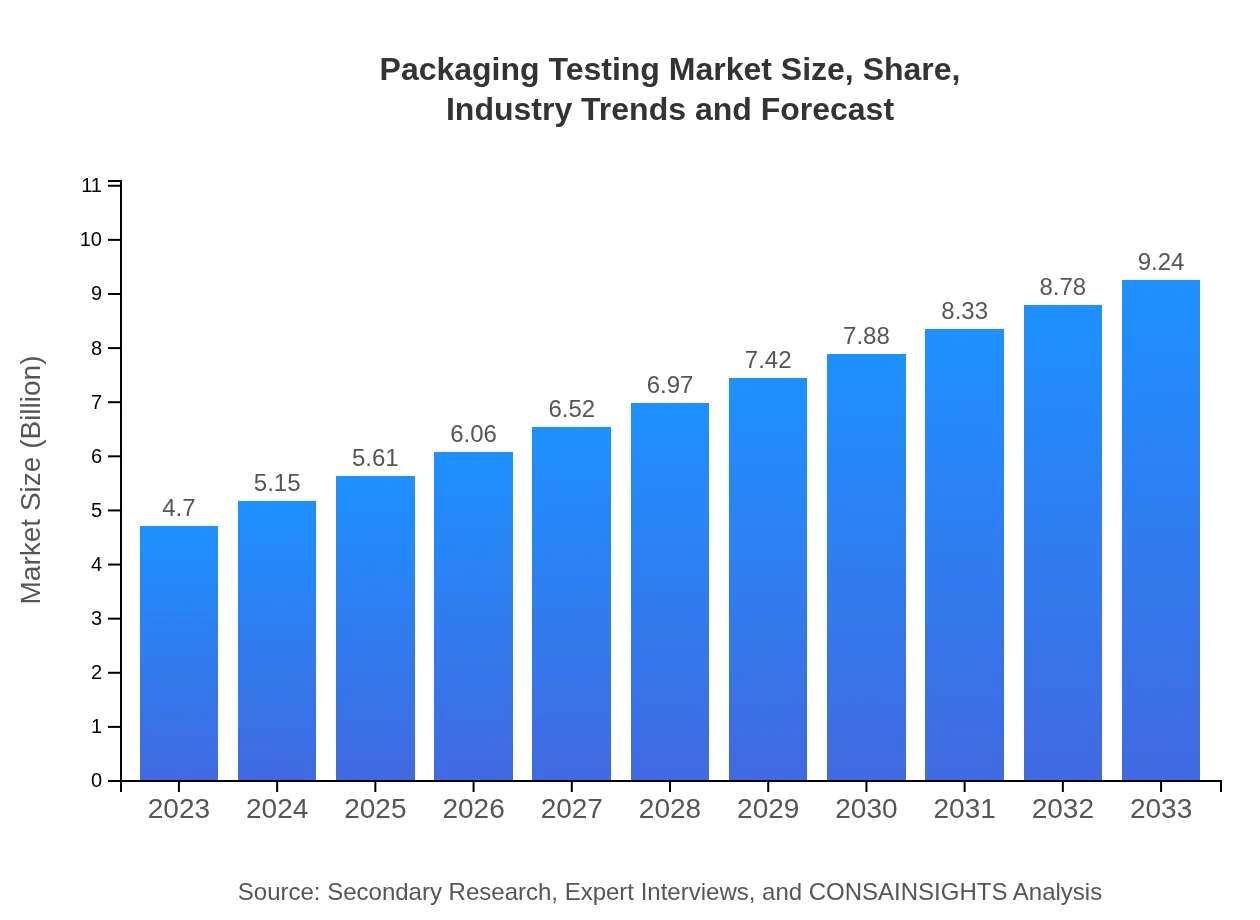

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.70 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $9.24 Billion |

| Top Companies | SGS SA, Bureau Veritas, Intertek Group plc, TÜV Rheinland |

| Last Modified Date | 22 January 2026 |

Packaging Testing Market Overview

Customize Packaging Testing Market Report market research report

- ✔ Get in-depth analysis of Packaging Testing market size, growth, and forecasts.

- ✔ Understand Packaging Testing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Packaging Testing

What is the Market Size & CAGR of Packaging Testing market in 2023?

Packaging Testing Industry Analysis

Packaging Testing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Packaging Testing Market Analysis Report by Region

Europe Packaging Testing Market Report:

The European market is anticipated to grow from $1.54 billion in 2023 to $3.02 billion by 2033, driven by stringent EU regulations concerning packaging safety and sustainability. The emphasis on circular economy practices further propels investment in innovative packaging materials and testing methodologies.Asia Pacific Packaging Testing Market Report:

The Asia Pacific region is witnessing significant growth in packaging testing, with a market value projected to grow from $0.90 billion in 2023 to $1.77 billion by 2033. This expansion is driven by increasing manufacturing activity, consumer goods demand, and stringent regulatory frameworks across countries like China and India that require comprehensive packaging testing solutions.North America Packaging Testing Market Report:

North America holds a substantial share of the Packaging Testing market, with a projected increase from $1.51 billion in 2023 to $2.97 billion by 2033. This growth is attributed to high consumer awareness regarding product safety and the vigorous regulations in place that mandate extensive testing of packaging materials and products.South America Packaging Testing Market Report:

In South America, the Packaging Testing market is expected to grow from $0.40 billion in 2023 to $0.78 billion by 2033. The growth is primarily influenced by the rising local market's focus on food safety and quality assurance, reinforcing the need for robust packaging solutions, especially in the food and beverage sector.Middle East & Africa Packaging Testing Market Report:

The Middle East and Africa region's packaging testing market is estimated to increase from $0.35 billion in 2023 to $0.70 billion by 2033. The growth is spurred by increasing foreign investments and a growing retail sector that requires efficient and compliant packaging solutions to ensure product durability.Tell us your focus area and get a customized research report.

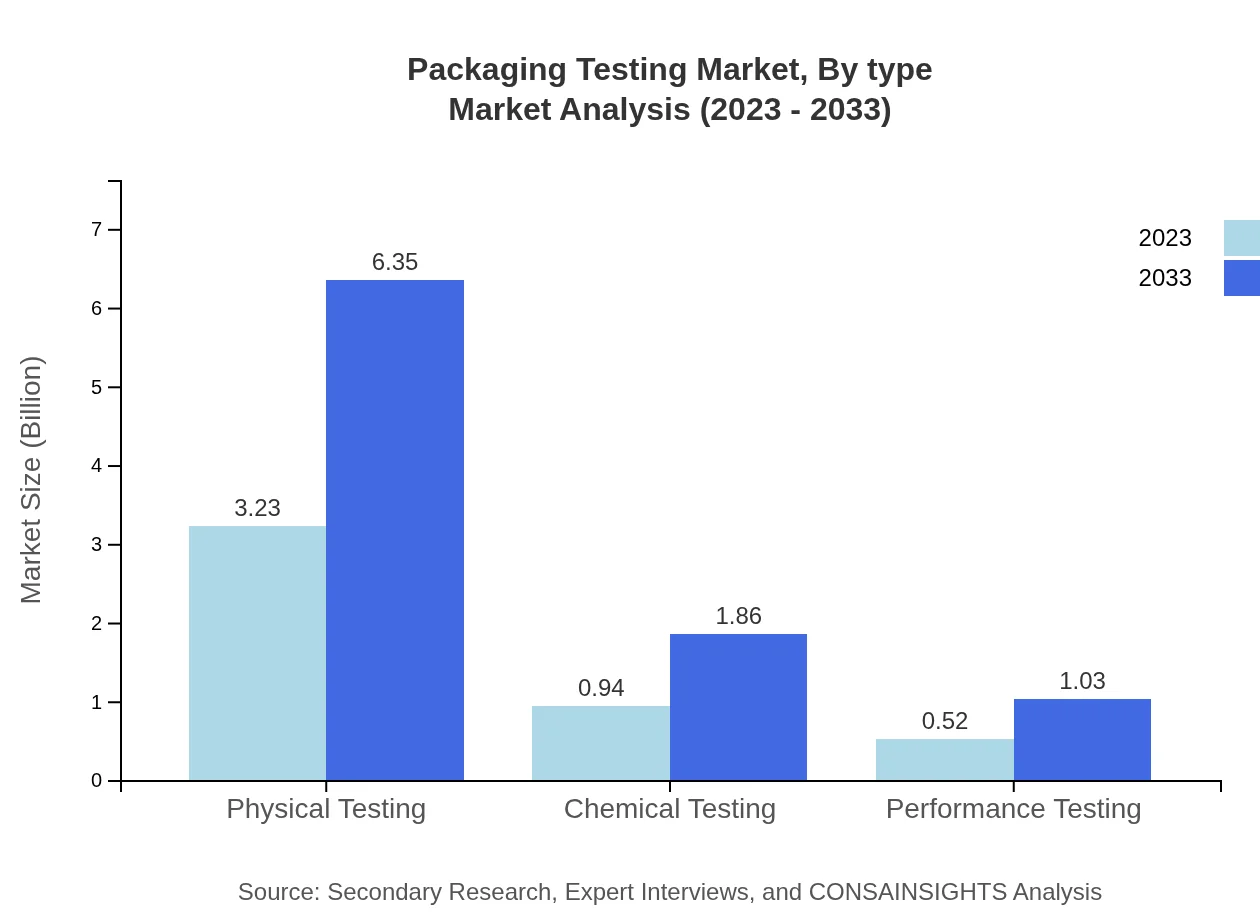

Packaging Testing Market Analysis By Type

The market is primarily composed of physical testing, which commands the largest share, projected to grow from $3.23 billion in 2023 to $6.35 billion in 2033, accounting for about 68.77% of the market share. Chemical testing follows, with a size of $0.94 billion expected to reach $1.86 billion by 2033, maintaining approximately 20.09% of the market share. Performance testing is also notable, expanding from $0.52 billion to $1.03 billion, holding 11.14% of the share through 2033.

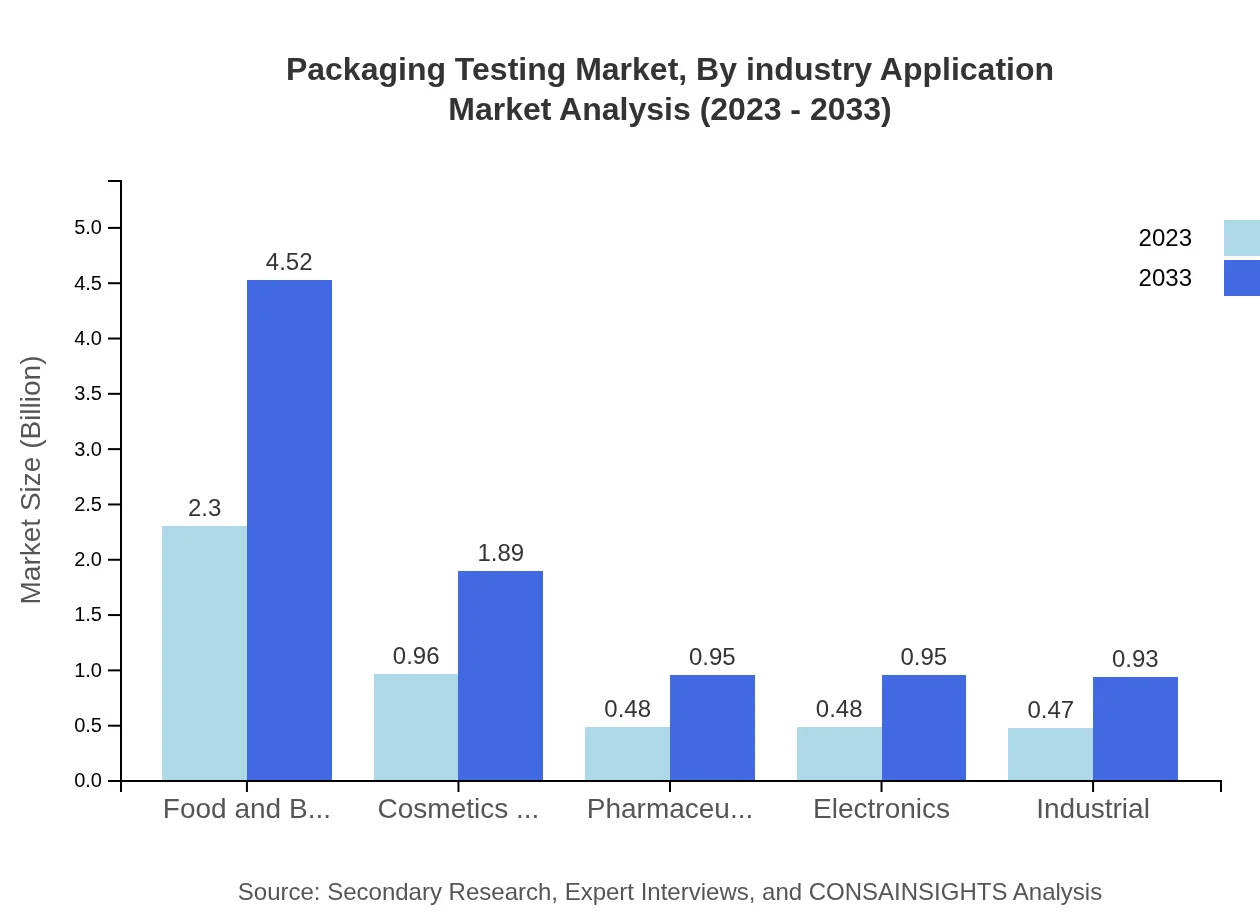

Packaging Testing Market Analysis By Industry Application

The Food and Beverage sector is leading the market with a size of $2.30 billion in 2023, anticipated to grow to $4.52 billion by 2033, which constitutes about 48.96% of market share. Following this, the Cosmetics and Personal Care industry projected to expand from $0.96 billion to $1.89 billion, comprising 20.45%. The Pharmaceuticals sector is expected to grow from $0.48 billion to $0.95 billion, capturing 10.26%, while the Electronics and Industrial sectors also hold similar shares.

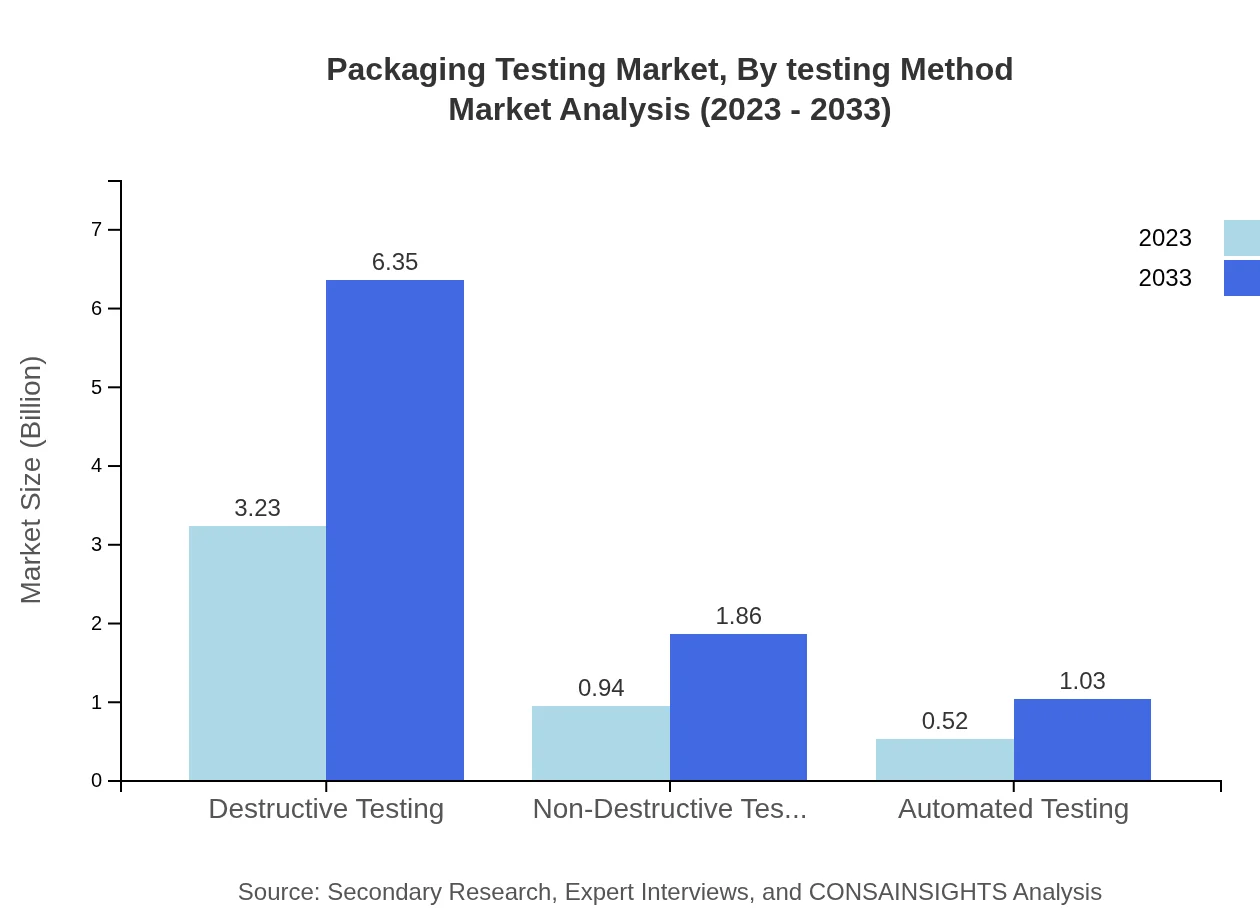

Packaging Testing Market Analysis By Testing Method

The market is divided into Destructive Testing, with a robust market size of $3.23 billion projected to expand to $6.35 billion by 2033, holding a significant share of 68.77%. Non-Destructive Testing is emerging, with a current market of $0.94 billion, expected to grow to $1.86 billion, representing 20.09%, while Automated Testing is also gaining traction, increasing from $0.52 billion to $1.03 billion, maintaining 11.14% of the share.

Packaging Testing Market Analysis By Compliance Standard

In terms of compliance standards, ASTM remains the dominant force, with a market size of $3.23 billion in 2023 predicted to rise to $6.35 billion by 2033, holding an extensive share of 68.77%. International standards are significant with $0.94 billion expected to grow to $1.86 billion, comprising 20.09%, while Industry Specific Standards show potential growth from $0.52 billion to $1.03 billion, retaining 11.14% of the market share.

Packaging Testing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Packaging Testing Industry

SGS SA:

SGS SA is a global leader in inspection, verification, testing, and certification services. Their expertise in packaging testing ensures that products comply with international standards, contributing to product safety and quality.Bureau Veritas:

Bureau Veritas provides a comprehensive range of testing services to the packaging industry, focusing on environmental sustainability and regulatory compliance, aiding businesses in maintaining high quality in their packaging processes.Intertek Group plc:

Intertek Group plc offers comprehensive services for testing packaging materials integrity, supporting companies in enhancing their product safety, and ensuring adherence to industry standards.TÜV Rheinland:

TÜV Rheinland is renowned for its stringent testing and certification processes, aiding companies in validating packaging quality and complying with international regulations.We're grateful to work with incredible clients.

FAQs

What is the market size of packaging Testing?

The global packaging testing market is valued at approximately $4.7 billion in 2023, with a projected CAGR of 6.8%, indicating strong growth potential through 2033.

What are the key market players or companies in the packaging Testing industry?

Key players in the packaging testing industry include prominent testing laboratories such as Intertek, SGS, and Bureau Veritas, which offer various testing solutions tailored to meet the needs of diverse sectors.

What are the primary factors driving the growth in the packaging Testing industry?

Factors such as increased demand for sustainable packaging, stringent regulatory standards, and a rise in e-commerce are significantly driving growth in the packaging testing industry.

Which region is the fastest Growing in the packaging Testing?

The fastest-growing regions for the packaging testing market are Europe and Asia Pacific, with significant growth estimates from $1.54 billion to $3.02 billion and $0.90 billion to $1.77 billion respectively between 2023 and 2033.

Does ConsaInsights provide customized market report data for the packaging Testing industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs, facilitating comprehensive insights and analysis for the packaging testing industry.

What deliverables can I expect from this packaging Testing market research project?

Expect deliverables such as market analysis reports, trend forecasts, competitive landscape assessments, and actionable insights tailored to your specific business requirements in packaging testing.

What are the market trends of packaging Testing?

Current trends in packaging testing include increasing reliance on automated and non-destructive testing methods, alongside a growing emphasis on compliance with industry standards and sustainable practices.